Académique Documents

Professionnel Documents

Culture Documents

History of J

Transféré par

rung_narayan14790Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

History of J

Transféré par

rung_narayan14790Droits d'auteur :

Formats disponibles

History of J&K Bank Almost seventy years ago, the then Maharaja of the State of Jammu & Kashmir,Maharaja

Hari Singh started thinking about setting up of State Bank of J&K with the solepurpose of overall development of his subjects.After prolonged deliberations and discussions, the assignment for establishment of TheJammu & Kashmir Bank Limited was given to the late Sir Sorabji N Pochkhanwala, thethen Managing Director of the Central Bank of India. Mr. Pochkhanwala formulated ascheme on 24.09.1930, suggesting establishment of a bank with participation in capitalby State and the public but under the control of State Government. Thus, was born theJ&K Bank, which commenced its business from 4th July 1939 from its Registered Office,Residency Road, Srinagar, Kashmir.It was in the year 1971 that Jammu and Kashmir Bank was granted the status of a'Scheduled Bank'. Five years later, it was declared as "A" Class Bank, by the ReserveBank of India (RBI). As the years passed on, the bank started achieving more and moresuccess. Today, it boasts of more than 560 branches across the country.Now listing some of the historical developments : Formulation of Board of Directors (1938) BODs on Oct 1st 1938 resolved and adopted the Article of Association Incorporated in 1938 as a limited company First meeting of BODs- 7th Jan 1939 Commencement of business on July 4th 1939 -R Road,Srinagar First Manager: Mr. Sohan Lal Kothari First Chairman:Major General Roy Bahadur Bishan Dass-Chief Minister First Safe Deposit vault at Residency Road 1940 Few more branches opened in the same year-Udhampur,Mirpur,Anantnag,Baramullah and Muzzaffarabad Appointment of Staff on professional basis-1945 State Minister to be on the BODs-1946 Introduction of Inspection-1946 First outside branch Amritsar Partition of India-1947 and its aftermath Loss of two branches-Mirpur & Muzzarabad Filling/Settling of Claims by the depositors

Bank at the verge of collapse Assistance from the Government-Nearly 6 Lakhs-1949 Recovery of bad debts Extension of Central Laws to the State of J & K Bank defined as govt: company-Indian Companies Act 1956 Financial Year changed Banking companies Act 1949 Real growth started from 1969-the era of Nationalization Social Control on banks First whole time Chairman Mr.A.A.Fazili, Nov.1970-June 1974 Lending Policy changed/reoriented Priority Sector advances Total No of Branches-26 as on December 1970 1973-Permission granted to establish currency chest at R.Road,Sgr

Total No of Branches-64 as on 1973 1976-Sponsored first Regional Rural Bank Jammu Rural Bank 1976-Responsibility of payment of pension to Civil Pensioners of the State 1976-Bank declared as A Class bank 1979-Total No of Branches rose to 190 1980-Total No of Branches rose to 212 1981-Permission granted by RBI to deal in the Foreign Exchange business

1981-Sponsored another Regional Rural Bank Kamraz Rural Bank 1980- Lead Bank responsibility Convener of SLBC 1984-Customer Service Cell 1987-Introduction of MICR technology 1989-Historic period Golden Jubilee Creation of J&K Bank Golden Jubilee Development and Social ServicesTrust Organizing Credit camps Turmoil in the State 1991-1992-Financial Sector Reforms Initiatives of introducing New Technology Maiden Public IssueThe arduous but illustrious journey that spans over almost seven decades has been areal story of commitment and enterprise. Today J&K Bank is one of the very few banksthat combine the best of public ownership; stability and safety with the best of privatefunctioning; growth and efficiency. Having an almost exclusive geographical area of operations and supported by a dedicated community, the bank enjoys an almostmonopolistic postion in the state and a sizeable presence in the rest of country.All these aspects accord unparalleled financial and non-financial advantages to the bankmaking it one of the best and most profitable old generation private sector banks.Being the flagship Institution of the state the bank aspires to lead by example bydelivering outstanding performance in growth and profitability, catalyse growth in thestate economy and create enabling conditions for the financial empowerment of thepeople of J&K.Accordingly the Vision of J&K Bank is to engender and catalyse the economictransformation of Jammu and Kashmir and capitalize from the growth induced financialprosperity.The banks overriding mission is to use its core competence to serve and empower thepeople in general and entrepreneurs in particular. The bank identifies empowerment asa process of enhancing the capacity of individuals or groups to make choices and totransform those choices into desired actions and outcomes. The bank is set todemonstrate that people with lesser means can be reached and reached profitably.J&K Bank is going from strength to strength as it witnesses tremendous revenue growthopportunities in all its businesses. In recognition of its excellent customer service, fair business practices, total operational efficiency, overall performance, etc. the bank hasbeen felicitated so many times during the last few years.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Assemble Smartphone Case SolutionDocument3 pagesAssemble Smartphone Case SolutionPravin Mandora50% (2)

- Bubble and Bee Lecture TemplateDocument2 pagesBubble and Bee Lecture TemplateMavin JeraldPas encore d'évaluation

- Asservation For NativityDocument27 pagesAsservation For Nativityjohnadams552266Pas encore d'évaluation

- Credit Risk Management in BanksDocument53 pagesCredit Risk Management in Banksrahulhaldankar100% (1)

- Economics of Wind Development in New Zealand: Prepared For The NZ Wind Energy AssociationDocument26 pagesEconomics of Wind Development in New Zealand: Prepared For The NZ Wind Energy AssociationNaveen KumarPas encore d'évaluation

- WAPDA Book of Financial Powers (May 2016)Document113 pagesWAPDA Book of Financial Powers (May 2016)waqar67% (3)

- Enriquez v. de VeraDocument2 pagesEnriquez v. de Veralaurana amataPas encore d'évaluation

- BERKS BROADCASTING vs. CRAUMERDocument2 pagesBERKS BROADCASTING vs. CRAUMERLara YuloPas encore d'évaluation

- TEME 6 Engl 2022Document50 pagesTEME 6 Engl 2022ihor.rudyk.mmeba.2022Pas encore d'évaluation

- DOJ: Buffett-Owned Mortgage Firm Guilty of Redlining in NCCoDocument50 pagesDOJ: Buffett-Owned Mortgage Firm Guilty of Redlining in NCCoCharlie MegginsonPas encore d'évaluation

- Assignment 2Document13 pagesAssignment 2Lyca Mae Cubangbang100% (2)

- Colege ReportDocument51 pagesColege ReportVarun WaynePas encore d'évaluation

- Capital AdequacyDocument11 pagesCapital AdequacyTezan RajkumarPas encore d'évaluation

- SBS Instalment Plans at 0% Markup With No Processing Fee: LED Mi Band 2Document2 pagesSBS Instalment Plans at 0% Markup With No Processing Fee: LED Mi Band 2James BondPas encore d'évaluation

- 12 Accounts CBSE Sample Papers 2019Document10 pages12 Accounts CBSE Sample Papers 2019Salokya KhandelwalPas encore d'évaluation

- Santander 219-432-Informe Anual ENG ACCE PDFDocument296 pagesSantander 219-432-Informe Anual ENG ACCE PDFvhsodaPas encore d'évaluation

- Rural Entrepreneurship: Scope & ChallengesDocument26 pagesRural Entrepreneurship: Scope & ChallengesSandeep KumarPas encore d'évaluation

- Chapter 009Document33 pagesChapter 009AfnanPas encore d'évaluation

- Sacombank EngDocument96 pagesSacombank EngMonkey2111Pas encore d'évaluation

- Application Form Self Help Groups For PrintoutDocument5 pagesApplication Form Self Help Groups For Printoutnilya7081Pas encore d'évaluation

- Richest Man in Babylon AnnotationDocument10 pagesRichest Man in Babylon Annotationmark jukicPas encore d'évaluation

- 407 - 1e LTN20170420808 PDFDocument196 pages407 - 1e LTN20170420808 PDFTony ZhangPas encore d'évaluation

- TAMPA - Vacant Contract (1 Owner)Document2 pagesTAMPA - Vacant Contract (1 Owner)Adam BellaPas encore d'évaluation

- UEM Annual Report 2011Document248 pagesUEM Annual Report 2011aimran_amirPas encore d'évaluation

- Allied Bank Limited Internship ReportDocument77 pagesAllied Bank Limited Internship ReportMuhammadUmairPas encore d'évaluation

- FDA POTOSI v-2104 PBL 05-05-2020 Blue Marlin - Xls - CompressedDocument69 pagesFDA POTOSI v-2104 PBL 05-05-2020 Blue Marlin - Xls - CompressedSade Park MaddoxPas encore d'évaluation

- Icici DmartDocument6 pagesIcici DmartGOUTAMPas encore d'évaluation

- Notice: Enforcement and Investor Protection DepartmentDocument2 pagesNotice: Enforcement and Investor Protection Departmentchristina loPas encore d'évaluation

- Cost AccountingDocument8 pagesCost AccountingKim Nicole ReyesPas encore d'évaluation

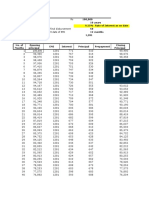

- Loan CalculatorDocument5 pagesLoan CalculatorHema Kumar Hema KumarPas encore d'évaluation