Académique Documents

Professionnel Documents

Culture Documents

Income Tax Calculator 2011-12

Transféré par

sachindehkarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Income Tax Calculator 2011-12

Transféré par

sachindehkarDroits d'auteur :

Formats disponibles

http://www.PankajBatra.

com

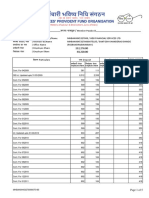

Income Tax Calculator F.Y. 2011-12 (AY 2012-13)

Gender Place of Residence Age Number of children

Salary Breakup

Male Non-Metro City 30 0

April 12,790 5,116 1,190 5,800 May 12,790 5,116 1,190 5,800 June 12,790 5,116 1,190 5,800 July 15,040 6,016 1,525 10,650 August 15,040 6,016 1,525 10,650 September 15,040 6,016 1,525 10,650 October 15,040 6,016 1,525 10,650 November 14,500 7,373 800 24,500 December 14,500 7,373 800 24,500 January 14,500 7,373 800 24,500 February 14,500 7,373 800 24,500 March 14,500 7,373 800 24,500 Total 171,030 76,277 13,670 182,500 615 1,066 4,000 1,066 500 615 1,066 4,000 1,066 500 615 1,066 4,000 1,066 500 1,254 500 1,254 500 1,254 500 1,254 500 1,254 1,254 1,254 1,254 1,254 723 1,254 723 1,254 723 1,254 723 1,254 700 700 700 700 700 8,237 8,214 12,000 14,484 3,500 32,143 32,143 32,143 36,962 36,962 36,962 36,962 49,127 49,127 49,127 49,127 49,127 489,912

Have a Question? Ask it here: http://www.SocialFinance.in

Basic Salary House Rent Allowance (HRA) Dearness allowance (DA) Transport/Conveyence Allowance Child Education Allowance Grade/Special/Management/Supplemementary Allowance City Compensatory Allowance (CCA) Arrears Gratuity Leave Travel Allowance (LTA) Leave Encashment Performance Incentive/Bonus Medical Reimbursement Food Coupons Periodical Journals Uniform/Dress Allowance Telephone Reimbursements Car Reimbursement Internet Expense Driver Salary Gifts From Non-Relatives Gifts From Relatives Agricultural Income House Rent Income (income from house property) Other income (Bank account/NSC/Post Office/SCSS Interest) Short Term Gains from Share Trading/Equity MFs Long Term Gains from Share Trading/Equity MFs

TOTAL INCOME

Exemptions Actual Rent paid as per rent receipts Availing both HRA and Home loan exemption Investment/Bills Details 14,484 9,600 8,214 3,500 -

7,500

7,500

7,500

7,500

7,500

7,500

7,500

7,500

7,500

7,500

7,500

7,500

90,000

HRA Exemption

5,116

5,116

5,116

5,996

5,996

5,996

5,996

5,800

5,800

5,800

5,800

5,800 68,332

Non-Taxable Allowances Child Education Allowance Medical Reimbursement receipts submitted Transport/Conv. Allowance LTA receipt submitted Food Coupons Periodical Journals Uniform/Dress Allowance Telephone Reimbursement receipts submitted Car Expenses Reimbursement receipts submitted Internet expense receipts submitted Driver Salary receipts submitted Other Reimbursement receipts submitted Balance Salary Professional Tax Net Taxable Salary House and Loan Status Home Loan Interest Component Any other Income Gross Total Income Deductions under chapter VIA Life Insurance Premium payment Employee's contribution to PF PPF (Public Provident Fund) Equity Tax saver Mutual Funds - ELSS National Savings Certificate (NSC) deposit National Service Scheme (NSS) deposit Senior Citizen Savings Scheme (SCSS) deposit Post Office/Tax saving Bonds investments New pension scheme (NPS) Deposit 80CCD Children Tution Fees paid Housing Loan Principal repayment Tax saving Fixed Deposit for 5 yrs. or more Stamp Duty/Registration charges for house Other Eligible Investments Total of Section 80C Pension Fund (80 CCC) Total Deduction under Sec. 80C & 80CCC 80D (Medical insurance premium for Self and/or Family) 80D (Medical insurance premium for Parents) 80DD (Maintainence of depandant disabled) 80DDB (Medical treatment for specific diseases) 80E (Interest paid on Higher Education Loan) 80U (Handicapped person/Perm. Disability) Donations - 80G (100 % deductions) Donations - 80G (50 % deductions) Long Term Infra. Bonds (Section 80CCF) Total Income Total Income rounded off Income Tax on Total Income Education Cess @ 3% Income tax including education cess TDS (Tax deducted at source) Pending Tax Payable

14,484 9,600 8,214 3,500 385,782 2,400 375,145

On loan and Self Occupied

375,145

23,500 17,005 10,000 50,000 15,000

115,505

115,505

100,000

10,000 With Severe Disability Parents above 60 years With Severe Disability Patient Below 65 years

10,000

-

265,145 265,150 8,515

255 8,770 8,770

Monthly Deductions from salary TDS (Tax deducted at source) Professional Tax Employee's PF Contribution Employee's NPS Contribution VPF (Voluntarily Provident Fund) contribution Deduction for company provided transport Deduction towards State Labour welfare Fund (LWF) Deduction towards company provided Group Term insurance Deduction towards Leave availed Deduction towards company provided medical insurance Other Deductions from Employer Employer's NPS Contribution Employer's PF Contribution In Hand Salary In Hand Salary without reimbursments

April 200

May 200

June 200 1,535

July 200 1,805

August 200 1,805

September 200 1,805

October 200 1,805

November 200 1,650

December 200 1,650

January 200 1,650

February 200 1,650

March 200 1,650 2,400 17,005 17,005

31,943 29,311

31,943 29,311

1,535 30,408 27,776

1,805 34,957 31,949

1,805 34,957 31,949

1,805 34,957 31,949

1,805 34,957 31,949

1,650 47,277 46,023

1,650 47,277 46,023

1,650 47,277 46,023

1,650 47,277 46,023

1,650 47,277 46,023

Total Income in this year

506,917

ADVANCE TAX SCHEDULE Total Tax as per Consolidation Sheet: PARTICULARS Payable upto 15th June, 2011 Payable upto 15th September, 2011 Payable upto 15th December, 2011 Payable upto 15th March, 2012 % 15% 30% 60% 100% 8,770 Payable 1,316 2,631 5,262 8,770 Paid Difference 1,316 2,631 5,262 8,770

Savings for Tax

PPF Investments Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Total Long Term infra bonds investment Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Total Post Office/Tax saving Bonds investments Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Total Pension Fund (80 CCC) investments Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Feb-12 Mar-12 Total GROSS TOTAL 1,500 1,500

85,350

Childr

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Aman VohraDocument116 pagesAman Vohraraman_bhoomi2761Pas encore d'évaluation

- BSF, ItbpDocument1 pageBSF, Itbpajay chaturvediPas encore d'évaluation

- Question Paper - Fundamentals of Insurance 2021 - Question & AnswersDocument14 pagesQuestion Paper - Fundamentals of Insurance 2021 - Question & Answersjeganrajraj100% (4)

- How To Get SSS ID Card in The Philippines? Requirements and ProcedureDocument11 pagesHow To Get SSS ID Card in The Philippines? Requirements and ProcedureDanilo Siquig Jr.Pas encore d'évaluation

- RMS BharatDocument16 pagesRMS BharatsecgenbpefPas encore d'évaluation

- Icitss Project FileDocument21 pagesIcitss Project FileShrey JainPas encore d'évaluation

- Financial Management OverviewDocument31 pagesFinancial Management OverviewSaif JillaniPas encore d'évaluation

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 592798150280920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 592798150280920 Assessment Year: 2020-21manishPas encore d'évaluation

- Components of CompensationDocument4 pagesComponents of CompensationAnil Kumar SinghPas encore d'évaluation

- Labor Relations Development Structure Process 12Th Edition Fossum Solutions Manual Full Chapter PDFDocument49 pagesLabor Relations Development Structure Process 12Th Edition Fossum Solutions Manual Full Chapter PDFNancyWardDDSrods100% (8)

- Gpi Projects Pvt. LTD.: November 2018 204 Pay Slip For The Month ofDocument1 pageGpi Projects Pvt. LTD.: November 2018 204 Pay Slip For The Month offGPas encore d'évaluation

- Tax CalculationDocument6 pagesTax CalculationClarencia VeronicaPas encore d'évaluation

- Application For Ontario Works AssistanceDocument4 pagesApplication For Ontario Works AssistanceAndre CashPas encore d'évaluation

- IAS 19 - Employee Benefits (2011)Document6 pagesIAS 19 - Employee Benefits (2011)Katrina EustacePas encore d'évaluation

- Director ResignationDocument3 pagesDirector ResignationAries MatibagPas encore d'évaluation

- MP2 FAQ April15Document3 pagesMP2 FAQ April15rieann09Pas encore d'évaluation

- Ispat Industries Annual Report 2006-07Document143 pagesIspat Industries Annual Report 2006-07Rupsa SinhaPas encore d'évaluation

- 46 Re Request of Atty. Bernardo ZialcitaDocument9 pages46 Re Request of Atty. Bernardo ZialcitaYaz CarlomanPas encore d'évaluation

- A Study On Awareness of Retirement Planning in IndiaDocument13 pagesA Study On Awareness of Retirement Planning in IndiakiziePas encore d'évaluation

- Aadhaar Enrolment Correction Form Version 4.0Document2 pagesAadhaar Enrolment Correction Form Version 4.0Ansar AliPas encore d'évaluation

- Gainshairng Vs Profit SharingDocument2 pagesGainshairng Vs Profit SharingIram ImranPas encore d'évaluation

- Salaries: After Studying This Chapter, You Would Be Able ToDocument80 pagesSalaries: After Studying This Chapter, You Would Be Able ToSatyam Kumar AryaPas encore d'évaluation

- Apply Leave FormDocument1 pageApply Leave FormAnuranjan KumarPas encore d'évaluation

- Working Analysis of The Case Truly Human Leadership at Barry-WehmillerDocument5 pagesWorking Analysis of The Case Truly Human Leadership at Barry-WehmillerRyan100% (1)

- Pay and BenefitsDocument2 pagesPay and BenefitsMonica ValentinaPas encore d'évaluation

- Passbook PFDocument5 pagesPassbook PFDarshan SarodePas encore d'évaluation

- Nominal CodesDocument3 pagesNominal Codesrohit5000Pas encore d'évaluation

- SAP HR Common Error MessagesDocument20 pagesSAP HR Common Error Messagesbelrosa2150% (2)

- China's Social Security System - China Labour BulletinDocument13 pagesChina's Social Security System - China Labour BulletinAvinash KhilnaniPas encore d'évaluation

- Insurance Assignment QuizDocument3 pagesInsurance Assignment QuizMotiram paudel100% (1)