Académique Documents

Professionnel Documents

Culture Documents

Issues Bates Boatyard 1

Transféré par

atiqahfauziDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Issues Bates Boatyard 1

Transféré par

atiqahfauziDroits d'auteur :

Formats disponibles

-

Bates did not have any proper accounting system. He only has record for cash disbursement and cash receipts. Bates should use cost accounting system. This system is suitable for her as she can identify and assign the costs to each department. We suggest Bates should implement segmental reporting for each of department so that she can assess the contribution and profitability of different departments by comparing the revenues and costs that they generate. Based on the segmental reporting, she can identify whichever departments that contribute profit or loss to her business. Thus, she can remove the unprofitable department. Bates should keep proper accounting records other than cash disbursements and cash receipts.

Too

many

business

activities

without

any

proper

accounting

management (core and non-core activities) Bates should identify which activity that she wants to focus more on and, thus, make it as her core business. Based on the segmental reporting used, Bates can analyze and determine which department can be turn into her core business. By solely depend on which business activity continuously gives profit to her. Base on the case study, she should set her core business into shipping due to most of her activities are related to repair, paint and construct a ship. As for the other business activities that is no related to shipping, she can set it as her non-core business such as refreshments in her store. sales of fishing tackle, sporting goods and

No proper IT system. Bates should develop suitable computerized accounting system in order to generate proper accounting records since manual records are subject to greater human error and can be easily misplaced. As for her store, additional automated system can be used to keep in track with the inventory.

No proper planning to add more activities. Bates did not conduct any cost-benefit analysis for the new activities. Furthermore, she does not have enough capital to venture into new activities. Bates has to determine whether by adding the retail shop into her business activity can add more value. For example, she may allocate more money on core business rather than adding more goods to be sold in her store.

Did not fully-utilized the season in which Bates businesses can operate more efficiently and effectively. Segregation of duties (internal control) only has one person who handle general office factotum and became bookkeeper

What kind of financial and cost information should be developed to control operations and to make proper charges to customers for services rendered? Bates should identify cost objects in order to measure and assign costs. Cost object can be defined as product or department for which costs are accumulated and measured. For this case, the cost objects are winter storage, empty land for outdoor storage, supplies store, yard, painting and repairing department and work shed for construction of boats. In order to obtain the cost object, Bates should identify the direct and indirect costs, so it is easier for her to allocate the costs to each department. Direct cost is a cost that directly relates to a particular cost object while indirect cost is a cost that must be allocated in order to be assigned to cost object. For supplies store, Bates can do an analysis on which product that is highly demanded. So she should consider setting it with a lower price since fixed cost per unit decrease as product level demanded goes up. Therefore, the total cost per product becomes lower.

For the large shed, she can raise up the rental fees of boat storage during winter season as there will be a lot of request among the owners of expensive boats. On the other hand, she can decrease the rental fees to encourage the summer people who were boating-minded to keep their boats at her shed.

Vous aimerez peut-être aussi

- Bates BoatyardDocument3 pagesBates BoatyardCherryl ValmoresPas encore d'évaluation

- Case 15.1Document5 pagesCase 15.1Gabriela LueiroPas encore d'évaluation

- Bates Case StudyDocument4 pagesBates Case StudyClerSaintsPas encore d'évaluation

- Case 2.3 HanauerDocument10 pagesCase 2.3 HanauerAlexa RodriguezPas encore d'évaluation

- Homework CaseDocument5 pagesHomework CaseChris DiazPas encore d'évaluation

- Redi This 1s DrafttDocument54 pagesRedi This 1s DrafttMelaku KiflePas encore d'évaluation

- Chap 025Document17 pagesChap 025Neetu Rajaraman100% (7)

- OPMATQM Unit 2 Activity PART 1 - Agner, Jam Althea O.Document1 pageOPMATQM Unit 2 Activity PART 1 - Agner, Jam Althea O.JAM ALTHEA AGNERPas encore d'évaluation

- Course Syllabus - Management TrendsDocument7 pagesCourse Syllabus - Management TrendsPat LanugonPas encore d'évaluation

- Assessing The Goal of Sports ProductsDocument2 pagesAssessing The Goal of Sports ProductsSean Chris ConsonPas encore d'évaluation

- Unit 9: Inventory /purchase AuditDocument5 pagesUnit 9: Inventory /purchase AudittemedeberePas encore d'évaluation

- Budgeting Case Study Kraft PDFDocument2 pagesBudgeting Case Study Kraft PDFpoojahj100% (1)

- Dell Computer CorporationDocument3 pagesDell Computer CorporationJamie Johnson0% (2)

- Case 15-1 - Private Fitness LLCDocument1 pageCase 15-1 - Private Fitness LLCMac Itaralde0% (1)

- Accounting With SolutionsDocument8 pagesAccounting With Solutions26 Athira S Nair CS1Pas encore d'évaluation

- Walmart Hoping For Another Big Holiday ShowingDocument5 pagesWalmart Hoping For Another Big Holiday ShowingSuman MahmoodPas encore d'évaluation

- Name: Date: Score: CASH BUDGET (25 Points) : 11 Task Performance 1Document2 pagesName: Date: Score: CASH BUDGET (25 Points) : 11 Task Performance 1DianePas encore d'évaluation

- Hospital Supply, Inc.: EXHIBIT 1 Costs Per Unit of Hydraulic HoistsDocument3 pagesHospital Supply, Inc.: EXHIBIT 1 Costs Per Unit of Hydraulic HoistsnirajPas encore d'évaluation

- Chap 023Document23 pagesChap 023Neetu RajaramanPas encore d'évaluation

- Synthesis ReviewerDocument10 pagesSynthesis ReviewerStela Marie CarandangPas encore d'évaluation

- ACC201 Solutions - 1T2018 - Workshop 07 - Week 08Document3 pagesACC201 Solutions - 1T2018 - Workshop 07 - Week 08Luu Minh100% (1)

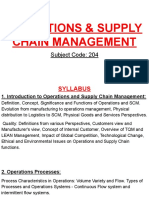

- Operations & Supply Chain ManagementDocument35 pagesOperations & Supply Chain ManagementAnimesh kumarPas encore d'évaluation

- A. Laboratory Manager : : Exercise 1-11 The Managerial ProcessDocument2 pagesA. Laboratory Manager : : Exercise 1-11 The Managerial ProcessNero VedsuPas encore d'évaluation

- Piedmont Univeristy PDFDocument7 pagesPiedmont Univeristy PDFDjoanePas encore d'évaluation

- Chap 028Document12 pagesChap 028Rand Al-akam100% (1)

- Job Order CostingDocument6 pagesJob Order CostingLoise Anne MadridPas encore d'évaluation

- Section - 1 Case-1Document9 pagesSection - 1 Case-1syafiraPas encore d'évaluation

- Shelter Partnership2Document2 pagesShelter Partnership2Raj GuptaPas encore d'évaluation

- Essay 5Document10 pagesEssay 5api-253222984Pas encore d'évaluation

- Alaska For Upload - Free EssayDocument23 pagesAlaska For Upload - Free Essaysophie_irishPas encore d'évaluation

- Chap 5 Accounting For Merchandising OperationDocument71 pagesChap 5 Accounting For Merchandising OperationtamimPas encore d'évaluation

- Cotter Company, IncDocument4 pagesCotter Company, IncSaswata BanerjeePas encore d'évaluation

- Chapter 1 2 3Document41 pagesChapter 1 2 3Cathleen Ancheta NavarroPas encore d'évaluation

- Aboitiz Power CorporationDocument10 pagesAboitiz Power CorporationrobertPas encore d'évaluation

- Budgeting Case Study: Put Laura's Budget TogetherDocument2 pagesBudgeting Case Study: Put Laura's Budget TogetherUsman Ali50% (2)

- Case Study Olympian Backpacks Inc.Document18 pagesCase Study Olympian Backpacks Inc.Rimuru TempestPas encore d'évaluation

- CH 21Document7 pagesCH 21Rand Al-akamPas encore d'évaluation

- Chapter 1Document28 pagesChapter 1Adhi WirayanaPas encore d'évaluation

- Accounts Payables - Session 3 & Q and A SlidesDocument23 pagesAccounts Payables - Session 3 & Q and A SlidesCrystal Fairy-Dust100% (1)

- Updated Case Westover ElectricalDocument8 pagesUpdated Case Westover ElectricalRalph Adrian MielPas encore d'évaluation

- Unit I - Accounting ConceptsDocument42 pagesUnit I - Accounting ConceptsSheetal NafdePas encore d'évaluation

- MR and Ms Lumina 2021Document32 pagesMR and Ms Lumina 2021NadzPas encore d'évaluation

- Translating Hallyu Phenomenon and Its Underlying Impact in The Purchasing Intentions of FilipinosDocument10 pagesTranslating Hallyu Phenomenon and Its Underlying Impact in The Purchasing Intentions of FilipinosKARYLLE KATE CAILING YEEPas encore d'évaluation

- Additional Questions For Maverick CaseDocument3 pagesAdditional Questions For Maverick Casefranz_karununganPas encore d'évaluation

- Westover Case StudyDocument2 pagesWestover Case StudyMohamad ELyas100% (2)

- SNFSS: Sto. Nino Formation and Science SchoolDocument26 pagesSNFSS: Sto. Nino Formation and Science Schoolariane pileaPas encore d'évaluation

- Reviewer in Abc Costing: Cost Accounting AND Control (B. Activity-Based Cost System)Document14 pagesReviewer in Abc Costing: Cost Accounting AND Control (B. Activity-Based Cost System)justine reine cornicoPas encore d'évaluation

- Ocean Manufacturing IncDocument8 pagesOcean Manufacturing Incnaura syahdaPas encore d'évaluation

- Chapter 3 AccountingDocument11 pagesChapter 3 AccountingĐỗ ĐăngPas encore d'évaluation

- CVP QuestionDocument4 pagesCVP QuestionIdoko Vincent0% (1)

- Quijonez Fashionables Comprehensive Prob Merchandising Solution - XLSX Direct Extension MethodDocument4 pagesQuijonez Fashionables Comprehensive Prob Merchandising Solution - XLSX Direct Extension MethodzairahPas encore d'évaluation

- Cost Accounting and Control OutputDocument21 pagesCost Accounting and Control OutputApril Joy ObedozaPas encore d'évaluation

- Private Fitness LLCDocument3 pagesPrivate Fitness LLCYayette BarimbadPas encore d'évaluation

- Cost AccountingDocument5 pagesCost AccountingNiño Rey LopezPas encore d'évaluation

- CFA Level 1 (Book-B)Document170 pagesCFA Level 1 (Book-B)butabutt100% (1)

- BUNDANG AIS Chapter 9Document34 pagesBUNDANG AIS Chapter 9Kathleen Grace Mugar BundangPas encore d'évaluation

- Garden and Landscaping EmporiumDocument7 pagesGarden and Landscaping EmporiumNatalie DaguiamPas encore d'évaluation

- Cash Flow ProjectionDocument8 pagesCash Flow ProjectionSuhailPas encore d'évaluation

- Assignment 1Document9 pagesAssignment 1Yashveer SinghPas encore d'évaluation

- Coca-Cola Case StudyDocument2 pagesCoca-Cola Case Studyatiqahfauzi89% (9)

- Report Xerox 1Document8 pagesReport Xerox 1atiqahfauziPas encore d'évaluation

- Audit Process in CIS EnvironmentDocument14 pagesAudit Process in CIS Environmentatiqahfauzi100% (1)

- Jurnal AmDocument1 pageJurnal AmatiqahfauziPas encore d'évaluation

- RCU II Open Protocol Communication Manual FV 9 10 31 08 PDFDocument17 pagesRCU II Open Protocol Communication Manual FV 9 10 31 08 PDFAndrés ColmenaresPas encore d'évaluation

- TTD Accommodation ReceiptDocument2 pagesTTD Accommodation ReceiptDharani KumarPas encore d'évaluation

- Muscular System NotesDocument6 pagesMuscular System NotesZussette Corbita VingcoPas encore d'évaluation

- Police Log September 24, 2016Document14 pagesPolice Log September 24, 2016MansfieldMAPolicePas encore d'évaluation

- Nestle IndiaDocument74 pagesNestle IndiaKiranPas encore d'évaluation

- Dpco 151223080520 PDFDocument23 pagesDpco 151223080520 PDFSiva PrasadPas encore d'évaluation

- Proceedings IndexDocument3 pagesProceedings IndexHumberto FerreiraPas encore d'évaluation

- Slides 5 - Disposal and AppraisalDocument77 pagesSlides 5 - Disposal and AppraisalRave OcampoPas encore d'évaluation

- Computer ArchitectureDocument46 pagesComputer Architecturejaime_parada3097100% (2)

- Ajol File Journals - 404 - Articles - 66996 - Submission - Proof - 66996 4813 136433 1 10 20110608Document12 pagesAjol File Journals - 404 - Articles - 66996 - Submission - Proof - 66996 4813 136433 1 10 20110608Lovely Joy Hatamosa Verdon-DielPas encore d'évaluation

- Contemporary Philippine MusicDocument11 pagesContemporary Philippine MusicmattyuuPas encore d'évaluation

- Ben ChanDocument2 pagesBen ChanAlibabaPas encore d'évaluation

- Technik: RefraDocument54 pagesTechnik: Reframustaf100% (1)

- Banking Adbl EnglishDocument74 pagesBanking Adbl Englishdevi ghimirePas encore d'évaluation

- AM2020-AFP1010 Installation Programming OperatingDocument268 pagesAM2020-AFP1010 Installation Programming OperatingBaron RicthenPas encore d'évaluation

- 2.fundamentals of MappingDocument5 pages2.fundamentals of MappingB S Praveen BspPas encore d'évaluation

- Graph 1: Temperature,° C of Mixture 1 (Naoh-Hcl) Against Time Taken, (Min)Document8 pagesGraph 1: Temperature,° C of Mixture 1 (Naoh-Hcl) Against Time Taken, (Min)LeeshaaLenee Paramanantha KumarPas encore d'évaluation

- People Vs CorreaDocument2 pagesPeople Vs CorreaRmLyn Mclnao100% (1)

- BestPractices PDFDocument14 pagesBestPractices PDFAnonymous tChrzngvPas encore d'évaluation

- Microsoft 365 LicensingDocument18 pagesMicrosoft 365 Licensingwendy yohanesPas encore d'évaluation

- Differentialequations, Dynamicalsystemsandlinearalgebra Hirsch, Smale2Document186 pagesDifferentialequations, Dynamicalsystemsandlinearalgebra Hirsch, Smale2integrationbyparths671Pas encore d'évaluation

- AI LabDocument17 pagesAI LabTripti JainPas encore d'évaluation

- Reglos, DISPUTE FORM 2020Document2 pagesReglos, DISPUTE FORM 2020Pipoy ReglosPas encore d'évaluation

- Math912 2Document7 pagesMath912 2Mbq ManbriquaPas encore d'évaluation

- Roundtracer Flash En-Us Final 2021-06-09Document106 pagesRoundtracer Flash En-Us Final 2021-06-09Kawee BoonsuwanPas encore d'évaluation

- Sears Canada: Electric DryerDocument10 pagesSears Canada: Electric Dryerquarz11100% (1)

- The Exchange Student (Dedicated To Rotary International)Document163 pagesThe Exchange Student (Dedicated To Rotary International)Nikita100% (1)

- IHRM Midterm ASHUVANI 201903040007Document9 pagesIHRM Midterm ASHUVANI 201903040007ashu vaniPas encore d'évaluation

- 2002PCDFCADocument78 pages2002PCDFCATin NguyenPas encore d'évaluation

- TV ExplorerDocument2 pagesTV Explorerdan r.Pas encore d'évaluation