Académique Documents

Professionnel Documents

Culture Documents

2011 05 MEOF Teaser

Transféré par

chinua_azubike0 évaluation0% ont trouvé ce document utile (0 vote)

17 vues10 pagesMongolia is the least densely populated country in the world with a population of just over 3 million'over 40 per cent of which live in the capital Ulaanbaatar. Mongolia embraced political and economic reforms in 1990 after abandoning its 70-year-old Soviet-style one-party state. The collapse of the economy after the withdrawal of Soviet support triggered widespread poverty and unemployment.

Description originale:

Titre original

2011 05 MEOF Teaser (2)

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentMongolia is the least densely populated country in the world with a population of just over 3 million'over 40 per cent of which live in the capital Ulaanbaatar. Mongolia embraced political and economic reforms in 1990 after abandoning its 70-year-old Soviet-style one-party state. The collapse of the economy after the withdrawal of Soviet support triggered widespread poverty and unemployment.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

17 vues10 pages2011 05 MEOF Teaser

Transféré par

chinua_azubikeMongolia is the least densely populated country in the world with a population of just over 3 million'over 40 per cent of which live in the capital Ulaanbaatar. Mongolia embraced political and economic reforms in 1990 after abandoning its 70-year-old Soviet-style one-party state. The collapse of the economy after the withdrawal of Soviet support triggered widespread poverty and unemployment.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 10

The Mongolia Equity Opportunities Fund

Private & Confidential

This document does not represent an offer Page 1 of 10

The Mongolia Equity Opportunities Fund

Khan Investment Management Limited (Khan) is a specialist Cayman Island Investment Management Group,

specifically created to structure and promote the Mongolia Equity Opportunities Fund (the Fund).

Khan has created and structured the Fund in accordance with what it believes are the most important

attributes for potential investors, including fund domicile, liquidity terms, portfolio diversification and

importantly, to provide access to the local Mongolian Stock Exchange and participate in the many local Initial

Public Offerings of private and state owned enterprises slated over the coming years.

Khan has also selected all third party services providers of the Fund, including importantly the Investment

Manager, Gordian Capital Singapore Private Limited, and the chief Investment Adviser Monet LLC.

About Mongolia

Perhaps most notably known as the birth place of Genghis Khan and the Mongol Empire, Mongolia is quickly

gaining strategic importance not seen since its 13

th

century heyday.

Land locked between Russia and China, Mongolia is roughly equivalent to the size of Western Europe. It is the

least densely populated country in the world with a population of just over 3 million over 40 per cent of

which live in the capital Ulaanbaatar.

Mongolia embraced political and

economic reforms in 1990 after

abandoning its 70-year-old Soviet-

style one-party state. Democracy

and privatisation were enshrined

in a new constitution, but the

collapse of the economy after the

withdrawal of Soviet support

triggered widespread poverty and

unemployment. Recently

however, the small economy has

begun to surge following

discoveries of significant mineral

and energy resources and rising

commodity prices.

The Mongolia Equity Opportunities Fund

Private & Confidential

This document does not represent an offer Page 2 of 10

Mongolia has expanded political and financial ties with the US, Japan and the European Union, but its main

trading partners are neighbouring Russia and China. The latter is the biggest market for Mongolian exports,

8 M

Substantial deposits of gold, copper, and above all coal have been discovered in recent years. Oyu Tolgoi, the

-copper mine is scheduled to begin production in 2013, and Tavan Tolgoi, one

s largest coal deposits, is already exporting to China. There are also immense deposits of uranium

and rare earths, as well as molybdenum, tin, tungsten, lead and zinc.

S -owned investment fund,

Temasek, believes that the value of raw

materials in the ten largest mines alone in

Mongolia could exceed USD 1.3 trillion (2010

prices), and according to emerging market

investor Marc Faber, Mongolia could be become

the Saudi Arabia of Asia (Eurasia Capital, 2011).

It should be noted however that it is difficult to

M

commodity reserves at present, as only a small

part of them have been explored in this

enormous country.

Despite vast quantities of untapped mineral and energy resources, and numerous mining projects already

underway, Mongolia currently remains significantly underdeveloped. There is immense scope for catch-up and

growth in the secondary sector, from infrastructure to property. The financial sector represents a similar

picture, as the industry is not yet prepared for the economic changes that await it. (Renaissance Capital, 2011)

The Mongolia Equity Opportunities Fund

Private & Confidential

This document does not represent an offer Page 3 of 10

Economic Outlook

The world is thirsting for commodities and prices have been rising for over a decade. Mongolia has large raw

The outlook for real GDP growth is underpinned by the rapidly developing commodity-based economy,

dominated by large scale productions starting at Oyu Tolgoi, Tavan Tolgoi, and other mines.

From 2004 to 2008 the Mongolian economy grew by an annual average of 9%. After bottoming out at minus

1.3 per cent in 2009, real GDP growth hit 6.1 per cent in 2010 fuelled by mineral exports notably from copper

and coal. Production from Oyu Tolgoi mine is expected to start by 2013, while that from Tavan Tolgoi is

expected to be gradually scaled up and to reach full capacity by 2016. According to International Monetary

l lMl Ms GDP is expected to grow around 10 per cent this year, rise to over 20 per

cent in 2013 and continue double-digit expansion annually for the rest of the decade. (IMF, 2011)

Real GDP growth is expected to average 13 per cent over the medium term (2013 2018), taking into account

the impact on the non-mineral economy (IMF, 2011).

Growth drivers for 2011 and beyond (Eurasia Capital, 2011);

x USD 2.3 billion capital budget (over one third of

M Cu l

Mines and Rio Tinto for Oyu Tolgoi (2011)

x Strong and growing investments across the

mining sector as well as other asset classes

x Substantial increase in government

expenditures

x Positive outlook for commodity prices

x Rising export values driven by strong Chinese

demand

x Growth in personal income underpinned by

inflows of foreign capital and the expansion in

government social payments

The Mongolian economy has a bright economic future as development of the mining sector will lead to a

substantial growth in mineral GDP and will have significant knock-on effects on other sectors through a

reallocation of resources and changes in relative prices.

The Mongolia Equity Opportunities Fund

Private & Confidential

This document does not represent an offer Page 4 of 10

Major mining projects

Tavan Tolgoi

Tavan Tolgoi is one of the largest undeveloped coking and thermal coal deposits in the world with total

resources estimated to be 6.4 billion tonnes according to the World Bank (IMF, 2011). The coal field has a rich

percentage of high-quality coking coal, which can be used for steelmaking, and the rest as fuel in power plants

(Baasangombo, 2011). Dai Bing, a senior analyst at www.coal.com.cn, the leading e-commerce service

platform for the coal industry in China, estimates the total value of the Tavan Tolgoi coal mine to be USD 300

billion (Juan, 2011).

Mongolia has split Tavan Tolgoi into 2 zones: central-west and

east. The government has shortlisted 6 bidders to develop the

central-western part of Tavan Tolgoi which will be developed

by a group of mining companies. Successful bidders to

develop the central-western block are expected to be

announced in July (Juan, 2011). Erdenes Tavan Tolgoi LLC (a

wholly owned subsidiary of the state owned mining company

Erdenes MGL LLC) owns the rights to mine the eastern, or

Tsenkhi block of Tavan Tolgoi, which is estimated to contain

2.2 billion tonnes of coal. It will be developed by a number of

companies working in conjunction with the government (The

UB Post, 2011).

Energy Resources LLC (a consortium of top Mongolian companies) and Erdenes Tavan Tolgoi LLC are currently

exporting close to 3 million tonnes per year, however production is expected to quickly ramp up to over 10

million tonnes per year by 2014 (IMF, 2011)

The government has announced that it will retain a 50 per cent stake hold in Erdenes Tavan Tolgoi and will

offer the balance to investors and its own citizens. Mongolian Prime Minister Sukhbaatar told an Australian

Government trade forum in Sydney in February this year that the initial public offering of part of the Tavan

Tolgoi coal deposit is scheduled to go ahead in the second half of this year (Mining Journal, 2011).

The Wall Street Journal reported on 9 February, 2011, that an IPO of Erdenes Tavan Tolgoi may value the

company at between USD 10 billion and USD 15 billion, citing people familiar with the deal (Mining Journal,

2011).

Development of the deposit, which is close to the border with China, would make Mongolia a major world coal

producer. Initially, its development will increase equipment imports, FDI, and loan inflows, but soon after it

will lead to a large increase in exports.

China consumed 3.25 billion tons of coal and imported 164.83 million tons in 2010, a growth rate of 30.99 per

cent year-on-year, according to the National Bureau of Statistics and National Development and Reform

Commission (NDRC) (Juan, 2011) C nergy resources,

including coal, highlighting the importance of the development of the nearby Tavan Tolgoi resource.

The Mongolian government is also considering proposals to build a 1,000 kilometre rail line to shuttle Tavan

Tolgoi coal to the Russian rail system and its ports in the far east of the country as this could open up access to

markets in Japan, South Korea and Taiwan, leaving Ulaanbaatar less dependent on resource hungry China (The

UB Post, 2011).

The Mongolia Equity Opportunities Fund

Private & Confidential

This document does not represent an offer Page 5 of 10

Oyu Tolgoi undeveloped copper-gold mine

Discovered by Canadian based Ivanhoe Mines in 2001, Oyu Tolgoi is the largest undeveloped copper-gold mine

project in the world and is located in the South Gobi region of Mongolia, 550km south of the capital

Ulaanbaatar and 80kms north of the border with China where the mined copper is expected to be shipped.

8 l M C 1

estimates indicate that Oyu Tolgoi contains approximately 81 billion pounds of copper and 46 million ounces

of gold in measured, indicated and inferred resources (Ivanhoe Mines Ltd, 2011). Production is scheduled to

begin in 2013 and to reach full capacity in 2018. Over the anticipated 45 year life of the mine, Oyu Tolgoi is

scheduled to produce 450,000 tonnes of copper per year (3% of global production) and 330,000 ounces of gold

annually, whilst employing 18,000 people.

The Mongolian Government will acquire 34% in the project and Ivanhoe Mines will retain 66% interest in the

project. Global miner Rio Tinto which joined Ivanhoe Mines as a strategic partner three years ago, presently

holds an approximate 49 per cent interest in in Ivanhoe Mines (December 2010) (Ivanhoe Mines Ltd, 2011).

The 2010 estimated cost of bringing the Oyu Tolgoi mine into production was USD 4.6 billion.

The Mongolia Equity Opportunities Fund

Private & Confidential

This document does not represent an offer Page 6 of 10

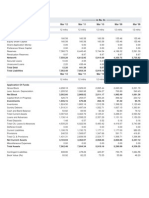

The Mongolia Stock Exchange

The Mongolia Stock Exchange (MSE) was established in early 1991 by the government to facilitate the

privatisation of state- M Currently

dominated by resource related companies within the metals and mining sector, the MSE was the best

performing equity market globally in 2010 with the benchmark SME Top-20 Index gaining 138% (or 173.7% in

USD terms).

M is often considered too small for

institutional investors. The total market capitalisation of over 300 Mongolian listed companies on the MSE is

only slightly more than USD 1 billion, which pales in to comparison to the USD 33 billion market capitalisation

of internationally listed companies with assets and operations in Mongolia who have sought liquidity abroad

with listings on exchanges in London, Hong Kong, Australia and Canada.

However, expected major initial public offerings (IPOs) by Mongolian State Owned Enterprises (SOEs) and large

private sector companies, coupled with possible dual listings by Mongolia-focussed international listed

companies (with a current USD 33 billion in market capitalisation) are likely to catapult the MSE into one of the

largest frontier markets globally within the next 4-5 years, resolving current low liquidity concerns and easing

the high volatility in the market.

Growth of the MSE

The Mongolian government has approved a list of more than 50 SOEs that are slated for privatisation starting

from 2011, including through IPOs. The SOEs are in the mining, mineral processing, construction material,

power distribution and generation, telecommunications and airline industries. Many will pursue a listing locally

on the MSE to serve as a vehicle for privatisation and then seek additional listings in regional or international

markets to raise capital for expansion and modernisation. There are also a number of SOEs with ownership in

strategic mineral deposits, infrastructure service providers and manufacturing entities expecting to offer

diversified exposure to a wide range of investors (Eurasia Capital, 2011).

Major SOEs to be Privatized by 2012 Industry

Thermal Power Station - III Power Generation

Shivee-Ovoo Coal Mining

Baganuur Coal Mining

Mongolia Stock Exchange Financial

Darkhan Metal Production Iron Ore Processing

Mongolia Telecom Airline

Erdenet Thermal Power Station Power Distribution

Source: Government of Mongolia

The Mongolia Equity Opportunities Fund

Private & Confidential

This document does not represent an offer Page 7 of 10

Furthermore, a number of leading domestic private companies are expected to launch substantial capital

raisings on the MSE. The most anticipated IPO at the MSE is the offering of Erdenes Tavan Tolgoi LLC, a state

owned holding company for the Tavan Tolgoi ce. The

government is planning the company IPO by the end of 2011 or early 2012. About 30 per cent of the

MSE partnership with the London Stock Exchange

Mongolia took a historically important step to develop its capital markets when MSE and the London Stock

Exchange (LSE) signed a landmark Master Service Agreement to manage the MSE on April 7 of this year.

According to the agreement, the London bourse will appoint a management team to oversee MSE

development and privatisation. Over the next three years the LSE will assist the MSE to introduce an

integrated securities trading system, create effective legal environment and bring the infrastructure,

(Eurasia Capital, 2011).

Under LSE management, MSE should be become an effective source of capital for Mongolia companies and

widen opportunities for local and international investors with expected IPOs and increased market size.

The expectation that LSE would be able to assist in unlocking the huge potential of the Mongolia capital

markets valuation rerating, boost liquidity, improvement in corporate governance, stronger pipeline of IPOs

and equity offerings as well as dual listings by international listed companies with operations in Mongolia, is

likely to fuel MSE global outperformance over the next several years.

Currency

Growing export revenues, along with surging foreign capital inflows and expected tightening measures to fight

inflation will put upward pressure on the Mongolian Tugrik (MNT). Export revenue growth will come from

increasing export demand and rising commodity prices (Eurasia Capital, 2011).

The MNT has emerged as a new resource currency, following the crisis, and its movements have become

coal, copper and gold (Eurasia Capital,

2011).

The Mongolia Equity Opportunities Fund

Private & Confidential

This document does not represent an offer Page 8 of 10

About the Fund

The Mongolia Equity Opportunities Fund is an open-end Cayman Island investment vehicle with monthly

dealing that provides long-only, unleveraged and un-hedged

economies.

1 l

Mongolian economy by investing in local and international listed companies, or companies soon to be listed,

with assets and operations in Mongolia.

The Fund has partnered with and appointed industry leading service providers to achieve its capital growth

objectives and position itself as the preeminent investment vehicle for investors who want to gain a diversified

Gordian Capital Singapore Private Limited, a specialist fund management group offering full service fund

management infrastructure and operational support, has been appointed as the Investment Manager of the

Fund.

Monet LLC, a leading independent investment banking firm operating in Mongolia, has been appointed as the

chief Investment Adviser to the Investment Manager.

The proposed launch date for the Fund is July 1, 2011.

Investment Philosophy and Approach

The Investment Adviser will initially apply a top-down screening process to identify those sectors which should

most benefit from sectoral growth trends. The Mining Sector is leading M

prospective stocks will be exploration and operational mining companies. However, as the market progresses,

additional opportunities are likely to arise in other sectors especially as more SOEs are privatized and private

companies seek additional growth capital through stock listings. Infrastructure, real estate, and services will

leverage the mining boom in the near future.

Fundamental industry and company analysis, rather than benchmarking, will form the basis of both stock

selection and portfolio construction. In the normal course of events, the Investment Adviser expects the Fund

to be fully-invested, although the Fund may however, hold cash reserves pending new IPOs. It is expected that

the Fund will hold positions for the long-term and thus have limited turnover.

As more Mongolian companies offer their shares to the public, the Investment Adviser will be well-placed to

participate in these IPOs and offer shares to its clients, including the Fund.

The Mongolia Equity Opportunities Fund

Private & Confidential

This document does not represent an offer Page 9 of 10

The Investment Advisor Monet LLC

Monet LLC is a leading independent investment banking firm operating in Mongolia. Founded at Bats Invest in

1997, the company provides brokerage, dealing, underwriting and investment banking services for both

domestic and international clients. As a private investment banking firm, Monet LLC has a strong market

position in each of its core business areas - equity capital markets, investment banking and debt capital

markets. Monet LLC is member of both the Mongolian Stock Exchange (MSE) and Business Council of Mongolia

(BCM). With acknowledged capabilities and accolades for the best execution and advice, Monet LLC is

dedicated to creating real value

The Investment Manager Gordian Capital Singapore Private Limited

Gordian Capital Limited (Gordian) was established as a Cayman Islands corporation in April, 2004. The firm was

conceived to offer offshore structuring and fund management solutions to both Japanese and other Asian fund

managers seeking to attract capital from international investors. Gordian identifies both new and emerging

investment managers, assisting talented fund managers by providing a full service infrastructure which they

can rely upon to grow their fund business. The firm takes on the business risk and provides fund managers

with infrastructure and operational support. An experienced investment operations team handles all the

operational aspects of funds which include long only, absolute return and hedge funds, managed accounts,

limited partnerships and fund of hedge funds. Gordian marshals the operational resources needed to assist the

manager to efficiently and effectively run their strat 1 operations

are conducted through a Singapore subsidiary, Gordian Capital Singapore Private Limited, an exempted

manager under the Monetary Authority of Singapore which provides the regulatory compliant fund

management services. Gordian provides efficient and effective vehicles that meet the standard of international

institutional investors which make up their investor base of pension funds, institutional investors, Family

Offices, Fund of Funds, Manager of Managers and High Net Worth Investors. Since inception Gordian has

grown in scope and now manages and operates a number of funds each with varying strategies and structures

with total assets under management of USD250 million.

Additional Information

Please contact Khan Investment Management Ltd for further information.

contact@khan-management.com

The Mongolia Equity Opportunities Fund

Private & Confidential

This document does not represent an offer Page 10 of 10

Works Cited

Baasangombo, M. (2011, March 31). Executive Director, Erdenes MGL LLC. (Bloomberg, Interviewer)

Eurasia Capital. (2011). Mongolia 2010 - 2020.

Eurasia Capital. (2011). Mongolian Stock Market - Capitalising on Frontier Opportunites.

IMF. (2011). IMF Executive Board Concludes 2011 Article IV Consultation, Post Program Monitoring, and Ex

Post Evaluation with Mongolia. External Relations Department.

Ivanhoe Mines Ltd. (2011). Ivanhoe Mines Ltd. Retrieved from www.ivanhoe-mines.com

Juan, D. (2011, March 24). Shenhua shortlisted in bid to develop Mongolian coalfield. China Daily.

Mining Journal. (2011). Tavan Tolgoi IPO may take place in second half. Mining Journal.

Renaissance Capital. (2011). Mongolia.

The UB Post. (2011, April 15). Foreign Firms Aim to Win Big on Mongolia Coal Mine. The Ulan Bator Post.

Disclaimer: The Information contained in this presentation is strictly for informational purposes only and

should be considered neither an offer nor a solicitation to invest in the Mongolia Equity Opportunities Fund

(the Fund) both now or in the future. The information has been obtained from or is based upon sources

believed to be reliable but is not guaranteed as to its accuracy, adequacy or completeness. Liability for errors

or omissions is expressly disclaimed. The information is provided without obligation and on the understanding

that any person or entity who acts upon it does so entirely at their own risk. No investment decisions should

be based on the information herein. Past performance of the Fund is not a guarantee of future performance.

Potential investors in funds should obtain independent legal, financial, tax, accounting and other professional

advice in respect to investing. Neither the Fund, nor KHAN INVESTMENT MANAGEMENT assumes any

responsibility to supply any corrections or updates to the information contained herein.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Dividend Policy and Firm Value Assignment 2Document2 pagesDividend Policy and Firm Value Assignment 2riddhisanghviPas encore d'évaluation

- High Probability Trading Setups For The Currency Market PDFDocument100 pagesHigh Probability Trading Setups For The Currency Market PDFDavid VenancioPas encore d'évaluation

- Integrated Management System) : (Prime Constructions LTDDocument17 pagesIntegrated Management System) : (Prime Constructions LTDsniparagPas encore d'évaluation

- Corvex Capital - Restoring The Health To Commonwealth - 2013.02.26Document69 pagesCorvex Capital - Restoring The Health To Commonwealth - 2013.02.26Wall Street WanderlustPas encore d'évaluation

- Tay Yu Jie - ResumeDocument1 pageTay Yu Jie - ResumeTay Yu JiePas encore d'évaluation

- Ratio AnalysisDocument84 pagesRatio AnalysisSurendra ShuklaPas encore d'évaluation

- 72 Inventory Management and Financial PeDocument22 pages72 Inventory Management and Financial PeKiersteen AnasPas encore d'évaluation

- Balance Sheet and P&L of CiplaDocument2 pagesBalance Sheet and P&L of CiplaPratik AhluwaliaPas encore d'évaluation

- A Case Study Entitled: The Collapse of Lehman BrothersDocument10 pagesA Case Study Entitled: The Collapse of Lehman BrothersRoby IbePas encore d'évaluation

- FIN347 DraftDocument11 pagesFIN347 DraftMUHAMMAD AIMANPas encore d'évaluation

- SBP Basel IIII Islamia College 29 Dec 2021Document46 pagesSBP Basel IIII Islamia College 29 Dec 2021Abdul HaseebPas encore d'évaluation

- Financial Analyst Certification Program PDFDocument43 pagesFinancial Analyst Certification Program PDFdouglasPas encore d'évaluation

- Commercial BanksDocument11 pagesCommercial BanksSeba MohantyPas encore d'évaluation

- Foreign Capital Inflows and Stock Market Development in PakistanDocument10 pagesForeign Capital Inflows and Stock Market Development in PakistanSadaf KazmiPas encore d'évaluation

- Muthoot Finance Rs. 5B NCD IssueDocument3 pagesMuthoot Finance Rs. 5B NCD IssueKannan SundaresanPas encore d'évaluation

- Kekra-01 220119Document8 pagesKekra-01 220119rastamanrmPas encore d'évaluation

- ARMSDocument4 pagesARMSWorld NewPas encore d'évaluation

- San Miguel CorporationDocument13 pagesSan Miguel CorporationLeslie KinaadmanPas encore d'évaluation

- Analyzing the financial situation of Victor and Maria HernandezDocument3 pagesAnalyzing the financial situation of Victor and Maria Hernandezelizabeth bernales50% (2)

- 120113-DCCBs in Maharashtra by SunilDocument7 pages120113-DCCBs in Maharashtra by SunilGauresh NaikPas encore d'évaluation

- CAIIB-BFM-Short Notes by MuruganDocument100 pagesCAIIB-BFM-Short Notes by Murugananon_410699614Pas encore d'évaluation

- Eco Project Chapter 5Document2 pagesEco Project Chapter 5Sanket KumarPas encore d'évaluation

- An Introduction To Callable Debt SecuritiesDocument37 pagesAn Introduction To Callable Debt SecuritiesrpcampbellPas encore d'évaluation

- Ioqm DPP-4Document1 pageIoqm DPP-4tanishk goyalPas encore d'évaluation

- USSIF ImpactofSRI FINALDocument64 pagesUSSIF ImpactofSRI FINALmansavi bihaniPas encore d'évaluation

- Introduction to Currency Trading: The Ultimate Beginner's GuideDocument25 pagesIntroduction to Currency Trading: The Ultimate Beginner's Guidearunchary007Pas encore d'évaluation

- Ichimoku - Eu: Ichimoku On High Time Frame IntervalsDocument4 pagesIchimoku - Eu: Ichimoku On High Time Frame IntervalsDiallo abassPas encore d'évaluation

- Introduction To Financial System OverviewDocument3 pagesIntroduction To Financial System OverviewChristian FloraldePas encore d'évaluation

- Business Plan Horse RidingDocument39 pagesBusiness Plan Horse RidingJames ZacharyPas encore d'évaluation

- Money Banking MGT 411 LecturesDocument148 pagesMoney Banking MGT 411 LecturesshazadPas encore d'évaluation