Académique Documents

Professionnel Documents

Culture Documents

Paul Ryan Table

Transféré par

Committee For a Responsible Federal BudgetDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Paul Ryan Table

Transféré par

Committee For a Responsible Federal BudgetDroits d'auteur :

Formats disponibles

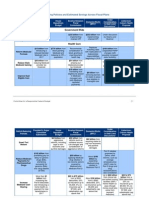

Paul Ryans Budget Proposals

Budget Category Discretionary Defense/ Security Roadmap 1 (2008) Roadmap 2 (2010) Path to Prosperity 1 (2011) Path to Prosperity 2 (2012)

Details unspecified, but Unspecified, but defense non-entitlement spending is spending appears to grow with inflation estimated to grow above inflation

Details unspecified, but

Non-Defense (NDD)/ NonSecurity (NSD) Health Care

Freezes NDD at 2009 non-entitlement spending is levels through 2019 Indexes to CPI+.7% estimated to grow above thereafter inflation

Fulfills Presidents defense Reprioritizes most security request (above BCA levels) savings from BCA and sequester to non-defense Retains sequester for 2014 and beyond. Cuts NSD to 2006 levels, Reduces NDS by ~$20 bn freezes for 5 years in 2013, reallocates security savings to non-security in Indexes to inflation future years. thereafter Retains sequester for 2014 and beyond. Premium support for beneficiaries below 55, with FFS Medicare competing, indexed to GDP+0.5% per beneficiary Means-tests premiums for higher earners Increases Medicare eligibility age to 67 between 2023 and 2036 Assumes doc fixes are offset (unspecified) Block grants all Medicaid in Block grants in 2013, grows 2013, grows by inflation by inflation plus population plus population

Medicare

Premium support for Premium support for Premium support for beneficiaries below 55, beneficiaries below 55, beneficiaries below 55, indexed to halfway between indexed to halfway between indexed to inflation per general and medical general and medical beneficiary inflation inflation Increases Medicare eligibility age to 67 by 2 Means-tests premiums for Means-tests premiums for higher earners higher earners month intervals each year beginning in 2023 Phases out DSH payments Raises Medicare age from 65 to 69.5 by 2022 Assumes doc fixes are offset (unspecified)

Medicaid

Allows states to participate Block grants long-term in tax credit plan or block care, indexed to halfway grants current Medicaid between general and program, grows by inflation medical inflation plus plus population population Replaces Medicaid acute care w/ subsidies for private

________________________________________________________________________________________________________________________________ Committee for a Responsible Federal Budget 1

Budget Category

Other

Roadmap 2 Path to Prosperity 1 (2010) (2011) insurance Replaces health tax Replaces health tax Repeals coverage exclusion with tax credits exclusion with tax credits provisions of PPACA; indexed to halfway between indexed to halfway between keeps most spending cuts general and medical general and medical Enacts tort reform inflation plus population inflation plus population Enacts tort reform Enacts tort reform Indexes retirement age to Sets up reform trigger, longevity where President and Congress required to Implements progressive consider reforms under price indexing Creates minimum benefit at expedited process 120% of FPL Offers optional individual accounts Consolidates and reforms job training programs Repeals most unobligated funds from American Recovery & Reinvestment Act Reduces TARP authority Block grants food stamps and limits spending increases to inflation and population growth beginning in 2015 Consolidates and reforms job training programs Eliminated in-school interest subsidies for undergraduates and graduate students Restricts FDIC too-big-tofail authority Expands spectrum auctions Reduces farm subsidies Reforms civil service retirement Sells excess federal assets

Roadmap 1 (2008)

Path to Prosperity 2 (2012) Repeals coverage provisions of PPACA; keeps most spending cuts and revenue Enacts tort reform

Social Security Indexes retirement age to longevity Implements progressive price indexing Social Security Creates minimum benefit at 120% of FPL Offers optional individual accounts Other Mandatory Sets up reform trigger, where President and Congress required to consider reforms under expedited process

Block grants food stamps and limits spending increases to inflation and population growth beginning in 2016 Consolidates and reforms job training programs Reduces student loan subsidies Reduces farm subsidies Reforms civil service retirement Sells excess federal assets and property Privatizes Fannie and Freddie Reforms PBGC Reforms SSI

2

________________________________________________________________________________________________________________________________ Committee for a Responsible Federal Budget

Budget Category

Roadmap 1 (2008)

Roadmap 2 (2010)

Path to Prosperity 1 Path to Prosperity 2 (2011) (2012) and property Reforms other meansPrivatizes Fannie and tested entitlement programs Freddie Reforms PBGC Reforms SSI Reforms other meanstested entitlement programs Calls for revenue neutral tax reform with two brackets of 10%and 25% Repeals the AMT Reduces tax preferences (unspecified)

Tax Reform Limits revenues to no more Limits revenues to no more than 18.5% of GDP than 19% of GDP Offers an alternative Offers an alternative Simplified Tax, with: Simplified Tax, with: - No AMT - No AMT - No estate tax - No estate tax - No taxes on - No taxes on investment income investment income - Few tax preferences - Few tax preferences - 2 rates of 10%, 25% - 2 rates of 10%, 25% Replaces corporate income Replaces corporate income tax with broad-based 8.5% tax with broad-based 8.5% business consumption tax business consumption tax (BCT) (BCT) Calls for revenue neutral tax reform with 25% top rate with fewer brackets Reduces tax preferences (unspecified)

Individual

Corporate

Reduces corporate rate to 25% Reduces tax preferences (unspecified)

Reduces corporate rate to 25% Enacts territorial system Reduces tax preferences (unspecified) 65.1% of GDP (AFS Assumes 89%) 1.0% of GDP (AFS Assumes 5.3%) 10% of GDP (AFS Assumes 334%) 3% of GDP (AFS Assumes 25.3%)

Other Details Debt in 2020 Deficit in 2020 Debt in 2050 Deficit in 2050 ~40% of GDP (AFS Assumes 53%) 2.2% of GDP (AFS Numbers Unspecified) ~110% of GDP (AFS Assumes 292%) 5.5% of GDP (AFS Numbers Unspecified) 69.2% of GDP (AFS Assumes 87%) 3.8% of GDP (AFS Assumes 7.4%) 95.8% of GDP (AFS Assumes 321%) 2.6% of GDP (AFS Assumes 22.3%) 68.7% of GDP (AFS Assumes 97%) 1.8% of GDP (AFS Assumes 7.2%) 10% of GDP (AFS Assumes 344%) 4.3% of GDP (AFS Assumes 26%)

________________________________________________________________________________________________________________________________ Committee for a Responsible Federal Budget 3

Vous aimerez peut-être aussi

- Paul Ryan Comparison TableDocument3 pagesPaul Ryan Comparison TableCommittee For a Responsible Federal BudgetPas encore d'évaluation

- Background and Summary of Fiscal Commission PlanDocument8 pagesBackground and Summary of Fiscal Commission PlanCommittee For a Responsible Federal BudgetPas encore d'évaluation

- November 2010Document32 pagesNovember 2010cookie1961Pas encore d'évaluation

- Comparing Medicare Reform ProposalsDocument1 pageComparing Medicare Reform ProposalsDonald SjoerdsmaPas encore d'évaluation

- Deficit Committee PaperDocument5 pagesDeficit Committee PaperRyan DeCaroPas encore d'évaluation

- Sequester: Mechanics and ImpactsDocument39 pagesSequester: Mechanics and ImpactsAshley Swearingen100% (1)

- Summers 12-15-08 MemoDocument57 pagesSummers 12-15-08 MemochenjiayuhPas encore d'évaluation

- FRBM Act 2003 Related - StudentsDocument5 pagesFRBM Act 2003 Related - StudentsKamran AliPas encore d'évaluation

- CHAPTER 30 & 31: Macroeconomic PolicyDocument37 pagesCHAPTER 30 & 31: Macroeconomic PolicyAdam BabaPas encore d'évaluation

- Tuesday Goss GlennDocument32 pagesTuesday Goss GlennNational Press FoundationPas encore d'évaluation

- Year-End Tax Planning: (In Uncertain Times)Document28 pagesYear-End Tax Planning: (In Uncertain Times)Jayati BhasinPas encore d'évaluation

- 2022 Proposed Budget For Livingston CountyDocument384 pages2022 Proposed Budget For Livingston CountyWatertown Daily TimesPas encore d'évaluation

- Trustees PaperDocument6 pagesTrustees PaperCommittee For a Responsible Federal BudgetPas encore d'évaluation

- A Bipartisan Plan To Reduce Our Nation'S Deficits Executive SummaryDocument5 pagesA Bipartisan Plan To Reduce Our Nation'S Deficits Executive SummaryMarkWarnerPas encore d'évaluation

- Projected Impacts of COVID-19 On City BudgetDocument18 pagesProjected Impacts of COVID-19 On City BudgetAnonymous Pb39klJPas encore d'évaluation

- Presentation On Economic Survey Final 2014-15 FinalDocument87 pagesPresentation On Economic Survey Final 2014-15 FinaltrvthecoolguyPas encore d'évaluation

- Economic Survey 2022Document119 pagesEconomic Survey 2022sangeerthana sanaPas encore d'évaluation

- CalPERS LTC Recommendation and AnalysisDocument6 pagesCalPERS LTC Recommendation and Analysisjon_ortizPas encore d'évaluation

- Averting A Fiscal Crisis 0 0 0Document23 pagesAverting A Fiscal Crisis 0 0 0Committee For a Responsible Federal BudgetPas encore d'évaluation

- Medicare Table of Reform Proposals 2 0518Document1 pageMedicare Table of Reform Proposals 2 0518mng1mng1Pas encore d'évaluation

- Union Budget 2010-2011: Presented byDocument44 pagesUnion Budget 2010-2011: Presented bynishantmePas encore d'évaluation

- Fiscal Policy Is The Policy of Regulating and Contracting The Revenue and Expenditure of The Procurement To Achieve Certain Macro Economic ObjectivesDocument4 pagesFiscal Policy Is The Policy of Regulating and Contracting The Revenue and Expenditure of The Procurement To Achieve Certain Macro Economic Objectivesmnasir_virgo14Pas encore d'évaluation

- Budget Balancing Exercise: 1 BackgroundDocument14 pagesBudget Balancing Exercise: 1 Backgroundzagham11Pas encore d'évaluation

- Healthcare Reform ActDocument3 pagesHealthcare Reform Actpeterlouisanthony7859Pas encore d'évaluation

- Session 13 The Government BudgetDocument22 pagesSession 13 The Government BudgetSourabh AgrawalPas encore d'évaluation

- Sample Essay MacroDocument18 pagesSample Essay MacropotpalPas encore d'évaluation

- Social Security and Medicare Trustees ReportDocument28 pagesSocial Security and Medicare Trustees ReportAustin DeneanPas encore d'évaluation

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Document53 pagesAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Committee For a Responsible Federal BudgetPas encore d'évaluation

- Fiscal PolicyDocument22 pagesFiscal Policyshailendersingh74Pas encore d'évaluation

- MNGOP 2011 Points BudgetDocument4 pagesMNGOP 2011 Points BudgetCory MerrifieldPas encore d'évaluation

- Pension Costs: September 14, 2011 House Finance Committee Senate Finance CommitteeDocument62 pagesPension Costs: September 14, 2011 House Finance Committee Senate Finance Committeepcapineri8399Pas encore d'évaluation

- Connecticut General Assembly: Office of Fiscal AnalysisDocument16 pagesConnecticut General Assembly: Office of Fiscal AnalysisJordan FensterPas encore d'évaluation

- Monetary & Fiscal Policies: by Anupriya Sharma (1) Sohaila Sawhney (8) Pratiek Sahu (39) Arnab Roy (47) KathiresanDocument29 pagesMonetary & Fiscal Policies: by Anupriya Sharma (1) Sohaila Sawhney (8) Pratiek Sahu (39) Arnab Roy (47) KathiresanKenny AdamsPas encore d'évaluation

- Fiscal Policy MeaningDocument27 pagesFiscal Policy MeaningVikash SinghPas encore d'évaluation

- CBO Long Term FINALDocument6 pagesCBO Long Term FINALCommittee For a Responsible Federal BudgetPas encore d'évaluation

- 0 To Secure Improved Value For Money Following An Appraisal That Determined The Optimal Support Appropriate (Telecoms Policy Unit)Document10 pages0 To Secure Improved Value For Money Following An Appraisal That Determined The Optimal Support Appropriate (Telecoms Policy Unit)PrakashsogoyalPas encore d'évaluation

- CRFB's Long-Term Realistic Baseline June 30, 2011: HairmenDocument4 pagesCRFB's Long-Term Realistic Baseline June 30, 2011: HairmenCommittee For a Responsible Federal BudgetPas encore d'évaluation

- Overlapping Policies and Estimated Savings Across Fiscal PlansDocument13 pagesOverlapping Policies and Estimated Savings Across Fiscal PlansCommittee For a Responsible Federal BudgetPas encore d'évaluation

- Budget and Its Implications On Fiscal Deficit and EconomyDocument29 pagesBudget and Its Implications On Fiscal Deficit and EconomyNedaabdiPas encore d'évaluation

- FinalDocument20 pagesFinalSonam Peldon (Business) [Cohort2020 RTC]Pas encore d'évaluation

- Why Super Committee Must GobigDocument2 pagesWhy Super Committee Must GobigCommittee For a Responsible Federal BudgetPas encore d'évaluation

- Five DebatesDocument12 pagesFive DebatesraviPas encore d'évaluation

- Healthcare Reform TimelineDocument16 pagesHealthcare Reform TimelinenfibPas encore d'évaluation

- Resident's Guide: Volume 1 FY2013Document15 pagesResident's Guide: Volume 1 FY2013ChicagoistPas encore d'évaluation

- 2019 Riverside County Pension Advisory Review Committee ReportDocument20 pages2019 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comPas encore d'évaluation

- Definition of Fiscal Policy: ADocument21 pagesDefinition of Fiscal Policy: Amanish9890Pas encore d'évaluation

- Medicaid Health Website VersionDocument6 pagesMedicaid Health Website VersionsenategopILPas encore d'évaluation

- Fiscal PolicyDocument24 pagesFiscal Policyરહીમ હુદ્દાPas encore d'évaluation

- Fiscal Policy and Budget: Presented By: Group 4 (Roll. No 46-60)Document13 pagesFiscal Policy and Budget: Presented By: Group 4 (Roll. No 46-60)Sanjiv KumarPas encore d'évaluation

- 4 Classical Theory of The Interest RateDocument28 pages4 Classical Theory of The Interest RateAYUSHI PATELPas encore d'évaluation

- Budget Update March 142006Document10 pagesBudget Update March 142006Committee For a Responsible Federal BudgetPas encore d'évaluation

- DeficitReduction ScreenDocument46 pagesDeficitReduction ScreenPeggy W SatterfieldPas encore d'évaluation

- Fiscal Policy NavinDocument17 pagesFiscal Policy NavinRoopesh KumarPas encore d'évaluation

- Union Budget: Prof. M K SahooDocument30 pagesUnion Budget: Prof. M K SahoosanujeePas encore d'évaluation

- A Message To The PublicDocument24 pagesA Message To The Publicthe kingfishPas encore d'évaluation

- Livingston County Adopted Budget (2023)Document401 pagesLivingston County Adopted Budget (2023)Watertown Daily TimesPas encore d'évaluation

- Special Coverage: Most Important For Full MarksDocument21 pagesSpecial Coverage: Most Important For Full MarksLekshmi UPas encore d'évaluation

- Averting A Fiscal Crisis 0Document23 pagesAverting A Fiscal Crisis 0Committee For a Responsible Federal BudgetPas encore d'évaluation

- Fiscal Deficits and Government Debt: Implications For Growth and StabilisationDocument14 pagesFiscal Deficits and Government Debt: Implications For Growth and Stabilisationnavya111Pas encore d'évaluation

- CRFB On SGR Deal 3262014Document1 pageCRFB On SGR Deal 3262014Committee For a Responsible Federal BudgetPas encore d'évaluation

- Reforming The Corporate Tax CodeDocument14 pagesReforming The Corporate Tax CodeCommittee For a Responsible Federal BudgetPas encore d'évaluation

- Prepplan PDFDocument12 pagesPrepplan PDFCommittee For a Responsible Federal BudgetPas encore d'évaluation

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Document53 pagesAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Committee For a Responsible Federal BudgetPas encore d'évaluation

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0Document60 pagesAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0Committee For a Responsible Federal Budget100% (1)

- Politco Fiscal Cliff Ad FinalDocument1 pagePolitco Fiscal Cliff Ad FinalCommittee For a Responsible Federal BudgetPas encore d'évaluation

- CRFB Reacts To Six-Month Continuing Resolution 9-11-2012Document1 pageCRFB Reacts To Six-Month Continuing Resolution 9-11-2012Committee For a Responsible Federal BudgetPas encore d'évaluation

- Debate The Debt Press Release 7-26-12 0Document2 pagesDebate The Debt Press Release 7-26-12 0Committee For a Responsible Federal BudgetPas encore d'évaluation

- Averting A Fiscal Crisis 0Document26 pagesAverting A Fiscal Crisis 0Committee For a Responsible Federal BudgetPas encore d'évaluation

- Americans Sign Debt Petition in One WeekDocument2 pagesAmericans Sign Debt Petition in One WeekCommittee For a Responsible Federal BudgetPas encore d'évaluation

- Davis Steele Rendell Gregg Call For Debates On Debt ReductionDocument3 pagesDavis Steele Rendell Gregg Call For Debates On Debt ReductionCommittee For a Responsible Federal BudgetPas encore d'évaluation

- CRFB Analysis of The FY2013 Mid-Session ReviewDocument5 pagesCRFB Analysis of The FY2013 Mid-Session ReviewCommittee For a Responsible Federal BudgetPas encore d'évaluation

- Statements of Support For FTDDocument5 pagesStatements of Support For FTDCommittee For a Responsible Federal BudgetPas encore d'évaluation

- Averting A Fiscal Crisis 0Document25 pagesAverting A Fiscal Crisis 0Committee For a Responsible Federal BudgetPas encore d'évaluation

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0Document58 pagesAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0Committee For a Responsible Federal BudgetPas encore d'évaluation

- Between A Mountain of Debt and A Fiscal CliffDocument17 pagesBetween A Mountain of Debt and A Fiscal CliffCommittee For a Responsible Federal BudgetPas encore d'évaluation

- Garrido Vs TuasonDocument1 pageGarrido Vs Tuasoncmv mendozaPas encore d'évaluation

- The Lure of The Exotic Gauguin in New York CollectionsDocument258 pagesThe Lure of The Exotic Gauguin in New York CollectionsFábia Pereira100% (1)

- Labor Law BarVenture 2024Document4 pagesLabor Law BarVenture 2024Johnny Castillo SerapionPas encore d'évaluation

- Service Letter SL2019-672/CHSO: PMI Sensor Calibration RequirementsDocument3 pagesService Letter SL2019-672/CHSO: PMI Sensor Calibration RequirementsSriram SridharPas encore d'évaluation

- Sharmeen Obaid ChinoyDocument5 pagesSharmeen Obaid ChinoyFarhan AliPas encore d'évaluation

- Industrial Marketing StrategyDocument21 pagesIndustrial Marketing StrategyNor AzimaPas encore d'évaluation

- Beowulf Essay 1Document6 pagesBeowulf Essay 1api-496952332Pas encore d'évaluation

- Au L 53229 Introduction To Persuasive Text Powerpoint - Ver - 1Document13 pagesAu L 53229 Introduction To Persuasive Text Powerpoint - Ver - 1Gacha Path:3Pas encore d'évaluation

- 99 Names of AllahDocument14 pages99 Names of Allahapi-3857534100% (9)

- Remote Lab 1013Document3 pagesRemote Lab 1013cloud scapePas encore d'évaluation

- Consolidated Terminals Inc V Artex G R No L 25748 PDFDocument1 pageConsolidated Terminals Inc V Artex G R No L 25748 PDFCandelaria QuezonPas encore d'évaluation

- In-CIV-201 INSPECTION NOTIFICATION Pre-Pouring Concrete WEG Pump Area PedestalsDocument5 pagesIn-CIV-201 INSPECTION NOTIFICATION Pre-Pouring Concrete WEG Pump Area PedestalsPedro PaulinoPas encore d'évaluation

- Insura CoDocument151 pagesInsura CoSiyuan SunPas encore d'évaluation

- Pre-Qualification Document - Addendum 04Document4 pagesPre-Qualification Document - Addendum 04REHAZPas encore d'évaluation

- History and Culture of The Indian People, Volume 10, Bran Renaissance, Part 2 - R. C. Majumdar, General Editor PDFDocument1 124 pagesHistory and Culture of The Indian People, Volume 10, Bran Renaissance, Part 2 - R. C. Majumdar, General Editor PDFOmkar sinhaPas encore d'évaluation

- CH 09Document31 pagesCH 09Ammar YasserPas encore d'évaluation

- Depreciation, Depletion and Amortization (Sas 9)Document3 pagesDepreciation, Depletion and Amortization (Sas 9)SadeeqPas encore d'évaluation

- ERRC Grid and Blue Ocean StrategyDocument2 pagesERRC Grid and Blue Ocean StrategyferePas encore d'évaluation

- Project Driven & Non Project Driven OrganizationsDocument19 pagesProject Driven & Non Project Driven OrganizationsEkhlas Ghani100% (2)

- How To Claim Your VAT RefundDocument5 pagesHow To Claim Your VAT Refundariffstudio100% (1)

- Students Wants and NeedsDocument1 pageStudents Wants and Needsapi-262256506Pas encore d'évaluation

- EthicsDocument11 pagesEthicsFaizanul HaqPas encore d'évaluation

- Sop Draft Utas Final-2Document4 pagesSop Draft Utas Final-2Himanshu Waster0% (1)

- Brunon BradDocument2 pagesBrunon BradAdamPas encore d'évaluation

- Core Values Behavioral Statements Quarter 1 2 3 4Document1 pageCore Values Behavioral Statements Quarter 1 2 3 4Michael Fernandez ArevaloPas encore d'évaluation

- 2 Quiz of mgt111 of bc090400798: Question # 1 of 20 Total Marks: 1Document14 pages2 Quiz of mgt111 of bc090400798: Question # 1 of 20 Total Marks: 1Muhammad ZeeshanPas encore d'évaluation

- DocumentDocument2 pagesDocumentHP- JK7Pas encore d'évaluation

- Letter To Singaravelu by M N Roy 1925Document1 pageLetter To Singaravelu by M N Roy 1925Avinash BhalePas encore d'évaluation

- Case 3 - Ecuadorean Rose IndustryDocument6 pagesCase 3 - Ecuadorean Rose IndustryMauricio BedonPas encore d'évaluation

- Quiet Time Guide 2009Document2 pagesQuiet Time Guide 2009Andrew Mitry100% (1)