Académique Documents

Professionnel Documents

Culture Documents

Chase Freedom Pricing & Terms

Transféré par

Deepak SinghaniaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chase Freedom Pricing & Terms

Transféré par

Deepak SinghaniaDroits d'auteur :

Formats disponibles

Pricing & Terms

https://www.firstusa.com/cgi-bin/webcgi/webserve.cgi?card=DWS ...

Pricing & Terms

Please take a moment to carefully review the Pricing & Terms below.

PRICING INFORMATION

INTEREST RATES AND INTEREST CHARGES Purchase Annual Percentage Rate (APR)

0% Intro APR for the first 15 billing cycles that your Account is open.

After that, 12.99% to 22.99%, based on your creditworthiness. These APRs will vary with the market based on the Prime Rate.

a

Balance Transfer APR

0% Intro APR for the first 15 billing cycles that your Account is open. After that, 12.99% to 22.99%, based on your creditworthiness. These APRs will vary with the market based on the Prime Rate.

a

Cash Advance APR

19.24% or, if your purchase APR is 22.99%, then 23.24%, based on your creditworthiness. These APRs will vary with the market based on the Prime Rate.

b

Overdraft Advance APR Penalty APR and When It Applies

19.24% or, if your purchase APR is 22.99%, then 23.24%, based on your creditworthiness. These APRs will vary with the market based on the Prime Rate.

b c

29.99%. This APR will vary with the market based on the Prime Rate. The Penalty APR will be applicable to your Account if you:

fail to make any Minimum Payment by the date and time due (late payment); exceed your credit limit; make a payment to us that is returned unpaid; or do any of the above on another account or loan you have with us or any of our related banks.

How Long Will the Penalty APR Apply: If your APRs are increased for any of these reasons, the Penalty APR will apply indefinitely. How to Avoid Paying Your due date will be a minimum of 21 days after the close of each Interest on billing cycle. We will not charge you periodic interest on purchases if Purchases you pay your entire balance by the due date each month. We will begin charging interest on balance transfers, cash advances, and overdraft advances on the transaction date. Minimum Interest Charge If you are charged periodic interest, the charge will be no less than $1.50.

Credit Card Tips from To learn more about factors to consider when applying for or using a the Federal Reserve credit card, visit the website of the Federal Reserve Board at http://www.federalreserve.gov/creditcard. Board FEES

PDF created with pdfFactory Pro trial version www.pdffactory.com

1 of 4

9/4/2012 11:40 PM

Pricing & Terms

https://www.firstusa.com/cgi-bin/webcgi/webserve.cgi?card=DWS ...

Annual Membership Fee Transaction fees Balance Transfers Cash Advances Foreign Transactions Penalty Fees Late Payment Over-the-Credit-Limit Return Payment Return Check

None

Either $5 or 3% of the amount of each transfer, whichever is greater. Either $10 or 3% of the amount of each transaction, whichever is greater. 3% of each transaction in U.S. dollars. Up to $15 if the balance is less than $100; up to $25 if the balance is $100 to less than $250; up to $35 if the balance is $250 or more. Up to $35. Up to $35. Up to $35.

Loss of Intro APR: We will end your introductory APR if any required Minimum Payment is 60 days late, and apply the Penalty APR. How We Will Calculate Your Balance: We use the daily balance method (including new transactions). Prime Rate: Variable APRs are based on the 3.25% Prime Rate as of 2/22/2010.

a b c

We add 9.74% to 19.74% to the Prime Rate to determine the Purchase/Balance Transfer APR. We add 15.99% or 19.99% to the Prime Rate to determine the Cash/Overdraft Advance APR.

We add 26.99% to the Prime Rate to determine the Penalty APR. Maximum APR 29.99%.

TERMS & CONDITIONS

JPMorgan Chase Bank, N.A. is making this offer to you on behalf of its Delaware affiliate, Chase Bank USA, N.A. Chase USA is the issuer of Chase Consumer and Business credit cards. Authorization: When you respond to this credit card offer from Chase Bank USA, N.A., a subsidiary of JPMorgan Chase & Co. ("Chase", "we", or "us"), you agree to the following:

1. You authorize us to obtain credit bureau reports that we will use when considering your

application for credit. You also authorize us to obtain credit bureau reports and any other information about you in connection with: 1) extensions of credit on your account; 2) the administration, review or collection of your account; and 3) offering you enhanced or additional products and services. If you ask, we will tell you the name and address of the credit bureau from which we obtained a report about you.

2. If an account is opened, you will receive a Cardmember Agreement with your card(s). You

agree to the terms of this agreement by: using the account or any card, authorizing their use, or making any payment on the account.

3. To service and manage any of your account(s), we, our representatives, JPMorgan Chase

Bank, N.A. representatives, and/or affiliates, may contact you at any telephone number you

PDF created with pdfFactory Pro trial version www.pdffactory.com

2 of 4

9/4/2012 11:40 PM

Pricing & Terms

https://www.firstusa.com/cgi-bin/webcgi/webserve.cgi?card=DWS ...

provide or any number where we believe we may reach you. This may include calls or text messages to mobile, cellular, or similar devices, and calls or text messages using automatic telephone dialing systems and/or prerecorded messages.

4. Balance transfers will be applied to your account and sent to your designated payee(s) 13 days

after your account is opened. During this time period, you may cancel or modify your balance transfer request by calling the number on the back of your card.

5. Rates, fees, and terms may change: We have the right to change the account terms

(including the APRs) in accordance with your Cardmember Agreement. Before we approve you for a credit card, we will review your credit report and the information you provide with your response to confirm that you meet the criteria for this offer. Based on this review, you may receive a card with different costs or you may not receive a card. You must be at least 18 years old to qualify (19 in AL and NE). An applicant, if married, may apply for a separate account. We reserve the right to change the benefit features associated with your card at any time. New York Residents: New York residents may contact the New York State Banking Department at 1-800-518-8866 to obtain a comparative list of credit card rates, fees, and grace periods. Ohio Residents: The Ohio laws against discrimination require that all creditors make credit equally available to all customers, and that credit reporting agencies maintain separate histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with the law. Notice to Married Wisconsin Residents: No provision of any marital property agreement, unilateral statement or court decree adversely affects our rights, unless you give us a copy of such agreement, statement or court order before we grant you credit, or we have actual knowledge of the adverse obligation. All obligations on this account will be incurred in the interest of your marriage or family. You understand that we may be required to give notice of this account to your spouse. Married Wisconsin residents must furnish their (the applicant's) name and social security number as well as the name and address of their spouse to Cardmember Service at P.O. Box 15218, Wilmington, DE 19850-5218. Balance Transfer Option: The Visa, MasterCard, Discover, American Express or any store card account(s) you list will show a credit, reducing the amount you owe them by the amount you transferred. The available credit on your new account will be reduced, just as if you had made a purchase. The balance transfer amount(s) will show up on your initial statement for your new account. Your other credit card account(s) will not be closed even if you transfer your entire balance(s). If you want to close an account, please contact the other credit card company directly. It may take up to three weeks to set up your account and post the balance transfers. Therefore, you may need to make payments to your other account(s) to keep them current. Balance transfers are contingent upon issuance of your new account. There will be a transaction fee for each balance transfer if one is disclosed in the Pricing Information that accompanies this offer. We may decline to process any balance transfer request and will not process a balance transfer request from any other account or loan that we or any of our affiliates issued, or balance transfer checks made out to cash or to any cardmember. To ensure you have enough credit available for purchases, we limit the amount of your credit limit that is available for balance transfers. We will evaluate your balance transfer requests in the order listed on your response. Each request will be evaluated against the available credit limit. We will only process those requests that can be fulfilled for the entire dollar amount listed. If we cannot process a request in full, we will evaluate the next requests, if any, until there is a request we can complete in full. This may result in the fulfillment of none or only some of your

3 of 4 9/4/2012 11:40 PM

PDF created with pdfFactory Pro trial version www.pdffactory.com

Pricing & Terms

https://www.firstusa.com/cgi-bin/webcgi/webserve.cgi?card=DWS ...

balance transfers. Affiliate Information Sharing: We and our affiliates may share information about you among affiliates in order to offer products and services of interest to you. If you would prefer that we do not share information from your application, credit bureaus or third parties, please call us at 1-888-868-8618. For more information about our information handling policies, visit us on the web at http://www.chase.com/privacypolicy. Replying to this offer: If you omit any information on the form, we may deny your request for an account. If applicable, Chase cardmembers who currently have or have had a Chase credit card in any Rewards Program associated with this offer or have received a similar bonus offer, may not be eligible for a second Chase credit card in the same Rewards Program, or for any bonus offer. Chase cardmembers currently receiving promotional pricing, or Chase cardmembers with a history of only using their current or prior Chase card for promotional pricing offers, are not eligible for a second Chase credit card with promotional pricing. You must have a valid permanent home address within the 50 United States or the District of Columbia. The information about the costs of the card described in this form is accurate as of 2/22/2010. This information may have changed after that date. To find out what may have changed, write to us at Cardmember Service, P.O. Box 15043, Wilmington, DE 19850-5043. USA PATRIOT Act: To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means to you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license or other identifying documents.

2012 JPMorgan Chase & Co.

PDF created with pdfFactory Pro trial version www.pdffactory.com

4 of 4

9/4/2012 11:40 PM

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

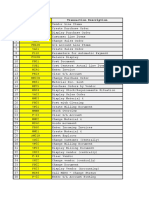

- Account Analysis Report: Subledger AccountingDocument4 pagesAccount Analysis Report: Subledger AccountingDeepak SinghaniaPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Chase Freedom Pricing & TermsDocument4 pagesChase Freedom Pricing & TermsDeepak SinghaniaPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Account Analysis Report: Subledger AccountingDocument1 pageAccount Analysis Report: Subledger AccountingDeepak SinghaniaPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Chase Freedom Pricing & TermsDocument4 pagesChase Freedom Pricing & TermsDeepak SinghaniaPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- SchoolingPro's ORACLE R12 Financial Course OutlineDocument10 pagesSchoolingPro's ORACLE R12 Financial Course OutlineDeepak SinghaniaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Claim FormDocument4 pagesClaim FormomeyinPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Prestest Cocu 2 - TheoryDocument6 pagesPrestest Cocu 2 - TheoryVinetha KarunanithiPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- PosterDocument1 pagePosterRamesh MPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- R17AMR ReleaseHighlightsDocument48 pagesR17AMR ReleaseHighlightstayutaPas encore d'évaluation

- Jabalpur NizamuddinDocument1 pageJabalpur Nizamuddinpraveen_356Pas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Introduction of Leadership (OSIM)Document7 pagesIntroduction of Leadership (OSIM)Azhar PropertyPas encore d'évaluation

- Personal Bond Refund FormDocument2 pagesPersonal Bond Refund FormbestniazPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Citibank CreditCard 0807stmt 19102018 1540449049176Document6 pagesCitibank CreditCard 0807stmt 19102018 1540449049176Flora Ho100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Access funds anywhere with ATMsDocument10 pagesAccess funds anywhere with ATMsprofessor_manojPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- B2C Business Platform in BangladeshDocument4 pagesB2C Business Platform in BangladeshKhan FarhanaPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- What Is The Definition of E-BankingDocument2 pagesWhat Is The Definition of E-BankingdivyangaminPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Internship Report On Himalayan Bank Limited: 1.1 Background of StudyDocument19 pagesInternship Report On Himalayan Bank Limited: 1.1 Background of StudySuman ShahiPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Public records workshop intro guideDocument5 pagesPublic records workshop intro guideJeremy White100% (4)

- DR L. Ravindran, CFP, Ph. D, Founder Managing Director & CEO, Wealthmax Enterprises Management P LTD, BangaloreDocument14 pagesDR L. Ravindran, CFP, Ph. D, Founder Managing Director & CEO, Wealthmax Enterprises Management P LTD, Bangalorekeyur1975Pas encore d'évaluation

- Cisco UC5XX Default Conf 111Document12 pagesCisco UC5XX Default Conf 111LA-ZOUBE GAELPas encore d'évaluation

- Kalahandi Tier I RoutesDocument121 pagesKalahandi Tier I RoutesnirliptaPas encore d'évaluation

- A Comparitive Study Between Amazon and Flipkarrt: MR - SandeepDocument64 pagesA Comparitive Study Between Amazon and Flipkarrt: MR - Sandeepj lohitha reddyPas encore d'évaluation

- SAP Transaction Code ModulesDocument6 pagesSAP Transaction Code ModulesVivek Shashikant SonawanePas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- International Roaming - Terms & ConditionsDocument1 pageInternational Roaming - Terms & ConditionsPatel KevalPas encore d'évaluation

- ECE 313 Communication Systems and Noise AnalysisDocument4 pagesECE 313 Communication Systems and Noise AnalysisGrezel MaicoPas encore d'évaluation

- CCNA 1 v7 de 7 9Document19 pagesCCNA 1 v7 de 7 9Riadh SalhiPas encore d'évaluation

- Assignment - MBF 307 - Finacle Trade FinanceDocument2 pagesAssignment - MBF 307 - Finacle Trade Financeranvir kumarPas encore d'évaluation

- Accounting Equation Explained - Assets, Liabilities & Owner's EquityDocument43 pagesAccounting Equation Explained - Assets, Liabilities & Owner's Equitythella deva prasadPas encore d'évaluation

- Screenshot 2022-12-22 at 11.05.07Document1 pageScreenshot 2022-12-22 at 11.05.07Bhavsar DharnendraPas encore d'évaluation

- Enhanced Voice Transit + Global Insights - Customer Facing Slides-VoxboneDocument12 pagesEnhanced Voice Transit + Global Insights - Customer Facing Slides-VoxboneMamta MittalPas encore d'évaluation

- Avidia Bank CSDocument5 pagesAvidia Bank CSgoranksPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

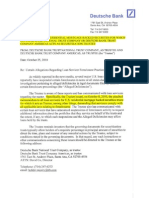

- Deutsche Bank NTC - Internal MemoDocument10 pagesDeutsche Bank NTC - Internal Memothe_rufsPas encore d'évaluation

- Wage TypeDocument4 pagesWage TypeFareha RiazPas encore d'évaluation

- Wells Fargo StatementDocument4 pagesWells Fargo Statementandy0% (1)

- Features of Money MarketDocument3 pagesFeatures of Money MarketAnurita MajumdarPas encore d'évaluation

- 28 Mar CHQDocument59 pages28 Mar CHQanon-140976100% (2)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)