Académique Documents

Professionnel Documents

Culture Documents

Asset Process For Local Reporting

Transféré par

Aditya KumarDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Asset Process For Local Reporting

Transféré par

Aditya KumarDroits d'auteur :

Formats disponibles

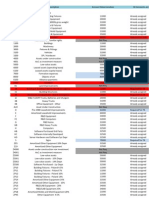

Fixed Asset & Depreciation for Local reporting:

The following solution is to use the existing Book depreciation correction for FICR and FIEU co codes where the local asset life is not correct. 01 Book Local Asset Life and LC 32 Book Local Asset Life and USD (Derived from 01) 30 Book US Asset life and LC 31 Book- US asset Life and USD (Derived from 30) So initially we planned to go in for separate depreciation book 40. Then it was told that the existing books may be corrected. As per the requirement we can correct the asset life as per local requirement After doing the same the next Depreciation run recalculates for the current year and post the difference amount. However the previous closed calendar year depreciation difference is not posted automatically. The difference amount may be posted as unplanned depreciation We have developed LSMW for correcting the asset life We have developed LSMW for posting Unplanned Depreciation for all the assets. The below screen shots give the details of the Unplanned depreciation posted.

Asset :215709

T.code ABZP. Tracsaction Type : 640.

Input File for Unplanned depreciation posting:

Asset value after posting the unplanned depreciation

Planned value and will get posted by AFAB run:

Vous aimerez peut-être aussi

- Parallel Ledgers in AssetDocument35 pagesParallel Ledgers in AssetSharad TiwariPas encore d'évaluation

- Offices of Nonresidential Real Estate Agents Revenues World Summary: Market Values & Financials by CountryD'EverandOffices of Nonresidential Real Estate Agents Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Events After The Reporting Period Final 6 KiloDocument13 pagesEvents After The Reporting Period Final 6 Kilonati100% (1)

- The Projected October 31 2011 Balance Sheet For Blanco CoDocument1 pageThe Projected October 31 2011 Balance Sheet For Blanco CoAmit PandeyPas encore d'évaluation

- Parallel LedgerDocument35 pagesParallel LedgerhshasapPas encore d'évaluation

- Parallel Ledgers in Asset AccountingDocument26 pagesParallel Ledgers in Asset AccountingHridya PrasadPas encore d'évaluation

- Ias 10 Events After Reporting PeriodDocument13 pagesIas 10 Events After Reporting Periodesulawyer2001Pas encore d'évaluation

- New GL: Parallel Ledger Doc Spliting Segment Repoting Co-Fi Online ReconcilitionDocument32 pagesNew GL: Parallel Ledger Doc Spliting Segment Repoting Co-Fi Online Reconcilitionvenki1986Pas encore d'évaluation

- Offices of Real Estate Agents & Brokers Revenues World Summary: Market Values & Financials by CountryD'EverandOffices of Real Estate Agents & Brokers Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Financial Reporting Final AttemptedDocument10 pagesFinancial Reporting Final AttemptedMAGOMU DAN DAVIDPas encore d'évaluation

- Lessors of Miscellaneous Nonresidential Buildings Revenues World Summary: Market Values & Financials by CountryD'EverandLessors of Miscellaneous Nonresidential Buildings Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- FFM LRP Questions 2019 To 2020Document42 pagesFFM LRP Questions 2019 To 2020Fatimah Rashidi VirtuousPas encore d'évaluation

- Programmazione e Controllo Esercizi Capitolo 7aDocument14 pagesProgrammazione e Controllo Esercizi Capitolo 7aMavzky RoquePas encore d'évaluation

- Nstro, Vostro and Mirror AccountsDocument18 pagesNstro, Vostro and Mirror AccountsPrerna RajoraPas encore d'évaluation

- FI - Q&A - DocumentDocument17 pagesFI - Q&A - DocumentD. Sai LaxmiPas encore d'évaluation

- FM-I AssignmentDocument2 pagesFM-I Assignmentgwakijira006Pas encore d'évaluation

- Parallel Ledger Management in SAP Fixed Assets ModuleDocument23 pagesParallel Ledger Management in SAP Fixed Assets ModuleJuan Diego GonzálezPas encore d'évaluation

- Fai Chapter 4Document16 pagesFai Chapter 4Hussien AdemPas encore d'évaluation

- Midterm 2 Review ProbsDocument10 pagesMidterm 2 Review ProbsLinda FangPas encore d'évaluation

- Sap Inhouse CM Acct EntriesDocument14 pagesSap Inhouse CM Acct EntriesNiranjan PatroPas encore d'évaluation

- Part ADocument6 pagesPart AUsama Riaz VlogsPas encore d'évaluation

- ACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionDocument14 pagesACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionXiaoying XuPas encore d'évaluation

- TB21 PDFDocument33 pagesTB21 PDFJi WonPas encore d'évaluation

- TB21Document33 pagesTB21Aiden Pats100% (1)

- SAP Workshop - Unit 2Document70 pagesSAP Workshop - Unit 2Iheanyi Achareke100% (1)

- General Ledger Breakup of Account PayablesDocument11 pagesGeneral Ledger Breakup of Account PayablesAnand SharmaPas encore d'évaluation

- Lessors of Real Estate Revenues World Summary: Market Values & Financials by CountryD'EverandLessors of Real Estate Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Accounting 101 - Final Exam Part 4Document15 pagesAccounting 101 - Final Exam Part 4AuroraPas encore d'évaluation

- Work in Process Calculation - For ProjectsDocument6 pagesWork in Process Calculation - For ProjectsgildlreiPas encore d'évaluation

- Interview Preperation Document 1Document45 pagesInterview Preperation Document 1krishnakumar k100% (1)

- Tfin50 1Document29 pagesTfin50 1Mohit KumarPas encore d'évaluation

- The Financial Statements and Notes of ZETA Corporation Are Reproduced Over The Next Several PagesDocument5 pagesThe Financial Statements and Notes of ZETA Corporation Are Reproduced Over The Next Several PagesJesia DjaduPas encore d'évaluation

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- FA HW JP Morgan + Case (Louis Faujour)Document2 pagesFA HW JP Morgan + Case (Louis Faujour)louis.faujour02Pas encore d'évaluation

- Document Types and Number RangesDocument20 pagesDocument Types and Number RangesNiharika MokaPas encore d'évaluation

- Chapter 4Document12 pagesChapter 4jeo beduaPas encore d'évaluation

- Article No.25intersol & FinacleDocument31 pagesArticle No.25intersol & FinacleMahendra VanzaraPas encore d'évaluation

- FMGHDocument3 pagesFMGHKeith Joanne SantiagoPas encore d'évaluation

- MM and SD - Manual Steps To CutoverDocument19 pagesMM and SD - Manual Steps To Cutovercmocatto100% (1)

- The Balance Sheet IdentityDocument2 pagesThe Balance Sheet IdentityAnonymous ji62REkBvPas encore d'évaluation

- GRA6515 PracticeExercises ProbabilityDocument3 pagesGRA6515 PracticeExercises ProbabilityHien NgoPas encore d'évaluation

- Accounts PayableDocument4 pagesAccounts PayableMohammed RaihanPas encore d'évaluation

- CCD Opening SolutionDocument14 pagesCCD Opening Solutionspectrum_4820% (5)

- Chapter 16 Homework SolutionsDocument6 pagesChapter 16 Homework SolutionsJackPas encore d'évaluation

- Rac 101 - The General Ledger and Double EntryDocument10 pagesRac 101 - The General Ledger and Double EntryKevin TamboPas encore d'évaluation

- Ifrs Exam WorkshopDocument5 pagesIfrs Exam WorkshopSameh AhmedPas encore d'évaluation

- Classifications by Due Date Balance in Category Estimated % Uncollectible Estimated Uncollectible AmountDocument4 pagesClassifications by Due Date Balance in Category Estimated % Uncollectible Estimated Uncollectible AmountallyssajabsPas encore d'évaluation

- CH 13Document6 pagesCH 13Zahid AkhtarPas encore d'évaluation

- Annual Report 2010 - FinalDocument177 pagesAnnual Report 2010 - Finalbrkelly007Pas encore d'évaluation

- HW Business 3Document1 pageHW Business 3Motaz IsmailPas encore d'évaluation

- CH 23 Exercises ProblemsDocument4 pagesCH 23 Exercises ProblemsAhmed El KhateebPas encore d'évaluation

- Chapter 4 and Other Questions Chapters 1 To 5Document8 pagesChapter 4 and Other Questions Chapters 1 To 5Beatrice BallabioPas encore d'évaluation

- HW 15-2 Task Budget Prep MCQ StudDocument5 pagesHW 15-2 Task Budget Prep MCQ StudКсения НиколоваPas encore d'évaluation

- Oracle R12 Fixed Asset Solution For Dual GAAP LedgersDocument30 pagesOracle R12 Fixed Asset Solution For Dual GAAP LedgersKripaShankarPas encore d'évaluation

- Activities Related to Real Estate Revenues World Summary: Market Values & Financials by CountryD'EverandActivities Related to Real Estate Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Problema in FAGL - FC ValuationDocument3 pagesProblema in FAGL - FC ValuationShankar KollaPas encore d'évaluation

- Prerequisites: Parallel Accounting Using LedgersDocument4 pagesPrerequisites: Parallel Accounting Using LedgersjksdjkfhksjdhfPas encore d'évaluation

- CookBook - CollectiveBillDocument32 pagesCookBook - CollectiveBillRahul Jain75% (4)

- Financial Statements Practice ProblemsDocument5 pagesFinancial Statements Practice ProblemsnajascjPas encore d'évaluation

- Recreational Goods Rental Revenues World Summary: Market Values & Financials by CountryD'EverandRecreational Goods Rental Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Asset ClasesDocument4 pagesAsset ClasesAditya KumarPas encore d'évaluation

- Statement of Financial Accounting Standards No. 52: Foreign Currency TranslationDocument54 pagesStatement of Financial Accounting Standards No. 52: Foreign Currency TranslationJuan Alejandro AguirrePas encore d'évaluation

- Sap Fico PDFDocument4 pagesSap Fico PDFmsaadnaeemPas encore d'évaluation

- What Do You Want in An Advisor? When The Advisor Chooses YouDocument23 pagesWhat Do You Want in An Advisor? When The Advisor Chooses YouAditya KumarPas encore d'évaluation