Académique Documents

Professionnel Documents

Culture Documents

Bunnell Loan

Transféré par

blogeditorDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bunnell Loan

Transféré par

blogeditorDroits d'auteur :

Formats disponibles

January 12, 2009

Bunnell begs FDOT to forgive loan

By HEATHER SCOFIELD

Staff Writer

BUNNELL -- City officials say they can't afford to repay a half-million dollar loan

from the state and now they're hoping for a miracle.

When Bunnell accepted the $529,000 loan from the Florida Department of Transportation

in 2005, "we didn't know that Amendment 1 and an economic downturn was coming,"

said City Manager Armando Martinez. "We didn't know the future would be so gray."

The funds were accepted years before Martinez took over as city manager but now he

must find a solution to the small city's inability to repay the debt.

The money was used to move utility lines along State Road 100 when state officials

decided to widen the road. County Adminstrator Craig Coffey, who also wasn't around in

2005, said he doesn't know if city officials had much say in whether they even wanted to

move the lines. It was something that had to be done for the state road project, Coffey

said.

A spokeswoman at FDOT conceded Bunnell officials never signed the loan documents

that dictate an obligation to repay. But she said it doesn't matter, state laws obligate the

city of a few thousand residents to repay the loan even without a signature on the

promissory note.

Martinez has sent a letter to FDOT officials requesting forgiveness of the loan. Flagler

County Commission Chairwoman Milissa Holland and several other Flagler officials also

sent letters of support for the request to FDOT as well.

Holland's letter begs state officials to understand that the tax rate freezes, voter-imposed

tax cuts and economic slump which have marked the last few years have affected Bunnell

more than most other Florida cities. She said skyrocketing unemployment and a small,

rural population has put the city into a bad situation that will likely only "worsen for the

foreseeable future."

"Bunnell is definitely less financially stout than other cities," Coffey said. "If there's a

criteria for a hardship exemption, I'd think Bunnell would fit."

But there's no program that allows for anything like this, said FDOT spokeswoman Pam

Griffis. The only way for Bunnell to get some relief, either through a total forgiveness of

the debt or a restructuring of the payment plan, is with an order from state legislators.

And that's happened only twice before, Griffis said.

She said the most recent case was in 1999 when Milton-- a small city in the Florida

panhandle -- had a utility loan forgiven through legislation. The other was granted during

an economic downturn in the 1980s when Opalocka, a South Florida city, was allowed to

delay making payments on a loan until the economy improved, Griffis said.

Martinez and Coffey said they weren't aware it would take legislation to handle the debt

problem. Coffey said he plans to recommend that Martinez personally address Flagler's

legislative delegates on the matter when they visit later this month.

Griffis said FDOT also plans to send local officials a letter telling them they'll have to

take their request to legislators.

Martinez said if Bunnell is forced to repay the loan under current conditions, it will hurt

local residents. The city can't raise taxes to pay the bill, he said, because "the residents are

suffering financially, too."

Instead it will mean further cinching of a belt that's already painfully tight, Martinez said.

Vous aimerez peut-être aussi

- Special 02102009Document1 pageSpecial 02102009blogeditorPas encore d'évaluation

- Regular 02122009Document3 pagesRegular 02122009blogeditorPas encore d'évaluation

- Cra 02122009Document1 pageCra 02122009blogeditorPas encore d'évaluation

- Special 01292009Document2 pagesSpecial 01292009blogeditorPas encore d'évaluation

- PARB Agenda 3-23-09Document1 pagePARB Agenda 3-23-09blogeditorPas encore d'évaluation

- CRA Handouts 12-4-08Document1 pageCRA Handouts 12-4-08blogeditorPas encore d'évaluation

- Inc. (Ed Note: See Info Below) Over The Commission's Decision Not To Approve TheDocument2 pagesInc. (Ed Note: See Info Below) Over The Commission's Decision Not To Approve TheblogeditorPas encore d'évaluation

- CRANews 2009 Volume 1 JanuaryrDocument2 pagesCRANews 2009 Volume 1 JanuaryrblogeditorPas encore d'évaluation

- LeslieDocument2 pagesLeslieblogeditorPas encore d'évaluation

- Geo ServicesDocument2 pagesGeo ServicesblogeditorPas encore d'évaluation

- City Charter Review CommitteeDocument1 pageCity Charter Review CommitteeblogeditorPas encore d'évaluation

- Agenda 1-8-09Document3 pagesAgenda 1-8-09blogeditorPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- CR Bank ListDocument1 pageCR Bank ListHonest ReviewsPas encore d'évaluation

- Banks Phone NumbersDocument1 pageBanks Phone NumbersVallela Jagan MohanPas encore d'évaluation

- India BricsDocument10 pagesIndia BricsSyeda SameehaPas encore d'évaluation

- Big Mac IndexDocument6 pagesBig Mac IndexsriadityadPas encore d'évaluation

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPPas encore d'évaluation

- Vaish College of Education, Rohtak: PPT On BankingDocument10 pagesVaish College of Education, Rohtak: PPT On BankingSuraj NagpalPas encore d'évaluation

- Q2 2022-23 GDP EstimatesDocument8 pagesQ2 2022-23 GDP EstimatesRepublic WorldPas encore d'évaluation

- Turkey's Kriz: Deteriorating Balance of Payments: Stephanie Goldin Kyaw Min Htet Mark Johnson Matt Mikulka Andre LeseanDocument24 pagesTurkey's Kriz: Deteriorating Balance of Payments: Stephanie Goldin Kyaw Min Htet Mark Johnson Matt Mikulka Andre LeseanStephanie GoldinPas encore d'évaluation

- EXIMBANK - реквизиты - 27.01.2020 PDFDocument7 pagesEXIMBANK - реквизиты - 27.01.2020 PDFRoxana RusuPas encore d'évaluation

- Complete Puzzle of ASBLP File of 2007Document112 pagesComplete Puzzle of ASBLP File of 2007BLP Cooperative96% (25)

- Role of Banks in Marine Insurance: Submitted To: Shri.N.Chandra Mohan Submitted By: K.Samhitha ROLL NO-FS10-017Document8 pagesRole of Banks in Marine Insurance: Submitted To: Shri.N.Chandra Mohan Submitted By: K.Samhitha ROLL NO-FS10-017Samhitha KandlakuntaPas encore d'évaluation

- Customs Invoice - 22191894-1Document1 pageCustoms Invoice - 22191894-1leo bluePas encore d'évaluation

- RCEP and E-Commerce: Mapping Indonesia's Potencies and ChallengesDocument4 pagesRCEP and E-Commerce: Mapping Indonesia's Potencies and ChallengesTHIFANI TIARA RANTI RANTIPas encore d'évaluation

- Economic Project Mohd Naved Alam Ansari B.A.LL.B (S/F) Ist Year Jamia Millia IslamiaDocument13 pagesEconomic Project Mohd Naved Alam Ansari B.A.LL.B (S/F) Ist Year Jamia Millia IslamiaMohd ArhamPas encore d'évaluation

- Chapter 2 Marketing EnvironmentDocument26 pagesChapter 2 Marketing EnvironmentBích ChâuPas encore d'évaluation

- Asb 3201Document1 pageAsb 3201Faisal DerbasPas encore d'évaluation

- Exchange Control Mechanisms PDFDocument27 pagesExchange Control Mechanisms PDFNazmul H. PalashPas encore d'évaluation

- Concept Paper - Mandanas Ruling and The Lgu's Bigger Budget This Fy 2022Document3 pagesConcept Paper - Mandanas Ruling and The Lgu's Bigger Budget This Fy 2022Analou Agustin Villeza100% (2)

- ICAAP Overview Core Concepts TocDocument3 pagesICAAP Overview Core Concepts TocJawwad FaridPas encore d'évaluation

- Costa RicaDocument13 pagesCosta RicaFranco Angelo ReyesPas encore d'évaluation

- Credit Co-Operative SocietiesDocument31 pagesCredit Co-Operative SocietiesGurpreet Singh Deol100% (1)

- 5 - The Economy of Growth and Impoverishment in The Marcos EraDocument8 pages5 - The Economy of Growth and Impoverishment in The Marcos EraanigygrhtPas encore d'évaluation

- Credit and DevelopmentDocument98 pagesCredit and DevelopmentMckenziePas encore d'évaluation

- A Multiple Choice Questions (4 Marks)Document2 pagesA Multiple Choice Questions (4 Marks)Sze VincentPas encore d'évaluation

- 06 Task Performance 1Document1 page06 Task Performance 1Kim JessiPas encore d'évaluation

- Increased Opportunities in Attraction of Investment Into The ATU GagauziaDocument13 pagesIncreased Opportunities in Attraction of Investment Into The ATU Gagauziab01eru84Pas encore d'évaluation

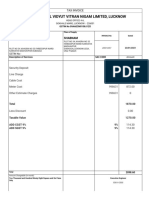

- Madhyanchal Vidyut Vitran Nigam Limited, Lucknow: Shabnam ShabnamDocument2 pagesMadhyanchal Vidyut Vitran Nigam Limited, Lucknow: Shabnam ShabnamYadav Manish KumarPas encore d'évaluation

- International Business PlanDocument30 pagesInternational Business PlanKomal ShehlaPas encore d'évaluation

- An Overview of Bangladesh Furniture IndustryDocument13 pagesAn Overview of Bangladesh Furniture Industryspurtbd67% (3)

- FIN 40500: International Finance: Purchasing Power ParityDocument25 pagesFIN 40500: International Finance: Purchasing Power Parityvinodgupta114Pas encore d'évaluation