Académique Documents

Professionnel Documents

Culture Documents

Ec 590 PF F 08 Raw 2

Transféré par

Bartholomew SzoldDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ec 590 PF F 08 Raw 2

Transféré par

Bartholomew SzoldDroits d'auteur :

Formats disponibles

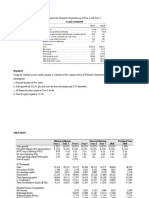

California State University, Fullerton Department Of Economics Dr.

Morteza Rahmatian

Economics 590 Fall 2008 First Exam

Name__________________________

Student ID (Last four digits) _______________

Part I:

Please answer the following 10 questions. Use graphs where they aid the discussion but remember that an unlabelled graph is useless. (6 Points each) Why the market demand for a private good is obtained by summing individual demands horizontally, but the market demand for a public good is obtained by summing them vertically? What is the free rider problem in the case of public goods? The smaller the group of payers or beneficiaries, the smaller the problem is likely to be. Why?

List and discuss three problems that might arise when using the Coase theorem. Ans: Bargaining costs are generally not zero. Identifying damages is difficult. There is generally some amount of asymmetric information.

1.

2.

3.

4.

The US government spends about $1.5 billion for research on alternative medicine, such as herb and energy field therapy. Is such research a public good? Is it sensible for the government to pay for such research? Research on alternative medicine is a public good if the research leads to treatments or cures that are non-excludable, meaning that others besides those who discovered the treatment may profit from the treatments. This would happen if discoveries cannot be patented. Whether or not it is sensible for government to pay for such research depends on the potential benefits of the research, which could be substantial if alternative medicine provides effective treatments, and whether or not the treatments can be patented.

5.

What are the primary reasons that explains an increase in federal expenditures for Social Security since 1965. Ans: Federal expenditures for Social Security have increased since 1965 for several reasons, including increases in the number of persons entitled to benefits and the introduction of Medicare and other programs.

6.

Why do/should we care that federal expenditures are becoming an increasingly larger portion of GDP? Ans: We should care that federal expenditures are becoming an increasingly larger portion of GDP because of public sector crowding out.

7.

It is possible that two different economists can examine the same situation, such as school funding, and reach entirely different conclusions. Why is this so? Ans: Reasoning resulting in differing results includes the time period under examination, the data sources and proxies used, the econometric tools employed, and many other reasons. This is not to say that because different researchers come to different conclusions the analysis is confused. It just means further investigation is needed.

8. 9.

What is market failure? What are the cases of market failure and how they are corrected. Social welfare functions can be formed in many ways. They can be additive, meaning that the all utilities curves are added together. They incorporate the idea of least-best, meaning that the utility of the person with the least is maximized. If you were a central planner for an economy, what type of social welfare function would you create? Ans: Answers will vary, but generally you need a social welfare function that incorporates some collectively agreed upon notion of fairness. It must also be function that can be implemented without causing undue stress on citizens or the economy.

10.

In recent years, a number of states have instituted taxes on patrons of nude and topless dance bars. Such taxes are known as sin taxes, because they target behavior that is believed to be sinful. How do sin taxes relate to the notion of merit goods? Musgrave (1959) developed the concept of merit goods to describe commodities that ought to be provided even if the members of society do not demand them. Sin taxes work the opposite way and apply to commodities that members of society might demand, but ought not to have.

Part II:

Please answer the following 4 of the following 5 questions. Use graphs where they aid the discussion but remember that an unlabelled graph is useless. (10 Points each)

1.

What is externality? Please explain positive and negative externality. With use of a graph please show the analysis of Pigouvian tax solution for internalizing the externality. Please read page 83, figure 5.4

2.

Explain how you would expect a libertarian, a social democrat, and someone with an organic conception of the state to react to the following laws: a. A law prohibiting gambling b. A law mandating seat belt use c. A law mandating child safety seats d. A law prohibiting prostitution e. A law prohibiting polygamy f. A law requiring all commercial signs be written in the countrys native language. Libertarians believe in a very limited government and are skeptical about the ability of government to improve social welfare. Social democrats believe that substantial government intervention is required for the good of individuals. Someone with an organic conception of the state believes that the goals of society are set by the state and individuals are valued only by their contribution to the realization of social goals.

a.

A law prohibiting gambling would probably be opposed by a libertarian and advocated by a social democrat. Someone with an organic conception of the state would first decide whether gambling would help to achieve the states goals before taking a position on this issue. If the

2

view is that gambling keeps individuals from being productive, then someone with an organic view would probably be in favor of prohibiting it, but if gambling is considered a good way to raise more revenue for the state, then they might oppose the prohibition. b. Libertarians oppose the law mandating seat belt use, arguing that individuals can best decide whether or not to use seat belts without government coercion. Social democrats take the position that the mandate saves lives and ultimately benefits individuals. The organic view would probably lead to favoring the mandate on the grounds that reduced health care costs caused by fewer accidents benefit society. Libertarians oppose the law mandating child safety seats, arguing that individuals can best decide whether or not to use child safety seats without government coercion. Social democrats take the position that the mandate saves lives and ultimately benefits individuals. The organic view would probably lead to favoring the mandate on the grounds that reduced health care costs caused by fewer accidents benefit society.

c.

d.

Libertarians would probably oppose a law prohibiting prostitution, while social democrats would likely favor such a law. The organic view depends on the type of society policymakers are attempting to achieve. The law would probably be favored on moral grounds. Libertarians would probably oppose a law prohibiting polygamy, while social democrats would likely favor such a law. The organic view depends on the type of society policymakers are attempting to achieve. The law would probably be favored on moral grounds. Libertarians would likely oppose the law, believing that individual business owners should make the decision about which language is used for their signs. Social democrats would also probably oppose the law in order to foster a more inclusive society. Those with an organic view would probably favor the law if they hold the view that every member of the society should speak the native language.

e.

f.

3.

Which of the following do you consider pure public goods? Private goods? Why? a. b. c. d. e. a. b. c. d. e. Wilderness areas Satellite television Medical school education Public television programs An Internet site providing information on airplane schedules Wilderness area is an impure public good at some point, consumption becomes nonrival; it is, however, nonexcludable. Satellite television is nonrival in consumption (although it is excludable). Medical school education is a private good. Television signals are nonrival in consumption. An Internet site is nonrival in consumption (although it is excludable).

4.

In each case listed below, can you rationalize the government policy on the basis of welfare economics? a. In Los Angeles, the police respond to 127,000 burglar alarm calls per year. There is no charge. (97 percent of the alarms are false.) b. Honey production is subsidized by the federal government. c. The Federal Government regulates cherry frozen fruit pies, requiring at that at least 25 percent of each pie by weight contains Cherries and that no more than 15 percent of the cherries be blemished. There are no such regulations for apple, blueberry or peach frozen pies. d. In Washington, DC, you cannot become a hairdresser unless you have a license from the city government. e. The National Energy Policy Act requires that all new toilets flush with only 1.6 gallons of water. Most American homes have toilets the consume 5.5 to 7 gallons per flush. f. The federal government subsidizes the production of electricity from chicken manure. [Note: I am not making this up.]

a.

There is no obvious reason why there is a market failure with burglar alarm calls; the Los Angeles police could set a response fee equal to the marginal cost. Welfare economics provides little basis for such a subsidy of honey production. There is no economic reason why cherry pies should be regulated, especially since there are no such regulations for apple, blueberry, or peach frozen pies. It is hard to imagine a basis in welfare economics for this regulation for hairdressers.

b. c.

d. e.

This is not an efficient policy. If the problem is that too much water is being consumed, then the answer is to increase the price of water. On that basis, people can decide whether or not they want to buy toilets that require less water. Water, like most other resources, is a private good. There is no economic reason why the federal government should subsidize the production of electricity, whether the electricity comes from coal, nuclear power, or chicken manure. One can assume the question that the R&D process of creating electricity from chicken manure is already developed, so there is not a positive externality argument. Since the production of electricity is a private good, with no obvious violations of the fundamental welfare theorem, there is no justification

f.

5.

The private marginal benefit for commodity X is given by 10 X, where X is the number of units consumed. The private marginal cost of producing X is constant a $5. For each unit of X produced, an external cost of $2 is imposed on members of society. In the absence of any government intervention, how much X is produced? What is the efficient level of production of X? What is the gain to society involved in moving from the inefficient to the efficient level of production? Suggest a Pigouvian tax that would lead to the efficient level. How much revenue would the tax raise. Private Marginal Benefit = 10 - X Private Marginal Cost = $5 External Cost = $2 Without government intervention, PMB = PMC; X = 5 units. Social efficiency implies PMB = Social Marginal Costs = $5 + $2 = $7; X = 3 units. Gain to society is the area of the triangle whose base is the distance between the efficient and actual output levels, and whose height is the difference between private and social marginal cost. Hence, the efficiency gain is (5 - 3)(7 - 5) = 2. A Pigouvian tax adds to the private marginal cost the amount of the external cost at the socially optimal level of production. Here a simple tax of $2 per unit will lead to efficient production. This tax would raise ($2) (3 units) = $6 in revenue.

Vous aimerez peut-être aussi

- WALEED GHILAN - F19401067 The Diamond Model To Analyze TeslaDocument1 pageWALEED GHILAN - F19401067 The Diamond Model To Analyze TeslasalanfPas encore d'évaluation

- Chapter ThreeDocument24 pagesChapter ThreeYeyPas encore d'évaluation

- Question and Answer - 8Document30 pagesQuestion and Answer - 8acc-expertPas encore d'évaluation

- Chapter Review and Self-Test Problem: 692 Part SevenDocument15 pagesChapter Review and Self-Test Problem: 692 Part SevenRony RahmanPas encore d'évaluation

- Chapter 9 Prospective AnalysisDocument23 pagesChapter 9 Prospective AnalysisPepper CorianderPas encore d'évaluation

- Chapter 4Document50 pagesChapter 4mohihsanPas encore d'évaluation

- Chapter 2Document17 pagesChapter 2jinny6061100% (1)

- FSA 8e Ch04 SMDocument63 pagesFSA 8e Ch04 SMmonhelPas encore d'évaluation

- Hoyle Chapter 10 Advanced Acct SolutionsDocument34 pagesHoyle Chapter 10 Advanced Acct SolutionsclevereuphemismPas encore d'évaluation

- Nontax Costs of Tax Planning - 6Document30 pagesNontax Costs of Tax Planning - 6Tanvir HossainPas encore d'évaluation

- Adopting A Stakeholder OrientationDocument13 pagesAdopting A Stakeholder OrientationAdy Pratama PutraPas encore d'évaluation

- CH1 - Case 4 Kardell Paper (Chapter 4, Pages 237-239)Document2 pagesCH1 - Case 4 Kardell Paper (Chapter 4, Pages 237-239)zoehyhPas encore d'évaluation

- Texas Instrument and Hewlett-PackardDocument3 pagesTexas Instrument and Hewlett-PackardMuhammad KamilPas encore d'évaluation

- Comparative International Auditing and Corporate Governance: ThirteenDocument47 pagesComparative International Auditing and Corporate Governance: ThirteenCatalina OrianiPas encore d'évaluation

- Inventory Observation MemoDocument1 pageInventory Observation MemoYefinia OpianaPas encore d'évaluation

- Materi Persentasi SIA (Semester 4)Document3 pagesMateri Persentasi SIA (Semester 4)Rahmad Bari BarrudiPas encore d'évaluation

- Chapter 14Document44 pagesChapter 14mahmoud100% (2)

- Tugas MCS Case2-1 SD 3 NajmalindaZenithaDocument4 pagesTugas MCS Case2-1 SD 3 NajmalindaZenithaNajmalinda ZenithaPas encore d'évaluation

- Chapter 16, Modern Advanced Accounting-Review Q & ExrDocument25 pagesChapter 16, Modern Advanced Accounting-Review Q & Exrrlg4814100% (4)

- Case - Ohio Rubber Works Inc PDFDocument3 pagesCase - Ohio Rubber Works Inc PDFRaviSinghPas encore d'évaluation

- Bonus Plan HypothesisDocument1 pageBonus Plan Hypothesisnajihah radziPas encore d'évaluation

- The Lang Michener AffairDocument6 pagesThe Lang Michener AffairMichaelaPas encore d'évaluation

- QuestionDocument1 pageQuestionrajbhandarishishirPas encore d'évaluation

- Chapter 2 - Case StudyDocument3 pagesChapter 2 - Case StudyAngelicaPas encore d'évaluation

- RequiredDocument3 pagesRequiredKplm StevenPas encore d'évaluation

- Chapter 7 - The FASB ' S Conceptual FrameworkDocument29 pagesChapter 7 - The FASB ' S Conceptual FrameworkelizabethPas encore d'évaluation

- Chapter OneDocument18 pagesChapter OneBelsti AsresPas encore d'évaluation

- Chapter 7 BVDocument2 pagesChapter 7 BVprasoonPas encore d'évaluation

- Kumpulan Soal UTS AKL IIDocument19 pagesKumpulan Soal UTS AKL IIAlessandro SitopuPas encore d'évaluation

- 18-32 (Objectives 18-2, 18-3, 18-4, 18-6)Document8 pages18-32 (Objectives 18-2, 18-3, 18-4, 18-6)image4all100% (1)

- FSDocument4 pagesFSCiptawan CenPas encore d'évaluation

- Scott CH 8 TRNSLTDocument36 pagesScott CH 8 TRNSLTTika Tety PratiwiPas encore d'évaluation

- Question SamplesDocument10 pagesQuestion SamplesJinu JosephPas encore d'évaluation

- Self Study Solutions Chapter 13Document11 pagesSelf Study Solutions Chapter 13ggjjyy0% (1)

- Beams10e Ch01 Business CombinationsDocument39 pagesBeams10e Ch01 Business CombinationsmegaangginaPas encore d'évaluation

- Case 5-1&5-4Document3 pagesCase 5-1&5-4Tiffany SmithPas encore d'évaluation

- Case 5-1Document4 pagesCase 5-1fitriPas encore d'évaluation

- To Take Into Account 2Document12 pagesTo Take Into Account 2Anii HurtadoPas encore d'évaluation

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesNguyen VyPas encore d'évaluation

- Tugas Week 10Document6 pagesTugas Week 10Carissa WindyPas encore d'évaluation

- Kelompok 5 Soal TerjemahanDocument1 pageKelompok 5 Soal TerjemahanElgaNurhikmahPas encore d'évaluation

- Development of The Institutional Structure of Financial AccountingDocument5 pagesDevelopment of The Institutional Structure of Financial Accountingtiyas100% (1)

- Accounting Chapter 10 Solutions GuideDocument56 pagesAccounting Chapter 10 Solutions GuidemeaningbehindclosedPas encore d'évaluation

- Galvor CompanyDocument27 pagesGalvor CompanyAbbasgodhrawalaPas encore d'évaluation

- The Effect of Myopia and Loss Aversion On Risk TakingDocument16 pagesThe Effect of Myopia and Loss Aversion On Risk TakingbboyvnPas encore d'évaluation

- All HOMEWORK ANSWER KEYDocument6 pagesAll HOMEWORK ANSWER KEYhy_saingheng_7602609Pas encore d'évaluation

- CR Par Value PC $ 1,000 $ 40: 25 SharesDocument4 pagesCR Par Value PC $ 1,000 $ 40: 25 SharesBought By UsPas encore d'évaluation

- CH 09Document21 pagesCH 09Ahmed Al EkamPas encore d'évaluation

- Capital Budgeting Narain NotesDocument35 pagesCapital Budgeting Narain NoteskrishanptfmsPas encore d'évaluation

- Chapter 5 Portfolio Risk and Return Part IDocument25 pagesChapter 5 Portfolio Risk and Return Part ILaura StephaniePas encore d'évaluation

- Chapter 18Document17 pagesChapter 18queen hassaneenPas encore d'évaluation

- Data Mining To Increase State Tax Revenue in CaliforniaDocument33 pagesData Mining To Increase State Tax Revenue in Californiamy1bimaPas encore d'évaluation

- Applying Theory To Accounting Regulation: Godfrey Hodgson Holmes TarcaDocument32 pagesApplying Theory To Accounting Regulation: Godfrey Hodgson Holmes TarcaJokoPas encore d'évaluation

- Let's Fix Medicare, Replace Medicaid, and Repealthe Affordable Care Act: Here Is Why and How.D'EverandLet's Fix Medicare, Replace Medicaid, and Repealthe Affordable Care Act: Here Is Why and How.Pas encore d'évaluation

- Rent Control: The Perennial Folly (Cato Public Policy Research Monograph No. 2)D'EverandRent Control: The Perennial Folly (Cato Public Policy Research Monograph No. 2)Évaluation : 4 sur 5 étoiles4/5 (1)

- Exam Questions Fina4810Document9 pagesExam Questions Fina4810Bartholomew Szold75% (4)

- Topics Class Date Assignments Films: Ms. MagazineDocument3 pagesTopics Class Date Assignments Films: Ms. MagazineBartholomew SzoldPas encore d'évaluation

- Exam Questions Fina4810Document9 pagesExam Questions Fina4810Bartholomew Szold75% (4)

- Overview of Accounting: EGR 403 Capital Allocation TheoryDocument18 pagesOverview of Accounting: EGR 403 Capital Allocation TheoryBartholomew SzoldPas encore d'évaluation

- Breakeven Analysis: EGR 403 Capital Allocation TheoryDocument12 pagesBreakeven Analysis: EGR 403 Capital Allocation TheoryBartholomew SzoldPas encore d'évaluation

- EPID 4070 Group ProjectDocument2 pagesEPID 4070 Group ProjectBartholomew SzoldPas encore d'évaluation

- Overview of Accounting: EGR 403 Capital Allocation TheoryDocument13 pagesOverview of Accounting: EGR 403 Capital Allocation TheoryBartholomew SzoldPas encore d'évaluation

- Class 08 - 09-06-2012 - Risk & ControlDocument14 pagesClass 08 - 09-06-2012 - Risk & ControlBartholomew SzoldPas encore d'évaluation

- Contact Info 6A 6ADocument3 pagesContact Info 6A 6ABartholomew SzoldPas encore d'évaluation

- Marital Status and Household Income in Relation To EducationDocument3 pagesMarital Status and Household Income in Relation To EducationBartholomew SzoldPas encore d'évaluation

- Cost-Volume-Profit Analysis: © 2012 Pearson Prentice Hall. All Rights ReservedDocument18 pagesCost-Volume-Profit Analysis: © 2012 Pearson Prentice Hall. All Rights ReservedBartholomew SzoldPas encore d'évaluation

- CMLTquiz 1Document3 pagesCMLTquiz 1Bartholomew SzoldPas encore d'évaluation

- DR - Colleen O'Brien Cherry: Child HealthDocument20 pagesDR - Colleen O'Brien Cherry: Child HealthBartholomew SzoldPas encore d'évaluation

- Chapter Eight: Cost-Volume-Profit AnalysisDocument34 pagesChapter Eight: Cost-Volume-Profit AnalysisBartholomew SzoldPas encore d'évaluation

- Chap 005Document49 pagesChap 005Bartholomew Szold100% (1)

- Chap 006Document59 pagesChap 006Bartholomew Szold93% (15)

- Role of TaxationDocument5 pagesRole of TaxationCarlo Francis Palma100% (1)

- Economics Outcome 3 Assessment TemplateDocument6 pagesEconomics Outcome 3 Assessment TemplateConnor ChivasPas encore d'évaluation

- Vipin SharmaDocument2 pagesVipin SharmaManmohan ParasharPas encore d'évaluation

- 1 - 10 - 89 Estt - Pay I 30081989Document7 pages1 - 10 - 89 Estt - Pay I 30081989Sourabh MandalPas encore d'évaluation

- Taxation LectureDocument42 pagesTaxation LectureTatek DinberuPas encore d'évaluation

- Chapter 14 - Documentary Stamp TaxDocument3 pagesChapter 14 - Documentary Stamp TaxairishcutePas encore d'évaluation

- Org Man Act 1 FinalDocument2 pagesOrg Man Act 1 FinalElla ArceniaPas encore d'évaluation

- 6th CPC Audit OrdersDocument351 pages6th CPC Audit Ordersadhitya100% (1)

- Tax Calculation SheetDocument2 pagesTax Calculation Sheetpallab2110Pas encore d'évaluation

- Closed Economy With GovernmentDocument8 pagesClosed Economy With GovernmentRandyScribdPas encore d'évaluation

- Emulsion and Bitumen Rates BPCL - CBE - 01.09.11Document2 pagesEmulsion and Bitumen Rates BPCL - CBE - 01.09.11karunamoorthi_p22090% (1)

- Welfare State, Concept of Government in Which TheDocument2 pagesWelfare State, Concept of Government in Which TheAnonymous FDZiWuE3pPas encore d'évaluation

- History of MonetarismDocument2 pagesHistory of MonetarismUnknown WandererPas encore d'évaluation

- Wa0002.Document2 pagesWa0002.shubhamsg1222Pas encore d'évaluation

- Way Rilau2013Document104 pagesWay Rilau2013RahayuArmanPas encore d'évaluation

- Chart of AccountsDocument3 pagesChart of AccountsOzioma Ihekwoaba0% (1)

- Book List For Public AdministrationDocument2 pagesBook List For Public AdministrationVarun SinghPas encore d'évaluation

- Acctg 1 PS 1Document3 pagesAcctg 1 PS 1Aj GuanzonPas encore d'évaluation

- HE 53 Pub Econ 2021 Final MinutesDocument3 pagesHE 53 Pub Econ 2021 Final MinutesHarshita SinghPas encore d'évaluation

- 17 - Filippelli - Le Misure Correttive Per Abusi Di Posizione Dominante e Cartelli Tra Imprese Nel Diritto Della Concorrenza - C-M - 2011Document4 pages17 - Filippelli - Le Misure Correttive Per Abusi Di Posizione Dominante e Cartelli Tra Imprese Nel Diritto Della Concorrenza - C-M - 2011fabiana_porto_3Pas encore d'évaluation

- 1700015555Document1 page1700015555neerajhclPas encore d'évaluation

- FinanceDocument5 pagesFinanceOnemustika SeahayaPas encore d'évaluation

- Patron Letters PDFDocument319 pagesPatron Letters PDFBerold HindsPas encore d'évaluation

- Public Finance PaperDocument10 pagesPublic Finance PaperDaniyal AbbasPas encore d'évaluation

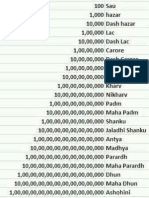

- Count On ZerosDocument3 pagesCount On Zerosmahendrasing2Pas encore d'évaluation

- The Free Rider Problem in Public Good DomainDocument10 pagesThe Free Rider Problem in Public Good DomainSafwan SallehPas encore d'évaluation

- New Public ManagementDocument7 pagesNew Public ManagementImelda Silvania MarianoPas encore d'évaluation

- A Call For Unity, A Call To Collective ActionDocument3 pagesA Call For Unity, A Call To Collective ActionVen DeePas encore d'évaluation

- Public Finance AssignmentDocument6 pagesPublic Finance AssignmentmoniquePas encore d'évaluation

- Regulation No 184 2010 Public Procurement and Property Disposal Service EstablishmentDocument5 pagesRegulation No 184 2010 Public Procurement and Property Disposal Service EstablishmentAbrahamPas encore d'évaluation