Académique Documents

Professionnel Documents

Culture Documents

Crap Zone

Transféré par

tagacapizDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Crap Zone

Transféré par

tagacapizDroits d'auteur :

Formats disponibles

BFDacquel@yahoo.

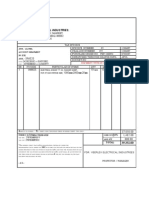

com 920-6446 / client writes a check payable to RCBC, intended to be credited to his trading ac count with the same financial institution mb picks this up. a provisional receipt is issued at this point. and to follow would be the official receipt supposedly. BUY CONFIRMATION what the client got for the past few years were CTCs. SRC Rule 30.2-2 (sending of written Confirmation Invoices to customers), 52.1-7 (Order Ticket Rule) & 52.1-8 D. Where the Commission makes an inquiry under Section 53 of the Code, the Commi ssion will refer to the requirements set forth in this Rule in considering wheth er any person is guilty of a violation of this Code and should remain registered . 2. Confirmation of Customer Orders A. A Broker Dealer shall report to its customers all transactions entered into f or the customer's account, and to this end, shall send the customer a written co nfirmation of purchases and sales as promptly as possible on the day on which th ey are made. An employee or salesman of a Broker Dealer shall not be authorized to accept a confirmation for or on behalf of a customer. B. The Broker Dealer shall give its clients the option to choose whether confirm ation of customer orders will be done by way of courier, facsimile transmission or electronic mail and such preference should be clearly stated in the Customer Account Information Form (CAIF). The confirmation shall be sent to the customer at the address indicated in the CAIF. Parties subscribing to facsimile transmis sion or electronic mail confirmation of customer orders are governed by the spec ial procedure provided in the immediately succeeding paragraph. C. Broker Dealers shall send to their clients, during office hours and on the da y of the transaction, their confirmations. Clients subscribing to such arrangeme nts are required to attest to the accuracy of the information communicated by re plying via facsimile transmission or electronic mail to the Broker Dealer, not l ater than 12:00 noon of the next business day. The Broker Dealer shall then keep a printout of such reply together with the file notifications and transaction d ata being confirmed. D. The confirmation required by paragraph 2A above shall contain at least the fo llowing information: i. A statement as to whether the Broker Dealer is broking for a customer or ano ther Broker Dealer or is dealing for himself pursuant to Section 34.1 (a) to (d ) of the Code and SRC Rule 34.1, paragraph 1; ii. That the Broker Dealer is controlled by, or controls, or is under common con trol with the issuer of such security if such be the fact; iii. Whether the transaction was solicited or unsolicited by the Broker Dealer o r whether the transaction was executed pursuant to the exercise of discretionary power; and iv. For facsimile transmission and electronic confirmations, the reminder that c lients must confirm their orders, not later than 12 noon of the next business da

y. E. The Commission, when it deems necessary, may require a Broker Dealer to submi t a report of his commission or remuneration on a particular transaction. 3. Client Agreement A. A Broker Dealer and its registered persons who deal directly with clients sha ll ensure that a written agreement (hereinafter "Client Agreement") is entered i nto with a client before any service is provided to that client. B. The Client Agreement shall be in a language understood by the client. The reg istered persons who deal directly with clients shall explain to the client the c ontents of the agreement. C. A Client Agreement shall contain, among others, the following information: i. the full name and address of the client, as evidenced by a retained copy of t he identity card, relevant sections of the passport, business registration certi ficate, corporation documents, or any other official document which uniquely ide ntifies the client; ii. the full name and registered address of the Broker Dealer; iii. the Broker Dealer's registration status with the Commission; iv. undertakings by the Broker Dealer and the client to notify the other in the event of any material change to the information provided in the agreement; v. a description of the nature of services to be provided to or available to the client, such as securities cash account, securities margin account, discretiona ry account, portfolio management, investment advice, derivatives trading; vi. a description of any remuneration (and the basis for payment) that is to be paid by the client to the Broker Dealer, such as commission, brokerage, and any other fees and charges; vii. a statement indicating the circumstances under which the Broker Dealer will be acting as principal in relation to the client and that in all other circumst ances the Broker Dealer will be acting as agent for the client; viii. if the Broker Dealer is acting as a Dealer in relation to securities and i s a member of an Exchange (or an Exchange Trading Participant), a statement expl aining the application of Section 34 of the Code, and if the client specifically authorizes the Dealer to pledge the client's securities or subject such securit ies to liens of third parties; ix. if margin or short selling facilities are to be provided to the client, deta ils of margin requirements, interests charges, margin calls, and the circumstanc es under which a client's position may be closed without the client's consent; a nd x. risk disclosure statement as set forth in Annex 30.2-A D. A registered person shall ensure that he complies with his obligations under this rule and the Client Agreement and that the Client Agreement does not operat e to remove, exclude, or restrict any rights of a client or obligations of a Bro ker Dealer under the Code. E. A Broker Dealer shall not effect a transaction on behalf of a client unless b efore the transaction is effected, the client, or a person designated by the cli ent, specifically authorizes the transaction, or the client has authorized in wr iting the Broker Dealer to effect transactions on behalf of the client without t he client's specific authorization. If the Broker Dealer has obtained such an a uthorization, the Client Agreement shall specify that the account is a discretio

nary account. F. A copy of the required Client Agreement is set forth in Annex 30.2-B. 4. Suitability Rule A. In recommending to a customer the purchase, sale or exchange of any security, a Broker Dealer or an associated person or salesman of a Broker Dealer, shall h ave reasonable grounds for believing that the recommendation is suitable for su ch customer upon the basis of the facts disclosed by such customer as to his oth er security holdings and as to his financial situation and needs. B. Except as provided in SRC Rule 52.1, paragraph 6, prior to the execution of a transaction recommended to a customer, a Broker Dealer shall execute a customer account information form which complies with SRC Rule 52.1, paragraph 6. 5. Commissions and Charges for Services Performed by a Broker Dealer A. Charges by a Broker Dealer for services performed, including: i. miscellaneous services such as collection of monies due for principal, divide nds or interest; ii. exchange or transfer of securities; and iii. appraisals, safekeeping or custody of securities, and other services, shall be reasonable. B. All Broker Dealers, in compliance with existing laws, shall file a schedule of their minimum commission rates with the Commission. No discounts and/or rebat es shall be permitted from the minimum rates.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Marketing Plan Vinasoy CollagenDocument24 pagesMarketing Plan Vinasoy CollagenNguyễn Ngọc Quỳnh AnhPas encore d'évaluation

- Bic Product Life CycleDocument4 pagesBic Product Life Cycleapi-505775092Pas encore d'évaluation

- CHAPTER 3 Question SolutionsDocument3 pagesCHAPTER 3 Question Solutionscamd12900% (1)

- Customer Delivery - Stock in Transit (EHP5 - LOG - MM - SIT Functionality)Document43 pagesCustomer Delivery - Stock in Transit (EHP5 - LOG - MM - SIT Functionality)Dmitry Popov100% (1)

- Marketing Mix:: ProductDocument2 pagesMarketing Mix:: Productbilal asifPas encore d'évaluation

- Uv5631 Xls EngDocument37 pagesUv5631 Xls EngCarmelita EsclandaPas encore d'évaluation

- Request: Special InstructionsDocument1 pageRequest: Special InstructionstagacapizPas encore d'évaluation

- SHOPs RadiatorDocument1 pageSHOPs RadiatortagacapizPas encore d'évaluation

- Nissan Grandeur atDocument3 pagesNissan Grandeur attagacapizPas encore d'évaluation

- Nokia Lumia 720 UG en GBDocument107 pagesNokia Lumia 720 UG en GBtagacapizPas encore d'évaluation

- Cable RulesDocument30 pagesCable RulestagacapizPas encore d'évaluation

- Barangay FiscalDocument9 pagesBarangay FiscaltagacapizPas encore d'évaluation

- 2009 ListDocument67 pages2009 ListtagacapizPas encore d'évaluation

- Scra List Date To Volume ReferenceDocument10 pagesScra List Date To Volume Referencetagacapiz100% (3)

- Withdrawal FundDocument1 pageWithdrawal FundtagacapizPas encore d'évaluation

- Case Digests Volume IIIDocument35 pagesCase Digests Volume IIItagacapiz100% (4)

- Nilamadhab Mohanty CimpDocument14 pagesNilamadhab Mohanty CimpSuraj KumarPas encore d'évaluation

- Atil 05Document2 pagesAtil 05anon-685406Pas encore d'évaluation

- Value Chain Management Project Due Date: On The Final Exam DateDocument4 pagesValue Chain Management Project Due Date: On The Final Exam Dateminale destaPas encore d'évaluation

- Analysis of The Tablet Market in 2010 - Is Apple Abusing Market Power?Document17 pagesAnalysis of The Tablet Market in 2010 - Is Apple Abusing Market Power?Zakaria Cassim100% (1)

- Objective of The Study AmaronDocument7 pagesObjective of The Study AmaronJaveed GurramkondaPas encore d'évaluation

- ReportDocument1 pageReportarun_algoPas encore d'évaluation

- Quiz 2Document5 pagesQuiz 2Yazmine Aliyah A. CaoilePas encore d'évaluation

- Interest: Interest Is A Fee That Is Charged For The Use of Someone Else's Money. The Size of The Fee Will DependDocument2 pagesInterest: Interest Is A Fee That Is Charged For The Use of Someone Else's Money. The Size of The Fee Will DependAlexandra BanteguiPas encore d'évaluation

- Top Seven HR Challenges.Document20 pagesTop Seven HR Challenges.myasirnsPas encore d'évaluation

- Technical Analysis by MetastockDocument47 pagesTechnical Analysis by MetastockRoulette Taurosso100% (1)

- DOSDOS, BIANCA MIKAELA F. Economic GlobalizationDocument12 pagesDOSDOS, BIANCA MIKAELA F. Economic GlobalizationBianx Flores DosdosPas encore d'évaluation

- Tissue Paper Factory: Marketing Plan and PrefeasibilityDocument98 pagesTissue Paper Factory: Marketing Plan and Prefeasibilityhinah100% (1)

- Basic Option Valuation-QDocument2 pagesBasic Option Valuation-QmikePas encore d'évaluation

- Study of Stock Market Working FrameworkDocument13 pagesStudy of Stock Market Working Frameworkbenjoel1209Pas encore d'évaluation

- APC Ch8sol.2014Document5 pagesAPC Ch8sol.2014Death ValleyPas encore d'évaluation

- Outsourced Chief Investment Officer (OCIO) - Details, Activities and BenefitsDocument4 pagesOutsourced Chief Investment Officer (OCIO) - Details, Activities and BenefitsTanyamagistralPas encore d'évaluation

- Activity # 3: Corporate Strategies: Questions 5.1Document5 pagesActivity # 3: Corporate Strategies: Questions 5.1Jonela LazaroPas encore d'évaluation

- BAML Spread Chart 1apr2020Document11 pagesBAML Spread Chart 1apr2020abhayadPas encore d'évaluation

- Topic: Challenges Face by StartupsDocument3 pagesTopic: Challenges Face by StartupsUnEeb WaSeemPas encore d'évaluation

- Explanation of Goodbelly Sales Spreadsheet: Variable Definitions 1 2 3 4 5 6 7 8 9Document38 pagesExplanation of Goodbelly Sales Spreadsheet: Variable Definitions 1 2 3 4 5 6 7 8 9nkjhlhPas encore d'évaluation

- Challenges Facing EQUITY BANKDocument52 pagesChallenges Facing EQUITY BANKSimon Muteke50% (2)

- Actg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizDocument4 pagesActg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizMarilou Arcillas PanisalesPas encore d'évaluation

- Kardex - Job Description - Territory Sales SouthDocument2 pagesKardex - Job Description - Territory Sales SouthMayank RawatPas encore d'évaluation

- Applied EconomicsM3 - Lapeceros, Mary Anntoneth R. BSTM 2-ADocument14 pagesApplied EconomicsM3 - Lapeceros, Mary Anntoneth R. BSTM 2-Amaryie lapecerosPas encore d'évaluation