Académique Documents

Professionnel Documents

Culture Documents

CUC International Case Study.: Business Analysis and Valuation

Transféré par

vikasmax50Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CUC International Case Study.: Business Analysis and Valuation

Transféré par

vikasmax50Droits d'auteur :

Formats disponibles

Concise :CUC International Case Study. By: Vikash Anand Saptarshi Bhattacharya Hemant Khosla Business Model: 1.

Membership based customer service company 2. Recurring revenues using member ship renewal 3. Direct selling and no inventory 4. Varieties of new member ship based products- traveler advantage ,auto Vantage, premier dining 5. Marketing channel direct marketing approaches 6. Main determinant of profitability is membership renewable premium

Risk in business:

Business Risk and Financial Risk Business Risk: 1. High uncertain in future renewable rate. 2. Undervaluation due to asymmetric information leads to fall in share prices. 3. Dependency on financial service industry like credit cards companies

Investors Concerned about COC: 1. Capitalized marketing cost has to be written off due to uncertainty. 2. Concerns over companies accounting methods 3. Delay write down of membership acquisition cost : Ans 3. Cash and cash equivalents at the end of 1988 =$25,953,000

Net Income at the year ended 1988= $17,423,000 Supposing, the company considers a large stock repurchase or one-time dividend payment of $25,953000, using debt No. of shares= 19.4 million Dividend Per Share= ($25,953,000/(19.4*1000000))= $1.33 Assuming the price of share being $16.3 Dividend Yield = (1.33/16.3)*100 = 8.15% Dividend Payout = (25,953,000/17,423,000)*100= 148% Generally, median dividend payout of listed companies is in the range of 65-70%. Dividend payout of 148% and yield of 8.15% yield would signal positively to the shareholders regarding the prospects of the company. Market to Book Equity= 16.3/5.83= 2.79 Considering repurchase shares at market price, total purchase not exceeding $25,953,000. No. of shares repurchased= 25,953,000/16.3= 1592208 No. of outstanding shares = 19.4m 1592208 = 17.8 million New EPS = 0.9*19.4/17.8= $0.98 Percentage increase in EPS= (0.08/0.90)*100 = 8.88% Considering the amount of debt $25,953,000 to be paid back at 10% Interest Paid= $2,595,300 Interest Coverage= EBIT/Interest = 31,440,000/2,595,300= 12.11 Since, Interest Coverage is high CUC will be able to service its debt.

Ans 4. CUC should adopt a more conservative policy to account for membership acquisition costs. By writing off previously capitalized expenses and adopting a policy of expensing future outlays as incurred, the firm would be able to eliminate the major analysts criticism

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Job SitDocument1 pageJob Sitvikasmax50Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Coastal Zones of India PDFDocument609 pagesCoastal Zones of India PDFvikasmax50100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Cabbage StrategyDocument2 pagesCabbage Strategyvikasmax50Pas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Rupee Crisis StepsDocument1 pageRupee Crisis Stepsvikasmax50Pas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Denundation PDFDocument1 pageDenundation PDFvikasmax50Pas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Food Security Bill 2013Document3 pagesFood Security Bill 2013vikasmax50Pas encore d'évaluation

- Bio FortificationDocument1 pageBio Fortificationvikasmax50Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- History of IndiaDocument367 pagesHistory of IndiaViraj DhuratPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

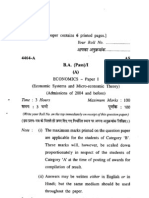

- B A (Pass) - I (A) Economics - Paper I (Economiic Systams and Micro - Econanic)Document6 pagesB A (Pass) - I (A) Economics - Paper I (Economiic Systams and Micro - Econanic)vikasmax50Pas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Modern India A History Textbook For Class XII Chandra BipanDocument317 pagesModern India A History Textbook For Class XII Chandra Bipanvikasmax500% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- CUC International Case Study.: Business Analysis and ValuationDocument3 pagesCUC International Case Study.: Business Analysis and Valuationvikasmax50100% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Ram Narayan Singh Letter HeadDocument1 pageRam Narayan Singh Letter Headvikasmax50Pas encore d'évaluation

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Accounting BetaDocument12 pagesAccounting Betavikasmax50Pas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Xuberence 2010 XIMBDocument12 pagesXuberence 2010 XIMBvikasmax50Pas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)