Académique Documents

Professionnel Documents

Culture Documents

Marketing Strategy in Action

Transféré par

Steven AhongDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Marketing Strategy in Action

Transféré par

Steven AhongDroits d'auteur :

Formats disponibles

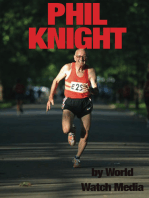

97 Marketing Strategy in Action Nike T wenty-five years ago, Nike stuck its foot in the door ofsports by providing

better shoes for competitive athletes.Simple. All it took was a passion for sports, a few goodideas, and the will to make it happen. Today, much in the world haschanged. Athletes are stronger and faster than ever. Competition ismore intense than at any other time in history. When combined withadvances in performance that technology can provide, the worldfrenzy for sports grows unabated.Twenty-five years from now, no one knows what the world will belike.Butwerethinkingabout it.Webelieveinit.Weknowthatcurios-ity and a competitive spirit will be alive and well. We know that we willbe there, helping athletes perform better. All it will take is a passionfor sports, a few good ideas, and the will to make it happen. Over andover again.Withthesewords,Nikebeganits1997annualreport andrevealedthecorevaluesofthishighlysuccessfulcompany.Itallstartedquitehumbly.Inthe1960syoungPhilipKnight,CEOofNike andformertrackstarattheUniversityofOregon,partneredwithhisoldtrackcoach,WilliamBowerman,tosellrunningshoestoathletes. TheydrovetohighschooltrackmeetsandsoldshoesoutofthetrunkofKnightscar.Asitgrew,theyoungcompanyfounditselfperfectly timedtocashinonAmericasrunningcrazeinthe1970s.Nikesold$3millioninshoesin1972,$270millionin1980,and$1billionin 1986.It has not been all easy running for Nike. After its initial success inthe 1970s, the company stumbled a bit in the mid-1980s. For onething,demographicchangesworkedagainstNikeasthebabyboom-ers pushed into their forties and felt less like running. Fewer peoplewere taking up jogging, and those who did were doing fewer laps.Also,themarketforrunningshoeshadbecomehighlysegmentedasure sign of a mature marketwith many different models for everynuanceofconsumerneed.Inaddition,pricecutting wasbeginningtoshowitsuglyhead.Thus,Nikesunitsalesofrunningshoesdecreased17percentin1984,anditsmarketsharedeclinedin thatyearfrom31percent to 26 percent. The decline continued, and by 1987 Nike hadonly an 18.6 percent share of the market for athletic shoes, a marketithaddominatedjustafewyearsearlier.Another problem for Nike came along in the 1980s: competition.Reebok in particular created a new marketing orientation to sellingsneakers based on fashion rather than performance, which Nike hademphasized (and still does). According to Reebok president PaulFireman, We go out to consumers and find out what they want. Othercompaniesdontseemtodothat.Fashionseemedtobewhat manyconsumers wanted in the mid-1980s. Reeboks soft-leather athleticshoes in fashion colors took the market by storm. Reebok sales in-creased from $84 million to $307 million in one year (1984 to 1985),and Reebok took over the top spot from Nike in 1986. Perhaps con-sumers interest in fashion should have been obvious by simpleobservation. Research showed that 70 to 80 percent of the shoesdesigned for basketball and aerobic exercise were actually used forcasual street wear instead of the intended sports.Nikefoughtbackwithtechnologicalfeaturesintendedto enhanceperformance. In 1987, Nike introduced air inserts into the soles of itshigh-end shoes. The key model was the Air Jordan, the basketballs h o e n a m e d a f t e r M i c h a e l J o r d a n , t h e s u p e r s t a r p l a ye r f o r t h e Chicago Bulls. Nike also had the brilliant idea of producing its top-of-the-line models with a cutout in the sole so the consumer could actu-ally see the attribute (encapsulated gas or air) that provided thecushioning benefit.Overtheyears,akeystrategyforNikehasbeen tocreateshoeswithspecialtechnicalattributes(airinserts,stabilityreinforcement,lac-ingpatterns)thatwouldenhanceperformance.Knight alsosignedupstarathletestowearNikeshoesandserveasspokespersons,astrat-egyheusedfromthebeginning.Themostdesirable spokespersonwaswhatthecompanyexecutivescalledaNikeguy:abrilliantathletewithacompetitiveattitudeandasomewhatrebellious demeanor.Mi-chaelJordanbecametheNikeguyinthelate1980s.NikespentveryheavilyonTVandprintadvertisingtopromoteboth Jordanandhisshoemodel.Allthisadvertisingwasaratherunusualmarketingstrat-egyforthecompanythatonceeschewedmass

advertisingasunnec-essaryandsomewhatdemeaning,butthethreatfromReebokloosenedKnightsthinkingaboutadvertising.Bythe mid-1990s,some35adslater,MichaelJordanwasthemostpopularathleteinthecountry.Currently it is estimated Nike pays out more than $100 million ayeartocontractathletestouseandpitchNikeproducts.Nikespokes-persons have included Andre Agassi in tennis, Alex Rodriguez inbaseball,CarlLewisandMichaelJohnsonintrackandfield,Bo Jack-s o n f o r m u l t i s p o r t s h o e s , a n d b a s k e t b a l l p l a ye r s s u c h a s K e v i n Garnett and Scottie Pippen. Nike adds new sports continuously,i n c l u d i n g m o u n t a i n b i k i n g , c l i m b i n g , a n d h i k i n g . N i k e m a d e t h e plungeintogolfbysigningafive-year,$40millioncontractwith TigerWoods.WoodsnotonlywearsNikeclothingandshoesandappearsin commercials, but also switched to a Nike golf ball in 2000 andpromptly won the U.S. Open tournament by a record margin. Laterthat year, Nike signed a new deal with Woods that pays him an esti-mated $100 million over five years. As usual, Nike also signed upwomensportsstarstowearandpromoteitsproducts(theNikeWebsiteprofilesseveralprominent femaleathletes,suchastrackandfieldstar Marion Jones). Nikes print ads have portrayed women trying toexcel in sports. A Nike ad in 1996 showed little girls imploring theirparents for a ball, not a doll, for Christmas.

Nike faced a new set of challenges in the late 1990s. For onething, the shoe market had changed. Many younger consumerseschewed athletic shoes in favor of hiking boots and more casualf o o t w e a r . P l u s , m o r e t e e n s b e g a n p a r t i c i p a t i n g i n n o n t r a d i t i o n a l extreme sportslikesnowboardingandskateboarding.Nikedidnothaveaproductthatsuccessfullyappealedtothissegmentoftheshoemarket.Toa lotofteens,Nikehadceasedtobecool.Thecompanyresponded in 1999 by establishing a separate division called ACG(whichstandsforall-conditionsgear).TheACGunithasdesignedaline of shoes and apparel that bears the distinctive ACG logo ratherthanthefamiliarNikeswoosh.NikealsoaddedextremeathleteslikesnowboarderMike Michalchuktoitsrosterofstarendorsers.T h e o p e n i n g s t a t e m e n t t o t h e 1 9 9 7 a n n u a l r e p o r t i n d i c a t e s Nikes commitment to sports. As a company, Nike is fascinated withthe dedication and effort needed to excel in sports and the satisfac-t i o n s u c h a c h i e v e m e n t p r o v i d e s t h e a t h l e t e . N i k e g o e s b e yo n d a concern with mere product attributes to focus on the personal ben-efits associated with using its products and the values satisfied byproduct use. Nikes advertising is designed to make a connectionwith the consumer, according to Dan Wieden, manager of Wieden &Kennedy, Nikes main advertising agency. Thus, Nike ads seldomp i t c h t h e p r o d u c t d i r e c t l y o r t a l k a b o u t p r o d u c t a t t r i b u t e s . I n f a c t , s o m e a d s d o n o t e v e n m e n t i o n t h e c o m p a n y s n a m e , f e a t u r i n g i n s t e a d o n l y t h e s w o o s h l o g o . M o s t N i k e a d s s e e k t o p o r t r a y t h e core values of sport as Knight sees them (striving, effort, achieve-ment, satisfaction). Most Nike ads activate these meanings and theirassociated emotions and moods, which then become linked to theproduct. Thus, for many consumers, Nike has an image that standsf o r p e r f o r m a n c e , c o m p e t i t i o n , a c h i e v e m e n t , a n d d o i n g yo u r p e r - sonal best.Despite its recent troubles, Nike is still a remarkable corporatesuccessstory.PhilipKnighthastransformedasimplesneakerintoasetofsymbolicmeanings.Sincethedark daysofthe1980s,Nikehasbecome one of the most powerful brand names in the world, in acategory with Coke, Levis, Disney, and Hallmark. Although overallsales dipped 8 percent in 1999 to $8.8 billion (with profits of $451million),Nikespositionatoptheathleticfootwearmarketisstillsecure,at least for now. By comparison, Nikes closest competitor, Reebok,recorded sales of just under $3 billion, with profits of $11 million, in1999.Nikesworldwideshoesaleshit$5.2billion(40percentmarketshare), while it raked in an additional $3.1 billion in sales of clothingandequipment.Ofcourse,Nikehasmanyviablecompetitors besidesReeboktoworryabout,includingAdidas,Fila,andConverse.Wecanbesurethesneakerwarswillcontinue. DiscussionQuestions

1. Apparently there are two market segments of consumers formany product forms of athletic shoes: those who use the shoesto engage in the designated athletic activity and those who usethe shoes primarily for casual wear and seldom engage in theathleticactivity.a . D i s c u s s t h e d i f f e r e n c e s b e t w e e n t h e s e t w o s e g m e n t s i n meansendchains,especiallyendgoals,needs,and valuesfor running, basketball, aerobics, or tennis shoes.b. Draw meansend chains to illustrate your ideas about howthesetwosegmentsdiffer.c.Whattypesofspecialdifficultiesdoesamarketerfaceinpro-moting its products to two market segments of consumerswhousetheproductinverydifferentways?2. Recently, Nike has been trying to lower its environmental impactby reducing waste and use of toxic materials. In your opinion,whatareNikesethicalresponsibilitiesinthissituation?3. Nike has expanded its product line well beyond the original run-ning shoes. It now includes models for virtually every type ofsportorphysical activity.VisittheNikeWebsite ( www.nike.com) for a complete listing of the models it sells. Moreover, Nike con-tinually introduces new models; on average, Nike introduces anewshoestyleeverydayoftheyear.Discusstheprosandconsof this continual churn of new attributes and new products. Howdoyouthinkconsumersreacttothis?4.DiscussNikestypicaladvertising strategyintermsofthetypesofmeansend connections it creates in consumers. Bring in anexampleofacurrent Nikeadtoanalyzeanddrawoutthemeaningconnectionsyoubelievethisadislikelytocreateinaconsumer.5. Recently Nike abandoned the swoosh logo in its advertising andreplaced it with the word nike in lowercase lettering. Why do youthinkNikemadethisdecision?6.WhatdoyouthinkofNikesattempttoreachthe alternativemar-ket through its ACG unit? What barriers and opportunities exist?Should ACG deviate from Nikes traditional advertising strategytoreachtheseconsumers?7.Noteveryonefindsathleticshoes highlyinvolving,butsomepeo-pledo.Forexample,kidswhoareintoshoesoftentalkinstag-geringdetailaboutthecharacteristicsand benefitsofthecurrentlypopularmodels.Identifysomeintrinsicandsituationalsourcesofinvolvement for athletic shoes, and describe some of the likelymeansendchainsforthemostinvolvedconsumers.DiscusshowNikesadvertisingstrategiesmight differinmarketingashoetohighlyinvolvedandmoderatelyinvolvedconsumers. Sources : Nike investor Web site ( www.nikebiz.com); Louise Lee, Can Nike Still Do It? BusinessWeek, February 21, 2000, pp.120128; Bill Richards, Nike Hires an Executive from Microsoft for New Post Focusing on Labor Policies, The Wall Street Journal, January 15, 1998, p. B14; David L. Marcus, The Other Shoe Drops. Nike Strikes Its Critics, U.S.News&WorldReport, May 15,2000,p.43;RandallLane,YouAreWhatYouWear, Forbes, October 14, 1996, pp. 4246 http://www.scribd.com/doc/70370740/Ebooksclub-org-Consumer-Behavior-Amp-MarketingStrategy-Ninth-Edition

155 Marketing Strategy in Action Coca-Cola C onsumer attitudes are very Important to Coca -Cola, theworlds largest marketer of soft drinks (2002 sales of $18billion cases worldwide). Coca-Cola is perhaps the best-known brand name in the world. According to Warren Buffett, thelargest holder of Coca-Cola stock, This is fundamentally the bestlarge business in the world. [The product] sells for a moderate price.Its universally liked. The per capita consumption goes up almostevery year in every country. There is not another product like it.Coca-Cola receives about 80 percent of its operating income($8.6 billion in 1992) from overseas markets. Once a big Americancompany with a substantial foreign market, Coca-Cola now is a hugeinternational company with a substantial market in the United States.What are consumers attitudes toward Coke in foreign markets? Con-sumers attitudes toward the Coke brand and Coca-Cola companytend to be most favorable in countries whose culture differs consider-ably from Americas. In many of these countriesespecially those inthe former communist worldCoke is an icon of American cultureand a symbol of a market economy. For instance, Polish consumersattitudes toward CocaCola were so positive that a crowd gatheredand spontaneously broke into applause when the first Coke deliverytruck came down the street. Brand attitudes like these are why Coca-Cola held a 45 percent share of the world market for soft drinks in1992. (Although Coke and Pepsi are closely matched in the UnitedStates, Coke outsells Pepsi by a 4-to-1 margin elsewhere in theworld.) CocaColas goal was to achieve a 50 percent market share.It seems consumers everywhere like the product (cola soft drinks)and the Coca-Cola brand. And those positive brand attitudes seem toinfluence consumers behavior. In the United States, where attitudestoward the Coke brand are positive, the per capita consumption ofCoke products in the early 1990s was 296. This means, on average,every person in the United States drank 296 8-ounce servings ofCoca-Cola products per year! Could this level of consumption goeven higher? Elsewhere around the world, there was substantial roomfor growth. In 1992, Austria had a per capita consumption of 150Coke servings per year, compared to 83 in Hungary and only 8 inRomania. Consumption in Iceland was inexplicably high at 397 serv-ings, and consumption was even higher in American Samoa at 500servings per year.Over the past 20 or so years, Coca-Cola has had many occasionsto pay special attention to the attitudes of U.S. consumers. In July1982, Coca-Cola did the unthinkable (at that time) and introduced anew brand called Diet Coke. Several executives feared diluting theCoca-Cola brand name and perhaps reducing favorable consumerattitudes toward the flagship brand. This did not occur, however. DietCoke became one of the most successful new products of the 1980s.By 1984 it had displaced 7UP to become the third most popular softdrink (after CocaCola and Pepsi). Thereafter the company rapidlyintroduced decaffeinated versions of Coca-Cola, Diet Coke, and Tab.But these successes were overshadowed by a highly controversialmarketing decision.In the spring of 1985, chairman Roberto Goizueta announced anew brand with an improved taste, to be called Coke. He alsoreported that the original Coca-Cola brand would be retired permanently. The original formula with its secret ingredient (Merchandise7X) was to be locked in a bank vault in Atlanta, never to be usedagain. New Coke was to permanently replace the 99-yearold Coca-Cola brand. Goizueta called the new product the most significantsoft-drink development in the companys history. Americans got theirfirst taste of the new Coke in late April 1985. By July, the companyreversed its earlier decision and announced that the original brand(and formula) was coming back under the brand name Coca-ColaClassic. New Coke was one of the most embarrassing new-productlaunches ever because the company failed to understand consum-ers

strong positive attitudes toward the original Coca-Cola brand.The positive attitudes and beliefs that kept Coca-Cola consumersbuying the brand over and over again are the basis of brand loyalty.Brand loyalty usually begins to develop when consumers acquirepositive attitudes based on beliefs about desirable product attributesand functional benefits (Coca-Cola is sweet, carbonated, or refresh-ing). After the brand has been around for awhile, it can accumulateextra meanings through consumers experiences in consuming theproduct. Some of these meanings can be highly emotional and self-relevant if the brand becomes associated with consumers lifestylesand self-images.In the case of Coca-Cola, many brand-loyal users associated thebrand with fond memories of days gone by. When the companyannounced that it was replacing the original Coca-Cola brand, theseconsumers reacted as if they had lost an old friend. They inundatedcompany headquarters with protests. One group in Seattle threat-ened to sue the company. Then, when June sales of new Coke didntpick up, the company hastily brought back the original brand,renamed Coca-Cola Classic.The decision to retire the old Coca-Cola formula had been verycarefully researched. Managers thought they had covered everyangle, especially taste characteristics. Coca-Cola had spent morethan $4 million on many different taste tests of the new flavor, involv-ing 200,000 consumers in some 25 cities. These tests revealed thatmore people preferred the new, sweeter flavor to the old (about

156 Section Two Affect and Cognition and Marketing Strategy 55 percent to 45 percent). But this research didnt measure every-thing. All the time and money and skill poured into consumer research on the new Coca-Cola could not measure or reveal the deepand abiding emotional attachment to original Coca-Cola, DonaldKeough, president of Coca-Cola, said later. A company spokesper-son put it this way: We had taken away more than the product Coca-Cola. We had taken away a little part of them and their past. Theysaid, You have no right to do that. Bring it back. So Coca-Cola did.In 1994, Coke Classic was the leading brand in the United Stateswith 20.4 percent market share (by volume); Pepsi had 17.8 percent;and New Coke, now called Coke II, had a tiny 0.1 percent. But Coca-Cola learned several valuable lessons from the New Coke fiasco,including the amount of equity associated with the Coke name.The highly positive meanings and feelings many consumers havefor Coca-Cola constitute its brand equity. Brand equity concernsthe meanings that attract consumers to the brand and underlie posi-tive attitudes toward it. The 1985 fiasco with New Coke clearly showedthat Coca-Cola has a powerful brand equity with its customers. Managers at Coca-Cola have used this equity to develop new brands,most of which have been successful. Most of these new brands areline extensions, minor variations of the original brand. For instance,the Coca-Cola section of a supermarket shelf might include Coca-Cola Classic, Caffeine-Free Coca-Cola Classic, Diet Coke, Caffeine-Free Diet Coke, Cherry, Lemon, and Vanilla Coke, and others.In the 1990s, Coca-Cola managed brand equity and consumerattitudeswithavarietyofstrategies.In1995itacquiredbrand equitybypurchasingtheBarqbrandofrootbeer.Coca-Colaattemptedtocreatebrandequitythroughnew-productdevelopmentbylaunchingaflotilla ofnewflavorsforitsFruitopiaandNesteabrands.IttriedtoenhancebrandequityforSpritebyusingmoredynamicgraphicsonthepackage.Coca-Cola attempted to borrow brand equity through its sponsorship of the1996SummerOlympics,heldinAtlanta(locationofworld headquarters).Finally,andmostsignificantly,Coca-Colaattemptedtoreactivatebrandequity by introducing new packages for Coke Classic that revived thevintage contour bottle. According to Goizueta, introducing the contourbottle throughout the world was the single most effective differentiationeffortinthesoft-drinkindustryforyears.Coca-Cola is the most popular beverage brand in North Americaand the rest of the world. For instance, Diet Coke and its variants

ownmore than a 55 percent share of the diet soft drink market in NorthAmerica. As further growth becomes increasingly difficult, Coke isfocusing on niche markets by creating new versions of Coke to sellto narrowly defined demographic segments.Currently Coke off ers four different varieties of no -caloriessodasoriginal Diet Coke, Diet Coke with Splenda, Coca-ColaZero, and TAB. Coke believes that the new Coke Zero will be popu-lar among young men who dont like to drink something diet. Clas-sic Diet Coke is marketed to those in their late twenties to earlythirties, while Diet Coke with Splenda is marketed to an even olderdemographic, those 30 to 40. TAB, Cokes iconic brand, is notadvertised at all and survives by the brand loyalty of aging baby boomers. Recently, Coke introduced a completely new and differentbrand to the Coca-Cola lineup Coke BlaK. This low-cal coffee-inspired soda is targeted to consumers who want a more sophisti-cated drinking experience.Since its blunder in the 1980s, Coca-Cola has been extremelycareful not to impinge on its loyalty base. But some believe that Cokeis slowly cannibalizing its core brands by offering too many choicesfor consumers, thus creating brand confusion. Consumers no longerhave the simple decision of choosing Coca-Cola Classic or DietCokenow they are faced with many flavor options.Soda sales are down for the first time in 20 years while energydrinks are becoming increasingly popular. Some believe that Ameri-cans are looking for healthy alternatives. Soda is seen as a cause ofthe childhood obesity epidemic while bottled water is increasing insales revenue. Even diet sodas arent performing as expected. Experts are now noticing a changing attitude about diet soda. Manyconsumers simply dont believe that the low-cal beverages and artifi-cial sweeteners are healthy. However, some consumers do believethat energy drinks are lower in sugar and calories, so they are turningto them instead of traditional soda.Some marketers argue that consumers want variety in their softdrinks and attribute the decline in overall soft drink sales to consumerboredom with the current offerings on the shelf. If consumers areasked it they want more Coke choices, most would respond yes.What do you think about Cokes proliferation of soft drink choices? Discussion Questions 1. Discuss the attitudes and related beliefs toward Coca-Cola ofintensely brand-loyal consumers (perhaps like those who wereupset by the New Coke in 1985). How might their attitudes andbeliefs differ from those of less involved, less loyal consumers?What marketing implications would these differences have?2. Do you think it possible for consumers to be loyal to more thanone brand of soft drink? What about more than one brand ofcola? Discuss the pros and cons of having several brands in aproduct category (as do Coca-Cola and Pepsi in the cola cate-gory). Compare the strategy of line extension to that of creatingcompletely distinct brands for these products. What factors should marketers consider in making this important decision?3. Many marketers made a distinction between customers and con-sumers. For instance, Coca-Cola sells cola syrup directly to itscustomers, the operators of bottling plants. The bottlers sell bot-tled Coke products to retailers, vending machine operators, res-taurants, airlines, and so forth. Those organizations, in turn, sellCoca-Cola products to individual consumers who drink it. Dis-cuss how the salient beliefs about Coke products might differ forcustomers and consumers. How might their attitudes towardCoke differ? Who should Coca-Cola pay more attention toitscustomers or the consumer? Why?

Chapter Six Attitudes and Intentions 157

4. Discuss Coca-Colas various strategies for managing brandequity of its many products. For instance, what are the pros andcons of borrowing versus creating brand equity? Analyze Cokesattempt to revive brand equity by reintroducing the contourbottle around the world.5. What is your opinion about the effects on consumer attitudes andintentions of Coca-Colas proliferation of choice alternatives? Whydo you think so? Sources: John Huey, The Worlds Best Brand, Fortune, May 31, 1993, pp. 4454; Anne B. Fisher, Cokes Brand-Loyalty Lesson, Fortune, August 5, 1985, pp. 4446; Thomas Moore, He Put the Kick Back into Coke, Fortune, October 26, 1987, pp. 4656; SethLublove, We Have a Big Pond to Play In, Forbes, September 13, 1993, pp. 216224; Andrew Wallenstein, Coca-Colas SweetReturn to Glory Days, Advertising Age, April 17, 1995, p. 6. Copyright, Crain Communications, Inc., 1995; Paul Lukas, The Mar-keting Gods Must Be Crazy, Fast Company, September 2005, p. 34; Melanie Warner, Soda Sales Are Showing Their Age, The New York Times, March 9, 2006, p. C1;

Marketing Strategy in Action Hallmark Cards I t is one of the least likely businesses ever invented. However, Hall-mark and its main competitorsAmerican Greetings and GibsonGreetings, plus an assortment of so-called alternative card com-panies make a good living selling sentiment to American consum-ers. In fact, a greeting card is one of the most profitable things thatcan be made with paper and ink. Consider the Three Little Angelscard, Hallmarks best-selling Christmas card ever, which has soldmore than 37 million units and brought in more than $22 million duringthe 24 years it has been produced.Messages of congratulations and good cheer have been exchanged for centuries, but not until recent times have they taken theform of greeting cards. The first greeting cards were Christmas cards,invented in 1843 by a British businessman too busy to write his tradi-tional Christmas letter. By the 1870s, expensive Christmas cards werequite popular among wealthy Americans. Joyce C. Hall and JacobSapirstein (founders of Hallmark and American Greetings, respec-tively) are regarded as the architects of the modern-day greeting cardindustry. (You can review the history of Hallmark at www.hallmark.com / and American Greetings at americangreetings.com/ .) Hall andSapirstein transformed a turn-of-the-century fad for picture postcardsinto a social custom in which consumers buy and send cards to con-vey their feelings and sentiments about birthdays, weddings, birthsand deaths, graduations, and so on. Todays consumer can buy agreeting card to signify virtually any situation and circumstance youcan imagine (and some you cant imagine). Sending greeting cards isso popular in the United States that greeting cards have sometimesconstituted as much as 50 percent of the volume of first-class mail.The business Joyce Hall started in 1910 has grown into HallmarkCards,Inc.,a$4.2billionworldwideorganization headquarteredinKan-sas City, Missouri. Hallmark publishes greeting cards in more than 30languagesanddistributestheminmore than100countries.Anestimated4 billion Hallmark cards are available in the United States alone. Thecompanyproduces11,000new carddesignsand8,000reuseddesignseachyear.Inaddition,Hallmarkmarketsthousandsofrelateditemssuchasgiftwrap,partygoods,Christmas ornaments,jigsawpuzzles,ribbon,andwritingpaper.HallmarkalsoownsBinney&Smith,makerofCrayolacrayons;aportraitstudiochain,ThePicture People;andHallmarkEnter-tainment,produceroffamily-orientedtelevisionprogramming. Hallmarks Traditional Products and Brands Consumers consistently rank the Hallmark brand name among thetop 10 quality brands in any category. The company markets greetingcards under a number of different brand names, including: Ambassador. A Hallmark tradebrand for mass merchandiseretailers such as grocery stores, drugstores, and discount stores.It is sold in more than 4,700 mass-channel stores across theUnited States. Warm Wishes. A line of 99-cent cards designed to help Hallmarkcompete against discount card retailers. Shoebox Greetings. A collection of witty, irreverent greeting cardsdesigned to compete with the so-called alternative cards. Thesecards reflect todays lifestyles, with topics ranging from malefemale relationships to pregnancy, and from stress in the work-place to congratulating a co-worker on a promotion.

Mahogany. A greeting card line created specifically for AfricanAmerican consumers. The designs and messages celebrate Afri-can American heritage, tradition, and culture. Hallmark en Espaol. A card line for Hispanic consumers withbilingual (Spanish and English) messages and culturally specificcaptions. This line contains cards for dates important to Hispanicconsumers. The Tree of Life. A line of cards for Jewish consumers for holidayssuch as Passover, Rosh Hashanah, and Hannukah. Hallmark Business Expressions. Customized cards created to helpbusiness clients form lasting relationships with their customers andemployees. Hallmark has designed custom cards for the New YorkYankees, NASA, Radio Shack, and State Farm Insurance. The company also offers Hallmark Keepsake Ornaments and PartyExpress party products, such as matching printed plates, tablecovers, and decorations appropriate for specific occasions.Hallmark personal expression products are found in more than43,000 retail outlets in the United States. About 5,600 are specialtystores, of which more than 4,000 are certified Hallmark Gold Crownstores. Another 30,000 are mass merchandise retailers, including dis-count, food, and drug stores. The Hallmark and Shoebox brands,along with exclusive Hallmark Keepsake Ornaments, are availableexclusively at the Gold Crown stores. Hallmark Online Hallmark launched its Web site in 1996. Initially the site containedcorporate information and soon expanded to allow consumers to send their own e-cards (some for free, some for a charge). However,the company that reall y prospered from the increased use ofe cards was not Hallmark but a newcomer, Blue Mountain Arts ( www.bluemountain.com ). Blue Mountain offered free e-cards andbecame one of the Internets most popular sites. In September 1999it attracted more than 9 million visitors, ranking it 18th on MediaMetrics list of the top 50 Web sites. American Greetings also reported a surge in activity on its site thanks in large part to an alli-ance with America Online. 186

Chapter Seven Consumer Decision Making 187 In the summer of 1999, Hallmark responded with a relaunch of itsconsumer Web site (the Web address is now listed on the back of allof Hallmarks traditional paper cards). Visitors can choose from a col-lection of about 600 free e-cards, which are unique to the Web site(not available in stores). In fact, the e-cards are created by a sepa-rate team of designers. Customers can also purchase gifts and sendflowers at the Hallmark site. There is even a service that will e-mailyou a reminder of upcoming holidays, birthdays, anniversaries, andso forth. The notice is intended to stimulate problem recognition anda subsequent problem -solving session to select an appropriategreeting card (hopefully, a Hallmark card). Hallmark reported its1999 Web traffic increased 200 percent, with Web sales jumping up600 percent. The Marketing Problem

Distribution is a key element of Hallmarks marketing strategy: puttingits products where consumers can easily access them and make pur-chase decisions. Nationwide, Hallmark personal expression productsare found in more than 43,000 retail outlets. In the mid-1980s, Hall-mark emphasized the Hallmark Gold Crown stores as the place tobuy high-quality greeting cards and receive special services. To buythe exclusive high-end Hallmark card and other products, consumersfirst had to decide to go to a Hallmark card shop. This strategy ofdedicated Hallmark stores seemed to work well for many years, butby the mid to late 1990s it was in serious question. Between 1990 and2000, Hallmarks overall market share in the United States declinedfrom 50 percent to about 40 percent.Historically, about 75 percent of Hallmarks top-of-the-line cardswere sold in the specialty shops. This was fine as long as many con-sumers chose to shop at those locations. But as distribution of greet-ing cards to mass merchandisers and other locations (airports andbus stations) increasedand as the Internet grew in popularityconsumers shopping behavior changed. Fewer consumers weredeciding to go to a card specialty store first let alone a Hallmarkstoreto shop for cards. Many time-starved customers found it easierto buy cards at stores they already frequented (grocery stores, dis-count chains, drugstores) or to send a free card via e-mail rather thanmake a special trip to a Hallmark store. Specialty card shops onceaccounted for nearly 65 percent of greeting card sales but that figurefell to less than 33 percent by the late 1990s. Also, massmerchandisers were selling an increased number of cards. AlthoughHallmark produces its Ambassador and Warm Wishes lines of cardsfor sale in these outlets, it did not sell its top-ofthe-line cards there.How should Hallmark distribute its many brands if sales at dedi-cated card stores continue to fall? Should Hallmark develop distribu-t i o n d e a l s t o b e g i n s e l l i n g i t s u p s c a l e c a r d s t o t h e m a s s merchandisers, even at the risk of alienating the owners/operators ofthe Hallmark Gold Crown shops? Will its current Web strategy proveeffective in the long run? Solving these difficult marketing problemsrequires understanding many aspects of consumer decision makingand problem solving. But Hallmark has a major asset: its name. TheHallmark brand has considerable equity and a strong reputation forquality and integrity, particularly among older consumers. Discussion Questions 1. Why do so many consumers continue to buy and send greetingcards instead of writing a letter, sending an e-mail, or making aphone call? Discuss your answer in terms of the means endframework.2. The typical decision-making process for buying a Hallmarkcard is likely to vary in different situations. Think about three dif-ferent occasions for buying a card: a birthday, a graduation, anda wedding. How would consumer knowledge and involvementvary across these situations? Discuss how problem recognition,search, and evaluation might differ. What types or level of deci-sion making would you expect in each situation?3. Understanding how and why consumers make store choices(i.e., buying a card in a Wal-Mart rather than in a Hallmark GoldCrown store) is particularly important to Hallmark. Discuss howstore choice interacts with and influences choices of Hallmarkproducts and brands.4. Do you think Hallmark should modify its in-store distribution strat-egy? What about its Web strategy? What assumptions do youmake about consumer decision making that lead you to this rec-ommendation?5. Marketing research estimates men account for only 15 to 20 per-cent of greeting card purchases in the United States. Further-more, young consumers and those over 50 dont buy as manycards as those in middle age. Why do you think this is so? Whatcan Hallmark do to reach these two segments? Sources: Kipp Cheng, Hallmark.com Revamps Consumer-Targeted Site, Adweek, May 24, 1999, p. 46; Michael Hartnett, TheNew Card Game: Playing Catch-Up,

Supermarket Business, March 15, 2000, pp. 67, 74; Matt Hamblen, Greeting Card Rivals TapTechtoStayonTop, Computerworld, March 1, 1999, pp. 1, 97.

306 Marketing Strategy in Action Sony I n just over a half-century, Sony Corporation has gone from a10-person engineering research group operating out of a bombed-out department store to one of the largest, most complex, andbest-known companies in the world. Sony co-founders Masaru Ibukaand Akio Morita met while serving on Japans Wartime ResearchCommittee during World War II. After the war, in 1946, the pair gotback together and formed Tokyo Telecommunications EngineeringCorporation to repair radios and build shortwave radio adapters. Thefirst breakthrough product came in 1950, when the company pro-duced Japans first tape recorder, which proved very popular in musicschools and in courtrooms as a replacement for stenographers.In 1953, Morita came to the United States and signed an agree-ment to gain access to Western Electrics patent for the transistor.Although Western Electric (Bell Laboratorys parent company) sug-gested Morita and Ibuka use the transistor to make hearing aids, theydecided instead to use it in radios. In 1955, Tokyo Telecommunica-tions Engineering Corporation marketed the TR-55, Japans first tran-sistor radio, and the rest, as they say, is history. Soon thereafter,Morita rechristened the company as Sony, a name he felt conveyedyouthful energy and could be easily recognized outside Japan.Today Sony is almost everywhere. Its businesses include electron-ics, computer equipment, music, movies, games, and even life insur-ance. It employs 160,000 people worldwide and does business on sixcontinents. In 2005, Sony racked up sales of $67 billion; 31 percent ofthose sales came from Japan, 30 percent from the United States, and22 percent from Europe. (To visit some of Sonys country-specific Websites, go to www.sony.com and click on Global Sites.)Perhaps Sonys most famous product is the Walkman. Created in1979, the Walkman capitalized on what some perceived as the startof a global trend toward individualism. From a technological stand-point, the Walkman was fairly unspectacular, even by 1979 standards,but Sonys marketing efforts successfully focused on the freedom andindependence the Walkman provided. One ad depicted three pairs ofshoes sitting next to a Walkman with the tag line Why man learned towalk. By 2000 more than 250 million Walkmans had been sold world-wide, but Sony was concerned. Studies had shown that Generation Y(ages 14 to 24) viewed the Walkman as stodgy and outdated. SoSony launched a $30 million advertising and marketing campaign toreposition the product in the United States. The star of the new adswas Plato, a cool, Walkman-wearing space creature. The choice of anonhuman character was no accident according to Ron Boire, headof Sonys U.S. personal-mobile products group. He wanted a charac-ter that would appeal to the broadest possible range of ethnic groupsthus, the space creature. Boire explains, An alien is no one,so an alien is everyone.Sonys current vision, however, extends far beyond the Walkman:to become a leader in broadband technologies. Sony looks forwardto a day when all of its productstelevisions, DVDs, telephones,game machines, computers, and so oncan communicate with oneanother and connect with the Web on a personal network. A Sonyexecutive provides an example of such technology in action: Sayyou are watching TV in the den, and your kids are playing their musicway too loud upstairs, he says. You could use your TV remote to callup an onscreen control panel that would let you turn down your kidsstereo, all without having to get up from your recliner.Sony sees its PlayStation2 filling a major role in the Internet of thefuture. In March 2000, Sony introduced the PlayStation2 in Japan andsold 1 million units within a week. Newsweek

featured the PlaySta-tion2 on its cover that spring, even though it wasnt offered in theUnited States until later in the year. Most consumers probably boughtPlayStation2 to play video games, but its potential goes far beyondthat. It is actually powerful enough to be adapted to guide a ballisticmissile. Sony envisions consumers turning to the PlayStation2 for notonly games but also movies, music, online shopping, and any otherkind of digital entertainment currently imaginable. Ken Kutaragi, pres-ident of Sony Computer Entertainment, predicts the PlayStation2 willsomeday become as valuable as the PC is today: A lot of peoplealways assumed the PC would be the machine to control your homenetwork. But the PC is a narrowband device that . . . has been retro-fitted to play videogames and interactive 3-D graphics. The PlaySta-tion2 was designed from the ground up to be a broadband device.The PlayStation2 and now PlayStation3, introduced in late 2006,reflect a changing attitude within Sony regarding partnerships withother companies. Toshiba helped Sony design the Emotion Engine,which powers the PlayStation2. In previous years, these kinds ofalliances were the exception rather than the rule with Sony. Sony was perceived as arrogant because it rarely cooperated with othercompanies, preferring to develop and popularize new technologieson its own. Recently, however, that has changed. Sony has workedwith U.S.-based Palm to develop a hand-held organizer with multi-media capabilities, cooperated with Intel to create a set of stan -d a r d s f o r h o m e n e t w o r k s , a n d l a u n c h e d a j o i n t v e n t u r e w i t h Cablevision to build a broadband network in the New York metro-politan area. Nevertheless, some critics believe Sony remains tooinsular, look ing on from the sidelines while other companies joinforces to create entertainment powerhouses. Sony has no allianceswith U.S. cable or television networks, raising some doubts aboutits ability to fully develop its home Internet services. Sony hastalked with other music companies about possible joint ventures, but nothing has come to fruition.

Chapter Twelve Cultural and Cross-Cultural Influences 307 Unlike many U.S.-based multinationals, Tokyo-based Sony tra-ditionally has marketed itself on a regional rather than a globalbasis. For example, Sony has almost 50 different country-specificWeb sites from which consumers can order products. However,there are signs that strategy may be changing, at least to some degree. Sony launched www.Sonyst yle.com , aWeb site that is thecompanys primary online outlet for selling movies, music, andelectronic products. Sony also plans to provide product service and support on the site, and eventually software upgrades as well.The current main Web site ( www.sony.com) is mainly a source forcorporate and investor information. Also, in 1997 Sony embarkedon a worldwide ad campaign designed to make itself and its prod-ucts more relevant in the eyes of younger consumers. Ironicall y,much of Sonys future growth may come from its own backyard. Theprimary buyers of electronic and digital products are ages 15 to 40.It is estimated that by 2010, two-thirds of the people in the world inthat age bracket will live in Asia. Tokyo is already a powerful influ-ence on Asian culture. Asias most popular youth magazines are published in Tokyo, and most of the music Asian young

people lis-ten to comes from Tokyo. So part of Sonys challenge is to continueto grow on a global scale while paying close attention to the bur -geoning market at home.Immediately following World War II and for some years thereafter,the label Made in Japan connoted cheap, shoddy, imitation prod-ucts. Today, for many people, that same label stands for excellenceand innovation. Certainly Sony can take much of the credit for thattransformation. Now the question is whether Sonys products andmarketing efforts can keep pace (or set the pace) in the upcomingage of digital convergence. Discussion Questions 1. Identify and discuss some of the cultural meanings for Sony pos-sessed by consumers in your country. Discuss how these culturalmeanings were developed and how they influence consumersbehaviors (and affect and cognition). What is the role of market-ing strategies in creating and maintaining (or modifying) thesecultural meanings?2. It is often stated that the world is becoming smaller becausetoday people can communicate relatively easily across time anddistance. Discuss whether that has been beneficial for Sony.What are some marketing challenges it presents?3. What do you think about Sonys tradition of region-specific ornation-specific marketing? Would Sony be better served by work-ing to create a more uniform global image?4. What kinds of factors do you think Sony considers when decidinghow to market its products in various countries? How might itsAmerican marketing efforts differ from those in Japan or Europe?5. Describe the benefits Sony gets from some of the international alli-ances mentioned in this case study. Do you believe Sony needs tobecome more aggressive in forming such partnerships? Sources: Brent Schlender, Sony Plays to Win, Fortune, May 1, 2000, pp. 142157; Evan Ramstad, Backpacks with Speakers?Electronics Makers Court Jaded Gen YBig Ad Budget, Little Alien: Walkmans Plan for Reeling in the Ears of Wired Youths, The Wall Street Journal, May 18, 2000, p. B1; Janet Pinkerton, Sony Founded on Friendship, Ambition, Dealerscope, January2000, p. 16.

437 Marketing Strategy in Action The Cereal Wars W hats for breakfast? For more and more Americans, theanswer to that question is nothing.For decades, the breakfast cereal market was marked bysteady growthwhich seemed logical. An expanding population meantmore mouths to feed and thus more people eating breakfast. But in themid-1990s, lifestyles began to change. As Americans watched theirlives become more hectic, many opted to eat breakfast on the run orskip it entirely. They didnt have time to take the cereal from the cup-board and the milk from the fridge and sit down to a leisurely breakfast.According to one expert, People wish they could just get breakfastinjected into them on the run. From 1995 to 2000, the size of the break-fast cereal market slipped nearly $1 billion, down to $7.7 million. But inthe midst of all this was a success story: General Mills. While the indus-try as a whole was taking a beating, General Mills saw its cereal salesgrow an average of almost 6 percent per year between 1996 and 1999.At the end of 1999, General Mills became the nations number onecereal seller for the first time ever, supplanting Kellogg. How could acompany thrive in such a seemingly bleak market? Why had GeneralMills flourished while Kellogg tumbled? A primary reason is GeneralMills increasingly aggressive marketing strategies.The cereal market is highly competitive, with the top fourcompaniesGeneral Mills, Kellogg, Quaker Oats, and General Foods(Post Cereals)controlling more than 80 percent of the market in 1999.In the early 1980s, Kellogg turned up the competitive heat by increas-ing promotion expenditures, especially for advertising. Kellogg saw itsmarket share bounce 4.5 percent, from 36.7 percent in 1983 to 41.2percent in 1988. Over this same span, General Mills market share wasbasically flat, moving up from 20 to 21 percent over the five years, whilePosts market share fell nearly 3 percent. These changes were signifi-cant. In 2000 ready-to-eat cereal was a $7.7 billion market in the UnitedStates, making each share point worth about $75 million in sales.Kelloggdidnotintroduceanyhighlysuccessfulnewproductsduringtheseyears.Infact,itdidnotrolloutonesuccessfulnewproductfrom1964 through 1991. What it did do was promote its existing cerealsextremelywell,targetingespeciallythepoolof80millionbabyboomers.For instance,KelloggpositionedFrostedFlakes(anditsfamedTonytheTiger)ascerealappropriateforadults,withadsthatclaimed,FrostedFlakeshavethe tasteadultshavegrowntolove.Theextensivepromo-tion catapulted Frosted Flakes ahead of General Mills Cheerios tobecomethe nationsnumberonebreakfastcerealbrandby1988.Kel-logg supported its products with a promotion mix of extensive TV andprint advertising combined with various types of sales promotions. Foryears,morecouponsweredistributedforbreakfastcerealthanfor anyothercategory.A1992studyofcerealadscontainingcouponsfoundthat55 percent were from Kellogg, 22 percent from General Foods, and15percentfromGeneralMills.Kelloggsmostfrequentlyusedpromotiontechniquewastooffertwoboxesofcerealforthepriceofone, sometimesthreeforthepriceoftwo(31percentoftheiradsmadethisoffer).Bythemid-90s,Kelloggstillhadacomfortablegriponmarketleadership.But then the cereal market began to change, and General Millsmarketing department was up to the task. More than most products,breakfast cereal is marketing sensitive. That is, dollars spent on me-diocre promotions simply fall into the void; they have no noticeableeffect on consumers. But the same amount of money spent on a well-designed promotion strategy can dramatically increase sales andproduce significant shifts in market shares. For example, in 1996General Mills ran a very successful promotion tied into its sponsor-ship of the Olympics. Customers who sent in eight proofs of purchasefrom General Mills products received a coffee table book entitled TheOlympic Spirit. It was an immediate hit. Within one week, GeneralMills went through 20,000 books and generated sales of more than200,000 boxes of cereal, according to one expert. It was the mostsuccessful in-store promotion theyve ever run.General Mills has also successfully (and creatively) targeted thekids market over the past few years. In 1999, the company put the59-year-old Cheerios brand in front of a new generation of consumersby publishing a pair of childrens books with the Cheerios logo on thecover.Normallysuchbooks wouldsellabout25,000copiesayear.Thetwo Cheerios books sold more than 1 million. General Mills followed upin 2000 with the introduction of Cheerios puzzles, toys, and clothing.Among the new products was a toy cell phone that dispensed

Cheeriosand pajamas adorned with the smiling face of the Honey Nut Cheeriosbee. Leigh Ann Schwarzkopf, General Mills manager of trademarklicensing, says, Since 1998 weve gone from zero to about $100 millionat retail. General Mills has also tied in several of its cereal brands withpopular childrens movies and products. In 1998 it capitalized on SabanEntertainmentsdirect-to-videorelease of Casper Meets Wendy ,amoviefeaturing the lovable Casper the Friendly Ghost. General Mills CountChocula, Frankenberry, and Boo Berry cereals all contained marshmal-lows shaped like characters from the movie. Parents appreciated thecorresponding mailin offer: $15 in coupons in exchange for the pur-chaseoftwoGeneralMillscerealsandthreeHersheyproducts.In1999,a similar tie-in with Time Warner put Scooby Doo on (and in) 4 millionboxes of Count Chocula. When the company decided to place figurinesfrom the movie ToyStory2 inside cereal boxes, it created a new kind ofpackaging that allowed kids to see the toy before they even opened thebox. Also in 1999, General Mills reached out to teenagers, printing $5coupons for Sony PlayStation video games on boxes of Lucky Charms,Trix, Cocoa Puffs, and several other popular kids cereals. The GeneralMills Web site ( www.generalmills.com )has a You Rule Schoolsection, which includes games, educational information, and an oppor-tunity for kids to e-mail their favorite cereal characters.

438 Section Five Consumer Analysis and Marketing Strategy Nor did General Mills forget the adult consumer. In 2000 it launched Harmony, an oatmealfortified cereal geared toward health-conscious women. It promoted the new brand with a multimilliondol-lar TV and print advertising campaign. The company also persuadedthe American Heart Association to endorse the health benefits ofCheerios and added calcium to Lucky Charms. Moreover, in responseto Americans yearning for breakfast -on-the-go, General Millslaunched a line of Milk n Cereal bars made from its Honey Nut Cheer-ios, Cinnamon Toast Crunch, and Chex brands. It also supportedthese new products with an extensive advertising campaign. Con-sumers also like General Mills annual Salute to Savings coupon book,which offers discounts of up to $60 on future purchases.While General Mills was using these promotions to build marketshare, Kellogg seemingly could do nothing right. For one, its brandswere familiar, but not particularly strong. Analyst William Leach of Don-aldson, Lufkin, & Jenrette explains, At General Mills, Wheaties is abrand.ButKelloggsCornFlakes?Thatjustdescribeswhatsinthe box.ThelackofstrongbrandidentificationhasmadeKelloggcerealsespe-cially vulnerable to private-label imitators. Furthermore, Kellogg blun-dered in adapting to the healthier, faster-paced American lifestyle.Whereas General Mills rolled out healthier cereals, Kellogg was moretentative, creating a campaign called K-Sentials, which emphasizedthe nutritional value of its existing cereals. It flopped. As a writer for Fortune illustrates,WhothinksThisisgoodforme!whilemunchingonFroot Loops? Kelloggs early foray into quickie breakfasts was also adisaster.BreakfastMatescrammedcereal,milk,abowl,andaspoonallinto one package. Unfortunately, it was all but impossible to eat whiledriving.Saleswereweakandthecompanykilledtheproductin1999.Inaddition,asthemarketfortraditionalbreakfastcerealsdeclined,Kelloggwas reluctanttoreduceprices.Then,afterfinallydecidingtoofferdollar-offcoupons,ittriedtopreserveearningsbycuttingbackonadvertising.That strategy played right into General Mills hands. In 1999, GeneralMillsoutspentKellogginadvertisingbynearly2to1.Kellogg,however,isnow fightingbackbyboostingadvertisingexpen-ditures.Itisalsomakingaconcertedefforttowinbackchildrenby,amongotherthings,offeringvariousgiftitems insideboxesofselectedcerealsanddevelopingnew,moremobilebreakfastproducts.ItsWebsite(w w elloggs.com)discussesotherpromotionalefforts w. k thatareunderway.An important battleground in the future could be the internationalarena,whereKellogghastraditionallybeenvery

successful.Kellogghasbeen a leader in promoting cereal and milk to start the day in countrieswheresuchabreakfasthasnotbeenthe norm.Forexample,intheearly1990s,KelloggforayedintoIndiawiththelaunchofaproductmadefrombasmati rice, a premium, aromatic rice. To help entice consumers toswitch from fried breakfasts high in fat, its advertising communicated athemecommonlyusedin theAsia/PacificRimarea:eatingtoomanyfattyproducts such as butter and fried foods is bad for you, and so is skip-ping breakfast altogether (which about 20 percent of Indians did). Kel-logg also sponsored TV and radio shows featuring dieticians andnutritionists,andsetupbillboardswithnutritionalmessagesalongbusyhighwaysnearbigcitieslikeMumbai.Kelloggalsomanaged,aftermanyyears, tocracktheMexicanandEuropeanmarkets.General Mills has begun making strides internationally as well,thanks to partnerships with Pepsi and Nestl. In addition, it launcheda line of cereals ( Para su Familia) with bilingual packaging to appealto the growing Hispanic population in the United States.For General Mills and Kellogg, product diversity and creative mar-keting strategies appear to be the keys to future success both in theUnited States and around the world as the cereal wars continue. Discussion Questions 1. Use the meansend model to describe (based on your intuition)the consumerproduct relationship for three segments of thebreakfast cereal market: kids (ages 6 to 12), teens/young adults(ages 16 to 22), and baby boomers (ages 35 to 50). What impli-cations do your ideas suggest for promotion strategies targetedtoward these three groups?2. Find a current print ad for either Kelloggs or General Mills cereal.Describe the ad strategy using the MECCAS model described inthe text (identify the driving force, message elements, leveragepoint, and so on). Use the meansend approach to critique the adstrategy and make suggestions for improving the ad.3. Both companies discussed in this case use a mix of promotionsto market their cereals. Discuss how consumer reactions tobrand-oriented advertising and sales promotions (coupons ver-sus prizes and premiums) are likely to differ. Discuss the likelyeffects on consumers behavior, affect, and cognition for a 75-cent coupon for cereal versus a price reduction deal such asbuy three for the price of two.4. Discuss the likely effect on consumers behavior, affect, and cog-nition of the various forms of promotion General Mills has used totarget children. What do you think are the effects on both parentsand kids?5. Discuss the cultural issues faced by Kellogg and General Mills intrying to induce consumers in other cultures to adopt ready-to-eat cereal as a food for breakfast. What types of changes in con-sumers meanings and behaviors must occur before these consumers will accept ready-to-eat breakfast cereal? In additionto what is described in the case, what other promotional strate-gies could these companies use?6. Why do you think the breakfast cereal market is so marketingsensitive? Why do consumers respond to good marketing pro-motions but not at all to weak ones? Sources: Amy Kover, Why the Cereal Business Is Soggy, Fortune , March 6, 2000, p. 74; Linda Formichelli, Scoring Points withSports Incentives, Incentive, September 1999, pp. 9499; Keith Naughton, Crunch Time at Kellogg, Newsweek , February 14,2000, pp. 5253; Melinda Fulmer, Food Makers Cashing in by Turning Brands into Books, Toys, Los Angeles Times, March 26,2000, p. C4;

488 Marketing Strategy in Action Amazon.com I n 1994 Jeff Bezos, a young senior vice president at a Wall Streetinvestment firm, decided to become a part of the Internet revolu-tion. He decided to try to sell books via the World Wide Web. Whybooks? Because about 1.3 million books were in print at the time.Also, Bezos thought he would be able to provide the customer withdiscounted prices, the opportunity to get any book wanted, and con-venience. Bezos initially came up with a list of possible items to sellonline, including books, music, PC hardware and software, and mag-azines. After eliminating all but books and music, he realized that only250,000 music CDs were available at any one time compared to 1.5million English book titles (3 million titles if all languages were consid-ered). So Bezos decided to go with books and drew up a businessplan as he and his wife drove westward in search of their new home.He subsequently decided to start his new business in Seattle andsold his first book in July 1995. And with that, Amazon.com began itsrapid ascent toward becoming one of the most recognized busi-nesses in the world.Amazon.com has succeeded while many other fledgling Internetcompanies failed. Bezos, who was named Time magazines Personof the Year and Advertising Age s Marketer of the Year, is the first toadmit that first-mover advantage was instrumental in the growth of hiscompany. He also credits the companys success to the comprehen-sive selection of books available. Theres no way to have a physicalbookstore with 1.1 million titles, he says. Our catalog, if you were toprint it, would be the size of seven New York City phone books. Inaddition, Amazon.com is known for its ability to fulfill and deliver,thanks to large investments in nationwide warehouse distributioncenters.If you are worried that your local Barnes & Noble bookstore mightbe forced out of business any time soon, however, dont be. Amazon.com cannot compete when customers want the physical presence of abookstore. The online book behemoth cannot provide soft, comfortablecouches, music, and gourmet coffee. Nor does it allow consumers theopportunity to page through a book before purchasing it, savoring thecrisp new pages and the creaking of the binding when first opened.The company does, however, offer several advantages in the way ofcustomer-tocustomer and customer-to-author interaction. Customerscan log on to the site, post a review of any book they have read, andhave it permanently associated with that books entry in the online cata-log. Also, authors are able to answer a variety of stock interview ques-tions, which are then posted on the site associated with all of theirbooks. Authors can also leave their e-mail addresses so readers maye-mail their own opinions or comments. Bezos believes that his is theworlds most customer-centric company.Another unique feature the company offers readers who havetheir own Web sites is the opportunity to set up their own specializedbookstores. For example, an expert on investing can list severalinvestment strategy books on his or her Web site and then link themfrom the site directly into the Amazon.com catalog. The company isable to track books that are purchased in this manner and gives theindividual a commission on all sales.What else can customers expect when purchasing a book fromAmazon.com? Discounts. Roughly 30 percent of the book titles arediscounted by 10 to 30 percent. The others are sold at list price.The companys strategy of providing customers with a sense o f c o m m u n i t y w i t h i n i t s W e b s i t e s e e m s t o b e w o r k i n g . W h i l e many e-tailers went out of business and many others were barelys u r v i v i n g , A m a z o n . c o m s r e v e n u e s w e r e g r o w i n g a t 2 0 percentper year and reached $14.8 billion in 2007. Its operating

profitm a r g i n a t 5 p e r c e n t b e a t m o s t r e t a i l e r s a n d a p p r o a c h e d Walmarts 6 percent. The mammoth bookseller has branched into other areas. You cannow purchase CDs, toys, home improvement products, software, vid-eos and DVDs, and small appliances at Amazon.com as well as otherproducts. With this push into selling other products, the companyfaces increasing competition from traditional retailers and e-com-merce startups. Some believe the company risks diluting its brandname by expanding its business to too many lines, too quickly. ButBezos begs to differ. He says, I get asked a lot, Are you trying to bethe Walmart of the Web? The truth is, were not trying to be the Any-thing of the Web. Were genetically pioneers. The companys formerUK managing director, Simon Murdoch, adds, Its a great name.Amazon is not tied to any product category. The brand is extendible;it stands for delivery.Time will tell if the company will continue to deliver. For now, Ama-zon.com is recognized around the world. It is the most frequentedWeb site in America and one of the top few in France, Britain, Germany, and Japan. Jeff Bezoss vision has certainly become one ofthe great entrepreneurial success stories. Discussion Questions 1. Why did books and CDs sell successfully online immediatelywhile many other products took some time to sell online?2. Do you think consumers who buy from Amazon.com also shop atother Web sites for books and CDs and buy from the site thatoffers the lowest price?3. What aspects of customer service have contributed to Amazon.coms success?

Chapter Nineteen Consumer Behavior, Electronic Commerce, and Channel Strategy 489 4. What are the differences in the purchasing experience betweenbuying a book at Amazon.com and at a Barnes & Noble brick-and-mortar store?5. What problems arose when Amazon.com expanded its offeringsto products other than books? Sources: www.amazon.com, October 30, 2008; Elizabeth M. Gillespie, Amazon Has Nothing to Fear but Success, Wisconsin State Journal, July 6, 2005, pp. C 10+; Fred Vogelstein, Mighty Amazon, Fortune, May 26, 2003, pp. 6074; K. J. Bannan, BookBattle, Adweek, February 28, 2000, pp. 9094; Survey: E-Commerce: Amazons Amazing Ambition, The Economist, February 26,2000, p. S24; B. Rosier, Amazon Leads Race to Expand Web Services, Marketing, February 24, 2000, pp. 1920; D. A. William-son, Marketer of the Year: Amazon.comDotCommerce: Worlds Biggest E-tail Brand Writes Book on Marketing Savvy, Advertis- ing Age, December 13, 1999, pp. 1, 3640; K. Brooker, Amazon vs. Everybody, Fortune,

November 8, 1999, pp. 120128; M. H.Martin, The Next Big Thing: A Bookstore? Fortune, December 9, 1996, pp. 168170; K. Southwick, An Interview: Jeff Bezos,Amazon.com, Upside, October 1996, pp. 2933. www.amazon.com 2006 Amazon.com , Inc. or its affiliates. All Rights Reserved. Amazon, Amazon.com and the Amazon.com logo are registered trademarks of Amazon.com , Inc. or its affiliatesMicrosoft Internet Explorer screen shot reprinted with permission from Microsoft Corporation.

SOURCE: http://www.scribd.com/doc/70370740/Ebooksclub-org-Consumer-Behavior-Amp-MarketingStrategy-Ninth-Edition

Vous aimerez peut-être aussi

- Organisational Management in NikeDocument16 pagesOrganisational Management in NikeAyaz Tahir Butt100% (1)

- International Business Plan and Expansion Strategies of Foreign Company in India-NikeDocument15 pagesInternational Business Plan and Expansion Strategies of Foreign Company in India-NikeRapstar VyPas encore d'évaluation

- Case Study Marketing Excellence NikeDocument3 pagesCase Study Marketing Excellence NikeShweta ShettyPas encore d'évaluation

- Report On Nike Inc. Marketing Strategy Analysis: Presented ToDocument10 pagesReport On Nike Inc. Marketing Strategy Analysis: Presented ToPRAGYAN SHREYAPas encore d'évaluation

- 4 P S of NikeDocument7 pages4 P S of NikeSunny OZPas encore d'évaluation

- Nike: A Global Leader in Athletic Footwear and ApparelDocument25 pagesNike: A Global Leader in Athletic Footwear and ApparelVinod VenkatesanPas encore d'évaluation

- Nike Inc Strategic Recommendation Report Part IDocument13 pagesNike Inc Strategic Recommendation Report Part IIkram Chakir100% (1)

- NIKEDocument44 pagesNIKEcharu95% (21)

- Marketing Analysis of Nike, IncDocument36 pagesMarketing Analysis of Nike, IncShelron JordanPas encore d'évaluation

- Marketing Case StudiesDocument14 pagesMarketing Case StudiesSammir Malhotra83% (6)

- NikeDocument31 pagesNikeHarshi AggarwalPas encore d'évaluation

- Marketing Extra QuestionsDocument6 pagesMarketing Extra QuestionsJc Duke M EliyasarPas encore d'évaluation

- Case 7 - NikeDocument3 pagesCase 7 - NikeBharathi RajuPas encore d'évaluation

- A Joosr Guide to... Shoe Dog by Phil Knight: A Memoir by the Creator of NIKED'EverandA Joosr Guide to... Shoe Dog by Phil Knight: A Memoir by the Creator of NIKEPas encore d'évaluation

- Nike IntroductionDocument17 pagesNike IntroductionQudsia bano100% (3)

- Always On: Advertising, Marketing, and Media in an Era of Consumer ControlD'EverandAlways On: Advertising, Marketing, and Media in an Era of Consumer ControlÉvaluation : 2.5 sur 5 étoiles2.5/5 (2)

- Report On Operations Management Team ProjectDocument12 pagesReport On Operations Management Team ProjectFaqirullah SamimPas encore d'évaluation

- Marketing Management Case Study 1Document3 pagesMarketing Management Case Study 1Kumari SnehPas encore d'évaluation

- Show Me the Money!: How to Make Money through Sports MarketingD'EverandShow Me the Money!: How to Make Money through Sports MarketingPas encore d'évaluation

- Group Assignment Case StudyDocument4 pagesGroup Assignment Case StudyMuhammad HassanPas encore d'évaluation

- Nike Case Study SE 08022024Document4 pagesNike Case Study SE 08022024daliaahmedPas encore d'évaluation

- Assignment 01 - Case 01 - NikeDocument2 pagesAssignment 01 - Case 01 - NikeMahmudul HasanPas encore d'évaluation

- Marketing Management Case Study 1Document2 pagesMarketing Management Case Study 1niharaPas encore d'évaluation

- NikeDocument3 pagesNikeMaaz KhanPas encore d'évaluation

- Nike by HakimzadDocument11 pagesNike by HakimzadHakimzad9001 Faisal9001Pas encore d'évaluation

- How Nike Built a Global Brand Through Deep Customer RelationshipsDocument3 pagesHow Nike Built a Global Brand Through Deep Customer RelationshipsPeter PiperPas encore d'évaluation

- Ib End-Term Jury Nike11Document27 pagesIb End-Term Jury Nike11srishty dhanukaPas encore d'évaluation

- Nike Hit The Ground Running in 1962Document2 pagesNike Hit The Ground Running in 1962Sandeep LondhePas encore d'évaluation

- NIKE Case StudyDocument3 pagesNIKE Case StudyMohamed Lotfy ElNaggarPas encore d'évaluation

- Nike: It's Not A Shoe, It's A Community: The Footwear Giant Has Set Up A Web Site Where Soccer Fans Can NetworkDocument13 pagesNike: It's Not A Shoe, It's A Community: The Footwear Giant Has Set Up A Web Site Where Soccer Fans Can NetworknfigueiradoPas encore d'évaluation

- Nike Case For AnalysisDocument2 pagesNike Case For AnalysisAlzahraa TradingPas encore d'évaluation

- Ib End-Term Jury NikeDocument25 pagesIb End-Term Jury Nikesrishty dhanukaPas encore d'évaluation

- Assignment On Brand Building Nike Marketing EssayDocument7 pagesAssignment On Brand Building Nike Marketing EssayShariful Huq Khan RomelPas encore d'évaluation

- 1 Nike CaseDocument2 pages1 Nike CaseLeah Lou CamadduPas encore d'évaluation

- Nike's Journey to Becoming a Global Sports Brand LeaderDocument15 pagesNike's Journey to Becoming a Global Sports Brand LeaderShiVâ SãiPas encore d'évaluation

- Strategic Analysis of Nike, IncDocument44 pagesStrategic Analysis of Nike, IncWaseem AkramPas encore d'évaluation

- NIKE Case StudyDocument9 pagesNIKE Case StudyMukti GuptaPas encore d'évaluation

- Introduction of NikeDocument7 pagesIntroduction of NikeAmrit5187Pas encore d'évaluation

- Nike Just Do ItDocument3 pagesNike Just Do ItTú Anh NguyễnPas encore d'évaluation

- Nike's History as a Sportswear PioneerDocument2 pagesNike's History as a Sportswear PioneerAnkit SinghPas encore d'évaluation

- Nike Strategic Analysis 12.19.13 - Joseph PilcDocument19 pagesNike Strategic Analysis 12.19.13 - Joseph PilcJoePilcPas encore d'évaluation

- NikeDocument30 pagesNikesehaj01Pas encore d'évaluation

- NikeDocument4 pagesNikeratnaningsih2009Pas encore d'évaluation

- CapstoneDocument57 pagesCapstoneSahil DhawanPas encore d'évaluation

- Company NameDocument14 pagesCompany NameArpita PatnaikPas encore d'évaluation

- How Nike Achieved Strong Brand Equity Through Strategic MarketingDocument4 pagesHow Nike Achieved Strong Brand Equity Through Strategic MarketingShubhekchha Neupane PandayPas encore d'évaluation

- Nike's Rise as a Global Sports BrandDocument14 pagesNike's Rise as a Global Sports Brandprafulkk96Pas encore d'évaluation

- Nike's Global Distribution StrategyDocument2 pagesNike's Global Distribution StrategyNipun JainPas encore d'évaluation

- Black Book NikeDocument8 pagesBlack Book NikeChandu Suthar0% (1)

- Consumer Behavior of Nike FinalDocument35 pagesConsumer Behavior of Nike FinalsaanndyPas encore d'évaluation

- Group Assignment Group 1 mkt101 mkt101 eDocument18 pagesGroup Assignment Group 1 mkt101 mkt101 eDo Minh Hieu K17 HLPas encore d'évaluation

- Nike Project Report 20210305011Document12 pagesNike Project Report 20210305011Govind Vishwakarma0% (1)

- Nike's "VictoriaDocument29 pagesNike's "VictoriaDerick Flores0% (1)

- Marketing Management: Department of Faculty of Management StudiesDocument8 pagesMarketing Management: Department of Faculty of Management StudiesSwayam GaurPas encore d'évaluation

- Nike Inc- Complete Analysis: SWOT, PESTLE and Marketing strategyD'EverandNike Inc- Complete Analysis: SWOT, PESTLE and Marketing strategyPas encore d'évaluation

- Hail to the King of Sneakers: Michael Jordan Nike Air Jordan Retro Time (A social media-loaded, marketing campaign, success story): BestBusinessEbooks, #2D'EverandHail to the King of Sneakers: Michael Jordan Nike Air Jordan Retro Time (A social media-loaded, marketing campaign, success story): BestBusinessEbooks, #2Pas encore d'évaluation

- Game Changer The Untold Story of Nike Air Jordan And Its Successful MarketingD'EverandGame Changer The Untold Story of Nike Air Jordan And Its Successful MarketingPas encore d'évaluation