Académique Documents

Professionnel Documents

Culture Documents

Prism Cement LTD.: Structure of Current Assets

Transféré par

Javeed Ghany MTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Prism Cement LTD.: Structure of Current Assets

Transféré par

Javeed Ghany MDroits d'auteur :

Formats disponibles

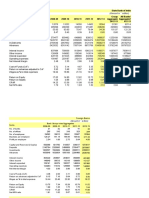

Liquidity ratios (times)

Prism Cement Ltd. Jun 2005 Jun 2006 Jun 2007 Jun 2008 Mar 2009 Mar 2010

(Non-Annualised) 12 mths 12 mths 12 mths 12 mths 9 mths 12 mths

-

Cash to current liabilities 0.0873067916 0.1584009051 0.072904898 0.1027337212 0.1558577406 0.0910167131

Cash to avg. cost of sales 7.1597247069 10.550403469 6.0545416056 6.1771000184 12.073290625 7.2183448897

Quick ratio 0.3844496487 0.4393739393 0.2566624576 0.4149199012 0.4295427376 0.5516713092

Current ratio 1.0638875878 1.1554780313 0.9450388782 1.3078823623 1.183726838 1.1513579387

Current ratio (incl. mktbl. securites) 1.0638875878 1.1554780313 1.8878846282 3.3111500757 1.6006425583 1.2204387187

Debt to equity ratio 1.2484100262 0.4291792588 0 0 0 0.6853954681

Interest cover 3.1063492063 6.2235772358 73.980099502 216.44217687 99.754966887 8.5845580625

Interest incidence (%) 7.2718878052 10.084328883 7.4492726767 Error Error 12.053844331

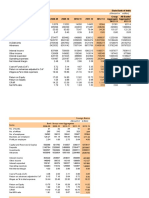

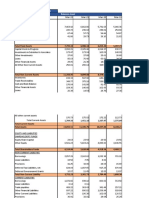

Structure of current assets

Inventories 61.16 61.78 85.22 90.35 76.9 274.24

Sundry debtors (outstanding less than six mont 10.5 11.46 1.46 1.55 0 199.62

Sundry debtors (outstanding over six months) 2.39 3.09 2.11 1.83 0 11.46

Bills receivable 0 0 0 0 0 0

Acccured income, lease rent & other receivable 21.22 18.34 26.19 37.62 36.63 64.98

Expenses paid in advance 0 0 0 0 1.37 6.57

Deposits 8.98 11.08 16.25 19.86 22.67 52.19

Sale of investments & other receivables 0 0 0 0 0 0

Cash & bank balance 9.4 16.91 11.04 12.97 25.87 52.5

Structure of current assets (%)

Inventories 53.852249714 50.412076703 59.929676512 55.05789153 48.538786846 41.467323918

Sundry debtors (outstanding less than six mont 9.2453993132 9.3512851897 1.0267229255 0.9445460085 0 30.184171531

Sundry debtors (outstanding over six months) 2.1044289865 2.5214198286 1.4838255978 1.1151736746 0 1.732845435

Bills receivable 0 0 0 0 0 0

Acccured income, lease rent & other receivable 18.684511755 14.965320277 18.417721519 22.925045704 23.120621094 9.8255057913

Expenses paid in advance 0 0 0 0 0.8647352143 0.9934375662

Deposits 7.9070176983 9.0412076703 11.427566807 12.1023766 14.309158619 7.8915535126

Sale of investments & other receivables 0 0 0 0 0 0

Cash & bank balance 8.2768336709 13.798449612 7.7637130802 7.9037172456 16.328978098 7.93842804

Net working capital 6.82 16.49 -8.27 38.63 24.59 86.94

Net working capital (as per cost of sales method 178.57558706 192.38452503 228.20231704 279.97758013 353.83627889 86.47941745

Current ratio Debt to equity ratio

Working cycle & turnover ratios

Prism Cement Ltd. Jun 2005 Jun 2006 Jun 2007 Jun 2008 Mar 2009 Mar 2010

Rs. Crore (Non-Annualised) 12 mths 12 mths 12 mths 12 mths 9 mths 12 mths

-

Working cycle (days)

Raw material cycle 179.12872382 175.01645624 187.84334971 185.18729349 264.04103566 60.209628231

WIP cycle 16.015118207 11.260383992 15.997696023 12.384779908 8.1471018301 4.3189070368

Finished goods cycle 4.5708542925 5.0773816693 3.8717055025 2.1061562902 1.7131802613 6.7523557159

Debtors 12.923030566 8.9340925487 4.9205604836 2.2117747257 1.4594889332 13.462689908

Gross working capital cycle 212.63772688 200.28831445 212.63331172 201.89000442 275.36080669 84.743580892

Creditors 75.454031309 79.470793015 86.684321466 67.720142868 70.568465899 72.803292809

Net working capital cycle 137.18369557 120.81752144 125.94899025 134.16986155 204.79234079 11.940288084

Turnover ratios (times)

Raw material turnover 1.5236580517 1.5791605716 1.4569102648 1.558434204 1.382360886 6.0621533586

Finished goods turnover 25.27287234 34.96 55.434199497 123.04684976 212.33670034 23.947549597

Debtors turnover 28.244148936 40.854736842 74.178541492 165.02584814 250.08754209 27.111966664

Creditors turnover 8.6144509767 9.2899073929 7.5407444046 9.2341137124 8.2196438208 10.471905327

Vous aimerez peut-être aussi

- SBI AND ASSOCIATES FINANCIAL PERFORMANCEDocument9 pagesSBI AND ASSOCIATES FINANCIAL PERFORMANCENehal Sharma 2027244Pas encore d'évaluation

- Group 9 - ONGC - MA ProjectDocument11 pagesGroup 9 - ONGC - MA ProjectShubham JainPas encore d'évaluation

- Balance Sheet - Subros: Optimistic Senario Normal ScenarioDocument9 pagesBalance Sheet - Subros: Optimistic Senario Normal ScenarioAnonymous tgYyno0w6Pas encore d'évaluation

- Accounts Case Study On Ratio AnalysisDocument6 pagesAccounts Case Study On Ratio AnalysisRADHIKA.J 19MCO033Pas encore d'évaluation

- UntitledDocument10 pagesUntitlednupur malhotraPas encore d'évaluation

- Bibliography: Edition) - Allahabad, India: Chaitanya Publishing HouseDocument5 pagesBibliography: Edition) - Allahabad, India: Chaitanya Publishing HouseSocialist GopalPas encore d'évaluation

- Adani Power Ltd. - Balance Sheet - Consolidated: INR CroresDocument46 pagesAdani Power Ltd. - Balance Sheet - Consolidated: INR CroresIshan ShahPas encore d'évaluation

- APB30091213FDocument9 pagesAPB30091213FAshaPas encore d'évaluation

- APB30091213FDocument9 pagesAPB30091213FMoorthy EsakkyPas encore d'évaluation

- Ultratech Cement LTD.: Total IncomeDocument36 pagesUltratech Cement LTD.: Total IncomeRezwan KhanPas encore d'évaluation

- Institute Program Year Subject Project Name Company Competitor CompanyDocument37 pagesInstitute Program Year Subject Project Name Company Competitor CompanyEashaa SaraogiPas encore d'évaluation

- Agneesh Dutta (PGFB2106) - Investment ManagementDocument71 pagesAgneesh Dutta (PGFB2106) - Investment ManagementAgneesh DuttaPas encore d'évaluation

- D-Mart Pranjali Agarwal - NMIMS BDocument440 pagesD-Mart Pranjali Agarwal - NMIMS BDewashish RaiPas encore d'évaluation

- Maruti Suzuki Balance SheetDocument6 pagesMaruti Suzuki Balance SheetMasoud AfzaliPas encore d'évaluation

- Financial performance and ratios of manufacturing companyDocument6 pagesFinancial performance and ratios of manufacturing companyShubham RankaPas encore d'évaluation

- Powegrid Financial ModelDocument14 pagesPowegrid Financial ModelPALASH SHAHPas encore d'évaluation

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDocument6 pagesCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaPas encore d'évaluation

- Indian Oil 17Document2 pagesIndian Oil 17Ramesh AnkithaPas encore d'évaluation

- SAIL Balance Sheet Shows Over Rs 29,000 Cr in ReservesDocument1 pageSAIL Balance Sheet Shows Over Rs 29,000 Cr in ReservesAishwaryaGopalPas encore d'évaluation

- STATE BANK OF INDIA ANALYSISDocument21 pagesSTATE BANK OF INDIA ANALYSISsarthak bhusalPas encore d'évaluation

- Project Management AccountingDocument10 pagesProject Management AccountingDiwaker LohaniPas encore d'évaluation

- V MartDocument44 pagesV MartPankaj SankholiaPas encore d'évaluation

- 39828211-ValuationDocument13 pages39828211-ValuationDian AgustianPas encore d'évaluation

- Financial Modelling AssignmentDocument24 pagesFinancial Modelling Assignmentaditiyab-pgdm-2022-24Pas encore d'évaluation

- Financial Statement Analysis: Indian Hotels Co. LTDDocument4 pagesFinancial Statement Analysis: Indian Hotels Co. LTDaayush vermaPas encore d'évaluation

- Raymond Balance Sheet Trend AnalysisDocument635 pagesRaymond Balance Sheet Trend AnalysisShashank PatelPas encore d'évaluation

- Comparative Balance Sheets Over 6 YearsDocument3 pagesComparative Balance Sheets Over 6 Yearsanshuman chowbeyPas encore d'évaluation

- Comparative Balance Sheet: Share Capital Reserves Total Equity Share WarrantsDocument3 pagesComparative Balance Sheet: Share Capital Reserves Total Equity Share Warrantsanshuman chowbeyPas encore d'évaluation

- Abridged Statement - Sheet1 - 2Document1 pageAbridged Statement - Sheet1 - 2KushagraPas encore d'évaluation

- Du Pont AnalysisDocument5 pagesDu Pont Analysisbhavani67% (3)

- Ratio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of PakistanDocument17 pagesRatio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of Pakistanshurahbeel75% (4)

- Percent To Sales MethodDocument8 pagesPercent To Sales Methodmother25janPas encore d'évaluation

- Balance Sheet (2009-2003) of TCS (US Format)Document15 pagesBalance Sheet (2009-2003) of TCS (US Format)Girish RamachandraPas encore d'évaluation

- Balance Sheet (2009-2000) in US Format For Tata Motors: All Numbers Are in INR and in x10MDocument16 pagesBalance Sheet (2009-2000) in US Format For Tata Motors: All Numbers Are in INR and in x10MGirish RamachandraPas encore d'évaluation

- ITC LTDDocument27 pagesITC LTDSneha BhartiPas encore d'évaluation

- All Numbers Are in INR and in x10MDocument6 pagesAll Numbers Are in INR and in x10MGirish RamachandraPas encore d'évaluation

- Hindalco Ratio Analysis Reveals Declining Liquidity, Rising ProfitabilityDocument13 pagesHindalco Ratio Analysis Reveals Declining Liquidity, Rising ProfitabilitySmall Town BandaPas encore d'évaluation

- Company Analysis - Format Basic - VardhamanDocument8 pagesCompany Analysis - Format Basic - VardhamanSuyashi BansalPas encore d'évaluation

- Ajanta Pharma LTD.: Net Fixed AssetsDocument4 pagesAjanta Pharma LTD.: Net Fixed AssetsDeepak DashPas encore d'évaluation

- VERTICAL LIABILITIES 1Document4 pagesVERTICAL LIABILITIES 1NL CastañaresPas encore d'évaluation

- My RatioDocument2 pagesMy RatioRahul PatelPas encore d'évaluation

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaPas encore d'évaluation

- (Billions) : Q2 2012 Data, Except Where NotedDocument17 pages(Billions) : Q2 2012 Data, Except Where Notedchatterjee rikPas encore d'évaluation

- Last 5 Years Balance Sheet of Tata Steel Limited: Particulars Mar'19 Mar'18 Mar'17 Mar'16 Mar'15Document5 pagesLast 5 Years Balance Sheet of Tata Steel Limited: Particulars Mar'19 Mar'18 Mar'17 Mar'16 Mar'15Sai Jithin KalayanamPas encore d'évaluation

- Financial Forecasting: Revenue, Costs, Profits, EPSDocument54 pagesFinancial Forecasting: Revenue, Costs, Profits, EPSRonakk MoondraPas encore d'évaluation

- Company Financial Analysis and Ratio Comparison Over 5 YearsDocument6 pagesCompany Financial Analysis and Ratio Comparison Over 5 YearsAanchal MahajanPas encore d'évaluation

- Punjab National BankDocument7 pagesPunjab National BankSandeep PareekPas encore d'évaluation

- Industry AvaragesDocument81 pagesIndustry Avaragessandeep kumarPas encore d'évaluation

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LohePas encore d'évaluation

- HDFC Axis DataDocument7 pagesHDFC Axis DataShruti KumariPas encore d'évaluation

- Grasim Balance SheetDocument2 pagesGrasim Balance Sheetrjaman9981Pas encore d'évaluation

- Ulars: Total Total Total Equity and LiabilitiesDocument4 pagesUlars: Total Total Total Equity and LiabilitiespritamPas encore d'évaluation

- Balance Sheet (2009-2001) of Maruti Suzuki: All Numbers Are in INR and in x10MDocument16 pagesBalance Sheet (2009-2001) of Maruti Suzuki: All Numbers Are in INR and in x10MGirish RamachandraPas encore d'évaluation

- Afs - QTLDocument6 pagesAfs - QTLKashif SaleemPas encore d'évaluation

- Horizontal & Vertical AnalysisDocument7 pagesHorizontal & Vertical AnalysisMisha SaeedPas encore d'évaluation

- EBL Balance Sheet and Profit AnalysisDocument21 pagesEBL Balance Sheet and Profit AnalysisDeepakPas encore d'évaluation

- Assets and Financial RatiosDocument15 pagesAssets and Financial RatiosBushraKhanPas encore d'évaluation

- Amount in Rupees CroreDocument40 pagesAmount in Rupees CrorePradeep MulaniPas encore d'évaluation

- Swot Analysis I. Strenghts: WeaknessesDocument5 pagesSwot Analysis I. Strenghts: WeaknessesNiveditha MPas encore d'évaluation

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyD'EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyPas encore d'évaluation

- 22.BBMA TechniqueDocument13 pages22.BBMA Techniquedrive01100% (7)

- Chapter 6 Cfas ReviewerDocument2 pagesChapter 6 Cfas ReviewerBabeEbab AndreiPas encore d'évaluation

- Managing Markets: J Sainsbury's PLCDocument10 pagesManaging Markets: J Sainsbury's PLCnobinkphilipPas encore d'évaluation

- 9023 - Joint ArrangementDocument4 pages9023 - Joint ArrangementAljur SalamedaPas encore d'évaluation

- Terminal ReportDocument3 pagesTerminal ReportVince YuPas encore d'évaluation

- The Wealth Report 2023Document35 pagesThe Wealth Report 2023kevinchung.sgPas encore d'évaluation

- Impact of FDI On Indian Entrepreneurship: Presented byDocument23 pagesImpact of FDI On Indian Entrepreneurship: Presented byAbhishek guptaPas encore d'évaluation

- Acct Statement - XX4264 - 29012023Document1 pageAcct Statement - XX4264 - 29012023Pritam GoswamiPas encore d'évaluation

- Percentage TaxDocument7 pagesPercentage TaxKyla Joy T. SanchezPas encore d'évaluation

- Nike Shoes ProjectDocument48 pagesNike Shoes ProjectPrateek AwasthiPas encore d'évaluation

- GST Tax Invoice Format For GoodsDocument3 pagesGST Tax Invoice Format For GoodsYaser Ali TariqPas encore d'évaluation

- Activity Assignment HND IBLDocument6 pagesActivity Assignment HND IBLOM Pk50% (2)

- Exercise 3 Adjusting Entries - Service BusinessDocument2 pagesExercise 3 Adjusting Entries - Service BusinessMarc Viduya75% (4)

- ForbesDocument140 pagesForbesobee1234Pas encore d'évaluation

- Statement of Axis Account No:244010100125703 For The Period (From: 01-01-2021 To: 31-12-2021)Document2 pagesStatement of Axis Account No:244010100125703 For The Period (From: 01-01-2021 To: 31-12-2021)nageswara reddyPas encore d'évaluation

- Microeconomics RevisionDocument3 pagesMicroeconomics Revision白鸟Pas encore d'évaluation

- Financial Management (Chapter 18: Working Capital Management)Document25 pagesFinancial Management (Chapter 18: Working Capital Management)kaylePas encore d'évaluation

- The Mathematics of Credit DerivativesDocument64 pagesThe Mathematics of Credit DerivativesMartin Martin MartinPas encore d'évaluation

- FAR T123 ASM-2-1-3 CaseStudy v3.1Document4 pagesFAR T123 ASM-2-1-3 CaseStudy v3.1fgbonaPas encore d'évaluation

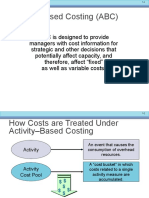

- Activity Based CostingDocument12 pagesActivity Based CostingMuhammad Imran AwanPas encore d'évaluation

- Foreign Exchange (FX) and Precious Metal (PM) Spot, Forward & SwapsDocument1 pageForeign Exchange (FX) and Precious Metal (PM) Spot, Forward & SwapsAdrian TurionPas encore d'évaluation

- METALLURGY IN BULGARIA - 2018 - EngDocument75 pagesMETALLURGY IN BULGARIA - 2018 - EngYogesh GuptaPas encore d'évaluation

- Abbah King Cement CorpDocument3 pagesAbbah King Cement Corphermestroyyap04Pas encore d'évaluation

- Advantages Disadvantages of A Partnerships PULALONLONTAJODocument6 pagesAdvantages Disadvantages of A Partnerships PULALONLONTAJOJv JulianPas encore d'évaluation

- Chapter 14 STRATEGIES FOR FIRM GROWTHDocument24 pagesChapter 14 STRATEGIES FOR FIRM GROWTHKishoPas encore d'évaluation

- Unit 1 Introduction To EstimationDocument6 pagesUnit 1 Introduction To EstimationNidhi Mehta100% (1)

- Accounting Chapter 6Document2 pagesAccounting Chapter 6Kelvin Rex SumayaoPas encore d'évaluation

- BARANGAY SUMINUNGGAY (C.O) BOOK (Autosaved) 1Document68 pagesBARANGAY SUMINUNGGAY (C.O) BOOK (Autosaved) 1Yusoph IbrahimPas encore d'évaluation

- CustomsDocument4 pagesCustomsVidit JainPas encore d'évaluation

- Environment SeminarDocument7 pagesEnvironment SeminarSuraj Srivatsav.SPas encore d'évaluation