Académique Documents

Professionnel Documents

Culture Documents

Financial Management: Howard & Upton

Transféré par

ak21679Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Management: Howard & Upton

Transféré par

ak21679Droits d'auteur :

Formats disponibles

FINANCIAL MANAGEMENT

Finance is the life of any business. No business can run properly unless it maintains its cash. Blood is essential for human being alive. In case of business finance take the position of blood. Now the question arises what is finance. Simply finance is known as cash and monetary terms but finance means more of it. Finance means measure the financial requirement and allocate cash in different heads for proper working of each department. The word management refers to manage-men-t. It means manage the men tactfully. Here the word men mean all those person who are working in the organization. Financial management is that managerial activity which is concerned with the planning and controlling of the firms financial resources According to Howard & Upton Financial Management is the application of planning and controlling function to the finance function. Thus financial management means manage the financial activity of the company. There are different approaches regarding financial management. Traditional Approach Under this approach financial management refers to rising of funds through various sources according to current need of the company. This approach is mainly concentrate on rising of fund. Through different sector in this approach the main thing is raising of capital. Transactional Approach Under this approach financial management refers to inflow and outflow of cash in operating activity. Operating activity means purchase and sale of material. Modern Approach Modern approach is rising of funds through different sources and utilizes them effectively. Capital budgeting and cost of capital must be kept in mind while raising the funds. Capital budgeting means the investment in capital goods in such a way so that we can get back our invested money easily and quickly. Cost of capital means what is the cost of raising capital. The return demanded by preference shareholders, the interest rates demanded by debenture holders, dividend requirement of equity capital holders is considered as cost of capital. Utilization of funds means effective utilization of funds in inflow-outflow; allocate the cash to different department in such a way so that business can run successfully. Thus financial management means rising of funds through different sources and utilizes them effectively.

SIGNIFICANT ACCOUNTING POLICIES

1. Basis of Preparation of Financial Statements The Financial statements have been prepared under the historical cost convention, in accordance with applicable Accounting Standards and provisions of the companies Act, 1956 as adopted consistently by the Company. 2. Recognition of Income/Expenditure All incomes & expenditures having a material bearing on the financial statement are accounted for on an accrual basis and provision is made fore all known losses and liabilities. 3. Fixed Assets Fixed assets are stated at cost, net of Modvat/Cenvat/Vat, less accumulated depreciation. Cost of fixed assets comprises purchase price, duties, levies borrowing cost, net charges on forward exchange contracts and exchange rate variations and any directly attributable cost of bringing the assets to its working condition for the intended use. Machinery spares that can be used only in connection with an item of fixed asset and their use is expected to be irregular are capitalized. Replacement of such spares is charged to revenue. Intangible assets acquired on or after 1st April 2003 satisfying the qualifying conditions prescribed under Accounting Standard 26- Intangible assets, issued by Institute of Chartered Accountants of India are capitalized.

4. Capital Work in Progress Advance paid towards acquisition of fixed assets and the cost of assets not ready to put to use before the year end, are disclosed under capital work in progress. 5. Impairment of Assets Carrying amount of cash generating units/assets is reviewed for impairments, Impairment, if any, is recognized where the carrying amount exceeds the recoverable amount being the higher of net realizable price and value in use.

6. Inventories Inventories are valued at lower of cost and net realizable value. The cost of raw material is determined by using First-In-First Out (FIFO) method. However, scrap is valued at Net realizable value. Cost of finished goods and work in progress includes cost of conversion and other cost incurred in brining the inventories to their present location and condition.

7. Sales Sales are recognized on dispatch of goods from the factory and are net of discounts but exclude sales tax. 8. Depreciation Depreciation on fixed assets is provided on written down value basis at the rate and in the manner prescribed in schedule XIV to the Companies Act, 1956. Depreciation is charged on pro-rata basis for assets purchased/sold during the year. Individual assets costing Rs. 5000 or less is depreciated in full in the year of purchase. Depreciation on incremental cost arising on account of translation of foreign currency liabilities for acquisition of fixed assets is provided as aforesaid over the residual life of the respective assets. Costs of intangible assets are amortized over five years. 9. Foreign Exchange Transactions Transactions denominated in foreign currencies are normally recorded at the exchange rate prevailing at the time of transaction. Monetary items denominated in foreign currencies outstanding at the year-end are translated at exchange rate applicable as on that date. Nonmonetary items denominated in foreign currency are valued at the exchange rate prevailing on the date of transaction. Any income or expenses on account of exchange difference either on settlement r on translation is recognized in the profit and loss account except in cases where these relate to the acquisition of fixed assets. 10. Borrowing Cost Borrowing Cost that is attributable to the acquisition or construction of qualifying Assets is capitalized as part of the cost of such assets. A qualifying asset is one that necessarily takes substantial period of time to get ready fore intended use. All other borrowing costs are charged to revenue. 11. Claims Claims receivable are accounted for on the certainty of receipt & claims payable are accounted at the time of acceptance. 12. Excise Duty Excise duty is accounted on the basis of both payments made in respect of goods cleared as also provision made for goods lying in bonded warehouse. Cenvat claimed on Capital goods is credited to capital Assets/capital work in process. Cenvat claimed on purchase of raw and other materials are deducted from cost of such material 13. Retirements Benefits Contribution to Provident fund are made to the Employees Provident fund schemes administered through Provident fund Commissioner and companys contributions is charged to revenue. The Gratuity is funded through payment to Life Insurance Corporation of India. Companys contribution paid/payable to said fund is charged to Profit & Loss Account. Provision is made for the value of unutilized leave due to employees as at the year on the basis of actuarial valuation.

14. Miscellaneous Expenditure Preliminary Expenses are amortized over a period of ten years. 15. Dividend Provision is made in the financial statements of dividend proposed for approval at the subsequent Annual General meeting. 16. Income Tax Provision for current Income Tax is made after taking credit for allowances and exemptions. In case of matters under appeal, due to disallowance or otherwise, the same is considered for provision when company accepts the said liabilities. In accordance with Accounting Standard 22- Accounting for Taxes on Income, issued by the Institute of Chartered Accountants of India, the deferred tax for timing differences between the book and tax profits for the year is accounted for using the tax rates and the tax laws that have been enacted or subsequently enacted as of the date of balance sheet. Deferred tax assets arising from temporary timing differences are recognized to the extent there is virtual certainty that the sufficient future taxable income will be available against which such deferred tax assets can be realized and are reviewed at each balance sheet date to reassure the realization.

Vous aimerez peut-être aussi

- Let's DanceDocument6 pagesLet's DancethierrystePas encore d'évaluation

- What Got You Here Won't Get You ThereDocument4 pagesWhat Got You Here Won't Get You ThereAbdi50% (6)

- Trinity The Father, The Son and The Holy SpiritDocument3 pagesTrinity The Father, The Son and The Holy SpiritThomas Lorenz (Fit For Faith Ministries)100% (1)

- Advanced Space Propulsion Based On VacuumDocument17 pagesAdvanced Space Propulsion Based On VacuumMystery Wire100% (1)

- 2022 PRUVenture and EDP For LeadersDocument26 pages2022 PRUVenture and EDP For LeadershkPas encore d'évaluation

- Ebook Setup EA Padu Viral v.100Document50 pagesEbook Setup EA Padu Viral v.100Muhd Burhanuddin100% (1)

- Honda FinanceDocument90 pagesHonda FinanceHarish MauryaPas encore d'évaluation

- Cost Allocation - PPT QweqweDocument9 pagesCost Allocation - PPT QweqweMiguel Lemuel De MesaPas encore d'évaluation

- Buku Panduan RTI Ver 9.1Document50 pagesBuku Panduan RTI Ver 9.1Rocks LeePas encore d'évaluation

- Forex Quotations and ArbitrageDocument25 pagesForex Quotations and Arbitragerohitpatil699Pas encore d'évaluation

- Chapter Fourteen Foreign Exchange RiskDocument14 pagesChapter Fourteen Foreign Exchange Risknmurar01Pas encore d'évaluation

- Islamic Social Finance Report 2015 PDFDocument164 pagesIslamic Social Finance Report 2015 PDFkalipucangPas encore d'évaluation

- Nougat Porting GuideDocument3 pagesNougat Porting GuideMandeep KumarPas encore d'évaluation

- Analisis Kredit (Likuiditas Dan Modal Kerja)Document42 pagesAnalisis Kredit (Likuiditas Dan Modal Kerja)Frans Willdansya FitranyPas encore d'évaluation

- Investment Portfolio Optimization and Performance (Case Study On PLN Pension Fund Period 2010-2020)Document6 pagesInvestment Portfolio Optimization and Performance (Case Study On PLN Pension Fund Period 2010-2020)International Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- 1 Important of Financial Advisor For Mutual Fund Investors Karvy FinalDocument113 pages1 Important of Financial Advisor For Mutual Fund Investors Karvy Finalranjeetmttl4Pas encore d'évaluation

- Accounting Information SystemDocument85 pagesAccounting Information SystemMyrna LaquitanPas encore d'évaluation

- Bse Trading SystemDocument4 pagesBse Trading SystemRaman Kumar67% (3)

- A Stock Trading Algoritm PDFDocument6 pagesA Stock Trading Algoritm PDFki_tsuketePas encore d'évaluation

- Forex Business Plan.01Document8 pagesForex Business Plan.01Kelvin Tafara SamboPas encore d'évaluation

- Commodity TradingDocument0 pageCommodity TradingNIKNISHPas encore d'évaluation

- Optimalisasi Porfolio Dana PensiunDocument12 pagesOptimalisasi Porfolio Dana Pensiunleonardoipj94Pas encore d'évaluation

- Rangkuman Rumus Screener DSIDocument2 pagesRangkuman Rumus Screener DSIParoki St Paulus NganjukPas encore d'évaluation

- PDF Bandarmology Vs Ta Vs Fa Mana Yang Lebih Bagus CompressDocument40 pagesPDF Bandarmology Vs Ta Vs Fa Mana Yang Lebih Bagus CompressRizalAbd IndoneziaPas encore d'évaluation

- Flowers For The Devil - A Dark V - Vlad KahanyDocument435 pagesFlowers For The Devil - A Dark V - Vlad KahanyFizzah Sardar100% (6)

- Analisis Fundamental IndofoodDocument31 pagesAnalisis Fundamental IndofoodtriaPas encore d'évaluation

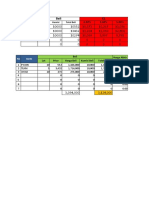

- Kalkulator Trading SahamDocument38 pagesKalkulator Trading SahamswelagiriPas encore d'évaluation

- Materi Transfer PricingDocument20 pagesMateri Transfer Pricingteamjkt48merchPas encore d'évaluation

- Ipotstock Manual PDFDocument121 pagesIpotstock Manual PDFkiriungPas encore d'évaluation

- Answers To Chapter ExercisesDocument4 pagesAnswers To Chapter ExercisesMuhammad Ibad100% (6)

- Annual ReportDocument160 pagesAnnual ReportSivaPas encore d'évaluation

- Valuasi TLKM Aditya Anjasmara Helmi DhanuDocument64 pagesValuasi TLKM Aditya Anjasmara Helmi DhanuSanda Patrisia KomalasariPas encore d'évaluation

- MergersAndAcquisition Case SolutionDocument3 pagesMergersAndAcquisition Case SolutionPranjul RaiPas encore d'évaluation

- Ohan Money Managemen Calculator: Account BalanceDocument4 pagesOhan Money Managemen Calculator: Account BalanceMiftakhul HudaPas encore d'évaluation

- Jurnal PajakDocument24 pagesJurnal PajakDiah PramestiPas encore d'évaluation

- Portfolio Selection & Asset AllocationDocument15 pagesPortfolio Selection & Asset AllocationNadea Fikrah RasuliPas encore d'évaluation

- FM 2012 WorksheetDocument9 pagesFM 2012 WorksheetBeing ShonuPas encore d'évaluation

- WSS 9.4.3 FinalDocument38 pagesWSS 9.4.3 FinalazlalchedinPas encore d'évaluation

- Writing Improvement Exercises 2022Document3 pagesWriting Improvement Exercises 2022abbyPas encore d'évaluation

- The Greatest Trading Book Ever PDFDocument12 pagesThe Greatest Trading Book Ever PDFTrần Quốc HùngPas encore d'évaluation

- Belajar Trading ADVANCEDocument18 pagesBelajar Trading ADVANCEnatania nanakoPas encore d'évaluation

- Analyzing Supermarket Shopping Paths From Indirect Observation and Simulation StudyDocument5 pagesAnalyzing Supermarket Shopping Paths From Indirect Observation and Simulation StudyArthur AguilarPas encore d'évaluation

- RW J Chapter 14 Problem SolutionsDocument6 pagesRW J Chapter 14 Problem SolutionsAlexandro Lai100% (1)

- Mutual Fund Term PaperDocument20 pagesMutual Fund Term PaperManish GuptaPas encore d'évaluation

- Wacc 4Document10 pagesWacc 4Rita NyairoPas encore d'évaluation

- A Study On The Importance of Corporate Restructuring Approches in MalaysiaDocument13 pagesA Study On The Importance of Corporate Restructuring Approches in MalaysiaValerie SintiPas encore d'évaluation

- Investment Avenues (Securities) in PakistanDocument7 pagesInvestment Avenues (Securities) in PakistanPolite Charm100% (1)

- Client Broker RelationshipDocument24 pagesClient Broker RelationshipMahbubul Islam KoushickPas encore d'évaluation

- Ebook Mmist09 v02Document52 pagesEbook Mmist09 v02abcplot123100% (1)

- Chap 012Document29 pagesChap 012azmiikptPas encore d'évaluation

- Example of Stock ValuationDocument51 pagesExample of Stock ValuationLiew Chee KiongPas encore d'évaluation

- Roles and Functions of FinanceDocument13 pagesRoles and Functions of FinanceNeil NaduaPas encore d'évaluation

- Ch-12 Recommending Model Portfolios and Financial PlansDocument8 pagesCh-12 Recommending Model Portfolios and Financial PlansrishabhPas encore d'évaluation

- Bachelor in Business Administration (Hons) FINANCE (BA242) : Future Trading Plan (FTP)Document25 pagesBachelor in Business Administration (Hons) FINANCE (BA242) : Future Trading Plan (FTP)Muhammad FaizPas encore d'évaluation

- Inter Trade Basic KnowledgeDocument84 pagesInter Trade Basic KnowledgeVictoria VCPas encore d'évaluation

- Put Option: Instrument ModelsDocument4 pagesPut Option: Instrument ModelsPutta Vinay KumarPas encore d'évaluation

- Companies Involved in Online TradingDocument10 pagesCompanies Involved in Online TradingAzaruddin Shaik B PositivePas encore d'évaluation

- Financial Invesment - EngDocument539 pagesFinancial Invesment - Eng41- Vy Võ TườngPas encore d'évaluation

- Santo Vibby Saham CurriculumDocument4 pagesSanto Vibby Saham CurriculumbeenosePas encore d'évaluation

- Sales Kit Backup 1Document28 pagesSales Kit Backup 1api-26863276Pas encore d'évaluation

- Chapter 17 Homework ProblemsDocument5 pagesChapter 17 Homework ProblemsAarti JPas encore d'évaluation

- Convertibles, Exchangeables, - and WarrantsDocument26 pagesConvertibles, Exchangeables, - and WarrantsPankaj ShahPas encore d'évaluation

- Swing Trading Plan by Juragan SahamDocument2 pagesSwing Trading Plan by Juragan SahamBillie TjahjonoPas encore d'évaluation

- Jurnal Trading - TP - CLDocument3 pagesJurnal Trading - TP - CLTrader Kaki LimaPas encore d'évaluation

- Hong Kong Stock Market for Beginners: Hang Seng Index Basics GuideD'EverandHong Kong Stock Market for Beginners: Hang Seng Index Basics GuideÉvaluation : 1 sur 5 étoiles1/5 (1)

- Take The MMPI Test Online For Free: Hypnosis Articles and InformationDocument14 pagesTake The MMPI Test Online For Free: Hypnosis Articles and InformationUMINAH0% (1)

- 1 - Pre-Bid Clarifications 16dec - 2016Document13 pages1 - Pre-Bid Clarifications 16dec - 2016Anirban DubeyPas encore d'évaluation

- Orange PeelDocument2 pagesOrange PeelCharul Shukla100% (1)

- Hampers 2023 - Updted Back Cover - FADocument20 pagesHampers 2023 - Updted Back Cover - FAHaris HaryadiPas encore d'évaluation

- Risk Management NotesDocument27 pagesRisk Management NoteskomalPas encore d'évaluation

- FSR 3.0 Frame Generation Mod Test Status (By LukeFZ)Document10 pagesFSR 3.0 Frame Generation Mod Test Status (By LukeFZ)Gabriel GonçalvesPas encore d'évaluation

- Java Programming - Module2021Document10 pagesJava Programming - Module2021steven hernandezPas encore d'évaluation

- Test 4Document8 pagesTest 4Phương AnhPas encore d'évaluation

- Cee 213 - Transport Principles in Environmental and Water Resources EngineeringDocument3 pagesCee 213 - Transport Principles in Environmental and Water Resources EngineeringenjpetPas encore d'évaluation

- Airworthiness Directive: Design Approval Holder's Name: Type/Model Designation(s)Document4 pagesAirworthiness Directive: Design Approval Holder's Name: Type/Model Designation(s)Kris Wuthrich BatarioPas encore d'évaluation

- A Deep Dive Into 3D-NAND Silicon Linkage To Storage System Performance & ReliabilityDocument15 pagesA Deep Dive Into 3D-NAND Silicon Linkage To Storage System Performance & ReliabilityHeekwan SonPas encore d'évaluation

- PMO Crossword 1Document4 pagesPMO Crossword 1Waseem NosimohomedPas encore d'évaluation

- (PRE-TEST) UPCAT Review 2014 - Math Questionnaire-1Document7 pages(PRE-TEST) UPCAT Review 2014 - Math Questionnaire-1Strawberry PancakePas encore d'évaluation

- Teaching The GospelDocument50 pagesTeaching The GospelgabrielpoulsonPas encore d'évaluation

- Using APpropriate LanguageDocument25 pagesUsing APpropriate LanguageVerna Dell CorpuzPas encore d'évaluation

- Nano Technology Oil RefiningDocument19 pagesNano Technology Oil RefiningNikunj Agrawal100% (1)

- Deep Learning The Indus Script (Satish Palaniappan & Ronojoy Adhikari, 2017)Document19 pagesDeep Learning The Indus Script (Satish Palaniappan & Ronojoy Adhikari, 2017)Srini KalyanaramanPas encore d'évaluation

- The 5 Best 5G Use Cases: Brian SantoDocument4 pagesThe 5 Best 5G Use Cases: Brian SantoabdulqaderPas encore d'évaluation

- Cesc Modules 8Document6 pagesCesc Modules 8kiethly juanitezPas encore d'évaluation

- Npcih IDocument2 pagesNpcih IRoYaL RaJpOoTPas encore d'évaluation

- Inside The Mind of A Master ProcrastinatorDocument5 pagesInside The Mind of A Master ProcrastinatorDianaPas encore d'évaluation

- Batangas Polytechnic College: The Morning After Case 7Document4 pagesBatangas Polytechnic College: The Morning After Case 7Jonard Marco RomeroPas encore d'évaluation

- Romantic Period - 12454982 - 2022 - 10 - 29 - 19 - 45Document3 pagesRomantic Period - 12454982 - 2022 - 10 - 29 - 19 - 45Paras BijarniyaPas encore d'évaluation

- My Slow Carb Diet Experience, Hacking With Four Hour BodyDocument37 pagesMy Slow Carb Diet Experience, Hacking With Four Hour BodyJason A. Nunnelley100% (2)

- Bank TaglineDocument2 pagesBank TaglineSathish BabuPas encore d'évaluation