Académique Documents

Professionnel Documents

Culture Documents

Ac 505 Project 1 Word

Transféré par

Adeola AdesokanDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ac 505 Project 1 Word

Transféré par

Adeola AdesokanDroits d'auteur :

Formats disponibles

Case 9-30

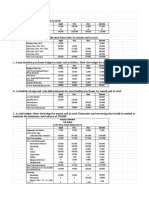

1. a. Sales budget:

April

May

June

Quarter

Budgeted unit sales ..... 65,000

100,000

50,000

215,000

Selling price per unit ....

$10

$10

$10

$10

Total sales ................... $650,000 $1,000,000 $500,000 $2,150,000

b. Schedule of expected cash collections:

February sales (10%)... $ 26,000

$ 26,000

March sales

(70%, 10%) ............. 280,000 $ 40,000

320,000

April sales

(20%, 70%, 10%) .... 130,000

455,000 $ 65,000

650,000

May sales

(20%, 70%) .............

200,000 700,000

900,000

June sales (20%) .........

100,000

100,000

Total cash collections ... $436,000 $695,000 $865,000 $1,996,000

c. Merchandise purchases budget:

Budgeted unit sales ..... 65,000

Add desired ending

inventory (40% of

the next months

unit sales)................. 40,000

Total needs.................. 105,000

Less beginning

inventory .................. 26,000

Required purchases...... 79,000

Cost of purchases at

$4 per unit ................ $316,000

100,000

50,000

215,000

20,000

120,000

12,000

62,000

12,000

227,000

40,000

80,000

20,000

42,000

26,000

201,000

$320,000 $168,000 $ 804,000

d. Budgeted cash disbursements for merchandise purchases:

Accounts payable .......... $100,000

April purchases ............. 158,000

May purchases ..............

June purchases .............

Total cash payments ..... $258,000

$ 100,000

$158,000

316,000

160,000 $160,000

320,000

84,000

84,000

$318,000 $244,000 $ 820,000

Case 9-30 (continued)

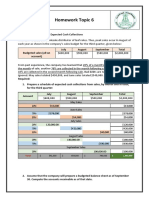

2.

Earrings Unlimited

Cash Budget

For the Three Months Ending June 30

Cash balance.....................

Add collections from

customers ......................

Total cash available............

Less disbursements:

Merchandise purchases ...

Advertising .....................

Rent ...............................

Salaries ..........................

Commissions (4% of

sales) ..........................

Utilities ...........................

Equipment purchases ......

Dividends paid ................

Total disbursements ...........

Excess (deficiency) of

receipts over

disbursements ................

Financing:

Borrowings .....................

Repayments ...................

Interest

($170,000 1% 3 +

$10,000 1% 2) ......

Total financing...................

Cash balance, ending .........

April

$ 74,000

May

June

$ 50,000 $ 50,000 $

Quarter

74,000

436,000

510,000

695,000

745,000

865,000

915,000

1,996,000

2,070,000

258,000

200,000

18,000

106,000

318,000

200,000

18,000

106,000

244,000

200,000

18,000

106,000

820,000

600,000

54,000

318,000

26,000

7,000

0

15,000

630,000

40,000

7,000

16,000

0

705,000

20,000

7,000

40,000

0

635,000

86,000

21,000

56,000

15,000

1,970,000

(120,000)

40,000

280,000

100,000

170,000

0

10,000

0

0

(180,000)

180,000

(180,000)

0

170,000

$ 50,000

0

10,000

$ 50,000

(5,300)

(185,300)

$ 94,700 $

(5,300)

(5,300)

94,700

Case 9-30 (continued)

3.

Earrings Unlimited

Budgeted Income Statement

For the Three Months Ended June 30

Sales (Part 1 a.) ........................................

Variable expenses:

Cost of goods sold @ $4 per unit.............

Commissions @ 4% of sales....................

Contribution margin ..................................

Fixed expenses:

Advertising ($200,000 3) .....................

Rent ($18,000 3) ................................

Salaries ($106,000 3) ..........................

Utilities ($7,000 3) ..............................

Insurance ($3,000 3) ..........................

Depreciation ($14,000 3) .....................

Net operating income ................................

Interest expense (Part 2)...........................

Net income ...............................................

$2,150,000

$860,000

86,000

600,000

54,000

318,000

21,000

9,000

42,000

946,000

1,204,000

1,044,000

160,000

5,300

$ 154,700

Case 9-30 (continued)

4.

Earrings Unlimited

Budgeted Balance Sheet

June 30

Assets

Cash .............................................................................

Accounts receivable (see below) .....................................

Inventory (12,000 units @ $4 per unit) ...........................

Prepaid insurance ($21,000 $9,000) .............................

Property and equipment, net

($950,000 + $56,000 $42,000) .................................

Total assets ...................................................................

Liabilities and Stockholders Equity

Accounts payable, purchases (50% $168,000) .............

Dividends payable ..........................................................

Capital stock ..................................................................

Retained earnings (see below) ........................................

Total liabilities and stockholders equity ...........................

Accounts receivable at June 30:

10% May sales of $1,000,000 ...........

80% June sales of $500,000 .............

Total ...................................................

$100,000

400,000

$500,000

Retained earnings at June 30:

Balance, March 31 ...............................

Add net income (part 3) .......................

Total ...................................................

Less dividends declared ........................

Balance, June 30..................................

$580,000

154,700

734,700

15,000

$719,700

94,700

500,000

48,000

12,000

964,000

$1,618,700

$

84,000

15,000

800,000

719,700

$1,618,700

Vous aimerez peut-être aussi

- Group 3 - Master Budget-Earrings UnlimitedDocument8 pagesGroup 3 - Master Budget-Earrings UnlimitedLorena Mae LasquitePas encore d'évaluation

- Project Case 9-30 Master BudgetDocument6 pagesProject Case 9-30 Master Budgetleizalm29% (7)

- Master Budgeting: June July August September October Third QuarterDocument10 pagesMaster Budgeting: June July August September October Third QuarterЭниЭ.Pas encore d'évaluation

- Magma Minerals Case StudyDocument6 pagesMagma Minerals Case StudyJoyce De LunaPas encore d'évaluation

- Exposure Management 2.0 - SAP BlogsDocument8 pagesExposure Management 2.0 - SAP Blogsapostolos thomasPas encore d'évaluation

- Includes $2,000 Depreciation Each MonthDocument3 pagesIncludes $2,000 Depreciation Each MonthLynnard Philip Panes100% (1)

- Budget Exercises - Part II (Model Answers)Document7 pagesBudget Exercises - Part II (Model Answers)Menna AssemPas encore d'évaluation

- Kitchen Aid Products, Inc., Manufactures Small Kitchen AppliancesDocument7 pagesKitchen Aid Products, Inc., Manufactures Small Kitchen AppliancesGalina FateevaPas encore d'évaluation

- Financial Forecasting: Production Requirements (LO2) Sales For Western Boot Stores Are Expected To Be 40,000Document13 pagesFinancial Forecasting: Production Requirements (LO2) Sales For Western Boot Stores Are Expected To Be 40,000Juliet Dorado100% (1)

- Months: Sales Purchases Wages ExpensesDocument2 pagesMonths: Sales Purchases Wages Expensespranay639Pas encore d'évaluation

- 03 Bank ReconliationDocument4 pages03 Bank Reconliationsharielles /Pas encore d'évaluation

- Cost Sheet Practical ProblemsDocument2 pagesCost Sheet Practical Problemssameer_kini100% (1)

- Problem 9-14 (45 Minutes) : Month April May June QuarterDocument8 pagesProblem 9-14 (45 Minutes) : Month April May June QuarterRowbby GwynPas encore d'évaluation

- Problems For Profit Planning Pt. 3Document7 pagesProblems For Profit Planning Pt. 3krisha milloPas encore d'évaluation

- Solution For C. Alvarez ManufacturingDocument12 pagesSolution For C. Alvarez ManufacturingHarvey AguilarPas encore d'évaluation

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoiePas encore d'évaluation

- Homework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionsDocument3 pagesHomework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionskhetamPas encore d'évaluation

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocument8 pagesTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- Rheyna Suryadana - GLSDocument4 pagesRheyna Suryadana - GLSNatasha HerlianaPas encore d'évaluation

- Budgetary ControlDocument5 pagesBudgetary ControlJasdeep Singh DeepuPas encore d'évaluation

- Worksheet Master BudgetDocument6 pagesWorksheet Master BudgetRUPIKA R GPas encore d'évaluation

- Earrings Suggested SolutionsDocument4 pagesEarrings Suggested Solutions9ry5gsghybPas encore d'évaluation

- Course Project ADocument9 pagesCourse Project AJay PatelPas encore d'évaluation

- (Jennifer / 1901469555 / LA53) : GSLC Assignment Profit PlanningDocument5 pages(Jennifer / 1901469555 / LA53) : GSLC Assignment Profit PlanningJennifer GunawanPas encore d'évaluation

- Cash BudgetDocument2 pagesCash BudgetJasmine ActaPas encore d'évaluation

- Exercise 2.1Document9 pagesExercise 2.1Nurul ShazalinaPas encore d'évaluation

- Forecasting Short Term Operating Sample ProblemsDocument8 pagesForecasting Short Term Operating Sample ProblemsJanaisa BugayongPas encore d'évaluation

- Group 2 Cash Budget N4ba2503Document3 pagesGroup 2 Cash Budget N4ba2503nuraz3169Pas encore d'évaluation

- TUTORIAL 8 BudgetDocument7 pagesTUTORIAL 8 Budgetsarahayeesha1Pas encore d'évaluation

- MS AssumptionDocument10 pagesMS AssumptionGbemisola FasuyiPas encore d'évaluation

- MAS ExerciseDocument9 pagesMAS ExerciseAlaine Milka GosycoPas encore d'évaluation

- Cash Inflows Jan Feb Mar Apr May Jun JulDocument2 pagesCash Inflows Jan Feb Mar Apr May Jun Julsbdhshrm146Pas encore d'évaluation

- Questions On Cash Budget-2Document7 pagesQuestions On Cash Budget-2Mpolokeng HlabanaPas encore d'évaluation

- Glass ChartDocument19 pagesGlass ChartMyo Tin Ko OoPas encore d'évaluation

- Ain20190418028 ModifiedDocument5 pagesAin20190418028 ModifiedNiomi GolraiPas encore d'évaluation

- Case StudiesDocument6 pagesCase StudiesFrancesnova B. Dela PeñaPas encore d'évaluation

- Book 3Document6 pagesBook 3Titania ErzaPas encore d'évaluation

- Group Managerial AccountingDocument9 pagesGroup Managerial AccountingSlamet SalimPas encore d'évaluation

- AF2110 Management Accounting 1 Assignment 08 Suggested Solutions Exercise 8-10 (45 Minutes)Document14 pagesAF2110 Management Accounting 1 Assignment 08 Suggested Solutions Exercise 8-10 (45 Minutes)Shadow IpPas encore d'évaluation

- SamigroupDocument9 pagesSamigroupsamidan tubePas encore d'évaluation

- Efika Noviana Lubis (192102001) - Tugas AkmDocument12 pagesEfika Noviana Lubis (192102001) - Tugas AkmLydia Nur Utami SikumbangPas encore d'évaluation

- Pria Mas04 002 Cost Terms, CDocument6 pagesPria Mas04 002 Cost Terms, CKristofer DomagosoPas encore d'évaluation

- Sales Price Per Unit: $12Document2 pagesSales Price Per Unit: $12Nojoke1Pas encore d'évaluation

- Chapter 2Document83 pagesChapter 2Eliza RiveraPas encore d'évaluation

- HorngrenIMA14eSM ch07Document57 pagesHorngrenIMA14eSM ch07Aries Siringoringo50% (2)

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256Pas encore d'évaluation

- HembyN Week 5 ProjectDocument4 pagesHembyN Week 5 Projectgaskinsje1Pas encore d'évaluation

- CVP VAnswer Practice QuestionsDocument5 pagesCVP VAnswer Practice QuestionsAbhijit AshPas encore d'évaluation

- MP2 CalculatorDocument20 pagesMP2 Calculatorangelo.tambadocPas encore d'évaluation

- Problem 9-14 (45 Minutes) : Month April May June QuarterDocument8 pagesProblem 9-14 (45 Minutes) : Month April May June QuarterChris MarasiganPas encore d'évaluation

- Boomstick CorpDocument14 pagesBoomstick CorpDivya GoyalPas encore d'évaluation

- Problem 9-15 (60 Minutes) : © The Mcgraw-Hill Companies, Inc., 2008. All Rights Reserved. Solutions Manual, Chapter 9 1Document14 pagesProblem 9-15 (60 Minutes) : © The Mcgraw-Hill Companies, Inc., 2008. All Rights Reserved. Solutions Manual, Chapter 9 1Tanvir AhmedPas encore d'évaluation

- MoviePass - 2Document6 pagesMoviePass - 2utopianzherePas encore d'évaluation

- Three Statement Model 14-07-2021 (F3)Document16 pagesThree Statement Model 14-07-2021 (F3)Vaibhav BoratePas encore d'évaluation

- Activity and Quiz - Ysabel Nicole Isip - Bsba2Document6 pagesActivity and Quiz - Ysabel Nicole Isip - Bsba2angel caoPas encore d'évaluation

- InventoryDocument6 pagesInventoryShayne BetudioPas encore d'évaluation

- Schedule For Loan DiskDocument3 pagesSchedule For Loan DiskOlumese EgbohPas encore d'évaluation

- Master Budget IllustrationDocument15 pagesMaster Budget IllustrationMaePas encore d'évaluation

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsD'EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsPas encore d'évaluation

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsD'EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsPas encore d'évaluation

- Profitability of simple fixed strategies in sport betting: Soccer, Spain Primera Division (LaLiga), 2009-2019D'EverandProfitability of simple fixed strategies in sport betting: Soccer, Spain Primera Division (LaLiga), 2009-2019Pas encore d'évaluation

- Profitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019D'EverandProfitability of simple fixed strategies in sport betting: Soccer, Italy Serie A League, 2009-2019Pas encore d'évaluation

- Course Project B Clark PaintsDocument3 pagesCourse Project B Clark PaintsDiana Cruz33% (3)

- Ac 505 Excel Work SheetDocument2 pagesAc 505 Excel Work SheetAdeola AdesokanPas encore d'évaluation

- AC 505 Case Study IIDocument3 pagesAC 505 Case Study IIAdeola AdesokanPas encore d'évaluation

- AC 505 Case Study IIDocument3 pagesAC 505 Case Study IIAdeola AdesokanPas encore d'évaluation

- Siemplify SOAR For Service Providers White PaperDocument9 pagesSiemplify SOAR For Service Providers White PaperSerge KuzminPas encore d'évaluation

- Fabm ExamDocument3 pagesFabm ExamRonald AlmagroPas encore d'évaluation

- All VouchersDocument23 pagesAll VouchersSunandaPas encore d'évaluation

- Dr. Monica Shrivastava: Curriculum Vitae Curriculum Vitae Curriculum Vitae Curriculum VitaeDocument5 pagesDr. Monica Shrivastava: Curriculum Vitae Curriculum Vitae Curriculum Vitae Curriculum VitaeengineeringwatchPas encore d'évaluation

- Tractor Supply Company Case Study 2Document1 pageTractor Supply Company Case Study 2KAR WAI PHOONPas encore d'évaluation

- Auditing NotesDocument65 pagesAuditing NotesTushar GaurPas encore d'évaluation

- Online Demo Session - FICO - 14 April 2021Document48 pagesOnline Demo Session - FICO - 14 April 2021Md Mukul HossainPas encore d'évaluation

- Solution Manual For Introduction To Finance Markets Investments and Financial Management 16th EditionDocument18 pagesSolution Manual For Introduction To Finance Markets Investments and Financial Management 16th EditionDawn Steward100% (40)

- NestleDocument14 pagesNestleSiddharth Sourav PadheePas encore d'évaluation

- Measuring and Forecasting Market DemandDocument24 pagesMeasuring and Forecasting Market DemandRodric Marbaniang100% (1)

- Dalberg Digitalizing Guidebook For Enterprise Support Organizations-1Document58 pagesDalberg Digitalizing Guidebook For Enterprise Support Organizations-1Ximena MoyaPas encore d'évaluation

- JD - Analyst Opex NLPDocument9 pagesJD - Analyst Opex NLPLakshmidevi pmPas encore d'évaluation

- THOUFIQ Resume MbaDocument3 pagesTHOUFIQ Resume MbanaveenPas encore d'évaluation

- International Business: by Charles W.L. HillDocument20 pagesInternational Business: by Charles W.L. HillAshok SharmaPas encore d'évaluation

- 23-12-2022 BSDocument22 pages23-12-2022 BSVenkat JagdishPas encore d'évaluation

- IsoDocument12 pagesIsoAjit JainPas encore d'évaluation

- CFMB AS CS3 v3Document6 pagesCFMB AS CS3 v3lawless.d90Pas encore d'évaluation

- Note Buad836 Mod1 Yj7myoyoou5ym38Document150 pagesNote Buad836 Mod1 Yj7myoyoou5ym38Adetunji TaiwoPas encore d'évaluation

- This Study Resource Was: Joyce Ann Clarize GalangDocument6 pagesThis Study Resource Was: Joyce Ann Clarize GalangYamna HasanPas encore d'évaluation

- Taxation of Partnerships and LlpsDocument5 pagesTaxation of Partnerships and LlpskalinovskayaPas encore d'évaluation

- Accounting For Decentralized Operations: Inventory at Cost of P40,000Document6 pagesAccounting For Decentralized Operations: Inventory at Cost of P40,000Nicole Allyson AguantaPas encore d'évaluation

- L1-L3 Introduction To Performance ManagementDocument24 pagesL1-L3 Introduction To Performance Managementshalini bhattPas encore d'évaluation

- Country Risk Analysis 2Document34 pagesCountry Risk Analysis 2donmogamboPas encore d'évaluation

- FR (Old & New) Imp IND AS Summary 2020Document15 pagesFR (Old & New) Imp IND AS Summary 2020Pooja GuptaPas encore d'évaluation

- Ayan Chakravarty BrandwagonDocument5 pagesAyan Chakravarty BrandwagonAyan ChakravartyPas encore d'évaluation

- Accounting in ActionDocument62 pagesAccounting in ActionbortycanPas encore d'évaluation

- Documents - Pub - Internship Report MTB Foreign Exchange OperationsDocument65 pagesDocuments - Pub - Internship Report MTB Foreign Exchange OperationsShuvoPas encore d'évaluation