Académique Documents

Professionnel Documents

Culture Documents

新股市奇才中Mark Minervini的选股策略SEPA Technology

Transféré par

stoneface2Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

新股市奇才中Mark Minervini的选股策略SEPA Technology

Transféré par

stoneface2Droits d'auteur :

Formats disponibles

Specific Entry Point Analysis TM - SEPA TM was developed by Mark Minervini

analysis of past stock market SUPER PERFORMERS.

1

over 24 years. The methodologys foundation is built upon historical precedent characteristics make a stock likely to advance significantly, historical models of top price performers and industry leaders are archived in our confidential database. winning stocks. These models are based upon sets of characteristics prevalent in exceptional To determine what

SEPA

RISK/REWARD

The convergence of significant factors to a specific point.

A DYNAMIC BLUEPRINT On-going efforts are focused on identifying in detail the characteristics of the most successful performers of the past to determine what makes a stock likely to candidates can be compared and scrutinized for criteria in-line with our proprietary "Leadership Profile. outperform its peers in the future. Based on these attributes, current investment This success blueprint is the fundamental basis

for our stock selection. The database and profile is continually updated to account

TM

thousands of historic company profiles going back over many market cycles

for market dynamics and new available data. The SEPA TM model takes into account

spanning numerous decades. In order to find rapidly growing companies with the ability to sustain above average appreciation, a unique combination of quantitative criteria for the SEPA TM investment process. screening, fundamental research and qualitative analysis serve as core selection Additionally, our ranking process scores each company based on earnings surprises,

SEPA Technology

estimate revisions and company issued guidance in order to determine the SEPA TM process is a focus on where a stock is within its earnings maturation cycle.

probability for future price performance catalysts. A unique component of the Each day, our computers systematically analyze thousands of stocks for specific data items using a proprietary series of absolute, relative and time dimension for probable earnings surprise. calculations. Our extensive fundamental research ranks each investment candidate Specific Entry Point Analysis TM focuses on identifying, company-by-company, the precursors of inefficient pricing in order to distinguish appropriate entry points. Utilizing SEPA Technology TM, stocks displaying the potential for significant price

appreciation are identified and pinpointed. While were not perfect, our proven SEPA Technology TM consistently highlights many of the best investment ideas and stock market leaders before theyre widely recognized by Wall Street.

MinerviniPrivateAccess.com

The SEPA screening process can be summarized as follows:

TM

1.

Stocks are screened through a series of "filters" based on earnings, sales & margin growth, relative price performance and price trend characteristics. Approximately 95% of all stocks in the market are eliminated in this first screen leaving roughly 1,000 initial contenders.

2.

These remaining stocks are scrutinized for similarity to a

proprietary leadership profile in-line with specific fundamental and technical factors exhibited by our historic models. This second

stage removes most of the remaining companies, leaving a narrowed list of investment ideas for further review and evaluation. 3. The final stage is a comprehensive manual review. The narrowed list of candidates are examined individually by Mark Minervini and scored according to a relative prioritizing ranking process which considers the following characteristics: Reported earnings and sales Earnings surprise history EPS growth rate and sales acceleration Company issued guidance Earnings estimate revisions Profit margins (historic & projected) Industry and market position Potential "catalysts" (new products, services or industry changes) Performance compared to other stocks in same sector Price momentum, price trend and trading volume analysis Liquidity

SEPA Technology

TM

The ranking process is focused on identifying three key elements: The potential for future earnings and sales surprises The potential for institutional volume support The potential for rapid price appreciation based on a supply/demand imbalance

MinerviniPrivateAccess.com

Profiting from the Earnings Cycle

Individual stocks can go through extended periods of underperformance, in some instances for decades Eastman Kodaks stock price took twenty-four years (1973-1997) to break even while the S&P 500 Index advanced 500%. While some stocks languish, companies with superior improving fundamentals can perform exceptionally well. Large institutional buyers (mutual funds, pension plans, hedge funds, etc.) have the greatest buying power to influence a stocks share price. So, what do they look for? Earnings and sales surprise and estimate revisions contribute to valuation model changes and thus impact buying and selling pressure. The subsequent buying pressure that comes from an earnings surprise or a company materially raising guidance generally leads to a higher stock price, which in turn attracts momentum buyers. An understanding of how Wall Street works and identifying what specific characteristic will attract institutional buyers into a stock is our daily focus. The graph below illustrates a typical earnings maturation cycle and where we focus our efforts on buying and selling within the cycle:

SEPA Technology

TM

Growth is Obvious Loss of EPS Momentum

Momentum Buyers EPS Momentum Estimates Revised Up Surprise Models

SELL

Negative Surprise Negative Surprise Models Estimates Revised Down

Positive Surprise NEGLECT

BUY

Stock Dumped NEGLECT

The SEPATM strategy exploits the institutional investment delay between points A and B

MinerviniPrivateAccess.com

SEPA

RISK/R EWARD

SUMMARY OF THE PROCESS

1.

HISTORICAL PRECEDENT ANALYSIS Study of the best performing stocks over each market cycle Characteristics defined and archived Blueprint is constructed based on attributes of winners

2.

COMPUTER SURVAEILLENCE Computers screen 8,000+ stocks daily Narrows down to the top 1% Companies displaying specific characteristics are identified

TM

SEPA Technology

3.

LEADERSHIP PROFILING Data is compared to all stocks Results are compared to a Leadership Profile Profile is continually updated to reflect new information

4.

RANKING AND SELECTION Candidates are monitored for specific criteria convergence Catalyst such as earnings surprise, company issued guidance Entry point defined based on risk/reward

MinerviniPrivateAccess.com

Vous aimerez peut-être aussi

- Richard Love's Approach to Identifying Stocks with Superperformance PotentialDocument7 pagesRichard Love's Approach to Identifying Stocks with Superperformance PotentialGEETHA PUSHKARANPas encore d'évaluation

- Mark Minervini - Webinar NotesDocument3 pagesMark Minervini - Webinar NotesSandip50% (4)

- The Trend Template Mark MinerviniDocument4 pagesThe Trend Template Mark Minerviniansar990% (1)

- Volatility Contraction PatternDocument1 pageVolatility Contraction PatternJames MelchorPas encore d'évaluation

- Mark Minervini - Keys To Winning in The Stock MarketDocument4 pagesMark Minervini - Keys To Winning in The Stock Marketmatrixit75% (4)

- Mark Minervini Webinar NotesDocument3 pagesMark Minervini Webinar NotesMaliha Zaman89% (18)

- Monster StocksDocument4 pagesMonster Stocksallexunnder80% (5)

- IBD Sell Buy Rules2 7Document22 pagesIBD Sell Buy Rules2 7Swami100% (1)

- Minervini Sepa MethodDocument5 pagesMinervini Sepa Methodmickael2850% (2)

- 20-Rules IBDDocument22 pages20-Rules IBDOJ100% (6)

- William J O Neil Sell RulesDocument4 pagesWilliam J O Neil Sell RulesArchie Trugo100% (5)

- IBD Virtual Meetup Trend LinesDocument17 pagesIBD Virtual Meetup Trend Linesapi-3837407100% (1)

- Iterview Mark Minervini - Business - WKDocument4 pagesIterview Mark Minervini - Business - WKviet100% (1)

- Mark Minervini Interview PDFDocument13 pagesMark Minervini Interview PDFgargPas encore d'évaluation

- Super Trader Tactics for Triple ReturnsDocument22 pagesSuper Trader Tactics for Triple Returnsjdalvaran85% (20)

- Can SlimDocument20 pagesCan Slimanon-13887100% (1)

- Technical Analysis of CAN SLIM StocksDocument82 pagesTechnical Analysis of CAN SLIM StocksVishwanath Swamy S M100% (3)

- Dan Zanger Trading RulesDocument4 pagesDan Zanger Trading Rulestestpat2250% (2)

- Trading Wisdom QuotesDocument69 pagesTrading Wisdom QuotesPeter L. Brandt80% (5)

- Learning CAN SLIM Education Resources: Lee TannerDocument43 pagesLearning CAN SLIM Education Resources: Lee Tannerneagucosmin67% (3)

- Super Performance Stocks - LoveDocument256 pagesSuper Performance Stocks - Lovedrewmx88% (8)

- Dan Zanger Trading Method PDFDocument6 pagesDan Zanger Trading Method PDFAkshay Shinde100% (4)

- Mark Minervini Stage 2 Uptrend and Trend TemplateDocument1 pageMark Minervini Stage 2 Uptrend and Trend TemplateL100% (1)

- IBD Buying StrategiesDocument16 pagesIBD Buying StrategiesVũ Huy Dương100% (2)

- The Volatility Contraction Pattern (VCP) : How To Day Trade With ItDocument11 pagesThe Volatility Contraction Pattern (VCP) : How To Day Trade With ItM. Div Choudhray100% (3)

- Chart Patterns Trading and Dan Zanger - Technical Analysis of Stocks & Commodities - (2003)Document5 pagesChart Patterns Trading and Dan Zanger - Technical Analysis of Stocks & Commodities - (2003)Sebastian100% (1)

- CAN Slim Method To Pick StocksDocument1 pageCAN Slim Method To Pick StocksSiddhartha Goenka33% (3)

- Principles of Ed Seykota (Trend Follower)Document7 pagesPrinciples of Ed Seykota (Trend Follower)Deng Qiang100% (4)

- Programming The Jesse Livermore Market KeyDocument12 pagesProgramming The Jesse Livermore Market KeyKH Tang80% (15)

- Essential IBD Stock Checklist for Growth InvestorsDocument4 pagesEssential IBD Stock Checklist for Growth InvestorsANIL19640% (1)

- The Best Trading Advice From 25 Top TradersDocument54 pagesThe Best Trading Advice From 25 Top TradersTUAN NGUYỄN100% (1)

- How to Invest in Stocks Like a ProDocument17 pagesHow to Invest in Stocks Like a ProAditya Jaiswal100% (2)

- How To Make Money Trading Part Time1Document27 pagesHow To Make Money Trading Part Time1emirav2100% (1)

- Mark Minervini InterviewDocument13 pagesMark Minervini Interviewgarg100% (3)

- My Personal 25 Trading Lessons PDFDocument88 pagesMy Personal 25 Trading Lessons PDFBhavesh Gelani100% (7)

- The 10 Key Differences Between Bull and Bear Rallies - Matt BlackmanDocument10 pagesThe 10 Key Differences Between Bull and Bear Rallies - Matt Blackmanwealthyjoe100% (1)

- How and Why I Use Investor's Business Daily - StockbeeDocument9 pagesHow and Why I Use Investor's Business Daily - StockbeePatrick LeGuignolPas encore d'évaluation

- Becoming Market SmithDocument82 pagesBecoming Market SmithTu D.Pas encore d'évaluation

- Systems & Trading Fundamentals - Van Tharp-5Document66 pagesSystems & Trading Fundamentals - Van Tharp-5Roberto Medino100% (3)

- Book Review of Trade Like A Stock Market WizardDocument16 pagesBook Review of Trade Like A Stock Market WizardKai Kowit100% (2)

- Van-Tharp - Trading SystemsDocument9 pagesVan-Tharp - Trading Systemspetefader67% (3)

- Ed Seykota On What Drives Prices and Donchian's Trade GuideDocument2 pagesEd Seykota On What Drives Prices and Donchian's Trade GuideJay King100% (2)

- O'Neil William J. - .Article - How To Make Money in Stocks. A Winning System in Good Times or Bad (Third Edition Summary)Document16 pagesO'Neil William J. - .Article - How To Make Money in Stocks. A Winning System in Good Times or Bad (Third Edition Summary)Ioana Ionescu85% (13)

- Mark Minervini (@markminervini) - Twitter5Document1 pageMark Minervini (@markminervini) - Twitter5LPas encore d'évaluation

- Trading Pocket PivotsDocument18 pagesTrading Pocket PivotsJose Rodriguez100% (9)

- VCP Pattern NotesDocument2 pagesVCP Pattern NotesAVIJIT DASPas encore d'évaluation

- Lectures 06-11Document26 pagesLectures 06-11minervini markPas encore d'évaluation

- Ed Seykota of Technical ToolsDocument8 pagesEd Seykota of Technical ToolsRonitSing89% (9)

- Lessons from the Greatest Stock Traders of All TimeD'EverandLessons from the Greatest Stock Traders of All TimeÉvaluation : 5 sur 5 étoiles5/5 (18)

- In The Trading Cockpit with the O'Neil Disciples: Strategies that Made Us 18,000% in the Stock MarketD'EverandIn The Trading Cockpit with the O'Neil Disciples: Strategies that Made Us 18,000% in the Stock MarketPas encore d'évaluation

- You Can Still Make It In The Market by Nicolas Darvas (the author of How I Made $2,000,000 In The Stock Market)D'EverandYou Can Still Make It In The Market by Nicolas Darvas (the author of How I Made $2,000,000 In The Stock Market)Évaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Short-Selling with the O'Neil Disciples: Turn to the Dark Side of TradingD'EverandShort-Selling with the O'Neil Disciples: Turn to the Dark Side of TradingPas encore d'évaluation

- Summary of Gil Morales & Chris Kacher's In The Trading Cockpit with the O'Neil DisciplesD'EverandSummary of Gil Morales & Chris Kacher's In The Trading Cockpit with the O'Neil DisciplesPas encore d'évaluation

- The Rule: How I Beat the Odds in the Markets and in Life—and How You Can Too: How I Beat the Odds in the Markets and in Life—and How You Can TooD'EverandThe Rule: How I Beat the Odds in the Markets and in Life—and How You Can Too: How I Beat the Odds in the Markets and in Life—and How You Can TooÉvaluation : 4.5 sur 5 étoiles4.5/5 (9)

- Summary of Mark Minervini's Trade Like a Stock Market WizardD'EverandSummary of Mark Minervini's Trade Like a Stock Market WizardPas encore d'évaluation

- The StockTwits Edge: 40 Actionable Trade Set-Ups from Real Market ProsD'EverandThe StockTwits Edge: 40 Actionable Trade Set-Ups from Real Market ProsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Trend Following Masters - Volume 1: Trading ConversationsD'EverandTrend Following Masters - Volume 1: Trading ConversationsPas encore d'évaluation

- Trend Following Mindset: The Genius of Legendary Trader Tom BassoD'EverandTrend Following Mindset: The Genius of Legendary Trader Tom BassoÉvaluation : 3 sur 5 étoiles3/5 (4)

- Trend Trading for a Living: Learn the Skills and Gain the Confidence to Trade for a LivingD'EverandTrend Trading for a Living: Learn the Skills and Gain the Confidence to Trade for a LivingÉvaluation : 5 sur 5 étoiles5/5 (1)

- Ir35 For Freelancers by YunojunoDocument17 pagesIr35 For Freelancers by YunojunoOlaf RazzoliPas encore d'évaluation

- Evaluating MYP Rubrics in WORDDocument11 pagesEvaluating MYP Rubrics in WORDJoseph VEGAPas encore d'évaluation

- Complete Guide To Sports Training PDFDocument105 pagesComplete Guide To Sports Training PDFShahana ShahPas encore d'évaluation

- Chem 102 Week 5Document65 pagesChem 102 Week 5CAILA CACHEROPas encore d'évaluation

- Hyper-Threading Technology Architecture and Microarchitecture - SummaryDocument4 pagesHyper-Threading Technology Architecture and Microarchitecture - SummaryMuhammad UsmanPas encore d'évaluation

- "Behind The Times: A Look at America's Favorite Crossword," by Helene HovanecDocument5 pages"Behind The Times: A Look at America's Favorite Crossword," by Helene HovanecpspuzzlesPas encore d'évaluation

- 20 Ua412s en 2.0 V1.16 EagDocument122 pages20 Ua412s en 2.0 V1.16 Eagxie samPas encore d'évaluation

- Case 5Document1 pageCase 5Czan ShakyaPas encore d'évaluation

- Simply Put - ENT EAR LECTURE NOTESDocument48 pagesSimply Put - ENT EAR LECTURE NOTESCedric KyekyePas encore d'évaluation

- Experiences from OJT ImmersionDocument3 pagesExperiences from OJT ImmersionTrisha Camille OrtegaPas encore d'évaluation

- Marketing Plan for Monuro Clothing Store Expansion into CroatiaDocument35 pagesMarketing Plan for Monuro Clothing Store Expansion into CroatiaMuamer ĆimićPas encore d'évaluation

- Manual Analizador Fluoruro HachDocument92 pagesManual Analizador Fluoruro HachAitor de IsusiPas encore d'évaluation

- Three-D Failure Criteria Based on Hoek-BrownDocument5 pagesThree-D Failure Criteria Based on Hoek-BrownLuis Alonso SAPas encore d'évaluation

- August 03 2017 Recalls Mls (Ascpi)Document6 pagesAugust 03 2017 Recalls Mls (Ascpi)Joanna Carel Lopez100% (3)

- MBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorDocument20 pagesMBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorPooja GodiyalPas encore d'évaluation

- John Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JDocument12 pagesJohn Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JFrances Ann TevesPas encore d'évaluation

- Cold Rolled Steel Sections - Specification: Kenya StandardDocument21 pagesCold Rolled Steel Sections - Specification: Kenya StandardPEng. Tech. Alvince KoreroPas encore d'évaluation

- Case Study Hotel The OrchidDocument5 pagesCase Study Hotel The Orchidkkarankapoor100% (4)

- If V2 would/wouldn't V1Document2 pagesIf V2 would/wouldn't V1Honey ThinPas encore d'évaluation

- Interpretation of Arterial Blood Gases (ABGs)Document6 pagesInterpretation of Arterial Blood Gases (ABGs)afalfitraPas encore d'évaluation

- C6 RS6 Engine Wiring DiagramsDocument30 pagesC6 RS6 Engine Wiring DiagramsArtur Arturowski100% (3)

- Neuropsychological Deficits in Disordered Screen Use Behaviours - A Systematic Review and Meta-AnalysisDocument32 pagesNeuropsychological Deficits in Disordered Screen Use Behaviours - A Systematic Review and Meta-AnalysisBang Pedro HattrickmerchPas encore d'évaluation

- Change Management in British AirwaysDocument18 pagesChange Management in British AirwaysFauzan Azhary WachidPas encore d'évaluation

- C6030 BrochureDocument2 pagesC6030 Brochureibraheem aboyadakPas encore d'évaluation

- System: Boehringer Mannheim/Hitachi AnalysisDocument20 pagesSystem: Boehringer Mannheim/Hitachi Analysismaran.suguPas encore d'évaluation

- 1.2 - Venn Diagram and Complement of A SetDocument6 pages1.2 - Venn Diagram and Complement of A SetKaden YeoPas encore d'évaluation

- Android software download guideDocument60 pagesAndroid software download guideRizky PradaniPas encore d'évaluation

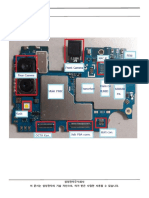

- Level 3 Repair PBA Parts LayoutDocument32 pagesLevel 3 Repair PBA Parts LayoutabivecuePas encore d'évaluation

- KPMG Inpection ReportDocument11 pagesKPMG Inpection ReportMacharia NgunjiriPas encore d'évaluation

- Column Array Loudspeaker: Product HighlightsDocument2 pagesColumn Array Loudspeaker: Product HighlightsTricolor GameplayPas encore d'évaluation