Académique Documents

Professionnel Documents

Culture Documents

AP Business Proposal Manoj Kumar

Transféré par

Snp PandeyDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

AP Business Proposal Manoj Kumar

Transféré par

Snp PandeyDroits d'auteur :

Formats disponibles

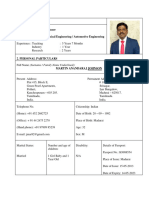

Dear Mr.

Manoj Kumar Urma

FCSL Authorized Person Proposal

Date: 18 NOVEMBER 2011

(FCSL refers to Future Capital Securities Ltd., Member Broker at NSE and BSE and AP refers to the Authorized Person) We thank you for your interest in becoming a part of the Future Capital Securities Ltd. Network. We are happy to present our business proposal to you as follows. Given mutual acceptance of the terms given in this proposal, FCSL would appoint you as Authorized Person (Business Associate) in Brijrajnagar, Jharsuguda of Orissa,. Some of the benefits you would be entitled to, as part of the FCSL Business Associate Network Centralized Advisory and Research Support: FCSL will map an equity advisor from Mumbai for daily advisory services***. Besides this, the investment and trading ideas shall also be flashed on the trading screens as well as thru an internal chat system. You will also be part of our daily and periodic teleconference calls. Marketing and Business Promotion: FCSL would share according to agreed sharing for initial marketing and brand promotion with an objective to generate new business prospects in your city. Consequently, FCSL would share brand promotion and marketing expenses as per the FCSL policy from time to time. All approved expenses would be reimbursed on submission of the original bills from your end. Business Development and Superior Product Offering: FCSL recognizes the efforts required to grow the business. We will provide business development support by providing regular trainings, new client acquisition support, client interaction and seminars, business analysis and actionable as well as business expansion ideas. This support shall be made available from the nearest regional office of FCSL. We offer a wide bouquet of products to suit varying investment needs. Seminars and Investor Meets: FCSL offers to support BA in organizing Seminar/Investor Meets with minimum 100 attendees by sharing the cost. This needs to be organized with prior approval from FCSL. Initial Training and Business Migration: FCSL offers dedicated hands-on onboarding to a BA after he enrolls with us as an Authorized Person. This includes thorough training and a detailed client and revenue migration process so that business is not lost in the transition process and the BA becomes conversant with FCSL processes and policies. Key Corporate Strategy is to Focus on the Business Associates Network: Unlike other firms, our Business Associates business is one of our most important businesses and senior management constantly reviews and constantly strive towards introduction of innovative strategies to consistently provide value add to our network. Easy Access to Senior Management: Our network has easy access to our senior and key personnel and our associates are involved in various internal forums and discussion panels for better business growth. Centralized Customer Servicing: Initially, for a period of 3 to 6 months, we will provide a dedicated desk to help you sort out the queries. This desk will also help you in understanding our processes as well as will help you coordinate with various operational departments viz. Account opening, Depository services, RMS, Operations and Banking. Once settled, we will migrate you to another desk of customer support executives where a larger set of executives service the business associates across the country. We have an internal deadline of 24 hours to respond to and resolve every query. Office Look and Feel: FCSL offers to provide initial branding accessories and marketing collaterals to the BAs office, the look and feel of BA office premises should be in accordance with the policies laid down by FCSL. FCSL shall decide on providing the same at its discretion on a case to case or relationship basis.

******************* ***Backed By proper research.

COMMERCIAL TERMS AND CONDITIONS

Eligibility Norms for AP: A person with a good track record & reputation in financial services/other business/social circles with a good client base. Minimum 2-3 years of experience in selling financial products as a Main broker/ Sub-broker / Remisor/ Mutual fund distributor /Insurance Advisor / Financial planner or an employee of existing Broker/Sub-broker. Capacity to invest minimum Rs.5.00 Lakhs initially and ability to invest continuously in infrastructure and teams for scaling up business. The AP should hold valid NCFM certificate for Cash and F&O segments and ensure that NCFM certificate holder in person has to sit on trading terminals in whose name the terminal ID has been generated. In case an employee of the AP holds the certification, then the AP shall submit a monthly certificate / confirmation to FCSL on such employee continuing with the AP in his / her employment as on the current date. The look and feel of APs office premises should be in accordance with the policies laid down by FCSL.

Security Deposit:AP to keep a minimum deposit of Rs 1, 00,000/- for Equity, F&O & commodity. Revenue Sharing- Equity, Derivatives Minimum Brokerage to be charged to end clients Brokerage Rate % 0.02% 0.20% 0.02% 0.02% 0.20% Minimum Brokerage 2 Paise 2 Paise 2 Paise 2 Paise 2 Paise

Revenue Sharing

Segment Cash

Type Trading Delivery

Ratio

Sharing Pattern

On Gross Revenue Derivatives

Trading Trading Delivery

35:65

FCSL:BA

Flat

Commodities*

Remisier and franchisee rights: - You can appoint them in your sharing slab. Account Opening Charges: - a/c opening for first 3 months (Up to 50 a/cs) BASE BROKERAGE SCHEME

Mutual Fund Revenue Sharing:AMC Commissions: 70% (includes Upfront, First Year Trail and 2nd Year Trail onwards for all schemes). Brokerage sharing same as equity broking.

PMS Revenue Sharing: - Available separately on request Connectivity Options: - FCSL shall advice / suggest Broadband as the economical mode of connectivity.

All Key Software like Back Office, DP, Client Management, and all future applications introduced by FCSL shall run on a single connection. However, for better performance, it is advised that the Trading Terminals are not used for general internet / browsing purposes.

Risk Management and Limits: We provide 4 times of base capital as exposure limits to clients in the cash market. Derivatives exposures are purely on the basis of margins specified by exchanges. We also accept shares (approved scrips only) towards margin for derivatives. Debtors management policy and thresholds for liquidation of Positions shall be separately sent to the AP.

Other Operational Terms:

Authorized Person Registration Fee:SEBI, NSE and BSE Exchange Registration Fee & Stamping Charges (One Time):- Rs 6948/- all segment ( Rs.2316/per segment)

Back office Software Charges:ODIN and Back Office Software Charges Rs 1000 per CTCL/Month Rs.425/=

Software

Odin User CTCL (ALL SEGMENTS) Broking NSE & BSE + DP Account Opening Charge

Legal & Compliance: All bad debts, or losses due to punching errors if any, will be borne by AP. No third Party transfer of funds or securities will be entertained. Any cheque return from client will entail penalty of 1% of the cheque amount payable by the client. Personal Trading of AP as an individual / proprietor / partner / Director will not be eligible for brokerage sharing. Statutory charges, as applicable from time to time, will be levied to the customers. Brokerage will be shared on a monthly only after deducting all network charges and Service Tax and aeging debits. DP AMC charges will be directly debited to Investors and AP shall ensure due settlement by Investors. As an Authorized Person of FCSL, AP is expected to sell all the products (Equity, E-broking, F&O, Commodities*, Mutual Funds, Margin Funding, Insurance*, IPO Funding etc.) promoted by FCSL & Group Companies. Requirements from AP Minimum 250 sq. Ft of office space (Owned, Rented, proposed), Standardized look and feel of the office as per FCSL guidelines, Commercial place (preferred ground floor / 1st floor)] Compulsory Quarterly System Audits at cost AP and his employees have to clear NCFM examination (Cash, Derivatives, CDSL & AMFI, Commodities*) AP has to keep himself updated about the byelaws of the Stock Exchange Commodities Exchanges or the SEBI and FMC regarding Stock Market, Depository, Commodities* or the Derivatives segment and follow them religiously. Note: This is an offer letter and does not constitute an agreement. FCSL reserves the right to amend any part or parts of this offer letter.

* Services Provided through Group Companies

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Punctuation WorksheetsDocument10 pagesPunctuation WorksheetsRehan Sadiq100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Subordination, Non - Disturbance and Attornment AgreementDocument7 pagesSubordination, Non - Disturbance and Attornment AgreementDavid CromwellPas encore d'évaluation

- The Secret of Forgiveness of Sin and Being Born Again by Pastor Ock Soo Park 8985422367Document5 pagesThe Secret of Forgiveness of Sin and Being Born Again by Pastor Ock Soo Park 8985422367Justinn AbrahamPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Augusta Issue 1145 - The Jail ReportDocument24 pagesAugusta Issue 1145 - The Jail ReportGreg RickabaughPas encore d'évaluation

- Assessment of Locomotive and Multi-Unit Fatigue Strength Considering The Results of Certifi Cation Tests in Ukraine and EU CountriesDocument8 pagesAssessment of Locomotive and Multi-Unit Fatigue Strength Considering The Results of Certifi Cation Tests in Ukraine and EU CountriesLeonardo Antônio Pereira100% (1)

- Performance Management Systems and Strategies by Dipak Kumar BhattacharyyaDocument385 pagesPerformance Management Systems and Strategies by Dipak Kumar Bhattacharyyasayal96amrit100% (3)

- Jean-Louis Cohen - Exhibitionist Revisionism - Exposing Architectural History (September 1999)Document10 pagesJean-Louis Cohen - Exhibitionist Revisionism - Exposing Architectural History (September 1999)Javier PerezPas encore d'évaluation

- Board Resolution On Assigning Signatories in The Voucher ProgramDocument2 pagesBoard Resolution On Assigning Signatories in The Voucher ProgramavinmanzanoPas encore d'évaluation

- Raw:/storage/emulated/0/download/1623980378472 - 1623980347729 - PE 4 Module 2Document11 pagesRaw:/storage/emulated/0/download/1623980378472 - 1623980347729 - PE 4 Module 2Marvin Espenocilla EspeñoPas encore d'évaluation

- Parkinson Hoehn and Yahr ScaleDocument3 pagesParkinson Hoehn and Yahr ScaleCarol Artigas GómezPas encore d'évaluation

- Catalogue Colorants TextilesDocument5 pagesCatalogue Colorants TextilesAs Des As BenedictionPas encore d'évaluation

- CV (Martin A Johnson)Document7 pagesCV (Martin A Johnson)kganesanPas encore d'évaluation

- LeaP Math G7 Week 8 Q3Document10 pagesLeaP Math G7 Week 8 Q3Reymart PalaganasPas encore d'évaluation

- Prishusingh Blogspot Com 2024 03 Digital-Marketing-Course HTMLDocument12 pagesPrishusingh Blogspot Com 2024 03 Digital-Marketing-Course HTMLsudharaj86038Pas encore d'évaluation

- A Randomised Clinical Trial Comparing Myoinositol and Metformin in PCOSDocument7 pagesA Randomised Clinical Trial Comparing Myoinositol and Metformin in PCOSAtika NajlaPas encore d'évaluation

- Would You Like Eddy Current, Video & Strip Chart in One Portable Case?Document2 pagesWould You Like Eddy Current, Video & Strip Chart in One Portable Case?Daniel Jimenez MerayoPas encore d'évaluation

- Creating A Pathway For Every Student: Holyoke High School Redesign Strategic PlanDocument29 pagesCreating A Pathway For Every Student: Holyoke High School Redesign Strategic PlanMike PlaisancePas encore d'évaluation

- New DOCX DocumentDocument2 pagesNew DOCX DocumentPunjabi FootballPas encore d'évaluation

- Samsung WF8500NMW8Document180 pagesSamsung WF8500NMW8Florin RusitoruPas encore d'évaluation

- Classical Mechanics MCQ GamecampuscoDocument3 pagesClassical Mechanics MCQ GamecampuscoFaryal TalibPas encore d'évaluation

- Plastics Library 2016 enDocument32 pagesPlastics Library 2016 enjoantanamal tanamaPas encore d'évaluation

- 1623 Asm2Document21 pages1623 Asm2Duc Anh nguyenPas encore d'évaluation

- Freeman Has Been A Partner in A Commercial Construction CompanyDocument1 pageFreeman Has Been A Partner in A Commercial Construction CompanyMuhammad ShahidPas encore d'évaluation

- Autonomic Nervous SystemDocument21 pagesAutonomic Nervous SystemDung Nguyễn Thị MỹPas encore d'évaluation

- SalivaDocument42 pagesSalivaAtharva KamblePas encore d'évaluation

- 310 311 320 321 Toilet Warranty Codes PDFDocument11 pages310 311 320 321 Toilet Warranty Codes PDFTerri MartinPas encore d'évaluation

- 10 TazmahalDocument12 pages10 TazmahalSifat E Noor SahibaPas encore d'évaluation

- Unit-4.Vector CalculusDocument32 pagesUnit-4.Vector Calculuskhatua.deb87Pas encore d'évaluation

- GlobalisationDocument8 pagesGlobalisationdummy12345Pas encore d'évaluation

- Sacramento County Compensation Survey Board of SupervisorsDocument13 pagesSacramento County Compensation Survey Board of SupervisorsCBS13Pas encore d'évaluation