Académique Documents

Professionnel Documents

Culture Documents

Lovable Lingerie

Transféré par

Roshankumar S PimpalkarDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lovable Lingerie

Transféré par

Roshankumar S PimpalkarDroits d'auteur :

Formats disponibles

Lovable Lingerie Premium pricing for premium brand with flagship brands Lovable and Daisy Dee, the

company is one of the leading women innerwear players in India

Promoted by Vinay Reddy, Lovable Lingerie (LLL) is headquartered in Mumbai and was incorporated in 1987. Initially named as Hyno Knit Private Limited, the company was renamed as Lovable Lingerie in 1995 and was converted to public limited company in February 2010. With flagship brands Lovable and Daisy Dee, LLL is one of the leading women Innerwear manufacturers in India, with product basket covering brassieres, panties, camisoles, home wear, shape wear, foundation garments and sleep wear products.

Brands Lovable(premium segment) Daisy Dee(mid segment) College Style(young segment) Manufacturing Facilities Two units in Bengaluru with installed capacity of 30 lakh pieces per annum One unit in Roorkee with installed capacity of 7.5 lakh pieces per annum Concessionaire-retailing model for marketing The company procures dedicated retail space in leading large format stores and makes arrangements for stocking, displays and visual merchandising of Lovable brand in form of shop in shop modules. Currently the company has 127 counters in leading large format stores across 21 cities. The network of the company constitutes 5 branches, 103 distributors, 1425 direct dealers and nearly 7500 multi brand outlets in 105 cities. In 2010, it entered in to a JV agreement with Lifestyle Galleries of London (LGL) (UK) to establish a JV company, Lovable Lifestyle Pvt Ltd, with majority 90% of the stake vested with LLL. The company is proposing to infuse capital of Rs 25 crore as equity capital in the JV Company. Lovable Lifestyle will carry on marketing, manufacturing, distribution and direct retail in the super premium segment in India and other contracted territories to be decided between the parties on the product lines of LGL in the categories of personality grooming/style, lifestyle enhancement and beauty, including but not limited to womens intimate apparels as well as mens undergarments under the London Calling brand in India. The other group entities of the company include Federal Brands, Hype Integracomm Pvt Ltd, La Reine Fashions Pvt Ltd, Holstein Ecofoods Pvt Ltd, Strategy Games Pvt Ltd, Bellini Fashions Pvt Ltd, Lovable Lifestyles Pvt Ltd, Vinay Hosiery Pvt Ltd, Reddy, and Pathare Elastic Pvt Ltd. Strength Vast experience in field 85 year old brand with global presence In-house design studio

Weakness & Threats Changing fashion, consumer preference Competition from group companies in mens wear segment Yarn, fabric prices are crucial factor Labour intensive industry

Future Plans In Lovable we are currently at little less than 1,500 retail doors and we are expecting to take that to about 3,000 retail doors in one years time. In Daisy Dee we have about 8,500 retail doors, which we currently reach through our distribution network. It operates a traditional distribution channel and we have a long range plan of three years to reach above 20,000 stores.- L Vinay Reddy Company is targeting 30% CAGR. Company is well funded for next two to three years because of last IPO so no plans to raise additional funds.

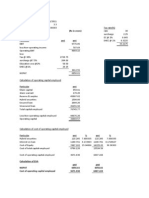

Company Bombay Rayon Pantaloon Retail Page Industries Shoppers St. Trent Raymond Rupa & Co Kewal Kir.Cloth. Mandhana Indus Lovable Lingerie Zodiac Cloth. Co KSL and Indus K P R Mill Ltd Trident Gokaldas Exports Market Cap (Rs in Cr) 3,568.92 3,044.94 2,664.85 2,137.47 2,089.23 2,035.05 1,129.70 757.49 710.76 553.98 392.58 346.83 318.21 282.74 257.85 P/E 16.48 44.11 32.69 27.05 52.88 13.27 30.3 14.2 10.09 40.46 37.81 0 10.04 4.77 0 P/BV 1.31 1.12 21.53 3.57 1.59 1.91 6.92 3.83 2.02 3.92 2.46 0.68 0.55 0.48 0.7 EV/EBIDTA 11.36 19.21 18.42 18.72 22.29 62.03 0 7.57 8.7 19.25 13.9 6.84 5.25 5.35 0 ROE 9.9 2.8 52.6 16.6 4.4 12.6 21.1 24.8 24.5 17.1 11.2 -0.6 12.7 11.7 -21.2 ROCE 8.4 6.7 48.2 20.5 5.6 8 20.5 36.2 17.7 23.3 13 5 10.9 9 -7.5 D/E 1.22 0.63 0.76 0.38 0.31 1.12 1.01 0.06 1.78 0 0.23 1.85 1 3.51 0.8

Company is debt free as on 31 march 2011. Among all the competitors its the only company with debt-equity ratio of 0/ YOY increase in sales, operating profit, interest coverage, net worth, working capital and PBDIT is quite good compared to companys competitors. However EPS of company is low in comparison to its competitors. For mar 11 EPS of company was 8.41 while the same for Page industries and Zodiac Clothing was 52.49 and 18.18 respectively. Raw material is one of the worry for company as over half of sales is consumed by cost of raw material.(mar 11 RM/sales= 53.27)

ROE and ROCE of the company is very low in comparison to its close competitor Page Industries. However at current PE of 40.46 which is the highest in the sector the stock appears to be quite expensive.

Monday, 26 December 2011

Vous aimerez peut-être aussi

- A Complete Lingerie Shop Business Plan: A Key Part Of How To Start A Lingerie StoreD'EverandA Complete Lingerie Shop Business Plan: A Key Part Of How To Start A Lingerie StoreÉvaluation : 2.5 sur 5 étoiles2.5/5 (3)

- Outbound Hiring: How Innovative Companies are Winning the Global War for TalentD'EverandOutbound Hiring: How Innovative Companies are Winning the Global War for TalentPas encore d'évaluation

- Cantabil OS - by TJDocument96 pagesCantabil OS - by TJYounus ahmedPas encore d'évaluation

- Presentation On Shoppers StopDocument28 pagesPresentation On Shoppers Stopabhishek_sinhaPas encore d'évaluation

- Apparel InfoDocument8 pagesApparel InfoKalpesh JaruPas encore d'évaluation

- Company Overview: Evolution Over The YearsDocument9 pagesCompany Overview: Evolution Over The YearsSushil GuravPas encore d'évaluation

- Reliance RetailDocument18 pagesReliance RetailAyushi ChoudharyPas encore d'évaluation

- Presentation ON: Presented By-Chetan Aneja Deepak Tewari Kartik Harish IrfanDocument30 pagesPresentation ON: Presented By-Chetan Aneja Deepak Tewari Kartik Harish IrfankartikharishPas encore d'évaluation

- The Reckitt Vs Retailer Story: Unified Response A Good ThingDocument4 pagesThe Reckitt Vs Retailer Story: Unified Response A Good ThingVarun RamuPas encore d'évaluation

- Financial Data: Neeraj Kumar Yadav (M1816)Document10 pagesFinancial Data: Neeraj Kumar Yadav (M1816)Neeraj YadavPas encore d'évaluation

- Major Apparel and Lifestyle Retailer in IndiaDocument7 pagesMajor Apparel and Lifestyle Retailer in IndianiftkislayPas encore d'évaluation

- Company Profile: Ample Supplementary Analyses PDFDocument4 pagesCompany Profile: Ample Supplementary Analyses PDFPrathmesh KalaPas encore d'évaluation

- Subject: Financial Management: Indira Institute of Management, PuneDocument23 pagesSubject: Financial Management: Indira Institute of Management, PunePrasad RandhePas encore d'évaluation

- Future GroupDocument55 pagesFuture GroupPrashant SinghPas encore d'évaluation

- Raymond Apparel Limited: Long-Term Bank Facilities Care A+ Short-Term Bank Facilities PR1+ CP/Short-term NCD/STD PR1+Document4 pagesRaymond Apparel Limited: Long-Term Bank Facilities Care A+ Short-Term Bank Facilities PR1+ CP/Short-term NCD/STD PR1+Pratik PatilPas encore d'évaluation

- Company Profile: Hero Motocorp LimitedDocument25 pagesCompany Profile: Hero Motocorp LimitedjupinderPas encore d'évaluation

- Kavita ShindeDocument36 pagesKavita ShindeSanjay SutarPas encore d'évaluation

- Godrej Consumer ProductsDocument2 pagesGodrej Consumer ProductsAman GargPas encore d'évaluation

- V2 Retail LTD - IC Report - DSPLDocument20 pagesV2 Retail LTD - IC Report - DSPLSiva KumarPas encore d'évaluation

- Odel PLC Annual Report 2014/15Document120 pagesOdel PLC Annual Report 2014/15Jee Nuu100% (1)

- RaymondDocument2 pagesRaymondAmol MahajanPas encore d'évaluation

- Reliance RetailDocument6 pagesReliance Retail07 Bharath SPas encore d'évaluation

- Liberty Shoes Limited: SynopsisDocument16 pagesLiberty Shoes Limited: SynopsisRakesh SrivastavaPas encore d'évaluation

- Promart Retalining Pvt. LTDDocument12 pagesPromart Retalining Pvt. LTDAashish SoniPas encore d'évaluation

- Leaders SpeakDocument4 pagesLeaders SpeakDeepal ShahPas encore d'évaluation

- Project On Customer SatisfactionDocument51 pagesProject On Customer SatisfactionOm ShetakePas encore d'évaluation

- Retail Covert Ops 1 (RCO) : News Regarding Arvind LimitedDocument4 pagesRetail Covert Ops 1 (RCO) : News Regarding Arvind Limitedanon_996094568Pas encore d'évaluation

- Big BazarDocument38 pagesBig BazarJyothi RameshPas encore d'évaluation

- Apparel Retail in IndiaDocument6 pagesApparel Retail in IndiakingshukbPas encore d'évaluation

- Big BazarDocument33 pagesBig BazarArjun JhPas encore d'évaluation

- Garden Silk MillsDocument32 pagesGarden Silk MillsKrishna KediaPas encore d'évaluation

- BIMBSec - Padini Holdings - 20120719 - Re-Initiate CoverageDocument12 pagesBIMBSec - Padini Holdings - 20120719 - Re-Initiate CoverageBimb SecPas encore d'évaluation

- Indian Kidswear Market Presentation - FinalDocument20 pagesIndian Kidswear Market Presentation - FinalMukund SinghPas encore d'évaluation

- Executive SummaryDocument9 pagesExecutive SummaryPurva MaluPas encore d'évaluation

- Trends ProjectDocument87 pagesTrends Projectajaykumar royalPas encore d'évaluation

- Yyyy YDocument74 pagesYyyy Ytariquewali11Pas encore d'évaluation

- Future GroupDocument1 pageFuture GroupNeelima MakaniPas encore d'évaluation

- Arvind LTDDocument11 pagesArvind LTDVicky GuleriaPas encore d'évaluation

- PantaloonsDocument33 pagesPantaloonsRanjeet Rajput50% (4)

- Raymond GroupDocument12 pagesRaymond GroupBhukti DhoruPas encore d'évaluation

- Project Report On Customer Behaviour in PantaloonsDocument16 pagesProject Report On Customer Behaviour in PantaloonsLeo Roy0% (1)

- Enterprise: RELIANCE TRENDS: Dentify An Enterprise and Give The Snapshot of The Company Websites With LinksDocument9 pagesEnterprise: RELIANCE TRENDS: Dentify An Enterprise and Give The Snapshot of The Company Websites With LinksAbbas KhanPas encore d'évaluation

- Aditya Birla Fashion and Retail LimitedDocument5 pagesAditya Birla Fashion and Retail LimitedishanPas encore d'évaluation

- The LOOT Success StoryDocument28 pagesThe LOOT Success StorySsneha DesaiPas encore d'évaluation

- Indian Shirts Market (Sept 2009)Document3 pagesIndian Shirts Market (Sept 2009)Urooj AnsariPas encore d'évaluation

- Dabur India LTD: Key Financial IndicatorsDocument4 pagesDabur India LTD: Key Financial IndicatorsHardik JaniPas encore d'évaluation

- Branding For Magsons 1Document22 pagesBranding For Magsons 1Nimit BhattPas encore d'évaluation

- LNCT 3Document54 pagesLNCT 3Ranjeet YadavPas encore d'évaluation

- RM Pptgrp2Document28 pagesRM Pptgrp2Pradeep BandiPas encore d'évaluation

- Veet RB Case Study CompetitionDocument19 pagesVeet RB Case Study Competitionsandeep_rawat_11100% (1)

- RB India Veet Case StudyDocument19 pagesRB India Veet Case Studyabhishek2937Pas encore d'évaluation

- Synopsis BUSHRA HOSSAINDocument11 pagesSynopsis BUSHRA HOSSAINAhmed BaharPas encore d'évaluation

- Corporate Finance Project On Ratio Analysis of PantaloonDocument15 pagesCorporate Finance Project On Ratio Analysis of PantaloonPravesh MarothiPas encore d'évaluation

- RM Project Big BazaarDocument42 pagesRM Project Big BazaarGowthami RayappanPas encore d'évaluation

- The Entrepreneur's Handbook Startup Your Dream Business: 1, #1D'EverandThe Entrepreneur's Handbook Startup Your Dream Business: 1, #1Pas encore d'évaluation

- Entrepreneurship: Model Assignment answer with theory and practicalityD'EverandEntrepreneurship: Model Assignment answer with theory and practicalityPas encore d'évaluation

- A Complete $1 Jewelry Store Business Plan: A Key Part Of How To Start A One Dollar Jewelry StoreD'EverandA Complete $1 Jewelry Store Business Plan: A Key Part Of How To Start A One Dollar Jewelry StorePas encore d'évaluation

- A Complete Beauty Supply Store Business Plan: A Key Part Of How To Start A Beauty Supply & Cosmetics StoreD'EverandA Complete Beauty Supply Store Business Plan: A Key Part Of How To Start A Beauty Supply & Cosmetics StoreÉvaluation : 5 sur 5 étoiles5/5 (1)

- Revised Schedule VIDocument16 pagesRevised Schedule VIRoshankumar S PimpalkarPas encore d'évaluation

- Lease IdentifierDocument9 pagesLease IdentifierRoshankumar S PimpalkarPas encore d'évaluation

- General Anti-Avoidance Rule (GAAR) : Roshankumar S PimpalkarDocument3 pagesGeneral Anti-Avoidance Rule (GAAR) : Roshankumar S PimpalkarRoshankumar S PimpalkarPas encore d'évaluation

- 234a, B, CDocument28 pages234a, B, CRoshankumar S PimpalkarPas encore d'évaluation

- WiproDocument18 pagesWiproRoshankumar S PimpalkarPas encore d'évaluation

- Crowding OutDocument3 pagesCrowding OutRoshankumar S PimpalkarPas encore d'évaluation

- Venture CapitalDocument16 pagesVenture CapitalRoshankumar S PimpalkarPas encore d'évaluation

- As 30 Part-IiDocument23 pagesAs 30 Part-IiRoshankumar S PimpalkarPas encore d'évaluation

- As 30Document40 pagesAs 30Roshankumar S PimpalkarPas encore d'évaluation

- CoalDocument16 pagesCoalRoshankumar S PimpalkarPas encore d'évaluation

- Harshad MehtaDocument32 pagesHarshad MehtaRoshankumar S PimpalkarPas encore d'évaluation

- India in A Debt TrapDocument4 pagesIndia in A Debt TrapRoshankumar S PimpalkarPas encore d'évaluation

- Reasons For Exchange Rate FluctuationDocument13 pagesReasons For Exchange Rate FluctuationRoshankumar S PimpalkarPas encore d'évaluation

- NewsDocument253 pagesNewsRoshankumar S Pimpalkar0% (1)

- Working Capital Management 4Document4 pagesWorking Capital Management 4Roshankumar S PimpalkarPas encore d'évaluation

- Working Capital Management 5Document3 pagesWorking Capital Management 5Roshankumar S PimpalkarPas encore d'évaluation

- Tisco EvaDocument2 pagesTisco EvaRoshankumar S PimpalkarPas encore d'évaluation

- Working Capital Management 1Document6 pagesWorking Capital Management 1Roshankumar S PimpalkarPas encore d'évaluation

- Working Capital Management 2Document5 pagesWorking Capital Management 2Roshankumar S PimpalkarPas encore d'évaluation

- Management Information SystemDocument4 pagesManagement Information SystemRoshankumar S PimpalkarPas encore d'évaluation

- Indian It SectorDocument6 pagesIndian It SectorRoshankumar S PimpalkarPas encore d'évaluation

- Pirated Product MarketDocument1 pagePirated Product MarketRoshankumar S PimpalkarPas encore d'évaluation

- Working Capital Management 3Document4 pagesWorking Capital Management 3Roshankumar S PimpalkarPas encore d'évaluation

- Fiscal Responsibility Budget Management ActDocument4 pagesFiscal Responsibility Budget Management ActRoshankumar S PimpalkarPas encore d'évaluation

- Financial Status-Transcorp International LTD 2011-12Document15 pagesFinancial Status-Transcorp International LTD 2011-12Roshankumar S PimpalkarPas encore d'évaluation

- Financial Status-Sumeet Industries LTDDocument14 pagesFinancial Status-Sumeet Industries LTDRoshankumar S PimpalkarPas encore d'évaluation

- Financial Status-Orient Paper & Industries LTDDocument14 pagesFinancial Status-Orient Paper & Industries LTDRoshankumar S PimpalkarPas encore d'évaluation

- Financial Status-Procter & Gamble Hygiene & Health Care Ltd.Document14 pagesFinancial Status-Procter & Gamble Hygiene & Health Care Ltd.Roshankumar S PimpalkarPas encore d'évaluation

- TolemicaDocument101 pagesTolemicaPrashanth KumarPas encore d'évaluation

- E.I Dupont de Nemours & Co. vs. Francisco, Et - Al.Document3 pagesE.I Dupont de Nemours & Co. vs. Francisco, Et - Al.Carmille Marge MercadoPas encore d'évaluation

- SIP Annex 5 - Planning WorksheetDocument2 pagesSIP Annex 5 - Planning WorksheetGem Lam SenPas encore d'évaluation

- Soal Paket B-To Mkks Diy 2019-2020Document17 pagesSoal Paket B-To Mkks Diy 2019-2020Boku Hero-heroPas encore d'évaluation

- Crisis Communications: Steps For Managing A Media CrisisDocument15 pagesCrisis Communications: Steps For Managing A Media Crisismargarita BellePas encore d'évaluation

- Statutory and Regulatory BodyDocument4 pagesStatutory and Regulatory BodyIzzah Nadhirah ZulkarnainPas encore d'évaluation

- Different Types of Equity Investors - WikiFinancepediaDocument17 pagesDifferent Types of Equity Investors - WikiFinancepediaFinanceInsuranceBlog.comPas encore d'évaluation

- Memorandum1 PDFDocument65 pagesMemorandum1 PDFGilbert Gabrillo JoyosaPas encore d'évaluation

- Alexei NavalnyDocument6 pagesAlexei NavalnyMuhammad M HakimiPas encore d'évaluation

- 1ST Term J3 Business StudiesDocument19 pages1ST Term J3 Business Studiesoluwaseun francisPas encore d'évaluation

- Greek Gods & Goddesses (Gods & Goddesses of Mythology) PDFDocument132 pagesGreek Gods & Goddesses (Gods & Goddesses of Mythology) PDFgie cadusalePas encore d'évaluation

- Mock Act 1 - Student - 2023Document8 pagesMock Act 1 - Student - 2023Big bundahPas encore d'évaluation

- RPA Solutions - Step Into The FutureDocument13 pagesRPA Solutions - Step Into The FutureThe Poet Inside youPas encore d'évaluation

- Easter in South KoreaDocument8 pagesEaster in South KoreaДіана ГавришPas encore d'évaluation

- Webinar2021 Curriculum Alena Frid OECDDocument30 pagesWebinar2021 Curriculum Alena Frid OECDreaderjalvarezPas encore d'évaluation

- Can God Intervene$Document245 pagesCan God Intervene$cemoara100% (1)

- Frias Vs Atty. LozadaDocument47 pagesFrias Vs Atty. Lozadamedalin1575Pas encore d'évaluation

- About ArevaDocument86 pagesAbout ArevaAbhinav TyagiPas encore d'évaluation

- Gender View in Transitional Justice IraqDocument21 pagesGender View in Transitional Justice IraqMohamed SamiPas encore d'évaluation

- Company Analysis of Axis BankDocument66 pagesCompany Analysis of Axis BankKirti Bhite100% (1)

- Sales Channel: ABB Limited, BangladeshDocument4 pagesSales Channel: ABB Limited, BangladeshMehedyPas encore d'évaluation

- Anderson v. Eighth Judicial District Court - OpinionDocument8 pagesAnderson v. Eighth Judicial District Court - OpinioniX i0Pas encore d'évaluation

- House Tax Assessment Details PDFDocument1 pageHouse Tax Assessment Details PDFSatyaPas encore d'évaluation

- Judgments of Adminstrative LawDocument22 pagesJudgments of Adminstrative Lawpunit gaurPas encore d'évaluation

- The State of Iowa Resists Anna Richter Motion To Expunge Search Warrant and Review Evidence in ChambersDocument259 pagesThe State of Iowa Resists Anna Richter Motion To Expunge Search Warrant and Review Evidence in ChambersthesacnewsPas encore d'évaluation

- Bangladesh Labor Law HandoutDocument18 pagesBangladesh Labor Law HandoutMd. Mainul Ahsan SwaadPas encore d'évaluation

- Unit 1 PDFDocument5 pagesUnit 1 PDFaadhithiyan nsPas encore d'évaluation

- Final Technical Documentation: Customer: Belize Sugar Industries Limited BelizeDocument9 pagesFinal Technical Documentation: Customer: Belize Sugar Industries Limited BelizeBruno SamosPas encore d'évaluation

- Final Annexes Evaluation Use Consultants ApwsDocument51 pagesFinal Annexes Evaluation Use Consultants ApwsSure NamePas encore d'évaluation

- People vs. DonesaDocument11 pagesPeople vs. DonesaEarlene DalePas encore d'évaluation