Académique Documents

Professionnel Documents

Culture Documents

Dow Chemicals Bid - Case Analysis

Transféré par

lummertDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Dow Chemicals Bid - Case Analysis

Transféré par

lummertDroits d'auteur :

Formats disponibles

Dow Chemicals Bid - Case Analysis

1. What are the critical success factors in the polyethylene business? Polyethylene is produced from ethylene or alpha olefins. Both are the product of a cracking process using either naphtha molecules derived from crude oil or ethane molecules derived from natural gas. The production of ethylene and derivatives such as polyethylene is highly integrated, requires large capital investments and goes along with a high operating leverage. Polyethylene is a commodity product, which trades globally and within a narrow price band. Critical success factors in the polyethylene business are: Large plant sizes as large plants offer significant economies of scale Vertical integration as a result of the highly integrated production process Stable supplies of ethane of naphtha to support the highly integrated process and to allow for operating rates near 100% Ethane as input o Plant cost for ethane cracking are about half of plant for cracking naphtha. o Operating cost are lower as dracking ethane requires less energy, manufacturing intensity and equipment than cracking naphtha Low transportation cost including duties and levies as a result of the commodity product nature and the narrow price brand of polyethylene. High global capacity utilization, as prices and profit margins are closely linked to the global operating rate i.e. industry overcapacity. Technology leadership and operational excellence to keep and enhance the cost leader position required to compete with government-subsidized chemical complexes having different targets (loss leader, zero return) -1-

Dow Chemicals Bid - Case Analysis 2. How would you convince Dow headquarters to invest in the PBB project? Dow Chemical has no foothold in polyethylene in Argentina or the rest of the Mercosur region and Dow Chemical cannot afford to risk its globally leading position in polyethylene by not being represented in a strong growth region with increasing demand, particularly in Argentina. At the same time, Dow Chemical has already collected country experience in Argentina via Dow Quimica which offers other products than ethylene and polyethylene. The project perfectly fits Dow Chemicals strategy to be a low cost producer looking for horizontal/vertical integration, technological leadership, and an international presence. The competitive attributes of PBB site are also very attractive : [a] availability and proximity of the two largest Argentine gas basins, [b] easy access (sea, rail, road), [c] close to Buenos Aires (50% of market), and [d] adequate service infrastructure and human resources. The project stages 1-3 represent a very rare opportunity to quickly build scale and be established in a new market, but stages 2 and 3 depend on the acquisition of PBB. It will be very difficult to become a cost leader in the region if another company acquires PBB. PBB is important for the Argentine economy. Dow Chemical would for the foreseeable future be the only producer in Argentina while representing about 25% of Mercosur production. Competitors will have a cost disadvantage, especially in Argentina. PBBs importance and the Argentine governments intention to keeps 49% is an advantage, not a disadvantage. The Argentine government will also appreciate the jobs being created in the later project stages, if successful, and a good relationship with the government will likely also be beneficial when discussing with YPF about long-term ethane supply. Profitability risks from FX fluctuations and freight/duties are limited because most of the demand is expected to come from Argentina. Capital repatriation regulations are much improved and expected to stay without any limits and restrictions on transfers in the future. -2-

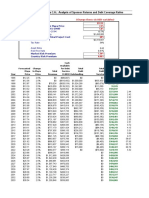

Dow Chemicals Bid - Case Analysis 3. How would you conduct a valuation of this project? The valuation should consist of the following components: Value each stage of the project independently using DCF valuation Build decision tree to combine the valuations for each stage estimating probabilities for successful bidding and analyzing the valuation sensitivity to success probabilities Discounted cash flow valuation using USD cashflows calculated using forward rates 8-10% WACC with relatively higher WACC for stages 1 and 3 due to development risk No WACC adjustment for FX risk given Dow Chemicals international presence and assuming that shareholders are sufficiently diversified w.r.t. FX risk No WACC adjustment for country risk e.g. on the basis sovereign spreads. Instead appropriate adjustments to the projects local currency cash flows. Adjustments are not required if one assumes that shareholders are sufficiently diversified w.r.t. country risk. Risk analysis to understand the valuation sensitivity with respect to [a] different competitive environments, [b] different tax rates (31%, 36%), [c] mix of $ cost and local currency cost, [d] different transport cost (feight, duties), [e] different financing models.

4. What would you bid for this project? The minimum bid is USD 150mn. My stand-alone DCF valuation of stage 1 ranges from USD 160mn to USD 220mn for a 51% stake in PBB depending on assumptions. I would actually bid as much as USD 220mn for a 51% stake in PBB, mainly to secure an option on stages 2 and 3. I assume [a] a high probability that Polisur can be bought at a reasonable price relative to my DCF value estimate of USD 330mn for 100% in stage 2. Furthermore, I assume [b] that there is at least a 50% chance for stage 3 which I consider highly attractive with a conservative NPV of USD 400mn and an optimistic NPV of USD 1,0bn.

-3-

Vous aimerez peut-être aussi

- Allen Lane Case Write UpDocument2 pagesAllen Lane Case Write UpAndrew Choi100% (1)

- Dow Chemicals’ $280 Million Bid for PBB in ArgentinaDocument7 pagesDow Chemicals’ $280 Million Bid for PBB in ArgentinaOrante100% (1)

- CV - Assignment - Group 8 - Teuer - Case BDocument6 pagesCV - Assignment - Group 8 - Teuer - Case BKhushbooPas encore d'évaluation

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajPas encore d'évaluation

- Master Budget Example MC Watters AIP8-13Document2 pagesMaster Budget Example MC Watters AIP8-13Muhammed muhabaPas encore d'évaluation

- Sharecropping Simulation ActivityDocument5 pagesSharecropping Simulation Activityapi-282568260100% (1)

- Dow Chemical's Bid for PBB ProjectDocument3 pagesDow Chemical's Bid for PBB ProjectFerSorinPas encore d'évaluation

- Dividend Policy at PFL GroupDocument5 pagesDividend Policy at PFL GroupWthn2kPas encore d'évaluation

- Petrozuata CaseDocument10 pagesPetrozuata CaseBiranchi Prasad SahooPas encore d'évaluation

- Case StudyDocument19 pagesCase StudyleePas encore d'évaluation

- Wk8 Laura Martin REPORTDocument18 pagesWk8 Laura Martin REPORTNino Chen100% (2)

- Project Finance CaseDocument15 pagesProject Finance CaseDennies SebastianPas encore d'évaluation

- Chad CameroonDocument17 pagesChad CameroonAshish BhartiPas encore d'évaluation

- AirbusDocument3 pagesAirbusHP KawalePas encore d'évaluation

- Energy GelDocument4 pagesEnergy Gelchetan DuaPas encore d'évaluation

- Marriott Corporation (Project Chariot) : Case AnalysisDocument5 pagesMarriott Corporation (Project Chariot) : Case AnalysisChe harePas encore d'évaluation

- VodafoneDocument15 pagesVodafoneloveshbhPas encore d'évaluation

- Apache Case Study Analysis of Risk Management TechniquesDocument14 pagesApache Case Study Analysis of Risk Management TechniquesSreenandan NambiarPas encore d'évaluation

- IB Case 5Document2 pagesIB Case 5s6789a100% (2)

- Analyse The Structure of The Personal Computer Industry Over The Last 15 YearsDocument7 pagesAnalyse The Structure of The Personal Computer Industry Over The Last 15 Yearsdbleyzer100% (1)

- De Beers Consolidated Mines LTD-SMQDocument16 pagesDe Beers Consolidated Mines LTD-SMQmusharibPas encore d'évaluation

- Aspen CaseDocument15 pagesAspen CaseWee Chuen100% (1)

- CBRM Calpine Case - Group 4 SubmissionDocument4 pagesCBRM Calpine Case - Group 4 SubmissionPranavPas encore d'évaluation

- Flavored Ice Candy Business PlanDocument17 pagesFlavored Ice Candy Business PlanJanice Suan100% (1)

- DowDocument16 pagesDowArslan Yousaf100% (2)

- Merger of BP-AmocoDocument16 pagesMerger of BP-AmocoRafidul Islam100% (1)

- Chad-Cameroon Oil Pipeline Project FinancingDocument13 pagesChad-Cameroon Oil Pipeline Project FinancingavijeetboparaiPas encore d'évaluation

- Motorola RAZR - Case PDFDocument8 pagesMotorola RAZR - Case PDFSergio AlejandroPas encore d'évaluation

- Chad Cameroon Petroleum Development andDocument24 pagesChad Cameroon Petroleum Development andYourick Evans Pouga MbockPas encore d'évaluation

- Westinghouse Electric Financials and Buyout TablesDocument22 pagesWestinghouse Electric Financials and Buyout TablesGonz�lez Alonzo Juan ManuelPas encore d'évaluation

- Chad Cameroon Case FinalDocument28 pagesChad Cameroon Case FinalAbhi Krishna ShresthaPas encore d'évaluation

- Royal Dutch ShellDocument3 pagesRoyal Dutch ShellZack StahlsmithPas encore d'évaluation

- Porsche CanadaDocument8 pagesPorsche CanadaMohammed Omer Elgindi100% (1)

- This Study Resource Was: Chad-Cameroon Project 1Document8 pagesThis Study Resource Was: Chad-Cameroon Project 1Ashutosh TulsyanPas encore d'évaluation

- Crown Cork and Seal CompanyDocument5 pagesCrown Cork and Seal CompanyShijin Mathew EipePas encore d'évaluation

- BP Amoco - A Case Study On Project FinanceDocument11 pagesBP Amoco - A Case Study On Project Financevinay5209100% (2)

- SS KuniangDocument8 pagesSS KuniangvaiidyaPas encore d'évaluation

- Petrolera Zueta, Petrozuata CDocument6 pagesPetrolera Zueta, Petrozuata CAnkur SinhaPas encore d'évaluation

- Asset Beta AnalysisDocument13 pagesAsset Beta AnalysisamuakaPas encore d'évaluation

- BP Amoco (Case Study)Document25 pagesBP Amoco (Case Study)Abhik Tushar Das67% (3)

- Chad Cameroon Pipeline - Project Finance v2Document27 pagesChad Cameroon Pipeline - Project Finance v2Ajay GuptaPas encore d'évaluation

- Analysis of Petrolera Zuata Petrozuata Debt CoverageDocument2 pagesAnalysis of Petrolera Zuata Petrozuata Debt CoveragedewanibipinPas encore d'évaluation

- ARAUCO SpeechDocument12 pagesARAUCO SpeechSpizspizPas encore d'évaluation

- AOL Acquires Time Warner in $160B DealDocument5 pagesAOL Acquires Time Warner in $160B DealJyoti GoyalPas encore d'évaluation

- Case 3 - Ocean Carriers Case PreparationDocument1 pageCase 3 - Ocean Carriers Case PreparationinsanomonkeyPas encore d'évaluation

- Victoria Chemicals Plc Project Selection: Merseyside vs RotterdamDocument6 pagesVictoria Chemicals Plc Project Selection: Merseyside vs RotterdamRivki MeitriyantoPas encore d'évaluation

- ACC to Acquire AirThread for $7.5 BillionDocument16 pagesACC to Acquire AirThread for $7.5 Billionbtlala0% (1)

- PetrozuataDocument13 pagesPetrozuataMikhail TitkovPas encore d'évaluation

- Investme C7 - Harvard Management Co. and Inflation-Protected Bonds, Spreadsheet SupplementDocument8 pagesInvestme C7 - Harvard Management Co. and Inflation-Protected Bonds, Spreadsheet SupplementANKUR PUROHITPas encore d'évaluation

- Sealed Air Corporation's Leveraged Recapitalization (A)Document7 pagesSealed Air Corporation's Leveraged Recapitalization (A)Jyoti GuptaPas encore d'évaluation

- Project Finance Petrolera Zuata, Petrozuata C.A: BackgorundDocument3 pagesProject Finance Petrolera Zuata, Petrozuata C.A: BackgorundPearly ShopPas encore d'évaluation

- Facebook ValuationDocument13 pagesFacebook ValuationSunil Acharya100% (2)

- Boeing's New 7E7 AircraftDocument10 pagesBoeing's New 7E7 AircraftTommy Suryo100% (1)

- Chad Cameroon PipelineDocument12 pagesChad Cameroon PipelineskhhmlPas encore d'évaluation

- Ethodology AND Ssumptions: B B × D EDocument7 pagesEthodology AND Ssumptions: B B × D ECami MorenoPas encore d'évaluation

- Chad Cameroon PipelineDocument12 pagesChad Cameroon PipelineUmang ThakerPas encore d'évaluation

- FIN RealOptionsDocument3 pagesFIN RealOptionsveda20Pas encore d'évaluation

- Deluxe Corporation Case StudyDocument3 pagesDeluxe Corporation Case StudyHEM BANSALPas encore d'évaluation

- USTDocument4 pagesUSTJames JeffersonPas encore d'évaluation

- Oracle's Acquisition of Sun MicrosystemsDocument12 pagesOracle's Acquisition of Sun MicrosystemsVarun Rana50% (2)

- Chloroprene Rubber 99259 WP PUBLIC Box393196BDocument229 pagesChloroprene Rubber 99259 WP PUBLIC Box393196BbowcoastiePas encore d'évaluation

- Assessment of Technical and Financial Viability of Nairit Chemical Plant OperationDocument205 pagesAssessment of Technical and Financial Viability of Nairit Chemical Plant OperationMaria de los AngelesPas encore d'évaluation

- WP PUBLIC Box393196BDocument205 pagesWP PUBLIC Box393196BLOLA PATRICIA MORALES DE LA CUBAPas encore d'évaluation

- Multiplier EffectDocument8 pagesMultiplier EffectCamille LaraPas encore d'évaluation

- Indian Taxation LawDocument22 pagesIndian Taxation LawEngineerPas encore d'évaluation

- BKAR 3033 Deferred Tax CalculationDocument2 pagesBKAR 3033 Deferred Tax Calculationdini sofiaPas encore d'évaluation

- Commercial Finance Director in United Kingdom UK Resume Adinde ShawDocument3 pagesCommercial Finance Director in United Kingdom UK Resume Adinde ShawAdindeShawPas encore d'évaluation

- TIffany and Co.Document52 pagesTIffany and Co.tmltanPas encore d'évaluation

- Global LCC Outlook v2Document310 pagesGlobal LCC Outlook v2JcastrosilvaPas encore d'évaluation

- Demand, Supply, and The Market Process: Full Length Text - Micro Only Text - Macro Only TextDocument66 pagesDemand, Supply, and The Market Process: Full Length Text - Micro Only Text - Macro Only TextCeline YoonPas encore d'évaluation

- Pricing of Holiday MarketDocument24 pagesPricing of Holiday MarketRabikumar HawaibamPas encore d'évaluation

- GuideStar's IRS Tax Exempt Org Codes PDFDocument5 pagesGuideStar's IRS Tax Exempt Org Codes PDFaleta356Pas encore d'évaluation

- Session 6. The Statement of Cash FlowsDocument22 pagesSession 6. The Statement of Cash FlowsAmrutaPas encore d'évaluation

- Niddf PDFDocument1 pageNiddf PDFMuhammad MudassarPas encore d'évaluation

- What Would You Do With A Million Dollars?: Philip BrewerDocument4 pagesWhat Would You Do With A Million Dollars?: Philip BrewerKatarina JovanovićPas encore d'évaluation

- Advanced Cost Accounting Operating Costing On Hotel, Hosptal,& TransportDocument52 pagesAdvanced Cost Accounting Operating Costing On Hotel, Hosptal,& TransportVandana SharmaPas encore d'évaluation

- Business Plan TemplateDocument26 pagesBusiness Plan TemplateUmAr FArooqPas encore d'évaluation

- AllowancesDocument19 pagesAllowanceshanumanthaiahgowdaPas encore d'évaluation

- TRIAL E Commerce Financial Model Excel Template v.4.0.122020Document68 pagesTRIAL E Commerce Financial Model Excel Template v.4.0.122020DIDIPas encore d'évaluation

- Cost Online QuestionDocument7 pagesCost Online QuestionKashif RaheemPas encore d'évaluation

- Topic 6 - Strategic ChoicesDocument70 pagesTopic 6 - Strategic ChoicesJamilah EdwardPas encore d'évaluation

- Primavera PERT Master Risk Analysis ToolDocument22 pagesPrimavera PERT Master Risk Analysis ToolPallav Paban BaruahPas encore d'évaluation

- La Consolacion College Manila: Finman IiDocument14 pagesLa Consolacion College Manila: Finman Iigerald calignerPas encore d'évaluation

- Nestle Maggi Sales Analysis in Indian MarketDocument60 pagesNestle Maggi Sales Analysis in Indian MarketMohd DilshadPas encore d'évaluation

- Exercises IAS 8 SolutionDocument5 pagesExercises IAS 8 SolutionLê Xuân HồPas encore d'évaluation

- Deluxe Corporation: Adil Bouzoubaa Med Amine Bekkal Hafida Hannaoui Zineb AbdouDocument18 pagesDeluxe Corporation: Adil Bouzoubaa Med Amine Bekkal Hafida Hannaoui Zineb AbdouAmineBekkalPas encore d'évaluation

- Introduction Project 1Document4 pagesIntroduction Project 1Vishal dubeyPas encore d'évaluation

- DXN Marketing Plan: Definition of TermsDocument28 pagesDXN Marketing Plan: Definition of TermsJayKumarPas encore d'évaluation

- F3 and FFA Full Specimen Exam Answers PDFDocument5 pagesF3 and FFA Full Specimen Exam Answers PDFFarhanHaiderPas encore d'évaluation

- S. Peter Lebowitz and Theresa Lebowitz v. Commissioner of Internal Revenue, 917 F.2d 1314, 2d Cir. (1990)Document10 pagesS. Peter Lebowitz and Theresa Lebowitz v. Commissioner of Internal Revenue, 917 F.2d 1314, 2d Cir. (1990)Scribd Government DocsPas encore d'évaluation