Académique Documents

Professionnel Documents

Culture Documents

TAN AO Code Master Version 3.5

Transféré par

Bheem PrakashDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

TAN AO Code Master Version 3.5

Transféré par

Bheem PrakashDroits d'auteur :

Formats disponibles

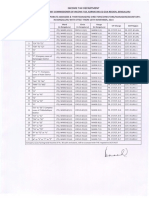

TAN AO CODE Master version 3.

5

SR. NO. RCC AREA CODE AO TYPE RANGE CODE AO NO. DESCRIPTION CITY

1 AGR KNP 2 AGR KNP 3 AGR KNP 4 5 6 7 8 9 10 11 12 AGR AHM AHM AHM AHM AHM AHM AHM AHM KNP GUJ GUJ GUJ GUJ GUJ GUJ GUJ GUJ

WT WT WT WT WT WT WT WT WT WT WT WT

93 94 94 94 116 118 119 120 121 122 123 124

1 INCOME TAX OFFICER (TDS), ALIGARH 1 DCIT/ACIT(TDS-I), AGRA 2 INCOME TAX OFFICER (TDS), JHANSI 4 1 1 1 1 1 1 1 1 INCOME TAX OFFICER (TDS-II), AGRA ITO (TDS), HIMMATNAGAR ITO (TDS), PALANPUR ITO (TDS) SURENDRANAGAR ITO (TDS) - 1, BHAVNAGAR ITO (TDS) - 2, BHAVNAGAR ITO (TDS), PATAN ITO (TDS) GANDHINAGAR ITO (TDS), MEHSANA

ALIGARH AGRA JHANSI AGRA HIMMATNAGAR PALANPUR SURENDRANAGAR BHAVNAGAR BHAVNAGAR PATAN GANDHINAGAR MEHSANA

13 AHM GUJ

CT

147

1 DCIT/ACIT (TDS) CIRCLE, AHMEDABAD

AHMEDABAD

14 AHM GUJ

WT

147

1 ITO (TDS) - 1, AHMEDABAD

AHMEDABAD

15 AHM GUJ

WO

147

1 TRO (TDS), AHMEDABAD

AHMEDABAD

16 AHM GUJ

WT

147

2 ITO (TDS) - 2, AHMEDABAD

AHMEDABAD

17 AHM GUJ

WT

147

3 ITO (TDS) - 3, AHMEDABAD

AHMEDABAD

18 19 20 21 22 23

AHM AHM AHM ALD ALD ALD

GUJ GUJ GUJ LKN LKN LKN

WT WT WT WT WT WT

147 147 147 9 9 9

4 5 6 1 2 3

ITO (TDS) - 4, AHMEDABAD ITO (TDS), GANDHINAGAR ITO (TDS)(OSD), AHMEDABAD AC/ITO (TDS), ALLAHABAD AC/ITO (TDS) VARANASI AC/ITO (TDS), GORAKHPUR

AHMEDABAD GANDHINAGAR AHMEDABAD ALLAHABAD VARANASI GORAKHPUR

24 AMR NWR

WT

310

1 ITO (TDS), CIT-I, AMRITSAR

AMRITSAR

25 AMR NWR

WT

310

2 ITO (TDS), CIT-II, AMRITSAR

AMRITSAR

26 AMR NWR

WT

310

3 ITO (TDS), CIT J&K AT JAMMU

JAMMU

27 AMR NWR 28 AMR NWR

WT WT

310 310

4 ITO (TDS), CIT, BATHINDA 5 ITO (TDS), CIT, J&K AT SRINAGAR

BATHINDA SRINAGAR

29 BBN BBN

CT

12

1 DCIT-1/TDS/BHUBANESWAR

BHUBANESWAR

30 BBN BBN

WT

12

1 ITO (TDS), BHUBANESWAR

BHUBANESWAR

31 BBN BBN

CT

12

2 ACIT-2/ TDS/ BHUBANESWAR

BHUBANESWAR

32 BBN BBN 33 BBN BBN 34 BBN BBN 35 BBN BBN 36 BBN BBN

WT WT WT WT WT

12 12 12 12 12

2 ITO (TDS), CUTTACK 3 ITO (TDS), BERHAMPUR 4 ITO (TDS), BALASORE 5 ITO (TDS), SAMBALPUR 6 ITO (TDS), ROURKELA

CUTTACK BERHAMPUR BALASORE SAMBALPUR ROURKELA

37 BLR

KAR

CT

181

1 TDS CIRCLE 16(1), BANGALORE

BANGALORE

38 BLR

KAR

WT

181

1 TDS WARD 16(1), BANGALORE

BANGALORE

39 BLR

KAR

CT

181

2 TDS CIRCLE 16(2), BANGALORE

BANGALORE

40 BLR

KAR

WT

181

2 TDS WARD 16(2), BANGALORE

BANGALORE

41 BLR

KAR

WT

181

6 TDS WARD 1, MYSORE

MYSORE

42 BLR

KAR

CT

182

1 TDS CIRCLE 18(1), BANGALORE

BANGALORE

43 BLR

KAR

WT

182

1 TDS WARD 18(1), BANGALORE

BANGALORE

44 BLR

KAR

WO

182

1 TRO TDS R-18, BANGALORE

BANGALORE

45 BLR

KAR

CT

182

2 TDS CIRCLE 18(2), BANGALORE

BANGALORE

46 47 48 49 50 51 52 53 54 55 56 57 58

BLR BLR BLR BLR BLR BLR BLR BLR BLR BLR BLR BLR BLR

KAR KAR KAR KAR KAR KAR KAR KAR KAR KAR KAR KAR KAR

WT CT WT WT WT WT CT WT CT WT WT WT WT

182 183 183 183 183 183 184 184 184 184 184 184 612

2 1 1 5 7 9 1 1 2 2 6 7 1

TDS WARD 18(2), BANGALORE TDS CIRCLE -1, BELLARY TDS WARD 1, BELLARY TDS WARD 1, HUBLI TDS WARD 1, DAVANGERE TDS WARD 1, GULBARGA TDS CIRCLE -1, PANAJI ITO TDS WARD - 1, PANAJI TDS CIRCLE -1, MANGALORE ITO TDS WARD - 2, PANAJI ITO TDS WARD - 1, BELGAUM ITO TDS WARD - 1 , MANGALORE LTU TDS WARD-1,BANGALORE

BANGALORE BELLARY BELLARY HUBLI DAVANGERE GULBARGA PANAJI PANAJI MANGALORE PANAJI BELGAUM MANGALORE BANGALORE

59 BPL 60 BPL

BPL BPL

WT CT

39 39

1 INCOME TAX OFFICER (TDS),TDS WARD BHOPAL 1 DCIT/ACIT (TDS), BHOPAL

BHOPAL BHOPAL

61 62 63 64 65 66 67 68

BPL BPL BPL BPL BPL BPL BPL BRD

BPL BPL BPL BPL BPL BPL BPL GUJ GUJ GUJ GUJ GUJ DLC

WT WT CT WT CT WT WT CT WT WT WT WT WT

39 39 59 59 59 59 59 320 320 320 320 320 511

2 3 1 1 2 2 3 1

INCOME TAX OFFICER (TDS), ITARSI INCOME TAX OFFICER (TDS),GWALIOR ACIT/DCIT TDS CIRCLE, INDORE INCOME TAX OFFICER, TDS WARD-1, INDORE ACIT/DCIT TDS CIRCLE, UJJAIN INCOME TAX OFFICER, TDS WARD-2, INDORE INCOME TAX OFFICER, TDS WARD, UJJAIN DCIT / ACIT TDS CIRCLE, BARODA

ITARSI GWALIOR INDORE INDORE UJJAIN INDORE UJJAIN BARODA BARODA BARODA BHARUCH ANAND KOLKATA

69 BRD 70 71 72 73 BRD BRD BRD CAL

1 INCOME TAX OFFICER TDS-1, BARODA 2 3 4 1 INCOME TAX OFFICER TDS-2, BARODA INCOME TAX OFFICER, TDS, BHARUCH INCOME TAX OFFICER, TDS, ANAND ITO,TDS,INT TAX-I

74 CAL 75 76 77 78 79 80 CAL CAL CAL CAL CAL CAL

WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG WBG CHE CHE CHE CHE CHE CHE

CT WT WT WT WT WT CT WT WT WT WT WT WT CT WT WT WT WT WT CT WT WT WT CT WT WT WO CT WT WO WT WT WT

161 161 161 161 161 161 162 162 162 162 162 162 162 163 163 163 163 163 163 164 164 164 164 165 165 165 182 151 151 151 151 151 151

1 DC TDS KOLKATA, NAD, MUR 157(1) 1 2 3 4 5 1 ITO TDS WARD 157(1) KOLKATA ITO TDS WARD 157(2) KOLKATA ITO TDS WARD 157(3) KOLKATA ITO TDS WARD 157(4) KOLKATA ITO TDS WARD 157(5) NAD MURSHIDABAD DC TDS 158(1) KOLKATA HOOGHLY ANM

KOLKATA KOLKATA KOLKATA KOLKATA KOLKATA MURSHIDABAD HOOGHLY KOLKATA KOLKATA KOLKATA KOLKATA HOOGHLY PORT BLAIR MIDNAPUR KOLKATA KOLKATA KOLKATA KOLKATA MIDNAPUR DURGAPUR DURGAPUR ASANSOL BURDWAN SILIGURI SILIGURI MALDA HOOGHLY CHENNAI CHENNAI CHENNAI CHENNAI CHENNAI CHENNAI

81 CAL 82 83 84 85 86 CAL CAL CAL CAL CAL

1 ITO TDS WARD 158(1) KOLKATA ANDM 2 3 4 5 6 ITO TDS WARD 158(2) KOLKATA ITO TDS WARD 158(3) KOLKATA ITO TDS WARD 158(4) KOLKATA ITO TDS WARD 158(5) HOOGHLY ITO TDS PORT BLAIR

87 CAL 88 CAL 89 CAL 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 CAL CAL CAL CAL CAL CAL CAL CAL CAL CAL CAL CHE CHE CHE CHE CHE CHE

1 DC TDS 159(1) KOLKATA HAL MIDNAPUR 1 ITO TDS WARD 159(1) KOLKATA 2 ITO TDS WARD 159(2) KOLKATA 3 4 5 1 1 2 3 2 2 3 1 1 1 1 2 3 4 ITO TDS WARD 159(3) KOLKATA ITO TDS WARD 159(4) KOLKATA ITO TDS WARD 159(5) HAL MIDNAPUR AC/DC TDS CIRCLE DURGAPUR BD SR BA ITO TDS WARD DURGAPUR SR BA ITO TDS ASANSOL PUR ITO TDS BURDWAN DCIT TDS, SILIGURI ITO TDS SILIGURI DARJEELING KA SI ITO TDS MALDA N S DINAJ TRO-HOOGHLY-1 DCIT/ACIT TDS CIRCLE I CHENNAI ITO TDS WARD I(1) CHENNAI TRO TDS I CHENNAI ITO TDS WARD I(2) CHENNAI ITO TDS WARD I(3) CHENNAI ITO TDS WARD I(4) CHENNAI

107 CHE 108 CHE

CHE CHE

WT WT

151 151

5 ITO TDS WARD I(5) CHENNAI 6 ITO TDS WARD I(6) CHENNAI

CHENNAI CHENNAI

109 CHE 110 111 112 113 114 115 116 117 118 119 120 121 CHE CHE CHE CHE CHE CHE CHE CHE CHE CHE CHE CHE

CHE CHE CHE CHE CHE CHE CHE CHE CHE CHE CHE CHE CHE

WT WT WO CT WT WT WT WT WT WT WT WT WT

151 151 152 152 152 152 152 152 152 152 152 152 152

11 ITO TDS, TAMBARAM 21 1 1 1 2 3 4 5 6 11 21 22 ITO TDS, VELLORE TRO TDS II, CHENNAI DCIT/ACIT TDS II CHENNAI ITO TDS WARD II(1) CHENNAI ITO TDS WARD II(2) CHENNAI ITO TDS WARD II(3) CHENNAI ITO TDS WARD II(4) CHENNAI ITO TDS WARD II(5) CHENNAI ITO TDS WARD II(6) CHENNAI ITO TDS, PUDUCHERRY ITO TDS I, CUDDALORE ITO TDS II, CUDDALORE

TAMBARAM VELLORE CHENNAI CHENNAI CHENNAI CHENNAI CHENNAI CHENNAI CHENNAI CHENNAI PONDICHERRY CUDDALORE CUDDALORE

122 CHE

CHE

WT

198

1 ITO (TDS) I, TRICHY

TRICHY

123 CHE 124 CHE 125 CHE

CHE CHE CHE

WT WT WT

198 198 198

2 ITO (TDS) II, TRICHY 11 ITO (TDS), KUMBAKONAM 21 ITO (TDS), SALEM

TRICHY KUMBHAKONAM SALEM

126 CHE 127 CHE 128 CHE

CHE CHE DLC

WT WT WT

198 801 513

31 ITO (TDS), HOSUR 1 INCOME TAX OFFICER (TDS), LTU, CHENNAI 1 ITO (INT. TAX.) - TDS, CHENNAI.

KRISHNAGIRI CHENNAI CHENNAI

129 CHN KRL

CT

17

1 DCIT/ACIT (TDS), KOCHI

KOCHI

130 CHN KRL

WT

17

1 ITO (TDS), KOCHI

KOCHI

131 CHN KRL

CT

17

2 DCIT/ACIT (TDS), KOZHIKODE

KOZHIKODE

132 CHN KRL

WT

17

2 ITO (TDS), THRISSUR

THRISSUR

133 CHN KRL

WT

17

3 ITO (TDS), KOZHIKODE

KOZHIKODE

134 CHN KRL

WT

17

4 ITO(TDS),PALAKKAD

PALAKKAD

135 CHN KRL

WT

17

5 ITO (TDS), KANNUR

KANNUR

136 CMB CHE

69

1 ACIT TDS CIRCLE - COIMBATORE

COIMBATORE

137 CMB CHE

69

11 ITO TDS WARD I(1) - COIMBATORE

COIMBATORE

138 CMB CHE

69

12 ITO TDS WARD I(2) - COIMBATORE

COIMBATORE

139 CMB CHE

69

13 ITO TDS WARD I(3) - COIMBATORE

COIMBATORE

140 CMB CHE

69

16 ITO TDS WARD I(4) - COIMBATORE

COIMBATORE

141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163

CMB CMB CMB DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL

CHE CHE CHE DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DEL DLC DLC DLC

W W W W W W W W W W W W W W W W W W W W W W WT

69 69 69 79 79 79 79 79 80 80 80 80 80 81 81 81 81 81 81 391 35 36 36

17 18 19 1 2 3 4 5 1 2 3 4 5 1 2 3 4 5 6 1 3 3 12

ITO TDS WARD I(5) - COIMBATORE ITO TDS WARD, ERODE ITO TDS WARD, TIRUPUR TDS WARD 49(1) (A) TDS WARD 49(2) (B& F) TDS WARD 49(3) (C & G) TDS WARD 49(4) (D & E) TDS WARD 49(5) TDS WARD 50(1) (H TO I) TDS WARD 50(2) (J & N) TDS WARD 50(3) (K & L) TDS WARD 50(4) (M) TDS WARD 50 (5) TDS WARD 51(1) (O, P & Q) TDS WARD 51(2) (R, U & V) TDS WARD 51(3) (SL-SZ, T) TDS WARD 51(4) (SA-SK, W-Z) TDS WARD 51(5) TDS WARD 51(6) ITO (TDS) (LTU), DELHI ITO,TDS (INT.TAX) W-1(1) ITO,TDS (INT.TAX.) W-2(1) ITO,TDS (INT.TAX)W-2(2), DELHI

COIMBATORE ERODE TIRUPUR DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI DELHI

164 HYD APR 165 HYD APR

CT WT

64 64

1 DCIT/ACIT,CIRCLE-14(1) (TDS), HYDERABAD 1 ITO,WARD-14(1) (TDS), HYDERABAD

HYDERABAD HYDERABAD

166 HYD APR 167 HYD APR 168 HYD APR

CT WT WT

64 64 64

2 DCIT/ACIT,CIRCLE-14(2) (TDS) HYDERABAD 2 ITO,WARD-14(2) (TDS), HYDERABAD 3 ITO,WARD-14(3) (TDS), HYDERABAD

HYDERABAD HYDERABAD HYDERABAD

169 HYD APR 170 HYD APR

CT WT

65 65

1 DC/ACIT,CIRCLE-15(1) (TDS) HYDERABAD 1 ITO,WARD-15(1) (TDS) HYDERABAD

HYDERABAD HYDERABAD

171 HYD APR 172 HYD APR 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 HYD HYD HYD HYD HYD HYD HYD HYD JBP JBP JBP JBP JBP JBP JBP JDH JDH JDH JDH JDH JDH JDH JDH JDH APR APR APR APR APR APR APR APR BPL BPL BPL BPL BPL BPL BPL RJN RJN RJN RJN RJN RJN RJN RJN RJN

CT WT WT CT WT WT WT WT WT WT WT CT WT CT WT CT WT CT WT CT WT WT CT WT WT WT

65 65 65 67 67 67 67 67 67 67 109 109 109 110 110 110 110 650 650 650 650 650 850 850 850 850

2 DC/ACIT,CIRCLE-15(2) (TDS) HYDERABAD 2 ITO,WARD-15(2) (TDS) HYDERABAD 3 1 1 2 3 4 5 6 1 1 2 1 1 2 2 1 1 2 2 3 1 1 2 3 ITO,WARD-15(3) (TDS) HYDERABAD DY.COMMISSIONER / ASST.COMMISSIONER (TDS) ITO (TDS),WARD-3(1), VIJAYAWADA ITO (TDS)-WARD-3(2),VIJAYAWADA ITO (TDS)-WARD-3(3),GUNTUR ITO (TDS)-WARD-3(4),GUNTUR ITO(TDS)-WARD-3(5).TIRUPATHI ITO(TDS)-WARD-3(6),TIRUPATHI INCOME TAX OFFICER TDS-1, JABALPUR DCIT/ACIT TDS CIRLCE, JABALPUR INCOME TAX OFFICER TDS-2, JABALPUR ACIT/DCIT TDS CIRCLE, RAIPUR INCOME TAX OFFICER,TDS WARD RAIPUR ACIT/DCIT TDS CIRCLE, BILASPUR INCOME TAX OFFICER,TDS WARD BILASPUR ACIT TDS, JODHPUR ITO TDS-1, JODHPUR ACIT (TDS), SRIGANGANAGAR ITO TDS-2, JODHPUR ITO (TDS), BIKANER ACIT (TDS), UDAIPUR ITO (TDS), UDAIPUR ITO (TDS), AJMER ITO (TDS), KOTA

HYDERABAD HYDERABAD HYDERABAD HYDERABAD VIJAYAWADA VIJAYAWADA GUNTUR GUNTUR TIRUPATHI TIRUPATHI JABALPUR JABALPUR JABALPUR RAIPUR RAIPUR BILASPUR BILASPUR JODHPUR JODHPUR SRIGANGANAGAR JODHPUR BIKANER UDAIPUR UDAIPUR AJMER KOTA

197 JLD

NWR

WT

401

1 ITO (TDS), CIT-1, JALANDHAR

JALANDHAR

198 JLD

NWR

WT

401

2 ITO (TDS), CIT-II, JALANDHAR

JALANDHAR

199 JLD

NWR

WT

401

3 ITO (TDS), CIT-1, LUDHIANA

LUDHIANA

200 JLD 201 JLD

NWR NWR

WT WT

401 401

4 ITO (TDS), CIT-II, LUDHIANA 5 ITO (TDS), CIT-III, LUDHIANA

LUDHIANA LUDHIANA

202 JPR 203 JPR

RJN RJN

WT CT

13 13

1 ITO TDS-1, JAIPUR 1 DCIT/ACIT (TDS), JAIPUR

JAIPUR JAIPUR

204 JPR

RJN

WT

13

2 ITO TDS-2, JAIPUR

JAIPUR

205 JPR

RJN

WT

13

3 ITO TDS-3, JAIPUR

JAIPUR

206 JPR 207 KLP

RJN PNE

WT C

13 32

4 ITO TDS, ALWAR 1 DC /ACIT TDS 2 PUNE AT KOLHAPUR

ALWAR KOLHAPUR

208 209 210 211 212 213 214

KLP KNP KNP KNP LKN LKN LKN

PNE KNP KNP KNP LKN LKN LKN LKN LKN LKN LKN LKN CHE CHE CHE CHE DLC DLC KNP KNP KNP KNP KNP

WT WT CT WT CT WT WT WT CT WT WT CT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT WT CT WT WT WT CT WT WT WT

32 95 95 95 131 131 131 131 131 133 133 133 577 577 577 577 560 561 96 96 96 96 96 97 97 97 97 97 81 81 81 81 81 81 82 82 82 82 82 83 83 83 83 83 83 51 51 51 51 52 52 52 52

1 1 1 2 1 1 2

ITO (TDS), KOLHAPUR. INCOME TAX OFFICER (TDS)-I, KANPUR ASST./DY. CIT (TDS), KANPUR INCOME TAX OFFICER (TDS)-II, KANPUR ACIT TDS, LUCKNOW ITO TDS - I, LUCKNOW ITO TDS -II, LUCKNOW

KOLHAPUR KANPUR KANPUR KANPUR LUCKNOW LUCKNOW LUCKNOW FAIZABAD LUCKNOW BAREILLY MORADABAD BAREILLY MADURAI TUTICORIN VIRUDHUNAGAR TIRUNELVELI NOIDA DEHRADUN MEERUT GHAZIABAD NOIDA MUZAFFARNAGAR NOIDA DEHRADUN HALDWANI HARDWAR KASHIPUR DEHRADUN MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI MUMBAI NAGPUR NAGPUR AKOLA NAGPUR NAGPUR NAGPUR AMRAVATI CHANDRAPUR

215 LKN 216 LKN 217 218 219 220 221 222 223 224 225 226 227 228 229 230 LKN LKN LKN MRI MRI MRI MRI MRT MRT MRT MRT MRT MRT MRT

3 ITO TDS, FAIZABAD 11 ADDL.CIT TDS RANGE ,LUCKNOW 1 2 11 11 22 33 44 1 1 1 2 3 4 5 ITO TDS BAREILLY ITO TDS MORADABAD JCIT TDS, BAREILLY INCOME-TAX OFFICER, TDS WARD, MADURAI INCOME-TAX OFFICER, TDS WARD, TUTICORIN INCOME-TAX OFFICER, TDS WARD, VIRUDHUNAGAR INCOME-TAX OFFICER, TDS WARD, TIRUNELVELI ITO TDS (INTL TAX), NOIDA ITO TDS (INTL.TAX.), DEHRADUN ITO TDS MEERUT ITO TDS GHAZIABAD ACIT/DCIT TDS NOIDA ITO TDS MUZAFFARNAGAR DCIT TDS NOIDA

231 MRT KNP 232 233 234 235 MRT MRT MRT MRT KNP KNP KNP KNP

1 ITO TDS DEHRADUN 2 3 4 5 ITO TDS HALDWANI ITO TDS HARDWAR ITO TDS KASHI PUR DCIT/ ACIT/ TDS, DEHRADUN

236 MUM MUM 237 238 239 240 241 242 243 244 245 246 247 248 249 250 251 252 253 254 255 256 257 258 259 260 MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM NGP NGP NGP NGP NGP NGP NGP NGP MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM MUM NGP NGP NGP NGP NGP NGP NGP NGP

1 ITO (TDS) WARD 1(1), MUMBAI[NEW] 2 3 4 5 6 1 2 3 4 5 1 2 3 4 5 8 1 1 2 3 1 1 2 3 ITO (TDS) WARD 1(2), MUMBAINEW] ITO (TDS) WARD 1(3), MUMBAI[NEW] ITO (TDS) WARD 1(4), MUMBAI[NEW] ITO (TDS) WARD 1(5), MUMBAI[NEW] ITO(OSD)(TDS) 1(3), MUMBAI ITO (TDS) WARD 2(1), MUMBAI[NEW] ITO (TDS) WARD 2(2), MUMBAI[NEW] ITO (TDS) WARD 2(3), MUMBAI[NEW] ITO (TDS) WARD 2(4), MUMBAI[NEW] ITO (TDS) WARD 2(5), MUMBAI[NEW] ITO (TDS) WARD 3(1), MUMBAI [NEW] ITO (TDS) WARD 3(2), MUMBAI [NEW] ITO (TDS) WARD 3(3), MUMBAI [NEW] ITO (TDS) WARD 3(4), MUMBAI [NEW] ITO (TDS) WARD 3(5), MUMBAI [NEW] [NEW] ITO(OSD)TDS RANGE 3(2) DC/AC TDS CIRCLE 51(1), NAGPUR ITO TDS WARD 51(1), NAGPUR ITO TDS WARD 51(2), AKOLA ITO TDS WARD 51(3), NAGPUR DC/AC TDS CIRCLE 52 (1), NAGPUR ITO TDS WARD 52 (1), NAGPUR ITO TDS WARD 52 (2), AMRAVATI ITO TDS WARD 52 (3), CHANDRAPUR

261 NSK 262 NSK 263 NSK 264 NSK 265 NSK 266 NSK 267 NSK

PNE PNE PNE PNE PNE PNE PNE

CT WT WO WT WT WT WT

31 31 31 31 31 31 31

1 DY./ASSTT.CIT, TDS CIRCLE, NASHIK 1 INCOME TAX OFFICER, TDS-I, NASHIK 1 TAX RECOVERY OFFICER, TDS, NASHIK 2 INCOME TAX OFFICER, TDS-II, NASHIK 3 INCOME TAX OFFICER, TDS, JALGAON 5 INCOME TAX OFFICER, TDS-II, AURANGABAD 6 INCOME TAX OFFICER, TDS, NANDED

NASHIK NASHIK NASHIK NASHIK JALGAON AURANGABAD NANDED

268 PNE

PNE

CT

65

1 DCIT/ACIT TDS-1, PUNE

PUNE

269 PNE

PNE

WT

65

1 ITO TDS-1, PUNE

PUNE

270 PNE

PNE

CT

65

2 DCIT/ACIT TDS-2, PUNE

PUNE

271 PNE

PNE

WT

65

2 ITO TDS-2, PUNE

PUNE

272 PNE 273 PNE 274 PNE

PNE PNE PNE

WT WT CT

65 65 66

3 ITO TDS-3, PUNE 4 ITO TDS-4, PUNE 1 DCIT/ACIT TDS, THANE

PUNE PUNE THANE

275 PNE

PNE

WT

66

1 ITO TDS-I, THANE

THANE

276 PNE

PNE

WT

66

2 ITO TDS-II, THANE

THANE

277 278 279 280 281 282 283 284 285 286 287 288 289 290 291

PNE PNE PTL PTL PTL PTL PTL PTL PTL PTL PTL PTL PTL PTL PTL

PNE PNE NWR NWR NWR NWR NWR NWR NWR NWR NWR NWR NWR NWR NWR

WT WT CT WT WT WT WT WT WT WT WT WT WT WT WT

66 66 403 403 403 403 404 404 404 404 405 405 405 405 405

3 4 1 1 2 3 1 2 3 4 1 2 3 4 5

ITO TDS, KALYAN ITO TDS, PANVEL ACIT(TDS), CHANDIGARH ITO (TDS), CIT-I, CHANDIGARH ITO (TDS), CIT-II, CHANDIGARH ITO (TDS), CIT, PATIALA ITO (TDS), CIT-I, AMRITSAR ITO (TDS), CIT-II, AMRITSAR ITO (TDS), CIT, JAMMU ITO (TDS), CIT, BATHINDA ITO TDS-I,LDH, JT./ADDL.CIT(TDS), LUDHIANA ITO TDS-II,LDH, JT./ADDL.CIT(TDS), LUDHIANA ITO TDS-III,LDH, JT./ADDL.CIT(TDS), LUDHIANA ITO TDS-I,JAL JT/ADDL.CIT(TDS), LUDHIANA ITO TDS-II,JAL JT/ADDL.CIT(TDS), LUDHIANA

KALYAN PANVEL CHANDIGARH CHANDIGARH CHANDIGARH PATIALA AMRITSAR AMRITSAR JAMMU BATHINDA LUDHIANA LUDHIANA LUDHIANA LUDHIANA LUDHIANA

292 PTL

NWR

WT

406

1 ACIT (TDS), SHIMLA

SHIMLA

293 PTL 294 PTL

NWR NWR

WT WT

406 406

2 ITO (TDS), MANDI & PALAMPUR 3 ITO (TDS), UNA

PALAMPUR UNA

295 PTL

NWR

WT

406

4 ITO (TDS), SOLAN

SOLAN

296 PTL

NWR

WT

406

5 ITO (TDS), NAHAN

NAHAN

297 PTL 298 PTN 299 PTN

NWR PTN PTN

WT CT CT

406 41 41

6 ITO (TDS), BADDI 1 NEW_ACIT/DCIT TDS CIRCLE, PATNA 2 NEW_DCIT/ACIT/ITO(HQ) TDS CIRCLE, PATNA

BADDI PATNA PATNA

300 PTN 301 PTN 302 PTN 303 RCH 304 RCH 305 RCH

PTN PTN PTN PTN PTN PTN

CT CT CT CT CT CT

41 43 43 66 66 66

3 NEW_ACIT/DCIT TDS, MUZAFFARPUR 1 NEW_ACIT/DCIT TDS, BHAGALPUR 2 NEW_ACIT/DCIT TDS, BEGUSARAI 1 TDS CIRCLE/WARD RANCHI 2 TDS CIRCLE/WARD JAMSHEDPUR 3 TDS CIRCLE/WARD BOKARO

MUZAFFARPUR BHAGALPUR BEGUSARAI RANCHI JAMSHEDPUR BOKARO

306 RCH

PTN

CT

68

1 DCIT/ACIT/ITO CIRCLE/WARD TDS DHANBAD

DHANBAD

307 RKT 308 RKT 309 RKT 310 RKT 311 RKT 312 RTK 313 314 315 316 317 318 RTK RTK RTK RTK RTK RTK

GUJ GUJ GUJ GUJ GUJ NWR NWR NWR NWR NWR NWR NWR

CT WT WT WT WT WT WT WT WT WT WT WT

206 206 206 206 206 74 74 74 74 74 74 74

1 ACIT TDS CIRCLE, RAJKOT 1 ITO TDS - 1, RAJKOT 2 ITO TDS - 2, RAJKOT 3 ITO TDS, JAMNAGAR 4 ITO TDS, GANDHIDHAM 1 ITO (TDS) FARIDABAD 2 3 4 5 6 7 ITO (TDS) ROHTAK ITO (TDS) HISSAR ITO (TDS) KARNAL ITO (TDS) PANCHKULA ACIT(TDS) GURGAON ITO(TDS), GURGAON

RAJKOT RAJKOT RAJKOT JAMNAGAR GANDHIDHAM FARIDABAD ROHTAK HISSAR KARNAL PANCHKULA GURGAON GURGAON

319 SHL

SHL

WT

10

1 ITO-TDS-1, GUWAHATI

GUWAHATI

320 SHL

SHL

CT

10

1 ACIT-TDS, BONGAIGAON

BONGAIGAON

321 SHL

SHL

CT

10

2 ACIT-TDS, TEZPUR

TEZPUR

322 SHL

SHL

WT

10

2 ITO-TDS-2, GUWAHATI

GUWAHATI

323 SHL 324 SHL 325 326 327 328 329 330 331 SHL SHL SHL SHL SHL SHL SRT

SHL SHL SHL SHL SHL SHL SHL SHL GUJ

WT CT WT CT WT CT CT CT CT

10 12 12 13 13 13 13 13 414

3 ITO-TDS-3, GUWAHATI 1 ACIT-TDS, JORHAT 1 1 1 2 3 4 1 ITO-TDS, IMPHAL ACIT (TDS), SHILLONG ITO (TDS), DIBRUGARH ACIT (TDS), SILCHAR ACIT (TDS), AGARTALA DCIT (TDS), TINSUKIA ACIT-TDS-CIRCLE,SURAT [NEW]

GUWAHATI JORHAT IMPHAL SHILLONG DIBRUGARH SILCHAR AGARTALA TINSUKIA SURAT

332 SRT

GUJ

WT

414

1 INCOME TAX OFFICER-TDS-1,SURAT [NEW]

SURAT

333 SRT

GUJ

WT

414

2 INCOME TAX OFFICER-TDS-2,SURAT [NEW]

SURAT

334 SRT

GUJ

WT

414

3 INCOME TAX OFFICER-TDS-3,SURAT [NEW]

SURAT

335 SRT

GUJ

WT

414

4 INCOME TAX OFFICER-TDS-4,SURAT [NEW]

SURAT

336 337 338 339 340 341

SRT TVD TVD TVD TVD TVD

GUJ KRL KRL KRL KRL KRL

WT CT WT CT WT WT

414 64 64 64 64 64

5 1 1 2 2 3

INCOME TAX OFFICER-TDS,VALSAD [NEW] DCIT/ACIT(TDS), TRIVANDRUM ITO(TDS), TRIVANDRUM DCIT/ACIT(TDS), KOTTAYAM ITO(TDS), ALLEPPY ITO(TDS), KOLLAM

VALSAD TRIVANDRUM TRIVANDRUM KOTTAYAM ALLEPPY KOLLAM

342 VPN APR

CT

96

1 ACIT CIRCLE-6(1) TDS VISHAKHAPATNAM

VISHAKHAPATNAM

343 VPN APR

WT

96

1 ITO WARD-6(1),TDS, VISHAKHAPATNAM

VISHAKHAPATNAM

344 VPN APR

WT

96

2 ITO WARD-6(2),TDS,VISHAKHAPATNAM

VISHAKHAPATNAM

345 VPN APR

WT

96

3 ITO WARD-6(3),TDS,VISHAKHAPATNAM

VISHAKHAPATNAM

346 VPN APR

WT

96

4 ITO, TDS, RAJAHMUMDHRY

RAJAHMUNDRY

CITY_AREA (JURISDICTION)

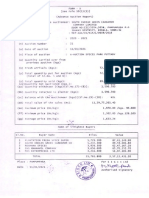

TDS OF ALIGARH, FARRUKHABAD, MAINPURI, KANNAUJ, KASGANJ, HATHRAS & ETAH DISTRICTS. TDS/TCS EXCEEDS RS. 10 LAKHS OF AGRA, MATHURA, ETAWAH, AURAIYA & FIROZABAD DISTRICTS. TDS OF JHANSI & LALITPUR DISTRICTS. TDS/TCS LESS THAN RS. 10 LAKHS OF AGRA, MATHURA, ETAWAH, AURAIYA & FIROZABAD DISTRICTS.

ASSIGNED CASES OF AREAS WITHIN THE TERRITORIAL LIMITS OF REVENUE DISTRICSTS OF AHMEDABAD BANASKANTA, BHAVNAGAR, GANDHINAGAR, MEHSANA, PATAN, SABARKANTA. AMRAIWADI, BAG-E-FIRDOSH, BEHRAMPURA, BHAIPURA, CHANDLOIDA, DANILIMDA, DASKROI AND VILLAGE OF DHOLKA, BAVLA, GHATLODIA, GOMITPUR, HANSOL, HATKESHWAR, JODHPUR, KANKARIA, KHOKHRA, KRISHNAGAR, KUBERNAGAR, MAKARBA GAM, MANINAGAR, MEMNAGAR, MUGDEMPUR, NARODA ROAD, PIELEJ, RAJPUR, RAKHIAL, RANIP, SAIJPURBOGHA, SANAND, SARASPUR, SARDARNAGAR, SARKHEJ-BAVLA ROAD, SARKEHJ GANDHIANGAR HIGHWAY (SARKHEJ BAVLA ROAD TO NIRMA INSTITUTE), SATELLITE, SOLA GAM-ROAD, THAKKAR BAPANAGAR, THALTEJ, VASTRAPUR, VEJAPUR, VIRAMGAM THE REVENUE DISTRICT OF SURENDRANAGAR AREAS WITHIN THE TERRITORIAL LIMITS OF REVENUE DISTRICTS OF AHMEDABAD.BANASKANTA, BHAVNAGAR, GANDHINAGAR, MEHSANA, PATAN, SABARKANTA

ANKUR, ASARWA, BAPUNAGAR, BHAVSAR HOSTEL, BHUANGDEV, BIBI TALAV, DAKSHINI SOCIETY, DUDESHWAR, DUDHNATH MAHADEV, GANDHI ASHRAM, GIDC CTM, GIRDNARNAGAR, ISANPUR, KALAPINAGAR, KHOKHRA, LAL BAHADUR SHASTRI STADIUM, MAHEMDABAD CTM, MEGHANINAGAR, NARANPURA, NAROL, NAVA WADAJ, NIKOL ROAD, NILOL, POTALIYA, RTO OFFICE, RABARI COLONY GODASAR, RANIPUR, SAMRAT NAGAR, SARDAR PATEL COLONY, SARDAR PATEL ELECTION WARD (STARTING FROM GANDHI BRIDGE TO STADIUM) SHAHWADI SMURTI MANDIR SOLA ROAD SUBASH BRIDGE, USMANPURA ( FROM MAHATMA GANDHI STATUE AT IT CIRCLE TO GANDHI ASHRAM GANDHI ASHRAM), VATVA, VIJYNAGAR, VINOBHAVE NAGAR, VINZOL, VIVEKANDNAGAR, WADAJ, THE REVENUE DISTRICT OF MEHSANA AND PATAN

AEM OFFICE, APMC, ASHRAM ROAD (FROM INCOME TAX CIRCLE TO ELLISBRIDGE POLICE STATION), BARDOLPURA, DARIAPUR, DELHI CHAKLA, DUDHESHWAR, FATEHPURA, GHEEKANTA, HIRABHAI MARKET, JAIN MERCHANT SOCIETY, JIVRAJ MEHTA HOSPITAL, JIVRAJ PARK, KALUPUR (ELECTION WARD), KOCHRAB BHATHA, MADALPUR, MADHPURA, MASKTI MARKET, PALDI, PRABHUDAS THAKKAR COLLEGE, PREM DARWAJA, PRITAMNAGAR, RAILWAYPURA, RATANPOLE, RELIEF ROAD, REVDI BAZAR, SHAIBAUG, SWAMINARAYAN MANDIR, TAVDIPURA, TERRITORIAL AREA BETWEEN SABARMATI RIVER AND RLY. TRACK, TOWN HALL, V.S. HOSPITAL, VASNA ELECTION WARD, THE REVENUE DISTRICT OF BANASKANTA

ARBUDA MILL, BHADRA, C.G. ROAD, DIGVIJAYNAGAR, ELLISBRIDGE, GANDHIGRAM, GITA MANDIR, GUJARAT BOTTLING, GULBHAI TEKRA, GVMM INDUSTRIAL ESTATE, HALIM KHADKI, JAGNATH TEMPLE, JAMA MASJID, JAMALPUR, KALIGAM, KATHWADA VILLAGE KESHAV NAGAR, MAIZE PRODUCTS, SINGRVA, KESHAVNAGAR, KHADIA, KHADI (ELECTION WARD), KHANPUR, LALDARWAJA, LAW GARDEN, MADALPUR, GUJARAT COLLEGE, MANEK CHOWK, MIRZAPUR, MITHAKHLI, UNIVERSITY, MUTHIA, NAGARWEL HANMAN, NARODA, NARODA GIDC, NARODA VILLAGE, NAVRANGPURA, NEHRUNAGAR CIRCLE, ODHAV, ODHAV GIDC, OLD RTO, ONGC WORKSHOP, PANCHKUVA, RABRI COLONY, BHIKSHUK GRUH, RAIKHAD, RAKHIAL, RANIP (NEW) RANIP, S.T., SABARMATI, SRANGPUR DARWAJA (OUTSIDE), SHAHPUR, SHAHPUR DARWAJA, SHREYAS TEKRA, SOMA TEXTILE, THREE GATE, THE REVENUE DISTRICT OF BHAVNAGAR THE REVENUE DISTRICT OF GANDHINAGAR AND SABARKANTA

RANGE I, II AND III OF AMRITSAR i.e. AREA FALLING UNDER THE JURISDICTION OF OLD AO CODES - NWR-WO-80-1, NWR-WO-81-1, NWRWO-82-1 RANGE IV, V AMRITSAR & RANGE PATHANKOT i.e. AREA FALLING UNDER THE JURISDICTION OF OLD AO CODES - NWR-WO-83-1, NWRWO-84-1, NWR-WO-85-1 RANGE I & II JAMMU i.e. AREA FALLING UNDER THE JURISDICTION OF OLD AO CODES - NWR-WO-86-1, NWR-WO-87-1 RANGE I, II BATHINDA & RANGE FEROZEPUR i.e. AREA FALLING UNDER THE JURISDICTION OF OLD AO CODES - NWR-WO-89-1, NWR-WO-90-1, NWR-WO-91-1 RANGE SRINAGAR i.e. AREA FALLING UNDER THE JURISDICTION OF OLD AO CODE - NWR-WO-88-1 A. Revenue district of Khurda including the areas within the limits of Bhubaneswar Municipal Corporation. B. Revenue district of Puri and Nayagarh C. Revenue district of Dhenkanal and Angul. A. Revenue district of Khurda including the areas within the limits of Bhubaneswar Municipal Corporation. B. Revenue district of Puri and Nayagarh C. Revenue district of Dhenkanal and Angul. PURI,NAYAGARH,GANJAM,GAJAPATI,KORAPUT,RAYAGARH,NABARANG APUR,MALKANGIRI,KHANDHAMAL,BOUDH,CUTTACK,JAGATSINGHPUR, KENDRAPARA,JAJPUR,BHADRAK,BALASORE & MAYURBHANJ A. Revenue district of Cuttack including the areas coming under the Cuttack. B. Revenue district of Kendrapara, Jajpur, Jagatsinghpur. Revenue district of Ganjam, Gajapati, Koraput, Malkanagir, Nawarangapur, Boudh, Phulbani and Rayagada. Revenue districts of Balasore, Bhadrak and Mayurbhanj. Revenue districts of Sambalpur, Bargarh, Keonjar, Jharsuguda, Bolangir, Deogarh, Sonepur, Kalahandi, Nuapada. Revenue districts of Sundergarh.

1) ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING ANNUAL TDS AND OR TAX COLLECTED AT SOURCE OF RS 10 LAKHS AND ABOVE UNDER IT-ACT 1961 AND A) WHOSE NAMES START WITH ENGLISH ALPHABETS "A" TO "F" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION) B) WHOSE NAMES START WITH NUMERALS "0" TO "4" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION)

1) ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING ANNUAL TDS AND OR TAX COLLECTED AT SOURCE OF LESS THAN RS 10 LAKHS UNDER IT-ACT 1961 AND A) WHOSE NAMES START WITH ENGLISH ALPHABETS "A" TO "F" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION) B) WHOSE NAMES START WITH NUMERALS "0" TO "4" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION) ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING ANNUAL TDS AND OR TAX COLLECTED AT SOURCE OF RS 10 LAKHS AND ABOVE UNDER ITACT 1961 AND WHOSE NAMES START WITH ENGLISH ALPHABETS "G" TO "L" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION) ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING ANNUAL TDS AND OR TAX COLLECTED AT SOURCE OF LESS THAN RS 10 LAKHS UNDER ITACT 1961 AND WHOSE NAMES START WITH ENGLISH ALPHABETS "G" TO "L" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION) ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING ANNUAL TDS AND OR TAX COLLECTED AT SOURCE OF LESS THAN RS 10 LAKHS UNDER ITACT 1961 AND AREAS FALLING WITHIN THE TERRITORIAL JURISDICTION OF COMMISSIONER OF INCOME TAX, MYSORE

1) ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING ANNUAL TDS AND OR TAX COLLECTED AT SOURCE OF RS 10 LAKHS AND ABOVE UNDER IT-ACT 1961 AND A) WHOSE NAMES START WITH ENGLISH ALPHABETS "M" TO "Q" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION) B) WHOSE NAMES START WITH NUMERALS "5" TO "9" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION)

1) ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING ANNUAL TDS AND OR TAX COLLECTED AT SOURCE IS LESS THAN RS 10 LAKHS UNDER IT-ACT 1961 AND A) WHOSE NAMES START WITH ENGLISH ALPHABETS "M" TO "Q" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION) B) WHOSE NAMES START WITH NUMERALS "5" TO "9" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION)

1) ALL PERSONS WHO ARE RESPONSIBLE FOR TDS AND OR TAX COLLECTED AT SOURCE OF THE IT-ACT 1961 AND IS FALLING A) WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II / III / IV / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION) B) AREAS FALLING WITHIN TERRITORIAL JURISDICTION OF COMMISSIONER OF IT- MYSORE EXCLUDING THE PERSONS WHO ARE RESPONSIBLE FOR MAKING DEDUCTION OF TAX AT SOURCE U/S. 195 OF IT ACT 1961 ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING ANNUAL TDS AND OR TAX COLLECTED AT SOURCE OF RS 10 LAKHS AND ABOVE UNDER ITACT 1961 AND WHOSE NAMES START WITH ENGLISH ALPHABETS "R" TO "Z" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION) ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING ANNUAL TDS AND OR TAX COLLECTED AT SOURCE IS LESS THAN RS 10 LAKHS UNDER ITACT 1961 AND WHOSE NAMES START WITH ENGLISH ALPHABETS "R" TO "Z" WITHIN AREA OF URBAN & RURAL DISTRICTS OF BANGALORE COMING UNDER COMMISSIONER OF IT BANGALORE I / II (EXCLUDING DISTRICT OF TUMKUR) / III / IV (EXCLUDING DISTRICT OF KOLAR) / V / CENTRAL DIRECT OF IT (TRANSFER PRICING) AND DIRECTOR OF IT (EXEMPTION)

NISHAT COLONY, VALLABH BHAWAN, MLA REST HOUSE, MALVIYA NAGAR, T.T.NAGAR, NEW MARKET, ROSHANPURA, JINSI, JEHANGIRABAD, BARKHEDI, CHANDBAD, AISHBAGH, JOGIPURA, SUBHASH NAGAR, SHAKTI NAGAR, SHIVAJI NAGAR,CHAR IMLI, ARERA COLONY, SHAHPURA, HABIBGANJ, SAKET NAGAR,SHAKTI NAGAR, RACHNA NAGAR, GOUTAM NAGAR, KASTURBA NAGAR, GOVINDPURA, BARKHEDA, PIPLANI, SONAGIRI, INDRAPURI, ASHOKA GARDEN, PUNJABI BAGH, LAJPATRAI COLONY, BHANPURA, HARDA, ITARSI, HOSHANGABAD. MANGALWARA, JUMERATI BAZAR, CHOWK, IBRAHIMPURA, BELDARPURA, GHORANAKKAS, ITWARA, KUMGHARPURA, MARWARI ROAD, LOHA BAZAR, LALWANI PRESS ROAD, AZAD MARKET, SABJI MANDI, JAWAHAR CHOWK, SHASTRI NAGAR, KOTRA SULTANABAD, BETUL, SEHORE BAIRAGARH, SAIFIA COLLEGE ROAD, SHAHJEHANABAD, IDGAH HILLS, KOHEFIZA, PARI BAZAR, OLD SECRETARIATE, SHAHIL NAGAR, BAZARIA, OLD CHOLA ROAD, NEW KABAD KHANA, NEW SINDHI COLONY, CATEGORISED MARKET, IBRAHIMGANJ, HAMIDIA ROAD, SUTANIA ROAD, NAVIBAGH AREA, VIDISHA, RAISEN, MANDIDEEP, SANCHI.

NISHAT COLONY, VALLABH BHAWAN, MLA REST HOUSE, MALVIYA NAGAR, T.T.NAGAR, NEW MARKET, ROSHANPURA, JINSI, JEHANGIRABAD, BARKHEDI, CHANDBAD, AISHBAGH, JOGIPURA, SUBHASH NAGAR, SHAKTI NAGAR, SHIVAJI NAGAR,CHAR IMLI, ARERA COLONY, SHAHPURA, HABIBGANJ, SAKET NAGAR,SHAKTI NAGAR, RACHNA NAGAR, GOUTAM NAGAR, KASTURBA NAGAR, GOVINDPURA, BARKHEDA, PIPLANI, SONAGIRI, INDRAPURI, ASHOKA GARDEN, PUNJABI BAGH, LAJPATRAI COLONY, BHANPURA, HARDA, ITARSI, HOSHANGABAD. MANGALWARA, JUMERATI BAZAR, CHOWK, IBRAHIMPURA, BELDARPURA, GHORANAKKAS, ITWARA, KUMGHARPURA, MARWARI ROAD, LOHA BAZAR, LALWANI PRESS ROAD, AZAD MARKET, SABJI MANDI, JAWAHAR CHOWK, SHASTRI NAGAR, KOTRA SULTANABAD, BETUL, SEHORE BAIRAGARH, SAIFIA COLLEGE ROAD, SHAHJEHANABAD, IDGAH HILLS, KOHEFIZA, PARI BAZAR, OLD SECRETARIATE, SHAHIL NAGAR, BAZARIA, OLD CHOLA ROAD, NEW KABAD KHANA, NEW SINDHI COLONY, CATEGORISED MARKET, IBRAHIMGANJ, HAMIDIA ROAD, SUTANIA ROAD, NAVIBAGH AREA, VIDISHA, RAISEN, MANDIDEEP, SANCHI. GWALIOR INDORE

UJJAIN TOP 150 CASES OF RCC BARODA A TO L ALPHABET OF BARODA DISTRICT AND ALL CASES OF GODHRA DISTRICT M TO Z ALPHABET OF BARODA DISTRICT + ALL CASES OF DAHOD DISTRICT ALL CASES OF BHARUCH, NARMADA DISTRICT ALL CASES OF ANAND, NADIAD DISTRICT NUMERALS & NAMES [STARTING WITH A-H] AND ALL WB GOVT. OFFICES & LOCAL BODIES AND ALL OFFICES UNDER CENTRAL GOVT. AND RETURN INCOME > 50 LACS NUMERALS & NAMES [STARTING WITH A] AND RETURN INCOME < = 50 LACS NAMES [STARTING WITH B] AND RETURN INCOME < = 50 LACS NAMES [STARTING WITH C-G] AND RETURN INCOME <= 50 LACS NAMES [STARTING WITH H] AND RETURN INCOME <= 50 LACS NAMES [STARTING WITH I TO P] AND RETURN INCOME > 50 LACS NAMES [STARTING WITH I] AND RETURN INCOME < = 50 LACS AND ALL OFFICES UNDER CENT.GOVT. NAMES [STARTING WITH J TO K] AND RETURN INCOME <= 50 LACS NAMES [STARTS WITH L TO M] AND RETURN INCOME <= 50 LACS NAMES [N TO P] AND RETURN INCOME = 50 LACS ALL NAMES [STARTS WITH Q TO Z] AND ALL EDUCATION INSTITUTIONS AND TCS CASES AND RETURN INCOME > 50 LACS NAMES [STARTS WITH Q TO R] AND RETURN INCOME <= 50 LACS SCHOOL, COLLEGE, UNIVERSITY, EDUCATIONAL INSTITUTIONS [STARTS WITH SP TO SZ], TCS CASES NAMES[STARTS WITH SA TO SO] AND RETURN INCOME <= 50 LACS NAMES [STARTS WITH T TO Z] AND RETURN INCOME <= 50 LACS

HAKIMPARA

ENTIRE DISTRICT HOOGHLY NAME BEGINS WITH ALPHABETS FROM A TO M NAME BEGINS WITH ALPHABET 'C' NAME BEGINS WITH ALPHABETS 'F' OR 'G' OR 'H' NAME BEGINS WITH ALPHABETS 'I' OR 'J' OR 'K' NAME BEGINS WITH ALPHABETS 'L' OR 'M'

NAME BEGINS WITH ALPHABETS 'A' OR 'D' NAME BEGINS WITH ALPHABETS 'B' OR 'E'

< PIN codes: 600016,600019,600027,600037,600043 TO 600049,600050 TO 600077,600080,600088,600089,600091,600095><MADURAVOYAL AREAS ONLY>,600098,600100,600103,600109,600114,600116,600117,600119, 600120,603101,603302,603401,603201,603402,603303,603102,603112, 603304,603305,603105,603403,603319,603002,603118,603312,603404, 603309,603107,603314,603311,603202,603209,603306,603301,603310, 603109,602102,603102,603110 <AND THE FOLLOWING TALUKS OF KANCHIPURAM & TIRUVALLUR DISTRICTS CHENGALPET,MADURANTAKAM,CHEYUR,TIRUKALULUNDRAM> VELLORE, THIRUVALLUR DIST,THIRUVANNAMMALAI KANCHEEPURAM DISTRICT NAME BEGINS WITH ALPHABETS FROM N TO Z NAME BEGINS WITH ALPHABETS 'N' OR 'P' OR 'Q' NAME BEGINS WITH ALPHABETS FROM SB TO SM NAME BEGINS WITH ALPHABETS 'R' OR 'U' OR 'W' OR 'X' OR 'Y' OR 'Z' NAME BEGINS WITH ALPHABETS FROM SN TO SZ NAME BEGINS WITH ALPHABET 'T' NAME BEGINS WITH ALPHABETS 'O' OR 'SA' OR 'V' ENTIRE PONDICHERRY ENTIRE CUDDALORE DIST ENTIRE VILLUPURAM DIST TRICHY <THURAIYUR, MANAPAR, KULITALAI, KRISHNAPURAM, THOTTIYAM, LALGUDI, MUSIRI, PERAMBALUR, VEPPANTHATTAI, MANACHANALLUR>, PUDUKOTTAI TRICHY <ARIYALUR,JAYAMKONDAN,UDAYAARPALAYAM,SENDURAI>, KARUR KUMBHAKONAM, THANJAVAR, NAGAPATTINAM NAMAKKAL AND SALEM DISTS. KRISHNAGIRI, HOSUR, DENKANIKOTTAI, POCHAMPALLI, UTHANGARAI, DHARMAPURI, PALACODE, PAPPIREDDIPATTI, HARUR, PENNAGARAM

Thrissur and thodupuzha, Devikulam and Udupanchola taluks of Idukki district a) persons other than companies deriving income from sources other than income from business or profession and residing within the territorial areas mentioned in column 10 who have deducted /collected at source of Rs 5,00,000/- or more under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year. b Persons other than companies deriving income from business or profession and whosev principal place of business is within the territorial area mentioned in col 10 who have deducted /collected at source of Rs 5,00,000/- or more under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year. c) Any other person responsible for deducting / collecting tax at source within the territorial area mentioned in col 10 who has deducted /collected tax at source of Rs 5,00,000/- or more under all thodupuzha, Devikulam and Udupanchola taluks of Idukki district a) persons other than companies deriving income from sources other than income from business or profession and residing within the territorial areas mentioned in column 10 who have deducted /collected at source of less than Rs 5,00,000/- under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year or were responsible to deduct/ collect tax at source under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year but failed to do so. b) Persons other than companies deriving income from business or profession and whose principle place of business is within the territorial area mentioned in col 10 who has deducted /collected tax at source of Rs 5,00,000/- or more under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year or were responsible to deduct/ collect tax at source under all sections of Chapter XVII of the Income Tax Act 1961

wayannad and malappuram and territorial limits of districts of Palakkad, Kasargod and Kannur a) persons other than companies deriving income from sources other than income from business or profession and residing within the territorial areas mentioned in column 10 who have deducted /collected at source of Rs 5,00,000/- or more under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year. b Persons other than companies deriving income from business or profession and whosev principal place of business is within the territorial area mentioned in col 10 who have deducted /collected at source of Rs 5,00,000/- or more under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year. c) Any other person responsible for deducting / collecting tax at source within the territorial area mentioned in col 10 who has deducted /collected tax at source of Rs 5,00,000/- or more under all a) persons other than companies deriving income from sources other than income from business or profession and residing within the territorial areas mentioned in column 10 who have deducted /collected at source of less than Rs 5,00,000/- under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year or were responsible to deduct/ collect tax at source under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year but failed to do so. b) Persons other than companies deriving income from business or profession and whose principle place of business is within the territorial area mentioned in col 10 who have deducted / collected tax at source within the territorial area mentioned in col 10 who has deducted /collected tax at source of Rs 5,00,000/- or more under all sections of wayannad and malappuram a) persons other than companies deriving income from sources other than income from business or profession and residing within the territorial areas mentioned in column 10 who have deducted /collected at source of less than Rs 5,00,000/- under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year or were responsible to deduct/ collect tax at source under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year but failed to do so. b) Persons other than companies deriving income from business or profession and whose principle place of business is within the territorial area mentioned in col 10 who have deducted / collected tax at source within the territorial area mentioned in col 10 who has deducted a) persons other than companies deriving income from sources other than income from business or profession and residing within the territorial areas mentioned in column 10 who have deducted /collected at source of less than Rs 5,00,000/- under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year or were responsible to deduct/ collect tax at source under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year but failed to do so. b) Persons other than companies deriving income from business or profession and whose principle place of business is within the territorial area mentioned in col 10 who have deducted / collected tax at source within the territorial area mentioned in col 10 who has deducted /collected tax at source of Rs 5,00,000/- or more under all sections of

KASARGODE a) persons other than companies deriving income from sources other than income from business or profession and residing within the territorial areas mentioned in column 10 who have deducted /collected at source of less than Rs 5,00,000/- under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year or were responsible to deduct/ collect tax at source under all sections of Chapter XVII of the Income Tax Act 1961 other than section 194E, 195, 195a, 196B, 196C, 196D during the previous year but failed to do so. b) Persons other than companies deriving income from business or profession and whose principle place of business is within the territorial area mentioned in col 10 who have deducted / collected tax at source within the territorial area mentioned in col 10 who has deducted /collected tax at source of Rs 5,00,000/- or more under all sections of TDS PAYMENTS ABOVE RS.10 LACS CASES COVERING COIMBATORE CITY, TALUKS OF POLLACHI, ANAIMALAI, VALPARAI, UDUMALPET & METTUPALAYAM COIMBATORE CITY,TALUKS OF POLLACHI,ANAIMALAI,VALPARAI,UDUMALPET & METTUPALAYAM < ALPHABET A TO C > COIMBATORE CITY,TALUKS OF POLLACHI,ANAIMALAI,VALPARAI,UDUMALPET & METTUPALAYAM < ALPHABET D TO K > ALPHABET START FROM S, COIMBATORE CITY,TALUKS OF POLLACHI,ANAIMALAI,VALPARAI,UDUMALPET & METTUPALAYAM < ALPHABET S > ALPHABET START FROM L - Q, COIMBATORE CITY,TALUKS OF POLLACHI,ANAIMALAI,VALPARAI,UDUMALPET & METTUPALAYAM < ALPHABET L TO Q > ALPHABET START FROM R, T - Z, COIMBATORE CITY,TALUKS OF POLLACHI,ANAIMALAI,VALPARAI,UDUMALPET & METTUPALAYAM <ALPHABETS R TO Z> >

ALPHABET STARTS FROM "Aa to Am" ALPHABET STARTS FROM "B & F". ALPHABET STARTS FROM "C & Ea to Em" ALPHABET STARTS FROM "D & En to Ez" ALPHABET STARTS FROM "An TO Az" ALPHABET STARTS FROM "H & I" ALPHABET STARTS FROM "J & N" ALPHABET STARTS FROM "K & L" ALPHABET STARTS FROM "M" ALPHABET STARTS FROM "G" ALPHABET STARTS FROM "P" ALPHABET STARTS FROM "R" ALPHABET STARTS FROM "Sj TO Sz " ALPHABET STARTS FROM "Sa TO Si " ALPHABET STARTS FROM " O, Q, T, W" ALPHABET STARTS FROM " U, V, X, Y, Z"

A' to 'G' where TDS >= Rs. 20 lacs A.P. State PSU and Autonomous Bodies of Hyderabad & Ranga Reddy Dists. All cases of Adilabad & Karimnagar Dists. A' to 'C' where TDS < Rs. 20 lacs of Hyderabad & Ranga Reddy Dists. H' to 'M' where TDS >= Rs. 20 lacs A.P. State Govt. Offices & Local Authorities of Hyderabad & Ranga Reddy Dists. All cases of Medak & Nizamabad Dists. D' to 'H' where TDS < Rs. 20 lacs of Hyderabad & Ranga Reddy Dists. I' to 'M' where TDS < Rs. 20 lacs of Hyderabad & Ranga Reddy Dists. N' to 'S' where TDS >= Rs. 20 lacs and Central Govt. PSUs and Autonomous Bodies of Hyderabad & Ranga Reddy Dists. All cases of Mahabobnagar & Kurnool Dists. N' to 'R' where TDS < Rs. 20 lacs of Hyderabad & Ranga Reddy Dists.

T' to 'Z' where TDS >= Rs. 20 lacs and All Central Govt. Offices of Hyderabad & Ranga Reddy Dists. All cases of Warangal & Nalgonda Dists. S' where TDS < Rs. 20 lacs of Hyderabad & Ranga Reddy Dists. T' to 'Z' where TDS < Rs. 20 lacs of Hyderabad & Ranga Reddy Dists.

JABALPUR

RAIPUR BILASPUR

TERRITORIAL JURISDICTION OF ADDL CIT, TANGE SRIGANGANAGAR

WHOLE OF HOSHIARPUR DISTT. HAVING TEHSILS OF HOSHIARPUR, GARHSHANKAR, DASURYA, MUKERIAN MAHILPUR, WHOLE OF NAWANSHAHAR DISTT. HAVING TEHSILS OF NAWANSHAHAR, BANGA, BALACHAUR. FOLLOWING AREAS OF JALANDHAR CITY:- INDUSTRIAL AREA, FOCAL POINT, TANDA ROAD, MAQSUDAN, RANDHAWA MASANDAN, SODAL ROAD, RAMA MANDI, BASTI SHEIKH, BASTI DANISHMANDAN, SPORTS & SURGICAL COMPLEX, NAKODAR ROAD, SHAKTI NAGAR, NIJATAM NAGAR, PATEL CHOWK, TANDA, INDUSTRIAL ESTATE, TRANSPORT NAGAR, AMRITSAR BYE PASS, CHOGITTI, SURANUSSI, HOSHIARPUR ROAD, BASTI NAU, BASTI BAWA KHEL, KAPURTHALA ROAD, LEATHER COMPLEX, SHAHEED UDHAM SINGH NAGAR, AVTAR NAGAR, ADARSH NAGAR, MAHAVIR MARG. WHOLE OF KAPURTHALA DISTT. HAVING TEHSILS OF KAPURTHALA, SULTANPUR, LODHI, PHAGWARA, TEHSIL OF JALANDHAR DIST., TEHSIL OF NAKODAR, PHILLAUR, JALANDHAR TEHSIL. FOLLOWING AREAS OF JALANDHAR CITY: - G.T. ROAD, CIRCULAR ROAD, RAILWAY ROAD, LAJPAT NAGAR, GARHA, ALL AREAS HAVING THE WORD "BAZAR" IN THE ADDRESS, MANDI ROAD, KARTARPUR, ADAMPUR, JALANDHAR CANTT, MAI HIRAN GATE, NEHRU GARDEN ROAD, MODEL TOWN, NEW JAWAHAR NAGAR, URBAN ESTATE -I & II, MANDI FENTON GANJ, NEW GRAIN MARKET, BHOGPUR. FOCAL POINT, MOTI NAGAR, CHAURA BAZAR, BHADOUR HOUSE, MATA RANI CHOWK, SARAFAN BAZAR, MEENA BAZAR, CHAWAL BAZAR, HIND BAZAR, PHALAHI BAZAR, DAL BAZAR, AKAL MARKET, MADHOPURI, NEW MADHOPURI, SUNDER NAGAR, RAHON ROAD,, BAHUDUR-KE ROAD, BASTI JODHEWAL, SAMRALA CHOWK, LINK ROAD, TRANSPORT NAGAR, G.T. ROAD (WEST), NOORWALA ROAD, SALEM TABRI, TAJPUR ROAD, TIBBA ROAD, CHAURI SARAK, FIELD GANJ, KIDWAI NAGAR, SHAHPUR ROAD, KARIMPURA BAZAR, SABHANI BUILDING, SABAN BAZAR, GUR MANDI, TALAB BAZAR, BOOKS MARKET, DR.GUJJARMAL ROAD, SHIV PURI, NEW SHIV PURI, DRESI ROAD, BAJWA NAGAR, CIRCULAR ROAD, SARDAR NAGAR, GURU NANAK DEV NAGAR, CHANDIGARH ROAD, JAMALPUR (SITUATED IN LUDHIANA). MULLANPUR, JAGRAON, RAI KOT, MOGA, SIDWAN BET, SIDWAN KHURD AND ALL VILLAGES OF LUDHIANA TEHSIL.

INDUSTRIAL AREA-A, INDUSTRIAL AREA-B, INDUSTRIAL AREA-C, INDUSTRIAL ESTATE, G.T. ROAD, GILL ROAD, SHIMLAPURI, DASHMESH NAGAR, JANTA NAGAR, NEW JANTA NAGAR, MILLER GANJ, CHET SINGH NAGAR, CIVIL LINES, MALL ROAD, FEROZEPUR ROAD, HAIBOWAL KALAN, HAIBOWAL KHURD KITCHULU NAGAR, RISHI NAGAR, SARABHA NAGAR, BRS NAGAR, AGGAR NAGAR, RAJGURU NAGAR, PAKHOWAL ROAD, MODEL TOWN, MODEL GRAM, BHARAT NAGAR CHOWK, RANI JHANSI ROAD, COLLEGE ROAD, GHUMAR MANDI, CEMENTRY ROAD, TAGORE NAGAR, UDHAM SINGH NAGAR, MAYA NAGAR, MAHARAJA NAGAR, DHANDARI KALAN, SUA ROAD, ISHAR SINGH NAGAR, JASSIAN ROAD, CHANDER NAGAR, BINDRABAN ROAD (SITUATED IN LUDHIANA). KHANNA, DORAHA, PAYAL, SAHNEWAL, DHURI, MALERKOTA, AHMEDGARH, SAMRALA, MACHHIWARA. KOTPUTLI) COMPRISING OF THE FOLLOWING AREAS, JOHARI BAZAAR(BOTH SIDES AND LANES ADJOINING CHOURA RASTA), JAIPUR. CHOURA RASTA(BOTH SIDES AND ADJOINING LANES) AND LANES ADJOINING TO KISHANPOLE BAZAAR(BOTH SIDES), KATLA PUROHI, MANIHARI KATLA, JAIPUR KISHANPOLE BAZAAR AND ITS LANES TOWARDS TOPKHANADESH, INDIRA MARKET, NEHRU BAZAAR, BAPU BAZAAR, LINK ROAD, CHANDPOLE TO SURAJPOLE GATE JAIPUR, GHATGATE BAZAAR(LEFT AND RIGHT) AND LANES JOINING TO JOHARI BAZAAR, JAIPUR, M.I.ROAD( FROM SANGANERI GATE TO KHASA KOTHI), AJMERI GATE SUBJI MANDI, YADGAR BYE LANES, NEW COLONY, JAYANTI MARKET, GOPINATH MARKET, CHURCH ROAD, VIDHAYAK PURI, GOPALBARI, SARDAR PATEL MARG, SUDERSHANPURA,INDUSTRIAL AREA, BAIS GODOWN, SODALA, NEW SANGANER ROAD, CHOMU HOUSE, CIVIL LINES, RAMNAGAR, HAWA SADAK, MADRAMPURA, LAXMINAGAR AND MUNCIPAL LIMITS ON AJMER ROAD(BOTH SIDES AND CONNECTING LANES)JAIPUR, AREA OUTSIDE CHANDPOLE GATE, GRAIN MANDI, SANSAR CHANDRA ROAD, JALUPURA, NAWALGARH HOUSE AREA LOHA MANDI, BANASTHALI MARG, BANIPARK, STATION ROAD, KANTI NAGAR, SINDHI COLONY, POWER HOUSE ROAD, JHOTWARA INDUSTRIAL AREA, GANPATHINAGAR, HASANPURA, KHATIPURA, VAISHALI NAGAR, KHATIPURA ROAD, QUEENS ROAD, CHITRAKUT SCHEME, JHOTWARA AND KALWAR ROAD, JAIPUR DISTRICTS OF JAIPUR(OTHER THAN TEHSIL OF KOTPUTLI.

IN THE STATE OF RAJASTHAN (A) DISTRICT OF JAIPUR(OTHER THE TEHSIL OF KOTPUTLI) COMPRISING OF THE FOLLOWING AREAS (I) LEFT SIDE LANES OF GANGORI BAZAAR(CHOTI CHOUPAR TO BHRAMPURI) RIGHT SIDE OF CHANDPOLEBAZAAR(CHOTI CHAUPAR TO CHANDPOLE GATE) PURANI BASTI, RIGHT SIDE OF CHANDPOLE GATE, SIKAR HOUSE, KHETRI HOUSE, POWER HOUSE ROAD, NAHARI KA NAKA, SUBHASH NAGAR, SUBHASH COLONY, RAM NAGAR, HOUSING BOARD SHASTRINAGAR, JAI PRAKASH NAGAR, NEHRU NAGAR, BASSISITARAMPURA, AMBABARI, JHOTWARA ROAD(BOTH SIDES) SIKAR ROAD CHOURAHA TO V.K.I AREA, (II)GANGORI BAZAAR MAIN MARKET INCLUDING RIGHT SIDE LANES OF GANGORI BAZAAR, BHRAMPURI AND BOTH SIDES OF AMER ROAD, GOVIND NAGAR, SHANKAR NAGAR, GANGAPOLE, CHAR DARWAJA, SHERIDYODHI BAZAAR, JALEBI CHOWK, RAMGANJ BAZAAR, GALTA ROAD, SURAJPOLE MANDI, LAXMINARAINPURI, RAGHUNATHPURI, TRANSPORT NAGAR, GARDEN, GOVIND MARG, BURMESE COLONY, SAKET COLONY, SETHI COLONY (IV) JAWAHAR NAGAR, RAJA PARK, MALVIYA NAGAR, JJAGATPURA. (V) TONK ROAD C-SCHEME,ASHOK MARG< SUBHASH MARG, B.S.ROAD, (B) DISTT.OF JAIPUR(OTHER THAN TEHSHIL OF KOTPUTILI) IN THE STATE OF RAJASTHAN (A) DISTT OF JAIPUR (OTHER THAN THE TEHSIL OF KOTPUTLI) NOT COVERED UNDER THE JURISDICTION OF COMMISSIONER OF INCOME TAX JAIPUR-1 AND COMMISSIONER OF INCOME TAX JAIPUR-II, (B) DISTRICT OF JAIPUR (OTHER THAN THE TEHSIL OF KOTHPUTLI), (C) DISTRICT OF JAIPUR (OTHER THAN THE TEHSIL OF KOTHPUTLI) IN THE STATE OF RAJASTHAN DISTRICTS OF ALWAR , BHARATPUR, DHOLPUR, DAUSA , KOTPUTLI, & SUBDIVISION OF THE DISTRICT OF JAIPUR KOLHAPUR

1) ALL PERSONS WHOSE TDS AND OR TAX COLLECTED AT SOURCE COMES UNDER CHAPTER XVII OF THE IT-ACT 1961 IS BELOW RS 1 CRORE AS PER THE RETURNS UNDER SECTION 206 & 206C WITHIN AREA OF KOLHAPUR, SANGLI, RATNAGIRI, SINDHUDURG DISTRICT 2) ALL DEDUCTORS OF OFFICES OF STATE GOVT. & LOCAL AUTHORITIES CONTROLLED BY GOVT. OF MAHARASHTRA WITHIN AREA THE OF KOLHAPUR, SANGLI, RATNAGIRI, SINDHUDURG DISTRICT 3) ALL DEDUCTORS OF OFFICES OF CENTRAL GOVT. CONTROLLED BY GOVT. OF INDIA WITHIN THE AREA OF KOLHAPUR, SANGLI, RATNAGIRI, SINDHUDURG DISTRICT

ALPHABET A TO M, LUCKNOW, BARABANKI, UNNAO ALPHABET N TO Z, LUCKNOW, BARABANKI, UNNAO FAIZABAD, GONDA, SULTANPUR, JAUNPUR, BASTI, BAHARAICH, RAIBAREILLY, PRATAPGARH BAREILLY, SHAHJAHANPUR, PILIBHIT, SITAPUR, LAKHIMPUR-KHERI, HARDOI MORADABAD, BIJNORE, BADAYUN, RAMPUR, J.P.NAGAR ITO (TDS), MADURAI, DINDIGUL, THENI ITO (TDS) TUTICORIN ITO (TDS) VIRUDHUNAGAR, KARAIKUDI, RAMNAD ITO (TDS) TIRUNELVELI, NAGERCOIL

CGO-1 COMPLEX, KAMLA NEHRU NAGAR, HAPUR CHUNGI, GHAZIABAD

DEHRADUN, HARIDWAR, RISHIKESH, ROORKI & ALL GARHWAL MANDAL DISTT. HALDWANI, ALL KUMAYUN MANDAL DIST (eg: ALMORA, NAINITAL). HARDWAR KASHIPUR

NAME OF THE DEDUCTOR STARTING WITH ALPHABET "AA" TO "AM" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "AN" TO "AZ" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "B" & "H" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "C" & "G" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "D,E,F" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "I" & "J" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "K" & "L" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "M" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "N" & "O" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "P" & "Q" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "R" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "SA"TO "SH" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "SI" TO "SZ" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "T" & "U" NAME OF THE DEDUCTOR STARTING WITH ALPHABET "V' TO "Z"

DISTRICT OF NAGPUR, ALPHABETS A TO M DISTRICT OF AKOLA, BOLDHANA AND WASHIM. DISTRICT OF WARDHA AND YAVATMAL. DISTRICT OF NAGPUR, ALPHABETS N TO Z DISTRICT OF AMRAVATI. DISTRICT OF CHANDRAPUR AND GADCHIROLI.

ALL PERSON/COMPANY DEDUCTING TDS/TCS IN THE DISTRICTS OF NASHIK, DHULE, NANDURBAR, JALGAON, AURANGABAD, BEED, JALNA, PARBHANI, HINGOLI, NANDED, LATUR AND OSMANABAD WHOSE NAMES START WITH NUMERALS 0-9 ALL PERSON/COMPANY DEDUCTING TDS/TCS IN THE DISTRICT OF NASHIK WHOSE NAMES STARTING WITH ALPHABETS 'A' TO 'M'. ALL PERSON/COMPANY DEDUCTING TDS/TCS IN THE DISTRICT OF NASHIK WHOSE NAMES STARTING WITH ALPHABETS 'N' TO 'Z'. ALL PERSON/COMPANY DEDUCTING TDS/TCS IN THE DISTRICT OF DHULE, NANDURBAR, AND JALGAON. AURANGABAD NANDED 1) ALL PERSONS WHOSE TDS AND OR TAX COLLECTED AT SOURCE EQUALS OR EXCEEDS RS 1 CRORE AND A) WHOSE NAMES START WITH ENGLISH ALPHABETS "A" TO "I' AND "R" TO "Z" WITHIN AREA OF PUNE DISTRICT B) WHOSE NAMES START WITH ENGLISH ALPHABETS "A" TO "Z" WITHIN AREA OF AHMEDNAGAR AND SOLAPUR DISTRICT 2) ALL PERSONS WHOSE TDS AND OR TAX COLLECTED AT SOURCE COMES UNDER CHAPTER XVII OF THE IT-ACT 1961 AND A) WHOSE NAMES START WITH NUMERALS "0" TO "9" WITHIN AREA OF PUNE, AHMEDNAGAR AND SOLAPUR DISTRICT 3) ALL DEDUCTORS OF OFFICES OF STATE GOVT. & LOCAL AUTHORITIES CONTROLLED BY GOVT. OF MAHARASHTRA WITHIN THE AREA OF PUNE DISTRICT 4) ALL DEDUCTORS OF OFFICES OF CENTRAL GOVT. CONTROLLED BY GOVT. OF INDIA WITHIN THE AREA OF PUNE DISTRICT 5) ANY OTHER CASE ASSIGNED BY CIT (TDS), PUNE OR ADDL. CIT/JCIT (TDS), PUNE 1) ALL PERSONS WHOSE TDS AND OR TAX COLLECTED AT SOURCE IS BELOW RS 1 CRORE AND A) WHOSE NAMES START WITH ENGLISH ALPHABETS "A" TO "I" WITHIN AREA OF PUNE DISTRICT B) WHOSE NAMES START WITH ENGLISH ALPHABETS "A" TO "Z" WITHIN AREA OF AHMEDNAGAR DISTRICT 2) ALL DEDUCTORS OF OFFICES OF STATE GOVT. & LOCAL AUTHORITIES CONTROLLED BY GOVT. OF MAHARASHTRA WITHIN THE AREA OF AHMEDNAGAR DISTRICT 3) ALL DEDUCTORS OF OFFICES OF CENTRAL GOVT. CONTROLLED BY GOVT. OF INDIA WITHIN THE AREA OF AHMEDNAGAR DISTRICT 4) ANY OTHER CASE ASSIGNED BY CIT (TDS), PUNE OR ADDL. CIT/JCIT (TDS), PUNE 1) ALL PERSONS WHOSE TDS AND OR TAX COLLECTED AT SOURCE EQUALS OR EXCEEDS RS 1 CRORE AND A) WHOSE NAMES START WITH ENGLISH ALPHABETS "J" TO "Q" WITHIN AREA OF PUNE DISTRICT B) WHOSE NAMES START WITH ENGLISH ALPHABETS "A" TO "Z" WITHIN AREA OF SATARA, KOLHAPUR, SANGLI, RATNAGIRI, SINDHUDURG DISTRICT 2) ALL PERSONS WHOSE TDS AND OR TAX COLLECTED AT SOURCE COMES UNDER CHAPTER XVII OF THE IT-ACT 1961 AND A) WHOSE NAMES START WITH NUMERALS "0" TO "9" WITHIN AREA OF PUNE, AHMEDNAGAR AND SOLAPUR DISTRICT 3) ANY OTHER CASE ASSIGNED BY CIT (TDS), PUNE OR ADDL. CIT/JCIT (TDS), PUNE 1) ALL PERSONS WHOSE TDS AND OR TAX COLLECTED AT SOURCE IS BELOW RS 1 CRORE AND A) WHOSE NAMES START WITH ENGLISH ALPHABETS "J" TO "Q" WITHIN AREA OF PUNE DISTRICT B) WHOSE NAMES START WITH ENGLISH ALPHABETS "A" TO "Z" WITHIN AREA OF AHMEDNAGAR DISTRICT 2) ALL DEDUCTORS OF OFFICES OF STATE GOVT. & LOCAL AUTHORITIES CONTROLLED BY GOVT. OF MAHARASHTRA WITHIN THE AREA OF SATARA DISTRICT 3) ALL DEDUCTORS OF OFFICES OF CENTRAL GOVT. CONTROLLED BY GOVT. OF INDIA WITHIN THE AREA OF SATARA DISTRICT 4) ANY OTHER CASE ASSIGNED BY CIT (TDS), PUNE OR ADDL. CIT/JCIT (TDS), PUNE

1) ALL PERSONS WHOSE TDS AND OR TAX COLLECTED AT SOURCE IS BELOW RS 1 CRORE AND A) WHOSE NAMES START WITH ENGLISH ALPHABETS "R" TO "Z" WITHIN AREA OF PUNE DISTRICT B) WHOSE NAMES START WITH ENGLISH ALPHABETS "A" TO "Z" WITHIN AREA OF SOLAPUR DISTRICT 2) ALL DEDUCTORS OF OFFICES OF STATE GOVT. & LOCAL AUTHORITIES CONTROLLED BY GOVT. OF MAHARASHTRA WITHIN THE AREA OF SOLAPUR DISTRICT 3) ALL DEDUCTORS OF OFFICES OF CENTRAL GOVT. CONTROLLED BY GOVT. OF INDIA WITHIN THE AREA OF SOLAPUR DISTRICT 4) ANY OTHER CASE ASSIGNED BY CIT (TDS), PUNE OR ADDL. CIT/JCIT (TDS), PUNE

ALPHABETS A TO M WITH IN THE TERRITORIAL AREA OF DISTRICT OF THANE EXCLUDING AREAS/TALUKA OF KALYAN, BHIWANDI, ULHASNAGAR, AMBERNATH, BADLAPUR AND DOMBIVILL. ALPHABETS N TO Z WITH IN THE TERRITORIAL AREA OF DISTRICT OF THANE EXCLUDING AREAS/TALUKA OF KALYAN, BHIWANDI, ULHASNAGAR, AMBERNATH, BADLAPUR AND DOMBIVILL. DISTRICT OF THANE CONSISTING OF AREAS/TALUKA OF KALYAN, BHIWANDI, ULHASNAGAR, AMBERNATH, BADLAPUR AND DOMBIVILL. DISTRICT OF RAIGARH. CHANDIGARH CHANDIGARH PATIALA

AREAS LYING WITHIN THE TERRITORIAL JURISDICTION OF ADDL/JT. COMMISSIONER OF INCOME TAX, SHIMLA RANGE,SHIMLA. AREAS LYING WITHIN THE TERRITORIAL JURISDICTION OF ADDL/JT. COMMISSIONER OF INCOME TAX PALAMPUR & ADDL/JT. COMMISSIONER OF INCOME TAX, MANDI RANGE, MANDI, MANDI (EXCEPT THE DISTRICT OF UNA IN PALAMPUR RANGE) AREAS LYING WITHIN THE DISTRICT OF UNA. FALLING WITHIN THE AREAS OF TEHSIL SOLAN,ARKI,KANDAGHAT AND SUB-TEHSIL KISHANGARH OF SOLAN DISTRICT AND TEHSILRAJGARH,SANGARH AND PACHCHAD OF DISTT-SIRMOUR AND ALSO TEHSIL KASAULI OF DISTT. SOLAN EXCEPT BAROTIWALA AREA (FALLING UNDER BBNDA OF TEHSIL KASAULI OF DISTT. SOLAN) ALL CASES FALLING WITHIN THE TERRITORIAL AREA OF DISTT SIRMOUR EXCEPT TEHSIL RAJGARH, TEHSIL SANGARH AND TEHSIL PACHCHAD. FALLING WITHIN THE AREA OF TEHSIL NALAGARH AND BAROTIWALA AREA (FALLING UNDER BBNDA) OF TEHSIL KASAULI OF DISTT. SOLAN. PATNA DISTT. ARRA, JEHANABAD, ARWAL, AURANGABAD, VAISHALI, NALANDA, BHABHUA, KAIMUR, GAYA, ROHTAS CHAPRA, SARAN, SAMASTIPUR, SITAMARHI, SHEOHAR, MOTIHARI, DARBHANGA, MADHUBANI, BETIAH & ALL CIT-MUZ. CHARGE KATIHAR, SAHARSA, ARARIA & ALL CIT-BGL CHARGE PURNIA, KISHANGANJ, MUNGER, L.SARAI, SHEIKHPURA, JAMUI, SUPAUL, MADHEPURA & ALL BEGUSARAI DISTT. AREA COVERED BY THE DISTRICT RANCHI, GUMLA, LOHARDAGA, SIMDEGA, GARWA, PALAMU, LATEHAR, KHUNTI, DALTONGANJ AREA COVERED BY THE DISTRICT EAST SINGHBHUM, WEST SIGHBHUM, SARAIKELA KHARSAWAN AREA COVERED BY THE DISTRICT BOKARO, RAMGARH, HAZARIBAGH, KODERMA, CHATRA

AREA COVERED THE DISTRICT DHANBAD, PAKUR, GIRIDIH, DEOGHAR, SAHEBGANJ, DUMKA, GODDA, JAMTARA RAJKOT <REVENUE DIST. OF RAJKOT,JUNAGADH,AMRELI,JAMNAGAR,PORBANDAR,KUTCH & UT OF DIU.> RAJKOT <REVENUE DIST. OF RAJKOT,JUNAGADH,AMRELI & U/T OF DIE>/ DHORAJI/ GONDAL/ MORBI

JAMNAGAR <REVENUE DIST. OF JAMNAGAR & PORBANDAR>/ DWARKA REVENUE DIST. OF KUTCH> FARIDABAD, RANGE I AND FARIDABAD, RANGE II ROHTAK / JHAJJAR / BAHADURGARH / SONEPAT / REWARI / NARNAUL. Sonepat (HQ. Rohtak) all villages Distt Rohtak HISSAR / SIRSA / FATEHABAD / BHIWANI / JIND KARNAL / PANIPAT / KURUKSHETRA / KAITHAL PANCHKULA / AMBALA / YAMUNA NAGAR GURGAON LESS THAN 10 LAKHS TDS MUNICIPAL WARD NOS. 30 TO 36 OF THE GUWAHATI MUNICIPAL CORPORATION, GUWAHATI IN KAMRUP, NAGAON AND MORIGAON DISTRICT IN THE STATE OF ASSAM. BONGAIGAON, DHUBRI, GOALPARA AND KOKRAJHAR DISTRICT IN THE STATE OF ASSAM. DISTRICT OF EAST GARO HILLS, WEST GARO HILLS, SOUTH GARO HILLS AND BAGHMARA DISTRICT IN THE STATE OF MEGHALAYA. SONITPUR, DARRANG, UDALGURI, NORTH LAKHIMPUR AND DHEMAJI DISTRICT IN THE STATE OF ASSAM. TAWANG, EAST KAMENG, WEST KAMENG, PAPUMPARE, UPPER SUBANSIRI, LOWER SUBANSIRI AND KURUNG KUMEY DISTRICT IN THE STATE OF ARUNACHAL PRADESH. MUNICIPAL WARD NOS. 18,19,28 & 29 OF THE GUWAHATI MUNICIPAL CORPORATION, GUWAHATI IN KAMRUP, NALBARI AND BARPETA DISTRICT IN THE STATE OF ASSAM. MUNICIPAL WARD NOS. 1 TO 17 AND 20 TO 27 AND 37 TO 60 OF THE GUWAHATI MUNICIPAL CORPORATION, GUWAHATI IN KAMRUP, DISTRICT IN THE STATE OF ASSAM. OTHER AREAS OF KAMRUP DISTRICT NOT COVERED BY THE GUWAHATI MUNICIPAL CORPORATION IN THE STATE OF ASSAM. JORHAT AND GOLAGHAR DISTRICT IN THE STATE OF ASSAM SIBSAGAR AND KARBI ANGLONG DISTRICT IN THE STATE OF ASSAM, THE WHOLE STATE OF NAGALAND AND MANIPUR. SHILLONG DIBRUGARH SILCHAR, KARIMGANJ, DHARAMANAGAR AGARTALA TINSUKIA

ANJANA, BOMBAY MARKET, GOLWAD, GOPIPURA, INDERPURA, KAILASH NAGAR, KHATODARA, KOTSAFIL ROAD, MALINIWADI, MANDARWAJA, MOMNAWAD, NATALI STREET, NAVAPURA, NAVSARI BAZAR, RUDERPURA, RUSTAMPURA, SACHIN GIDC (INCLUDING HAZIRA ROAD FROM L & T TO ESSAR & REST OF THE HAZIRA), SALABATPURA, SUMAN-DESAI -NI WADI SURAT TEXTILE MARKET, UDHNA MAGDALLA ROAD, UDHNAGAM, UMERWADA, ZAMPA BAZAR, ADAJAN, ADAJAN ROAD, ADARSH SOCIETY, AMBAJI ROAD, AMBIKANIKETAN, AMLIPURA, ANNI BESANT ROAD, ATHWA GATE, BALAJI ROAD, BHATAR ROAD, BHANDARIWAD, BADEKHA CHAKLA, BEGUMPURA, BAWA SIDI TEKRO, BORWAD, CHAUTA BAZAR, DIWALIBAUG, DUMBHAL, GHOD DOD ROAD, GREEN PARK, HARIJANWAS, JEHANGIRPURA, KUMBHARWAD, KUNVERSINGH SHERI, KANPITH BAZAR, KARANJ, MALIFALIA, MAGOB, MORABHAGAL, NIZAM FALIA, NANPURA, NANAVARACHHA, PARSIWAD, PUMPING STATION, RAMNAGAR, RANDER ROAD, SANGHADIAWAD, SHETANFALIA, SONIFALIA, TADWADI, UMARWADA, UMRA JAKATNAKA, CHORYASI INCLUDING HAZIRA ROAD FROM KRIBHCO TO RELIANCE (LEFT HAND SIDE AREA), TALUKAS OF KAMREJ, OLPAD.

ALTHAN, BAMROLI, BHAJIWALI POLE, BHAVANIWAD, BHARANPURI BHAGAL, BHEDWAD, BHESTAN, DINDOLI, GHEEKANTA, HARIPURA, JADAKHADI, JEHANGIRABAD, KASKIWAD, LIMBAYAT, MACHHLIPITH, MAHIDERPURA, MAJURA GATE, ONGC CIRCLE TO ICHHAPORE CIRCLE (LEFT HAND SIDE AREA) INCLUDING ABG SHIPYARD, PIPLOD, PANDESARA, RAMPURA, RANITALAV, SAIYEDPURA, UMRA. TALUKAS OF BARDOLI , MANGROL , MANDVI, NIZAR , PALSANA , SONGADH, VALOD , VYARA, UCHHAL .

ADARSHNAGAR, A.K. ROAD, AMBEDKAR ROAD, BOMBAY COLONY, BARODA PRESTIGE, BETHI COLONY, BRAHMIMATA, BARTESWAR MAHDEV TO VED DARWAJA, BHAGATALAO, CHOWK BAZAR, DUDHARA SHERI, FULPADA, FULPADA - GIDC, GALEMANDI BAZAR, GURUNAGAR, GOTALAWADI, HALPATIWADI, JALARAM NAGAR, KATARGAM DARWAJA, KATARGAM, KANSA NAGAR, KUBER NAGAR, LEKHADIA SHERI, LAL DARWAJA, LAL GATE, LAMBE HANUMAN ROAD, MATAWADI ROAD, NANIVED, NANI BAHUCHARAJI, NANAVAT, NURMOHALLO, OM BAUG, PARSIWAD, PATELNAGAR, PATEL FALIA, RAILWAY STATION ROAD, RUGHNATHPURA, SUMUL DAIRY ROAD, SARDAR NAGAR, SAHARA DARWAJA, SANTNIWADI, SHANKER NAGAR, SODAGARWAD, SURAT TEXTILE MILL, TALAOFALIA, UNAPANI ROAD, VARACHHA ROAD, VARIAVI BAZAR, VASTADEVI ROAD, AND ALL OTHER AREAS OF SURAT INCLUDING ONGC CIRCLE TO KRIBHCO COLONY(RIGHT HAND SIDE AREA) AREAS LYING WITHIN THE TERRITORIAL LIMITS OF REVENUE DISTRICTS OF [ 1] VALSAD [2] DANGS [3] NAVSARI [4] UNION TERRITORIES OF DADAR & NAGAR HAVELI (SILVASA) & DAMAN TRIVANDRUM ALLEPPEY KOLLAM ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING DEDUCTION AND /OR COLLECTION OF INCOME TAX AT SOURCE AND WHOSE NAMES START WITH THE ENGLISH ALPHABETS A, B, C, D, E, F, H AND R, FALLING WITHIN THE TERRITORIAL AREAS OF REVENUE DISTRICTS OF VISHAKHAPATNAM IN THE STATE OF ANDHRA PRADESH. 1.)ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING DEDUCTION AND /OR COLLECTION OF INCOME TAX AT SOURCE AND WHOSE NAMES START WITH THE ENGLISH ALPHABETS G, I, J, K AND L FALLING WITHIN THE TERRITORIAL AREAS OF REVENUE DISTRICTS OF VISHAKHAPATNAMIN THE STATE OF ANDHRA PRADESH AND 2.) ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING DEDUCTION AND /OR COLLECTION OF INCOME TAX AT SOURCE FALLING WITHIN THE TERRITORIAL AREAS OF REVENUE DISTRICTS OF SRIKAKULAM IN THE STATE OF ANDHRA PRADESH 1.)ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING DEDUCTION AND /OR COLLECTION OF INCOME TAX AT SOURCE AND WHOSE NAMES START WITH THE ENGLISH ALPHABETS M, N, O, P AND Q FALLING WITHIN THE TERRITORIAL AREAS OF REVENUE DISTRICTS OF VISHAKHAPATNAMIN THE STATE OF ANDHRA PRADESH AND 2.) ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING DEDUCTION AND /OR COLLECTION OF INCOME TAX AT SOURCE FALLING WITHIN THE TERRITORIAL AREAS OF REVENUE DISTRICTS OF VIZIANAGARAM IN THE STATE OF ANDHRA PRADESH ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING DEDUCTION AND /OR COLLECTION OF INCOME TAX AT SOURCE AND WHOSE NAMES START WITH THE ENGLISH ALPHABETS S, T, U, V, W, X, Y AND Z FALLING WITHIN THE TERRITORIAL AREAS OF REVENUE DISTRICTS OF VISHAKHAPATNAM IN THE STATE OF ANDHRA PRADESH. ALL PERSONS WHO ARE RESPONSIBLE FOR MAKING DEDUCTION AND /OR COLLECTION OF INCOME TAX AT SOURCE FALLING WITHIN THE TERRITORIAL AREAS OF REVENUE DISTRICTS OF EAST GODAVARI AND WEST GODAVARIIN THE STATE OF ANDHRA PRADESH.

Vous aimerez peut-être aussi

- Gas Sweetening and Processing Field ManualD'EverandGas Sweetening and Processing Field ManualÉvaluation : 4 sur 5 étoiles4/5 (7)

- Pan Ao Codes: Sr. No. RCC Area - Code Ao - Type Range - CD AO - NO. Description Additional Description CityDocument168 pagesPan Ao Codes: Sr. No. RCC Area - Code Ao - Type Range - CD AO - NO. Description Additional Description Citykasim_khan07100% (1)

- Singhania-CO2 INERTISATION SYSTEM DataDocument12 pagesSinghania-CO2 INERTISATION SYSTEM DataAnandharaj .KPas encore d'évaluation

- 2nd Set of STK5 20221031Document6 pages2nd Set of STK5 20221031Movies ArrivalPas encore d'évaluation

- A Inkoppamsi Price List 03 2011 Meter & AccessoriesDocument8 pagesA Inkoppamsi Price List 03 2011 Meter & AccessoriesKho RadiyusPas encore d'évaluation

- Jurisdiction Details PDFDocument57 pagesJurisdiction Details PDFjigneshPas encore d'évaluation

- Factory InfoDocument51 pagesFactory InfoKavitha SureenPas encore d'évaluation

- List of Officers Awaiting TransfersDocument149 pagesList of Officers Awaiting TransfersaggarwalmanojPas encore d'évaluation

- List of Files - Sales Tax - Department List of Files - Tds - DepartmentDocument5 pagesList of Files - Sales Tax - Department List of Files - Tds - DepartmentAnil SainiPas encore d'évaluation

- National Guard (In Federal Status) and Reserve Activated As of July 26, 2011Document463 pagesNational Guard (In Federal Status) and Reserve Activated As of July 26, 2011Good Soldiers OrganizationPas encore d'évaluation

- (I R - ) OF Vie: Cwil-1289 /1:11 1-5-2020Document2 pages(I R - ) OF Vie: Cwil-1289 /1:11 1-5-2020Rahul GuptaPas encore d'évaluation

- Jadwal Akhir Semester Genap TH. AKADEMIK 2011/2012Document10 pagesJadwal Akhir Semester Genap TH. AKADEMIK 2011/2012Globe HandycraftPas encore d'évaluation

- Con-Stab Id Seal Fittings: Gas Distribution Products ®Document7 pagesCon-Stab Id Seal Fittings: Gas Distribution Products ®Adam KnottPas encore d'évaluation

- Sony-Vaio-Mbx-126-Je5-Schematic-Mb-Mp SCHEMATICDocument36 pagesSony-Vaio-Mbx-126-Je5-Schematic-Mb-Mp SCHEMATICvideoson0% (1)

- C913: Track Work and Overhead Line System C913: Track Work and Overhead Line SystemDocument5 pagesC913: Track Work and Overhead Line System C913: Track Work and Overhead Line SystemkunalkhubaniPas encore d'évaluation

- Form For New Ration Card 5507 Under NFSA 06 03 2014 PDFDocument10 pagesForm For New Ration Card 5507 Under NFSA 06 03 2014 PDFDeepakSharmaPas encore d'évaluation

- Vehicles For Sale ReducedDocument9 pagesVehicles For Sale Reducedgishi_sjdc6983Pas encore d'évaluation

- 3 SBDocument70 pages3 SBdeepu168Pas encore d'évaluation

- CGL Tier II MarksDocument3 939 pagesCGL Tier II MarksIndiaresultPas encore d'évaluation

- (T) of Of: CarriedDocument15 pages(T) of Of: CarriedRoshniPas encore d'évaluation

- PAN AO Codes International Taxation Ver2.7 18062013Document12 pagesPAN AO Codes International Taxation Ver2.7 18062013Mutyala VijayPas encore d'évaluation

- National Guard (In Federal Status) and Reserve Activated As of August 30, 2011Document342 pagesNational Guard (In Federal Status) and Reserve Activated As of August 30, 2011Good Soldiers OrganizationPas encore d'évaluation

- National Guard (In Federal Status) and Reserve Activated As of August 16, 2011Document342 pagesNational Guard (In Federal Status) and Reserve Activated As of August 16, 2011Good Soldiers OrganizationPas encore d'évaluation

- 05.03.2021 SigclDocument14 pages05.03.2021 SigclRoshniPas encore d'évaluation

- PT 14 September 2016Document19 pagesPT 14 September 2016Zaka DwidianPas encore d'évaluation

- National Guard (In Federal Status) and Reserve Activated As of August 2, 2011Document346 pagesNational Guard (In Federal Status) and Reserve Activated As of August 2, 2011Good Soldiers OrganizationPas encore d'évaluation

- Ortofon - Cartridge Recommandations For Turnta) Bles 1981Document19 pagesOrtofon - Cartridge Recommandations For Turnta) Bles 1981Marco Dei Bi AivPas encore d'évaluation

- Neonatos con diagnósticos y soporte ventilatorioDocument24 pagesNeonatos con diagnósticos y soporte ventilatorioJhonathan Alejandro Barros de la CruzPas encore d'évaluation

- National Guard (In Federal Status) and Reserve Activated As of August 9, 2011Document345 pagesNational Guard (In Federal Status) and Reserve Activated As of August 9, 2011Good Soldiers OrganizationPas encore d'évaluation

- Venus Chemicals CMF ProInvDocument2 pagesVenus Chemicals CMF ProInvDivesh GuptaPas encore d'évaluation

- National Guard (In Federal Status) and Reserve Activated As of August 23, 2011Document342 pagesNational Guard (In Federal Status) and Reserve Activated As of August 23, 2011Good Soldiers OrganizationPas encore d'évaluation

- TH VNP DVKH Sau Khi Ghep Cong Thiet Bi TDN - Bo Sung 42 E1 TTBHDocument645 pagesTH VNP DVKH Sau Khi Ghep Cong Thiet Bi TDN - Bo Sung 42 E1 TTBHlahoangiaPas encore d'évaluation

- 6.L339-1-2013 Psi GM 4.3Document27 pages6.L339-1-2013 Psi GM 4.3JOAO BIANCHINIPas encore d'évaluation

- Port - Location Master (Terminals, CFS & Depot)Document22 pagesPort - Location Master (Terminals, CFS & Depot)SurajPandeyPas encore d'évaluation

- Gas Detection List Rev.0Document28 pagesGas Detection List Rev.0Mihaela CazacPas encore d'évaluation

- TAN AO Code MasterDocument105 pagesTAN AO Code MasterRanjanPas encore d'évaluation

- PT Indonesia Power equipment mappingDocument6 pagesPT Indonesia Power equipment mappingDhira GunawanPas encore d'évaluation

- University Wide Courses: Covenant University: 2020/2021 Omega Mid-Semester Exam TimetableDocument3 pagesUniversity Wide Courses: Covenant University: 2020/2021 Omega Mid-Semester Exam TimetableekenePas encore d'évaluation

- Mcnally Bharat Engg. Co - LTD.: RemarskDocument2 pagesMcnally Bharat Engg. Co - LTD.: RemarskAshutosh VermaPas encore d'évaluation

- !or Aucric' (:C!A: O::Otai Q!Antily: Lsee 10 (1) (LLLDocument6 pages!or Aucric' (:C!A: O::Otai Q!Antily: Lsee 10 (1) (LLLRoshniPas encore d'évaluation

- National Guard (In Federal Status) and Reserve Activated As of July 19, 2011Document347 pagesNational Guard (In Federal Status) and Reserve Activated As of July 19, 2011Good Soldiers OrganizationPas encore d'évaluation

- Calculul PresiuniiDocument37 pagesCalculul PresiuniiSergiu LazărPas encore d'évaluation

- Sony Vaio Mbx-126 - Quanta Je5.1Document36 pagesSony Vaio Mbx-126 - Quanta Je5.1nunoq171Pas encore d'évaluation

- Final 2011 New Rice Varieties (Nsic Name)Document4 pagesFinal 2011 New Rice Varieties (Nsic Name)Miriam Du BaltazarPas encore d'évaluation

- TAN AO CODE Master Version 3.6: Sr. No. RCC Area Code Ao Type Range Code Ao NoDocument90 pagesTAN AO CODE Master Version 3.6: Sr. No. RCC Area Code Ao Type Range Code Ao NosahilgeraPas encore d'évaluation

- Salamat-1 Mud Report 54-28092012Document4 pagesSalamat-1 Mud Report 54-28092012mega87_2000Pas encore d'évaluation

- Ahmedabad Airport ChartsDocument10 pagesAhmedabad Airport Chartsravaiyamayank100% (1)

- PAN AO Codes International Taxation Ver2.5 13022012Document10 pagesPAN AO Codes International Taxation Ver2.5 13022012Gyanendra DwivediPas encore d'évaluation

- CGL 12 T1q-SicDocument26 pagesCGL 12 T1q-SicDharmesh SuvagiyaPas encore d'évaluation

- Charles A. Pittinger, Donald J. Versteeg, Beverly A. Blats and Ellen M. MeiersDocument20 pagesCharles A. Pittinger, Donald J. Versteeg, Beverly A. Blats and Ellen M. MeiersKanraPas encore d'évaluation

- SIGCCL Advance Auction - 10(1) ReportDocument14 pagesSIGCCL Advance Auction - 10(1) ReportRoshniPas encore d'évaluation

- Instrumen 2016 - 2018Document4 pagesInstrumen 2016 - 2018carolinaPas encore d'évaluation

- Daftar BHP Gudang Farmasi NB: K (Keluar), M (Masuk) NO Nama Masuk Keluar Sisa 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 TotalDocument6 pagesDaftar BHP Gudang Farmasi NB: K (Keluar), M (Masuk) NO Nama Masuk Keluar Sisa 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Totalreny08Pas encore d'évaluation

- Videsh PrintingDocument22 pagesVidesh PrintingAbroadnayak KumarPas encore d'évaluation

- Pipe Fittings: S# Description No Size Unit Rate (RS/FT) Cost Rs. Dia (Rs/No)Document20 pagesPipe Fittings: S# Description No Size Unit Rate (RS/FT) Cost Rs. Dia (Rs/No)angel gabriel perez valdezPas encore d'évaluation

- (11.05.2020) Letter Reg. Unhindered Movement of Medical StaffDocument2 pages(11.05.2020) Letter Reg. Unhindered Movement of Medical Staffchetan mojidraPas encore d'évaluation

- Slurry Treatment Equipment Performance and SpecificationsDocument29 pagesSlurry Treatment Equipment Performance and SpecificationsKathirgamanathan SivanathanPas encore d'évaluation

- Time Table 2011 Odd FinalDocument3 pagesTime Table 2011 Odd FinalSidhartha Sankar RoutPas encore d'évaluation

- GE's Nine Cell Strategic Business ScreenDocument2 pagesGE's Nine Cell Strategic Business ScreenBheem PrakashPas encore d'évaluation

- 19.0 KG CYLINDERS TENDERDocument6 pages19.0 KG CYLINDERS TENDERBheem PrakashPas encore d'évaluation

- Financial ManagementDocument11 pagesFinancial ManagementAshish VishwakarmaPas encore d'évaluation

- SummaryDocument1 pageSummaryBheem PrakashPas encore d'évaluation

- List of Maharatna, Navratna and Miniratna Cpses: As Per Available InformationDocument4 pagesList of Maharatna, Navratna and Miniratna Cpses: As Per Available InformationDhirajPas encore d'évaluation

- XII AP AAGMH - JawabanDocument16 pagesXII AP AAGMH - JawabanFRANSISKA AYU KRISNASARIPas encore d'évaluation

- Mp3 (23Mb, Duration 1:06:51) "Man! Know Thyself"Document10 pagesMp3 (23Mb, Duration 1:06:51) "Man! Know Thyself"Olica MaximovaPas encore d'évaluation

- Cancer Nanotechnology Research and ApplicationsDocument16 pagesCancer Nanotechnology Research and ApplicationsShridhar MathadPas encore d'évaluation

- Lesson From RamayanaDocument2 pagesLesson From Ramayanaananda_joshi5178Pas encore d'évaluation

- Resume SujaDocument3 pagesResume Sujabharathi.sunagar5389Pas encore d'évaluation

- Arguments For Defendant (Amritam Shankar Yadav Roll-115) : Case Law: MR. Sharma V MR. NitinDocument2 pagesArguments For Defendant (Amritam Shankar Yadav Roll-115) : Case Law: MR. Sharma V MR. Nitinshambhavi sinhaPas encore d'évaluation

- Dasa Maha Vidya SthothrasDocument7 pagesDasa Maha Vidya SthothrasNarayanan Muthuswamy100% (1)

- Apply Student LoanDocument3 pagesApply Student LoanNitesh MishraPas encore d'évaluation

- Pi Ai LokåcåryaDocument88 pagesPi Ai Lokåcåryaraj100% (1)

- Agrarianproblems00giri PDFDocument380 pagesAgrarianproblems00giri PDFhemant kumarPas encore d'évaluation

- Out PDFDocument24 pagesOut PDFGayathriGopinathPas encore d'évaluation

- Sem XDocument51 pagesSem XAnantHimanshuEkkaPas encore d'évaluation

- Panel JBT (Tet) To TGT Arts June 2018-Upload by Vijay Kumar HeerDocument12 pagesPanel JBT (Tet) To TGT Arts June 2018-Upload by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- The African Dispersal in The DeccanDocument186 pagesThe African Dispersal in The DeccanAbuAbdur-RazzaqAl-Misri100% (2)

- UG NON-NEET - B.Pharm. FINAL MERIT LIST (UPDATED) - PUDUCHERRY U.T. - OVERALL - CompressedDocument62 pagesUG NON-NEET - B.Pharm. FINAL MERIT LIST (UPDATED) - PUDUCHERRY U.T. - OVERALL - CompressedFathimaPas encore d'évaluation

- Museum Report - 29.7.15Document23 pagesMuseum Report - 29.7.15bhartisikriPas encore d'évaluation

- MajjhimapaṇṇāsapāḷiDocument218 pagesMajjhimapaṇṇāsapāḷiHelious HephaestusPas encore d'évaluation

- Date $43,473.00 SL - No Company Name Contact Person DeptDocument189 pagesDate $43,473.00 SL - No Company Name Contact Person DeptAbhijitPas encore d'évaluation

- Students' Marks ListDocument2 pagesStudents' Marks ListTej PatelPas encore d'évaluation

- Holi Festival IndiaDocument15 pagesHoli Festival IndiaIndo Asia ToursPas encore d'évaluation

- Karma: What It Is, What It Isn't, Why It Matters. by Traleg KyabgonDocument2 pagesKarma: What It Is, What It Isn't, Why It Matters. by Traleg KyabgonSylvia CheungPas encore d'évaluation

- Grah SagarDocument5 pagesGrah SagarsastrologyPas encore d'évaluation

- THE DUTTAs - by Dhruba Dutta ChaudhuryDocument6 pagesTHE DUTTAs - by Dhruba Dutta ChaudhuryDhruba Dutta ChaudhuryPas encore d'évaluation

- The Mirror of Self-Supremacy or Svatantrya-DarpanaDocument152 pagesThe Mirror of Self-Supremacy or Svatantrya-DarpanaRam SharmaPas encore d'évaluation

- Internal Directory 2068Document125 pagesInternal Directory 2068kamalgaihrePas encore d'évaluation

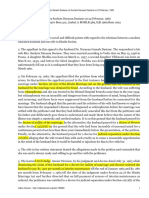

- Narayan Ganesh Dastane Vs Sucheta Narayan Dastane On 24 February, 1969Document18 pagesNarayan Ganesh Dastane Vs Sucheta Narayan Dastane On 24 February, 1969fishPas encore d'évaluation

- New Navi MumbaiDocument23 pagesNew Navi MumbaiDivya SinghPas encore d'évaluation

- Jammu and Kashmir: Submitted By: Hemant Emoliya M.Plan 2 SemDocument18 pagesJammu and Kashmir: Submitted By: Hemant Emoliya M.Plan 2 SemAbdul SakurPas encore d'évaluation

- IT Leaders List with DesignationsDocument5 pagesIT Leaders List with DesignationsVikramPas encore d'évaluation

- Nectar of Instructions Slides PDFDocument53 pagesNectar of Instructions Slides PDFUbhay Singh100% (3)