Académique Documents

Professionnel Documents

Culture Documents

Reed Clothier Income Statement

Transféré par

Manal ElkhoshkhanyDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Reed Clothier Income Statement

Transféré par

Manal ElkhoshkhanyDroits d'auteur :

Formats disponibles

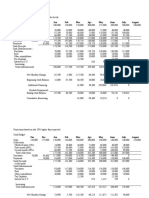

Reed Clothier Income Statement Net Sales Cost of Goods Gross profit General & administrative Expenses Depreciation

& amortization Interest expense Earnings before taxes Income Taxes Net income Balance Sheet Cash Inventories Accounts receivable Total current assets Fixed assets Total assets Accounts payable Notes payable Other current liabilities Total current liabilities Long-term debt Total liabilities Stockholders' equity Total liabilities and Stockholders' Equity

2,000 1,500 500 300 30 60 110 43 67

20 500 400 920 700 1,620 200 250 50 500 600 1,100 520 1,620

Liquidity Ratios Current ratio Quick ratio Receivables turnover Average collection period Efficiency Ratios Total asset turnover Inventory turnover Payable turnover

Reed 1.84 0.84 5.00 73.00

Industry 2.70 1.60 7.70 47.40

1.23 3.00 7.50

1.90 7.00 15.10

Profitability Ratios Gross profit margin Net profit margin Return on common equity

25.0% 3.4% 12.9%

33 7.8 25.9

Year 1991 1992 1993 1994

Inventories Net Sales Change in inventory $378 1,812 411 1,886 8.73% 452 1,954 9.98% 491 2,035 8.63%

4) Reed Clothiers Income Statement Sales Cost of Goods Sold Gross Profit General & Administrative Expenses Depreciation & Amortization Interest Expense Earnings before Taxes Income Tax Net Income

$1,938,000 $1,298,460 $639,540 $352,716 $32,000 $23,256 $231,568 $94,962 $136,606

100% 75% 33%

Change in sales Inventory as % of sales 4.08% 3.61% 4.15% 21.79% 23.13% 24.13%

Vous aimerez peut-être aussi

- SearsDocument11 pagesSearsHelplinePas encore d'évaluation

- Target: Our Brand PromiseDocument26 pagesTarget: Our Brand Promisejennmai85Pas encore d'évaluation

- Assignment 3 SolutionsDocument2 pagesAssignment 3 SolutionsHennrocksPas encore d'évaluation

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarPas encore d'évaluation

- Financial Status-Siyaram Silk Mills LTD 2011-12Document15 pagesFinancial Status-Siyaram Silk Mills LTD 2011-12Roshankumar S PimpalkarPas encore d'évaluation

- CAP2 EstadosFinancieros2014Document17 pagesCAP2 EstadosFinancieros2014LuisAlonzoPas encore d'évaluation

- Financial Status Sesa Goa 2011-12Document13 pagesFinancial Status Sesa Goa 2011-12Roshankumar S PimpalkarPas encore d'évaluation

- Kansai Nerolac Balance SheetDocument19 pagesKansai Nerolac Balance SheetAlex KuriakosePas encore d'évaluation

- RatioDocument6 pagesRatioSing Kian GanPas encore d'évaluation

- Ratios PrblmsDocument13 pagesRatios PrblmsAbraz KhanPas encore d'évaluation

- Adam Sugar LTD Financial AnalysisDocument20 pagesAdam Sugar LTD Financial AnalysiswamiqrasheedPas encore d'évaluation

- Excel Solutions To CasesDocument38 pagesExcel Solutions To CaseselizabethanhdoPas encore d'évaluation

- S7 WEEK8 REI Corporate Finance 15 16Document6 pagesS7 WEEK8 REI Corporate Finance 15 16StefanAndreiPas encore d'évaluation

- Eicher Motors LTDDocument6 pagesEicher Motors LTDshivam mehraPas encore d'évaluation

- Submitted By: Salman Mahboob REGISTRATION NO.: 04151113057 Submitted To: Mr. Wasim Abbas Shaheen Class: Bs (Ba) - 4 Section: BDocument9 pagesSubmitted By: Salman Mahboob REGISTRATION NO.: 04151113057 Submitted To: Mr. Wasim Abbas Shaheen Class: Bs (Ba) - 4 Section: BtimezitPas encore d'évaluation

- Balance Sheet of John Limited As OnDocument19 pagesBalance Sheet of John Limited As OnAravind MaitreyaPas encore d'évaluation

- (5414) Specialized Design Services Sales Class: $500,000 - $999,999Document15 pages(5414) Specialized Design Services Sales Class: $500,000 - $999,999Christyne841Pas encore d'évaluation

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorPas encore d'évaluation

- Chapter 2 - Basic Financial StatementsDocument12 pagesChapter 2 - Basic Financial StatementsParas AbbiPas encore d'évaluation

- Banks DIH Financial AnalysisDocument15 pagesBanks DIH Financial AnalysisRetishaLoaknauthPas encore d'évaluation

- Evaluacion Salud FinancieraDocument17 pagesEvaluacion Salud FinancieraWilliam VicuñaPas encore d'évaluation

- Problems 1-30: Input Boxes in TanDocument24 pagesProblems 1-30: Input Boxes in TanSultan_Alali_9279Pas encore d'évaluation

- Case SolutionsDocument106 pagesCase SolutionsRichard Henry100% (5)

- System LimitedDocument11 pagesSystem LimitedNabeel AhmadPas encore d'évaluation

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkPas encore d'évaluation

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyPas encore d'évaluation

- Lecture5 6 Ratio Analysis 13Document39 pagesLecture5 6 Ratio Analysis 13Cristina IonescuPas encore d'évaluation

- Start Date End Date Template VersionDocument52 pagesStart Date End Date Template VersionshobuzfeniPas encore d'évaluation

- Annual Report 2014 RevisedDocument224 pagesAnnual Report 2014 RevisedDivya AhujaPas encore d'évaluation

- Financial Statistical Summary: Attock Refinery LimitedDocument2 pagesFinancial Statistical Summary: Attock Refinery Limitedabrofab123Pas encore d'évaluation

- Vertical Analysis For Att and VerizonDocument4 pagesVertical Analysis For Att and Verizonapi-299644289Pas encore d'évaluation

- Nishat Balance Sheet and Income StatementDocument56 pagesNishat Balance Sheet and Income StatementMohsin RasheedPas encore d'évaluation

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Document9 pagesMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruPas encore d'évaluation

- Axis Bank Limited Group - Consolidated Profit & Loss AccountDocument66 pagesAxis Bank Limited Group - Consolidated Profit & Loss Accountshreyjain88Pas encore d'évaluation

- EddffDocument72 pagesEddfftatapanmindaPas encore d'évaluation

- Operating Model Build v33Document22 pagesOperating Model Build v33chandan.hegdePas encore d'évaluation

- 2012 Annual Financial ReportDocument76 pages2012 Annual Financial ReportNguyễn Tiến HưngPas encore d'évaluation

- CAT ValuationDocument231 pagesCAT ValuationMichael CheungPas encore d'évaluation

- Woolworths Analyst Presentation Feb 2005Document45 pagesWoolworths Analyst Presentation Feb 2005rushabPas encore d'évaluation

- 5 Year Financial PlanDocument36 pages5 Year Financial PlanVenance EdsonPas encore d'évaluation

- 2014 Full-Year Results Briefing PresentationDocument75 pages2014 Full-Year Results Briefing PresentationRachelLooPas encore d'évaluation

- Excel Solutions - CasesDocument26 pagesExcel Solutions - CasesFitrahwansyah Al Amien50% (2)

- Grab & Go 2years Projected Financial Statements2Document11 pagesGrab & Go 2years Projected Financial Statements2Abid YousafPas encore d'évaluation

- Excel Solutions - CasesDocument25 pagesExcel Solutions - CasesJerry Ramos CasanaPas encore d'évaluation

- Corporate Finance: Assignment No 1Document3 pagesCorporate Finance: Assignment No 1Ali AhmedPas encore d'évaluation

- Industry OverviewDocument7 pagesIndustry OverviewBathula JayadeekshaPas encore d'évaluation

- Financial Status-Somany Ceramics LTD 2011-12Document15 pagesFinancial Status-Somany Ceramics LTD 2011-12Roshankumar S PimpalkarPas encore d'évaluation

- Ch03 P15 Build A ModelDocument2 pagesCh03 P15 Build A ModelHeena Sudra77% (13)

- Financial Ratios: LiquidityDocument4 pagesFinancial Ratios: LiquidityJohn MiguelPas encore d'évaluation

- Cash Flow ExerciseDocument1 pageCash Flow ExercisecoeprodpPas encore d'évaluation

- Competition: Name Last Price Market Cap. Sales Net Profit Total Assets (Rs. CR.) TurnoverDocument13 pagesCompetition: Name Last Price Market Cap. Sales Net Profit Total Assets (Rs. CR.) Turnoverchintan61@gmail.comPas encore d'évaluation

- Ratios Analysis: Lahore Leads UniversityDocument24 pagesRatios Analysis: Lahore Leads UniversityZee ShanPas encore d'évaluation

- Excel Solutions - CasesDocument33 pagesExcel Solutions - CasesChris DeconcilusPas encore d'évaluation

- Kbank enDocument356 pagesKbank enchead_nithiPas encore d'évaluation

- 10k Exhibits1Document209 pages10k Exhibits1api-265210781Pas encore d'évaluation

- Financial PlanDocument15 pagesFinancial PlanIshaan YadavPas encore d'évaluation

- Balance Sheet Common Size AnalysisDocument34 pagesBalance Sheet Common Size AnalysisFarhat BukhariPas encore d'évaluation

- Banking System of Japan Financial DataDocument44 pagesBanking System of Japan Financial Datapsu0168Pas encore d'évaluation

- Chapter 4Document5 pagesChapter 4Kamarulnizam ZainalPas encore d'évaluation

- Auditing SP 2008 CH 5 SolutionsDocument13 pagesAuditing SP 2008 CH 5 SolutionsManal ElkhoshkhanyPas encore d'évaluation

- Egypt Revolution Inc.Document4 pagesEgypt Revolution Inc.Manal ElkhoshkhanyPas encore d'évaluation

- Omaha 1Document7 pagesOmaha 1Manal ElkhoshkhanyPas encore d'évaluation

- Auditing SP 2008 CH 6 SolutionsDocument19 pagesAuditing SP 2008 CH 6 SolutionsManal ElkhoshkhanyPas encore d'évaluation

- Omaha 1Document7 pagesOmaha 1Manal ElkhoshkhanyPas encore d'évaluation

- Hightower ServiceDocument3 pagesHightower ServiceManal Elkhoshkhany100% (2)

- Chapters 11 & 12Document4 pagesChapters 11 & 12Manal ElkhoshkhanyPas encore d'évaluation

- Financial AccountingDocument3 pagesFinancial AccountingManal Elkhoshkhany100% (1)

- Managerial AccountingDocument5 pagesManagerial AccountingManal ElkhoshkhanyPas encore d'évaluation

- 50 Multiple Choice, T/F, & Essay QuestionsDocument24 pages50 Multiple Choice, T/F, & Essay QuestionsManal Elkhoshkhany100% (1)

- StatsDocument1 pageStatsManal ElkhoshkhanyPas encore d'évaluation

- Accounting For Managers FinalDocument4 pagesAccounting For Managers FinalManal ElkhoshkhanyPas encore d'évaluation

- Parent, Inc Actual Financial Statements For 2012 and OlsenDocument23 pagesParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyPas encore d'évaluation

- Comprehensive Problem 2Document3 pagesComprehensive Problem 2Manal ElkhoshkhanyPas encore d'évaluation

- Project A Project B Probability Net Cash Flow Probability Net Cash FlowDocument1 pageProject A Project B Probability Net Cash Flow Probability Net Cash FlowManal ElkhoshkhanyPas encore d'évaluation

- Nov Dec Jan Feb Mar Apr May June July AugustDocument9 pagesNov Dec Jan Feb Mar Apr May June July AugustManal ElkhoshkhanyPas encore d'évaluation

- Fashion ShoeDocument5 pagesFashion ShoeManal ElkhoshkhanyPas encore d'évaluation

- Summertime Corporation Statement of Owner's Equity For The Year Ending 12/31/2012Document2 pagesSummertime Corporation Statement of Owner's Equity For The Year Ending 12/31/2012Manal ElkhoshkhanyPas encore d'évaluation

- Gray HouseDocument2 pagesGray HouseManal ElkhoshkhanyPas encore d'évaluation

- Finance QuizDocument2 pagesFinance QuizManal ElkhoshkhanyPas encore d'évaluation

- JanDocument1 pageJanManal ElkhoshkhanyPas encore d'évaluation

- Finance QuizDocument3 pagesFinance QuizManal ElkhoshkhanyPas encore d'évaluation