Académique Documents

Professionnel Documents

Culture Documents

TAX Case Digests

Transféré par

lchieSDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

TAX Case Digests

Transféré par

lchieSDroits d'auteur :

Formats disponibles

Silicon Philippines Intel Philippines Manufacturing vs. CIR Facts: Silicon Philippines, Inc.

is a corporation duly organized and existing under the laws of the Philippines. It is registered with the BIR das a VAT-taxpayer and with the BOI as a preferred pioneer enterprise. Then, on May, 1999, Silicon filed with the CIR an application for credit/refund of unutilized input VAT for the period of Oct. 1, 1998 to Dec. 31, 1998. Due to the inaction of the CIR, Silicon, on Dec. 27, 2000, filed a Petition for Review with the CTA Division. Silicon alleged that the 4th quarter of 1998, it generated and recorded zero-rated export sales paid to Silicon in acceptable foreign currency and that for the said period, Silicon paid input VAT in the total amount which have not been applied to any output VAT. The CIR, on the other hand, raised the defenses that: 1. Silicon did not show that it complied with the provisions of Sec. 229 of the Tax Code; 2. That claims for refund are construed strictly against the claimant similar to the nature of exemption from taxes; and that Silicon failed to prove that is entitled for refund. The CTA Division granted Silicons claim for refund of unutilized input VAT on capital goods. However, it denied Silicons claim for credit/refund of input VAT attributable to its zero-rated export sales. It is because Silicon failed to present an Authority to Print (ATP) from the BIR neither did it print on its export sales invoices the ATP and the word zero-rated. Silicon moved for reconsideration claiming that it is not required to secure an ATP since it has a Permit to Adopt Computerized Accounting Documents such as Sales Invoice and Official Receipts from the BIR. And that the printing of the word zerorated on its export sales invoices is not necessary because all its finished products are exported to its mother company, Intel Corp., a non-resident corporation and a non-VAT registered entity. ISSUE: W/N Silicon entitled to claim from refund of Input VAT attributable to its zero-rated sales. Ruling: no. There are two types of input VAT credits: 1. A credit/refund of input VAT attributable to zero-rated sales under Sec. 112(A) of the NIRC; and A credit/refund of input VAT on capital goods pursuant to Sec. 112(B) of the same Code.

2.

The taxpayer must be engaged in sales which are zerorated or effectively zero-rated; The claim must be filed within 2 years after the close of the taxable quarter when such sales were made; and

3.

4. The creditable input tax due or paid must be attributable

to such sales, except the transitional input tax, to the extent that such input tax has not been applied against the output tax.

A. Printing the ATP on the invoices or receipts is not

required.

In a case, the SC ruled that ATP need not be reflected or indicated in the invoices or receipts because there is no law or regulation requiring it. Thus, failure to print the ATP on the invoices or receipts should not result in the outright denial of a claim or the invalidation of the invoices or receipts for purposes of claiming a refund. B. ATP must be secured from the BIR

Sec. 238 of the NIRC expressly requires persons engaged in business to secure an ATP from the BIR prior to printing invoices or receipts. Failure to do so, makes the person liable under Sec. 264 of the Tax Code.

W/N a claimant for unutilized input VAT on zero-rated sales is required to present proof that it has secured an ATP from the BIR prior to the printing of its invoices or receipts. YES. Since ATP is not indicated in the invoices or receipts, the only way to verify whether the invoices or receipts are duly registered is by requiring the claimant to present its ATP from the BIR. Without which, the invoices would have no probative value for the purpose of refund. Failure to print the word zero-rated on the sales invoices is fatal to a claim for refund of input VAT. In compliance with Sec. 4.108-1 of RR 7-95, requiring the printing of the word zero-rated on the invoice covering zerorate sales is essential as this regulation proceeds from the rulemaking authority of the Secretary of Finance under Sec. 244 of the NIRC.

2.

To claim for credit/refund of input VAT attributable to zero-rated sales, Sec. 112(A) laid down 4 requisites: 1. The taxpayer must be a VAT-registered;

In this case, Silicon failed to present its ATP and to print the word zero-rated on its export sales invoices. Thus, the claim for credit/refund of input VAT attributable to its zero-rated sales must be denied.

ATLAS CONSOLIDATED VS. CIR Facts: Atlas Consolidated is a zero-rated VAT person for being an exporter of copper concentrates. On January 1994, Atlas filed its VAT return for the fourth quarter of 1993, showing a total input tax and an excess VAT credit. Then, on January 1996, Atlas filed for a tax refund or tax credit certificate with CIR. However, the CTA denied Atlas claim for refund due to Atlas failure to comply with the documentary requirements prescribed under Sec. 16 of RR No. 5-87, as amended by RR No. 3-88. CTA denied Atlas MR stating that Atlas has failed to substantiate its claim that it has not applied its alleged excess in put taxes to any of its subsequent quarters output tax liability. The CA affirmed CTAs ruling. ISSUE: What are the documents required to claim for VAT input refund? W/N Atlas is entitled to claim to a tax refund. Ruling: When claiming tax refund/credit, the VAT-registered taxpayer must be able to establish that it does not have refundable or creditable input VAT, and the same has not been applied against its output VAT liabilities information which are supposed to be reflected in the taxpayers VAT returns. Thus, an application for tax refund/credit must be accompanied by copies of the taxpayers VAT return/s for the taxable quarter/s concerned. The formal offer of evidence of Atlas failed to include photocopy of its export documents, as required. Without the export documents, the purchase invoice/receipts submitted by Atlas as proof of its input taxes cannot be verified as being directly attributable to the goods so exported. Atlas claim for credit or refund of input taxes cannot be granted due to its failure to show convincingly that the same has not been applied to any of its output tax liability as provided under Sec. 106(a) of the Tax Code.

National Internal Revenue Code; value-added tax; claim for credit or refund of input value-added tax; documentary requirements. When claiming tax refund or credit, the valueadded taxpayer must be able to establish that it does have refundable or creditable input value-added tax (VAT), and the same has not been applied against its output VAT liabilitiesinformation which are supposed to be reflected in the taxpayers VAT returns. Thus, an application for tax refund or credit must be accompanied by copies of the taxpayers VAT return or returns for taxable quarter or quarters concerned. Atlas Consolidated Mining and Development Corporation vs Commissioner of Internal Revenue, G.R. No. 159471, January 26, 2011. In the recent case of Mirant Pagbilao Corporation vs. CIR (G.R. No. 172129, September 12, 2008), the Supreme Court had ruled that the claim for refund of unutilized input VAT payments must be filedwithin two (2) years from the close of the taxable quarter when the relevant sales were made. Said ruling, however, should not be made to apply to the present case but should be applied prospectively pursuant to and consistent with the numerous rulings of the Supreme Court, given that petitioner Kepco's claim involves unutilized input taxes for the 3rd quarter of 2000. Hence, the prescriptive period applicable in the instant case would still be the period enunciated in the case of Atlas Consolidated Mining and Development Corporation vs. CIR (G.R. Nos. 141104 & 148763, June 8, 2007), where it was held that the counting of the two-year prescriptive period is reckoned from the filing of the quarterly VAT returns. Kepco Ilijan Corporation v. Commissioner of Internal Revenue, C.T.A. E.B. Case No. 528 (C.T.A. Case No. 6550), October 14, 201

CIR vs. Sony Philippines, Inc. Facts: On Dec. 6, 1999 CIR issued a preliminary assessment for 1997 deficiency taxes and penalties to Sony, which it protested. A petition for review was filed by Sony before the CTA, within 30 days after the lapse of the 180 days from the submission of the supporting documents to the CIR. CTA-1st Division disallowed the deficiency VAT assessment the subsidized advertising expense paid by Sony was duly covered by a VAT invoice resulted in an input VAT credit. However, for the EWT, the deficiency assessment was upheld. CIR sought reconsideration on the ground that Sony should be liable for the deficiency VAT. It contends that Sonys advertising expense cannot be considered as an input VAT credit because the same was eventually reimbursed by Sony International Singapore (SIS). As a result, Sony is not entitled to a tax credit and that the said advertising expense should be for the account of SIS. ISSUE: W/N the source of the payment of tax is relevant to determine Ruling: NO. Sonys deficiency VAT assessment derived from the CIRs allowance of the input VAT credits that should have been realized from advertising expense of the latter. Under Sec. 110 of the 1997 Tax Code, an advertising expense duly covered by a VAT invoice is a legitimate business expense. It cannot be denied that Sony incurred advertising expense. CIRs own witness Aluquin even testified that advertising companies issued invoices in the name of Sony and the latter paid for the same. Hence, Sony incurred and paid for advertising expense services. Where the money came from is another matter all together. Before any VAT is levied, there must be sale, barter or exchange of goods or property. In this case, there was no sale, barter, exchange in the subsidy given by SIS to Sony. It was but a dole out and not in payment for the goods or properties sold, bartered or exchanged by Sony.

COMMISSIONER OF INTERNAL REVENUE VS. SONY PHILIPPINES, INC.- Value Added Tax, Final Withholding Tax, Letter of Authority FACTS: Sony Philippines was ordered examined for the period 1997 and unverified prior years as indicated in the Letter of Authority. The audit yielded assessments against Sony Philippines for deficiency VAT and FWT, viz: (1) late remittance of Final Withholding Tax on royalties for the period January to March 1998 and (2) deficiency VAT on reimbursable received by Sony Philippines from its offshore affiliate, Sony International Singapore (SIS). ISSUES: (1) Is Petitioner liable for deficiency Value Added Tax? (2) Was the investigation of its 1998 Final Withholding Tax return valid? HELD: (1) NO. Sony Philippines did in fact incur expenses supported by valid VAT invoices when it paid for certain advertising costs. This is sufficient to accord it the benefit of input VAT credits and where the money came from to satisfy said advertising billings is another matter but does not alter the VAT effect. In the same way, Sony Philippines can not be deemed to have received the reimbursable as a fee for a VAT-taxable activity. The reimbursable was couched as an aid for Sony Philippines by SIS in view of the companys dire or adverse economic conditions. More importantly, the absence of a sale, barter or exchange of goods or properties supports the non-VAT nature of the reimbursement. This was distinguished from the COMASERCO case where even if there was similarly a reimbursement-on-cost arrangement between affiliates, there was in fact an underlying service. Here, the advertising services were rendered in favor of Sony Philippines not SIS. (2) NO. A Letter of Authority should cover a taxable period not exceeding one year and to indicate that it covers unverified prior years should be enough to invalidate it. In addition, even if the Final Withholding Tax was covered by Sony Philippines fiscal year ending March 1998, the same fell outside of the period 1997 and was thus not validly covered by the Letter of Authority.

Diaz and Timbol vs. CIR Facts: Petitioners Diaz and Timbol filed a petition for declaratory relief assailing the validity of the imposition of VAT by BIR on the collections of the tollway operators. They claim that VAT would result in increased toll fees. That the Congress in enacting the Tax Code, did intend to not include toll fees within the meaning of sale of services that are subject to VAT; that toll fee is a users tax, not a sale of services; that to impose VAT on toll fees would amount to a tax on public service. The OSG, on the other hand, stated that the Tax Code imposes VAT on all kinds of services of franchise grantees, including tollway operations, except where the law provides otherwise. ISSUE: ARE TOLLWAY OPERATORS COVERED BY VAT? Ruling: YES, BECAUSE THEY RENDER SERVICES FOR A FEE. THEY ARE JUST LIKE LESSORS, WAREHOUSE OPERATORS , AND OTHER GROUPS EXPRESSLY MENTIONED IN THE LAW. Issue: Now, do tollway operators render services for a fee? Presidential Decree (P.D.) 1112 or the Toll Operation Decree establishes the legal basis for the services that tollway operators render. Essentially, tollway operators construct, maintain, and operate expressways, also called tollways, at the operators expense. Tollways serve as alternatives to regular public highways that meander through populated areas and branch out to local roads. Traffic in the regular public highways is for this reason slow-moving. In consideration for constructing tollways at their expense, the operators are allowed to collect governmentapproved fees from motorists using the tollways until such operators could fully recover their expenses and earn reasonable returns from their investments. When a tollway operator takes a toll fee from a motorist, the fee is in effect for the latters use of the tollway facilities over which the operator enjoys private proprietary rights[8][12] that its contract and the law recognize. In this sense, the tollway operator is no different from the following service providers under Section 108 who allow others to use their properties or facilities for a fee: 1. Lessors of property, whether personal or real; 2. Warehousing service operators; 3. Lessors or distributors of cinematographic films; 4. Proprietors, operators or keepers of hotels, motels, resthouses, pension houses, inns, resorts; 5. Lending investors (for use of money); 6. Transportation contractors on their transport of goods or cargoes, including persons who transport goods or cargoes for hire and other domestic common carriers by land relative to their transport of goods or cargoes; and

7. Common carriers by air and sea relative to their transport of passengers, goods or cargoes from one place in thePhilippinesto another place in thePhilippines. It does not help petitioners cause that Section 108 subjects to VAT all kinds of services rendered for a fee regardless of whether or not the performance thereof calls for the exercise or use of the physical or mental faculties. This means that services to be subject to VAT need not fall under the traditional concept of services, the personal or professional kinds that require the use of human knowledge and skills. XXXXXXXXXXXXXXXXX ISSUE: GOVERNMENT ARGUES THAT TOLL OPERATORS ARE FRANCHISEES AND THEREFORE EXPRESSLY COVERED BY VAT LAW. PETITIONERS ARGUE THAT THEY ARE NOT FRANCHISEES BECAUSE THEY DO NOT HAVE LEGISLATIVE FRANCHISE. WHAT IS CORRECT? Toll operators are francishees because franchise covers government grants of a special right to do an act or series of acts of public concern. The construction, operation, and maintenance of toll facilities on public improvements are activities of public consequence that necessarily require a special grant of authority from the state. Also, the VAT law does not define franchisees as only those who have legislative franchise. And not only do tollway operators come under the broad term all kinds of services, they also come under the specific class described in Section 108 as all other franchise grantees who are subject to VAT, except those under Section 119 of this Code. Tollway operators are franchise grantees and they do not belong to exceptions (the low-income radio and/or television broadcasting companies with gross annual incomes of less than P10 million and gas and water utilities) that Section 119[9][13] spares from the payment of VAT. The word franchise broadly covers government grants of a special right to do an act or series of acts of public concern. Petitioners, of course contend that tollway operators cannot be considered franchise grantees under Section 108 since they do not hold legislative franchises. But nothing in Section 108 indicates that the franchise grantees it speaks of are those who hold legislative franchises. Petitioners give no reason, and the Court cannot surmise any, for making a distinction between franchises granted by Congress and franchises granted by some other government agency. The latter, properly constituted, may grant franchises. Indeed, franchises conferred or granted by local authorities, as agents of the state, constitute as much a legislative franchise as though the grant had been made by Congress itself. The term franchise has been broadly construed as referring, not only to authorizations that Congress directly issues in the form of a special law, but also to those granted by administrative agencies to which the power to grant franchises has been delegated by Congress.

Tollway operators are, owing to the nature and object of their business, franchise grantees. The construction, operation, and maintenance of toll facilities on public improvements are activities of public consequence that necessarily require a special grant of authority from the state. Indeed, Congress granted special franchise for the operation of tollways to the Philippine National Construction Company, the former tollway concessionaire for the North and South Luzon Expressways. Apart from Congress, tollway franchises may also be granted by the TRB, pursuant to the exercise of its delegated powers under P.D. 1112.[13][17] The franchise in this case is evidenced by a Toll Operation Certificate.[14][18] XXXXXXXXXXXXXXXXXX ISSUE: PETITIONERS CONTEND THAT TOLL FEES ARE OF PUBLIC NATURE AND THEREFORE NOT SALE OF SERVICES. IS THEIR CONTENTION CORRECT? No. The law in the same manner includes electric utilities, telephone, telegraph, and broadcasting companies in its list of vatcovered businesses. Their services are also of public nature. Petitioners contend that the public nature of the services rendered by tollway operators excludes such services from the term sale of services under Section 108 of the Code. But, again, nothing in Section 108 supports this contention. The reverse is true. In specifically including by way of example electric utilities, telephone, telegraph, and broadcasting companies in its list of VAT-covered businesses, Section 108 opens other companies rendering public service for a fee to the imposition of VAT. Businesses of a public nature such as public utilities and the collection of tolls or charges for its use or service is a franchise. XXXXXXXXXXXXXXXXX ISSUE: PETITIONERS ARGUE THAT THE STATEMENTS MADE BY SOME LAWMAKERS DURING THE THE DELIBERATIONS ON THE VAT LAW SHOW INTENT TO EXEMPT TOLLWAY OPERATORS. CAN THE STATEMENTS OF THESE LAWMAKERS BE CONSIDERED BINDING ON THE INTERPRETATION OF VAT COVERAGE? No. Statements made by individual members of congress in the consideration of a bill do not necessarily reflect the sense of that body and are, consequently, not controlling in the interpretation of law. The congressional will is ultimately determined by the language of the law that the lawmakers voted on.

No. Toll fee is not a tax. It is not collected by bir or by the govt. It does not go to government coffers. It is not collected for a public purpose. ISSUE: BUT IN THE CASE OF MIAA VS. CA FEES PAID TO AIRPORTS WERE CONSIDERED TAX. DOES THE CASE OF MIAA APPLY? No. The subject of the maiaa case is terminal fee which goes to the government. Also the issue in the miaa case is whether paranaque city can sell at auction property of the national government. The discussion on the terminal fee is just to emphasize the fact that the local government cannot tax the national government. Two. Petitioners argue that a toll fee is a users tax and to impose VAT on toll fees is tantamount to taxing a tax. Actually, petitioners base this argument on the following discussion in Manila International Airport Authority (MIAA) v. Court of Appeals: No one can dispute that properties of public dominion mentioned in Article 420 of the Civil Code, like roads, canals, rivers, torrents, ports and bridges constructed by the State, are owned by the State. The term ports includes seaports and airports. The MIAA Airport Lands and Buildings constitute a port constructed by the State. Under Article 420 of the Civil Code, the MIAA Airport Lands and Buildings are properties of public dominion and thus owned by the State or the Republic of the Philippines. x x x The operation by the government of a tollway does not change the character of the road as one for public use. Someone must pay for the maintenance of the road, either the public indirectly through the taxes they pay the government, or only those among the public who actually use the road through the toll fees they pay upon using the road. The tollway system is even a more efficient and equitable manner of taxing the public for the maintenance of public roads. The charging of fees to the public does not determine the character of the property whether it is for public dominion or not. Article 420 of the Civil Code defines property of public dominion as one intended for public use. Even if the government collects toll fees, the road is still intended for public use if anyone can use the road under the same terms and conditions as the rest of the public. The charging of fees, the limitation on the kind of vehicles that can use the road, the speed restrictions and other conditions for the use of the road do not affect the public character of the road. The terminal fees MIAA charges to passengers, as well as the landing fees MIAA charges to airlines, constitute the bulk of the income that maintains the operations of MIAA. The collection of such fees does not change the character of MIAA as an airport for public use. Such fees are often termed users tax. This means

XXXXXXXXXXXXXXXX ISSUE: IS TOLL FEE A USERS TAX AND SO VAT ON TOLL FEE WOULD BE TAX ON TAX?

taxing those among the public who actually use a public facility instead of taxing all the public including those who never use the particular public facility. A users tax is more equitable a principle of taxation mandated in the 1987 Constitution. Petitioners assume that what the Court said above, equating terminal fees to a users tax must also pertain to tollway fees. But the main issue in the MIAA case was whether or not Paraaque City could sell airport lands and buildings under MIAA administration at public auction to satisfy unpaid real estate taxes. Since local governments have no power to tax the national government, the Court held that the City could not proceed with the auction sale. MIAA forms part of the national government although not integrated in the department framework. Thus, its airport lands and buildings are properties of public dominion beyond the commerce of man under Article 420(1)[21][25] of the Civil Code and could not be sold at public auction. As can be seen, the discussion in the MIAA case on toll roads and toll fees was made, not to establish a rule that tollway fees are users tax, but to make the point that airport lands and buildings are properties of public dominion and that the collection of terminal fees for their use does not make them private properties. Tollway fees are not taxes. Indeed, they are not assessed and collected by the BIR and do not go to the general coffers of the government. It would of course be another matter if Congress enacts a law imposing a users tax, collectible from motorists, for the construction and maintenance of certain roadways. The tax in such a case goes directly to the government for the replenishment of resources it spends for the roadways. This is not the case here. What the government seeks to tax here are fees collected from tollways that are constructed, maintained, and operated by private tollway operators at their own expense under the build, operate, and transfer scheme that the government has adopted for expressways. Except for a fraction given to the government, the toll fees essentially end up as earnings of the tollway operators. In sum, fees paid by the public to tollway operators for use of the tollways, are not taxes in any sense. A tax is imposed under the taxing power of the government principally for the purpose of raising revenues to fund public expenditures. Toll fees, on the other hand, are collected by private tollway operators as reimbursement for the costs and expenses incurred in the construction, maintenance and operation of the tollways, as well as to assure them a reasonable margin of income. Although toll fees are charged for the use of public facilities, therefore, they are not government exactions that can be properly treated as a tax. Taxes may be imposed only by the government under its sovereign authority, toll fees may be demanded by either the government or private individuals or entities, as an attribute of ownership.

Parenthetically, VAT on tollway operations cannot be deemed a tax on tax due to the nature of VAT as an indirect tax. In indirect taxation, a distinction is made between the liability for the tax and burden of the tax. The seller who is liable for the VAT may shift or pass on the amount of VAT it paid on goods, properties or services to the buyer. In such a case, what is transferred is not the sellers liability but merely the burden of the VAT. Thus, the seller remains directly and legally liable for payment of the VAT, but the buyer bears its burden since the amount of VAT paid by the former is added to the selling price. Once shifted, the VAT ceases to be a tax[26][30] and simply becomes part of the cost that the buyer must pay in order to purchase the good, property or service. Consequently, VAT on tollway operations is not really a tax on the tollway user, but on the tollway operator. Under Section 105 of the Code, [27][31] VAT is imposed on any person who, in the course of trade or business, sells or renders services for a fee. In other words, the seller of services, who in this case is the tollway operator, is the person liable for VAT. The latter merely shifts the burden of VAT to the tollway user as part of the toll fees. For this reason, VAT on tollway operations cannot be a tax on tax even if toll fees were deemed as a users tax. VAT is assessed against the tollway operators gross receipts and not necessarily on the toll fees. Although the tollway operator may shift the VAT burden to the tollway user, it will not make the latter directly liable for the VAT. The shifted VAT burden simply becomes part of the toll fees that one has to pay in order to use the tollways.[28] [32] XXXXXXXXXXXXXXXX ISSUE: DOES PETITIONER TIMBOL HAVE A PERSONALITY AS PETITIONER? No. She will not be affected by the reduction of profits. The right to recover investments belong to the tollway investors.

PAGCOR vs. BIR: ISSUE : W/N PAGCOR IS EXEMPTED FROM VAT. YES. Facts: With the passage of Republic Act No. (RA) 9337, the Philippine Amusement and Gaming Corporation (PAGCOR) has been excluded from the list of government-owned and -controlled corporations (GOCCs) that are exempt from tax under Section 27(c) of the Tax Code; PAGCOR is now subject to corporate income tax. The Supreme Court (SC) held that the omission of PAGCOR from the list of tax-exempt GOCCs by RA 9337 does not violate the right to equal protection of the laws under Section 1, Article III of the Constitution, because PAGCORs exemption from payment of corporate income tax was not based on classification showing substantial distinctions; rather, it was granted upon the corporations own request to be exempted from corporate income tax. Legislative records likewise reveal that the legislative intention is to require PAGCOR to pay corporate income tax. With regard to the issue that the removal of PAGCOR from the exempted list violates the non-impairment clause contained in Section 10, Article III of the Constitution which provides that no law impairing the obligation of contracts shall be passed the SC explained that following its previous ruling in the case of Manila Electric Company v. Province of Laguna 366 Phil. 428 (1999), this does not apply. Franchises such as that granted to PAGCOR partake of the nature of a grant, and is thus beyond the purview of the non-impairment clause of the Constitution. As regards the liability of PAGCOR to VAT, the SC finds Section 4.108-3 of Revenue Regulations No. (RR) 16-2005, which subjects PAGCOR and its licensees and franchisees to VAT, null and void for being contrary to the National Internal Revenue Code (NIRC), as amended by RA 9337. According to the SC, RA 9337 does not contain any provision that subjects PAGCOR to VAT. Instead, the SC finds support to the VAT exemption of PAGCOR under Section 109(k) of the Tax Code, which provides that transactions exempt under international agreements to which the Philippines is a signatory or under special laws [except Presidential Decree No. (PD) 529] are exempt from VAT. Considering that PAGCORs charter, i.e., PD 1869 which grants PAGCOR exemption from taxes is a special law, it is exempt from payment of VAT. Accordingly, the SC held that the BIR exceeded its authority in subjecting PAGCOR to VAT, and thus declared RR 16-05 null and void insofar as it subjects PAGCOR to VAT for being contrary to the NIRC, as amended by RA 9337.

PAGCOR is subject to income tax but remains exempt from the imposition of value-added tax. With the amendment by R.A. No. 9337 of Section 27 (c) of the National Internal Revenue Code of 1997 by omitting PAGCOR from the list of government corporations exempt for income tax, the legislative intent is to require PAGCOR to pay corporate income tax. However, nowhere in R.A. No. 9337 is it provided that PAGCOR can be subjected to VAT. Thus, the provision of RR No. 16-2005, which the respondent BIR issued to implement the VAT law, subjecting PAGCOR to 10% VAT is invalid for being contrary to R.A. No. 9337. (Philippine Amusement and Gaming Corporation vs. BIR, G.R. No. 172087, March 15, 2011) With the passage of Republic Act No. (RA) 9337, the Philippine Amusement and Gaming Corporation (PAGCOR) has been excluded from the list of government-owned and controlled corporations (GOCCs) that are exempt from tax under Section 27(c) of the Tax Code; PAGCOR is now subject to corporate income tax. The Supreme Court (SC) held that the omission of PAGCOR from the list of tax-exempt GOCCs by RA 9337 does not violate the right to equal protection of the laws under Section 1, Article III of the Constitution, because PAGCORs exemption from payment of corporate income tax was not based on classification showing substantial distinctions; rather, it was granted upon the corporations own request to be exempted from corporate income tax. Legislative records likewise reveal that the legislative intention is to require PAGCOR to pay corporate income tax. With regard to the issue that the removal of PAGCOR from the exempted list violates the non-impairment clause contained in Section 10, Article III of the Constitution which provides that no law impairing the obligation of contracts shall be passed the SC explained that following its previous ruling in the case of Manila Electric Company v. Province of Laguna 366 Phil. 428 (1999), this does not apply. Franchises such as that granted to PAGCOR partake of the nature of a grant, and is thus beyond the purview of the non-impairment clause of the Constitution. As regards the liability of PAGCOR to VAT, the SC finds Section 4.108-3 of Revenue Regulations No. (RR) 16-2005, which subjects PAGCOR and its licensees and franchisees to VAT, null and void for being contrary to the National Internal Revenue Code (NIRC), as amended by RA 9337. According to the SC, RA 9337 does not contain any provision that subjects PAGCOR to VAT. Instead, the SC finds support to the VAT exemption of PAGCOR under Section 109(k) of the Tax Code, which provides that transactions exempt under international agreements to which the Philippines is a signatory or under special laws [except Presidential Decree No. (PD) 529] are exempt from VAT. Considering that PAGCORs charter, i.e., PD 1869 which grants PAGCOR exemption from taxes is a special law, it is exempt from payment of VAT. Accordingly, the SC held that the BIR exceeded its authority in subjecting PAGCOR to VAT, and thus declared RR 16-05 null and void insofar as it subjects PAGCOR to VAT for being contrary to the NIRC, as amended by RA 9337. [Philippine Amusement and Gaming Corporation (PAGCOR) v. the Bureau of Internal Revenue (BIR), et. al., GR 172087, March 15, 2011.

Vous aimerez peut-être aussi

- CIR v. Pascor Realty and Development DigestDocument1 pageCIR v. Pascor Realty and Development DigestKristineSherikaChy100% (1)

- Atty Ligon Tx2Document92 pagesAtty Ligon Tx2karlPas encore d'évaluation

- Punsalan Vs Municipal Board of ManilaDocument3 pagesPunsalan Vs Municipal Board of ManilaGayFleur Cabatit RamosPas encore d'évaluation

- Taxation Law PrinciplesDocument86 pagesTaxation Law PrinciplesEdmart Vicedo100% (1)

- CIR V Enron Subic Power CorporationDocument1 pageCIR V Enron Subic Power CorporationiciamadarangPas encore d'évaluation

- Dimaampao Tax NotesDocument63 pagesDimaampao Tax Notesnia coline mendozaPas encore d'évaluation

- Barcelon Vs CirDocument1 pageBarcelon Vs CirJoshuaPas encore d'évaluation

- Sec. 76 NIRC Taxation Case DigestDocument8 pagesSec. 76 NIRC Taxation Case DigestbrendamanganaanPas encore d'évaluation

- Dy - 2017 Tax 2 RecitsDocument6 pagesDy - 2017 Tax 2 RecitsJAIRA MANAOISPas encore d'évaluation

- 4 CIR Vs Reyes GR 159694-GR 163581 Jan 27 2006Document10 pages4 CIR Vs Reyes GR 159694-GR 163581 Jan 27 2006FredamoraPas encore d'évaluation

- TAX REMEDIES by Sababan Reviewer 2008 EdDocument11 pagesTAX REMEDIES by Sababan Reviewer 2008 Edolaydyosa95% (20)

- CIR vs. Metro StarDocument1 pageCIR vs. Metro StarRodney SantiagoPas encore d'évaluation

- Contex Corporation vs. CIR Persons LiableDocument16 pagesContex Corporation vs. CIR Persons LiableEvan NervezaPas encore d'évaluation

- Tax Lumbera Income Tax TranscriptDocument4 pagesTax Lumbera Income Tax Transcriptchibi_carolPas encore d'évaluation

- Case Digest Atty CabaneiroDocument11 pagesCase Digest Atty CabaneiroChriselle Marie DabaoPas encore d'évaluation

- Antam Pawnshop Corp. vs. CIRDocument1 pageAntam Pawnshop Corp. vs. CIRPaolo AdalemPas encore d'évaluation

- Transportation Law - Bar QuestionsDocument192 pagesTransportation Law - Bar Questionsrevilo ordinarioPas encore d'évaluation

- CIR vs. Fortune Tobacco Tax RulingDocument18 pagesCIR vs. Fortune Tobacco Tax RulingJayson RHPas encore d'évaluation

- Part I: Concept of Tax AdministrationDocument22 pagesPart I: Concept of Tax AdministrationShiela Marie Sta AnaPas encore d'évaluation

- Rohm Apollo vs. CIRDocument6 pagesRohm Apollo vs. CIRnikkisalsPas encore d'évaluation

- RR 16-86Document1 pageRR 16-86saintkarriPas encore d'évaluation

- Taxation Law Mock BarDocument4 pagesTaxation Law Mock BarKrizzy GaylePas encore d'évaluation

- W12-Module Penalties and Remedies of The Taxpayer - PPTDocument20 pagesW12-Module Penalties and Remedies of The Taxpayer - PPTDanica VetuzPas encore d'évaluation

- National Taxation (Income & Business Tax) OCTOBER 1, 2014Document39 pagesNational Taxation (Income & Business Tax) OCTOBER 1, 2014Eliza Corpuz GadonPas encore d'évaluation

- (Digest) Taganito v. CIRDocument1 page(Digest) Taganito v. CIRHomer SimpsonPas encore d'évaluation

- Tax-1 SyllabusDocument16 pagesTax-1 SyllabusJennica Gyrl DelfinPas encore d'évaluation

- MOCK BAR CIVIL LAW TOPICSDocument18 pagesMOCK BAR CIVIL LAW TOPICSJaliel Moeen Metrillo BasayPas encore d'évaluation

- Summary of Significant SC Decisions (April May June 2011)Document2 pagesSummary of Significant SC Decisions (April May June 2011)elmersgluethebombPas encore d'évaluation

- Cir Vs San Roque 690 Scra 336Document5 pagesCir Vs San Roque 690 Scra 336Izzy Martin MaxinoPas encore d'évaluation

- TAX-CPAR Lecture Filing and Penalties Version 2Document23 pagesTAX-CPAR Lecture Filing and Penalties Version 2YamatePas encore d'évaluation

- Module 1-Tax AdministrationDocument7 pagesModule 1-Tax AdministrationBella RonahPas encore d'évaluation

- Rakham's loan to Alfonso deemed non-deductible bad debtDocument17 pagesRakham's loan to Alfonso deemed non-deductible bad debtClarince Joyce Lao DoroyPas encore d'évaluation

- 108 Republic of The Philippines v. Ret (Andojoyan)Document3 pages108 Republic of The Philippines v. Ret (Andojoyan)Mich Kristine BAPas encore d'évaluation

- 7 CIR V PhoenixDocument1 page7 CIR V PhoenixFrancesca Isabel MontenegroPas encore d'évaluation

- 09 BPI vs. CIRDocument2 pages09 BPI vs. CIRCleinJonTiuPas encore d'évaluation

- 20 BPI vs. CIR (GR No. 139736, October 17, 2005)Document41 pages20 BPI vs. CIR (GR No. 139736, October 17, 2005)Alfred Garcia100% (1)

- Kepco Philippines Corporation Vs. CIR VAT Refund CaseDocument4 pagesKepco Philippines Corporation Vs. CIR VAT Refund CaseWhere Did Macky GallegoPas encore d'évaluation

- CIR Vs ReyesDocument16 pagesCIR Vs Reyes123456789Pas encore d'évaluation

- NPC vs Municipal Government of Navotas Tax ExemptionDocument2 pagesNPC vs Municipal Government of Navotas Tax Exemptionhigoremso giensdksPas encore d'évaluation

- Spoused Manzanilla v. Waterfields Industries CorpDocument5 pagesSpoused Manzanilla v. Waterfields Industries Corplaila ursabiaPas encore d'évaluation

- Cadalin Vs POEA G.R. No. L-104776 December 5, 1994Document10 pagesCadalin Vs POEA G.R. No. L-104776 December 5, 1994Emrico CabahugPas encore d'évaluation

- Questions and Answers On Significant Supreme Court Taxation Law Jurisprudence For The 2018 BarDocument12 pagesQuestions and Answers On Significant Supreme Court Taxation Law Jurisprudence For The 2018 BarKre GLPas encore d'évaluation

- Requisites of Tort LiabilityDocument42 pagesRequisites of Tort LiabilityMaePas encore d'évaluation

- Possibilities in Taxation - Atty. Bobby LockDocument14 pagesPossibilities in Taxation - Atty. Bobby LockROCHELLEPas encore d'évaluation

- 2014 Tax Updates and Common Errors To AvoidDocument110 pages2014 Tax Updates and Common Errors To AvoidMcrislbPas encore d'évaluation

- Pre Week Notes in Remedial LawDocument11 pagesPre Week Notes in Remedial LawElla MarceloPas encore d'évaluation

- Succession Atty Viviana Paguirigan PDFDocument7 pagesSuccession Atty Viviana Paguirigan PDFNombs NomPas encore d'évaluation

- 100% CIR VS. SOLIDBANK - GR NO. 160756, 09 March 2010 (Validity of imposition of GRT on interest income subject to FWTDocument5 pages100% CIR VS. SOLIDBANK - GR NO. 160756, 09 March 2010 (Validity of imposition of GRT on interest income subject to FWTzanePas encore d'évaluation

- Velayo vs. OrdovezaDocument2 pagesVelayo vs. OrdovezaBrian DelacruzPas encore d'évaluation

- CIR V. TRANSITIONS OPTICAL PHILIPPINES, INC. (G.R. No. 227544, November 22, 2017)Document2 pagesCIR V. TRANSITIONS OPTICAL PHILIPPINES, INC. (G.R. No. 227544, November 22, 2017)Digna LausPas encore d'évaluation

- Criminal Law Syllabus For The 2022 Bar Examinations.Document4 pagesCriminal Law Syllabus For The 2022 Bar Examinations.Ruwee O TupuePas encore d'évaluation

- Revenue Regulations No 01-81Document5 pagesRevenue Regulations No 01-81RaymondPas encore d'évaluation

- Estate Tax - Ust PDFDocument14 pagesEstate Tax - Ust PDFFordan AntolinoPas encore d'évaluation

- Problem Exercises in TaxationDocument38 pagesProblem Exercises in TaxationSHeena MaRie ErAsmoPas encore d'évaluation

- Silicon Philippines V CirDocument2 pagesSilicon Philippines V CirKia BiPas encore d'évaluation

- SILICON PHILIPPINES, INC., (Formerly INTEL PHILIPPINES MANUFACTURING, INC.) vs. COMMISSIONER OF INTERNAL REVENUEDocument4 pagesSILICON PHILIPPINES, INC., (Formerly INTEL PHILIPPINES MANUFACTURING, INC.) vs. COMMISSIONER OF INTERNAL REVENUETrishaPas encore d'évaluation

- Vat DigestsDocument10 pagesVat DigestsTrishaPas encore d'évaluation

- CIR Vs Manila Mining CorpDocument9 pagesCIR Vs Manila Mining CorpJulian DubaPas encore d'évaluation

- SILICON PHILIPPINES, INC Vs CIR G.R. No. 172378 January 17, 2011Document7 pagesSILICON PHILIPPINES, INC Vs CIR G.R. No. 172378 January 17, 2011Francise Mae Montilla MordenoPas encore d'évaluation

- Landmark VAT Cases on Zero-Rated Sales and Franchise OperationsDocument12 pagesLandmark VAT Cases on Zero-Rated Sales and Franchise OperationsJudeRamosPas encore d'évaluation

- General Contract ServicesDocument2 pagesGeneral Contract ServicesJa Mi LahPas encore d'évaluation

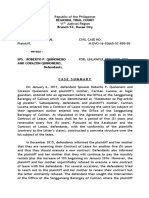

- Case Summary (Unlawful Detainer)Document3 pagesCase Summary (Unlawful Detainer)lchieSPas encore d'évaluation

- Effectivity of OrdinanceDocument7 pagesEffectivity of OrdinanceSoc Sabile100% (2)

- WELCOMING REMARKS Wedding ScriptDocument7 pagesWELCOMING REMARKS Wedding Scriptmaranatha rallosPas encore d'évaluation

- MCLE SkedDocument1 pageMCLE SkedlchieSPas encore d'évaluation

- Children Welfare Code of Davao City ApprovedDocument27 pagesChildren Welfare Code of Davao City ApprovedlchieSPas encore d'évaluation

- Chain of CustodyDocument8 pagesChain of CustodyKuya Kim100% (1)

- Bank Certification of Specimen SignatureDocument1 pageBank Certification of Specimen SignatureIlaw-Santonia Law OfficePas encore d'évaluation

- Child Welfare Code PDFDocument30 pagesChild Welfare Code PDFlchieSPas encore d'évaluation

- Sample Format of Judicial Affidavit (English)Document6 pagesSample Format of Judicial Affidavit (English)Samantha BugayPas encore d'évaluation

- Land Bank letter authorizing info retrievalDocument1 pageLand Bank letter authorizing info retrievallchieS80% (5)

- Cases On BP BLG 22Document23 pagesCases On BP BLG 22lchieSPas encore d'évaluation

- Contract As Defined by Article 1305 of The Civil CodeDocument1 pageContract As Defined by Article 1305 of The Civil CodelchieSPas encore d'évaluation

- Calendar - PrintableDocument9 pagesCalendar - PrintablelchieSPas encore d'évaluation

- Mou 1Document3 pagesMou 1karenPas encore d'évaluation

- Toyota SwiftDocument1 pageToyota SwiftlchieSPas encore d'évaluation

- Jurisprudence - Unlawful DetainerDocument18 pagesJurisprudence - Unlawful DetainerlchieSPas encore d'évaluation

- Chain of CustodyDocument8 pagesChain of CustodyKuya Kim100% (1)

- Notes On Unlawful DetainerDocument2 pagesNotes On Unlawful DetainerlchieSPas encore d'évaluation

- Jurisprudence On BP 22Document2 pagesJurisprudence On BP 22lchieSPas encore d'évaluation

- Notes On Inhibition of JudgesDocument3 pagesNotes On Inhibition of JudgeslchieSPas encore d'évaluation

- Chain of CustodyDocument8 pagesChain of CustodyKuya Kim100% (1)

- Jurisprudence - Unlawful DetainerDocument18 pagesJurisprudence - Unlawful DetainerlchieSPas encore d'évaluation

- Cases On BP BLG 22Document23 pagesCases On BP BLG 22lchieSPas encore d'évaluation

- Unilateral Deed of Sale - SAMPLEDocument2 pagesUnilateral Deed of Sale - SAMPLElchieS86% (37)

- CSC Resolution No. 1500088 Sworn Statement of Assets FormDocument4 pagesCSC Resolution No. 1500088 Sworn Statement of Assets Formwyclef_chin100% (6)

- Law and Logic (Fallacies)Document10 pagesLaw and Logic (Fallacies)Arbie Dela TorrePas encore d'évaluation

- Election Law Reviewer SummaryDocument110 pagesElection Law Reviewer SummarylchieSPas encore d'évaluation

- Law and Logic (Fallacies)Document10 pagesLaw and Logic (Fallacies)Arbie Dela TorrePas encore d'évaluation

- Election Law Reviewer SummaryDocument110 pagesElection Law Reviewer SummarylchieSPas encore d'évaluation

- Social Contract TheoryDocument35 pagesSocial Contract Theorydivyanshu sharmaPas encore d'évaluation

- Chapter 18 - Enforcement of Law of WarDocument79 pagesChapter 18 - Enforcement of Law of WarwellsbennettPas encore d'évaluation

- CA For Bank Exams Vol 1Document167 pagesCA For Bank Exams Vol 1VenkatesanSelvarajanPas encore d'évaluation

- Re. Balia and San Francisco RlyDocument2 pagesRe. Balia and San Francisco RlyJnine McNamaraPas encore d'évaluation

- Judicial Clemency GuidelinesDocument13 pagesJudicial Clemency GuidelinesMunchie MichiePas encore d'évaluation

- Lectures 8 & 9: Protection of CreditorsDocument36 pagesLectures 8 & 9: Protection of CreditorsYeung Ching TinPas encore d'évaluation

- De Jure: Kottiah Vazha Yrl Devki and Others v. Arya Kandu Kunhi Knnan and OthersDocument25 pagesDe Jure: Kottiah Vazha Yrl Devki and Others v. Arya Kandu Kunhi Knnan and OthersShruti RaiPas encore d'évaluation

- CSEC Tourism QuestionDocument2 pagesCSEC Tourism QuestionJohn-Paul Mollineaux0% (1)

- The Complete Guide to The WireDocument329 pagesThe Complete Guide to The Wirec8896360% (2)

- Christian History of AlbaniaDocument10 pagesChristian History of AlbaniaŞərif MəcidzadəPas encore d'évaluation

- KyleDocument5 pagesKyleBasma Sanson MokamadPas encore d'évaluation

- Merchant of Venice Act 1 Scene 3 SummaryDocument9 pagesMerchant of Venice Act 1 Scene 3 SummaryAnmol AgarwalPas encore d'évaluation

- The First American Among The Riffi': Paul Scott Mowrer's October 1924 Interview With Abd-el-KrimDocument24 pagesThe First American Among The Riffi': Paul Scott Mowrer's October 1924 Interview With Abd-el-Krimrabia boujibarPas encore d'évaluation

- Cuban Missile Crisis 13 Days On The Brink PowerpointDocument18 pagesCuban Missile Crisis 13 Days On The Brink Powerpointapi-251502216Pas encore d'évaluation

- Preagido v. SandiganbayanDocument17 pagesPreagido v. SandiganbayanJohn FerarenPas encore d'évaluation

- Defender Of: Protector of Those at SeaDocument2 pagesDefender Of: Protector of Those at SeaElenie100% (3)

- George Washington - Farewell Address of 1796Document11 pagesGeorge Washington - Farewell Address of 1796John SutherlandPas encore d'évaluation

- Perspectives Test 1Document5 pagesPerspectives Test 1ΒΡΕΦΟΝΗΠΙΑΚΟΣ ΝΕΑΣ ΚΥΔΩΝΙΑΣ50% (2)

- Ham D PDFDocument4 pagesHam D PDFJenna MillerPas encore d'évaluation

- CollinsCourier NovDocument5 pagesCollinsCourier NovNZNatsPas encore d'évaluation

- Paraphrasing Exercises With AnswersDocument3 pagesParaphrasing Exercises With AnswersOscar Guerrero50% (2)

- Jissen Issue 6Document92 pagesJissen Issue 6Antoine Hoang100% (1)

- Saad Zaghlul PashaDocument27 pagesSaad Zaghlul PashaPetru MoiseiPas encore d'évaluation

- Communism's Christian RootsDocument8 pagesCommunism's Christian RootsElianMPas encore d'évaluation

- Mildred Aebisher and Muriel Gruff v. Bernard Ryan, Individually and in His Official Capacity as Principal, Oldfield Junior High School, Harborfields Central School District, 622 F.2d 651, 2d Cir. (1980)Document7 pagesMildred Aebisher and Muriel Gruff v. Bernard Ryan, Individually and in His Official Capacity as Principal, Oldfield Junior High School, Harborfields Central School District, 622 F.2d 651, 2d Cir. (1980)Scribd Government DocsPas encore d'évaluation

- Strategies for Ending the Sino-Japanese and Russo-Japanese WarsDocument18 pagesStrategies for Ending the Sino-Japanese and Russo-Japanese Warscoca COLAPas encore d'évaluation

- 78 - Wee vs. de Castro 562 SCRA 695Document8 pages78 - Wee vs. de Castro 562 SCRA 695Patrice ThiamPas encore d'évaluation

- Republic vs. Court of Appeals - Docx GR No. L-61647Document10 pagesRepublic vs. Court of Appeals - Docx GR No. L-61647Friendship GoalPas encore d'évaluation

- Ieds Catalog 09-21-2017 Low CompressDocument40 pagesIeds Catalog 09-21-2017 Low Compresswhorne24Pas encore d'évaluation

- Dworkin, Right To RidiculeDocument3 pagesDworkin, Right To RidiculeHelen BelmontPas encore d'évaluation

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesD'EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesÉvaluation : 4 sur 5 étoiles4/5 (9)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyD'EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyPas encore d'évaluation

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesD'EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesÉvaluation : 3 sur 5 étoiles3/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- The Hidden Wealth Nations: The Scourge of Tax HavensD'EverandThe Hidden Wealth Nations: The Scourge of Tax HavensÉvaluation : 4.5 sur 5 étoiles4.5/5 (40)

- The Payroll Book: A Guide for Small Businesses and StartupsD'EverandThe Payroll Book: A Guide for Small Businesses and StartupsÉvaluation : 5 sur 5 étoiles5/5 (1)

- How to get US Bank Account for Non US ResidentD'EverandHow to get US Bank Account for Non US ResidentÉvaluation : 5 sur 5 étoiles5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProD'EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProÉvaluation : 4.5 sur 5 étoiles4.5/5 (43)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingD'EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingÉvaluation : 5 sur 5 étoiles5/5 (3)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemD'EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemPas encore d'évaluation

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessD'EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessÉvaluation : 5 sur 5 étoiles5/5 (5)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistD'EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistÉvaluation : 5 sur 5 étoiles5/5 (6)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsD'EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsÉvaluation : 4 sur 5 étoiles4/5 (1)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)D'EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Évaluation : 4.5 sur 5 étoiles4.5/5 (43)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.D'EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.Pas encore d'évaluation

- The Long Hangover: Putin's New Russia and the Ghosts of the PastD'EverandThe Long Hangover: Putin's New Russia and the Ghosts of the PastÉvaluation : 4.5 sur 5 étoiles4.5/5 (76)

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreD'EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MorePas encore d'évaluation

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyD'EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyÉvaluation : 4 sur 5 étoiles4/5 (52)

- Streetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessD'EverandStreetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessPas encore d'évaluation