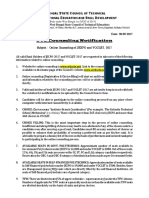

Académique Documents

Professionnel Documents

Culture Documents

Lovable Lingerie Ipo Note

Transféré par

Neha Gupta AgarwalDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lovable Lingerie Ipo Note

Transféré par

Neha Gupta AgarwalDroits d'auteur :

Formats disponibles

Enamored

March 7, 2011

Consumer Rs 195-Rs 205 March 08, 2011 March 11, 2011 Rs 878-923 mn 12.3 mn 4.5 mn 16.8 mn Rs 3.3-3.4 bn

Subscribe

Issue Details

Sector Price band Issue opens Issue closes Funds to be raised No. of pre-issue shares Issue size (No. of shares) No. of shares post issue Post issue market cap

Lovable Lingerie is one of the leading players (20% market share) in the Rs3bn super premium segment of womens lingerie in India Increasing disposable income, rising working women population and wider distribution reach are the key growth catalysts Reported impressive revenue and earnings CAGR of 30% and 38%, respectively over FY06-10 and has generated operating cash flows of Rs 97 mn for FY10 PER valuations at 19.5x-20.5x annualized FY11E EPS look attractive vs 31x FY11E (consensus EPS) for Page Industries expect market to assign scarcity premium

Leading presence in the premium womens lingerie segment

Lovable Lingerie launched the 85-year old international brand, Lovable in India in 1996. Currently, it is amongst the top three most preferred brands in womens innerwear in India (Source: CARE Report) and commands 20% share in the super premium market. It has a strong retail presence in 1,425 stores spread across major cities in the country. The companys second flagship brand, Daisy Dee, which caters to the mid-market segment, reaches 7,500 direct outlets, primarily in Southern India.

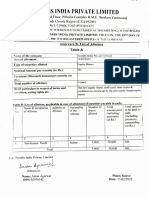

Share holding pattern

27%

Well-defined plans for future growth

It plans to invest Rs 250mn in a 90:10 joint venture with Lifestyle Galleries of London Ltd, UK to introduce, in India, the London Calling brand that caters to men and women innerwear. It also plans to set up 60 exclusive brand outlets (EBOs) for Lovable, on a franchisee model, to directly tap top tier cities in country. This would help explore and capture the untapped market in India and propel the next leg of growth.

6% 67%

Promoters

Sequoia Capital

Public and others

Strong growth potential increasing disposable income a key catalyst

The market for the premium and super premium womens lingerie segment in India is relatively small at Rs 12 bn and is expected to grow at 33% CAGR over 2009-14E, according to CARE research. We believe that, with increasing disposable income along with higher number of working women and rising product awareness, this segment is poised for a strong growth in the future.

Post issue

Objects of the issue

Particulars 2.5 mn pcs capacity expansion Brand building Brand development for College Style Investment in joint venture Setting up of EBOs (60) Shop in shops formats Upgradation of design studios Total Rs mn 228 180 60 250 141 36 76 971

Impressive performance in the past likely to continue

Lovable Lingerie has reported impressive revenue and earnings CAGR of 30% and 38%, respectively over FY06-10 and has generated cash flows of Rs 97 mn for FY10. On an annualized basis, it is expected to grow earnings at 59% in FY11E. Most likely, it would continue healthy performance in future.

Attractive valuations SUBSCRIBE

Lovable Lingerie has done a pre-IPO placement of 1mn shares at Rs200 per share with Sequoia Capital, which values the company at Rs3.4bn. At the higher price band, the stock will trade at 20.5x FY11E annualized EPS of Rs10, which is a 34% discount to Page Industries. Considering the strong growth potential and likely scarcity premium similar to Jubilant Foodworks and Page Industries, we believe the offered valuations appear attractive and could provide significant upside potential in the future. Hence, we recommend SUBSCRIBE to the issue.

Net YE-Mar FY2008 FY2009 FY2010 9MFY11 Sales 601 692 870 881 EBITDA (Core) 73 85 161 167 (%) 12.2 12.3 18.6 18.9 APAT 42 29 106 126 AEPS (Rs) 2.5 1.7 6.3 7.5 AEPS % Chg 19.6 52.9 62.6 NA ROE % 43.7 21.5 54.1 41.2 P/E 82.8 120.2 32.6 27.3 EV/ EBITDA 47.6 41.0 21.2 20.6 P/BV 28.7 23.5 14.1 9.3

Emkay Global Financial Services Ltd

IPO Note

Lovable Lingerie Ltd

Lovable Lingerie Ltd. Company background

IPO Note

Incorporated in 1987, Lovable Lingerie is promoted by Mr. L.Vinay Reddy, son of Mr. L. Jaipal Reddy, who was a pioneer in establishing branded innerwear market in India with brands like VIP and Frenchie. Mr. Vinay Reddy is the Chairman and Managing Director of the company and has over 20 years of work experience in the innerwear industry. The companys flagship brand, Lovable, was earlier licensed to the company, since 1995, from Lovable World Trading Company, USA. In December 2000, the Company acquired the brand Lovable on an exclusive basis for India, Nepal and Bhutan. The company had also acquired Daisy Dee, a mid-segment brand, from Maxwell Industries in 2004 and College Style from Levitus Trading Limited, Hong Kong in 2009 to cater to the young customer segment. Lovable Lingerie has two manufacturing facilities at Bengaluru and Uttarakhand with a total capacity of 6.7mn pieces a year.

Strong growth potential

Lovable Lingerie operates in the nascent and under penetrated market of branded womens lingerie segment. We expect that with increasing brand awareness and rising urbanization along with higher women workforce, this segment will witness robust growth in the future. CARE reports estimate the premium and super premium segment of the lingerie market to grow at 33% over 2009-14. Lovable Lingerie has reported strong revenue and earnings CAGR of 30% and 38%, respectively over FY06-10 and is likely to sustain healthy growth in future. Robust 30% revenue CAGR over FY06-10

1,000 800 600 400 200 0 9MFY11 FY06 FY07 FY08 FY09 FY10 50 40 30 20 10 0

driven by healthy 18% growth in volumes

8 Mn pcs 6 4 2 0 9MFY11 FY06 FY07 FY08 FY09 FY10

140 120 100 80 60 40 20 0

Net Sales

Source: Company, Emkay Research

Growth (YoY)

Volumes

Realization

EBITDA margins - healthy at 18.9% in 9MFY11

Net Profit recorded 38% CAGR over FY06-10

200 Rs mn 150 100 50 0 FY06 FY07 FY08 FY09 FY10 9MFY11

20 15 10 5 0 %

140 120 100 80 60 40 20 0 9MFY11 FY06 FY07 FY08 FY09 FY10

16 14 12 10 8 6 4 2 0

Rs mn

EBITDA

Source: Company, Emkay Research

EBITDA margin

PAT

PAT margin

Emkay Research

7 March 2011

Rs per pc

Rs mn

Lovable Lingerie Ltd.

IPO Note

. at attractive valuations

Lovable Lingerie is one of the few players to be listed in the domestic innerwear, especially womens lingerie market. While not a direct comparable, we would like to peg its valuations to Page Industries that operates in the domestic innerwear segment catering to all the segments. Lovable Lingeries IPO, priced at Rs195-205 per share and valued at 19.5-20.5x FY11E earnings (annualized for 9MFY11), is offered at a 34% discount to Page Industries. Besides, we expect a scarcity premium to be assigned by investors for short-to-medium term, as it happened in the public offerings of Page Industries, Jubilant Foodworks, etc. Hence, considering attractive valuations and the strong earnings growth potential, we recommend investors to SUBSCRIBE to the issue. Peer comparison

Mcap (Rs bn) Mcap to sales (x) FY11E Lovable Lingerie Page Industries* 3.4 17.2 2.9 3.5 EPS growth (%) FY11E 59.2 50.2 FY10 32.6 46.6 PER (x) FY11E 20.5 31.0 EV/EBITDA (x) FY10 21.2 28.9 FY11E 13.7 18.6 FY10 54.1 39.1 RoE (%) FY11E 40.9 52.6

* Source: Bloomberg. Note: Valuations for Lovable Lingerie is calculated on upper price band of Rs 205 and FY11E calculations are on an annualized basis.

Key risks

Lovable Lingerie operates in a single segment of womens innerwear, which is subject to constant innovations. Higher advertising spends to increase product awareness in this nascent market could lead to margin pressure and impact profitability for a temporary period. Increasing competition from higher number of international as well as domestic brands could impact its profitability.

Emkay Research

7 March 2011

Lovable Lingerie Ltd. Appendix Industry overview

IPO Note

The Indian lingerie market worth Rs 79 bn has reported a healthy 16.8% CAGR over 200609. According to Credit Analysis & Research Limited (CARE), this segment is expected to grow at a CAGR of 18.3 % to Rs 183 bn over 2009-2014. This robust growth is likely to be driven by increasing disposable income, rising number of working women, increasing product awareness and rising urbanization in the country. Indian lingerie market to grow at 18%

200 150 Rs bn 100 50 0 2006 2007 2008 Value

Source: RHP, CARE Research

700 600 500 300 200 100 0 2009 Volumes 2014E % 400

The super-premium and premium segment contributed 15.8% to the total lingerie market in 2009 and is expected to grow to 28 % by 2014. Lovable commands 20% market share in the super premium category, led by other leading brands like Enamor, Triumph, etc. Super premium and premium segment expected to grow at 33% CAGR

100% 80% 60% Mid-market (Rs 100-Rs 250) 40% 20% 0% 2006

Source: RHP, CARE Research

Low (Rs 50-below) Economy (Rs 50- Rs 100)

Premium (Rs 250- Rs 500) Super Premium (Rs 500above)

2009

2014E

Emkay Research

7 March 2011

Lovable Lingerie Ltd. Financial highlights

Income Statement

Y/E, Mar (Rs. m) Net Sales Growth (%) Expenses Growth (%) Raw Materials % Of Sales Employee Cost % Of Sales Manufacturing Exps % Of Sales Admin Expenses % Of Sales Selling & Distribn Exp % Of Sales Ebidta Growth (%) Ebidta% Other Income Interest Depreciation PBT Tax PAT (Before EO Item) Growth (%) Net Margin% E/O Item Reported PAT FY08 601 44.6 527 46.3 243 40.5 81 13.5 22 3.6 26 4.3 156 25.9 73 33.0 12.2 1 6 3 65 26 39 19.6 6.6 2 42 FY09 692 15.3 607 15.2 286 41.3 91 13.1 27 3.9 33 4.8 170 24.5 85 15.9 12.3 1 14 4 69 8 60 52.9 8.7 -32 29 FY10 870 25.6 708 16.6 404 46.5 93 10.7 28 3.2 28 3.2 155 17.8 161 89.8 18.6 1 9 13 140 42 98 62.6 11.3 8 106 9MFY11 881 714 385 43.7 88 10.0 34 3.9 207 23.5 0.0 167 18.9 9 4 10 161 34 126 14.3 0 126

IPO Note

Balance Sheet

Y/E, Mar (Rs. m) Equity Share Capital Reserves Networth Secured Loans Unsecured Loans Loan Funds Capital Employed Gross Block Less: Depreciation Net Block Investments Current Assets Inventories Debtors Cash & Bank Loans & Advances Other Current Assets Current Liabilities & Prov Net Current Assets Miscellaneous Expenditure Deferred Tax Capital Deployed FY08 15 105 120 55 15 70 190 67 31 36 10 295 166 61 20 47 151 144 0 190 FY09 15 132 147 37 27 64 211 167 35 132 10 334 135 87 20 91 260 73 -5 211 FY10 75 169 244 3 0 3 247 175 48 128 20 317 131 136 27 23 209 108 -9 247 9MFY11 113 257 369 3 3 372 183 58 126 0 370 142 176 22 29 112 257 -11 372

CashFlow

Y/E, Mar (Rs. m) Pre-Tax Profit Depreciation Non Cash Chg in Working Cap Tax Paid Operating Cash Flow Capex Free Cash Flow Investments Change in Equity Capital Loans Dividend Others Net Change in Cash Opening Cash Position Closing Cash Position FY08 65 3 6 1 -41 34 -7 27 (10) 10 8 -19 -11 4 15 19 FY09 43 4 13 75 -13 122 -100 22 (2) 0 -7 -2 -14 -2 19 16 FY10 143 13 9 -47 -21 97 -9 88 (7) 0 -61 -2 -9 9 16 26 9MFY11 161 10 -4 -45 -38 85 -105 -20 29 0 1 -9 -4 -4 26 22

Key Ratios

Y/E, Mar Profitability % Ebidta Mgn PAT Mgn ROCE ROE Per Share Data EPS CEPS BVPS DVPS Valuations (X) PER CPER P/BV Ev/Sales Ev/Ebidta Dividend Yield (%) Turnover X Days Debtor TO Days Inventory TO Days Gearing Ratio Net Debt/Equity Total Debt/Equity 12.2 6.6 26.3 43.7 2.5 2.6 7.1 0.1 82.8 79.6 28.7 5.8 47.6 0.0 37.0 101.0 0.4 0.6 12.3 8.7 36.0 21.5 1.7 1.9 8.7 0.1 120.2 107.2 23.5 5.0 41.0 0.0 45.9 71.3 0.3 0.4 18.6 11.3 45.6 54.1 6.3 6.8 14.5 0.1 32.6 30.0 14.1 3.9 21.2 0.0 57.3 54.8 -0.1 0.0 18.9 14.3 41.8 41.2 7.5 8.0 22.0 0.0 27.3 25.7 9.3 3.9 20.6 0.0 73.1 58.8 -0.1 0.0 FY08 FY09 FY10 9MFY11

Note: Valuations for 9MFY11 are calculated on the upper price band of Rs. 205

Emkay Research

7 March 2011

Lovable Lingerie Ltd.

IPO Note

Emkay Global Financial Services Ltd. Paragon Center, H -13 -16, 1st Floor, Pandurang Budhkar Marg, Worli, Mumbai 400 013. Tel No. 6612 1212. Fax: 6624 2410

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner

of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with Emkay Global Financial Services Ltd. is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither Emkay Global Financial Services Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees world wide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or may perform or seek to perform investment banking services for such company(ies)or act as advisor or lender / borrower to such company(ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without Emkay Global Financial Services Ltd.'s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.

Emkay Research

7 March 2011

www.emkayglobal.com 6

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Sample Blogger Agreement-14Document3 pagesSample Blogger Agreement-14api-18133493Pas encore d'évaluation

- CBF 10 Motion For Provisional Dismissal For Failure To Present WitnessDocument3 pagesCBF 10 Motion For Provisional Dismissal For Failure To Present WitnessAndro DayaoPas encore d'évaluation

- Legal OpinionDocument8 pagesLegal OpinionFrancis OcadoPas encore d'évaluation

- Tectabs Private: IndiaDocument1 pageTectabs Private: IndiaTanya sheetalPas encore d'évaluation

- Reducing Samples of Aggregate To Testing Size: Standard Practice ForDocument5 pagesReducing Samples of Aggregate To Testing Size: Standard Practice FormickyfelixPas encore d'évaluation

- Powerpoint For Chapter Four of Our Sacraments CourseDocument23 pagesPowerpoint For Chapter Four of Our Sacraments Courseapi-344737350Pas encore d'évaluation

- Stevens V University of Birmingham (2016) 4 All ER 258Document25 pagesStevens V University of Birmingham (2016) 4 All ER 258JYhkPas encore d'évaluation

- Electronic Ticket For 1gjtsx Departure Date 20-05-2022Document3 pagesElectronic Ticket For 1gjtsx Departure Date 20-05-2022Vikas BalyanPas encore d'évaluation

- LABOR LAW 1 - ARTICLE 36 To 39Document69 pagesLABOR LAW 1 - ARTICLE 36 To 39MONTILLA LicelPas encore d'évaluation

- IMO Online. AdvtDocument4 pagesIMO Online. AdvtIndiaresultPas encore d'évaluation

- Clado-Reyes V LimpeDocument2 pagesClado-Reyes V LimpeJL A H-DimaculanganPas encore d'évaluation

- Cpi Sells Computer Peripherals at December 31 2011 Cpi S InventoryDocument1 pageCpi Sells Computer Peripherals at December 31 2011 Cpi S Inventorytrilocksp SinghPas encore d'évaluation

- Pre Counseling Notice Jexpo Voclet17Document2 pagesPre Counseling Notice Jexpo Voclet17Shilak BhaumikPas encore d'évaluation

- JibranDocument15 pagesJibranMuhammad Qamar ShehzadPas encore d'évaluation

- 2 Multi-Realty Vs Makati TuscanyDocument21 pages2 Multi-Realty Vs Makati TuscanyLaura MangantulaoPas encore d'évaluation

- GR 220835 CIR vs. Systems TechnologyDocument2 pagesGR 220835 CIR vs. Systems TechnologyJoshua Erik Madria100% (1)

- Form No. 1: The Partnership Act, 1932Document3 pagesForm No. 1: The Partnership Act, 1932MUHAMMAD -Pas encore d'évaluation

- Education As An Agent of ChangeDocument6 pagesEducation As An Agent of ChangeHammad Nisar100% (1)

- Basis OF Judicial Clemency AND Reinstatement To The Practice of LawDocument4 pagesBasis OF Judicial Clemency AND Reinstatement To The Practice of LawPrincess Rosshien HortalPas encore d'évaluation

- Rent Agreement Format MakaanIQDocument2 pagesRent Agreement Format MakaanIQShikha AroraPas encore d'évaluation

- Ebecryl-4175 en A4Document1 pageEbecryl-4175 en A4I Love MusicPas encore d'évaluation

- Editorial by Vishal Sir: Click Here For Today's Video Basic To High English Click HereDocument22 pagesEditorial by Vishal Sir: Click Here For Today's Video Basic To High English Click Herekrishna nishadPas encore d'évaluation

- Revocation of Patent in IndiaDocument8 pagesRevocation of Patent in IndiaAartika SainiPas encore d'évaluation

- Republica Italiana Annual ReportDocument413 pagesRepublica Italiana Annual ReportVincenzo BrunoPas encore d'évaluation

- Bullet Proof G WashingtonDocument5 pagesBullet Proof G Washingtonapi-239094488Pas encore d'évaluation

- Bulletin: The Institute of Cost Accountants of IndiaDocument40 pagesBulletin: The Institute of Cost Accountants of IndiaABC 123Pas encore d'évaluation

- Share-Based Payments With Answer PDFDocument9 pagesShare-Based Payments With Answer PDFAyaka FujiharaPas encore d'évaluation

- 04 Dam Safety FofDocument67 pages04 Dam Safety FofBoldie LutwigPas encore d'évaluation

- FeeInformation BarclaysBasicAccountDocument2 pagesFeeInformation BarclaysBasicAccountkagiyir157Pas encore d'évaluation

- 05 Solution 1Document18 pages05 Solution 1Mohar SinghPas encore d'évaluation