Académique Documents

Professionnel Documents

Culture Documents

Audited Annual Report 2010-11

Transféré par

Peoples' Vigilance Committee on Human rights0 évaluation0% ont trouvé ce document utile (0 vote)

186 vues28 pages.K. A. And ASSOCIATES CHARTERED ACCOUNTANTS E-1. KAILGARH MARKET MALDAHIAqVARANASI as at 31st March 2011 and Income and Expenditure Account for the year ended on thMt date which are in aqreement with the books 01 acc oun+ ma:i.n ta]ned bv t.he s;.i.i

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce document.K. A. And ASSOCIATES CHARTERED ACCOUNTANTS E-1. KAILGARH MARKET MALDAHIAqVARANASI as at 31st March 2011 and Income and Expenditure Account for the year ended on thMt date which are in aqreement with the books 01 acc oun+ ma:i.n ta]ned bv t.he s;.i.i

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

186 vues28 pagesAudited Annual Report 2010-11

Transféré par

Peoples' Vigilance Committee on Human rights.K. A. And ASSOCIATES CHARTERED ACCOUNTANTS E-1. KAILGARH MARKET MALDAHIAqVARANASI as at 31st March 2011 and Income and Expenditure Account for the year ended on thMt date which are in aqreement with the books 01 acc oun+ ma:i.n ta]ned bv t.he s;.i.i

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 28

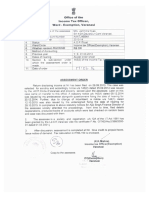

ANTL KUMAR AGARWAL A .K. A. & ABSOCIATI

F.C.A CHARTERED ACCOUNTA

: E-1, KAILGARH MARKET —

MALDAHIA . VARANASI

PHONE : 2207805

FORM 10 8

(See Rule 17 B)

A REPEAL ANE SECT AAO

THE (CASE (OF (CHARITABLE OR REL OBINS TRUSTS (GR NETIMUT OOM.

We have examined the Balance Sheet of GAN MITRAL. INVAS.\WARANAST

as at Sist March, 2011 and Income and Expenditure Account for the

year ended on that date which are in agreement with the books of

account maintained by the said TRUST .

We-have obtained all the information and explanations which to the

best of our knowledae and belief were necessary for the purposes of

the audit. In our opinion, proper books of account have been kept

by the head office and branches of the above mentioned trust visited

by us.so for as appears from our examination of the books and proper

returns adequate for the purpose of audit have been received from

branches not visited by us subject to comments given below:

In our opinion and to the best of our information and acccordina

to the information given to us, the said accounts gives a true and

fair view:

(i) In the case of the Balance Sheet . of the state of affairs

of the above named TRUST as at Sist March,2011 and

(ii) In the case of the Income and Expenditure Account, of the

Income of its accounting year ending on that date.

The prescribed particulars are annexed hereto .

FOR A.K.A. & ASSOCIATES

CHARTERED — ACCOUNTANTS

PLACE 1 VARANASI.

DATE + 30-7.2011

ANIL KUMAR AGARWAL A .K. A. & ASSOCIATES

F.C. CHARTERED ACCOUNTANTS

E-1, KAILGARH MARKET

MALDAHIA . VARANASI

PHONE : 2207806

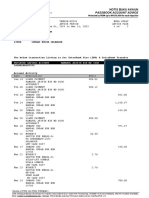

ANNE XURE,

STATEMENT OF PARTICULARS

oF

JAN MITRA NYAS

APPLICATION OF INCOME FOR CHARITABLE OR RELIGIOUS PURPOSES

Amount of income for the previous year VIDE INCOME & EXP. A/C

applied to the charitable or religious RS.9449489.45,

purpose. in India during that year. APPLIED FOR FIXED ASSETS:

818711 .00

TOTAL 10246200.45

Whether the trust has exercised the YES,

option under the clause (2) of the option has been exercised

explanation te section 11(1). If so for rs. 36.00 lac to be

the details of the amount of income expensed in immediately

deemed to have been applied ta next succeeding previous

charitable or religious purposes in year vide governing body

India during the previous year. meeting

Amount of income accumulated or set

apart finally set apart for application

to Charitalbe or Religious purposes, to

the extent it does not exceeds 16

percent of the income derived from the

property held under trust wholly or

in part only for such purposes.

Amount ot income elaible for exemption

under Section 41(1) (c)(qive details) Nea

Amount of income in addition to the amount RS. 36.00 LACS

referred to in item 3 above,accumlated or

set apart for specified purpose u/s 11(2)

Whether the amount of income mentioned in already deposited

in‘item 5 above,has been invested or in scheduled 6

deposited in the manner laid down in 11(2)(b)

If so the details thereof.

Whether any part of the income in respect

of which an option was exercised under

clause (2) of the explanation to section

41(1) in any earlier years is deemed to be

income of the previous year u/s 11(1B).if

so the details thereof.

Whether during the previous year.any part of

the income accumulated or set apart for

“specified purposes u/s 11(2) in any earlier

year.

has been applied for the purposes other than

itable or reliaious purposes. or

has ceased to remain invested in any security

referred to in any sec 11(2).(b) (i) or

deposited in any account referred to in sec

1102),0b).Gii) or sec 11 (2) (b) (iii) or

has not been utilised for purposes for which

dt was accumulated or set apart during PERTOD

the for which was to be accumulated or set apart, NO

or in the year immediately following the expiry

thereof if so the details thereof

APPLICATION FOR USE GF INCOME GR PROPERTY FOR THE BENIFIT

OF PERSONS REFERRED TO IN SECTION 13(3)

Whether any part of the income or property

of the trust was lent or continues to be lent

in the previous year to any persons referred

to in sec 15(3) (hereinafter referred to in his

annexure as such person). If so qive details of

the property and the amount,rate or interest

charaed and nature of security if any

Whether any land building or any other property

of the trust was made or continued to be mada,

available for the use of any such persons during

the previous year.If so.give details of the

property and the amount of rent or compensation

charoed If any.

Whether any payment was made to any such persons salary to

during the orevious year by way of salary.allowance = -— =

or otherwise If so.give details.

Lanin raghuvanshi — 357050.00

shruti nagvanshi —108000.09 _

Whether the service of the trust was made available

te any such person during the previous year

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Property Management Accounting BookDocument81 pagesProperty Management Accounting Booklou4ket86% (14)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- PERPETUAL INVENTORY SYSTEM - Practice SetDocument25 pagesPERPETUAL INVENTORY SYSTEM - Practice SetJAY100% (2)

- Cost Accounting Solman de Leon 2014 1Document181 pagesCost Accounting Solman de Leon 2014 1Mark Anthony Siva94% (16)

- Rekening Koran (Account Statement) : Date & Time Value Date Description Debit Balance Credit Reference NoDocument2 pagesRekening Koran (Account Statement) : Date & Time Value Date Description Debit Balance Credit Reference NofirmanPas encore d'évaluation

- Bank Reconciliation: Sample ProblemsDocument39 pagesBank Reconciliation: Sample ProblemsXENA LOPEZ78% (9)

- Management of Sales Territories and QuotasDocument7 pagesManagement of Sales Territories and QuotasRavimohan RajmohanPas encore d'évaluation

- UOK VoucherDocument1 pageUOK VouchertalhaPas encore d'évaluation

- ACCTG102 - PrelimSW4 Accounts Receivable Part 1 Answer KeyDocument2 pagesACCTG102 - PrelimSW4 Accounts Receivable Part 1 Answer KeyJessica Albaracin100% (1)

- Problem 8Document13 pagesProblem 8Chrisron CasanoPas encore d'évaluation

- Kunci Jawab Paket ADocument31 pagesKunci Jawab Paket ASilva Fitri AnjaniPas encore d'évaluation

- FCRA Return October-December17Document1 pageFCRA Return October-December17Peoples' Vigilance Committee on Human rightsPas encore d'évaluation

- BHU - The School For ScandalDocument2 pagesBHU - The School For ScandalPeoples' Vigilance Committee on Human rightsPas encore d'évaluation

- FCRA Return 2016-17Document4 pagesFCRA Return 2016-17Peoples' Vigilance Committee on Human rightsPas encore d'évaluation

- Round Table Invitation Letter-Mr. Lenin RaghuvanshiDocument1 pageRound Table Invitation Letter-Mr. Lenin RaghuvanshiPeoples' Vigilance Committee on Human rightsPas encore d'évaluation

- One of Best Interim Order of NHRC On Custodial Death and TortureDocument2 pagesOne of Best Interim Order of NHRC On Custodial Death and TorturePeoples' Vigilance Committee on Human rightsPas encore d'évaluation

- KAP Report On Child and Maternal HealthDocument129 pagesKAP Report On Child and Maternal HealthPeoples' Vigilance Committee on Human rightsPas encore d'évaluation

- IT Assessment of Jan Mitra NyasDocument19 pagesIT Assessment of Jan Mitra NyasPeoples' Vigilance Committee on Human rightsPas encore d'évaluation

- FC Return July - Sep, 2016Document1 pageFC Return July - Sep, 2016Peoples' Vigilance Committee on Human rightsPas encore d'évaluation

- A Story On Weavers of VaranasiDocument5 pagesA Story On Weavers of VaranasiPeoples' Vigilance Committee on Human rightsPas encore d'évaluation

- Invitation 2016 PDFDocument1 pageInvitation 2016 PDFPeoples' Vigilance Committee on Human rightsPas encore d'évaluation

- Income Tax Department Assessment 13-14Document4 pagesIncome Tax Department Assessment 13-14Peoples' Vigilance Committee on Human rightsPas encore d'évaluation

- Evalution Report PVCHRDocument82 pagesEvalution Report PVCHRPeoples' Vigilance Committee on Human rightsPas encore d'évaluation

- Bernas Karla Pauline 11 Bonifacio FABM1 Q4Document45 pagesBernas Karla Pauline 11 Bonifacio FABM1 Q4Karla pauline BernasPas encore d'évaluation

- Properaite and Corporate Transaction AccountingDocument41 pagesProperaite and Corporate Transaction Accountingroheed100% (1)

- Jonaryl S. MacatuggalDocument2 pagesJonaryl S. MacatuggalJohn Paul TomasPas encore d'évaluation

- ACT3110 - Accounting Equation and Accounting Cycle - Accounting Process Part I (S)Document30 pagesACT3110 - Accounting Equation and Accounting Cycle - Accounting Process Part I (S)amirah1999Pas encore d'évaluation

- SKANS School of Accountancy, MultanDocument6 pagesSKANS School of Accountancy, MultanEhsan ElahiPas encore d'évaluation

- CEP Course On Supply Chain ManagementDocument5 pagesCEP Course On Supply Chain ManagementdebkinkarPas encore d'évaluation

- Transactions Relating To GoodsDocument14 pagesTransactions Relating To GoodsThrijithPas encore d'évaluation

- Getalado, Jericho M.Document18 pagesGetalado, Jericho M.Ruth Getalado0% (1)

- RHB Islamic Bank BerhadDocument2 pagesRHB Islamic Bank BerhadVape Hut KlangPas encore d'évaluation

- Aud Probs Cash and Cash EquivalentsDocument10 pagesAud Probs Cash and Cash EquivalentsPolly WollyPas encore d'évaluation

- IncotermDocument3 pagesIncotermsree_v123Pas encore d'évaluation

- S4HANA1709 BP BB Best Practices Scenerio Guide v1Document6 pagesS4HANA1709 BP BB Best Practices Scenerio Guide v1Habitacion Alquiler SevillaPas encore d'évaluation

- Employee Travel Expenses SheetDocument5 pagesEmployee Travel Expenses SheetPrashant HartiPas encore d'évaluation

- Homework Ch2Document19 pagesHomework Ch2salehin1969Pas encore d'évaluation

- FABM - L-10Document16 pagesFABM - L-10Seve HanesPas encore d'évaluation

- Kedia Scientific & Surgical (Darbhanga) PDFDocument1 pageKedia Scientific & Surgical (Darbhanga) PDFM.R. Engg. WorksPas encore d'évaluation

- Chapter 1 OperationsDocument9 pagesChapter 1 Operationsrietzhel22100% (1)

- Salary February 2022Document36 pagesSalary February 2022Mandarin FarmPas encore d'évaluation

- Prinsip Perakaunan: Tingkatan 4Document16 pagesPrinsip Perakaunan: Tingkatan 4黄志兴-WONG CHEE HENGPas encore d'évaluation