Académique Documents

Professionnel Documents

Culture Documents

Small Biz Community and Economic Development Corp.

Transféré par

My-Acts Of-SeditionDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Small Biz Community and Economic Development Corp.

Transféré par

My-Acts Of-SeditionDroits d'auteur :

Formats disponibles

REVIEW / ANALYSIS OF SUB-GRANTEES

2009/10 Small Biz Community and Economic Development Corp. Current/Previous Officers and Directors: Mary Scofield-Phillips Vince L. Johnson Marshall Mosley Ira Blue David A. McMillon Jimmy Lang Paul Rouquie Edward Phillips Jr. Gregory Mitchell Community Development Advisory Committee Meeting (6/11/2009) A Community Development Advisory Committee Meeting was held on 6/11/2009. Discussed within this meeting was the amount allocated to Small Biz Community and Economic Development Corp. (Small Biz) in the amounts of $11,000.00 and $45,000.00. On page 3 of the minutes it states, Mr. Jones and Mr. Blue recuse themselves from the Public Service projects voting process because they both belong to organizations that requested funding. Mr. Jones suggested that Mr. Blue not recuse himself from the Public Service projects voting process but instead not vote on the Economic Development projects. Mr. Blue agreed.

Regarding the discussion of granting money towards Economic Development, Small Biz requested $11,104.02 for the Job Creation program and the staff recommended $11,000.00. Additionally, $44,632.00 was requested for the Business Resource Center and the staff recommended $45,000.00. Ira Blue abstained from voting because he is an officer/director of Small Biz (Exhibit 1).

Job Creation On 4/10/2009, Small Biz submitted a Community Development Block Grant & HOME Investment Partnership Program Request for Proposal Application, requesting $11,104.02 in funding to create two jobs to help benefit residents in the area (Exhibit 2). 94

The RFP Application indicates that no previous funding had been allocated to Small Biz.

The proposed project description is,

The project will create two jobs, one to support the Small Biz Building Trades Program and one to support the Business Resource Center. Both jobs will be located in the CDBG and provide a general benefit to residents and businesses in the Pompano Beach area to create jobs, provide business assistance and training to residents of Pompano Beach, Florida.

This job creation project was projected to help benefit 332 housing units in the area. It further states out of the 332 being served, 80 of them are moderate income persons, 45 low income persons, and 32 very low income persons.

The RFP continues to state, The HUD funds will be used to pay for 4 tables, 17 chairs, 6 computers, 1 networking system, 1 laser printer, 1 42-inch TV, 1 laminating machine, 1 partition unit, 1 computer desk, 1 file cabinet, 1 DVD player, 1 projector.

Attached with the RFP application is a Conflict of Interest Exception (Exhibit 3). The conflict is between the officer/director of Small Biz, Mary Philips, and her husband Edwards Philips. The document states that Edward Philips is not a board member of Small Biz, yet on the Not-for-Profit Corporation Annual Report, it lists Edward Philips on the Officers and Directors section. Additionally, the Conflict of Interest Exception indicates, an oral agreement to lease desk space for $300 per month from PF Insurance and Financial Service until the organizations can obtain funds to pay for the space or find a suitable location. Additionally, the Conflict of Interest Exception indicates, The rent of $750 per month total will include space, water, electric and the use of the phones and receptionist service. There seems to be a discrepancy with the conflict of interest exception in that it falsely states that Edward Philips is not a board member of Small Biz.

95

It should be noted that Mary S. Phillips (Phillips) is listed as an officer / director of PF Insurance & Financial Services, Inc. PF Insurance & Financial Services, Inc. is a Florida Profit corporation located at 160 N Powerline Road, Pompano Beach, FL 33069 (Exhibit 4).

An agreement was entered into on 10/1/2009 for the Job Creation Project for the term of the agreement October 1, 2009 through September 30, 2010 to provide $11,000 in funding. The agreement is signed by Mary Phillips, President of Small Biz on 11/25/2009. Mayor Lamar Fisher and Interim City Manager Phyllis Korab signed on the Citys behalf on 12/10/2009 (Exhibit 5).

The terms of the agreement allow the City to audit the records of the grantee for a period of three (3) years after final payment is made (Section 2.6). The CD Division will also conduct on-site monitoring visits of the grantee as often as necessary. Additionally, section 4.1 indicates, GRANTEE shall use CDBG funds in the amount of $11,000 for the Job Creation Project as outlined in the proposal and budget which are attached to this agreement as Exhibit A. No Exhibit A was included in the case file.

A Quarterly Progress Report was available indicating that 0 clients had been served for the period of October 2009 through December 2009. The report, however, does indicate that the corporation has worked on producing promotional materials to help promote the project. The report mentions that Small Biz plans on creating a website to help attract more attendance at the seminars. The report is dated 2/24/2010 and is signed by the Accountant/Treasurer, Gregory Mitchell and states that $11,000.00 was spent for computers/equipment to date, with $0.00 in funding remaining. Only one Progress Report was contained in the case file for Kesslers review (Exhibit 6).

As per the Job Creation agreement dated 10/1/2009, monitoring visits should have been conducted, but there is no information available in the case file indicating as such. The monitoring visits are to be conducted to review project records, inventory control records, procurement records, and records supporting the use of equipment that was purchased 96

with CDBG funds (Exhibit 7). It appears there was a failure to conduct these visits by Medina, Program Specialist, in violation of the agreement between Small Biz and the City.

Kessler had asked Medina various questions regarding the purchases made by Small Biz and Medina explained that he personally helped Small Biz with their setup. Medina noted that he helped move all the chairs that were purchased into the Small Biz office. Additionally, Medina mentioned that he has been to the Small Biz office multiple times and that they are using the equipment received for the correct purposes. Even though Medina maintained that multiple visits were conduct to the premise no monitoring reports were observed in the case file.

An invoice dated 12/11/2009 was issued to the City from Small Biz in the amount of $11,000.00. The invoice listed 12 computers, screens & wireless ($4,978.64), 2 printers ($599.68), 36 chairs ($1,415.64), 10 tables ($1,520.82), 1 TV ($648.00) and 7 software/screens/display board ($1,836.92) (Exhibit 8). On 12/14/2009, a City of Pompano Beach Purchase Order, #101426, was requisitioned by Medina and confirmed by Mary A. Scofield-Phillips for the invoice amount of $11,000.00 (Exhibit 9). The purchase order was then canceled on 2/16/2010 as per Medina (Exhibit 10). Additional purchase orders were in the case file in the amount of $2,106.88 and $1,187.12; these were purchase orders #101943 and #101926, respectively. It appears these purchase orders were paid, yet there are no checks in the case file to reconcile these orders.

Additional research was done relative to the purchase order pertaining to Small Biz. Kessler contacted the finance department to receive support for the purchase orders that were in the case file. The purchase order in the amount of $1,187.12 was for office supplies, a copier and a printer (Exhibit 11). The purchase order in the amount $2,106.88 was for chairs that were purchased from bizchair.com (Exhibit 12).

When questioned about the total expenses paid, the Controller of the City, Andrew JeanPierre (Jean-Pierre), indicated that it appeared Small Biz still had available funds. 97

Kessler then informed Jean-Pierre that Medina, Program Specialist of the OHUI, indicated that the City purchased 10 computers for Small Biz. Jean-Pierre stated that he was unaware of this transaction and requested that Kessler provide additional documents to further research this discrepancy. Kessler was able to secure a REQ. NO. 2010002721, which enabled Jean-Pierre to further research the query and find the invoice for the purchase of 10 computers. The invoice was not contained in the case file. Check #546893 dated 3/31/2010 was made payable to Dell in the amount of $7,643.50 for 10 computers. Purchase order #102240 in the amount of $7,643.60 is dated 3/17/2010 and was requested by Medina on 3/11/2010. This purchase order was then confirmed by Simon Gervais of Dell Marketing, L.P. and authorized by the purchasing agent, Leeta Hardin (Exhibit 13).

Business Resource Center On 4/10/2009, Small Biz submitted a Request for Project Proposal Application to the City requesting $44,632.00 in CDBG funding for the Business Resource Center. The summary of the project indicates, The project will provide a classroom environment to benefit local businesses in the community by providing workshops and technical assistance to beginning and existing businesses located in the target area. The workshops will focus on computer skill, taxes, marketing, management, credit and capital, business certifications and how to complete and submit RFPs etc.

The Application indicates that 300 people will benefit from the project, including 125 moderate income individuals, 70 low income and 40 very low income. The $44,632.00 requested in CDBG funding will be utilized for $39,132.00 in personnel expenditures, $2,500.00 in supplies and $3,000.00 in other (advertising/materials/software). Also included in the application is a Certification of Compliance with the City, Conflict of Interest and Procurement Policies, signed and dated by Mary Scofield Phillips on 4/10/2009. This Certification of Compliance indicates in section I (A),

Conflict of Interest It shall be unlawful for any employee of the city to participate, directly or indirectly, through decision, approval, disapproval, recommendation, 98

preparation of any part of a purchase request, influencing the content of any specification or purchase standard, rendering advice, investigation, auditing or otherwise, in any proceeding or application, request for ruling or other determination, claim or controversy or other matter pertaining to any contract or subcontract or any solicitation or proposal therefore to the employees knowledge there is a financial interest possessed by:

1) The employee or the employees immediate family; 2) A business other than a public agency in which the employee or a member of the employees immediate family serves as an officer, director, trustee, partner or employee; or 3) Any other person or business with whom the employee or a member of the employees immediate family is negotiating or has an arrangement concerning prospective employment.

As per Section I (C) of the Certification of Compliance states,

No person who is an employee, agent, consultant, officer, or elected or appointed official of the grantee, nonprofit recipient that receives emergency shelter grant amounts and who exercises or has exercised any functions or responsibilities with respect to assisted activities, or who is in a position to participate in a decision making process or gain inside information with regard to such activities, may obtain a subcontract, or agreement with respect to thereto, or the proceeds there under, either for him or herself or for those with whom he or she has family or business ties, during his or her tenure, or for one year thereafter. HUD may grant an exception to this exclusion as provided in 24 CFR 570.611 (d) and (e) and/or 92 CFR 92.356 (f) (2) (Exhibit 14).

It appears that Small Biz may be in violation of the Certification of Compliance and the Conflict of Interest and procurement Policies.

99

On 12/8/2009 Resolution No. 2010-65 was submitted and approved by Mayor Lamar Fisher and attested by the City Clerk Mary L. Chambers. The resolution approved and authorized the proper City Officials to execute a sub-grantee agreement between the City and Small Biz Community & Economic Development Corp. for workshops and technical assistance (Exhibit 15).

The Sub-grantee Agreement dated 10/1/09 was signed by Mary Phillips from Small Biz on 11/25/2009 and by Lamar Fisher, Mayor, and Phyllis Korab, Interim City Manager, on 12/10/2009. The Agreement indicates that $45,000.00 in CDBG funding has been allocated to Small Biz for the Business Resource Center. Enclosed as Exhibit A to the agreement is a 2010 Budget Summary which indicates that $39,321.00 is allocated to personnel ($36,000.00 for the Program Director and $3,321.00 for FICA), $1,700.00 for accounting services and contract services, $1,529.00 for advertisement materials/software and $2,450.00 for supplies (Exhibit 16).

Two Quarterly Progress Reports were provided in the case file for Program Year 2009-10 for October 2009 through December 2009 and January 2010 through March 2010. The October 2009 through December 2009 Quarterly Progress Report appears to be a duplicate of the same Quarterly Progress Report that was submitted for the Job Creation Project for the same period. The only difference is the Contract Financial Tracking section, which delineates the contract financial tracking for Program Director Salary ($9,000.00); Fringe Benefits ($688.50); Accounting Services ($450.00) and Advertisement Materials/Suppliers ($1,037.50) with $33,593.50 in remaining budget (Exhibit 17).

The Quarterly Progress Report for the period January 2010 through March 2010 denotes that eleven (11) new clients have entered the program and that the website has been designed and developed, a class schedule has been set-up and advertisements have been placed in various media outlets. The total amount of expenditures claimed to date were salary & fringe benefits ($19,754.00), general admin. ($895.42) and supplies ($12.10).

100

The total amount remaining for the budget is $21,206.48. The document was signed and dated by Mary Phillips on 4/2/2010 (Exhibit 18).

A purchase order was requested on 12/11/2009 by Medina, and confirmed by Mary A. Scofield-Phillips in the amount of $45,000.00. The purchase order description for the money requested indicates Human Services Counseling, CDBG Grant Program Business Resource Center Sub-grantee Agreement Approved VIA City Commission Resolution 12/8/09 #10. No documentation was contained in the case file to indicate that this purchase order was ever paid (Exhibit 19).

On 12/11/2009, Small Biz submitted an invoice to the City in the amount of $2,910.82 for accounting ($250.00), computer hosting / website ($812.00), advertising materials ($469.48), software ($601.88), computer set up ($150.00) and supplies ($627.46). The only document provided to support this expense is an invoice (#1) from Gregory Mitchell (officer/director of Small Biz) for monthly accounting services ($100.00 per month) and accounting system setup ($150.00). Additionally, invoice #1 from 3G Graphicsdezines and Printing cites an amount of $974.00 for website, comprised of ($812.00), web hosting ($12.00) and computer set up ($150.00) (Exhibit 20). Documentation was clearly not supplied to substantiate the expenses incurred by Small Biz. It should be noted that an address for 3G Graphicsdezines and Printing is not provided on the invoice. Kessler was unable to locate a business or fictitious business by the name of 3G Graphicsdezines and Printing on www.sunbiz.org. A website was secured with the same business name as 3G Graphicsdezines and Printing located at http://www.3ggraphics.com, but Kessler has not been able to verify if these two companies are connected in any way.

An invoice dated 12/17/2009 from Small Biz was provided to the City for reimbursement of the Program Director salary for October through December 2009. The Program Director (Mary Phillips) is claimed to be paid $3,000.00 per month and $302.97 per month in fringe benefits. The invoice totals $9,688.50 and Kessler was unable to 101

reconcile the calculation of fringe benefits per month. Additionally, no supporting documentation was provided in the case file to substantiate these expenses (Exhibit 21). It does not appear that any payments were made to Small Biz from the City for this expense.

Another invoice was submitted to the City by Small Biz on 4/2/2010 in the amount of $20,661.52. The invoice lists the following expenditures incurred by Small Biz: Description Salary & Fringe Benefits 10/1/09 12/31/09 Salary & Fringe Benefits 1/1/10 3/31/10 Accounting Service Set Up Monthly Accounting Services 10/1/09 3/31/10 Advertising Materials & Postage Supplies Amount $10,065.50 $9,688.50 $150.00 $600.00 $145.62 $12.10

Kessler noted that the invoice for Salary & Fringe Benefits 10/1/2009 12/31/2009 originally submitted on 12/17/2009 was in the amount of $9,688.50. However, on the most recent invoice (4/2/2010), this amount was changed to $10,065.50. Documentation was submitted to substantiate the hours worked by the Program Director (Mary Phillips). The invoice submitted on 4/2/2010 for the Accounting Services by Gregory A. Mitchell (officer/director of Small Biz) is the same invoice number (#1) produced by Small Biz for reimbursement of costs incurred on 12/17/2009 invoice, except with conflicting information and different dates. Advertising materials and postage on the 4/2/2010 invoice totaled $145.62, but only supporting documentation for $124.27 was provided (Exhibit 22). It does not appear that any payments were made by the City to Small Biz for these expenses, as no documentation is contained in the case file to support payment of these invoices by the City.

Contained in the case file is a Memorandum dated 4/16/2010 from Carrillo, Interim Director to Dennis Beach, City Manager thru Willie Hopkins, Assistant City Manager. The memorandum states, This memo serves as a formal response to the City Commissions request for an explanation as to my recommendation to not fund Small Biz Community and Economic Development Corporation (SBCEDC). Carrillo indicates 102

that there is a possible conflict of interest because an officer / director of Small Biz is listed a member of the Citys Community Development Advisory Committee (Exhibit 23). A letter was sent by Willie A. Hopkins, Jr., Assistant City Manager on 4/29/2010 to Mary Scofield Phillips stating,

In recent review of Small Biz Community and Economic Development Corporation (SBCEDC) sub-grantee agreement, it was brought to our attention that there may be serious conflict(s) of interest issues. This is a potentially serious problem because it may, as you are currently constituted, impede your ability to carry out the program. During our review, we discovered the following conflict of interest violation relating to Mr. Edward Phillips, Mr. Ira Blue and Mrs. Mary Scofield Phillips. One of the threshold requirements, for an exemption, is that the conflict be publicly disclosed (24 CFR 570.611 (d) (1)). It is required that all agencies disclose instances of this nature. We did note a disclosure reference for Mr. Edward Phillips in your file, but it was not a public disclosure. There was not a disclosure of the nature of Mr. Ira Blues affiliation as a board member of the organization and the City of Pompano Beachs Community Development Advisory Committee. Finally, you receive a salary as the Director of Small Biz Community and Economic Development Corporation (SBCEDC) and you are the President of the Board of Small Biz Community and Economic Development Corporation (SBCEDC).

The letter continues to cite various HUD regulations supporting allegations of a conflict of interest (Exhibit 24).

In a letter dated 5/4/2010 Mary Phillips responds to the letter sent by Willie A. Hopkins, Jr. Phillips states that on 9/8/2008 Mr. Edward Phillips resigned from being a board member. Phillips continues to indicate that Mr. Gregory Mitchell, on the board of Small Biz, conducts the bookkeeping functions of the organization and is compensated for his services. Regarding Mr. Ira Blue, Phillips indicated that Ira Blue disclosed to the City 103

that he was a board member of Small Biz and the Community Development Advisory Committee and does not receive any compensation for serving on the board of Small Biz. Phillips also includes various documents to further substantiate her claim that no conflicts of interest occurred. No resolution to the possible conflict of interest was contained in the case file. Interviews and Analysis of Documents Provided by Small Biz Community & Economic Development Corp. Kessler conducted an onsite visit to Small Biz, located at 160 N Powerline Road, Pompano Beach, FL 33069. During the visit, Phillips indicated that they requested 12 computers and only 10 computers were received from the City. Kessler confirmed that there were 10 computers at the location of Small Biz and 24 chairs (23 black/gray and 1 green).

Phillips stated that on average, one (1) workshop is conducted per month. Phillips also offered Kessler access to documents located on premise, which included information pertaining to the programs already held. She stated that the types of classes and/or workshops provided by Small Biz include a computer workshop, website design and a grant writing and financing your business seminar (provided in part by Bank of America). Kessler noted that there were 5 seminars held by Small Biz for which Phillips provided documentation, including:

Small Biz Development Expo / Suit Donation (undated) Phillips indicated that this seminar was held off-site on a Saturday with a $50 donation recommended for the individuals attending. She continued to indicate that 12 people / organizations donated suits and 9 exhibitors attended the expo. Phillips stated that she was unaware of the time frame in which the expo occurred.

Unnamed Workshop (undated) Kessler noted that there were 8 individuals who attended the workshop, all of which paid the $25.00 registration fee (8 X $25.00 = $200.00).

104

Financing Your Business (provided in part by Bank of America) (5/6/2010) Kessler was advised by Phillips that this workshop had 17 individuals attend. Of the 17 in attendance, 8 people were marked as paying an amount of $15.00 each (8 X $15.00 = $120.00).

Contract Preference (6/26/2010) Only one individual attended this workshop, and the person paid $15.00.

Grant Writing Workshop (7/10/2010) Phillips indicated that 16 people attended this workshop on 7/10/2010, including State Representative Gwendolyn Clarke-Reed. Additionally Phillips stated that individuals from Miami and Deerfield Beach also attended the workshop.

On numerous occasions Kessler was told by Phillips that the most requested workshop is for a QuickBooks seminar. Phillips indicated that she does not have the funds to purchase 10 licenses for the QuickBooks software, and it would be inefficient for a workshop to function with only a couple versions of QuickBooks installed on a few computers.

Phillips also voiced her disapproval regarding the process in which the City has been issuing the CDBG funding. She stated that the City works on a reimbursement basis, where the sub-grantee that has been allocated funding must incur expenses and then request reimbursement from the City.

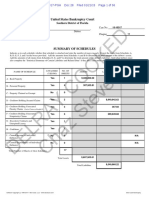

Kessler requested from Phillips that the Profit and Loss Statement and Balance Sheet for Small Biz be provided for 2009 and 2010. On 7/22/2010, Phillips provided the requested documents (Exhibit 26). The financial statements supplied do not indicate any grants provided by the City to Small Biz. Additionally, Kessler was advised by Phillips that the instructors are paid $25.00 per hour yet on the 2010 Profit Statements only $50.00 is listed as the fee for Contract Services for Instructors. A schedule of the income, expenditures and net income is provided below: 105

2009 Income Expenses Net Income $ 890.30 $ 1,061.10 $ (170.80)

January through June 2010 $ 565.71 $ 647.48 $ (81.77)

Kessler placed a telephone call on 7/27/2010 to Lauryn Charles of Accountable Financial Services Group, Inc. (Charles), an accounting instructor for Small Biz. Charles refused to discuss in detail anything about Small Biz Community & Economic Development Corp. until she, checked us out. Charles did state that there were no classes and/or seminars conducted by her during 2009.

106

Vous aimerez peut-être aussi

- Chaz - Misuse Seal DonnellyDocument3 pagesChaz - Misuse Seal DonnellyMy-Acts Of-SeditionPas encore d'évaluation

- Service ReturnedDocument1 pageService ReturnedMy-Acts Of-SeditionPas encore d'évaluation

- L Lakes Comm MTG 3 24 15Document5 pagesL Lakes Comm MTG 3 24 15My-Acts Of-SeditionPas encore d'évaluation

- Binder 1Document19 pagesBinder 1My-Acts Of-SeditionPas encore d'évaluation

- Coddington - 106.071 - Sign - ElecCommDocument2 pagesCoddington - 106.071 - Sign - ElecCommMy-Acts Of-SeditionPas encore d'évaluation

- Sasser Decision - 022315Document7 pagesSasser Decision - 022315My-Acts Of-SeditionPas encore d'évaluation

- Maos Chaz Stevens Suck On This: L L L LDocument3 pagesMaos Chaz Stevens Suck On This: L L L LMy-Acts Of-SeditionPas encore d'évaluation

- Delrabian Chaz Stevens: Filing# 23315866 E-Filed 02/03/2015 03:39:01 PMDocument1 pageDelrabian Chaz Stevens: Filing# 23315866 E-Filed 02/03/2015 03:39:01 PMMy-Acts Of-SeditionPas encore d'évaluation

- BinderDocument17 pagesBinderMy-Acts Of-SeditionPas encore d'évaluation

- Cooked Chaz Stevens: United States Bankruptcy CourtDocument56 pagesCooked Chaz Stevens: United States Bankruptcy CourtMy-Acts Of-SeditionPas encore d'évaluation

- RedactedDocument2 pagesRedactedMy-Acts Of-SeditionPas encore d'évaluation

- United States Bankruptcy Court: Southern District of FloridaDocument56 pagesUnited States Bankruptcy Court: Southern District of FloridaMy-Acts Of-SeditionPas encore d'évaluation

- Cooked Chaz Stevens: United States Bankruptcy CourtDocument56 pagesCooked Chaz Stevens: United States Bankruptcy CourtMy-Acts Of-SeditionPas encore d'évaluation

- Coddington - Misuse Seal DonnellyDocument3 pagesCoddington - Misuse Seal DonnellyMy-Acts Of-SeditionPas encore d'évaluation

- Maos Cease and Desist RobbDocument2 pagesMaos Cease and Desist RobbMy-Acts Of-SeditionPas encore d'évaluation

- Ac 2015 0122 Review Rocs ProgramDocument51 pagesAc 2015 0122 Review Rocs ProgramMy-Acts Of-SeditionPas encore d'évaluation

- Ron Gilinsky EvictionDocument4 pagesRon Gilinsky EvictionMy-Acts Of-SeditionPas encore d'évaluation

- Christina Morrison Sells Her SoulDocument12 pagesChristina Morrison Sells Her SoulMy-Acts Of-SeditionPas encore d'évaluation

- Delray Trash ContractDocument2 pagesDelray Trash ContractMy-Acts Of-SeditionPas encore d'évaluation

- Coffey Wheelbrator BullshitDocument1 pageCoffey Wheelbrator BullshitMy-Acts Of-SeditionPas encore d'évaluation

- Binder 2Document12 pagesBinder 2My-Acts Of-SeditionPas encore d'évaluation

- Cooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5Document13 pagesCooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5My-Acts Of-SeditionPas encore d'évaluation

- Preston - Campaign Kickoff FundraiserDocument1 pagePreston - Campaign Kickoff FundraiserMy-Acts Of-SeditionPas encore d'évaluation

- Waste ManagementDocument38 pagesWaste ManagementMy-Acts Of-SeditionPas encore d'évaluation

- Jarjura - 196 - FDLE - RedactedDocument2 pagesJarjura - 196 - FDLE - RedactedMy-Acts Of-SeditionPas encore d'évaluation

- Suggestion of BankruptcyDocument5 pagesSuggestion of BankruptcyMy-Acts Of-SeditionPas encore d'évaluation

- Christina Morrison Deadbeat DebtorDocument5 pagesChristina Morrison Deadbeat DebtorMy-Acts Of-SeditionPas encore d'évaluation

- NDocument3 pagesNMy-Acts Of-SeditionPas encore d'évaluation

- H Inners SettlementDocument18 pagesH Inners SettlementMy-Acts Of-SeditionPas encore d'évaluation

- Unpaid LienDocument1 pageUnpaid LienMy-Acts Of-SeditionPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Objective TestsDocument2 pagesObjective TestsobepspPas encore d'évaluation

- LPCC Lab Assignment - 1Document13 pagesLPCC Lab Assignment - 1YUVRAJ SHARMAPas encore d'évaluation

- Data PreprocessingDocument38 pagesData PreprocessingPradhana RizaPas encore d'évaluation

- SIP5 Operating V07.00 Manual C003-6 enDocument218 pagesSIP5 Operating V07.00 Manual C003-6 enMadhavasrinivasanSathiamoorthyPas encore d'évaluation

- Manual de GoniometríaDocument4 pagesManual de GoniometríaEd RománPas encore d'évaluation

- What Can You Do With Windows Subsystem For LinuxDocument14 pagesWhat Can You Do With Windows Subsystem For LinuxDavid SofitaPas encore d'évaluation

- VLF Trendsetter User ManualDocument118 pagesVLF Trendsetter User Manualmsamsoniuk0% (1)

- FrancisJayYumul Philippines 8.09 YrsDocument2 pagesFrancisJayYumul Philippines 8.09 YrsJV FPas encore d'évaluation

- Stretton Hathaway1.1Document132 pagesStretton Hathaway1.1Sreeraj ThekkethilPas encore d'évaluation

- LogDocument122 pagesLogmahdi.afgPas encore d'évaluation

- AP03-AA4-EV04. Inglés - Elaboración de Resúmenes para Comprender Textos Básicos en InglésDocument9 pagesAP03-AA4-EV04. Inglés - Elaboración de Resúmenes para Comprender Textos Básicos en InglésJuan carlos TrianaPas encore d'évaluation

- Bim - RipacDocument11 pagesBim - RipacxnazmiexPas encore d'évaluation

- Testing PreliminaryDocument6 pagesTesting PreliminaryPrashantHegdePas encore d'évaluation

- Being Himachali - ... - .Document4 pagesBeing Himachali - ... - .nk637Pas encore d'évaluation

- CS6306 - Unified Functional Testing - Final Quiz 2 - Attempt ReviewDocument8 pagesCS6306 - Unified Functional Testing - Final Quiz 2 - Attempt ReviewLolita CrebilloPas encore d'évaluation

- Proposal Spotify Recommendation SystemDocument13 pagesProposal Spotify Recommendation SystemAmarjeet VishwakarmaPas encore d'évaluation

- Java MCQDocument12 pagesJava MCQrony royPas encore d'évaluation

- Set Up IP and Port Send SMS: Adminip123456 Ip Port Such As: Adminip123456 220.231.142.241 7700Document4 pagesSet Up IP and Port Send SMS: Adminip123456 Ip Port Such As: Adminip123456 220.231.142.241 7700Driff SedikPas encore d'évaluation

- Arya's ResumeDocument1 pageArya's ResumeAyush SaxenaPas encore d'évaluation

- Plan and dispatch efficiently with IVU.railDocument32 pagesPlan and dispatch efficiently with IVU.railmakbadrusPas encore d'évaluation

- APM - 9.5 Cross Enterprise Integration GuideDocument194 pagesAPM - 9.5 Cross Enterprise Integration Guideggen_mail.ruPas encore d'évaluation

- FreshdeskDocument17 pagesFreshdeskChristian JoePas encore d'évaluation

- PICASA Software DocumentationDocument12 pagesPICASA Software DocumentationFurrukh MahmoodPas encore d'évaluation

- Solved Question Paper Computer Operator 2011 Samsad SewaDocument13 pagesSolved Question Paper Computer Operator 2011 Samsad SewaksunilbPas encore d'évaluation

- Lab 9-The C# Station ADO - Net TutorialDocument11 pagesLab 9-The C# Station ADO - Net TutorialHector Felipe Calla MamaniPas encore d'évaluation

- Vietnam Legislation - Ekino Vietnam - Web VersionDocument7 pagesVietnam Legislation - Ekino Vietnam - Web VersionTam NguyenPas encore d'évaluation

- Epp Ict and Entrepreneurship 6Document5 pagesEpp Ict and Entrepreneurship 6francismagno14Pas encore d'évaluation

- Oracle Fusion Middleware: User's Guide For Oracle Data Visualization DesktopDocument96 pagesOracle Fusion Middleware: User's Guide For Oracle Data Visualization DesktopppmurilloPas encore d'évaluation

- The AdES Family of Standards - CAdES XAdES PAdESDocument11 pagesThe AdES Family of Standards - CAdES XAdES PAdESDanielSilvaPas encore d'évaluation

- Developing A Template For Linked ListDocument10 pagesDeveloping A Template For Linked ListsujithamohanPas encore d'évaluation