Académique Documents

Professionnel Documents

Culture Documents

About Prime Bank

Transféré par

Arif Hossain AryanDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

About Prime Bank

Transféré par

Arif Hossain AryanDroits d'auteur :

Formats disponibles

About Prime Bank In the backdrop of economic liberalization and financial sector reforms, a group of highly successful local

entrepreneurs conceived an idea of floating a commercial bank with different outlook. For them, it was competence, excellence and consistent delivery of reliable service with superior value products. Accordingly, Prime Bank was created and commencement of business started on 17th April 1995. The sponsors are reputed personalities in the field of trade and commerce and their stake ranges from shipping to textile and finance to energy etc. As a fully licensed commercial bank, Prime Bank is being managed by a highly professional and dedicated team with long experience in banking. They constantly focus on understanding and anticipating customer needs. As the banking scenario undergoes changes so is the bank and it repositions itself in the changed market condition. Prime Bank has already made significant progress within a very short period of its existence. The bank has been graded as a top class bank in the country through internationally accepted CAMELS rating. The bank has already occupied an enviable position among its competitors after achieving success in all areas of business operation. Prime Bank offers all kinds of Commercial Corporate and Personal Banking services covering all segments of society within the framework of Banking Company Act and rules and regulations laid down by our central bank. Diversification of products and services include Corporate Banking, Retail Banking and Consumer Banking right from industry to agriculture, and real state to software. Prime Bank, since its beginning has attached more importance in technology integration. In order to retain competitive edge, investment in technology is always a top agenda and under constant focus. Keeping the network within a reasonable limit, our strategy is to serve the customers through capacity building across multi-delivery channels. Our past performance gives an indication of our strength. We are better placed and poised to take our customers through fast changing times and enable them compete more effectively in the market they operate.

Hasanah Prime Bank started its operations in the year 1995 as 'A bank with a difference', blending its conventional banking system with that of Islamic Banking operations based on Shari'ah principles. Five of the branches of the bank provide Islamic Banking operations to serve the increasing demand of customers for Islamic products and services. Prime Bank is the pioneer in such a kind of blending (of conventional and Islamic banking) in the country which is followed by many other banks. In the year 2008, the bank has taken initiative to identify all of its Islamic banking activities by adopting a generic name of 'Hasanah' - the brand name for Islamic products and services of the bank, which has been used in the Qur'an and the Hadith several times to denote good deed, welfare, virtue, beauty spot etcetera, that expresses Prime Bank's willingness for working towards well-being of humanity through Islamic banking activities. Hasanah Deposit Products

Al-Wadeeah Al-Wadeeah Current Account Al-Wadeeah Concept Mudaraba Savings Account - Mudaraba Savings Account - Mudaraba Short Notice Deposit Term Deposit - Mudaraba Term Deposit Receipt Schemes - Mudaraba Double Benefit Deposit Scheme (MDBDS) - Mudaraba Contributory Savings Scheme (MCSS) - Mudaraba Education Savings Scheme (MESS) - Mudaraba Hajj Savings Scheme (MHSS) - Mudaraba Monthly Benefit Deposit Scheme (MMBDS) - Mudaraba Lakhpati Deposit Scheme (MLDS) - Mudaraba Millionaire Deposit Scheme (MMDS) - Mudaraba House Building Deposit Scheme (MHBDS)

Hasanah Investment Products

Investments Hasanah Home Investment (Manjeel) Hasanah Auto Investment (Burak) Hasanah Household Durables Investment (Asbab) Hasanah Medical Investment (Shifa) Hire Purchase under Shirkatul Melk concept Bai Mechanism - Bai-Murabaha - Bai-Muajjal - Bai-Salam Hire Purchase/Ijara Share Mechanism - Musharaka - Mudaraba

Mobile Banking What is EasyCash? EasyCash, Prime Bank Mobile Banking Service, is a secured mobile financial service to access cash easily and conveniently using mobile phone technology. EasyCash can be accessed from anywhere at anytime including remote rural areas of the country. The EasyCash Account model of Prime Bank works on the fundamental principle of giving everyone an access to a bank account and adding value to lifestyle of customers irrespective of social strata in Bangladesh. Prime Cash Prime Bank Ltd. and Dipon Consultancy Services jointly brings a banking service, a Biometric Smart Card based alternate banking service in the brand name Prime Cash for the un-banked rural and urban people to address banking needs and payment needs of the broader Bangladesh community. Most importantly, it will provide a fast, safe and simple mechanism for the un-banked men/women across Bangladesh in all municipalities and upazilas. What is Prime Cash? Prime Cash is a Biometric Smart Card where your thumb impression will work as authentication code. Phone Banking Service Benefits Our Phone Banking Service provides 24/7 continuous support for you. The main services are:

Balance Enquiry: Customer will get account balance information. Change TIN: Customer can change their TIN (Telephone Identification Number). Activate ATM/Master Card: Customer can activate ATM/Master Debit card by dialing the service contact number. Block ATM/Master Card: Customer can block ATM/ Master Debit card by dialing the service contact number. Credit Card Available Limit: Credit Card user can get current available limit. Credit Card Total Outstanding: Credit Card user can know credit card total outstanding bill amount. Credit Card Minimum Payable Amount: Credit Card user can know minimum payable amount of last bill amount. Credit Card Last Statement Generation Date: Credit Card user can know last statement generation date. Credit Card Last Date of Payment: Credit Card user can know last date of payment for recent bill amount. Service Accessibility All account holders of Prime Bank or holding a Prime Bank Debit Card and Credit Card can get this service. To access this service customer must fill up the Phone Banking Application Form and must acknowledge the Terms & Conditions for the service. Charges and Fees Tk. 100 + VAT as a service charge per year Contact To avail the services, please visit your respective branch. For queries, please call: +88 02 9553837 (ext: 141) +88 02 9567265 (ext: 375), +88 01730326804 Board of Directors

Md. Shirajul Islam Mollah Chairman

M. A. Khaleque Vice Chairman

Mizanur Rahman Bhuiyan Vice Chairman

Marina Yasmin Chowdhury Director

Nasim Anwar Hossain Director

Nazma Haque Director

Khandker Mohammad Khaled Director

Quazi Sirazul Islam Director

Salma Huq Director

Muslima Shirin Director

Mafiz A. Bhuiyan Director

Md. Abul Quashem Director

Md. Nader Khan Director

Imran Khan Director

Md. Shahadat Hossain Director

Nafis Sikder Director

Tanjil Chowdhury Director

Prof. Mohammed Aslam Bhuiyan Director

Prof. Ainun Nishat, Ph.D Director

Manzur Murshed Director

Md. Ehsan Khasru Managing Director

Vous aimerez peut-être aussi

- Brand Names On PackagesDocument1 pageBrand Names On PackagesArif Hossain AryanPas encore d'évaluation

- Aggression Means Feelings of Anger or Antipathy Resulting in Hostile or Violent BehaviorDocument3 pagesAggression Means Feelings of Anger or Antipathy Resulting in Hostile or Violent BehaviorArif Hossain AryanPas encore d'évaluation

- Report On Meghna Cement Mills LimitedDocument47 pagesReport On Meghna Cement Mills LimitedArif Hossain AryanPas encore d'évaluation

- Kirkpatrick's Four Levels of Evaluation ModelDocument6 pagesKirkpatrick's Four Levels of Evaluation ModelArif Hossain AryanPas encore d'évaluation

- Cover LetterDocument1 pageCover LetterArif Hossain AryanPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 5g-core-guide-building-a-new-world Переход от лте к 5г английскийDocument13 pages5g-core-guide-building-a-new-world Переход от лте к 5г английскийmashaPas encore d'évaluation

- Img - Oriental Magic by Idries Shah ImageDocument119 pagesImg - Oriental Magic by Idries Shah ImageCarolos Strangeness Eaves100% (2)

- Executive SummaryDocument3 pagesExecutive SummarySofia ArissaPas encore d'évaluation

- A List of Run Commands For Wind - Sem AutorDocument6 pagesA List of Run Commands For Wind - Sem AutorJoão José SantosPas encore d'évaluation

- Hanumaan Bajrang Baan by JDocument104 pagesHanumaan Bajrang Baan by JAnonymous R8qkzgPas encore d'évaluation

- TIMELINE - Philippines of Rizal's TimesDocument46 pagesTIMELINE - Philippines of Rizal's TimesAntonio Delgado100% (1)

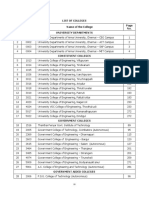

- TNEA Participating College - Cut Out 2017Document18 pagesTNEA Participating College - Cut Out 2017Ajith KumarPas encore d'évaluation

- Wastewater Treatment: Sudha Goel, Ph.D. Department of Civil Engineering, IIT KharagpurDocument33 pagesWastewater Treatment: Sudha Goel, Ph.D. Department of Civil Engineering, IIT KharagpurSubhajit BagPas encore d'évaluation

- TrematodesDocument95 pagesTrematodesFarlogy100% (3)

- Science Technology and SocietyDocument46 pagesScience Technology and SocietyCharles Elquime GalaponPas encore d'évaluation

- Feng Shui GeneralDocument36 pagesFeng Shui GeneralPia SalvadorPas encore d'évaluation

- Boot CommandDocument40 pagesBoot CommandJimmywang 王修德Pas encore d'évaluation

- CRM Final22222222222Document26 pagesCRM Final22222222222Manraj SinghPas encore d'évaluation

- MagmatismDocument12 pagesMagmatismVea Patricia Angelo100% (1)

- Rudolf Steiner - Twelve Senses in Man GA 206Document67 pagesRudolf Steiner - Twelve Senses in Man GA 206Raul PopescuPas encore d'évaluation

- The Music Tree Activities Book Part 1 Music Tree Summy PDF Book by Frances ClarkDocument3 pagesThe Music Tree Activities Book Part 1 Music Tree Summy PDF Book by Frances ClarkRenata Lemes0% (2)

- The Skylane Pilot's CompanionDocument221 pagesThe Skylane Pilot's CompanionItayefrat100% (6)

- Pilapil v. CADocument2 pagesPilapil v. CAIris Gallardo100% (2)

- Damodaram Sanjivayya National Law University VisakhapatnamDocument6 pagesDamodaram Sanjivayya National Law University VisakhapatnamSuvedhya ReddyPas encore d'évaluation

- Walt Whitman Video Worksheet. CompletedDocument1 pageWalt Whitman Video Worksheet. CompletedelizabethannelangehennigPas encore d'évaluation

- Kozier Erbs Fundamentals of Nursing 8E Berman TBDocument4 pagesKozier Erbs Fundamentals of Nursing 8E Berman TBdanie_pojPas encore d'évaluation

- Specification - Pump StationDocument59 pagesSpecification - Pump StationchialunPas encore d'évaluation

- Tesmec Catalogue TmeDocument208 pagesTesmec Catalogue TmeDidier solanoPas encore d'évaluation

- Duterte Vs SandiganbayanDocument17 pagesDuterte Vs SandiganbayanAnonymous KvztB3Pas encore d'évaluation

- KB000120-MRK456-01-HR SamplingDocument15 pagesKB000120-MRK456-01-HR SamplingMiguel Zuniga MarconiPas encore d'évaluation

- Stress Corrosion Cracking Behavior of X80 PipelineDocument13 pagesStress Corrosion Cracking Behavior of X80 Pipelineaashima sharmaPas encore d'évaluation

- August 2023 Asylum ProcessingDocument14 pagesAugust 2023 Asylum ProcessingHenyiali RinconPas encore d'évaluation

- Cover Letter For Lettings Negotiator JobDocument9 pagesCover Letter For Lettings Negotiator Jobsun1g0gujyp2100% (1)

- Community Service Learning IdeasDocument4 pagesCommunity Service Learning IdeasMuneeb ZafarPas encore d'évaluation

- TOURISM AND HOSPITALITY ORGANIZATIONS Di Pa TapooosDocument97 pagesTOURISM AND HOSPITALITY ORGANIZATIONS Di Pa TapooosDianne EvangelistaPas encore d'évaluation