Académique Documents

Professionnel Documents

Culture Documents

Dear Members of The TARO Boardv2-0927-Letter

Transféré par

JohnDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Dear Members of The TARO Boardv2-0927-Letter

Transféré par

JohnDroits d'auteur :

Formats disponibles

Mr. Kedrowski, Please forward this amended letter to the TARO board and TARO Special Committee.

Additional shareholders wanted to participate in this communication. Thank you TARO Shareholders

Dear Members of the TARO Board, TARO Special Committee,

We are retail shareholders of TARO. We have the following very serious concerns regarding the proposed merger of TARO with SUN and TAROs 08/31 filing ("merger agreement"). We continue to believe TAROs fair value using market multiples of its comparable peers is around $120 as we originally stated in our 05/20 letter. In that same letter dated 05/20, we articulated the actions that needed to be taken so TARO trades at fair value and closer to the market multiples of its market peers like Perrigo. That letter is linked here. To date, none of those actions that would have resulted in TARO to trade at fair value have been taken. 05/20 TARO Shareholders Letter to the Taro Board-> http://www.scribd.com/doc/95697207/Tarominorityshareholderspetitiont oSpecialCommitteeandBoard-05202012 The merger agreement filing on 08/31 raises extremely serious concerns regarding the procedures undertaken to approve this merger agreement. Upon the boards response we as Shareholders will determine the next steps. Please electronically send your response to taro-minority-shareholders@googlegroups.com to the below questions or make Regulation Fair-Disclosure filing by 10/10. The concerns and questions are enumerated below: 1. Did the TARO board review and consider the Average LTM EBIDTA multiples that the recent acquisition of peer generic companies happened at? -> Medicis at about 13 times LTM EBIDTA ->Actavis at 14.8 times LTM EBIDTA -> Fougera at 8.8 times LTM EBIDTA* -> The Median valuation multiple was 14 times Ebitda in eight other recent pharmaceuticals takeovers.

TARO at 15 times Q2 annualized EBIDTA would be valued approximately at $120 per share. The current offer of $39.5 translates to approximately 5 times 2012 EBIDTA of approximately 300-320m. The Q2 2012 EBIDTA was 79m.

* Fougera was a private company with little public detail known on its margin, balance sheet and growth.

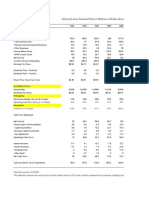

** Industry analysts are expecting improved TARO performance in Q3. 2. TARO assisted by Citi relied on the Discounted Cash Flow (DCF) approach in valuating TARO. Why did the board not consider "LTM EBIDTA Multiple" approach? Majority of the precedent transactions including TARO peer acquisitions (Actavis, Medicis, etc) used the "LTM EBIDTA Multiple" valuation approach. The DCF approach is based on sales and EBIDTA estimates for the next 5 years. These estimates and the assumptions behind the estimates are based on, are inherently inaccurate and highly untenable. In addition, these estimates are indicated to be sourced from TARO's management. With TARO management being accountable to the TARO board and its future employment prospects depending on TARO board members, which is full of members from the prospective acquirer SUN, isnt there a conflict of interest? Wouldn't that be reason enough to shun DCF approach? Even if TARO were relying on the DCF approach, shouldn't TARO source these sales estimates and importantly the assumptions behind those estimates from multiple industry analysts that are independent? 3. From 2008 to 2011, TARO's year-on-year EBIDTA growth rate was ~50% and year-on-year Sales growth rate was ~15%. How could TARO's management possibly arrive at the low-ball sales estimates for 2013-2016? The filing says "The financial forecast was presented by Taro management to Citi as of June 14, 2012." No details are provided on the assumptions made to arrive at these sales estimate which seem unbelievably low considering TARO's historical sales and growth rate. Were the 2 NDAs pending FDA approval as well as several ANDAs pending approval factored in to these estimates? Did the "Management case"(the low-ball sales and EBIDTA estimates) have to be vetted with the TARO board for their acceptance before it was sent to Citi? TARO's new chairman Kal Sundaram (ex-SUN CEO) and SUN founder Mr. Shangvi have stated "TARO's opportunistic drug pricing can not be maintained". This appears to be the speculative basis on which the 2013-2017 estimates are based. Did TARO consult independent industry analysts when coming up with these estimates and the assumptions behind them?

4. Why is there a significant step-up in R&D expense from 2011 to 2012? This is a 60% year-on-year increase in R&D Spend. The step-up is also significant from 2010 base. This has a big impact on EBIDTA and valuation of TARO shares. The timing of this step-up is questionable. 5. Why is there absolutely NO mention of any financial estimates of synergy savings in the Merger agreement? Why is there no consideration for premium? Some highly anticipated synergies are general SG&A synergies(combined company can have one sales force, one Legal representation, one Auditor, one Human resources department, one Investor Relations department, etc) opening up of new markets(India, etc) for TARO's products where SUN already has a presence, potential transfer of TARO manufacturing to low cost India and other R&D synergies. When Valeant purchased 2 other dermatology companies in late 2011 it quickly realized $110m in synergy savings in 1st quarter 2012. Valeant is expecting 225m in synergy savings in the first 6 months of after acquiring Medicis. The Medicis acquisition by Valeant was announced in September. We remind you again to read our letter date "05/20" that highlighted how unique and valuable the TARO asset would be for any Pharma company and especially an Indian Pharma company. TARO is in a limited competition and higher barrier-toentry generic business.* Taro has a 50% market share in its top 18 products(see IsZo capital letter dated 05/11). Past generic M&A transactions were at an average of 14.8 times EBIDTA TARO's competitor Perrigo trades at 16 times ttm EBIDTA. Taro's 3 year sales and EBIDTA growth, operating margin, balance sheet and leverage ratio are all superior to Perrigo. The valuation of parent Sun's and relative contribution of TARO's to Sun's EBIDTA, would easily value TARO in excess of $100. SUNs generic business is a commoditized business with Several Indian Pharma competitors unlike TAROs business with no competition from ANY Indian Pharma. *None of the big Indian generic pharma companies that are significant players in the US generics market, have any meaningful presence in the dermatology and topical market due to the lack of technology. With the

acquisition of Taro, Sun Pharma would likely end up to be the only Indian company armed with the technology and manufacturing know-how for dermatology/topical from Taro, with the ability to leverage tremendous cost arbitrage opportunities in manufacturing and R&D from India. Inevitably, this will throw up margin expansion and market-share opportunities for Sun Pharma in the dermatology/topical space both for existing as well as for new products. 6. It has been publicly said by SUN pharma billionaire founder Mr. Shangvi that TARO is overvalued when it was trading around $39. Why wouldn't TARO board open the company for a formal auction process and other consider strategic alternatives? Why did the Special Committee not consider strategic alternatives? A lot of TARO shareholders believe Perrigo, Valeant or another Indian Pharma would bid for TARO at 15 times LTM EBIDTA ($120 per share). This would have been a win-win-win situation for ALL 3 parties involved: SUN pharma would get $120 per share(SUN's founder has publicly said at $39 TARO is overvalued), TARO's minority shareholders and for a Strategic Acquirer. 7. The Special Committee was evaluating $24.5 offer when during the same period the TARO shares traded hands for many months around $40. Which committee that is expressly set up to maximize the value for ALL shareholders would do this ? As another institutional shareholder correctly pointed, merely going through the motions of creating Special committee will NOT relieve you from the "fairness test" and absolve the board from its fiduciary duties towards its shareholders. We, like Iszo Capital stated in its 09/20 letter , have the same concerns on the proposed voting procedures and its inability to identify interested party from being counted as minority vote. Please let us know how you plan to resolve these concerns. 8. As pointed out by ISZO capital, in its letter on 09/20, Citis conflict of interest should bar them from being considered independent financial advisor. If Citi is going to be paid $5.7 million ONLY upon consummation of merger, how can be Citi considered independent? 9. Finally, please be reminded that we are determined to take this fight to the next level, if the company does not respond timely to these serious concerns raised by TARO shareholders.

The following TARO shareholders have approved this letter be sent to the TARO Board Your First Name and Last Name Zvi Landau John Ithak Gil Leonardo Mosca Mattis Ezren Benzion Geifman Ofhir Gil Alexander Kaplun Michael Sirr Ronen Ariely Larry Tooker Valery Libenzon Valerie davis Pasi Havia John Moy Degem William Folsom Since when are you holding Taro shares after 2010 after 2010 Private before 2006 before 2006 2008-2010 2006-2009 2006-2009 before 2006 after 2010 before 2006 before 2006 Private after 2010 Private after 2010

Total TARO Holdings Represented by the Requesting Shareholders

FY 2010-11A and FY 2012-2016E

~96,000 Shares

2013E 2014E 2015E 2016E

$mm (1)(2) 2010A Income Statement Net sales 392.5 (145. COGS 0 ) (103. SG&A 2 ) R&D (36.4 ) Impairment (2.6 ) EBITDA (3) 105.3 Depreciatio n& amortizatio n (18.8 )

2011A

2012E

505.7 498.2 573.6 535.4 514.3 491.6 (162. (165. (162. (159. (158. (161. 1 ) 8 ) 1 ) 6 ) 4 ) 8 ) (89.2 ) (87.5 ) (88.0 ) (30.9 ) (53.0 ) (53.5 ) (0.8 ) --222.7 231.8 267.3 (88.6 ) (51.4 ) -214.7 (89.6 ) (49.2 ) -194.4 (92.0 ) (49.8 ) -194.5

(18.7 ) (20.0 ) (20.0 ) (22.0 ) (22.0 ) (22.0 )

Operating income Foreign exchange

86.5 (5.3

204.0 ) 6.9

247.3 (0.2

211.8 ) --

192.7

172.4

172.5

Vous aimerez peut-être aussi

- Novexatin Expert Clinical OpinionDocument14 pagesNovexatin Expert Clinical OpinionJohnPas encore d'évaluation

- Thirdpoint 4q12investorletter 010913Document9 pagesThirdpoint 4q12investorletter 010913DistressedDebtInvestPas encore d'évaluation

- Taro Why The Valuation DiscountDocument3 pagesTaro Why The Valuation DiscountJohnPas encore d'évaluation

- Voice of Shareholders - SurveyDocument11 pagesVoice of Shareholders - SurveyJohnPas encore d'évaluation

- Anacor Investor Presentation June 2013 (Compatibility Mode)Document51 pagesAnacor Investor Presentation June 2013 (Compatibility Mode)JohnPas encore d'évaluation

- Quality Affordable Healthcare Products™: William Blair Growth Stock ConferenceDocument37 pagesQuality Affordable Healthcare Products™: William Blair Growth Stock ConferenceJohnPas encore d'évaluation

- Shareholder Proposals - Annual Shareholders MeetingDocument3 pagesShareholder Proposals - Annual Shareholders MeetingJohnPas encore d'évaluation

- TARO VIC ThesisDocument3 pagesTARO VIC ThesisJohnPas encore d'évaluation

- 13272520Document23 pages13272520JohnPas encore d'évaluation

- 001 Investor Presentation June2012Document27 pages001 Investor Presentation June2012JohnPas encore d'évaluation

- Fusilev (Levoleucovorin) Humana Coverage PolicyDocument6 pagesFusilev (Levoleucovorin) Humana Coverage PolicyJohnPas encore d'évaluation

- 12 Civ 8195 ComplaintDocument51 pages12 Civ 8195 ComplaintJohnPas encore d'évaluation

- Amrn Response To Final RejectionDocument4 pagesAmrn Response To Final RejectionJohnPas encore d'évaluation

- Knight Capital Group, Inc.: Sandler O'Neill Global Exchange and Brokerage Conference - June 7, 2012Document13 pagesKnight Capital Group, Inc.: Sandler O'Neill Global Exchange and Brokerage Conference - June 7, 2012JohnPas encore d'évaluation

- Patent CaseDocument15 pagesPatent CaseJohnPas encore d'évaluation

- Lavin DeclarationDocument21 pagesLavin DeclarationJohnPas encore d'évaluation

- Amended Claims-MarineDocument5 pagesAmended Claims-MarineJohnPas encore d'évaluation

- TarominorityshareholderspetitiontoSpecialCommitteeandBoard 05202012Document3 pagesTarominorityshareholderspetitiontoSpecialCommitteeandBoard 05202012JohnPas encore d'évaluation

- Bill Ackman's Ira Sohn JCP PresentationDocument64 pagesBill Ackman's Ira Sohn JCP PresentationJohnCarney100% (1)

- Marine Patent Applicant ArgumentsDocument11 pagesMarine Patent Applicant ArgumentsJohnPas encore d'évaluation

- TARO Valuation 2Document1 pageTARO Valuation 2JohnPas encore d'évaluation

- Disclosure ComparisonDocument1 pageDisclosure ComparisonJohnPas encore d'évaluation

- Taro GrowthDocument1 pageTaro GrowthJohnPas encore d'évaluation

- Disclosure ComparisonDocument1 pageDisclosure ComparisonJohnPas encore d'évaluation

- Taro Pharmaceutical Industries LTDDocument4 pagesTaro Pharmaceutical Industries LTDJohnPas encore d'évaluation

- Fairholme Case Study I (With Disclaimers)Document27 pagesFairholme Case Study I (With Disclaimers)VariantPerceptionsPas encore d'évaluation

- TARO ValuationDocument2 pagesTARO ValuationJohnPas encore d'évaluation

- TaroPharmaceuticalIndustriesLtd 20F 20120405Document157 pagesTaroPharmaceuticalIndustriesLtd 20F 20120405JohnPas encore d'évaluation

- 12815569Document7 pages12815569JohnPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- CFEE Financial Literacy and Essential Skills - Final Report July 2012Document72 pagesCFEE Financial Literacy and Essential Skills - Final Report July 2012Jaime Tiburcio CortésPas encore d'évaluation

- Securities Fraud in The CourtsDocument32 pagesSecurities Fraud in The Courtsmike97% (38)

- The Capital Asset Pricing Model (Chapter 8)Document47 pagesThe Capital Asset Pricing Model (Chapter 8)kegnataPas encore d'évaluation

- 2019 Ifrs GuideDocument5 pages2019 Ifrs GuideLouremie Delos Reyes MalabayabasPas encore d'évaluation

- Indirect Interest in AssociatesDocument3 pagesIndirect Interest in AssociatesRabiatul AdawiyahPas encore d'évaluation

- What Needs To Happen To Salvage Some Value of The Broken Viva ProjectDocument2 pagesWhat Needs To Happen To Salvage Some Value of The Broken Viva Projectalec hahnPas encore d'évaluation

- The Anjuman Wazifa DIRECTOARY1Document25 pagesThe Anjuman Wazifa DIRECTOARY1Shoaib Raza JafriPas encore d'évaluation

- (Trading Ebook) Thomas Stridsman - Trading Systems That WorkDocument366 pages(Trading Ebook) Thomas Stridsman - Trading Systems That WorkAnurag Saini85% (20)

- INDF AnnualReport2013Document300 pagesINDF AnnualReport2013Jansen GunardiPas encore d'évaluation

- 5 - ERC Rate-Setting Methodologies - AJMO PDFDocument47 pages5 - ERC Rate-Setting Methodologies - AJMO PDFCavinti LagunaPas encore d'évaluation

- International Trade and Finance (Derivatives)Document52 pagesInternational Trade and Finance (Derivatives)NikhilChainani100% (1)

- Portfolio ManagementDocument75 pagesPortfolio Managementsheemankhan82% (17)

- Muhamad Said Fathurrohman, CVDocument3 pagesMuhamad Said Fathurrohman, CVMuhamad Said FathurrohmanPas encore d'évaluation

- IAMIPS VanguardDocument4 pagesIAMIPS VanguardDahagam SaumithPas encore d'évaluation

- Gazprom Annual Report 2016 en PDFDocument200 pagesGazprom Annual Report 2016 en PDFMauricio AceroPas encore d'évaluation

- Stanaford V Genevese Et Al - Second Amended Class Action ComplaintDocument55 pagesStanaford V Genevese Et Al - Second Amended Class Action ComplaintSam E. AntarPas encore d'évaluation

- HomesfyDocument54 pagesHomesfyRubina MansooriPas encore d'évaluation

- Nominal and Real Interest RatesDocument6 pagesNominal and Real Interest RatesGeromePas encore d'évaluation

- CEO International Business Development in Houston TX Resume Alex Levy-ThiebautDocument1 pageCEO International Business Development in Houston TX Resume Alex Levy-ThiebautAlexLevyThiebautPas encore d'évaluation

- Rain Industries: QIP-Pitch BookDocument20 pagesRain Industries: QIP-Pitch BookRanjith KumarPas encore d'évaluation

- Fund-BarometerDocument134 pagesFund-BarometerVanessa DavisPas encore d'évaluation

- What Is CAPM?: CAPM Formula and CalculationDocument3 pagesWhat Is CAPM?: CAPM Formula and CalculationMillat AfridiPas encore d'évaluation

- A REPORT ON Working Capital Management IDocument78 pagesA REPORT ON Working Capital Management IAriful Islam RonyPas encore d'évaluation

- Notes To FSDocument3 pagesNotes To FSdhez10Pas encore d'évaluation

- Bitpanda Globalwebindex Report CryptocurrencyDocument47 pagesBitpanda Globalwebindex Report CryptocurrencyDaniel Sun ArguelloPas encore d'évaluation

- Session3 - MSC Spring2015Document49 pagesSession3 - MSC Spring2015Bia LopezPas encore d'évaluation

- Linear Tech Dividend PolicyDocument25 pagesLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- Divya Merge PDFDocument86 pagesDivya Merge PDFLïkïth RäjPas encore d'évaluation

- UberDocument34 pagesUberSUPREME ADHIKARIPas encore d'évaluation

- Sample Financial Due Diligence For A MergerDocument6 pagesSample Financial Due Diligence For A MergerCurt KlecklerPas encore d'évaluation