Académique Documents

Professionnel Documents

Culture Documents

Answer Sir 28 July

Transféré par

gauravtripathi429Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Answer Sir 28 July

Transféré par

gauravtripathi429Droits d'auteur :

Formats disponibles

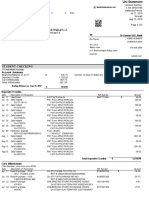

Trial balance Rs. Million Rs.

Million Share capital 200 Share premium 2000 Retained earnings 3886 9% Preference share capital 100 Furniture & Equipment 5000 Plant & machinery 400 Building 500 Land 400 Vehicles 200 Purchases of raw material 4000 Sales 8000 Advance to suppliers 300 Advance from customers 600 Loans to Group companies 1000 Loans to employees 250 Convertible Debentures 720 Salaries and wages 2000 Obligation for retirement gratuity of emplyees 0 200 Investments earmarked for retirement gratuity 200 Current service cost for retirement gratuity 20 Opening Stock 100 Cash and bank balances 257 Investments 300 Provision for customer loyalty programme 0 20 Spares 20 Spares purchased 100 Power & Fuel 500 Commission 30 12% Loans 2000 Brand 500 Patent 300 Software 100 Distribution Right 100 Accumulated Depreciation 1311 Accumulated Amortisation 590 Valuation Allowance 500 Other factory expenses 400 Trade Receivables 1200 Administrative expenses 300 Sales promotion 100 Trade discount 600 Dividend on Equity Shares paid for 2009-10000 1 Advance for purchase of land 50 Security deposit from contractor 100 20227 20227

Tangible Fixed Asset Schedule Land Building Plant & Machinery Furniture & Equipment Vehicles

Rs. in Million Cost Additions 1.4.2010 During the year 400 500 400 5000 200 6500 Scrap 25 20 250 10 Useful life ( Years)

Sales 50 -100

50

-100 Annual SLM Depreciation 9.5 19 475 38

Depreciation Building Plant & Machinery Furniture & equipment Vehicles

50 20 10 5

Agreed to purchased a piece of new land but not yet registered A piece of machinery costing 100 is sold for 75 ; this is not yet recorded Intangible Asset Schedule Brand Patent Software Distribution Right Cost 1.4.2010 500 300 100 100 1000 Useful life ( Years) 10 20 5 5 Expired life 5 12 4 4

Closing stock Closing stock of spares

160 30 Old spares 20 are still in stock

Trade receivables include receivables amounting to 200 which remained uncollected over 2 years Valuation allowance on such trade receivables 50% Bad debt to be written off 50 Additional allowance to be created 75 Contractors are engaged to construct a new factory building . They deposited 100 Work is in progress . As on 31.3.2011 they billed 500 . The work has been approved.

Convertible debentures are issued on 1.4.2010 in the form of a zero coupon bond @ 720 per bond having par value of 1000. These bond are optionally convertible into one equity shares of 1000 after 5 years The company issued 1 million CDs Issue price of plain vanilla bond issued by similar rated companies

Accumulated depreciation 1.4.2010 0 95 152 950 114 1311 Expired life ( Years) 10 8 2 3

Depreciation for the year Accumulated depreciation

Annual Amortisation 50 15 20 20 105

Accumulated amortisation 1.4.2010 31.3.2011 250 300 180 195 80 100 80 100 590 695

per bond having par value of 1000.

Trial balance Rs. Million Share capital Share premium Retained earnings 9% Preference share capital Furniture & Equipment Plant & machinery Building Land Vehicles Purchases of raw material Sales Advance to suppliers Advance from customers Loans to Group companies Loans to employees Convertible Debentures Salaries and wages Obligation for retirement gratuity of emplyees Investments earmarked for retirement gratuity Current service cost for retirement gratuity Opening Stock Cash and bank balances Investments Provision for customer loyalty programme Spares Spares purchased Power & Fuel Commission 12% Loans Brand Patent Software Distribution Right Accumulated Depreciation Accumulated Amortisation Valuation Allowance Other factory expenses Trade Receivables Administrative expenses Sales promotion Trade discount Dividend on Equity Shares paid for 2009-10 Advance for purchase of land Security deposit from contractor

Rs. Million 200 2000 3886 100 5000 400 500 400 200 4000 8000 300 600 1000 250 720 2000 0 200 20 100 257 300 0 20 100 500 30 500 300 100 100 1311 590 500 400 1200 300 100 600 1000 50 20227 100 20227 200

20

2000

FS Element Equity Equity Equity Liability as per IFRS ; equity as per Indian GAAP Asset Asset Classified as prperty , plant and equipment Asset Asset Asset Expense Income Asset assumed as current assets ; classified as sho Liability assumed as current liabilities ; classified as o Asset Classified as long term loans and advances Asset Compound financial instruments to be segregated into l Expense Liability Other non-current liability Asset Other non-current asset Expense Asset/ Expense Asset Current assets Asset Liability Current liability of to be settled within 12 mo Asset ( it is a stock) Expense Expense Expense Liability Asset Asset Classified as intangible assets Note 2 Asset Asset Equity Check updating of accumulated depreciation Equity in Notes 1A & 1B , 2 Liability ( deduction from asset for which allowance is c Expense Asset Current assets Expense Expense Deduction from sales ; sales are presented net Equity ( deduction from retained earnings) ; In India it is Asset Other current assets Liability Other non-current liabilities

bility as per IFRS ; equity as per Indian GAAP Classified as prperty , plant and equipment

assumed as current assets ; classified as short term loans and advances assumed as current liabilities ; classified as other current liabilities Classified as long term loans and advances

Note 1 A Rs. in Million Tangible Fixed Asset Schedule Cost 1.4.2010 Land 400 Building 500 Plant & Machinery 400 Furniture & Equipment 5000 Vehicles 200 6500 Note 1B Depreciation Scrap Building 25 Plant & Machinery 20 Furniture & equipment 250 Vehicles 10

mpound financial instruments to be segregated into liability and equity Other non-current liability Other non-current asset

Current assets Current liability of to be settled within 12 months after 31.3.2011

Agreed to purchased a piece of new land but not yet register A piece of machinery costing 100 is sold for 75 ; this is not ye Note 2 Intangible Asset Schedule Cost 1.4.2010 Brand 500 Patent 300 Software 100 Distribution Right 100 1000 Closing stock Clsoing stock of spares 160 30

Classified as intangible assets Note 2

Note 6 Closing Old spares 20 non New spares 10 current as

Check updating of accumulated depreciation & amortisation in Notes 1A & 1B , 2 bility ( deduction from asset for which allowance is created , for example ,trade receivables) Current assets Note 7 Inventories as on 31.3.2011 classified as current asset Stock of Raw material Stock of spares Classified as current assets

duction from sales ; sales are presented net uity ( deduction from retained earnings) ; In India it is presented as a liability Other current assets Other non-current liabilities

Rs. in Million Additions Sales During the year 50

50

Accumulated depreciation the year Depreciation for Ne 1.4.2010 31.3.2011 0 0 400 95 104.5 395.5 -100 152 128.25 171.75 950 1425 3575 114 152 48 -100 1311 1809.75 4590.25

Useful life ( Annual SLMExpired life ( Years) Years) Depreciation 50 9.5 10 20 19 8 10 475 2 5 38 3 541.5 hased a piece of new land but not yet registered inery costing 100 is sold for 75 ; this is not yet recorded

1852.5

Useful life ( Expired life Annual Amortisation Years) Accumulated amortisation Balance Net 1.4.2010 31.3.2011 10 5 50 250 300 200 20 12 15 180 195 105 5 4 20 80 100 0 5 4 20 80 100 0 105 590 695 305 Deduction from Opening stock + Purchases ; it is an asset Old spares 20 are still in stock

Note 6 Closing stock of spares Old spares 20 non-current asset New spares 10 current assets

n 31.3.2011 classified as current asset 160 10 170

Profit and Loss Statement Sales net Other Income Expenses Raw material consumed Employee Benefit Expenses Expenses Valuation allowance Depreciation & Amortisation Interest Profit before tax Current tax Profit After Tax

Comment 7400.00 net of trade discount 17.75 7417.75 3940.00 2020.00 1420.00 75.00 646.50 249.00 8350.50 -932.75 0.00 -932.75 Opening stock + Purchases - Closing stock Salaries & wages + Current service cost of retirement gratuity Notes 1 A &1B, 2 Note 3

Balance Sheet as on 31.3.2011 Assets Non-current Assets Intangible Assets Property , Plant & Equipment Long term Investment Long term Loans and advances Other Non-current Assets Current Assets Inventories Trade Receivables 1150 Less valuation Allowance 525 Cash & Cash equivalents Other current Assets Total Assets Equity & Liabilities Equity Equity Share Capital Share Premium Retained earnings Non-current Liabilities

Note 2 1A 305.00 4590.25 300.00 1250.00 220.00 6665.25 170.00 625.00 257.00 425.00 1477.00 8142.25

7 5

200.00 2000.00 1953.25 4153.25

Long term borrowings Other Non-current Liabilities Current Liabilities Provisions Other current liabilities Total Liabilities Total Equity & Liability

2820.00 300.00 3120.00 20.00 849.00 869.00 3989.00 8142.25

Statement of Changes in Equity Share Capital Balance as on 1.4.2010 Additions during 2010-11 Dividend paid Balance as on 31.3.2011 Share Premium Retained earnings Total 200 2000.0 3886 -932.8 -1000.0 200 2000 1953.25

rement gratuity

Expenses Repairs & Maintenance 90.00 Consumption of spares = Opening stock of spares + Purchases - closing stock of spa Power Fuel 500.00 Commission 30.00 Other Fy Expenses 400.00 Adminsitrative Expenses 00.00 3 Sales promotion 100.00 1420.00

Note 3 Interest 9% Preference share capital 12% Loans Note 4 Profit / Loss on sale of plant and machinery Cost Accumulated depreciation as on 31.3.2011 Written down value Sale proceeds Profit Note 5 Valuation Allowance Opening balance Bad debt New allowance charged Closing balance

9 240 249

100 42.75 57.25 75 17.75 Classified as other income

500 -50 this is an adjustment to provision 75 this a charge against profit 525

Note 8 Long term Borrowings Convertible Debentures 12% Loans 9% Preference Share Capital

720 2000 100 2820

Note 8A Segregation of convertible debentures

s + Purchases - closing stock of spares

s other income

djustment to provision ge against profit

Trial balance Share capital Share premium Retained earnings 9% Preference share capital Property, Plant & Equipment Raw material consumed Sales Advance to suppliers Advance from customers Loans to Group companies Loans to employees Convertible Debentures Salaries and wages Obligation for retirement gratuity of emplyees Investments earmarked for retirement gratuity Current service cost for retirement gratuity Closing Stock Cash and bank balances Investments Provision for customer loyalty programme Closing Stock of Spares Spares consumed Power & Fuel Commission 12% Loans Intangible Assets Accumulated Depreciation Accumulated Amortisation Amortisation Depreciation Valuation Allowance Current provision for Bad and doubtful debt Other factory expenses Trade Receivables Administrative expenses Sales promotion Dividend on Equity Shares paid for 2009-10 Advance for purchase of land Security deposit from contractor Profit on sale of asset Receivables for sale of asset Interest Outstanding interest

Rs. Million

Rs. Million 200.00 2000.00 3886.00 100.00 6400.00 3940.00 7400.00 300.00 600.00 1000.00 250.00 720.00 2000.00 0.00 200.00 20.00 160.00 257.00 300.00 0.00 30.00 90.00 500.00 30.00 1000.00 1809.75 695.00 105.00 541.50 525.00 75.00 400.00 1150.00 300.00 100.00 1000.00 50.00 100.00 17.75 75.00 249.00 200.00

20.00

2000.00

20522.50

249.00 20522.50

Equity Equity Equity Liability as per IFRS ; equity as per Indian GAAP Asset Expense 3940.00 Income 2020.00 Asset 90.00 Liability 500.00 Asset 30.00 Asset 646.50 Compound financial instruments to be segregated into liability and equity 75.00 Expense 400.00 Liability 300.00 Asset 100.00 Expense 249.00 Asset 8350.50 Asset Asset Liability Asset ( it is a stock) 20 Non-current Expense Expense Expense Liability Asset Equity Equity Expense Expense Liability ( deduction from asset for which allowance is created , for example ,trade receivables) Expense Expense Asset Expense Expense Equity ( deduction from retained earnings) ; In India it is presented as a liability Asset Liability Income Asset Expense Liability 0

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Income ExemptDocument22 pagesIncome ExemptNicky WG50% (2)

- US Bank StatementDocument4 pagesUS Bank StatementBlake Hudson100% (2)

- HSBC Bank Usa, N.A.: Trade & Supply Chain Foreign Exchange and Risk ManagementDocument13 pagesHSBC Bank Usa, N.A.: Trade & Supply Chain Foreign Exchange and Risk ManagementStephen BgoyaPas encore d'évaluation

- April JuneDocument15 pagesApril JuneSanjivPas encore d'évaluation

- Negotiable Instruments Act, 1881Document25 pagesNegotiable Instruments Act, 1881Deepak PatilPas encore d'évaluation

- 7110 w12 Ms 21Document6 pages7110 w12 Ms 21mstudy123456Pas encore d'évaluation

- Mini Case 29Document3 pagesMini Case 29Avon Jade RamosPas encore d'évaluation

- Calculate capital ratios for bank from financial detailsDocument2 pagesCalculate capital ratios for bank from financial detailsssssPas encore d'évaluation

- Effects of Merchant Banking on Financial Growth of ICICIDocument62 pagesEffects of Merchant Banking on Financial Growth of ICICIij EducationPas encore d'évaluation

- ENCE 422 Homework #1Document2 pagesENCE 422 Homework #1MariaPas encore d'évaluation

- GEN009 - q2Document14 pagesGEN009 - q2CRYPTO KNIGHTPas encore d'évaluation

- Assignment: Financial Management: Dividend - MeaningDocument4 pagesAssignment: Financial Management: Dividend - MeaningSiddhant gudwaniPas encore d'évaluation

- Accounting Textbook Solutions - 64Document19 pagesAccounting Textbook Solutions - 64acc-expert0% (1)

- Intermediate Accounting 17th Edition Kieso Solutions ManualDocument22 pagesIntermediate Accounting 17th Edition Kieso Solutions Manualdilysiristtes5100% (29)

- Trump's June 3, 2016 Tax BillDocument2 pagesTrump's June 3, 2016 Tax Billcrainsnewyork67% (3)

- ALEKSANDRADocument1 pageALEKSANDRARODRIGUE ACCIAROPas encore d'évaluation

- Job Description - CashierDocument1 pageJob Description - CashierNilda AdadPas encore d'évaluation

- How E-banking Affects Customer SatisfactionDocument40 pagesHow E-banking Affects Customer SatisfactionNafeun AlamPas encore d'évaluation

- Philippine Money - MicsDocument9 pagesPhilippine Money - MicsMichaela VillanuevaPas encore d'évaluation

- Financial Reports and Balance Sheets of a CompanyDocument14 pagesFinancial Reports and Balance Sheets of a CompanySalsa nabila Raflani putriPas encore d'évaluation

- Cash & Bank Break Up AuditDocument87 pagesCash & Bank Break Up AuditFaraz KhanPas encore d'évaluation

- Financial Management PPT PresentationDocument52 pagesFinancial Management PPT PresentationJadez Dela CruzPas encore d'évaluation

- Gold As A Portfolio DiversifierDocument14 pagesGold As A Portfolio DiversifierJamil AhmedPas encore d'évaluation

- Comp 202207302138301255Document1 pageComp 202207302138301255nidhikanpur8052Pas encore d'évaluation

- 1601 EqDocument2 pages1601 EqJam DiolazoPas encore d'évaluation

- Econ CH 10Document16 pagesEcon CH 10BradPas encore d'évaluation

- Exchange Deed: Description of The DeedDocument3 pagesExchange Deed: Description of The DeedAdan HoodaPas encore d'évaluation

- Notes MBADocument46 pagesNotes MBAAghora Siva100% (3)

- For The Love of MoneyDocument12 pagesFor The Love of MoneyLayla S Yankle100% (1)