Académique Documents

Professionnel Documents

Culture Documents

Appendix 1

Transféré par

Ankush Sharma0 évaluation0% ont trouvé ce document utile (0 vote)

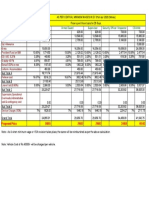

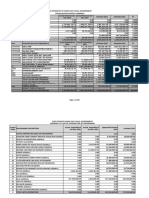

3 vues2 pagesThis document presents an economic feasibility analysis of a project over 7 years. It calculates the net present value (NPV) of benefits and costs using a 12% discount rate. The NPV of total benefits is $48,036.63 while the NPV of total costs is -$84,018.30, resulting in an overall NPV of -$35,981.70 and an ROI of -42.8%. A break-even analysis shows that project break-even occurs between years 6 and 7, with an actual break-even at 6.19787 years.

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis document presents an economic feasibility analysis of a project over 7 years. It calculates the net present value (NPV) of benefits and costs using a 12% discount rate. The NPV of total benefits is $48,036.63 while the NPV of total costs is -$84,018.30, resulting in an overall NPV of -$35,981.70 and an ROI of -42.8%. A break-even analysis shows that project break-even occurs between years 6 and 7, with an actual break-even at 6.19787 years.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

3 vues2 pagesAppendix 1

Transféré par

Ankush SharmaThis document presents an economic feasibility analysis of a project over 7 years. It calculates the net present value (NPV) of benefits and costs using a 12% discount rate. The NPV of total benefits is $48,036.63 while the NPV of total costs is -$84,018.30, resulting in an overall NPV of -$35,981.70 and an ROI of -42.8%. A break-even analysis shows that project break-even occurs between years 6 and 7, with an actual break-even at 6.19787 years.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

APPENDIX I

Discount

ECONOMIC FEASIBILITY ANALYSIS Rate 12.00%

Year of Project

0 1 2 3 4 5 6 7

Net Economic Benefit 0 20000 20000 20000 20000 20000 20000 20000

Discount rate 1 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523

PV of benefits 0 17857.14286 15943.878 14235.605 12710.362 11348.537 10132.622 9046.9843

Total PV Of Benefits 48036.63

One-time COSTS -60000

Recurring Costs 0 -10000 -10000 -10000

Discount rate (12%) 1 0.8929 0.7972 0.7118

-

PV of Recurring Costs 0 8928.571429 -7971.94 -7117.8

Total PV of Recurring Costs -24018.3

NPV of total COSTS -84018.3

Overall NPV -35981.7

Overall ROI - (Overall NPV / NPV of all COSTS) -0.42826

Break-even Analysis

-

Yearly PV Costs -60000 68928.57143 -76900.5 -84018.3

- - - - -

Cumulative Net Cash Flow -84018.3 -66161.16983 50217.292 35981.687 23271.326 11922.789 1790.1662 7256.8181

Project break-even occurs between years 6 and 7

Actual break-even occurred at 6.19787years

APPENDIX I

Vous aimerez peut-être aussi

- UntitledDocument4 pagesUntitledUST AC HEDPas encore d'évaluation

- Investor Presentaion Q3 FY22 DAA 202202 1 (08-08)Document1 pageInvestor Presentaion Q3 FY22 DAA 202202 1 (08-08)PowerPas encore d'évaluation

- IRR and NPV Analysis-3Document19 pagesIRR and NPV Analysis-3Sarah BunoPas encore d'évaluation

- Week 4Document9 pagesWeek 4kishorbombe.unofficialPas encore d'évaluation

- Project RequirementDocument4 pagesProject RequirementAlina Binte EjazPas encore d'évaluation

- Financial Model EE ProjectDocument24 pagesFinancial Model EE ProjectRetno PamungkasPas encore d'évaluation

- TugasDocument5 pagesTugasstefanus aNggaPas encore d'évaluation

- QT Company AssignmentDocument21 pagesQT Company AssignmentAISHWARYA MADDAMSETTYPas encore d'évaluation

- Chapter 9 - Home WorkDocument8 pagesChapter 9 - Home WorkFaisel MohamedPas encore d'évaluation

- Chapter 9 - Home WorkDocument8 pagesChapter 9 - Home WorkFaisel MohamedPas encore d'évaluation

- Purchase Price 10000 Life 6 Years Salvage/Liquidation Value 4000 Book Value at 5 1666.667 0 - 10000 Capital Gains 2333.333 1 Tax 700 2 After Tax Cash Flow On Asset Sale 3300 3 4 5 4000Document6 pagesPurchase Price 10000 Life 6 Years Salvage/Liquidation Value 4000 Book Value at 5 1666.667 0 - 10000 Capital Gains 2333.333 1 Tax 700 2 After Tax Cash Flow On Asset Sale 3300 3 4 5 4000Sneha DasPas encore d'évaluation

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwPas encore d'évaluation

- Financial Analysis For Project One: Created By: I Putu Gede Geo R B NIM: E1700869Document6 pagesFinancial Analysis For Project One: Created By: I Putu Gede Geo R B NIM: E1700869candra brataPas encore d'évaluation

- Elasticity Ratio - Security RatioDocument17 pagesElasticity Ratio - Security Ratiotangtandung4576Pas encore d'évaluation

- Break-Even Point (BEP) Waktu Balik ModalDocument2 pagesBreak-Even Point (BEP) Waktu Balik ModalDodik ArviantoPas encore d'évaluation

- Biznes-Layihe (3) ENGDocument9 pagesBiznes-Layihe (3) ENGaide.xelilova29Pas encore d'évaluation

- Assignment 3-IndividualDocument5 pagesAssignment 3-IndividualAva MedPas encore d'évaluation

- RJC Fin ProjectionsDocument1 pageRJC Fin Projectionsapi-365066163Pas encore d'évaluation

- Nike Inc Cost of Capital Blaine KitchenwDocument11 pagesNike Inc Cost of Capital Blaine KitchenwAlvaro Gallardo FernandezPas encore d'évaluation

- Poultry CBADocument6 pagesPoultry CBAjohnzenbano120Pas encore d'évaluation

- Project Report Final 1Document11 pagesProject Report Final 1ManiyarSant & Co., Chartered AccountantsPas encore d'évaluation

- Book1 (AutoRecovered)Document5 pagesBook1 (AutoRecovered)Tayba AwanPas encore d'évaluation

- Final Excel Model (Group 1)Document107 pagesFinal Excel Model (Group 1)FaizanPas encore d'évaluation

- Commercial Confirmation JSW BarbilDocument1 pageCommercial Confirmation JSW BarbilSabuj SarkarPas encore d'évaluation

- Rolling Forecast TemplateDocument4 pagesRolling Forecast TemplatebenaikodonPas encore d'évaluation

- BSBA FM140 AutosavedDocument23 pagesBSBA FM140 AutosavedJay ArPas encore d'évaluation

- Name: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureDocument8 pagesName: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureErick KinotiPas encore d'évaluation

- Engg. Economics ProjectDocument13 pagesEngg. Economics ProjectkawtharPas encore d'évaluation

- ExcerciseDocument10 pagesExcercisehafizulPas encore d'évaluation

- GDV: TDC:: Per PeriodDocument9 pagesGDV: TDC:: Per PeriodM. HfizzPas encore d'évaluation

- Moneycontrol P&LDocument2 pagesMoneycontrol P&Lveda sai kiranmayee rasagna somaraju AP22322130023Pas encore d'évaluation

- Component Cost Per Unit Model No. of Units 1 2 3 4 5 6 BAS GOO - ADV TOP No. of Components Required Component CostDocument6 pagesComponent Cost Per Unit Model No. of Units 1 2 3 4 5 6 BAS GOO - ADV TOP No. of Components Required Component CostAnmol KaurPas encore d'évaluation

- MockDocument5 pagesMockamna noorPas encore d'évaluation

- Pricing Strategy: I I O M, BDocument5 pagesPricing Strategy: I I O M, BPraveen RevankarPas encore d'évaluation

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiPas encore d'évaluation

- Assignment Capital BudgetingDocument29 pagesAssignment Capital BudgetingYasha Sahu0% (1)

- Front Valuation Page: Un-Levered Firm ValueDocument61 pagesFront Valuation Page: Un-Levered Firm Valueneelakanta srikar100% (1)

- BAV Assignment-1 Group8Document18 pagesBAV Assignment-1 Group8Aakash SinghalPas encore d'évaluation

- DCF Case StudyDocument17 pagesDCF Case StudyVivekananda RPas encore d'évaluation

- FMIBDocument10 pagesFMIBVu Ngoc QuyPas encore d'évaluation

- Ondo East 2022 Finalt BudgetDocument182 pagesOndo East 2022 Finalt Budgetojo bamidelePas encore d'évaluation

- Feasibility WorksheetDocument2 pagesFeasibility WorksheetjscansinoPas encore d'évaluation

- SPW - Cash - Flow - CopyDocument21 pagesSPW - Cash - Flow - CopyKulkarni AbhiramPas encore d'évaluation

- 34 - Neha Sabharwal - Panacea BiotechDocument10 pages34 - Neha Sabharwal - Panacea Biotechrajat_singlaPas encore d'évaluation

- NPV ClassworkDocument3 pagesNPV ClassworkRicardo PuyolPas encore d'évaluation

- Book 1Document1 pageBook 1api-324903184Pas encore d'évaluation

- SL2-Corporate Finance Ristk ManagementDocument17 pagesSL2-Corporate Finance Ristk ManagementKrishantha WeerasiriPas encore d'évaluation

- CH-3 Finance (Parth)Document11 pagesCH-3 Finance (Parth)princePas encore d'évaluation

- Q4 2020 Revenue PerformanceDocument11 pagesQ4 2020 Revenue PerformanceVoiture GermanPas encore d'évaluation

- Hina Naveed Sumission#4 Nishat Power LTDDocument10 pagesHina Naveed Sumission#4 Nishat Power LTDSaeed MahmoodPas encore d'évaluation

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwPas encore d'évaluation

- Financial Analysis Template (NPV, IRR & PP)Document11 pagesFinancial Analysis Template (NPV, IRR & PP)charlainecebrian22Pas encore d'évaluation

- Chino Materials Systems Capital Budgeting SolutionDocument12 pagesChino Materials Systems Capital Budgeting Solutionalka murarka100% (1)

- Poultry - CBA 123Document9 pagesPoultry - CBA 123johnzenbano120Pas encore d'évaluation

- Project Solution 1 - SampleDocument11 pagesProject Solution 1 - SampleNguyễn Diệu LinhPas encore d'évaluation

- Análise HCB 260323Document4 pagesAnálise HCB 260323IlidiomozPas encore d'évaluation

- TSU - Public AdminDocument45 pagesTSU - Public AdminaileenrconcepcionPas encore d'évaluation

- Listed Companies Highlights: Financial FocusDocument1 pageListed Companies Highlights: Financial FocusT'Tee MiniOns'TmvsPas encore d'évaluation

- Schedule - I Calculation of Sales RevenueDocument20 pagesSchedule - I Calculation of Sales RevenueRohitPas encore d'évaluation