Académique Documents

Professionnel Documents

Culture Documents

On Restricted Least Squares - The Cobb-Douglas Production Function For The Nigerian Economy

Transféré par

decker4449Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

On Restricted Least Squares - The Cobb-Douglas Production Function For The Nigerian Economy

Transféré par

decker4449Droits d'auteur :

Formats disponibles

Developing Country Studies

ISSN 2224-607X (Paper) ISSN 2225-0565 (Online)

Vol 2, No.8, 2012

On Restricted Least Squares:

Funct

ADETUNJI, Ademola A

1. adecap4u@yahoo.com

2.

Department of Mathematics and Statistics, The Federal Polytechnic, P.M.B. 5351, Ado

Abstract

The Cobb-Douglas production function (

empirical analyses of growth and productivity

economy from 1990 to 2009 and uses the F

linear restriction of Cobb-Douglas production functions parameters

Using data on Nigerias Gross Domestic Product (GDP), Capital and total labour forc

Nigerian economy is probably characterized by constant returns to scale over the sample period and therefore,

using the restricted regression as stipulated by Cobb

Capital/Labour ratio increased by 1 percent, on average, labour productivity went up by about 1 percent.

Keywords: Regression, Restricted Least Square, Cobb

1. Introduction

In economic, the Cobb-Douglas functional form of production is widely

output and two inputs. It was developed and tested against statistical evidence by Charles Cobb and Paul

Douglas during 1900 1947, (Douglas, 1976).

work of (Cobb and Douglas, 1928), who used data for the U.S. manufacturing sector for 1899

researchers like (Brown, 1966); (Sandelin, 1976)

have been given to Wicksell for its disc

Douglas, 1928) were not the first economists to use the functional form named after them.

that Wicksell employed the Cobb-Douglas functional form in production analysi

also notes that Pareto used the Cobb

parameters of aggregate production functions is central to many of todays works on growth, technological change

productivity, and labour. Empirical estimates of aggregate production functions are essential tools of analysis in

macroeconomics, and important theoretical constructs, such as potential output, technical change, or the demand

for labour, are based on them, (Felipe and Adams, 2005)

In its most standard form for production of a single good (output) with two factors (inputs), the Cobb

function is: Y = AL

Y = total production (like the monetary value of all goods in a year)

A = Total factor productivity

L = Labour input

K = Capital input

and = output elasticities of Labour and Capital respectively

Cobb and Douglas were influenced by statistical evidence that applied to show that labour and capital shares of

total output were constant over tim

squares regression of their production function,

In stochastic form, Cobb-Douglas function becomes:

= oX

1

[

X

2

0

c

u

i

Y = output of a production process (like GDP of a country)

X

1i

= input 1 (one of the inputs that contributes to the output Y e.g. labour)

X

2i

= input 2 (the second input that contributes to the output Y e.g. capital)

u = stochastic disturbance term

e = base of natural logarithm

0565 (Online)

68

On Restricted Least Squares: the Cobb-Douglas Production

Function for the Nigerian Economy

ADETUNJI, Ademola A

1

IBRAHEEM, Ademola G

2

ADEMUYIWA, Justus A

adecap4u@yahoo.com +2348060754267 (Corresponding Author)

ibraheemademola30@yahoo.com +2348032271093

3. ademuyiwajustus@yahoo.com +2348067604823

Department of Mathematics and Statistics, The Federal Polytechnic, P.M.B. 5351, Ado-Ekiti, Ekiti State, Nigeria

Douglas production function (Y = AL

) is still today the most ubiquitous form in theoretical and

empirical analyses of growth and productivity (Felipe and Adams, 2005). This paper examines the Nigerian

economy from 1990 to 2009 and uses the F-test approach of Restricted Least Square (RLS) to find out if the

Douglas production functions parameters ( + ) = 1 is significant to Nigeria economy.

Using data on Nigerias Gross Domestic Product (GDP), Capital and total labour force, it was found that

Nigerian economy is probably characterized by constant returns to scale over the sample period and therefore,

using the restricted regression as stipulated by Cobb-Douglas function may not be misleading. Hence, if

tio increased by 1 percent, on average, labour productivity went up by about 1 percent.

Regression, Restricted Least Square, Cobb-Douglas, Returns to Scale

Douglas functional form of production is widely used to represent the relationship of

output and two inputs. It was developed and tested against statistical evidence by Charles Cobb and Paul

Douglas, 1976). The origin of the Cobb-Douglas form is dated back to the original

, who used data for the U.S. manufacturing sector for 1899

(Sandelin, 1976); and (Samuelson, 1979) had indicated that the credit should

for its discovery since he started working on it in the 19th century.

were not the first economists to use the functional form named after them.

Douglas functional form in production analysis, twenty years earlier. Weber

also notes that Pareto used the Cobb-Douglas functional form to represent Utility in 1892.

parameters of aggregate production functions is central to many of todays works on growth, technological change

productivity, and labour. Empirical estimates of aggregate production functions are essential tools of analysis in

macroeconomics, and important theoretical constructs, such as potential output, technical change, or the demand

(Felipe and Adams, 2005).

In its most standard form for production of a single good (output) with two factors (inputs), the Cobb

= total production (like the monetary value of all goods in a year)

= output elasticities of Labour and Capital respectively

Cobb and Douglas were influenced by statistical evidence that applied to show that labour and capital shares of

total output were constant over time in developed countries. They explained this by statistically fitting least

squares regression of their production function, (Gujarati and Sangeetha, 2007).

Douglas function becomes:

= output of a production process (like GDP of a country)

= input 1 (one of the inputs that contributes to the output Y e.g. labour)

= input 2 (the second input that contributes to the output Y e.g. capital)

www.iiste.org

Douglas Production

ADEMUYIWA, Justus A

3

+2348060754267 (Corresponding Author)

+2348032271093

+2348067604823

Ekiti, Ekiti State, Nigeria

is still today the most ubiquitous form in theoretical and

This paper examines the Nigerian

roach of Restricted Least Square (RLS) to find out if the

( + ) = 1 is significant to Nigeria economy.

e, it was found that the

Nigerian economy is probably characterized by constant returns to scale over the sample period and therefore,

Douglas function may not be misleading. Hence, if

tio increased by 1 percent, on average, labour productivity went up by about 1 percent.

used to represent the relationship of

output and two inputs. It was developed and tested against statistical evidence by Charles Cobb and Paul

Douglas form is dated back to the original

, who used data for the U.S. manufacturing sector for 1899 1922. Although,

had indicated that the credit should

overy since he started working on it in the 19th century. (Cobb and

were not the first economists to use the functional form named after them. (Weber, 1998) notes

s, twenty years earlier. Weber

Douglas functional form to represent Utility in 1892. The estimation of the

parameters of aggregate production functions is central to many of todays works on growth, technological change,

productivity, and labour. Empirical estimates of aggregate production functions are essential tools of analysis in

macroeconomics, and important theoretical constructs, such as potential output, technical change, or the demand

In its most standard form for production of a single good (output) with two factors (inputs), the Cobb-Douglas

Cobb and Douglas were influenced by statistical evidence that applied to show that labour and capital shares of

e in developed countries. They explained this by statistically fitting least

(i)

Developing Country Studies

ISSN 2224-607X (Paper) ISSN 2225-0565 (Online)

Vol 2, No.8, 2012

2. Properties of Cobb-Douglas Production Function

is the (partial) elasticity of output with respect to the labour input, that is, it measures the percentage change

in output for, say, a 1% change in the labour input, holding the capital input constant.

is the (partial) elasticity of output with respe

The sum ( + ) gives information about the returns to scale, that is, the response of output to a proportionate

change in the inputs.

If the sum is 1, then, there are constant returns to scale, t

tripling the input will triple the output, and so on.

If the sum is less than 1, there are decreasing returns to scale

output.

If the sum is greater than 1, there are increasing returns to scale

the output.

Output elasticity measures the responsiveness of output to a change in levels of either labour or capital

production, ceteris paribus. If ( + ) = 1, the production function has a constant returns to scale (i.e. the

production output increases by a constant factor). This implies that doubling capital (K) and labour (L) will yield

double output (Y). If ( + ) < 1, returns to scale are decreasing, and if ( + ) > 1, returns to scale are

increasing.

3. Literature Review

(Elias, 1992) in (Gujarati and Sangeetha, 2007)

from 1955 1974. Using data on the countrys Gross Domestic Product, Employment (labour), and Fixed capital,

they found that Mexican economy was probably characterized by constant returns to scale over the sampled

period and concluded that using Restricted Least Squares obtained for

also observed that increasing capital/employment ratio by 1 percent, on the average will increase the labour

productivity by about 1 percent.

(Effiong and Umoh, 2010) estimated the profit efficiency and the relevant

levels for egg-laying industry in Akwa

stochastic profit frontier. With the aid of a structured questionnaire, they collected primary data from sixty

poultry farms across the six agricultural zones of the state. Empirical results revealed the mean economic

efficiency of 65.00% implying the need for increased resource use efficiency Their results further showed that

variable inputs such as price of feeds, p

that profit decreased with increase in input prices while fixed inputs such as capital inputs and farm size were

statistically significant and had the right sign a

its utilization. Their study suggested that policy that would enhance extension services, encourage membership

in cooperative farming and enhanced good and adequate utilization of improved livestock inp

place.

(Abidemi, 2010) examines productivity in the banking sector by way of estimating two major production

functions known in the economic literature. The result obtained from the Ordinary Least Square (OLS) estimates

shows that substitution parameters and (substitution parameters for capital and labour, respectively) confirms

the a priori expectation that the duo of and are positive values of less than one. He found that the addition of

the values of and is greater than o

capital and labour, the output in terms of deposit will be more than doubled. He also observes that the

substitution parameters in the Constant Elasticity of Substitution Product

which supports the theory. In his final analysis, his study supports economic theory on the specification of both

Cobb-Douglas and Constant Elasticity of Substitution production functions.

In (Abiola, 2010), (Douglas, 19

concluded that labour is the single most important factor of production in a certain subtle sense. Both labour and

capital are needed in production: they opined that when capital is taken

negligible total products will be left with. But they found that a one percent increase in labour seems to increase

output about three times as much as would a one percent increase in capital. This largely corresponds

widely known fact that wages are about three

(Liedholm, 1964) was perhaps the first work to be done on productivity in Nigeria. An attempt was made at

finding out between labour and capital, which input con

Nigeria and it was found that labours contribution to the output of the selected manufacturing industries was

larger than that of capital. This position was confirmed by

(Ekanem, 2003) provides estimates of Total Factor Productivity for the banking industry in Nigeria for the

period 1986 2000. The methodology in the work involved the use of the Growth Accounting Model based on

0565 (Online)

69

Douglas Production Function

is the (partial) elasticity of output with respect to the labour input, that is, it measures the percentage change

in output for, say, a 1% change in the labour input, holding the capital input constant.

is the (partial) elasticity of output with respect to the capital input, holding the labour input constant.

) gives information about the returns to scale, that is, the response of output to a proportionate

If the sum is 1, then, there are constant returns to scale, that is, doubling the inputs will double the output,

tripling the input will triple the output, and so on.

If the sum is less than 1, there are decreasing returns to scale doubling the inputs will give less double the

there are increasing returns to scale doubling the inputs will give more double of

Output elasticity measures the responsiveness of output to a change in levels of either labour or capital

production, ceteris paribus. If ( + ) = 1, the production function has a constant returns to scale (i.e. the

production output increases by a constant factor). This implies that doubling capital (K) and labour (L) will yield

( + ) < 1, returns to scale are decreasing, and if ( + ) > 1, returns to scale are

Gujarati and Sangeetha, 2007) used Restricted Least Squares to observe Mexican Economy

on the countrys Gross Domestic Product, Employment (labour), and Fixed capital,

they found that Mexican economy was probably characterized by constant returns to scale over the sampled

period and concluded that using Restricted Least Squares obtained for the data set could not be harmful. They

also observed that increasing capital/employment ratio by 1 percent, on the average will increase the labour

estimated the profit efficiency and the relevant indices determining efficiency

laying industry in Akwa-Ibom State, Nigeria utilizing Cobb-Douglas production function based on

stochastic profit frontier. With the aid of a structured questionnaire, they collected primary data from sixty

ltry farms across the six agricultural zones of the state. Empirical results revealed the mean economic

efficiency of 65.00% implying the need for increased resource use efficiency Their results further showed that

variable inputs such as price of feeds, price of drugs and medication were statistically significant thus indicating

that profit decreased with increase in input prices while fixed inputs such as capital inputs and farm size were

statistically significant and had the right sign a-priori indicating that profit increased with increase in the level of

its utilization. Their study suggested that policy that would enhance extension services, encourage membership

in cooperative farming and enhanced good and adequate utilization of improved livestock inp

examines productivity in the banking sector by way of estimating two major production

functions known in the economic literature. The result obtained from the Ordinary Least Square (OLS) estimates

titution parameters and (substitution parameters for capital and labour, respectively) confirms

the a priori expectation that the duo of and are positive values of less than one. He found that the addition of

the values of and is greater than one, which indicates that as the banking sector doubles its inputs in terms of

capital and labour, the output in terms of deposit will be more than doubled. He also observes that the

substitution parameters in the Constant Elasticity of Substitution Production Function were equally positive,

which supports the theory. In his final analysis, his study supports economic theory on the specification of both

Douglas and Constant Elasticity of Substitution production functions.

(Abiola, 2010), (Douglas, 1934) and (Solow, 1957) in their study on capital

concluded that labour is the single most important factor of production in a certain subtle sense. Both labour and

capital are needed in production: they opined that when capital is taken away, or alternatively all labour and

negligible total products will be left with. But they found that a one percent increase in labour seems to increase

output about three times as much as would a one percent increase in capital. This largely corresponds

widely known fact that wages are about three-fourth of the share of property incomes.

was perhaps the first work to be done on productivity in Nigeria. An attempt was made at

finding out between labour and capital, which input contributed more to the output of major industries in Eastern

Nigeria and it was found that labours contribution to the output of the selected manufacturing industries was

larger than that of capital. This position was confirmed by (Osagie and Odaro, 1975).

provides estimates of Total Factor Productivity for the banking industry in Nigeria for the

2000. The methodology in the work involved the use of the Growth Accounting Model based on

www.iiste.org

is the (partial) elasticity of output with respect to the labour input, that is, it measures the percentage change

ct to the capital input, holding the labour input constant.

) gives information about the returns to scale, that is, the response of output to a proportionate

hat is, doubling the inputs will double the output,

doubling the inputs will give less double the

doubling the inputs will give more double of

Output elasticity measures the responsiveness of output to a change in levels of either labour or capital used in

production, ceteris paribus. If ( + ) = 1, the production function has a constant returns to scale (i.e. the

production output increases by a constant factor). This implies that doubling capital (K) and labour (L) will yield

( + ) < 1, returns to scale are decreasing, and if ( + ) > 1, returns to scale are

used Restricted Least Squares to observe Mexican Economy

on the countrys Gross Domestic Product, Employment (labour), and Fixed capital,

they found that Mexican economy was probably characterized by constant returns to scale over the sampled

the data set could not be harmful. They

also observed that increasing capital/employment ratio by 1 percent, on the average will increase the labour

indices determining efficiency

Douglas production function based on

stochastic profit frontier. With the aid of a structured questionnaire, they collected primary data from sixty

ltry farms across the six agricultural zones of the state. Empirical results revealed the mean economic

efficiency of 65.00% implying the need for increased resource use efficiency Their results further showed that

rice of drugs and medication were statistically significant thus indicating

that profit decreased with increase in input prices while fixed inputs such as capital inputs and farm size were

g that profit increased with increase in the level of

its utilization. Their study suggested that policy that would enhance extension services, encourage membership

in cooperative farming and enhanced good and adequate utilization of improved livestock inputs should be put in

examines productivity in the banking sector by way of estimating two major production

functions known in the economic literature. The result obtained from the Ordinary Least Square (OLS) estimates

titution parameters and (substitution parameters for capital and labour, respectively) confirms

the a priori expectation that the duo of and are positive values of less than one. He found that the addition of

ne, which indicates that as the banking sector doubles its inputs in terms of

capital and labour, the output in terms of deposit will be more than doubled. He also observes that the

ion Function were equally positive,

which supports the theory. In his final analysis, his study supports economic theory on the specification of both

in their study on capital-labour substitution

concluded that labour is the single most important factor of production in a certain subtle sense. Both labour and

away, or alternatively all labour and

negligible total products will be left with. But they found that a one percent increase in labour seems to increase

output about three times as much as would a one percent increase in capital. This largely corresponds with the

was perhaps the first work to be done on productivity in Nigeria. An attempt was made at

tributed more to the output of major industries in Eastern

Nigeria and it was found that labours contribution to the output of the selected manufacturing industries was

provides estimates of Total Factor Productivity for the banking industry in Nigeria for the

2000. The methodology in the work involved the use of the Growth Accounting Model based on

Developing Country Studies

ISSN 2224-607X (Paper) ISSN 2225-0565 (Online)

Vol 2, No.8, 2012

aggregate production functions. In the study

production process of the industry in Nigeria was found to be the Cobb

estimated Cobb-Douglas function were used to calibrate the Growth Accounting Model. The res

measured aggregate output grew at an average annual rate of 4.29%, while Total Factor Productivity grew at an

average annual rate of 3.33%. The study analyzed that TFP provided 78% of the recorded growth in the industry

during this period.

(Ekanem and Oyefusi, 2000) estimated the Cobb

production functions for the manufacturing industry in Nigeria for the period 1980

consideration the phenomenon of idle capacity th

models when compared with the work of

results in terms of goodness of fit. Of the two production functions estimated, the Cobb

Function performs better considering all the relevant econometric test criteria. This then showed that the

Cobb-Douglas Production Function gives a better explanation of the aggregate production process in the

manufacturing industry in Nigeria for the period studied.

4. Materials and Method

The dataset used for this research work are Real Gross Domestic Product and Capital expenditure has obtained

from Central Bank of Nigerias Statistical Bulletin, 2011 and the total labour force of Ni

obtained from World Bank national accounts data, and OECD National Accounts data files.

Written (i) in log form, the equation becomes:

ln

= lno + [ lnX

1

+ 0 lnX

2

+ u

ln

= + [ lnX

1

+ 0 lnX

2

+ u

If there are constant returns to scale (equiproportional change in output for an equiproportional change in the

input), economic theory suggests that + = 1. This is a form of linear equality

the validity of (ii), there are two possible approaches.

The t-Test Approach (The unrestricted/unconstrained Regression)

This procedure involves estimating parameters of (iii) without considering the linear equality restric

1) explicitly by using Ordinary Least Squares (OLS) method. Having estimated and , a test of

hypothesis/restriction is conducted using t

t

0

=

([

+ 0

)-1

_vu([

)+ vu(0

)+2 Co([

)

The test statistic is compared with

observation and k is the number of estimated parameters in (iii) and appropriate decision is taken on the set

hypothesis {H

0

: (+) = 1}

The F-Test Approach (Restricted Least Square, RLS)

The t-test approach is post-mortem in that it only finds out whether the linear restriction is satisfied after

estimating the unrestricted regression. However, the F

into the estimating procedure at the outset.

Since + = 1, hence = 1 . Substituting (1

ln

= + (1 - 0) lnX

1

+ 0 lnX

2

ln

= + lnX

1

- 0 lnX

1

+ 0 lnX

(ln

- lnX

1

) = + 0 (lnX

2

-ln

ln(

X

1

) = + 0 ln(X

2

X

1

) +

Variables (

X

1

) and (X

2

X

1

)

output with one of the inputs and (

estimated from (v), can be estimated using = 1

The overall implication of this is that the procedure ensures that sum of the estimated coefficients of the two

inputs equal 1 and hence, the name Restricted Least Squares, RLS. The generalization of this procedure into

more than one linear equality restriction is explained by

Examining the validity of RLS

The validity of the Restricted Least Squares can be examined by applying F

0565 (Online)

70

aggregate production functions. In the study, the most appropriate production function that describes the

production process of the industry in Nigeria was found to be the Cobb- Douglas. The parameters of the

Douglas function were used to calibrate the Growth Accounting Model. The res

measured aggregate output grew at an average annual rate of 4.29%, while Total Factor Productivity grew at an

average annual rate of 3.33%. The study analyzed that TFP provided 78% of the recorded growth in the industry

estimated the Cobb-Douglas and the Constant Elasticity of Substitution (CES)

production functions for the manufacturing industry in Nigeria for the period 1980

consideration the phenomenon of idle capacity that has characterized the industry at the time. The results of the

models when compared with the work of (Liedholm, 1964) and (Osagie and Odaro, 1975)

results in terms of goodness of fit. Of the two production functions estimated, the Cobb

Function performs better considering all the relevant econometric test criteria. This then showed that the

Douglas Production Function gives a better explanation of the aggregate production process in the

Nigeria for the period studied.

The dataset used for this research work are Real Gross Domestic Product and Capital expenditure has obtained

from Central Bank of Nigerias Statistical Bulletin, 2011 and the total labour force of Ni

World Bank national accounts data, and OECD National Accounts data files.

Written (i) in log form, the equation becomes:

u

(lno = )

If there are constant returns to scale (equiproportional change in output for an equiproportional change in the

input), economic theory suggests that + = 1. This is a form of linear equality restriction. In order to examine

the validity of (ii), there are two possible approaches.

Test Approach (The unrestricted/unconstrained Regression)

This procedure involves estimating parameters of (iii) without considering the linear equality restric

1) explicitly by using Ordinary Least Squares (OLS) method. Having estimated and , a test of

hypothesis/restriction is conducted using t-test where the test statistic is given by:

The test statistic is compared with to

2

(n -k) where is the level of significance, n is the number of

observation and k is the number of estimated parameters in (iii) and appropriate decision is taken on the set

Test Approach (Restricted Least Square, RLS)

mortem in that it only finds out whether the linear restriction is satisfied after

estimating the unrestricted regression. However, the F-test approach incorporates the linear equality restriction

into the estimating procedure at the outset.

. Substituting (1 ) for in (iii) gives:

2

+ u

X

2

+u

lnX

1

) + u

are of great economic importance since (

X

1

) measures the ratio of the

(X

2

X

1

) compares one of the input variables with the other. Once can be

estimated from (v), can be estimated using = 1 .

The overall implication of this is that the procedure ensures that sum of the estimated coefficients of the two

inputs equal 1 and hence, the name Restricted Least Squares, RLS. The generalization of this procedure into

restriction is explained by (Theil, 1971).

The validity of the Restricted Least Squares can be examined by applying F-test where

www.iiste.org

, the most appropriate production function that describes the

Douglas. The parameters of the

Douglas function were used to calibrate the Growth Accounting Model. The results showed that

measured aggregate output grew at an average annual rate of 4.29%, while Total Factor Productivity grew at an

average annual rate of 3.33%. The study analyzed that TFP provided 78% of the recorded growth in the industry

Douglas and the Constant Elasticity of Substitution (CES)

production functions for the manufacturing industry in Nigeria for the period 1980 1997, taking into

at has characterized the industry at the time. The results of the

(Osagie and Odaro, 1975) gave satisfactory

results in terms of goodness of fit. Of the two production functions estimated, the Cobb-Douglas Production

Function performs better considering all the relevant econometric test criteria. This then showed that the

Douglas Production Function gives a better explanation of the aggregate production process in the

The dataset used for this research work are Real Gross Domestic Product and Capital expenditure has obtained

from Central Bank of Nigerias Statistical Bulletin, 2011 and the total labour force of Nigeria 1990 2009

World Bank national accounts data, and OECD National Accounts data files.

(ii)

(iii)

If there are constant returns to scale (equiproportional change in output for an equiproportional change in the

restriction. In order to examine

This procedure involves estimating parameters of (iii) without considering the linear equality restriction ( + =

1) explicitly by using Ordinary Least Squares (OLS) method. Having estimated and , a test of

(iv)

where is the level of significance, n is the number of

observation and k is the number of estimated parameters in (iii) and appropriate decision is taken on the set

mortem in that it only finds out whether the linear restriction is satisfied after

ach incorporates the linear equality restriction

(v)

measures the ratio of the

compares one of the input variables with the other. Once can be

The overall implication of this is that the procedure ensures that sum of the estimated coefficients of the two

inputs equal 1 and hence, the name Restricted Least Squares, RLS. The generalization of this procedure into

Developing Country Studies

ISSN 2224-607X (Paper) ISSN 2225-0565 (Online)

Vol 2, No.8, 2012

F

cuI

=

(SSL

R

- SSLg

UR

)u

SSL

UR

(n-k)

SSE

R

is the sum of squares of error for restricted regression in (v)

SSE

0R

is the sum of squares of error for unrestricted regression in (iii)

a is number of linear restriction ( a = 1 in Cobb

k is the number of estimated parameters in (iii)

n is the number of observations

The F

cal

is compared with F

table

with [

hypothesis, H

0

: The Restricted Least Squares (RLS) is not significant. If the RLS is not si

is probably characterized by constant returns to scale over the sampled period and hence, there may be no harm

in using the restricted regression in (v).

5. Results and Discussion

Fitting the Cobb-Douglas production function to the

and total labour force from 1990 to 2009 gives:

ln0P

t

= -129.4S92u8 +8.u9S468

t = (-7.609275) (7.644071)

P-value = (0.000001) (0.000001)

Std Err. = (17.010715) (1.059052)

R

2

= 0.978207

The equation above (vii) shows that the output/labour elasticity is about 8.

about 0.25. if we add these coefficients, we obtain 8.36, indicating that the Nigeria economy has a very high

increasing returns to scale. As high as this value, it is very essential to subject this finding to statis

hypothesis. Imposing the restriction of constant returns to scale gives the following result:

ln(0PIobour)

t

= S.78SSu7

t = (6.845303)

P-value =

Std Err. = (0.553008)

R

2

= 0.876866

* UR Unrestricted Regression

Since the independent variables in (vii) and (viii) differ,

F

cuI

=

(SSE

R

- SSE

0R

)o

SSE

0R

(n -k)

=

(S.9SS77u

The F

cal

follows the F-distribution

and 5% (4.45) level.

6. Conclusion

The conclusion then is that the Nigerian economy is probably characterized by constant returns to scale over the

sample period and therefore, using the restricted regression as stipulated by Cobb

harmful. Hence, if Capital/Labour ratio increased by 1 percent, on average, labour productivity went up by about

1 percent over the sampled period.

7. Policy Implications

This study examined Cobb-Douglas coefficients restriction on Nigeria economy from 1990 to 2009 by way of

estimating the mostly utilized production functions in the economics literature. The result obtained from the OLS

estimates shows that substitution parameters, and do not support economic theory of the duo being positive

values of less than one. The addition of the values of and is greater than one which suggests that as the

Nigeria economy doubles its inputs in terms of labour and capital, the output in terms of GDP will be more than

doubled but a test of significance revealed otherwise. The study su

the Cobb-Douglas and production functions in researching into inputs/output relationship. The study, therefore,

recommends for Nigerian government and those involve in decision making that for desired increase

productivity in terms of output like the GDP, more units of both labour and capital should be employed.

0565 (Online)

71

is the sum of squares of error for restricted regression in (v)

is the sum of squares of error for unrestricted regression in (iii)

a is number of linear restriction ( a = 1 in Cobb-Douglas function)

eters in (iii)

with [a, (n k)] degree of freedom at specified level of significance with the null

: The Restricted Least Squares (RLS) is not significant. If the RLS is not si

is probably characterized by constant returns to scale over the sampled period and hence, there may be no harm

in using the restricted regression in (v).

Douglas production function to the data on Nigerias Gross Domestic Product (GDP), Capital

and total labour force from 1990 to 2009 gives:

u9S468 lnIobour

t

+ u.2SSSS9 lnCopitol

t

(7.644071) (1.951656)

(0.000001) (0.067654)

(1.059052) (0.129817)

*

RSS

UR

= 38.525827

*

SSE

UR

= 0.858280

The equation above (vii) shows that the output/labour elasticity is about 8.10 and the output/capital elasticity is

about 0.25. if we add these coefficients, we obtain 8.36, indicating that the Nigeria economy has a very high

increasing returns to scale. As high as this value, it is very essential to subject this finding to statis

hypothesis. Imposing the restriction of constant returns to scale gives the following result:

+ 1.19u4S6 ln(CopitolIobour)

t

(viii)

(6.845303) (11.321751)

(0.000002) (0.000000)

(0.553008) (0.105146)

^

RSS

R

= 28.169922

^

SSE

R

= 3.955770

^ Restricted Regression

Since the independent variables in (vii) and (viii) differ, F

cal

in (vi) is used to obtain F-value

( 9SS77u - u.8S828u)1

u.8S828u17

= S.6u89S

with (1, 17) degree of freedom. Hence, F

cal

is significant at both 1% (8.40)

The conclusion then is that the Nigerian economy is probably characterized by constant returns to scale over the

sample period and therefore, using the restricted regression as stipulated by Cobb-Douglas function may not be

l/Labour ratio increased by 1 percent, on average, labour productivity went up by about

Douglas coefficients restriction on Nigeria economy from 1990 to 2009 by way of

timating the mostly utilized production functions in the economics literature. The result obtained from the OLS

estimates shows that substitution parameters, and do not support economic theory of the duo being positive

tion of the values of and is greater than one which suggests that as the

Nigeria economy doubles its inputs in terms of labour and capital, the output in terms of GDP will be more than

doubled but a test of significance revealed otherwise. The study supports economic theory in the specification of

Douglas and production functions in researching into inputs/output relationship. The study, therefore,

recommends for Nigerian government and those involve in decision making that for desired increase

productivity in terms of output like the GDP, more units of both labour and capital should be employed.

www.iiste.org

(vi)

degree of freedom at specified level of significance with the null

: The Restricted Least Squares (RLS) is not significant. If the RLS is not significant, the economy

is probably characterized by constant returns to scale over the sampled period and hence, there may be no harm

Nigerias Gross Domestic Product (GDP), Capital

(vii)

= 0.858280

10 and the output/capital elasticity is

about 0.25. if we add these coefficients, we obtain 8.36, indicating that the Nigeria economy has a very high

increasing returns to scale. As high as this value, it is very essential to subject this finding to statistical

hypothesis. Imposing the restriction of constant returns to scale gives the following result:

(viii)

value

is significant at both 1% (8.40)

The conclusion then is that the Nigerian economy is probably characterized by constant returns to scale over the

Douglas function may not be

l/Labour ratio increased by 1 percent, on average, labour productivity went up by about

Douglas coefficients restriction on Nigeria economy from 1990 to 2009 by way of

timating the mostly utilized production functions in the economics literature. The result obtained from the OLS

estimates shows that substitution parameters, and do not support economic theory of the duo being positive

tion of the values of and is greater than one which suggests that as the

Nigeria economy doubles its inputs in terms of labour and capital, the output in terms of GDP will be more than

pports economic theory in the specification of

Douglas and production functions in researching into inputs/output relationship. The study, therefore,

recommends for Nigerian government and those involve in decision making that for desired increase

productivity in terms of output like the GDP, more units of both labour and capital should be employed.

Developing Country Studies

ISSN 2224-607X (Paper) ISSN 2225-0565 (Online)

Vol 2, No.8, 2012

References

Abidemi Abiola (2010): Capital-Labour Substitution and Banking Sector Performance in Nigeria (1960

Central Bank of Nigeria Economic

Brown, M. (1966): On the Theory and Measurement of Technological Change, Cambridge,

University Press.

Cobb, C. W. and Douglas, P. H. (1928): A Theory of Production,

Douglas, Paul H. (1976): The Cobb

New Empirical Values". University of Chicago Press,

Douglas P.H. (1934): Theory of Wage

Effiong E. O. and Umoh G. S. (2010):

laying enterprise in Akwa Ibom State, Nigeria,

Environment and Extension, Volume 9 Number 1, pp. 1

Ekanem O.T. (2003), Productivity in the Banking Industry in Nigerian

Studies 3(7) 24

Ekanem, O. T. and Oyefusi, S. A. (2000): Estimating Aggregate production Function for the Manufacturing

Industry in Nigeria 1980-1997

Elias, Victor J. (1992): Sources of Growth: A Study of Seven Latin American Economies

Vol. 108, pp. 383-398.

Felipe, J. and Adams F. G. (2005): A Theory of Production, The Estimation of the

retrospective view, Eastern Economic Journal,

Gujarati D. N. and Sangeetha B. (2007): Basic Econometrics, 4th ed.,

Liedholm, C. E. (1964): Production for Eastern Nigerian I

Social Studies Vol. 24 (1), Pp. 37

Osagie E. and Odaro (1975): Rate of Capital

Nigerian Manufacturing Industry 1960

24(1) pp. 37-60.

Samuelson, P. (1979): Paul Douglass Measurement of Production Functions and Marginal Productivities,

Journal of Political Economy, pp. 923

Sandelin, B. (1976): On the Origin of the Cobb

pp. 117 125

Solow, R.M. (1957): Technical Change and the Aggregate Production Function,

Statistics. Vol. 39, pp. 312-320.

Theil Henri (1971): Principles of Econometrics,

Weber C. E. (1998): Pareto and the Wicksell

Economic Thought, 20 (2), 203

World Bank national accounts data, and OECD National Accounts data files (2012)

Wikipedia, Cobb-Douglas: http://en.wikipedia.org/wiki/cobb_douglas

0565 (Online)

72

Labour Substitution and Banking Sector Performance in Nigeria (1960

Central Bank of Nigeria Economic and Financial Review, Volume 48(2) pp. 109 130

Brown, M. (1966): On the Theory and Measurement of Technological Change, Cambridge,

Cobb, C. W. and Douglas, P. H. (1928): A Theory of Production, American Economic Review,

Douglas, Paul H. (1976): The Cobb-Douglas Production Function Once Again: Its History, Its Testing, and Some

New Empirical Values". University of Chicago Press, Journal of Political Economy 84 (5): pp. 903

Douglas P.H. (1934): Theory of Wages, Macmillan New York.

(2010): Cobb Douglas Production Function with composite error term in egg

laying enterprise in Akwa Ibom State, Nigeria, Agro-Science Journal of Tropical Agriculture, Food,

olume 9 Number 1, pp. 1-7

Ekanem O.T. (2003), Productivity in the Banking Industry in Nigerian Journal of Economics and Social

Ekanem, O. T. and Oyefusi, S. A. (2000): Estimating Aggregate production Function for the Manufacturing

1997 Unpublished Work

Sources of Growth: A Study of Seven Latin American Economies

Felipe, J. and Adams F. G. (2005): A Theory of Production, The Estimation of the Cobb

Eastern Economic Journal, Vol. 31, No. 3, pp. 427 - 445

Gujarati D. N. and Sangeetha B. (2007): Basic Econometrics, 4th ed., Tata McGraw-Hill, New Delhi.

Liedholm, C. E. (1964): Production for Eastern Nigerian Industries. The Nigerian Journal of Economic and

(1), Pp. 37-60.

Osagie E. and Odaro (1975): Rate of Capital-Labour Substitution in Time Series Production Function in the

Nigerian Manufacturing Industry 1960-1975. The Nigerian Journal of Economic and Social Studies

Samuelson, P. (1979): Paul Douglass Measurement of Production Functions and Marginal Productivities,

pp. 923 939

Sandelin, B. (1976): On the Origin of the Cobb-Douglas Production Function, Economy and History,

Solow, R.M. (1957): Technical Change and the Aggregate Production Function, Review of Economics and

320.

Theil Henri (1971): Principles of Econometrics, John Wiley & Sons, New York, pp. 43 45

Weber C. E. (1998): Pareto and the Wicksell-Cobb-Douglas Functional Form, Journal of the History of

, 20 (2), 203-210.

World Bank national accounts data, and OECD National Accounts data files (2012)

http://en.wikipedia.org/wiki/cobb_douglas

www.iiste.org

Labour Substitution and Banking Sector Performance in Nigeria (1960-2008),

130

Brown, M. (1966): On the Theory and Measurement of Technological Change, Cambridge, Cambridge

American Economic Review, pp. 139 165

Douglas Production Function Once Again: Its History, Its Testing, and Some

84 (5): pp. 903916

Cobb Douglas Production Function with composite error term in egg

Science Journal of Tropical Agriculture, Food,

Journal of Economics and Social

Ekanem, O. T. and Oyefusi, S. A. (2000): Estimating Aggregate production Function for the Manufacturing

The Economic Journal,

Cobb-Douglas Function: A

Hill, New Delhi.

The Nigerian Journal of Economic and

Labour Substitution in Time Series Production Function in the

l of Economic and Social Studies Vol.

Samuelson, P. (1979): Paul Douglass Measurement of Production Functions and Marginal Productivities,

Economy and History, Vol. 19 (2),

Review of Economics and

45

Journal of the History of

Developing Country Studies

ISSN 2224-607X (Paper) ISSN 2225-0565 (Online)

Vol 2, No.8, 2012

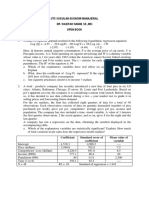

Figure 1

Figure 2

Figures 1 and 2 above show upward movements for the log transformation of all the variables under

consideration.

16

18

20

22

24

26

28

30

32

34

Cobb-Douglas Logarithmic

ln GDP_Current Basic Prices

6

7

8

9

10

11

12

13

14

Cobb-Douglas Logarithmic

ln (GDP/LABOUR)

0565 (Online)

73

Figures 1 and 2 above show upward movements for the log transformation of all the variables under

Year

Douglas Logarithmic-Scale for Nigeria GDP, Capital

and Labour

ln GDP_Current Basic Prices ln Labour ln Capital_Expenditure

Year

Douglas Logarithmic-Scale for (GDP/Capital ) and

(Labour/Capital)

ln (GDP/LABOUR) ln (CAPITAL/LABOUR)

www.iiste.org

Figures 1 and 2 above show upward movements for the log transformation of all the variables under

Scale for Nigeria GDP, Capital

ln Capital_Expenditure

Scale for (GDP/Capital ) and

This academic article was published by The International Institute for Science,

Technology and Education (IISTE). The IISTE is a pioneer in the Open Access

Publishing service based in the U.S. and Europe. The aim of the institute is

Accelerating Global Knowledge Sharing.

More information about the publisher can be found in the IISTEs homepage:

http://www.iiste.org

The IISTE is currently hosting more than 30 peer-reviewed academic journals and

collaborating with academic institutions around the world. Prospective authors of

IISTE journals can find the submission instruction on the following page:

http://www.iiste.org/Journals/

The IISTE editorial team promises to the review and publish all the qualified

submissions in a fast manner. All the journals articles are available online to the

readers all over the world without financial, legal, or technical barriers other than

those inseparable from gaining access to the internet itself. Printed version of the

journals is also available upon request of readers and authors.

IISTE Knowledge Sharing Partners

EBSCO, Index Copernicus, Ulrich's Periodicals Directory, JournalTOCS, PKP Open

Archives Harvester, Bielefeld Academic Search Engine, Elektronische

Zeitschriftenbibliothek EZB, Open J-Gate, OCLC WorldCat, Universe Digtial

Library , NewJour, Google Scholar

Vous aimerez peut-être aussi

- Method Vs MethodologyDocument6 pagesMethod Vs Methodologyalisyed37Pas encore d'évaluation

- Dupont Analysis of Pharma CompaniesDocument8 pagesDupont Analysis of Pharma CompaniesKalyan VsPas encore d'évaluation

- Research Holds The Following Significant DataDocument2 pagesResearch Holds The Following Significant Datarhomelyn malana100% (1)

- Chapter No.46Document8 pagesChapter No.46Kamal Singh100% (1)

- Monday Tuesday Wednesday Thursday Friday: GRADES 1 To 12 Daily Lesson Log Ms. Rita A. MapacpacDocument3 pagesMonday Tuesday Wednesday Thursday Friday: GRADES 1 To 12 Daily Lesson Log Ms. Rita A. MapacpacJohnKennethPrescillaSilloriquezPas encore d'évaluation

- Factors Affecting Internet and E-Commerce Adoption Among Small andDocument14 pagesFactors Affecting Internet and E-Commerce Adoption Among Small anddecker4449100% (1)

- Fostering Creativity - A Four Elemental Model of Creative PedagogyDocument12 pagesFostering Creativity - A Four Elemental Model of Creative Pedagogydecker4449Pas encore d'évaluation

- Thought Control and OcdDocument10 pagesThought Control and OcdCella100% (1)

- Cobb-Douglas Prod FDocument3 pagesCobb-Douglas Prod FPriya ElizabethPas encore d'évaluation

- Cobb Douglas Production FunctionDocument5 pagesCobb Douglas Production Functionayushi jalanPas encore d'évaluation

- Production Analysis For Class Presentation - PPT 97-2003Document42 pagesProduction Analysis For Class Presentation - PPT 97-2003naveen00757Pas encore d'évaluation

- Estimating The Cobb-Douglas Production Function: Ashfaq Ahmad, Muhammad KhanDocument2 pagesEstimating The Cobb-Douglas Production Function: Ashfaq Ahmad, Muhammad KhanPutera Petir GundalaPas encore d'évaluation

- IntroDocument8 pagesIntroRIC SOUND MUSIC MR RIC ZULUPas encore d'évaluation

- Cobb DouglasDocument6 pagesCobb DouglasZeyituna AbePas encore d'évaluation

- Applied AssignmwntDocument24 pagesApplied Assignmwntvaishnavidevi dharmarajPas encore d'évaluation

- Production Function: Unit - IiiDocument18 pagesProduction Function: Unit - IiiKiran A SPas encore d'évaluation

- Group 4 Optimal Combination of InputsDocument7 pagesGroup 4 Optimal Combination of InputsJessaPas encore d'évaluation

- Week 12 Lectures 23 & 24 The Economy in The Long Run: Economic GrowthDocument43 pagesWeek 12 Lectures 23 & 24 The Economy in The Long Run: Economic GrowthPeter MikhailPas encore d'évaluation

- Macroeconomics & National IncomeDocument43 pagesMacroeconomics & National IncomeSusmriti ShresthaPas encore d'évaluation

- Models of Productivity in European Union, The Usa and JapanDocument16 pagesModels of Productivity in European Union, The Usa and JapanMego PlamoniaPas encore d'évaluation

- EKN214 Semester Test 1Document3 pagesEKN214 Semester Test 1HappinessPas encore d'évaluation

- OJS20120400004_20305807Document9 pagesOJS20120400004_20305807yimenueyassuPas encore d'évaluation

- Solow S Model and Growth AccountingDocument12 pagesSolow S Model and Growth AccountingAndrea RudanPas encore d'évaluation

- Theory of ProductionDocument28 pagesTheory of ProductionVrkPas encore d'évaluation

- ME-3 EconomicDocument45 pagesME-3 EconomicHrutik DeshmukhPas encore d'évaluation

- INDUDocument2 pagesINDUAishwarya SimhadriPas encore d'évaluation

- Global Macroeconomics Assignment 1 - Charan AilawadiDocument3 pagesGlobal Macroeconomics Assignment 1 - Charan Ailawadicharan.ailawadiPas encore d'évaluation

- Chapter 2 Macro SolutionDocument14 pagesChapter 2 Macro Solutionsaurabhsaurs100% (1)

- CH10 Revised ADocument16 pagesCH10 Revised AMaimoona Ghani0% (1)

- Long-Term Economic Growth FactorsDocument30 pagesLong-Term Economic Growth FactorsAAA820Pas encore d'évaluation

- (Frankel 1962) The Production Function in Allocation and GrowthDocument29 pages(Frankel 1962) The Production Function in Allocation and GrowthT-roy Taylor100% (1)

- Solow Growth ModelDocument28 pagesSolow Growth ModelMehul GargPas encore d'évaluation

- Econometric Estimation of Production Function in Indian Machinery IndustryDocument24 pagesEconometric Estimation of Production Function in Indian Machinery IndustrypodderPas encore d'évaluation

- The Solow Growth Model With A CES Production Function and DecliningDocument11 pagesThe Solow Growth Model With A CES Production Function and Decliningmeshael FahadPas encore d'évaluation

- Chap 8Document67 pagesChap 8Yiğit KocamanPas encore d'évaluation

- Lec 3 - AssumptionsDocument13 pagesLec 3 - AssumptionsPriyadharshan BobbyPas encore d'évaluation

- The Cobb-Douglas Production Function: An Antipodean Defence? Iain FraserDocument20 pagesThe Cobb-Douglas Production Function: An Antipodean Defence? Iain FraserMaimoona GhaniPas encore d'évaluation

- Development Economics PolMi Lecture 4Document30 pagesDevelopment Economics PolMi Lecture 4Zain FarhanPas encore d'évaluation

- Macroeconomics & The Global Economy: Session 3: National Income-Where It Comes and Where It Goes? (Classical Model)Document23 pagesMacroeconomics & The Global Economy: Session 3: National Income-Where It Comes and Where It Goes? (Classical Model)Susmriti ShresthaPas encore d'évaluation

- Chapter 3 Overhead #1.F2016Document21 pagesChapter 3 Overhead #1.F2016sutoraifuviiPas encore d'évaluation

- ps6 SolDocument7 pagesps6 SolAnkit KumarPas encore d'évaluation

- Measuring Productivity Service Sector Sept enDocument17 pagesMeasuring Productivity Service Sector Sept enshashik1007730Pas encore d'évaluation

- Global Macroeconomics Assignment 1 - Charan Ailawadi (1)Document3 pagesGlobal Macroeconomics Assignment 1 - Charan Ailawadi (1)charan.ailawadiPas encore d'évaluation

- 0 Humphrey Production Functions TheoryDocument33 pages0 Humphrey Production Functions TheoryBhagirath BariaPas encore d'évaluation

- Solow y DataDocument7 pagesSolow y DataVanessa Carlos morianoPas encore d'évaluation

- EC112 Quiz3Document1 pageEC112 Quiz3Iohc NedmiPas encore d'évaluation

- Cobb Douglas Production FunctionDocument10 pagesCobb Douglas Production Functionshivansh pandeyPas encore d'évaluation

- PS2 SolsDocument12 pagesPS2 SolsMatthew ZukowskiPas encore d'évaluation

- Economic Growth Lecture 4 2023Document35 pagesEconomic Growth Lecture 4 2023rribeiro70Pas encore d'évaluation

- 7 - Production FunctionDocument80 pages7 - Production FunctionSandeep SinghPas encore d'évaluation

- Information Technology and Total Factor Productivity: Full Length Research PaperDocument5 pagesInformation Technology and Total Factor Productivity: Full Length Research PaperJean-Loïc BinamPas encore d'évaluation

- Growth Data SLDocument36 pagesGrowth Data SLPeter FinzellPas encore d'évaluation

- Neoclassical Growth Theory: Solow Model & Kaldor FactsDocument16 pagesNeoclassical Growth Theory: Solow Model & Kaldor FactsxeniachrPas encore d'évaluation

- Unit-Ii Production Analysis FinalDocument8 pagesUnit-Ii Production Analysis FinalYugandhar YugandharPas encore d'évaluation

- Exam1 Review QuestionsDocument3 pagesExam1 Review QuestionsOpen ThedorPas encore d'évaluation

- Production FunctionDocument35 pagesProduction Functionrinky_trivedi100% (1)

- Chapter 5Document23 pagesChapter 5Krishna KumarPas encore d'évaluation

- Cobb-Douglas Production FunctionDocument7 pagesCobb-Douglas Production FunctionharidhraPas encore d'évaluation

- Algebraic Production Functions and Their Uses Before Cobb-DouglasDocument33 pagesAlgebraic Production Functions and Their Uses Before Cobb-DouglasMario CacasennoPas encore d'évaluation

- Critical Introduction of Solow Growth TheoryDocument14 pagesCritical Introduction of Solow Growth TheoryKASUN DESHAPPRIYA RAMANAYAKE RAMANAYAKE ARACHCHILLAGEPas encore d'évaluation

- Models of Economic Growth and DevelopmentDocument34 pagesModels of Economic Growth and DevelopmentHari SharmaPas encore d'évaluation

- 計畫類別: 個別型計畫 計畫編號: NSC91-2415-H-004-004-執行期間: 91 年 08 月 01 日至 92 年 07 月 31 日 執行單位: 國立政治大學經濟學系Document19 pages計畫類別: 個別型計畫 計畫編號: NSC91-2415-H-004-004-執行期間: 91 年 08 月 01 日至 92 年 07 月 31 日 執行單位: 國立政治大學經濟學系muhammadvaqasPas encore d'évaluation

- The Supply of Goods: Supplemental Notes To The SOLOW Growth Model Adapted From Mankiw 6eDocument5 pagesThe Supply of Goods: Supplemental Notes To The SOLOW Growth Model Adapted From Mankiw 6einteleccPas encore d'évaluation

- Technical Efficiency and Return To Scale in The Indonesia Economy During The New Order and The Reformation GovernmentsDocument7 pagesTechnical Efficiency and Return To Scale in The Indonesia Economy During The New Order and The Reformation GovernmentsraisaPas encore d'évaluation

- Distributional Consequences of Direct Foreign InvestmentD'EverandDistributional Consequences of Direct Foreign InvestmentPas encore d'évaluation

- Foreign Direct Investments and Economic Growth in Nigeria - A Disaggregated Sector AnalysisDocument10 pagesForeign Direct Investments and Economic Growth in Nigeria - A Disaggregated Sector Analysisdecker4449Pas encore d'évaluation

- Formal Education, Skill Development and VocationalisationDocument7 pagesFormal Education, Skill Development and Vocationalisationdecker4449Pas encore d'évaluation

- Foreign Direct Investment and Economic Growth in GhanaDocument14 pagesForeign Direct Investment and Economic Growth in Ghanadecker4449Pas encore d'évaluation

- Evaluation of Macro and Micro Mineral Concentrations of Browse Forages in Relationto Ruminants Requirement - A Case Study of GwozaDocument6 pagesEvaluation of Macro and Micro Mineral Concentrations of Browse Forages in Relationto Ruminants Requirement - A Case Study of Gwozadecker4449Pas encore d'évaluation

- Factors Underlying The Failure of OrganizationsDocument7 pagesFactors Underlying The Failure of Organizationsdecker4449Pas encore d'évaluation

- Evaluation of Indoor Environment Quality (IEQ) of EducationalDocument9 pagesEvaluation of Indoor Environment Quality (IEQ) of Educationaldecker4449Pas encore d'évaluation

- Followership Imperative of Good GovernanceDocument17 pagesFollowership Imperative of Good Governancedecker4449Pas encore d'évaluation

- Evaluation of Some Heavy Metals in Soils Along A Major Road in Ogbomoso, South West NigeriaDocument9 pagesEvaluation of Some Heavy Metals in Soils Along A Major Road in Ogbomoso, South West Nigeriadecker4449Pas encore d'évaluation

- Exploring E-Commerce Activity in MalaysiaDocument6 pagesExploring E-Commerce Activity in Malaysiadecker4449Pas encore d'évaluation

- Evaluation of Indoor Background Ionizing Radiation Profile in Some Hospitals in Jos, Plateau State-NigeriaDocument7 pagesEvaluation of Indoor Background Ionizing Radiation Profile in Some Hospitals in Jos, Plateau State-Nigeriadecker4449Pas encore d'évaluation

- Ethical Issues in The Construction Industry in KenyaDocument12 pagesEthical Issues in The Construction Industry in Kenyadecker4449100% (1)

- Evaluating The Challenges of Human Resource Management in NigeriaDocument9 pagesEvaluating The Challenges of Human Resource Management in Nigeriadecker4449Pas encore d'évaluation

- Ethics, Motivation and Performance in Nigeria's Public ServiceDocument8 pagesEthics, Motivation and Performance in Nigeria's Public Servicedecker4449Pas encore d'évaluation

- Educational Paradigms of Information Technology For Human Resource Training - Myths and Potentialities Across The NGOs of BalochistanDocument10 pagesEducational Paradigms of Information Technology For Human Resource Training - Myths and Potentialities Across The NGOs of Balochistandecker4449Pas encore d'évaluation

- Evaluating The Viability of Shea Butter ProductionDocument9 pagesEvaluating The Viability of Shea Butter Productiondecker4449Pas encore d'évaluation

- Effect of Selection Process On Organizational Performance in The Brewery Industry of Southern NigeriaDocument15 pagesEffect of Selection Process On Organizational Performance in The Brewery Industry of Southern Nigeriadecker4449Pas encore d'évaluation

- Energy Intake, Expenditure and Body Composition of Adolescent Boys and Girls in Public Boarding Secondary Schools in Umuahia, NigeriaDocument7 pagesEnergy Intake, Expenditure and Body Composition of Adolescent Boys and Girls in Public Boarding Secondary Schools in Umuahia, Nigeriadecker4449Pas encore d'évaluation

- Environmental and Socio-Economic Impact of Oil Exploration On The Niger Delta RegionDocument7 pagesEnvironmental and Socio-Economic Impact of Oil Exploration On The Niger Delta Regiondecker4449Pas encore d'évaluation

- Effect of Abiotic Factors On The Incidence of African Rice Gall Midge, Orseolia Oryzivora and Its Parasitism by Platygaster Diplosisae and Aprostocetus ProceraeDocument6 pagesEffect of Abiotic Factors On The Incidence of African Rice Gall Midge, Orseolia Oryzivora and Its Parasitism by Platygaster Diplosisae and Aprostocetus Proceraedecker4449Pas encore d'évaluation

- Edges Detection Based On Renyi Entropy With SplitDocument11 pagesEdges Detection Based On Renyi Entropy With Splitdecker4449Pas encore d'évaluation

- Emphasizing Landscape Elements As Important Components of A Sustainable Built Environment in NigeriaDocument11 pagesEmphasizing Landscape Elements As Important Components of A Sustainable Built Environment in Nigeriadecker4449Pas encore d'évaluation

- Effect of Market Crisis of Financial Efficiency On Underpricing - An VAR Overview of Indian IPOsDocument19 pagesEffect of Market Crisis of Financial Efficiency On Underpricing - An VAR Overview of Indian IPOsdecker4449Pas encore d'évaluation

- Effect of Germination On Cooking, Nutrient Composition and Organoleptic Qualities of African Yam Bean (Sphenostylis Stenocarpa) .Document5 pagesEffect of Germination On Cooking, Nutrient Composition and Organoleptic Qualities of African Yam Bean (Sphenostylis Stenocarpa) .decker4449100% (1)

- Effect of Included Experience Program On The Attitudes of Pre-Service Teachers Towards Students With Special NeedsDocument6 pagesEffect of Included Experience Program On The Attitudes of Pre-Service Teachers Towards Students With Special Needsdecker4449Pas encore d'évaluation

- Economic Loss Analysis of Crops Yield Due To Elephant Raiding - A Case Study of Buxa Tiger Reserve (West), West Bengal, IndiaDocument6 pagesEconomic Loss Analysis of Crops Yield Due To Elephant Raiding - A Case Study of Buxa Tiger Reserve (West), West Bengal, Indiadecker4449Pas encore d'évaluation

- Dominator Chromatic Number of Circular-Arc Overlap GraphsDocument7 pagesDominator Chromatic Number of Circular-Arc Overlap Graphsdecker4449Pas encore d'évaluation

- Economic Development in Nigeria - The Basic Needs ApproachDocument12 pagesEconomic Development in Nigeria - The Basic Needs Approachdecker4449Pas encore d'évaluation

- Linear Regression Assumptions: MulticollinearityDocument14 pagesLinear Regression Assumptions: MulticollinearityAmjad IqbalPas encore d'évaluation

- Use Traffic Conflicts Technique (TCT) To Evaluate Serious Intersections in DamascusDocument2 pagesUse Traffic Conflicts Technique (TCT) To Evaluate Serious Intersections in DamascusIng AnnaPas encore d'évaluation

- Oilwell Cable Company Presentation Group ADocument12 pagesOilwell Cable Company Presentation Group Akencon1Pas encore d'évaluation

- Political Science PU Outlines PDFDocument90 pagesPolitical Science PU Outlines PDFUrva TahirPas encore d'évaluation

- PR 2 2nd Quarter ExamDocument2 pagesPR 2 2nd Quarter ExamMerida BravoPas encore d'évaluation

- HLM7 PDFDocument366 pagesHLM7 PDFAnonymous tcPTEUOGJPas encore d'évaluation

- Architect's Role in Rural Community DevelopmentDocument32 pagesArchitect's Role in Rural Community DevelopmentedrizhPas encore d'évaluation

- Introduction to Behavioural EconomicsDocument7 pagesIntroduction to Behavioural EconomicsInemi StephenPas encore d'évaluation

- Statistical Data Analysis - 2 - Step by Step Guide To SPSS & MINITAB - NodrmDocument83 pagesStatistical Data Analysis - 2 - Step by Step Guide To SPSS & MINITAB - NodrmGerry Dela CruzPas encore d'évaluation

- Full Doc PDFDocument452 pagesFull Doc PDFRosita Bacon SuenoPas encore d'évaluation

- Well Integrity Risk Assessment in Geothermal Wells - Status of TodayDocument93 pagesWell Integrity Risk Assessment in Geothermal Wells - Status of Todaymayalasan1Pas encore d'évaluation

- Saranya ResumeDocument2 pagesSaranya Resumesaranyap44100% (1)

- New Microsoft Office Word DocumentDocument59 pagesNew Microsoft Office Word Document09m008_159913639Pas encore d'évaluation

- Chapter 1Document46 pagesChapter 1Carl Angel BasaPas encore d'évaluation

- UTS SusulanDocument4 pagesUTS SusulanHavis AkbarPas encore d'évaluation

- A Performance Comparison of Multi-Objective Optimization-BasedDocument13 pagesA Performance Comparison of Multi-Objective Optimization-Basedmeysam_gholampoorPas encore d'évaluation

- M - A - Mass Communication (Final Year) W - e - F - Session 2014-2015 (Through DDE)Document6 pagesM - A - Mass Communication (Final Year) W - e - F - Session 2014-2015 (Through DDE)satnamPas encore d'évaluation

- MLP Project - VarunDocument6 pagesMLP Project - VarunTangirala Ashwini100% (1)

- 5E Lesson Plan Template: TeacherDocument3 pages5E Lesson Plan Template: Teacherapi-554223866Pas encore d'évaluation

- Miller 1991Document12 pagesMiller 1991Osmel0% (1)

- Afac Fbim-Manual v3Document70 pagesAfac Fbim-Manual v3adrian brownPas encore d'évaluation

- Poshandevi Social Studies SBA COMPLETEDDocument23 pagesPoshandevi Social Studies SBA COMPLETEDFrëßh AsíáñPas encore d'évaluation

- The Main Factors Which Influence Marketing Research in Different Countries AreDocument42 pagesThe Main Factors Which Influence Marketing Research in Different Countries AreHarsh RajPas encore d'évaluation

- Research ProposalDocument2 pagesResearch Proposalapi-450514900Pas encore d'évaluation

- FCS195 - Essay 2 GuidelinesDocument2 pagesFCS195 - Essay 2 GuidelinesaaaaanksPas encore d'évaluation

- (5070) - 1004 M.B.A. 104:business Research Methods (2013 Pattern) (Semester-I) (CBCS)Document2 pages(5070) - 1004 M.B.A. 104:business Research Methods (2013 Pattern) (Semester-I) (CBCS)ajay rathiPas encore d'évaluation