Académique Documents

Professionnel Documents

Culture Documents

Cheat Sheet Exam 4

Transféré par

adviceviceDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cheat Sheet Exam 4

Transféré par

adviceviceDroits d'auteur :

Formats disponibles

FV = Future Value, PV = Present Value, i = interest rate t = time, A = annuity FV = PV(1 + i)t PV = FV/(1 + i)t FV of A = A((1 + i)t 1 / I) Annuity

y = A/i

Externalities In economics, an externality, or transaction spillover, is a cost or benefit that is not transmitted through prices and is incurred by a party who did not agree to the action causing the cost or benefit.[dubious discuss] The cost of an externality is a negative externality, or external cost, while the benefit of an externality is a positive externality, or external benefit. Market Failures In the case of both negative and positive externalities, Public Goods In economics, a public good is a good that prices in a competitive market do not reflect the full costs is both non-excludable and non-rivalrous in that individuals or benefits of producing or consuming a product or service. can not be effectively excluded from use and where use by Also, producers and consumers may neither bear all of the one individual does not reduce availability to others.[1] costs nor reap all of the benefits of the economic activity, Examples of public goods include fresh air, clean water, and too much or too little of the goods will be produced or knowledge, lighthouses, open source software, radio and consumed in terms of overall costs and benefits to society. television broadcasts, roads, street lighting. Public goods For example, manufacturing that causes air pollution that are available everywhere are sometimes referred to as imposes costs on the whole society, while fire-proofing a global public goods. home improves the fire safety of neighbors. If there exist external costs such as pollution, the good will be Free Rider Problem In economics, collective bargaining, overproduced by a competitive market, as the producer psychology, and political science, a free rider (or does not take into account the external costs when freeloader) is someone who consumes a resource without producing the good. If there are external benefits, such as in paying for it, or pays less than the full cost. The free rider areas of education or public safety, too little of the good problem is the question of how to limit free riding (or its would be produced by private markets as producers and negative effects). Free riding is usually considered to be an buyers do not take into account the external benefits to economic problem only when it leads to the non-production others. Here, overall cost and benefit to society is defined or under-production of a public good (and thus to Pareto as the sum of the economic benefits and costs for all parties inefficiency), or when it leads to the excessive use of a involved. common property resource. The term free rider comes from the example of someone using public transportation without Income Distribution paying the fare. If too many people do this, the system will not have enough money to operate. Another example of a free rider is someone who does not pay his or her share of taxes, which help pay for public goods that all citizens benefit from, such as roads, water treatment plants, and fire services. Asymmetric Information Adverse Selection Adverse selection, anti-selection, or negative selection is a term used in economics, insurance, statistics, and risk management. It refers to a market process in which "bad" results occur when buyers and sellers have asymmetric information (i.e. access to different information): the "bad" products or services are more likely to be selected. A bank that sets one price for all its checking account customers runs the risk of being adversely selected against by its low-balance, high-activity (and hence least profitable) customers. Two ways to model adverse selection are with signaling games and screening games. Moral Hazard In economic theory, a moral hazard is a situation where there is a tendency to take undue risks because the costs are not borne by the party taking the risk. A moral hazard may occur where the behavior of one party may change to the detriment of another after a transaction has taken place. For example, a person with insurance against automobile theft may be less cautious about locking their car, because the negative consequences of vehicle theft are now (partially) the responsibility of the insurance company. A party makes a decision about how much risk to take, while another party bears the costs if things go badly, and the party insulated from risk behaves differently from how it would if it were fully exposed to the risk.

Factors that shift S/D of Currency 1) Taste and Preference Foreign Purchase $CND Bank $USD US Seller Effect: Increase Supply CND CND Depreciate Increase Demand USD USD Appreciate 2) Relative Interest Rate US Investor USD Bank EUR US Inv Foreign Investment Effect: Increase Supply USD USD Depreciate Increase Demand EUR EUR Appreciate 3) Relative Income Level US Buyers USD Bank Peso US Buyers Mex Seller Effect: Increase Supply USD USD Depreciate Increase Demand Peso Peso Appreciate 4) Relative Price Level ROI US = 3%, CN = 5%, CND Buyers CND Bank USD CND Buyers US Sellers Effect: Increase Supply CND CND Depreciates Increase Demand USD USD Appreciates International Finance Pros Inc Purchase Power Decrease Inflation Inc Imports Inc Foreign Direct Inv. Decr National Debt Comparative Advantage Auto Rice JP 500 100

Cons Inc Capital Outflow Decr Tourists Decr Exports Inc Competition

Theory of comparative advantage Ricardo's theory that specialization and free trade will benefit all trading partners (real wages will rise), even those that may be absolutely less efficient producers. Absolute Advantage The advantage in the production of a good enjoyed by one country over another when it uses fewer resources to produce that good that the other country does. Comparative Advantage The advantage in the production of a good enjoyed by one country over another when that good can be produced at lower cost in terms of other goods that it could be in the other country. Tariff Increase in demand for product causes no change in Price of import+tariff, but does cause increase in size of import Quota Increase in demand cause Price of import to rise, but does cause increase in size of import Free Trade Pro low import price, variety, efficient use of resources. Cons trade deficit, quality control, lower demand, unfair competition to locals, Restricted Trade Pros safeguards national security, infant industries, Lower trade deficit, increase demand of local products, government revenue. Cons: increase price of imports, less variety

A:R 1A:1/5R

R:A 1R:5A 1R:4A

TH 100 25 1A:1/4R 1) Japan has Abs Adv in both 2) Japan has Comp Adv in Auto 3) Thailand has Comp Adv in Rice Direction of Trade JP Auto TH || JP Rice TH

Theories Utilitarian Justice money has less utility for the rich than for the poor. Karl Marx Equal distribution of wealth, tax credit, transfer payments, food stamp, social security, housing prog Reasons for International Trade 1) Scarcity 2) Well being 3) Specialization 4) Resources

Vous aimerez peut-être aussi

- Demand and Elasticities PDFDocument4 pagesDemand and Elasticities PDFHaroon ZafarPas encore d'évaluation

- Ch 2 Inv Appraisal IntroDocument5 pagesCh 2 Inv Appraisal IntroTeresaBachmannPas encore d'évaluation

- Guidelines For Answering Case Study From My LecturerDocument7 pagesGuidelines For Answering Case Study From My LecturerBenny KhorPas encore d'évaluation

- Use Cost and Volume Price Anlysis To Increase ProfitDocument2 pagesUse Cost and Volume Price Anlysis To Increase ProfitChristopher Raj0% (1)

- BM229 - Strategic Business MangamentDocument2 pagesBM229 - Strategic Business MangamentJohn Paul PrestonPas encore d'évaluation

- Lean Simplified: The Fast Eat The Slow! Key ToolsDocument2 pagesLean Simplified: The Fast Eat The Slow! Key ToolsVelangini Papi Reddy ThummaPas encore d'évaluation

- Midsem Cheat Sheet (Finance)Document2 pagesMidsem Cheat Sheet (Finance)lalaran123Pas encore d'évaluation

- Buss1040 Exam NotesDocument39 pagesBuss1040 Exam NotespiethepkerPas encore d'évaluation

- National Roads Authority: Project Appraisal GuidelinesDocument15 pagesNational Roads Authority: Project Appraisal GuidelinesPratish BalaPas encore d'évaluation

- Earned Value AnalysisDocument1 pageEarned Value AnalysisMohamad CharafPas encore d'évaluation

- Cheat Sheet Measuring ReturnsDocument1 pageCheat Sheet Measuring ReturnsthisisatrolPas encore d'évaluation

- Modern Project Management Strategies for SuccessDocument2 pagesModern Project Management Strategies for SuccessTri ArdhiansaPas encore d'évaluation

- FE 445 M1 CheatsheetDocument5 pagesFE 445 M1 Cheatsheetsaya1990Pas encore d'évaluation

- Ruble 4Document43 pagesRuble 4anelesquivelPas encore d'évaluation

- Academic Writing Assessment Scheme: Attendance, Participation, Assignments, ExamDocument2 pagesAcademic Writing Assessment Scheme: Attendance, Participation, Assignments, ExamNehal NabilPas encore d'évaluation

- Gitman 12e 525314 IM ch11rDocument22 pagesGitman 12e 525314 IM ch11rAnn!3100% (1)

- V16 Event 63 Cover Letter HelpDocument2 pagesV16 Event 63 Cover Letter HelprelonzPas encore d'évaluation

- FMV Cheat SheetDocument1 pageFMV Cheat SheetAyushi SharmaPas encore d'évaluation

- Quantitative Analysis for Linear Programming SolutionsDocument40 pagesQuantitative Analysis for Linear Programming SolutionsAhmed HusseinPas encore d'évaluation

- Job Safety Analysis (JSA) : DefinitionDocument5 pagesJob Safety Analysis (JSA) : DefinitionJude LichyPas encore d'évaluation

- Bloomberg Commands Cheat SheetDocument2 pagesBloomberg Commands Cheat SheetDong SongPas encore d'évaluation

- Financial Ratio Analysis FormulasDocument4 pagesFinancial Ratio Analysis FormulasVaishali Jhaveri100% (1)

- Student's CaseDocument11 pagesStudent's Caseremon4hr100% (1)

- MAF302 Formula Sheet: Key Financial ConceptsDocument2 pagesMAF302 Formula Sheet: Key Financial ConceptsWill LeePas encore d'évaluation

- ELECSDocument37 pagesELECSIra CervoPas encore d'évaluation

- Linear Programming Optimization and ApplicationsDocument35 pagesLinear Programming Optimization and ApplicationsGOO50% (2)

- Chemical Analysis Lab Manual PDFDocument20 pagesChemical Analysis Lab Manual PDFSundar SkPas encore d'évaluation

- All About Supply, Demand, Elasticity, UtilityDocument11 pagesAll About Supply, Demand, Elasticity, Utilityantara nodiPas encore d'évaluation

- Harshad Mehta's Stock Market Scam - 3 Weeks AgoDocument9 pagesHarshad Mehta's Stock Market Scam - 3 Weeks AgoHardik ShahPas encore d'évaluation

- Basic Mud Reportv1.5Document21 pagesBasic Mud Reportv1.5Anonymous MxwCc4Pas encore d'évaluation

- Physics 1 2020 For Cs StudentDocument112 pagesPhysics 1 2020 For Cs StudentSamPas encore d'évaluation

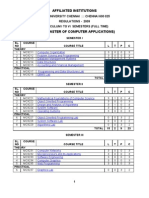

- MCA Syllabus Regulation 2009 Anna UniversityDocument61 pagesMCA Syllabus Regulation 2009 Anna UniversityJGPORGPas encore d'évaluation

- Annual Report Analysis of Allied BankDocument4 pagesAnnual Report Analysis of Allied BankAhmedPas encore d'évaluation

- Estimation of Acid Value in OilDocument20 pagesEstimation of Acid Value in OilSundar SkPas encore d'évaluation

- Aqueous solutions and redox reactionsDocument1 pageAqueous solutions and redox reactionsDanielle GuindonPas encore d'évaluation

- Cheat Sheet Derivatif Securities UTSDocument2 pagesCheat Sheet Derivatif Securities UTSNicole sadjoliPas encore d'évaluation

- Physics Formula Sheet EssentialsDocument2 pagesPhysics Formula Sheet EssentialsFrancis C FrancisPas encore d'évaluation

- Cheat SheetDocument1 pageCheat Sheetsullivn1Pas encore d'évaluation

- Lab ManualDocument155 pagesLab ManualKieu Phuong PhamPas encore d'évaluation

- Capital Budgeting Decisions A Clear and Concise ReferenceD'EverandCapital Budgeting Decisions A Clear and Concise ReferencePas encore d'évaluation

- Market Failures and Government InterventionsDocument58 pagesMarket Failures and Government InterventionsAliah de GuzmanPas encore d'évaluation

- Ch2 EEDocument24 pagesCh2 EEsinatra DPas encore d'évaluation

- Understanding Market FailuresDocument20 pagesUnderstanding Market FailuresGabriel Joaquin MoralesPas encore d'évaluation

- Definitions 1Document5 pagesDefinitions 1Manil FernandoPas encore d'évaluation

- ECON1101: Microeconomics 1: Chapter 1: Thinking As An EconomistDocument14 pagesECON1101: Microeconomics 1: Chapter 1: Thinking As An EconomistmaustroPas encore d'évaluation

- Economic Concepts Explained: Efficiency, Equity, Costs & MoreDocument3 pagesEconomic Concepts Explained: Efficiency, Equity, Costs & Moremaryam gullPas encore d'évaluation

- Advance Diploma Level ManagementDocument7 pagesAdvance Diploma Level ManagementmerusaPas encore d'évaluation

- 01A - 4 - Micro - Economic TermsDocument4 pages01A - 4 - Micro - Economic TermsAlicia Lopez-AlvarezPas encore d'évaluation

- Econ 1021 Course NotesDocument16 pagesEcon 1021 Course NotesAdrian TazPas encore d'évaluation

- Eco - NotesDocument4 pagesEco - NotesMukunth KLPas encore d'évaluation

- Market Failure - FinalDocument32 pagesMarket Failure - FinalM Manjunath100% (1)

- Health Economics PrelimDocument15 pagesHealth Economics PrelimMelchor Felipe SalvosaPas encore d'évaluation

- Econs DefinitionsDocument20 pagesEcons Definitionsjiwon yangPas encore d'évaluation

- Production Possibility Frontier (PPF) & Opportunity CostDocument10 pagesProduction Possibility Frontier (PPF) & Opportunity CostPandaPas encore d'évaluation

- ECON1101: Microeconomics 1: Chapter 1: Thinking As An EconomistDocument10 pagesECON1101: Microeconomics 1: Chapter 1: Thinking As An EconomistmaustroPas encore d'évaluation

- Micro and Macro Economics PDFDocument29 pagesMicro and Macro Economics PDFMayank JainPas encore d'évaluation

- Key Terms MicroDocument7 pagesKey Terms Micro김지현Pas encore d'évaluation

- Market Failur: Neoclassical Economics Pareto Efficient Economic ValueDocument9 pagesMarket Failur: Neoclassical Economics Pareto Efficient Economic ValuePRATIK ROYPas encore d'évaluation

- 1.4 Market FailureDocument79 pages1.4 Market FailureVed AsudaniPas encore d'évaluation

- EVERY ECON RESOURCE YOU'LL EVER NEED - Economics Definitions - SolutionsDocument11 pagesEVERY ECON RESOURCE YOU'LL EVER NEED - Economics Definitions - SolutionsHala ElhsPas encore d'évaluation

- Arvind Limited IC 070314Document30 pagesArvind Limited IC 070314Saurabh LohariwalaPas encore d'évaluation

- Electronics in IndiaDocument18 pagesElectronics in IndiaNaishadh BhattPas encore d'évaluation

- How to Manage MoneyDocument8 pagesHow to Manage Moneyisabel_boiaPas encore d'évaluation

- Posting Date Document Type External Document No. Vendor NoDocument4 pagesPosting Date Document Type External Document No. Vendor NoEuro OmnitransPas encore d'évaluation

- Annual Financial Statements and Management Report Deutsche Bank AG 2015Document178 pagesAnnual Financial Statements and Management Report Deutsche Bank AG 2015hieu lePas encore d'évaluation

- Sioux City Proposed Capital Improvement Budget 2014-2018Document551 pagesSioux City Proposed Capital Improvement Budget 2014-2018Sioux City JournalPas encore d'évaluation

- Chapter-1 IFMDocument51 pagesChapter-1 IFMNam LêPas encore d'évaluation

- Mega Sale of Select Publications by French Institute of PondicherryDocument28 pagesMega Sale of Select Publications by French Institute of PondicherryBackup BackupPas encore d'évaluation

- 203 Final Fall 2010 Answers POSTDocument15 pages203 Final Fall 2010 Answers POSTJonathan RuizPas encore d'évaluation

- Retail Financial Services Products 2022 FL 509 Report enDocument78 pagesRetail Financial Services Products 2022 FL 509 Report enStathis MetsovitisPas encore d'évaluation

- Mock 10 QDocument49 pagesMock 10 QHimanshuPas encore d'évaluation

- CurrencyDocument2 pagesCurrencystega_megasaurusPas encore d'évaluation

- Leykoma Irawards2009Document140 pagesLeykoma Irawards2009Michael WeaverPas encore d'évaluation

- Shaking The Invisible Hand Complexity Choices and CritiquesDocument578 pagesShaking The Invisible Hand Complexity Choices and CritiquesLut MilitaPas encore d'évaluation

- HSBC Holdings PLC Annual Report and Accounts 2015Document502 pagesHSBC Holdings PLC Annual Report and Accounts 2015lucindaPas encore d'évaluation

- Respuestas de Paridad InternacionalDocument15 pagesRespuestas de Paridad InternacionalDavid BoteroPas encore d'évaluation

- CMA2 P1 A Budgeting Alpha Tech P3694Q3Document4 pagesCMA2 P1 A Budgeting Alpha Tech P3694Q3Omnia HassanPas encore d'évaluation

- Greece03 PDFDocument253 pagesGreece03 PDFAbhiPas encore d'évaluation

- Texapon R K 12 P PH eDocument4 pagesTexapon R K 12 P PH ePedro MelendezPas encore d'évaluation

- Int Finance Practice - SolDocument7 pagesInt Finance Practice - SolAlexisPas encore d'évaluation

- EM Outlook 2012Document189 pagesEM Outlook 2012Rafael ShinPas encore d'évaluation

- Clifton Savings Bank S-1Document414 pagesClifton Savings Bank S-1suedtPas encore d'évaluation

- The Cleaning Industry in EuropeDocument10 pagesThe Cleaning Industry in EuropeAlan PulmanPas encore d'évaluation

- Tuck Casebook 2000 For Case Interview Practice - MasterTheCaseDocument71 pagesTuck Casebook 2000 For Case Interview Practice - MasterTheCaseMasterTheCase.comPas encore d'évaluation

- Fraport Greece Press Release CCD enDocument3 pagesFraport Greece Press Release CCD enSakis VoutosPas encore d'évaluation

- Business opportunities between Colombia and EuropeDocument38 pagesBusiness opportunities between Colombia and Europecomex comexPas encore d'évaluation

- New Europe Print Edition - Issue 962Document39 pagesNew Europe Print Edition - Issue 962suman5156Pas encore d'évaluation

- Case Study 41 - Mogen IncDocument15 pagesCase Study 41 - Mogen IncPat Cunningham100% (4)

- Analyzing Divisional Performance and Transfer PricingDocument44 pagesAnalyzing Divisional Performance and Transfer Pricingbryan albert0% (1)