Académique Documents

Professionnel Documents

Culture Documents

Computation of Total Income Income From Salary (Chapter IV A) 219179

Transféré par

psharma_100123456Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Computation of Total Income Income From Salary (Chapter IV A) 219179

Transféré par

psharma_100123456Droits d'auteur :

Formats disponibles

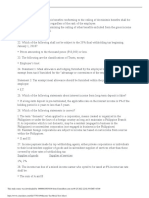

Name of Assessee Father's Name Address Office Status Ward PAN

Mr AJMER KAUR Sh SARWAG SINGH KOTHI NUMBER-1 PHASE-2 MOHALI Individual MOHALI () AKLPK5629E Assessment Year Year Ended Date of Birth 2011-2012 31.03.2011 29/06/23

Computation of Total Income Income from Salary (Chapter IV A) Salary Income from House Property (Chapter IV C) MAAN COMPLEX, SECTOR-70, Annual Rental Value u/s 23 Less: Deduction u/s 24(a) 219179 449191 219179

338101 101430 101430 236671

SCO 958, SECOND FLOOR, SECTOR-70 Annual Rental Value u/s 23 Less: Deduction u/s 24(a)

128400 38520 38520 89880

MANN COMPLEX , MOHALI Annual Rental Value u/s 23 Less: Deduction u/s 24(a)

89100 26730 26730 62370

FF8, RAJ GURU NAGAR Annual Rental Value u/s 23 Less: Deduction u/s 24(a)

86100 25830 25830 60270

Income from Other Sources (Chapter IV F) Interest From Bank Gross Total Income Less: Deductions (Chapter VI-A) u/s 80DDB (expenses Incurred Rs. 60000/-) 2384

2384

670754

40000

NAME OF ASSESSEE : AJMER KAUR

A. Y.2011-2012

PAN : AKLPK5629E

Total Income Round off u/s 288 A Agriculture Income Gross Tax Payable Rebate Agriculture Income Tax Due (Exemption Limit Rs. 240000) Educational Cess T.D.S. Advance Tax Interest u/s 234 A/B/C Deposit u/s 140(A) Tax Payable Interest Charged u/s 234C (660+0+21) (Rs.) 681 T.D.S./ T.C.S. From Non-Salary 173675 66300 107375 3221 110596 36934 73662 71500 2162 681 2843 2840 0

40000 630754 630750 461500

36934

Interest calculated upto May, 2011, Due Date for filing of Return July 31, 2011

Prepaid taxes (Advance tax and Self assessment tax) Sr.No. BSR Code Date Challan No Bank Name & Branch 1 0007884 03/12/10 00006 SBI SBI,S S I MOHALI 2 0007884 18/05/11 0003 SBI SBI,S S I MOHALI Total

Details of T.D.S. on Non Salary

S.No Name and address of the person who deducted the tax City State Pin Tax deduction A/C No. of the deductor PTLA1264 9A PTLG1506 6C PTLA1264 9A PTLG1506 6C PTLA1264 9A PTLG1506 6C PTLA1264 9A PTLA1264 9A PTLA1264 9A Date of payment /credit Amount paid/ credited (Rs.) Tax deducted including surcharge and education cess 2415 1040 1040 2415 2415 1040 1040 2415 2415 1040 1040 5998 5998 6052 6052 6052 6052 Amount out of (10) to be allowed as credit during the year 2415

Amount 71500 2840 74340

1 2

AK SPEAK WIRELESS P LTD 404, PHASE-4, MOHALI GALLANT SPINAL THERAPY SERVICES MANN COMPLEX,SECTOR-70 AK SPEAK WIRELESS P LTD 404, PHASE-4, MOHALI GALLANT SPINAL THERAPY SERVICES MANN COMPLEX,SECTOR-70 AK SPEAK WIRELESS P LTD 404, PHASE-4, MOHALI GALLANT SPINAL THERAPY SERVICES MANN COMPLEX,SECTOR-70 AK SPEAK WIRELESS P LTD 404, PHASE-4, MOHALI AK SPEAK WIRELESS P LTD 404, PHASE-4, MOHALI AK SPEAK WIRELESS P LTD 404, PHASE-4, MOHALI

MOHALI MOHALI

PUNJAB PUNJAB

160059 160071

09/04/10 30/04/10

24150 10400

3 4

MOHALI MOHALI

PUNJAB PUNJAB

160059 160071

13/05/10 31/05/10

24150 10400

5 6

MOHALI MOHALI

PUNJAB PUNJAB

160059 160071

01/06/10 30/06/10

24150 10400

7 8 9

MOHALI MOHALI MOHALI

PUNJAB PUNJAB PUNJAB

160059 160059 160059

08/12/10 09/01/11 05/02/11

59982 60505 60507

Page 2

NAME OF ASSESSEE : AJMER KAUR

10 AK SPEAK WIRELESS P LTD 404, PHASE-4, MOHALI TOTAL MOHALI

A. Y.2011-2012

PUNJAB 160059

PAN : AKLPK5629E

PTLA1264 9A 07/03/11 84657 369301 8467 8467 36934 36934

Signature (AJMER KAUR)

COMPUTAX P07 Professional Softec Pvt. Ltd.

Page 3

Vous aimerez peut-être aussi

- Ashok Kumar Paul 2010Document5 pagesAshok Kumar Paul 2010LoveSahilSharmaPas encore d'évaluation

- Manisha SfubramaniamDocument2 pagesManisha SfubramaniamSudhir KumarPas encore d'évaluation

- Computation of Total Income Income From Salary (Chapter IV A) 1696258Document3 pagesComputation of Total Income Income From Salary (Chapter IV A) 1696258amit22505Pas encore d'évaluation

- Quarterly Statement of Tax Collection at Source Under Section 206C of The I.T.Act, 1961 For The Quarter Ended September (Year) 2012Document7 pagesQuarterly Statement of Tax Collection at Source Under Section 206C of The I.T.Act, 1961 For The Quarter Ended September (Year) 2012amit22505Pas encore d'évaluation

- Sumona Chakraborty 2010Document6 pagesSumona Chakraborty 2010LoveSahilSharmaPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document5 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- IT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsDocument106 pagesIT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsnarayanan630% (1)

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalPas encore d'évaluation

- QUA04354 Form16Document3 pagesQUA04354 Form16rajanPas encore d'évaluation

- Vishwanath ComputationDocument14 pagesVishwanath ComputationAryan KumarPas encore d'évaluation

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountJyotirmay SahuPas encore d'évaluation

- Excel Payroll AdministrationDocument12 pagesExcel Payroll AdministrationBen AsamoahPas encore d'évaluation

- Income Tax Calculator Fy 2014-15 Ay 2015-16Document10 pagesIncome Tax Calculator Fy 2014-15 Ay 2015-16B GANAPATHY100% (1)

- Income Tax Calculator F.Y.12-13Document4 pagesIncome Tax Calculator F.Y.12-13reamer27Pas encore d'évaluation

- Rakesh BorlikarDocument4 pagesRakesh BorlikarShiv ReddyPas encore d'évaluation

- Ani Enterprise.10 11Document2 pagesAni Enterprise.10 11Raju RavalPas encore d'évaluation

- Form 16Document3 pagesForm 16Alla VijayPas encore d'évaluation

- Form16Document10 pagesForm16anon-263698Pas encore d'évaluation

- Comviva Technologies Limited: Pay Slip For The Month of April 2012Document1 pageComviva Technologies Limited: Pay Slip For The Month of April 2012Prabhakar KumarPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Fill in The Data Below: 0706764 B. Sankar SinghDocument24 pagesFill in The Data Below: 0706764 B. Sankar SinghMurali Krishna VPas encore d'évaluation

- PDF ReportsDocument3 pagesPDF ReportsSIVAPas encore d'évaluation

- Udhayakumar Rice MillDocument12 pagesUdhayakumar Rice Millcachandhiran0% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Taxmann BooksDocument32 pagesTaxmann BooksSameer Husain0% (1)

- Summary of Tax Deducted at Source: Part-ADocument5 pagesSummary of Tax Deducted at Source: Part-Achakrala_sirishPas encore d'évaluation

- Ankit HandloomDocument33 pagesAnkit HandloomSumeet SomaniPas encore d'évaluation

- Serv Let Control Le 11 RDocument2 pagesServ Let Control Le 11 Rgourav_bhardwajPas encore d'évaluation

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediPas encore d'évaluation

- Earnings: 10 Ca (PH Allowance)Document15 pagesEarnings: 10 Ca (PH Allowance)asrahaman9Pas encore d'évaluation

- Salary Slip For The Month of February 2014: Design & Engineering LTDDocument1 pageSalary Slip For The Month of February 2014: Design & Engineering LTDSaraswatapalitPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- TUYIYUDocument408 pagesTUYIYUAmarjeet KumarPas encore d'évaluation

- IT Calculator, Mohandas 2013Document36 pagesIT Calculator, Mohandas 2013DEEPTHISAIPas encore d'évaluation

- MPR Format (4 Panchayats)Document10 pagesMPR Format (4 Panchayats)rajt_26Pas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- SNO Po - No Shipment Date CUR Amount Rate Amount (RS.) : For ApprovalDocument16 pagesSNO Po - No Shipment Date CUR Amount Rate Amount (RS.) : For ApprovalJUNAIDALMPas encore d'évaluation

- 212619X Form16Document1 page212619X Form16Ajay KumarPas encore d'évaluation

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123Pas encore d'évaluation

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Kotaka Form16 41970Document4 pagesKotaka Form16 41970sai_gsrajuPas encore d'évaluation

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankPas encore d'évaluation

- FNDWRRDocument1 pageFNDWRRsreenidsPas encore d'évaluation

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Tally ERP AssignmentDocument42 pagesTally ERP Assignmentdisha_200983% (93)

- Apr'15 - Reports For MeetingDocument282 pagesApr'15 - Reports For MeetingJeetu RajPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- R.V. Nerurkar High School - Form 16 1Document180 pagesR.V. Nerurkar High School - Form 16 1rvnjcPas encore d'évaluation

- MR Krishan Kumar Yadav (L0351)Document1 pageMR Krishan Kumar Yadav (L0351)Shankar BanjaraPas encore d'évaluation

- Ashokkumar Form 16Document4 pagesAshokkumar Form 16sundar1111Pas encore d'évaluation

- Individual Assessment Year 2009-10 Pan No.Document10 pagesIndividual Assessment Year 2009-10 Pan No.Harshit DavePas encore d'évaluation

- FORM No. 16Document31 pagesFORM No. 16sebastianksPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Siva Agencies April 2015 Vat Payment ReceiptDocument1 pageSiva Agencies April 2015 Vat Payment ReceiptGavaskar VelayuthamPas encore d'évaluation

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionD'EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionPas encore d'évaluation

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionD'EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionPas encore d'évaluation

- Se/Omc/Nalgonda - Pay Unit Code: 5112: Pay Slip For The Month of August - 2020Document1 pageSe/Omc/Nalgonda - Pay Unit Code: 5112: Pay Slip For The Month of August - 2020babu xeroxPas encore d'évaluation

- A Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaDocument2 pagesA Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaRamchanderPas encore d'évaluation

- Allocation of Corporate Costs To Divisions Dusty RhodesDocument1 pageAllocation of Corporate Costs To Divisions Dusty Rhodestrilocksp SinghPas encore d'évaluation

- Case 2 - Acco 420Document7 pagesCase 2 - Acco 420Wasif SethPas encore d'évaluation

- Quiz 4 - Gross IncomeDocument6 pagesQuiz 4 - Gross IncomeVanessa Grace100% (1)

- Chapter 5 - Coporation Income TaxDocument17 pagesChapter 5 - Coporation Income TaxTiến TrươngPas encore d'évaluation

- Assignment 1Document4 pagesAssignment 1Rozina TabassumPas encore d'évaluation

- Mcq's Tax ScannerDocument533 pagesMcq's Tax ScannerSajal DixitPas encore d'évaluation

- 15 Withholding TaxDocument14 pages15 Withholding TaxHaRry PeregrinoPas encore d'évaluation

- Final Income Statement AnalysisDocument2 pagesFinal Income Statement AnalysisMohammad TalhaPas encore d'évaluation

- Non-Trading ConcernDocument5 pagesNon-Trading ConcernveenaPas encore d'évaluation

- Botswana Unified Revenue Service: Tax Compliance SummaryDocument1 pageBotswana Unified Revenue Service: Tax Compliance SummaryGaone Lydia SetlhodiPas encore d'évaluation

- Ann Julienne Aristoza Income Tax MatrixDocument5 pagesAnn Julienne Aristoza Income Tax MatrixJul A.Pas encore d'évaluation

- Goleta City Council Budget WorkshopDocument144 pagesGoleta City Council Budget WorkshopBrooke TaylorPas encore d'évaluation

- Review Questions AkuanDocument3 pagesReview Questions Akuanhumaira9167% (3)

- IRS Notice 1444-DDocument2 pagesIRS Notice 1444-DCourier JournalPas encore d'évaluation

- Adjusting Journal EntriesDocument2 pagesAdjusting Journal EntriesMicah Danielle S. TORMONPas encore d'évaluation

- Income Tax Mock Test 3Document2 pagesIncome Tax Mock Test 3Mary Ellen LuceñaPas encore d'évaluation

- T2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationDocument9 pagesT2 Corporation Income Tax Return (2019 and Later Tax Years) : IdentificationBryan WilleyPas encore d'évaluation

- Inter Paper11Document553 pagesInter Paper11PANDUPas encore d'évaluation

- Profit-Margin-Formula Excel TemplateDocument4 pagesProfit-Margin-Formula Excel TemplateMustafa Ricky Pramana SePas encore d'évaluation

- Chapt 10 - Mixed Business TransactionsDocument6 pagesChapt 10 - Mixed Business TransactionsGemine Ailna Panganiban NuevoPas encore d'évaluation

- On June 1 of This Year J Larkin Optometrist Established The Larkin Eye Clinic The ClinicsDocument3 pagesOn June 1 of This Year J Larkin Optometrist Established The Larkin Eye Clinic The ClinicsCharlottePas encore d'évaluation

- URP Income Tax Part SolutionsDocument127 pagesURP Income Tax Part SolutionsSushant MaskeyPas encore d'évaluation

- The Hand Book For Jewellers by Venugopal.GDocument11 pagesThe Hand Book For Jewellers by Venugopal.GMadhusudhan Thulasi100% (1)

- Chapter 2 - Income From House PropertyDocument15 pagesChapter 2 - Income From House PropertyPuran GuptaPas encore d'évaluation

- Capital Gains TaxDocument38 pagesCapital Gains TaxRenievave TorculasPas encore d'évaluation

- CIR vs. Procter and GambleDocument3 pagesCIR vs. Procter and GambleRobPas encore d'évaluation

- Income Taxation Solution Manual 2019 Ed 2Document40 pagesIncome Taxation Solution Manual 2019 Ed 2Alexander DimaliposPas encore d'évaluation

- PAS 16 - Property, Plant and EquipmentDocument3 pagesPAS 16 - Property, Plant and EquipmentDEX MAYPas encore d'évaluation