Académique Documents

Professionnel Documents

Culture Documents

Taxcode Config

Transféré par

vaishaliak2008Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Taxcode Config

Transféré par

vaishaliak2008Droits d'auteur :

Formats disponibles

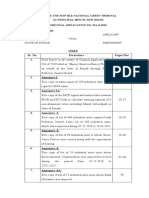

Step 0 : Maintain the excel sheet Tax Codes_SVKM with proposed codes, description and percentage.

Step I : Creation of Tax Code

Transaction Code : FTXP

Enter the code as per the Tax codes excel sheet

Enter the description of the tax code as per the excel sheet

Step II : Assign Tax Code to Company Codes

SPRO>Logistics General>Tax on Goods Movements>India>Basic Settings>Determination of Excise Duty >Condition-Based Excise Determination>Assign Tax Code to Company Codes

Save the entries and Transport request is generated. Copy description from excel sheet

Note down the number

Step III Save the tax code created in step I in the above request.

Transaction Code FTXP, country IN

Press Enter. Tax code > Transport > Export

Select the request by double clicking on it.

Select the tax code to be included in the transport request. Press Enter button to save after selecting the request.

Step IV Move the request to 120

Transaction Code : SCC1.

Enter request no. to be transported and press Start Immediately

Now the configuration of tax code and its assignment to company codes is in 120.

Step V Maintain tax rates in condition records as per the excel sheet. Transaction: FV11

Enter the condition type as per excel sheet.

Enter the tax code(2 times) , rate and validity from-to (if applicable) and save.

Repeat this again in FV11 if there are multiple condition types (e.g. in service tax). Note : While entering the rate for the second condition type for the same tax code, system may not take actual %. Hence first enter initial % and then change it to actual. Now tax code is ready for use in 120.

Step VI- Release the request and its sub task in 100 Transaction Code: SE10

And get it transported to quality by Basis. Now the tax code is in quality. Repeat step V to maintain the rates in quality (200). Fill up the transport request form and get the request transported to Production by basis. Repeat step V to maintain the rates in production (300).

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- GST Master Data ConfigDocument6 pagesGST Master Data Configvaishaliak2008100% (1)

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDSeema BhagatPas encore d'évaluation

- Creating Transaction and Screen VariantsDocument16 pagesCreating Transaction and Screen VariantsChanagorn SombatsutinPas encore d'évaluation

- User Manual Svkm-Sap Ps r001Document81 pagesUser Manual Svkm-Sap Ps r001vaishaliak2008100% (2)

- History ch-3Document13 pagesHistory ch-3Sadik farhat MollaPas encore d'évaluation

- ABUMN & ABT1N - Transfer of AssetsDocument18 pagesABUMN & ABT1N - Transfer of Assetsvaishaliak2008100% (2)

- 5.3 AA Asset Depreciation Posting - AFABDocument12 pages5.3 AA Asset Depreciation Posting - AFABvaishaliak2008100% (1)

- Transport Query - Variants & LayoutsDocument15 pagesTransport Query - Variants & Layoutsvaishaliak2008Pas encore d'évaluation

- CJ88 - Settlement in PSDocument25 pagesCJ88 - Settlement in PSvaishaliak2008100% (1)

- CJ88 - Settlement in PSDocument25 pagesCJ88 - Settlement in PSvaishaliak2008100% (1)

- AVC Control Problems in BCSDocument6 pagesAVC Control Problems in BCSvaishaliak2008Pas encore d'évaluation

- Extended Essay - IB Economic HL (B)Document34 pagesExtended Essay - IB Economic HL (B)Michelle Elie T.100% (1)

- Roles & Authorization - PSDocument7 pagesRoles & Authorization - PSvaishaliak2008Pas encore d'évaluation

- ME2DP Downpayment ManualDocument28 pagesME2DP Downpayment Manualvaishaliak2008100% (4)

- Config For Cashflow StatementDocument3 pagesConfig For Cashflow Statementvaishaliak2008Pas encore d'évaluation

- AIAB & AIBU & AIST - AUC Settlement & ReversalDocument10 pagesAIAB & AIBU & AIST - AUC Settlement & Reversalvaishaliak2008Pas encore d'évaluation

- Vendor Aging ReportDocument31 pagesVendor Aging Reportvaishaliak20080% (1)

- OBB8 - Installment PaymentsDocument14 pagesOBB8 - Installment Paymentsvaishaliak2008Pas encore d'évaluation

- 5.7 AA Asset Fiscal Year Closing - AJABDocument9 pages5.7 AA Asset Fiscal Year Closing - AJABvaishaliak2008Pas encore d'évaluation

- 2 All India Mix Business Database SampleDocument130 pages2 All India Mix Business Database SampleHuman BeingPas encore d'évaluation

- EUT Day4 - Individual ReversalDocument14 pagesEUT Day4 - Individual Reversalvaishaliak2008Pas encore d'évaluation

- TDS Config in SAPDocument31 pagesTDS Config in SAPvaishaliak2008Pas encore d'évaluation

- Settlement To Superior WBS... Note 211324Document2 pagesSettlement To Superior WBS... Note 211324vaishaliak2008Pas encore d'évaluation

- Imp. TablesDocument5 pagesImp. Tablesvaishaliak2008Pas encore d'évaluation

- FICA - Posting in The Cash JournalDocument4 pagesFICA - Posting in The Cash Journalvaishaliak2008Pas encore d'évaluation

- Check List For Yearly ClosingDocument4 pagesCheck List For Yearly Closingvaishaliak2008Pas encore d'évaluation

- Use T Code J1INCERT. The Following Screen Will AppearDocument8 pagesUse T Code J1INCERT. The Following Screen Will Appearvaishaliak2008Pas encore d'évaluation

- Vendor Reports: 1. C Vendor List (Master Data) : S - ALR - 87012086Document10 pagesVendor Reports: 1. C Vendor List (Master Data) : S - ALR - 87012086vaishaliak2008Pas encore d'évaluation

- S - AC0 - 52000888 Report of Vendor Bal PC WiseDocument10 pagesS - AC0 - 52000888 Report of Vendor Bal PC Wisevaishaliak2008Pas encore d'évaluation

- Al ShaheerDocument5 pagesAl ShaheerMuhammad AdilPas encore d'évaluation

- BusinessDocument3 pagesBusinessMonic AbalosPas encore d'évaluation

- Long-Run Economic Growth: Intermediate MacroeconomicsDocument23 pagesLong-Run Economic Growth: Intermediate MacroeconomicsDinda AmeliaPas encore d'évaluation

- IGNOU Unit 19Document29 pagesIGNOU Unit 19Rupa BuswasPas encore d'évaluation

- Moody's - Government of ArgentinaDocument28 pagesMoody's - Government of ArgentinaCronista.com100% (1)

- BOQ Perimeter Fence at Angono RizalDocument1 pageBOQ Perimeter Fence at Angono RizalJohnPaulLagguiPas encore d'évaluation

- Faculty of Commerce Department of Finance Group2 Student Name Student NumberDocument9 pagesFaculty of Commerce Department of Finance Group2 Student Name Student NumberRumbidzai KambaPas encore d'évaluation

- Social Inequality and Social Stratification in U S Society 1st Edition Doob Test BankDocument14 pagesSocial Inequality and Social Stratification in U S Society 1st Edition Doob Test BankNatalieSmithrktda100% (15)

- Mandi Gobindgarh Hazardous Waste Report NGT April2021Document739 pagesMandi Gobindgarh Hazardous Waste Report NGT April2021vinit gargPas encore d'évaluation

- Export MGMT Sem 5 MCQ 1Document40 pagesExport MGMT Sem 5 MCQ 1avijit kundu senco onlinePas encore d'évaluation

- Midterm Reviewer Monetary PolicyDocument54 pagesMidterm Reviewer Monetary PolicyWawi Dela RosaPas encore d'évaluation

- CA Inter Advanced Account - Regular Course by CA P S BeniwalDocument346 pagesCA Inter Advanced Account - Regular Course by CA P S BeniwalHarry PotterPas encore d'évaluation

- Hubungan Pengetahuan Ibu Terhadap Pemberian Makanan Pendamping Asi (MP-ASI) Dengan Kejadian Stunting Pada Baduta Di Kabupaten Pandeglang Provinsi BantenDocument7 pagesHubungan Pengetahuan Ibu Terhadap Pemberian Makanan Pendamping Asi (MP-ASI) Dengan Kejadian Stunting Pada Baduta Di Kabupaten Pandeglang Provinsi BantenUmroatul AlfiyahPas encore d'évaluation

- Risk Parity - The Truly Balanced Portfolio - Magazine - IPE - Ray DalioDocument4 pagesRisk Parity - The Truly Balanced Portfolio - Magazine - IPE - Ray Daliokuky6549369Pas encore d'évaluation

- Top 10 Reason Why Not and How Not To PPPs in Tje Developing and Emerging EconomicDocument42 pagesTop 10 Reason Why Not and How Not To PPPs in Tje Developing and Emerging EconomicawasesoPas encore d'évaluation

- Acct Statement XX6630 22032024Document28 pagesAcct Statement XX6630 22032024maahirzaveri27Pas encore d'évaluation

- Mba 1 Sem Managerial Economics p2 5679 Summer 2019Document1 pageMba 1 Sem Managerial Economics p2 5679 Summer 2019bhaleraomayur96Pas encore d'évaluation

- Business Taxation Set 4Document6 pagesBusiness Taxation Set 4NITESH GondPas encore d'évaluation

- (Fa-) Mpy, Mpyc, MpycyDocument3 pages(Fa-) Mpy, Mpyc, MpycyPT. Sari MandaPas encore d'évaluation

- Bangko Sentral NG PilipinasDocument2 pagesBangko Sentral NG PilipinasEllechir Jeanne100% (1)

- Motivation: Add To Cart and Check Out !Document14 pagesMotivation: Add To Cart and Check Out !serePas encore d'évaluation

- Materi Training Excel Mar 2022Document18 pagesMateri Training Excel Mar 2022Marsha ReginaPas encore d'évaluation

- MOSt - CONFERENCE REPORT Motilal Oswal 10th Annual Global Investor Conference, 2014Document130 pagesMOSt - CONFERENCE REPORT Motilal Oswal 10th Annual Global Investor Conference, 2014kaua1980Pas encore d'évaluation

- Chapter 3 - Balance of PaymentDocument19 pagesChapter 3 - Balance of PaymentAisyah AnuarPas encore d'évaluation

- Damodaram Sanjivayya National Law University Visakhapatnam (A.P.)Document19 pagesDamodaram Sanjivayya National Law University Visakhapatnam (A.P.)Rashie SharmaPas encore d'évaluation

- Group 12 - Final - Submission - Divyansh SrivastavaDocument9 pagesGroup 12 - Final - Submission - Divyansh Srivastavadev mhaispurkarPas encore d'évaluation