Académique Documents

Professionnel Documents

Culture Documents

53 Summary On Vat CST and WCT

Transféré par

Yogesh DeokarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

53 Summary On Vat CST and WCT

Transféré par

Yogesh DeokarDroits d'auteur :

Formats disponibles

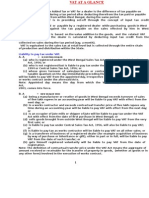

Maharashtra Value Added Tax Act, 2002 Index Sr. No.

Particulars Notes on VAT 1 Examples on VAT 2 Notes on Deemed Sale 3 Works Contract Tax Lease Transaction Examples on Works Contract Tax 4 Notes on Composition Scheme 5 Notes on CST 6 Examples on CST 7 Notes on CST Forms 8 Notes on Sale in Transit 9 10 Notes on VAT Audit 11 Examples on VAT Audit Page No. 1 to 3 4 to 6 7 to 9 10 to 11 12 to 13 14 to 15 16 17 18 to 23 24 25 to 26

Maharashtra Value Added Tax Act, 2002 What is VAT VAT is a form of sales tax i.e. it is a tax on the sale of goods. It is imposed on intra state sale i.e. sale of goods within the state. Since, it is imposed only on the amount of value addition made, it is known as Tax on Value Added or Value Added Tax. This is done by providing set off of tax paid on purchase against the tax payable on sales. Therefore, VAT is a multi point sale tax collected on the amount of Value addition at each stage. ( Example - 1 ) Unlike, Earlier Sales Tax law, VAT prevents cascading effect of taxation by providing input tax credit / set off tax paid at earlier stage. Cascading effect means imposition of tax on tax. ( Example 2 ). As per Entry 54 in List II ( State List ) of Schedule VII to Costitution of India, State are empowered to levy Tax on Sale or Purchase of goods. therefore there is VAT Act or Law for each state separately. Likewise, there is Maharashtra Value Added Tax, 2002 which governs in Maharashtra State and which is applicable from from 1st April,2005 and extends to whole of Maharashtra State. Some of the important definition What is the meaning of Goods As per Section 12 of MVAT Act,2002, goods means every kind of movable property not being newspaper, actionable claims, money, stocks, share, lottery, tickets, grass, trees, including property in such goods attached to or forming part of the land which are agreed to be severed before sale or contract. What is the meaning of Sale Sale means transfer of property in goods by one person to another for Cash or deferred payment. Following Transaction not regarded as sale 1) Gift - No price is charged. 2) Exchange / Barter - Consideration is not in monetory terms. 3) Branch Transfer - There is no transfer of property. 4) Job Work / Processing - In this case, goods are returned to owner after such job work is over. It is a contract of labour and not a contract of sale. Even if, Job work is done under a works contract, it will not liable to VAT so long as there is no transfer of property in goods in execution of such works contract. What is the meaning of Sale Price According to Section 2(25), Sales price means the amount of valuable consideration paid or payable to a dealer fro any sale madeincluding any sum charged for anything done by the seller in respect of goods at the time of or before delivery therefore other than cost of insurance in transit and installation, if, such cost is separately charges. ( Example 7 ). as per explanation II to section 2(25), sale price does not include tax paid or payable to seller in respect of such sale. What is the meaning of turnover of Sale According to Section 2(33), it means aggregate of sale price received or receivable by a dealer in respect of sale of goods during a period after deducting a amount of, Sale price, if any, refunded in respect of goods returned within prescribed time. ( r.w. rule 3 ).

Rate of VAT Like, Income Tax, in which Income is divided in Five heads, Under VAT system goods are divided into five Schedules. ( Example 3 ). Which State Govt. has right to collect Tax on Sale of goods 1) According to VAT provisions, State in which Delivery of goods terminates i.e. transfer right of property in goods has taken place, has right to collect tax on such sales. Therefore, Principle place of business is not important. ( Example 4 ). Input Tax Credit / Set off and Output Tax 1) Input Tax Credit - Means Tax paid or payable by a dealer of a state on purchase of any goods ( including raw materials, capital goods i.e. Plant, Machinery ect., goods intended for resale, or other inputs. made in the course of business. from registered dealer within the state. 2) Output Tax - Means tax charges or chargeable by a registered dealer on sale of goods made by him in the course of his business. Scope of Input Tax Credit ( ITC ) 1) It is allowed only to a registered dealer. 2) The purchasing dealer may be trader or manufacturer.

Exam ple 1

3) It is allowed only of the VAT paid/payable on intra state purchases. In other words, CST paid on purchases made from outside the state is not allowed as ITC under VAT system. ( Example 5 ). Eligible Purchses for availing input tax credit VAT paid can be claimes as ITC, which are purchased for one or more of the following purposes 1) for sale / resale within the state. 2) for inter state sale. 3) to be used as, packing material of goods, which are intended for sale in intra or inter state sale, export. 4) to be used as capital goods required for the purpose of Mfg. or resale of taxable goods, with certain exception. 5) It is allowed only if the purchase are supported by valid invoice. However, in the following cases no ITC is allowed 1) Purchase from unregistered dealer. 2) Inter State purchase. ( Example 5 ). 3) Purchase of goods for use of Mfg. of exempted goods. 4) Purchase of goods used for personal use or for own consumption. 5) Purchase of goods for sent outside state, as branch transfer with certain exceptions. ( Example 6 ). Maharashtra Value Added Tax Rules, 2005 There are around 90 Rules in MVAT Rules,2005. Some of the important rules are as follows Rule 3 - Period of Goods Returned - The period of goods returned u/s 2(32) and 2(33) shall be six months from the date of purchase or as the case amy be the sale. Rule 52 - Eligibility of ITC on Purchases - Claimant dealer is elogoble for ITC paid on Purchase made on or after 1/04/05. Rule 53 - Reduction in set off Purchase of goods for sent outside state, as branch transfer ( Example 6 ). Purchases of Office Equipment, Furniture ect., then, ITC is allowed only after reduction in set off @ 3%. Treatment is same as per Example 6. However, Plant and Machinery purchased for production of taxable goods, then, full ITC is allowed i.e. in this case there is no require to reduction in ITC. If, in the year, Gross sale is less than 50% of Gross receipts, then, ITC is allowed only if the sale is made within 6 months of corresponding purchases. According to Rule 53(6), Gross receipts means receipts from all activities including business activities, carried out in the state. If, there is discontinued business and stock is not transfer or sale, then, ITC on such purchase will not be allowed. If, the goods are used under Works contract under compostion scheme, then, there is a reduction of ITC @ 36% and balance 64% of ITC will be allowed as set off. Rule 54 - Non admissibility on ITC on Purchases Purchase of motor vehicle ( othe then goods vehicle ), which is capital asset unless dealer engaged in the business of transferring of the right to use for any purpose. any purchase of consumables. Rule 77 r.w. Section 86 - Tax Invoice For Eligibility of ITC, The Tax Invoice shall contain the following particulars a) The word Tax Invoice in bold letters at top or at prominent place. b) The name, address or TIN no. of the selling dealer as well as purchasing dealer. c) Serial number and date of issue Invoice. d) Description of goods with Quantity, price. e) Tax Amount shall be shown separately. f) Signed by selling dealer or any person authorised by dealer. g) Declaration which state that, dealer is registered under MVAT Act,2002. Rule 88 - Rate of Interest The Rate of Interest u/s 30 ( 2 ) i.e. for late payment shall be levy @ 1.25% of the amount of tax, for each month or for part thereof.

Maharashtra Value Added Tax Act, 2002

Examples 1) Concept of VAT Assume that Rate of VAT is 4%. Particulars Purchase price Sale Price Gross VAT Liability / Output Tax Input TAX Credit / Set off Net VAT Liability Manufacture Whole Seller Retailer 100 250 450 250 10 450 18 550 22

4 6

10 8

18 4

Under VAT system, only the Value addition suffers tax. The portion of the value of goods, which has already suffered tax, is not taxed again. This is done by providing set off of tax paid on purchase against the tax payable on sales. 2) How VAT prevents cascading effect of taxation Particulars Manufacture Raw Material Labour Overhead Cost Profit @ 20% Sale Price Tax @ 12.5% Cost to Wholeseller Wholeseller Cost Profit @ 20% Sale Price Add - Tax @ 12.5% Cost to Retailer Retailer Cost Profit @ 20% Sale Price Add - Tax @ 12.5% Price to Consumer Govt. Revenue 2700 540 3240 405 3645 2400 480 2880 360 2880 Earlier Law 1000 500 500 2000 400 2400 300 2700 Under VAT 1000 500 500 2000 400 2400 300 2400

3645 729 4374 546.75 4921 1252

2880 576 3456 432 3888 432

Benefits of VAT 1) Increased in demand Under Earlier Sales Tax Act price to consumer reaches to Rs. 4,921, although Mfg. cost remains the same, whereas under VAT system price to consumer is only Rs. 3,888. Thus, VAT leads to reduction in price, which leads to increased in demand, production and also creates more employment. This is one of the best advantages of VAT system. 2) Remove Cascading efffect Under Earlier Sales Tax Act price reached to Rs. 4,921 due to cascading effect, which is removed by VAT system, as, under VAT system VAT paid is not considered as cost. 3) Non - Evasion of Tax Although, under earlier system, Govt. gets higher amount of sales tax, as shown above, which leads to Evasion of Tax. 3) Rate of VAT - Sec. 5 and 6 of MVAT Act,2002 Schedule Description Rate ( % ) I 0 Basic Necessity goods, such as, Rice, Wheat, Milk, Bread. II 1 Precious Stones, Bullions, Gold and Silver ornaments. III 5 Industrial Inputs, Raw Materials, Packing Materials. IV 20 Wines, Liquor.

12.5

All othe goods, which are not falling in Schedules I to IV above.

4) Which State Govt. has right to collect Tax on Sale of goods I - Suppose that, Mr. A of Maharashtra sell goods to Mr. B of Gujrat and Mr. B has taken delivery in maharashtra only, then, in the given case MVAT will be levy., because, transaction palce in Maharashtra and also Transfer of property also made in Maharashtra State only. II - Suppose in the above case, if Mr. A of Maharashtra Sell goods to Mr. of Gujrat, and goods sent by road transport, then, delivery is taken palce out state and also transaction of sale completed in Gujrat state. Therefore, in this case, Maharashtra State can not levy MVAT and instead CST will be levy which is collected by Central Government. 5) Logic behind not allowing credit of CST Sales tax is a source of revenue for each state. CST is collected by the appropriate state on behalf of Central Govt., from which goods moved. Thus, if a dealer in rajasthan makes inter state sale to dealer of maharashtra, the CST on such sale will collected by the state of rajasthan. If, the credit of such CST is allowed to the dealer of Maharashtra against VAT payable to the state of Maharashtra, then, the revenue of the Maharashtra state will get reduced. Hence, the credit of CST is not allowed. 6) Purchase of goods for sent outside state, as branch transfer Inter State branch transfer do not involve sale i.e. not subject to tax. however, it involves reduction in set off of ITC on intra state purchases, which depends upon the state policy. According to MVAT rule 53, there is a reduction of Set off @ 2%. Suppose - Mr. X of Maharashtra purchases goods worth Rs. 5,00,000 ( VAT 12.5% ) from Maharashtra and transfer the same to his branch at gujrat. In this case, Gross ITC is Rs. 62,500 ( 5,00,000*12.5% ), but, eligible ITC is Rs. 52,500 ( 5,00,000*10.5% ). 7) Determination of Sale Price Particulars Amount paid or payable for sale of goods Add - Any statutory levy like excise duty ( excl. sales tax ) Add - Any sum charged for anything done in respect of sale of goods ( e.g. Packing Material ) Less - Cash or trade discount at the time of sale and evident from invoice Less - Cost of Insurance in transit or Installation, if, charges separately Sale price liable to Sales Tax Amount

( ) ( )

Maharashtra Value Added Tax Act, 2002

Deemed Sales Difference of Normal Sale and Deemed Sale In Normal Sale there is transfer of property in goods. The goods remain the same before and after the delivery of goods. However, in case of deemed sale, such as, works contract, goods before delivery and after execution of works contract are different. E.g., at the site of construction of building, before the construction ( works contract ) commences, the goods like cement, steel, sand are lying, but, after the construction, building comes into existence. This is the basic difference between Normal Sale or Deemed Sale. As per Artcile 366(29A) of the constitution of India, sale includes, a) A transfer of property in goods ( whether as goods or in some other form) involved in the execution of a works contract. b) A delivery of goods on hire purchase or any system of payment by installments. c) A transfer of the right to use any goods for any purpose ( whether or not for a specified period ) for cash, deferred payment or other valuable consideration ( i.e. Lease of goods ).

Works Contract Definition - " Works contract means a contract for carrying out any work which includes assembling, construction, building, altering, manufacturing, processing, erection, installation, fitting out, improvement, repair or commissioning of any movable or immovable property. As there is no separate act governing works contract transactions, all such transactions are taxable as deemed sale under the MVAT Act. The rate of tax on goods which are used in the execution of works contract, shall remain same as prescribed in the schedules of respective goods i.e. rate specify in the Sec. 5 and 6 of MVAT Act,2002. Howevwer, sale price of such goodshas may be determined in accordance with the provisions contained in Rule 58 of MVAT Rules,2005. Basics of Works Contract 1) Works contract means a contract to execute a job or to undertake an activity on behalf of a principle. 2) There are two parties invloved, one is contractor who accept the job and another party is Principle who awards the job. 3) Property in goods finally passes to the principle. 4) If, the passeing of property is incidental and contract is for rendering service only, transaction is not taxable under works contract. Scope of Works Contract - The following factors are to be considered while deciding whether there is a works contract or not a) Contract must be composite - A works contract is a composite works contract for sale and services. Where the " Contract for sale " is divisible from " Contract for services ", then, the " Contract for sale is separately charges to VAT and the " Contract for services " will be liable to Service Tax. Taxability under " Works Contract " arises only in the case of " Composite contract ", where " Sale " element and " Service" element cannot be segregated. b) Involvement of Goods - " Goods " must be involved in the execution of works contract. Where there are no goods involved, there cannot be any tax liability under VAT. c) Transfer of property - The property in " Goods " must be transferred ( whether as goods or in some other form ). In some other form, is intended to mean goods sold in form of immovable property such as property in goods like bricks, tiles etc. passed during construction of building. d) Property must pass during execution of works contract - The property in goods must pass during the execution of the works contract, not before or after of the execution of the works contract. Thus, outright sale of already constructed immovable property cannot be subjected to VAT under " Works contract ", as there is no transfer of property in the course of execution of building, the transfer took palce after construction. Taxable event in case of Works Contract The Taxable event would be the transfer of property in goods which takes place during the execution of works contract. The goods transferred or delivered at site of the contractee, will not liable to tax under works contract, but, when such goods are used in the execution of work contract, taxability arises. In other words, in case of execution of works contract, transfer of property in goods takes place not before or after, but, during the course of execution. Tax payable is on the value of goods transferred during the execution of works contract.

Determination of Sale Price for Works Contract There are two mathods for determining the sale price for works contract, as follows 1) Applying normal provision of MVAT Act,2002 and manner specify u/r 58 of MVAT Rule,2005. ( Example 1 ). 2) By applying method specify u/s 42(3) of MVAT Act,2005 i.e. composition Contract. Composition Scheme under Works Contract There are two types of Composition - Sec.42(3) of MVAT Act,2002 -( Example 3, 4 and 5 ). 1) Construction Contract - 5%. 2) Other Contract 8%( Example 2 ). Set off on goods used for Works Contract 1) WC opted for normal provision i.e. apply rule 58 - Full Set off. 2) WC opted for composition scheme ( Construction contract @ 5% ) - Set off after retention of 4%. 3) WC opted for composition for other contracts - Set off shall be reduced by 9 / 25 i.e. 36% i.e. allowable only 64%. TDS provision for Works contract 1) TDS provision applicable to payments made for works contracts. 2) No such deduction is made where the aggregate amount payable to dealer is less than 5 Lakhs during any year. 3) Rate of TDS is 2% of the amount payable to a contractor who is registered dealer or 4% in any other case. 4) No tax is to be deducted on amount of tax as well as Service Tax, if, any, Separatlely charged by the contractor. 5) TDS credit can be available in the month for which TDS was deducted or in the Month in which TDS Certificate was received - Sec. 31(4).

LEASE TRANSACTION What is Lease 1) Lease is a transaction whereby the owner of an asset ( called " Lessor " ) provides such asset to another person ( called " Lessee " ) for use over a period of time for a consideration ( called " Lease Rentals " ). 2) Legal ownership of the asset remains with the lessor, and the possession and use of the asset is transferred to the lessee for a specified period. " Lease - whether sale The definition of Sale includes a transfer of the right to use any goods for any purpose ( Whether or not for a specified period ) for cash, deferred payment or other valuable consideration. Since, Lease involves a transfer of right to use goods, therefore, " Lease " is deemed sales according to VAT Laws. Taxability under Lease Transaction The Taxability will arise, if, the following conditions are satisfied a) There must be goods. Lease of things which are not goods, cannot be taxed. Therefore, Lease of Immovable property is liable to VAT. b) Transfer may be for any purpsoe, whether, Commercial or Personal Purpsoe. c) Transfer must be for cash, deferred payment or other valuable consideration. Free Lease is not liable to VAT. d) Sub Lease of goods are also liable to VAT. e) The " Lessor " of goods must be a dealer. Lease of goods by an individual, who is not a dealer, to his friend is not liable to VAT. Taxable Turnover under Lease Transaction 1) Taxable turnover, in respect of Lease Transaction, will be the consideration paid or payable for such sale. Since, the sale takes place at the time of transfer of right to use the goods, therefore, the value of such right shall be the taxable turnover. 2) But, the Interest or other Finance cost shall not be laible to VAT, as the same is not consideration for sale.

Maharashtra Value Added Tax Act, 2002

Examples 1) Determination of Sale Price under Works Contract u/r 58 Particulars Total Contract Value ( Value of entire Contract ) Less - Allowable deduction 1) Sub - Contract Value paid 2) Labour and Service charges for execution of WC 3) Planning, Designing and Architect Fees 4) Hire charges for P/M for WC 5) Cost of Consumables in which there is no transfer of property. E.g. - Water, Electricity 6) Other cost related to supply of Labour and Service 7) Profit related to Supply of labour and service Balance Sale price - Liable to tax under WC Note 1) Above method is follow, when there is proper maintainance of books of Account. 2) If, Contractor has not maintained accounts, then, in lieu of deduction as above, deduct a LUMPSUM DEDUCTION, provided u/r 58 of MVAT Rules,2005. 3) The sub contract value shall be deduct first from total contract value and thereafter the Lumpsum deduction allowable as per rule 58. 4) The value of goods arrived as above will be liable to tax @ 0% / 1% / 4% / 12.5%, depends upon the nature of WC. 2) Examples of Various types of Contract Construction Contract. Printing Contract. Interior Decorator. Annual Maintenance Contract. Installation or Erection Contract. Repairs or Maintenance Contract. 3) Sale price under WC under Composition Scheme Particulars Total Contract Value Less - Sub contracts Balance Contract Value Amount ( ) Amount Amount

( )

The Subcontract value, which is allowed to be deducted, is the aggregate value of goods on which sub - contractor pays tax or the sub - contract value on which composition tax is paid. 4) Example of Taxability under WC Contract for Installation Plant and Machinery and No Sub - Contract Under rule 58 Composition Accounts Particulars Scheme Accounts Not Sec. 42(3) Maintanined Maintained Contract Value 100,000 100,000 100,000 Less - Deduction u/r 58 ( From table ) ( @ 25% ) 15,000 Less - Deduction of Labour and Service Charges 40,000 on actual basis Balance amount liable to tax 60,000 85,000 100,000 Tax @ 12.5 or @ 8% ( u/s 42(3) Eligible Set off Purchase of Goods Tax @ 4% on above Other Vatable expenses Tax @ 12.5% on above Total Tax paid Set off allow 7,500 10,625 8,000

15,000 600 15,000 1,875 2,475 2475 2475 1584

( Full ) Balance Payable 5,025

( Full ) 8,150

64% 6,416

5) Suppose in above example, there is sub contract for doing electrical installation, where the sub contractor opts for composition scheme and main contractor adopts rule 58. In this case, determination of sale price is Particulars Contract Value Less - Sub - Contract Value Sale price liable to Tax Tax @ 12.5% / 8% Main Sub Contracor Contractor 100,000 (86,400) 80,000 13,600 80,000 1,700 6,400 15,300 86,400

Maharashtra Value Added Tax Act, 2002

Composition Scheme In order to reduce the burden of maintaining detailed records by dealers, there is scheme introduce by state government which is called as Composition Scheme. The Scheme is available to 1) Resellers selling at retail. 2) Restaurants, hotels ( Excl. hotels having grade " 4 Star and above ". 3) Bakers. 4) Dealers of second - hand passenger motor vehicles. General features of composition scheme are as follows a) Composition scheme is optional for dealer. b) Option one exercised would continue till the end of the financial year. c) Amount of tax under composition scheme cannot be recovered separately. Accordingly, compostion dealers canont issue Tax Invoice. d) Composition dealers are not eligible for set off on certain class of purchases which are specifically excluded. 1) Composition scheme for resellers selling in retail For the purpose of this scheme, a retailer is dealer when atleast 90% of the turnover of sales is from goods sold to person who are not dealer. Scheme is not available to 1) A Manufacturer. 2) An Importer. 3) A dealer who effects Inter State Sales or Purchases or Branch Transfer form other State. Class of goods excluded from scheme Turnover of Sales or purchases not to be considered for calculation of composition. a) Drugs covered by Entry C 29. b) Notified Motor Spirit viz. High Speed Diesel, Petrol, Aviation Turbine Fuel and Aviation Gasoline. Turnover liable to tax under composition scheme Turnover of sales including turnover of tax free goods Less Turnover of Purchases including turnover of tax free goods and tax paid on Purchases. Rate of tax under composition scheme 1) 5% for retailers whose aggregate of the turnover of sales of goods covered by Schedule A and goods taxable at 4% is more than 50% of the total turnover of sales. 2) 8% in any other case. Conditions a) Not entitled to claim set off in respect of the purchases corresponding to any goods which are sold or resold or used in packing of goods. b) Dealer having previous year turnover of sales - Turnover not to exceeds 60 Lakhs. c) Taxable goods resold are purchased from Registered Dealer. d) Purchases of Tax free goods may be from RD or URD. 2) Composition scheme for Restaurants, Hotels etc. Class of dealers covered 1) Restaurants. 2) Clubs or refreshment rooms. 3) Hotels ( Other than four star and above ). 4) Caterers. Rate of tax under composition scheme Tax payable @ 8% of the turnover of Sales or 10% in case of URD. 3) Composition scheme for Bakers Applicable to Sales by manufacturer of bakery products. Rate of tax under composition scheme Tax payable at 4% ( 6% in case of URD ) of first 30 lakhs of turnover of sales of goods. Conditions 1) Eligibility for existing dealer - Turnover of sale of goods of brakery products not to exceeds 30 lakhs in the previous year. 2) Eligibility for new dealer - concession available for 1st 30 lakhs. 3) Turnover in excess of 30 lakhs, taxable at applicable rate.

4) Composition scheme for Dealers of second hand passenger motor Vehicles The dealer should be registered dealer whose principle business is of buying or selling of second hand motor vehicles, whether or not sold after reconditioning. Composition rate may be 12.5% or 15% of the sale price of Vehicle.

Central Sales Tax Act,1956 Inter State Sale According to Sec.3 of the Act, Inter State Sale means, if, Sale or Purchase of goods a) Occasions the movement of goods from one state to another, or b) is effected by a transfer of documents of title to the goods during their movment from one state to another. Who can collect the tax State from which movement of goods commences is entitled to collect CST. Sale in Transit Any sale is to be treated as sale in transit, if, following conditions are satisfied i) Subsequent Sale should be the very goods which were sold under the first Inter State Sale. ( Example 1 and 2 ). ii) It is to the registered Dealer, registered under CST. iii) Goods sold are covered in Registration Certificate by description of goods covered by Sec. 8(3) of the CST. iv) Form E -1 or E - 2 issued by dealer from whom the goods were purchased were produced. v) Form C issued by subsequent purchaser is produced. Export Sale A sale or purchase of goods is deemed to be in course of export of the goods out of the territory of india, only if i) Sale / Purchase either occassions such export, or ii) is effected by a transfer of documents of title to goods after the goods have crossed the customs frontiers of india, Sec. 5(1) of CST Act,1956. If a sale is export sale as explained above, no sales tax is leviable under CST and MVAT Act. High Seas Sale - Sec.5(2) of CST Act,1956 It means the sale of goods before crossing the Customs Frontiers of India by way of transfer of documents of title of goods. No CST is chargeable on High Seas Sale. High Seas transaction is always a Central Transaction even though it is made between two Local Dealers. The Goods cross the limits of customs port after the bill of entry and import duty is assessed, even though the assessed duty is not yet being paid, i.e. High seas sales cannot be made after filing of Bill of Entry. ( State of AP V. MMTC ). Penultimate sale for Export Means sale preceeding the sale occassioning export is also deemed to be in the course of export u/s 5(3). Penultimate Export Sale C B of D of Foreign Bombay Delhi PRE - REQUISITES 1) The transaction of last sale or purchase take place ( between B and D ) after the order received by the exporter from foreign buyer ( between B and C ). 2) Accordingly B place the order with A. 3) Received the consignment from A. 4) Export the same goods to B. 5) B shall issue " H Form " to D, for availing Exemption of sales tax. Even if, B and D resides in the same state, then, also this transaction will be considered as Penultimate Export Sale. Rate of Tax in case of Inter State Sale 1)a) Every dealer, who in the course of Inter State Trade, sells to Registered dealer, against C Form, shall be liable to pay tax under this act, @ 2% of his turnover. b) If, the sale is without C Form, then, shall be liable to pay tax at the rate applicable to the sale or purchase of such goods inside the appropriate state. In some states, like Gujarat additional tax of 2.5% will be levy, if, Inter State Sale is made without C Form. 2) If, the sell is made to Unregistered Dealer then, dealer is liable to pay tax as follows a) in the case of declared goods, shall be calculated at twice the rate applicable to the sale of purchase of such goods inside the appropriate state. b) in the case of goods other than declared goods, shall be calculated at the rate of 10% or at the rate applicable to the sale or purchase of such goods inside the appropriate state.

Central Sales Tax Act,1956 Example 1) Sale in Transit Inter State Sale Selling Dealer A of Ahemadabad Buying Person B of Bombay E 1 or E 2 A will submit E 1 to B B will submit E 2 to K K will submit E 2 to M Form C A should obtain Form C from B B should obtain Form C from C K should obtain Form C from M Is Taxable under CST Yes

First Sale

Second Sale ( During movement )

B of Bombay

K of Kochin

No

Third Sale ( During movement ) M sells after taking delivery

K of Kochin

M of Madurai

No

M of Madurai

H of Hyderabad

Yes

2) Sale in Transit Mr. X of Delhi purchased goods from Mr. Y in Punjab. Y booked the material on transport and send GR / RR ( goods receipt note issued by transporter ) to X. X instead of receiving material from transport himself sold the material to Mr. Z of Delhi ( same state ) by endorsing RR / GR in the name of Z. Z takes the delivery from the transporter. In this case sale from Y to X is covered under CST and X to Z is also covered ubder CST as sale in transit. To complete the transaction 1) X will issue C form to Y. 2) Y will issue E-1 form to X. 3) Z will issue C form to X. In the above case even X & Z both are situated in Delhi but the sale transaction is covered under sale in transit clause of CST act, so, CST will be applicable and vat is not be charged. CST is applicable only if goods movement is from one state to other state .If goods movement is started from one state and ends in same state then CST will not be applicable.

Central Sales Tax Act,1956 Details of Forms under CST Act,1956 Form Type A B C D Issue by whom Applicant Department Buyer Government First Seller

Sr. No. 1 2 3 4

Remarks Application of Registration. Registration Certificate under CST Act. For availing Concessional rate in the Inter State trade. Deleted Subsequent inter state sale while goods are in movement from one state to aother.

E1

E2 F ( Note 1 )

Subsequent Second or Subsequent Seller in case of Inter State Sale Seller in Transit for availing Exepmtion of CST Sales. State who Receive Goods Transfer to branch or agent outside the state For availing Exepmtion, if, F Form is not submited then, it will be treated as Inter State Sale.

Example 1 and 2 of CST Example

Branch Transfer

8 9 10 11

G H I J

Who lost the Statutory Form of Indemnity Bond. Form Buyer Buyer Buyer Certificate of Export ( Penultimate sale to Export ). Sale to Units in Special Economic Zone ( SEZ ). Claim Exemption u/s 6(4) of CST Act,1956, purchased by Diplomatic Mission, consulates, United Nations.

Note Generally, F Form is issued in case of Branch Transfer from one state to another in case of Transaction took place between principle and agent, Sec. 6A ( 1 ) of CST Act,1956, but, there is a exception to this, as stated below 1) Stock Transfer in case of Job Work A )In the case of State of U.P. V. M/s Ambica Steel Limited, it was held that, Furnishing of F Form is mandatory for claiming exepmtion by dealer for stock transfer from one state to another for the purpose otherwise than sale. It is immaterial whether the person to whom goods are sent for or received is a job worker or bailee. The requirement of file F Form is also applicable in case of goods returned. B) In consequent of the above judgement, Sales Tax department of the Maharashtra State has issued Trade Circular 2T of 2010, and clarify that, F Form are mandatory for all transaction of inter state transfer ( not by way of sale ), including Job Work and goods return.

Maharashtra Value Added Tax Act, 2002

Accounts to be Audited If, the Turnover of Sales or as the case may bePurchases exceeds Rs. 60 Lakhs ( w.e.f. 1/04/10 ) in any year, then, get his account in respect of such year audited by an Accountant within an prescribed period from the end of that year. Important Points 1) Accountant - Means a Chartered Accountant within the meaning of the Chartered Accountants Act,1949 or a Cost Accountant within the meaning of the Cost and Works Accoutants Act,1959. 2) Turnover of Sales - ( Example 1 ) 1) According to Section 2(33), it means aggregate of sale price received or receivable by a dealer in respect of sale of goods during a period after deducting a amount of, Sale price, if any, refunded in respect of goods returned within a period of Six Months. 2) It is to be noted that, Turnover of all sales i.e. turnover of trading goods, scrap, turnover of capital assets shall be taken into consideration. If a person is carrying on business at two or more places in same date under same R. C. No., the turnover of all such business shall be taken into consideration while calculating the prescribed turnover limit. 3) If, Dealer is fails to file the Audit report within the prescribed time, then, penalty will be levy, which is equal to 1/10th% of the Total Sales. 4) Unlike, Income tax Audit, auditor is not required to certify the true and fair view, but, is required to certify the correctness and completeness of VAT and CST Returns filed by the dealer. Types of Returns 1) Original Return. 2) Revised Return 1) Can be filed within 9 Months from the end of the relevant year. 2) As consequence of VAT Audit, it can be file within 30 days from the due date of filing audit report. 3) Fresh Return - If after filing original return, the department issues defect notice mentioning the defect remained in such return, the dealer will be required to file fresh return within one month from the date of defect notice.

Maharashtra Value Added Tax Act, 2002

Example 1) Details of Audit Applicability Turnover of Sale Particulars Net Sales of goods for F.Y. ( VAT + CST + Export ) Sale of moveble property or Fixed Assets Sales of by products Sales of Scrap Total Sales Less - Sales return ( Within 6 Months Only ) Turnover of Sales Turnover of Purchases Particulars Net Purchases for F.Y. ( VAT + CST + Import ) Purchases of moveble property or Fixed Assets Purchases of Scrap Vatable Expenses which are debited to Profit and Loss Account Total Purchases Less - Purchase return ( Within 6 Months Only ) Turnover of Purchases 2) Procedure to be followed for VAT Audit 1) Vouch / Verify Sales and Purchase Invoices with Sales and Purchase Register. 2) Vouch / Verify Vatable Expenses. 3) Verify the documents of Fixed Assets on which Set off is claimed. 4) Statement to be prepared a) Purchase summary as per Return. b) Sales summary as per Return. c) Tax Summary as per Return. d) Purchase summary as per determined or Audit. e) Sales summary as per determined or Audit. f) Tax summary as per determined or Audit. g) Reconciliation Statement between Turnover of Sales / Purchases as per VAT Audit and Profit and Loss Account. h) Working Capital Statement. 5) Verify the Forms issued under CST Act, such as, C Form, F Form, H Form with relevant documents. 3) Types of Forms for Filing Return Particulars Oil Companies and other dealer effecting sales of Motor Spirit Dealer holding entitlement certificate and obtain tax benefit under package scheme of incentives Works contract or leasing Composition scheme other than works contract Other Dealer

Amount

( )

Amount

( )

Form No. 235 234 233 232 231

Vous aimerez peut-être aussi

- Notes On MVAT Act For StudentsDocument23 pagesNotes On MVAT Act For StudentsDeepali SolankiPas encore d'évaluation

- EOU Regulations Act and GuidelinesDocument90 pagesEOU Regulations Act and Guidelinesascii02Pas encore d'évaluation

- Commonly Found Non-Compliances of SCH II&III of Companies Act - CA - Akshat BahetiDocument37 pagesCommonly Found Non-Compliances of SCH II&III of Companies Act - CA - Akshat BahetiCIBIL CHURUPas encore d'évaluation

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KPas encore d'évaluation

- Pub - Project Financing 7th Edition PDFDocument256 pagesPub - Project Financing 7th Edition PDFAlberto Baron Sanchez100% (1)

- Maharashtra Value Added Tax Act 2Document27 pagesMaharashtra Value Added Tax Act 2Minal ShethPas encore d'évaluation

- A Brief Introduction of MVAT - : by Chinmay GangwalDocument28 pagesA Brief Introduction of MVAT - : by Chinmay GangwalAmolaPas encore d'évaluation

- The The The The The: Published by AuthorityDocument92 pagesThe The The The The: Published by Authorityrahulchow2Pas encore d'évaluation

- Vat at A GlanceDocument19 pagesVat at A GlanceABHIJIT MONDAL100% (1)

- The MRTP ActDocument4 pagesThe MRTP ActKuber BishtPas encore d'évaluation

- R.kasi Vishwanathan & Bros. V Assist CIt (2014) 42 Taxmann - Com 176 Section 139 (5) - It 475-11 28.3.2016Document7 pagesR.kasi Vishwanathan & Bros. V Assist CIt (2014) 42 Taxmann - Com 176 Section 139 (5) - It 475-11 28.3.2016Prabhash ChandPas encore d'évaluation

- Delivery of GoodsDocument18 pagesDelivery of GoodsKartika Bhuvaneswaran NairPas encore d'évaluation

- 6 ItcDocument114 pages6 ItcRAUNAQ SHARMAPas encore d'évaluation

- Task 8Document23 pagesTask 8Anooja SajeevPas encore d'évaluation

- Impact of GST On Warehousing and Supply ChainDocument39 pagesImpact of GST On Warehousing and Supply ChainSundaravaradhan Iyengar100% (6)

- Checklist ProformaDocument4 pagesChecklist ProformasandipgargPas encore d'évaluation

- CST Form 1Document6 pagesCST Form 1Sarath Disha80% (5)

- GST Drona Material PDFDocument124 pagesGST Drona Material PDFAruna RajappaPas encore d'évaluation

- Impact of GST On Stock MarketDocument14 pagesImpact of GST On Stock MarketSiddhartha0% (1)

- Foreign Trade Policy (2015-2020)Document17 pagesForeign Trade Policy (2015-2020)Neha RawalPas encore d'évaluation

- Income From Capital Gain by Vishal GoelDocument57 pagesIncome From Capital Gain by Vishal Goelgoel76vishal100% (1)

- CUSTOMS Summary Book MAY 21 by CA Yachana Mutha BhuratDocument52 pagesCUSTOMS Summary Book MAY 21 by CA Yachana Mutha BhuratSandyPas encore d'évaluation

- Selected Indian Case Studies On Insider TradingDocument27 pagesSelected Indian Case Studies On Insider TradingYASH RAJPas encore d'évaluation

- Sindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFDocument64 pagesSindh Sales Tax On Services Rules 2011 (Amendede Upto 30 Nov 2012) PDFrohail51Pas encore d'évaluation

- 133 GST JudgmentsDocument224 pages133 GST Judgmentsrohit100% (1)

- VALUE ADDED TAX Value Added Tax, Popularly Known AsDocument6 pagesVALUE ADDED TAX Value Added Tax, Popularly Known AsCAclubindia100% (1)

- FEMA Rules & Policies: Government of India World Trade OrganisationDocument2 pagesFEMA Rules & Policies: Government of India World Trade OrganisationPradeep KumarPas encore d'évaluation

- PWC ODI Reg. AnalysisDocument5 pagesPWC ODI Reg. AnalysisVishwas SharmaPas encore d'évaluation

- Registration Under CST ActDocument2 pagesRegistration Under CST Actvikram2050100% (1)

- Foreign Trade Policy of India (Need, Objectives, Features of FTP 2009-2014)Document17 pagesForeign Trade Policy of India (Need, Objectives, Features of FTP 2009-2014)Shitansh NigamPas encore d'évaluation

- Investment Law Project Nisha Gupta Rajshri Singh and Raj Vardhan Agarwal (BBA - LLB (H) ) 8th SemesterDocument20 pagesInvestment Law Project Nisha Gupta Rajshri Singh and Raj Vardhan Agarwal (BBA - LLB (H) ) 8th Semesterraj vardhan agarwalPas encore d'évaluation

- Customs ActDocument24 pagesCustoms ActSoujanya NagarajaPas encore d'évaluation

- 02 Technical Guide On Appeal Before CIT (A) FinalDocument106 pages02 Technical Guide On Appeal Before CIT (A) FinalVivaan AgarwalPas encore d'évaluation

- Central ExciseDocument53 pagesCentral ExciseSuyash JainPas encore d'évaluation

- PPT-on-GST Annual-ReturnDocument33 pagesPPT-on-GST Annual-Returnshrutha p jainPas encore d'évaluation

- Taxation in BangladeshDocument6 pagesTaxation in BangladeshSakibPas encore d'évaluation

- Section 56 - Decoding Section 56 of The Income-Tax Act, 1961 (ITDocument5 pagesSection 56 - Decoding Section 56 of The Income-Tax Act, 1961 (ITNavyaPas encore d'évaluation

- DTAA Tax Project India PDFDocument31 pagesDTAA Tax Project India PDFShubham YadavPas encore d'évaluation

- Reverse Charge Mechanism in GST Regime With ChartDocument14 pagesReverse Charge Mechanism in GST Regime With ChartAnkur ShahPas encore d'évaluation

- Sindh Sales Tax On Services Act 2011Document74 pagesSindh Sales Tax On Services Act 2011Syed Sheraz Ahmed ShahPas encore d'évaluation

- INCOME TAX AND GST. JURAZ-Module 3Document11 pagesINCOME TAX AND GST. JURAZ-Module 3hisanashanutty2004100% (1)

- Problems & Prospects of VATDocument10 pagesProblems & Prospects of VATTHIMMAIAH BAYAVANDA CHINNAPPAPas encore d'évaluation

- 34 - Appeal To CITDocument9 pages34 - Appeal To CITsanjay panjwaniPas encore d'évaluation

- Exim PolicyDocument21 pagesExim PolicyRitu RanjanPas encore d'évaluation

- Form CHG-1-16032017 Signe Cfil CDocument6 pagesForm CHG-1-16032017 Signe Cfil CsunjuPas encore d'évaluation

- GST Annual Return and AuditDocument10 pagesGST Annual Return and AuditRachit ChhedaPas encore d'évaluation

- History of Customs ValuationDocument31 pagesHistory of Customs ValuationMandeep SanghaPas encore d'évaluation

- Vat Act-1991 (English Version)Document39 pagesVat Act-1991 (English Version)enamul100% (2)

- Residential StatusDocument17 pagesResidential Statussaif aliPas encore d'évaluation

- CS Executive Direct TaxDocument477 pagesCS Executive Direct TaxJanhaviPas encore d'évaluation

- Import Export Under GSTDocument9 pagesImport Export Under GSTVijaya PawarPas encore d'évaluation

- Transfer of Property PDFDocument15 pagesTransfer of Property PDFHarsh MangalPas encore d'évaluation

- GST Registration NotesDocument13 pagesGST Registration NotesNagashree RAPas encore d'évaluation

- Advance TaxDocument11 pagesAdvance TaxAdv Aastha MakkarPas encore d'évaluation

- Parag Pro Final 22Document52 pagesParag Pro Final 22Tushar DivsPas encore d'évaluation

- GST APL-01 Powertech Measurment SystemDocument12 pagesGST APL-01 Powertech Measurment SystemUtkarsh KhandelwalPas encore d'évaluation

- Unit 2 - Income From Business or ProfessionDocument13 pagesUnit 2 - Income From Business or ProfessionRakhi DhamijaPas encore d'évaluation

- Customs Tariff of Myanmar 2017 PDFDocument729 pagesCustoms Tariff of Myanmar 2017 PDFSaiNaung100% (1)

- Wealth TaxDocument5 pagesWealth TaxsadathnooriPas encore d'évaluation

- Contract Law II Kslu Notes FinalDocument83 pagesContract Law II Kslu Notes Finaljerome143Pas encore d'évaluation

- A Overview of Maharashtra Value Added Tax: IndexDocument10 pagesA Overview of Maharashtra Value Added Tax: IndexAdnan ParkarPas encore d'évaluation

- Gujarat Value Added Tax ActDocument7 pagesGujarat Value Added Tax ActvikrantkapadiaPas encore d'évaluation

- 1) Residential Status of An INDIVIDUAL Ans: Residential Status For Each Previous Year - Residential Status of An Assessee IsDocument14 pages1) Residential Status of An INDIVIDUAL Ans: Residential Status For Each Previous Year - Residential Status of An Assessee Isdhananjay7Pas encore d'évaluation

- Regular Income Tax: Bacc8 TaxationDocument18 pagesRegular Income Tax: Bacc8 TaxationsoonsPas encore d'évaluation

- Morales Taxation Topic 4 Fringe BenefitsDocument14 pagesMorales Taxation Topic 4 Fringe BenefitsMary Joice Delos santosPas encore d'évaluation

- Case Laws - TaxsutraorangeDocument30 pagesCase Laws - TaxsutraorangePrashanth GsPas encore d'évaluation

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document10 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Kiruthika nagarajanPas encore d'évaluation

- FABM2 Q2W3 TaxationDocument9 pagesFABM2 Q2W3 TaxationDanielle SocoralPas encore d'évaluation

- FY15 IC Payroll Chapter 4 Effective IC Over Payroll PDFDocument16 pagesFY15 IC Payroll Chapter 4 Effective IC Over Payroll PDFTony MorganPas encore d'évaluation

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicPas encore d'évaluation

- Taxation in IndiaDocument437 pagesTaxation in IndiaVishal Mandhare100% (1)

- Slip PDFDocument1 pageSlip PDFPratikDuttaPas encore d'évaluation

- Allowability of Investment Depreciation Reserve Provision Made by Banks - Taxguru.Document2 pagesAllowability of Investment Depreciation Reserve Provision Made by Banks - Taxguru.kavita.m.yadavPas encore d'évaluation

- dt7 PDFDocument215 pagesdt7 PDFAnkitaPas encore d'évaluation

- Direct Tax Case LawsDocument54 pagesDirect Tax Case LawsHemanath NarayanaPas encore d'évaluation

- Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForDocument45 pagesSpecification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForJoseph Shabin100% (1)

- Transfer Business Taxation Tabag Garcia 3rd EditionDocument39 pagesTransfer Business Taxation Tabag Garcia 3rd Editionnatalie clyde matesPas encore d'évaluation

- Cpa Licensure Examination Taxation SyllabusDocument3 pagesCpa Licensure Examination Taxation SyllabusKhrist Dulay100% (1)

- Swedish Migration Board InfoDocument15 pagesSwedish Migration Board InfoasdPas encore d'évaluation

- Energy Audit Notes On Economic Aspects Abd Financial AnalysisDocument11 pagesEnergy Audit Notes On Economic Aspects Abd Financial AnalysisChiru Dana100% (1)

- AssignmentDocument3 pagesAssignmentGeoffrey Rainier CartagenaPas encore d'évaluation

- Demerger - KanikaDocument30 pagesDemerger - KanikaTIRTHANKAR DASPas encore d'évaluation

- TAX-902 (Gross Income - Exclusions)Document5 pagesTAX-902 (Gross Income - Exclusions)Ciarie Salgado100% (1)

- CHAPTER 42 - Accounting For Income TaxDocument18 pagesCHAPTER 42 - Accounting For Income TaxJoshua Wacangan100% (1)

- TDS - Girish AhujaDocument13 pagesTDS - Girish AhujaShaleenPatniPas encore d'évaluation

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Document7 pagesSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Muhammad Usama SheikhPas encore d'évaluation

- Tax Finals Summative s02Document13 pagesTax Finals Summative s02Von Andrei MedinaPas encore d'évaluation

- Winebrenner-Inigo-Insurance-Brokers-Inc-v-CIRDocument24 pagesWinebrenner-Inigo-Insurance-Brokers-Inc-v-CIRDarrel John SombilonPas encore d'évaluation

- Basic Principles of TaxationDocument46 pagesBasic Principles of Taxation在于在Pas encore d'évaluation

- SMChap 015Document41 pagesSMChap 015testbank100% (1)