Académique Documents

Professionnel Documents

Culture Documents

Main 2111

Transféré par

priyamalviyaaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Main 2111

Transféré par

priyamalviyaaDroits d'auteur :

Formats disponibles

Page |1

Jai Narain Vyas University, Jodhpur

A Project Study Report on Training undertaken at

HDFC BANK

Study of HDFC Product

Submitted in partial fulfillment for the Award of degree of

Master of Finance analysis & Control

Submitted by: Priyanka Dhandia MFC Part 3

Submitted to: Mr. S.N. Modi Head of the department

2011-2012 JNVU OLD CAMPUS, JODHPUR

Page |2

ACKNOWLEDGEMENT

No trainee can deny the intellectual debt that he receives from the organization during the training period. I cannot in full measure, reciprocate the kindness shown and contribution made by various persons on this endeavor of mine. I want to convey my regards to Mr. Rahul Mittal who guided me throughout my training period at HDFC Bank. They told me about all the procedures and working criteria at HDFC Bank. I express my sincere thanks to my project guide, Mr. S.N Modi, head of the department for guiding me right from the inception till the successful completion of the project. I sincerely acknowledge him for extending their valuable guidance, support for literature, critical reviews of project and the report and above all the moral support he had provided to me with all stages of this project. I shall always remember them with gratitude and sincerity. I would also like to thank the supporting staff Department, for their help and cooperation throughout our project.

Priyanka Dhandia MFC 3rd Semester Jai narain vyas university, Jodhpur

Page |3

EXECUTIVE SUMMERY

The bases of the project was to understand the customers perception about the various schemes like loans and Current account and Cash Credit account under liability products for retail banking. The project also encompasses, identifies the scope and various parameters, a customer would look into while transacting with bank for certain scheme. HDFC bank is the second largest private sector bank in India. Its biggest competitors are ICICI Bank in private sector and SBI in public sector. HDFC Bank provides good rate of interest compared to its competitors. HDFC Bank provides personalized services to its clients and informs its clients about deposits, check bouncing, account details regularly. HDFC Bank provides transparent banking solutions not only in the savings but also in all the types of loans and borrowings. The duration of this project was 60 days from 1st Nov 2011 to 31st Dec 2011. During this period the study of HDFC Banks products especially personal banking & wholesale banking was done.

Page |4

Contents

HDFC Bank...........................................................................................................................4 3 Product and Service of HDFC Bank................................................................................10 SUGGESTIONS..................................................................................................................28 Conclusion..........................................................................................................................29 BIBLIOGRAPHY.................................................................................................................30

HDFC Bank

Page |5

Page |6

1 Company introduction:

. 1.1THE TOPIC: IN WHICH AREA MORE FOCUS MARKETING OR OPERATION At HDFC Bank, I was assigned with the topic as In Which Area more focus Marketing or Operation for my project work. I joined the company as a Personal Banker. The selection of the topic was to know how the company generates business through them. Personal Banker are those sources of a company who have their own relations and personal contacts among common public that they use to generate business through.

1.2 REASON FOR SELECTION OF THIS TOPIC:

The financial sector is one of the booming and increasing sectors in India. The Personal Banker are one of the most powerful, efficient and effective channel through which the company sales its various types of financial products and company takes operational work also. It is really difficult to convince customers and sell a single product and accomplish operational work. Whereas in my entire project work I found my interest in working in a team, dealing with customers and finally convincing them to buy a product.

1.3 IMPORTANCE TO THE COMPANY:

The ultimate purpose of giving me this topic was to know about the customers perceptions about the different products of the bank, and to know about operational process. how these products can attract them and how the company can generate maximum profit by convincing them through personal banker and to better understand customer requirement and to understand operational methodology.

1.4 LEARNING FROM THE STUDY:

The process of bank related transaction, bank related various terms, work environment of HDFC Bank. Different products and services provided by the bank. Customers perception about the different products. The brand image of the bank. What are the problems faced by customer on daily basis. How to communicate with the customers. Different techniques of dealing with the customers. How to convince and convert a customer into a real customer. and at the last how to better response to the customer problem.

2-ORGANIZATION PROFILE

2.1 COMPANY HISTORY:

The Housing Development Finance Corporation Limited (HDFC) was amongst the first to receive an 'in principle' approval from the Reserve Bank of India (RBI) to set up a bank in the private sector, as part of the RBI's liberalization of the Indian Banking Industry in 1994. The bank was incorporated in August 1994 in the name of 'HDFC Bank Limited', with its registered office in Mumbai, India. HDFC Bank commenced operations as a Scheduled Commercial Bank in January 1995.

Page |7

2.2 PROMOTER

HDFC is India's premier housing finance company and enjoys an impeccable track record in India as well as in international markets. Since its inception in 1977, the Corporation has maintained a consistent and healthy growth in its operations to remain the market leader in mortgages. Its outstanding loan portfolio covers well over a million dwelling units. HDFC has developed significant expertise in retail mortgage loans to different market segments and also has a large corporate client base for its housing related credit facilities. With its experience in the financial markets, a strong market reputation, large shareholder base and unique consumer franchise, HDFC was ideally positioned to promote a bank in the Indian environment.

2.3 BUSINESS FOCUS

HDFC Bank's mission is to be a World-Class Indian Bank. The objective is to build sound customer franchises across distinct businesses so as to be the preferred provider of banking services for target retail and wholesale customer segments, and to achieve healthy growth in profitability, consistent with the bank's risk appetite. The bank is committed to maintain the highest level of ethical standards, professional integrity, corporate governance and regulatory compliance. HDFC Bank's business philosophy is based on four core values Operational Excellence, Customer Focus, Product Leadership and People.

2.4 CAPITAL STRUCTURE

The authorized capital of HDFC Bank is Rs550 crore (Rs5.5 billion). The paid-up capital is Rs424.6 crore (Rs.4.2 billion). The HDFC Group holds 19.4% of the bank's equity and about 17.6% of the equity is held by the ADS Depository (in respect of the bank's American Depository Shares (ADS) Issue). Roughly 28% of the equity is held by Foreign Institutional Investors (FIIs) and the bank has about 570,000 shareholders. The shares are listed on the Stock Exchange, Mumbai and the National Stock Exchange. The bank's American Depository Shares are listed on the New York Stock Exchange (NYSE) under the symbol 'HDB'.

2.5 DISTRIBUTION NETWORK

HDFC Bank headquartered is in Mumbai. The Bank at present has an enviable network of over 1229 branches spread over 444 cities across India. All branches are linked on an online real-time basis. Customers in over 120 locations are also serviced through Telephone Banking. The Bank's expansion plans take into account the need to have a presence in all major industrial and commercial centers where its corporate customers are located as well as the need to build a strong retail customer base for both deposits and loan products. Being a clearing/settlement bank to various leading stock exchanges, the Bank has branches in the centers where the NSE/BSE has a strong and active member base. The Bank also has a network of about over 2526 networked ATMs across these

Page |8 cities. Moreover, HDFC Bank's ATM network can be accessed by all domestic and international Visa/MasterCard, Visa Electron/Maestro, Plus/Cirrus and American Express Credit/Charge cardholders.

2.6 Organizational Structure

1

2.7 MANAGEMENT

Mr. Jagdish Capoor took over as the bank's Chairman in July 2001. Prior to this, Mr. Capoor was a Deputy Governor of the Reserve Bank of India. The Managing Director, Mr. Aditya Puri, has been a professional banker for over 25 years and before joining HDFC Bank in 1994 was heading Citibank's operations in Malaysia. The Bank's Board of Directors is composed of eminent individuals with a wealth of experience in public policy,

Page |9 administration, industry and commercial banking. Senior executives representing HDFC are also on the Board. Senior banking professionals with substantial experience in India and abroad head various businesses and functions and report to the Managing Director. Given the professional expertise of the management team and the overall focus on recruiting and retaining the best talent in the industry, the bank believes that its people are a significant competitive strength.

2.8 TECHNOLOGY

HDFC Bank operates in a highly automated environment in terms of information technology and communication systems. All the bank's branches have online connectivity, which enables the bank to offer speedy funds transfer facilities to its customers. Multibranch access is also provided to retail customers through the branch network and Automated Teller Machines (ATMs). The Bank has made substantial efforts and investments in acquiring the best technology available internationally, to build the infrastructure for a world class bank. The Bank's business is supported by scalable and robust systems which ensure that our clients always get the finest services we offer. The Bank has prioritized its engagement in technology and the internet as one of its key goals and has already made significant progress in web-enabling its core businesses. In each of its businesses, the Bank has succeeded in leveraging its market position, expertise and technology to create a competitive advantage and build market share.

2.9 HDFC BANK business strategy emphasizes the following:

Increase market share in Indias expanding banking and financial services industry by following a disciplined growth strategy focusing on quality and not on quantity and delivering high quality customer service. Leverage our technology platform and open scaleable systems to deliver more products to more customers and to control operating costs. Maintain current high standards for asset quality through disciplined credit risk management.Develope innovative products and services that attract the targeted customers and address inefficiencies in the Indian financial sector. Continue to develop products and services that reduce banks cost of funds. Focus on high earnings growth with low volatility.

P a g e | 10

3 Product and Service of HDFC Bank

P a g e | 11

3.1PERSONAL BANKING

1.1.1 SAVINGS ACCOUNT

1) Regular savings a/c: An easy-to-operate savings account that allows you to issue cheques, draw Demand Drafts and withdraw cash. Check up on your balances from the comfort of your home or office through NetBanking, PhoneBanking and MobileBanking. Features & benefits Wide network of branches and over thousand ATMs to meet all your banking needs no matter where you are located. Bank conveniently with facilities like NetBanking and MobileBanking- check your account balance, pay utility bills or stop cheque payment, through SMS. Never overspend- Shop using your International Debit Card that reflects the actual balance in your savings account. Avail of facilities like Safe Deposit Locker, Sweep-In and Super Saver facility on your account. 2) NO FRILLS savings a/c: In an effort to make banking simpler and more accessible for our customers, we have introduced the 'No Frills' Savings Account, which offers you all the basic banking facilities. You can even avail of services like NetBanking, Mobilebanking free of cost. Features & benefits Access a wide network of branches and over a thousand ATMs across the country to meet all your banking needs. Use the Free Electronic Funds Transfer (EFT) facility to transfer funds from your HDFC Bank account to an account in another Bank at the locations as specified by RBItry to meet all your banking needs. Bank conveniently with facilities like Free NetBanking and MobileBanking. Enjoy Free IVR based PhoneBanking. (Agent assisted calls will be charged*)

P a g e | 12 Get Free Quarterly Account Statements.

3) Retail Trust a/c: The Retail Trust Account is beneficial for Trusts and Societies as it earns them a higher interest as compared to a conventional Current Account that offers no interest. Features & benefits Avail of Free Outstation Cheque Collection at HDFC Bank locations across the country. Enjoy free DD's payable on HDFC bank locations up to a limit of Rs. 50,000/per DD, per day. Payable at Par Cheque facility: At a nominal cost, you can avail a PAP cheque book of 25 leaves (Regular non-PAP cheque book come free of cost). Avail of Special discounts on Foreign exchange transactions and Forex rates at most branches across the country. Structured Investment Program: Avail of the facility for investing surplus funds lying in your account into Mutual Funds, RBI Bonds and other financial instruments through any of our branches across the country.

4) SALARY ACCOUNT a) Payroll salary a/c: Nil Interest payout on account balance Free Payroll Debit Card - (max cash withdrawal at ATMs- Rs 15,000/- and Rs 25,000 at shopping avenues) BillPay facility at Rs 25/- (plus taxes) per qtr. per Customer ID. Up to 6 free ATM cash withdrawal transactions; thereafter Rs. 30/- per transaction. Cheque book issuance @ charge of Rs.5 per leaf (only on request and this is not a standard offering )

P a g e | 13

b) Classic salary a/c: Features & benefits Zero Balance Account Free personalised cheque books. Free ATM Card with a withdrawal limit of up to Rs. 10,000/- per day. Free facilities like Net Banking, Phone Banking and Mobile Banking.

c) Regular salary a/c: Features & benefits No minimum balance required. Free International Debit card with ATM cash withdrawal limit of up to Rs. 15,000 and Rs. 25,000 (non-cash) at shopping avenues. Free issuance of Demand Drafts up to Rs. 25,000 per instrument, payable at branches within the HDFC Banking network. Preferential rates on loan products offered by the bank. Preferential rates on forex transactions.

d) Premium salary a/c: Features & benefits Free International Debit Card and Add-on Debit card for life. Free Personal Insurance Accident cover up to Rs. 2,00,000/- on the Debit card. Free Debit card withdrawals - max cash withdrawal at ATMs- Rs 25,000/- and Rs 50,000 (non-cash) at shopping avenues. Preferential rates for Gold and Silver credit cards. Free Demand Drafts up to Rs. 25,000 per instrument, per instrument payable at branches within the HDFC Banking network. Free Bill Pay and Insta Alert facility.

P a g e | 14 5) Kids Advantage Account: Features & benefits Automatically increases the balance in your Kids Advantage Account by transferring a fixed sum from your Savings Account every month. Amounts in excess of Rs. 5,000/- over and above a balance of Rs. 10,000/gets converted into Fixed Deposits for a specified period in your child's name. Free International Debit Card for your child (above 7 years of age) with a maximum drawing capability of Rs. 2,500/- per day. Free Education Insurance cover of up to Rs. 1,00,000/- for your child with every Kids Advantage Account

6) PENSION SAVING ACCOUNT: Features & benefits The Pension Saving account is a Zero Balance Account. Timely credit of receivables Free International Debit Card. Enjoy facilities such as NetBanking, PhoneBanking, BillPay, ATM facility, intercity and inter-branch banking. Pension Accounts are transferable from one branch/bank to another.

7)FAMILY SAVINGS ACCOUNT: Features & benefits All account holders can operate their account freely without worrying about their minimum balance. Family members with NRI status can also be part of the group. Get 5 Free Cash withdrawal transactions on SBI ATMs per group per month. Upto 2 free DD's/ MC's on HDFC Bank locations per account per month (max. up to Rs. 25,000/- per instrument per day). Free International Debit Card for all account holders till the account is part of the Family group. (NRO Accounts will be issued only ATM cards)

P a g e | 15

1.1.2 CURRENT ACCOUNT:

1) Plus Current a/c: In today's fast-paced world, your business regularly requires you to receive and send funds to various cities in the country. HDFC Bank Plus Current Account gives you the power of inter-city banking with a single account and access to more than 220 cities. Features & benefits Free outstation cheque collection (non HDFC Bank location cheques Free limited NetBanking for checking balances in accounts.Full FREE Demand Drafts (without any limit) payable at Mumbai, Delhi, Chennai, Ahmedabad, Bangalore, Hyderabad, Trivandrum,

will incur a nominal charge). fledged Net Banking can be availed of after completion of certain formalities. Kolkata,

Chandigarh, Bhopal, Nagpur, Jaipur, Bhubaneshwar, Kanpur, Patna & Guwahati. At all other HDFC Bank Branch locations, Demand Drafts will be issued Free up to a total of Rs.50 lacs per month, incremental to be charged @ Rs.0.25 Free per Rs.1,000, Funds minimum Rs.25/-, maximum Huge Rs.5,000. savings! These drafts are available free only from the Home Branch TransferYou can transfer funds absolutely FREE across all locations, except Dahej, in the HDFC Bank network up to a total value of Rs.100 lakhs per month. any incremental amount above Rs.100 lakhs will be charged @ Rs. 0.50 /Rs.1000. Easy cash deposit and withdrawal. You can avail of the service FREE, at home branch, as per the branch's discretion. At non-home branches within the same city, you can withdraw cash up to Rs.50,000/-, but cash deposits are allowed to account-holder (self) only, upto Rs.100,000/per day at a charge of Rs.2/- per Rs.1,000/-. Free Cheque book with "At Par" cheque leaves.

P a g e | 16 2) Trade Current a/c: In today's changing business requirements, you need to transfer funds across cities, and time is of the essence. HDFC Bank Trade Current Account gives you the power of inter-city banking with a single account. From special cheques that get treated at par with local ones in any city where we have a branch, to free** collection of outstation cheques (payable at branch locations), to free inter-city funds transfers of up to 25 lakhs, our priority services have become the benchmark for banking efficiency. Features & benefits Convenient Inter-city banking across more than 185 cities Safe & convenient Intra-city banking FREE Funds Transfer. Huge Savings.

3) Premium Current a/c: A Current Account with the benefits of accessing your account from a large network of branches, and through direct access channels - the phone, mobile, Internet and through the ATM. Features & benefits Convenient Inter-city banking across more than 185 cities. FREE ATM Card to access your account from the wide network of HDFC Bank ATMs, across the country. Enjoy facilities like 24-hour PhoneBanking, NetBanking and MobileBanking. Automatically transfer funds from your Fixed Deposit to your Current Account in times of need FREE Funds Transfer* across all locations in the HDFC Bank network up to a total value of Rs. 10 lacs per month, (except Dahej), any incremental amount above Rs.10 Lacs will be charged @ Rs.1.50 per Rs.1000/-

P a g e | 17 4) Regular Current a/c: A Current account is ideal for carrying out day-to-day business transactions. With the HDFC Bank Regular Current Account, you can access your account anytime, anywhere. Withdraw and deposit cash, issue and encash cheques, make balance-inquiries or ask for mini statements, and even request for cheque books anytime, anywhere. Features & benefits Enjoy FREE 24-hour PhoneBanking, NetBanking and MobileBanking that helps you check your balance, find out the status of your cheque or stop cheque payment. Sweep-In Account With the Sweep-In Facility you can automatically transfer funds from your Fixed Deposit to your Current Account in times of need. Attractive rates for inter-city/inter-branch transactions Your funds will be transferred at Rs.1.50/- per Rs.1000/-. The minimum charge is Rs. 50/-. You can also deposit or withdraw cash for an additional charge of Rs. 2 per Rs. 1000/- (on full amount, if amount is more than Rs. 50,000) at branches other than the branch where you have opened your account

5) Reimbursement Current a/c: No more paperwork, no more receipts to keep track of - a hassle-free account that allows you to deposit the reimbursements you receive from your company on a monthly basis. How to Open a Reimbursement Account Procure an Account Opening Document (AOD) from HDFC Bank. (If

you have just joined, first request your company to open up a Salary Account for you). Mention your Salary Account number and your Debit Card number on the AOD so that your Debit card can be linked to both, your Salary Account as well as your new Reimbursement Account. .Features & benefits Easily distinguish between reimbursements and basic monthly salary.

P a g e | 18 Choose from either your Salary Account or your Reimbursement Utilise Net Banking, Phone Banking and Mobile Banking facilities. Receive half-yearly statements of all your reimbursements, thus No need to maintain a minimum balance (Zero Balance Account) Receive a separate cheque book (on request) for your

Account when withdrawing cash from HDFC Bank ATMs.

doing away with filing individual receipts.

Reimbursement Account

6) RFC-Domestic a/c: How to Open a RFC Domestic Account Choose the currency in which you wish to operate. Open your account with an initial amount as per the following-US Dollar = 250 | Great Britain Pound = 200 | Euro = 250 and maintain an Average Quarterly Balance of the same amount.

1.1.3 FIXED ACCOUNT

Super saver a/c: Features & benefits It's like two Accounts working in tandem to give you better returns. Choose between a Savings Account or Current Account to link to your Fixed Deposit. Avail an overdraft facility to supplement your household or business needs Pay back with interest only on the drawn amount, while the remaining Fixed Deposit continues to earn you interest. Flexibility in altering period of deposit, maturity and payment instructions, principal amount and rollover mode.

P a g e | 19 Sweep in a/c: Features & benefits Choose between a Savings Account or Current Account to link to your Fixed Earn higher interest on the money till it is swept-in, while the remaining Only an exact amount required to make up for the deficit in the Savings

Deposit. Fixed Deposit continues to earn you interest. account is withdrawn from your Fixed Deposit (units of Re. 1/-) thereby minimising interest loss. Multiple deposits can be linked to the Savings account. Flexibility in altering the period of deposit, maturity and payment instructions,

principal amount and rollover mode.

1.1.4 DEMAT ACCOUNT:

HDFC BANK is one of the leading Depository Participant (DP) in the country with over 8 Lac demat accounts. HDFC Bank Demat services offers you a secure and convenient way to keep track of your securities and investments, over a period of time, without the hassle of handling physical documents that get mutilated or lost in transit.HDFC BANK is Depository particpant both with -National Securities Depositories Limited (NSDL) and Central Depository Services Limited (CDSL).

P a g e | 20

1.1.5 LOANS

PERSONAL LOAN Features & benefits Borrow up to Rs 10,00,000 for any purpose depending on your requirements. Flexible Repayment options, ranging from 12 to 48 months. Repay with easy EMIs. One of the lowest interest rates. Hassle free loans - No guarantor/security/collateral required. Speedy loan approval. Convenience of service at your doorstep. Customer privileges

HOME LOAN Features & benefits Home Loan - We offer home loans for individuals to purchase (fresh / resale) or construct houses. Home loans can be applied for individually or jointly. HDFC finances up to 85% maximum of the cost of the property (Agreement value + Stamp duty + Registration charges). Home Improvement Loan - HIL facilitates internal and external repairs and other structural improvements like painting, waterproofing, plumbing and electric works, tiling and flooring, grills and aluminium windows. HDFC finances up to 85% of the cost of renovation (100% for existing customers). Home Extension Loan - HEL facilitates the extension of an existing dwelling unit. All the terms are the same as applicable to Home Loan. Land Purchase Loan - Be it land for a dream house, or just an investment for the future, HDFC Land Purchase Loan is a convenient loan facility to purchase land. HDFC finances up to 70% of the cost of

P a g e | 21 the land (Conditions Apply). Repayment of the loan can be done over a maximum period of 10 years.

NEW CAR LOAN Features & benefits Covers the widest range of cars and multi-utility vehicles in India. Avail 100% finance on your favourite car Flexible repayment options, ranging from 12 to 84 months. Borrow up to 3 times your annual salary (for salaried professionals) and 6 times your annual income (for self employed professionals). Speedy processing - within 48 hours Repay with easy EMIs. Attractive car loan plans - To Fastrack your loan, just choose the plan that is right for you. Attractive Interest rates

LOAN AGAINST SECURITIES With HDFC Bank's Loan against Securities, one can get an overdraft against securities like Equity Shares, Mutual Fund Units, GOI Relief Bonds, LIC Policies, NSC, KVP, UTI Bonds (6.60% ARS & US64 Bonds) and Gold Deposit Certificates, while still retaining ownership. And the best part is that one can continue to enjoy all shareholder benefits such as rights, dividends and bonuses. Features & benefits Overdraft facility can be availed against pledge of: Equity Shares* - Demat Shares up to 50% of the value. Mutual Fund units* - Mutual Funds up to 50% of NAV (Net Asset Value). See approved Mutual Fund Schemes. GOI Relief Bonds LIC Policies

P a g e | 22

LOAN AGAINST PROPERTY HDFC Bank brings to you Loan Against Property (LAP). one can now take a loan against residential or commercial property, to expand his/her business, plan a dream wedding, fund child's education and much more. Loan to purchase Commercial Property (LCP) is a specially designed product to help you expand your business without reducing the capital from your business. Features & benefits Loans from Rs. 2 Lacs onwards depending on your needs Borrow up to 60% of market value of the property Flexibility to choose between an EMI based loan or an Overdraft - We also offer to you overdraft against your self-occupied residential or commercial property and you save money by paying interest only on the amount utilized. High tenure loans for ease of repayment. Attractive interest rates.

1.1.6 INVESTMENTS & INSURANCE

HDFC Bank ensures your money is not just in safe hands; it also works to their advantage. It helps them to invest wisely through its investment services. Mutual funds Mutual funds are funds that pool the money of several investors to invest in equity or debt markets. Mutual Funds could be Equity funds , Debt funds or balanced funds. Funds are selected on quantitative parameters like volatality, FAMA Model, risk adjusted returns, rolling return coupled with a qualitative analysis of fund performance and investment styles through regular interactions / due diligence processes with fund managers. financial and

P a g e | 23

Advantages of Investing Into a Mutual Fund A large part of the success of mutual funds is also the advantages they offer in terms of diversification, professional management and liquidity. Flexibilty - Mutual Fund investments also offers you a lot of flexibility with features such as systematic investment plans, systematic withdrawal plans & dividend reinvestment. Affordability - They are available in units so this makes it very affordable. Because of the large corpus, even a small investor can benefit from its investment strategy. Liquidity - In open ended schemes, you have the option of withdrawing or redeeming your money at any point of time at the current NAV. Diversification - Risk is lowered with Mutual Funds as they invest across different industries & stocks. Professional Management - Expert Fund Managers of the Mutual Fund analyse all options based on experience & research.

1.1.7 Insurance

HDFC Bank offers a world of choice in insurance. one can now avail of Life Insurance plans from HDFC Standard Life Insurance. Life Insurance Unit Linked Insurance Plans For your child: Give your children a head start by growing your savings. Invest in HDFC Unit Linked Young Star that gives double benefit.

P a g e | 24 For retirement Earn a pension for life by maximizing your returns. Invest in HDFC Unit Linked Pension. For the long-term Invest in a savings plan with a long-term horizon and get life cover too. Invest in HDFC Unit Linked Endowment. Conventional Insurance Plans To realize your child's goals Make your child's dreams come true by investing in a plan that fetches a lump sum amount at maturity. Invest in HDFC Children's Plan. For a long-term horizon Invest in HDFC Savings Assurance Plan which is a pure investment product having tax sops of an insurance product. For cash flow Get cash lump sums at regular intervals to meet your financial needs. Invest in HDFC Money Back Plan. Term Assurance Plan For life cover Secure the future of your loved ones by providing for their financial security. Buy HDFC Term Assurance Plan .

1.1.8 Financial Planning

The Financial Planning service is offered as an option to long term investors. The portfolio is advised on in a passive investment style with the asset category as mutual

P a g e | 25 funds. The planner is suitable for investors who wish to take a asset allocation based, long term investment outlook, ignoring the short term volatalities of financial markets. Financial Planning takes into account: Desired asset allocation, risk profile and return expectations Building cash flows correlating all expenses and income. Inflation and outflows Future goals like retirement, housing and children's education / marriage or other

due to loans are considering in building the financial plan needs

PAYMENT SERVICES With HDFC Bank's payment services, one can bid goodbye to queues and paper work. Our range of payment options make it easy for you to pay for a variety of utilities and services. NetSafe: Now shop online without revealing your HDFC Bank Credit Card number. Bill Pay: Pay your telephone, electricity and mobile phone bills at your convenience. Through the Internet, ATMs, your mobile phone and telephone - with BillPay, our comprehensive bill payments solution. InstaPay: Pay your bills, make donations and subscribe to magazines without going through the hassles of any registration. Direct Pay: Shop or Pay bills online without cash or card. Debit your account directly with our DirectPay service! Visa Money Transfer: Transfer funds to any Visa Card (debit or credit) within India at your own convenience through HDFC Bank's NetBanking facility.

1.1.9 PRIVATE BANKING

HDFC Bank offers Private Banking services to high net worth individuals and institutions. Our team of seasoned financial and investment

P a g e | 26 professionals provide objective guidance backed by thorough research and in-depth analysis keeping in mind your financial goals.Multiple Recognition from Euromoney: At HDFC Bank, we have always strived towards providing exceptional service to each of our esteemed customers. 1.15.10 NRI BANKING Features & Benefits Open the deposit jointly with a Resident Indian. Avail of a loan on upto 75% of your deposit. Repatriate the interest on your deposit Interest credited at least every three months Nomination Facility available Initial Fixed Deposit: Rs. 25,000/Add-on Fixed Deposits: Rs. 10,000/-

2. WHOLESALE BANKING

A. CORPORATES Corporate Banking reflects HDFC Bank's strengths in providing our corporate clients in India, a wide array of commercial, transactional and electronic banking products. We achieve this through innovative product development and a well-integrated approach to relationship management. 1) LARGE CORPORATES We offer blue chip companies in the India, a full range of client-focused corporate banking services, including working capital finance, trade and transactional services, foreign exchange and cash management, to name a few. The product offerings are suitably structured taking into account a client's risk profile and specific needs. Based on our superior product delivery, industry benchmark service levels and strong customer orientation, we have made significant inroads into the formal banking consortia of a number of Indian companies including multinationals, domestic business houses and prime public sector companies.

P a g e | 27

Funded Services Working Capital Finance Bill Discounting Export Credit Short Term Finance Structured Finance Term Lending

Non Funded Services Letter of Credit Collection of Documents Bank Guarantees

Value Added Services Syndication Services Real Time Gross Settlement Cash Management Services Channel Financing Vendor Financing Corporate Salary Accounts Reimbursement Account Forex Desk Money Market Desk Derivatives Desk Employees Trusts Cash Surplus Corporates Tax Collection Bankers to Right/Public Issue

I. Funded Services Funded Services from HDFC Bank are meant to directly bolster the day-to-day working of a small and a medium business enterprise. From working capital finance to credit substitutes; from export credit to construction equipment loan - we cater to virtually every business requirement of an SME.

II. Non-Funded Services

P a g e | 28 Under Non-Funded services HDFC Bank offers solutions that act as a catalyst to propel your business. Imagine a situation where you have a letter of credit and need finance against the same or you have a tender and you need to equip yourself with a guarantee in order to go ahead. This is exactly where we can help you so that you don't face any roadblocks when it comes to your business.. III. Value Added Services There is a plethora of services that we offer under value added services. There's corporate salary account which ensures smooth payment methods to your staff. You can avail an assortment of credit cards and debit cards from our merchant services. 2) Small & Medium Enterprises At HDFC Bank we understand how much of hard work goes into establishing a successful SME. We also understand that your business is anything but "small" and as demanding as ever. And as your business expands and enters new territories and markets, you need to keep pace with the growing requests that come in, which may lead to purchasing new, or updating existing plant and equipment, or employing new staff to cope with the demand. That's why we at HDFC Bank have assembled products, services, resources and expert advice to help ensure that your business excels. Our solutions are designed to meet your varying needs. The following links will help you identify your individual needs.

SUGGESTIONS

finally some recommendations for the company are as fallows: To make people aware about the benefit of becoming a customer of HDFC Bank, Following activities of advertisement should be done through

P a g e | 29 1. Print Media. 2. Hoarding & Banners. 3. Stalls in Trade Fares 4. Distribution of leaflets containing details information.

Other facilities must be providing to the customer:

The bank should provide life time valid ATM card to all its customers. Minimum balance for savings account should be reduced from Rs 10000 to Rs 1000, so that people who are not financially strong enough can maintain their account properly. The company should provide a pass book to all its customers. Make people understand about the various benefits of its products. Company should organize the program in the society, so that people will be aware about the company and different products of the bank. Company should open more branches in different cities

Conclusion

HDFC Bank, the banking arm of HDFC is expected to go on stream. The bank already has good number of employees on board and is recruiting personal banker heavily to take the headcount to many more. It is on the brim of increasing its customers through its attractive schemes and offer. The project opportunities provided was market segmentation and identifying prospective customers in potential geographical location and convincing them to attract more customers so that new business opportunities of the bank can be explored. Through this project, it could be concluded that people are not much aware about the various products of the bank and many of them not interested to open an account, to invest money at all. services was considered as unsought good which require hard core selling, but in

P a g e | 30 changing trend in income and people becoming financially literate, the demand for banking sector is increasing day by day. So, at last the conclusion is that there is tough competition ahead for the company from its major competitors in the banking sector. Last but not the least I would like to thank HDFC Bank for giving me an opportunity to work in the field of Marketing and Operation. I hope the company finds my analysis relevant.

BIBLIOGRAPHY

1. BOOKS

Marketing Management (10th Edition), Marketing Management (3rd Edition), Research Methodology (2nd Edition), Research Methodology(3rd Edition).

AUTHORS:

Philip Kotler ,V.S. Ramaswamy, C.R.Kothary, S.P. Kasande

2. NEWS PAPERS Times of India Financial Express

P a g e | 31

3. WEBSITES

www.hdfcbank.com, www.google.com

Vous aimerez peut-être aussi

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Account Statement 28-11-2023T02 21 53Document1 pageAccount Statement 28-11-2023T02 21 53ali hamzaPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- HDFC BankDocument50 pagesHDFC BankNikhil TyagiPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Bank Management System Project File1Document62 pagesBank Management System Project File1KharoudPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- NewDocument10 pagesNewKrystal MannPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Level Up Your CardingDocument114 pagesLevel Up Your Cardinggiopapiashvili9Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Midxx Prime Savings FormDocument2 pagesMidxx Prime Savings Formankitshinde1100% (1)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Dating FMTDocument5 pagesDating FMTTife DanielPas encore d'évaluation

- Customer Satisfaction of ATM ServicesDocument19 pagesCustomer Satisfaction of ATM Servicesnamnh0307Pas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- A Mega File of It For Current QuizzesDocument636 pagesA Mega File of It For Current QuizzesTalha ShaukatPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Tariff Booklet: October 2021Document16 pagesTariff Booklet: October 2021Anonymous ameerPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Final-E2 BelowDocument11 pagesFinal-E2 Belownaveen5670Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- FEB MAR Account StatementDocument2 pagesFEB MAR Account Statementhassanalisa2002Pas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Ned Bank Pay U AccountDocument4 pagesNed Bank Pay U AccountavarnPas encore d'évaluation

- Easy Cash ATM LLC #2Document4 pagesEasy Cash ATM LLC #2Hashim MughalPas encore d'évaluation

- Risk and Compliance Framework - v2 - July20Document25 pagesRisk and Compliance Framework - v2 - July20hospetPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- 2013-14 TOEFL Ibt Registration FormDocument4 pages2013-14 TOEFL Ibt Registration FormDaniel ParkerPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- MasterCard AssessmentDocument9 pagesMasterCard AssessmentPalluRaju100% (2)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Module 2 MoneyDocument78 pagesModule 2 Moneylord kwantoniumPas encore d'évaluation

- "CUSTOMER PREFERENCE OF ATMsDocument59 pages"CUSTOMER PREFERENCE OF ATMskeremaneviPas encore d'évaluation

- Payment of Tax: (SECTION 49 To 53A)Document36 pagesPayment of Tax: (SECTION 49 To 53A)Mehak KaushikkPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Credit Card Icici Bank: Membership GuideDocument14 pagesCredit Card Icici Bank: Membership GuideAnand RajPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- Summary Account Payable Statement: JiopayDocument35 pagesSummary Account Payable Statement: JiopayRiyaz HuddaPas encore d'évaluation

- MyGate ERP Module Features ListDocument3 pagesMyGate ERP Module Features ListVenkataraman AnandapadmanabanPas encore d'évaluation

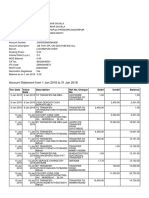

- Account Statement From 1 Jan 2018 To 31 Jan 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Jan 2018 To 31 Jan 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceATULPas encore d'évaluation

- Brokerage Account Customer Agreement PDFDocument46 pagesBrokerage Account Customer Agreement PDFgranatathPas encore d'évaluation

- Appraising Manual IIDocument96 pagesAppraising Manual IIrohit guptPas encore d'évaluation

- StatementDocument25 pagesStatementParveen SainiPas encore d'évaluation

- "Financial Services of Icici Bank": Project Report OnDocument106 pages"Financial Services of Icici Bank": Project Report OnRajat BansalPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Canadian PassportDocument7 pagesCanadian PassportSyed Irfan AhmedPas encore d'évaluation

- Estmt - 2022-3-31 10 PDFDocument4 pagesEstmt - 2022-3-31 10 PDFAaliyahPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)