Académique Documents

Professionnel Documents

Culture Documents

Reasoning For M& As

Transféré par

Kanika BhanotDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Reasoning For M& As

Transféré par

Kanika BhanotDroits d'auteur :

Formats disponibles

http://encyclopedia.thefreedictionary.

com/merger

Objectives behind Mergers & Acquisitions The two most common ones are growth and synergy. That is, M&As are a way in which a company can grow at an accelerated rate. This type of growth is usually much faster than growth through internal development. So when a company sees an opportunity in the market that it could fulfill if it had the resources to do so, one way to reach this goal in some cases is to buy a company that can help meet this objective. Synergy is also an often-cited motive for companies wanting to do deals. These synergies can come from reductions in costs as a result of a combination of two firms that have partially overlapping or redundant cost structures. Other sources of synergy can come from improved revenues that derive from the combination of the two companies. We will show that this source of synergy is often difficult to come by. It is much easier to talk about in advance of a deal than it is to actually make it come to pass. Other motives or reasons for M&As include economic motives, such as the pursuit of economies of scale such as cost reductions from being a larger company. We will see that economies of scale are one of the more achievable forms of synergy, although even here many companies never achieve the synergistic gains talked about before the deal. Other economic motives include economies of scope, where a company may be able to offer a broader product line to its current customer base. The reasons for M&As can be varied. We will review these motives and others that companies put forward to justify M&As. We will see that some types of deals are better than others for shareholders. For example, in many instances, mergers involving companies in different industries are often not well received

in the market. However, deals that enhance a companys focus tend to be better received. We will also see that the markets initial reactionsomething that is studied extensively by academic researchersis often telling about the longterm effects of the change that is being implemented. Although some managers may not learn from prior similar events, the market seems to have a longer memory. It is sometimes fooled, but it seems that it is more on target than managers who seem to quickly forget where other managers, or even themselves, have gone wrong in the past.

to help align leadership, management, and supervisory practices with the new combination's basic values - to provide guidance about managing the "people factor" in order to maintain productivity and job satisfaction - to facilitate multi-directional knowledge transfer and organizational learning within the new combination - to redesign core work processes in a way that involves employee stakeholders - to help to wisely select personnel for cross-border and cross-unit assignments - to develop global competencies in key managers and supervisors - to reconceptualize performance management and career planning - to align differing benefits and compensation packages - to facilitate the productivity of geographically dispersed "virtual" teams

To conduct benchmarking studies of important mergers & acquisitions processes. To create a cooperative environment where full understanding of the performance and enablers of "best in class" mergers & acquisitions management processes can be obtained and shared at reasonable cost. To use the efficiency of the association to obtain process performance data and related best practices from regarding mergers & acquisitions. To support the use of benchmarking to facilitate mergers & acquisitions process improvement and the achievement of accuracy, timeliness and efficiency.

By exploring restructuring strategies from various angles, you will improve your ability to reposition and revitalize your firm, create new opportunities, and maximize value for shareholders. Specifically, you will be better able to: Recognize situations in which restructuring can add significant value or create opportunity Identify the best restructuring options for a specific problem or challenge Use financial valuation and credit analysis to measure the potential value gains available through restructuring Manage the complex accounting, tax, legal, and regulatory issues that characterize many restructuring actions, avoiding pitfalls that can delay or derail the process Communicate and negotiate effectively with your firm's stakeholders to ensure the success of a restructuring effort Implement an effective decision-making and execution process that enables you and your team to formulate and act on restructuring plans in a rational, systematic way Analyze adjacent and new markets Determine financial and strategic attractiveness of M&A investments versus organic development or partnership / joint venture / alliance

Develop an informed (i.e., fact-based) investment thesis Establish investment criteria

Vous aimerez peut-être aussi

- Commercial Excellence: Slide 1 - Title SlideDocument8 pagesCommercial Excellence: Slide 1 - Title SlideMridul DekaPas encore d'évaluation

- MACR-03 - Drivers For M&ADocument6 pagesMACR-03 - Drivers For M&AVivek KuchhalPas encore d'évaluation

- Corporate Restructuring in India-Need of The Hour:: Health NetDocument21 pagesCorporate Restructuring in India-Need of The Hour:: Health NetKavitha PichandiPas encore d'évaluation

- NOTES On CORPORATE FinanceDocument54 pagesNOTES On CORPORATE Financevzsrg2fpj7Pas encore d'évaluation

- Strategic FitDocument3 pagesStrategic FitSana BaghlaPas encore d'évaluation

- Chapter 3 Strateging & Structuing M & A ActivityDocument13 pagesChapter 3 Strateging & Structuing M & A ActivityNareshPas encore d'évaluation

- Running A Winning M and 38a ShopDocument8 pagesRunning A Winning M and 38a ShopEvelynPas encore d'évaluation

- Mergers & Acquisitions: Prepared byDocument31 pagesMergers & Acquisitions: Prepared byhasansupPas encore d'évaluation

- Material No. 3Document9 pagesMaterial No. 3rhbqztqbzyPas encore d'évaluation

- Business Opportunity Thinking: Building a Sustainable, Diversified BusinessD'EverandBusiness Opportunity Thinking: Building a Sustainable, Diversified BusinessPas encore d'évaluation

- Ethics in Merger & AcquistiionDocument44 pagesEthics in Merger & AcquistiionJitin BhutaniPas encore d'évaluation

- Financial Strategies For Value Creation (IIP)Document8 pagesFinancial Strategies For Value Creation (IIP)Sayed Fareed HasanPas encore d'évaluation

- Chapter 1Document12 pagesChapter 1Shenne Minglana0% (2)

- CHAPTER 5. Types of StrategiesDocument23 pagesCHAPTER 5. Types of StrategiesAiralyn RosPas encore d'évaluation

- Diversification in The Context of Growth StrategiesDocument10 pagesDiversification in The Context of Growth StrategieskavenPas encore d'évaluation

- Operational Improvement JUL09Document8 pagesOperational Improvement JUL09ubeat0% (1)

- Forum Bussiness ManagementDocument3 pagesForum Bussiness ManagementNisha ShanmuganathanPas encore d'évaluation

- Entrepreneurship - MGT602 VUDocument5 pagesEntrepreneurship - MGT602 VUjawad khalidPas encore d'évaluation

- Short Answer Response To Each Dot Point YearlysDocument13 pagesShort Answer Response To Each Dot Point YearlysTimothy.CaiPas encore d'évaluation

- Overview of Cost Management and StrategyDocument6 pagesOverview of Cost Management and StrategyMaribeth BetewanPas encore d'évaluation

- Lessons of Successful Change ManagementDocument9 pagesLessons of Successful Change ManagementspmPas encore d'évaluation

- 7 Design Structure RequirementsDocument5 pages7 Design Structure RequirementsEswar StarkPas encore d'évaluation

- Mergers and Acquisitions Notes MBADocument24 pagesMergers and Acquisitions Notes MBAMandip Luitel100% (1)

- Corporate Governance NotesDocument27 pagesCorporate Governance NotesjeffPas encore d'évaluation

- Conceptual BackgroundDocument14 pagesConceptual BackgroundAnwar NejaPas encore d'évaluation

- Course 7: Mergers & Acquisitions (Part 1) : Prepared By: Matt H. Evans, CPA, CMA, CFMDocument18 pagesCourse 7: Mergers & Acquisitions (Part 1) : Prepared By: Matt H. Evans, CPA, CMA, CFMAshish NavadayPas encore d'évaluation

- Corporate ParentingDocument4 pagesCorporate ParentingMohd SajidPas encore d'évaluation

- July - Aug 2010 - Gaining Good Grades in ProcurementDocument8 pagesJuly - Aug 2010 - Gaining Good Grades in ProcurementlithonPas encore d'évaluation

- Finance Case StudiesDocument12 pagesFinance Case StudiesWasp_007_007Pas encore d'évaluation

- Basic Concepts: M & A DefinedDocument23 pagesBasic Concepts: M & A DefinedChe DivinePas encore d'évaluation

- Mergers and AcquisitionDocument56 pagesMergers and AcquisitionRakhwinderSinghPas encore d'évaluation

- Developing Leaders in Your CompanyDocument2 pagesDeveloping Leaders in Your CompanySyElfredGPas encore d'évaluation

- MAS 2 - Optimal Capital StructureDocument5 pagesMAS 2 - Optimal Capital StructureNathallie CabalunaPas encore d'évaluation

- Strategic Cost Management - A Bird's Eye View: Ms. Shweta Desai Mr. Bhargav PandyaDocument9 pagesStrategic Cost Management - A Bird's Eye View: Ms. Shweta Desai Mr. Bhargav PandyaJiwan Jot SinghPas encore d'évaluation

- 2013 Furrer Encyclopedia of Management TheoryDocument6 pages2013 Furrer Encyclopedia of Management Theoryjeemee0320Pas encore d'évaluation

- Merger Management Article CompendiumDocument52 pagesMerger Management Article CompendiumAkshay Rawat100% (2)

- Diversification Strategy: Diversification in The Context of Growth StrategiesDocument10 pagesDiversification Strategy: Diversification in The Context of Growth Strategiessunnysachdev780Pas encore d'évaluation

- M&a Pitch 2Document6 pagesM&a Pitch 2kashish khediaPas encore d'évaluation

- Diversification Strategy: Diversification in The Context of Growth StrategiesDocument7 pagesDiversification Strategy: Diversification in The Context of Growth StrategiesZainab ChitalwalaPas encore d'évaluation

- SM Quiz1Document4 pagesSM Quiz1Ah BiiPas encore d'évaluation

- Mergers and AcquisitionsDocument8 pagesMergers and AcquisitionsSudābe EynaliPas encore d'évaluation

- Horizontal Merger: Reason For MergersDocument5 pagesHorizontal Merger: Reason For MergershiteshPas encore d'évaluation

- Diversification StrategiesDocument9 pagesDiversification StrategiesJebin JamesPas encore d'évaluation

- Micheal Anyika A.: What Is Supply Chain Design?Document19 pagesMicheal Anyika A.: What Is Supply Chain Design?spartPas encore d'évaluation

- BB The 10 Steps To Successful M and A IntegrationDocument12 pagesBB The 10 Steps To Successful M and A IntegrationGabriella RicardoPas encore d'évaluation

- University of Petroleum and Energy StudiesDocument7 pagesUniversity of Petroleum and Energy StudiesHrithik SharmaPas encore d'évaluation

- Corporation SuitabilityDocument13 pagesCorporation SuitabilitycoehPas encore d'évaluation

- Past Year Part 2Document5 pagesPast Year Part 2eirulzPas encore d'évaluation

- Business Policy and Strategy PDFDocument13 pagesBusiness Policy and Strategy PDFAnmol GuptaPas encore d'évaluation

- Mergers and AcquisitionsDocument79 pagesMergers and Acquisitions匿匿100% (1)

- MICRO ENVIRONMENT Includes The Following FactorsDocument6 pagesMICRO ENVIRONMENT Includes The Following FactorsUchral TsePas encore d'évaluation

- A Study On Corporate Restructuring With Special Reference To Myfino Payment World (P) LTDDocument29 pagesA Study On Corporate Restructuring With Special Reference To Myfino Payment World (P) LTDParameshwari ParamsPas encore d'évaluation

- !!!!shree Ganesh!!!!!!Document60 pages!!!!shree Ganesh!!!!!!Sandra PalinPas encore d'évaluation

- A Modern Day Blueprint for Business Growth and ExpansionD'EverandA Modern Day Blueprint for Business Growth and ExpansionPas encore d'évaluation

- Managing ChangeDocument19 pagesManaging ChangeJack GlozierPas encore d'évaluation

- The Differences Between A Merger and Acquisition Are Important ToDocument4 pagesThe Differences Between A Merger and Acquisition Are Important ToAbhishek TripathiPas encore d'évaluation

- Introduction To Management AccountingDocument46 pagesIntroduction To Management AccountingBulelwa HarrisPas encore d'évaluation

- Targeted Tactics®: Transforming Strategy into Measurable ResultsD'EverandTargeted Tactics®: Transforming Strategy into Measurable ResultsPas encore d'évaluation

- Pest AnalysisDocument59 pagesPest AnalysisKanika BhanotPas encore d'évaluation

- LokPal BillDocument3 pagesLokPal Billamit kharePas encore d'évaluation

- HRD NotesDocument13 pagesHRD NotesKanika Bhanot100% (1)

- CorruptionDocument4 pagesCorruptionKanika BhanotPas encore d'évaluation

- System Development Life CycleDocument11 pagesSystem Development Life CycleKanika BhanotPas encore d'évaluation

- Thermodynamics WorksheetDocument5 pagesThermodynamics WorksheetMalcolmJustMalcolmPas encore d'évaluation

- Zero Tolerance 2010Document16 pagesZero Tolerance 2010Adrian KozelPas encore d'évaluation

- Intro To MavenDocument18 pagesIntro To MavenDaniel ReckerthPas encore d'évaluation

- Documentos de ExportaçãoDocument17 pagesDocumentos de ExportaçãoZinePas encore d'évaluation

- The Phases of The Moon Station Activity Worksheet Pa2Document3 pagesThe Phases of The Moon Station Activity Worksheet Pa2api-284353863100% (1)

- PCM Cables: What Is PCM Cable? Why PCM Cables? Application?Document14 pagesPCM Cables: What Is PCM Cable? Why PCM Cables? Application?sidd_mgrPas encore d'évaluation

- EC 2012 With SolutionsDocument50 pagesEC 2012 With Solutionsprabhjot singh1Pas encore d'évaluation

- Fortnite Task Courier Pack 1500 V Bucks - BuscarDocument1 pageFortnite Task Courier Pack 1500 V Bucks - Buscariancard321Pas encore d'évaluation

- DBM Uv W ChartDocument2 pagesDBM Uv W ChartEddie FastPas encore d'évaluation

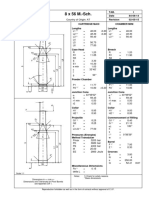

- 8 X 56 M.-SCH.: Country of Origin: ATDocument1 page8 X 56 M.-SCH.: Country of Origin: ATMohammed SirelkhatimPas encore d'évaluation

- Introduction Spreadable Media TtsDocument22 pagesIntroduction Spreadable Media TtsYanro FerrerPas encore d'évaluation

- SPFL Monitoring ToolDocument3 pagesSPFL Monitoring ToolAnalyn EnriquezPas encore d'évaluation

- Domesticity and Power in The Early Mughal WorldDocument17 pagesDomesticity and Power in The Early Mughal WorldUjjwal Gupta100% (1)

- How To Change Front Suspension Strut On Citroen Xsara Coupe n0 Replacement GuideDocument25 pagesHow To Change Front Suspension Strut On Citroen Xsara Coupe n0 Replacement Guidematej89Pas encore d'évaluation

- City Limits Magazine, December 1981 IssueDocument28 pagesCity Limits Magazine, December 1981 IssueCity Limits (New York)Pas encore d'évaluation

- VRARAIDocument12 pagesVRARAIraquel mallannnaoPas encore d'évaluation

- Thermal Physics Lecture 1Document53 pagesThermal Physics Lecture 1Swee Boon OngPas encore d'évaluation

- The DIRKS Methodology: A User GuideDocument285 pagesThe DIRKS Methodology: A User GuideJesus Frontera100% (2)

- Economics Exam Technique GuideDocument21 pagesEconomics Exam Technique Guidemalcewan100% (5)

- Densha: Memories of A Train Ride Through Kyushu: By: Scott NesbittDocument7 pagesDensha: Memories of A Train Ride Through Kyushu: By: Scott Nesbittapi-16144421Pas encore d'évaluation

- Dependent ClauseDocument28 pagesDependent ClauseAndi Febryan RamadhaniPas encore d'évaluation

- Kootenay Lake Pennywise April 26, 2016Document48 pagesKootenay Lake Pennywise April 26, 2016Pennywise PublishingPas encore d'évaluation

- New Presentation-Group AuditingDocument23 pagesNew Presentation-Group Auditingrajes wariPas encore d'évaluation

- 6int 2008 Dec ADocument6 pages6int 2008 Dec ACharles_Leong_3417Pas encore d'évaluation

- GrenTech Express Communication System Introduction 1.0Document30 pagesGrenTech Express Communication System Introduction 1.0Son NguyenPas encore d'évaluation

- Philippine Education Deteriorating - EditedDocument3 pagesPhilippine Education Deteriorating - EditedRukimi Yamato100% (1)

- Writ Petition 21992 of 2019 FinalDocument22 pagesWrit Petition 21992 of 2019 FinalNANDANI kumariPas encore d'évaluation

- Agenda - 2 - Presentation - MS - IUT - Thesis Proposal PPT Muhaiminul 171051001Document13 pagesAgenda - 2 - Presentation - MS - IUT - Thesis Proposal PPT Muhaiminul 171051001Tanvir AhmadPas encore d'évaluation

- Saudi Methanol Company (Ar-Razi) : Job Safety AnalysisDocument7 pagesSaudi Methanol Company (Ar-Razi) : Job Safety AnalysisAnonymous voA5Tb0Pas encore d'évaluation

- Chapter1 Intro To Basic FinanceDocument28 pagesChapter1 Intro To Basic FinanceRazel GopezPas encore d'évaluation