Académique Documents

Professionnel Documents

Culture Documents

Untitled

Transféré par

Sohaib KhanDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Untitled

Transféré par

Sohaib KhanDroits d'auteur :

Formats disponibles

A bank is a financial institution and a financial intermediary that accepts depo sits and channels those deposits into

lending activities, either directly or thr ough capital markets. A bank connects customers that have capital deficits to cu stomers with capital surpluses. Strengths The "Strengths" portion of the banking industrys SWOT analysis is a list of the i nternal operational elements where the banking industry is succeeding or excelli ng. These elements need to refer to features the industry can control and has a direct power to change. For example, the banking industrys strengths can include record-high annual returns, diversified investment portfolio offerings, decrease s in transaction and trading fees, an increase in the number of ATM machines and increased market share. Weaknesses The "Weaknesses" element of the banking industrys SWOT analysis is a list of the internal operational elements the banking industry needs to improve upon. These elements need to refer to features the industry can control and has a direct pow er to change. For example, the banking industry s weaknesses can include high lo an rates, low bond credit ratings, an increased number of outstanding junk bonds , an increase in loan-sharking activity and an increased number of high-risk inv estment options. Opportunities The "Opportunities" part of the banking industrys SWOT analysis is a list of the external environmental elements the banking industry can potentially take advant age of in the near future or long-term. These external environmental elements sh ould not reflect the internal components of the industry, but rather the factors or features outside the industrys control. For example, the banking industrys opp ortunities can include a growing economy, banking deregulation, increased client borrowing, an increase in the number of banks, an increase in the money supply, low government-set credit rates and larger customer checking account balances. Threats The "Threats" component of the banking industrys SWOT analysis is a list of the e xternal environmental elements that can potentially harm the banking industry. T hese external environmental elements do not reflect the internal components of t he industry, but the factors or features outside the industrys control. For examp le, the banking industrys threats could include a declining economy, increased ba nking regulations, larger capital gains taxes, new high-risk investment vehicles or higher health care costs. Its important to realize these examples are not bla ck and white. For example, new high-risk investment vehicles are inherently a liab ility because they include increased risk, but depending on the financial stake and position, it could be an opportunity or threat.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Wicktator Trade MaterialDocument11 pagesWicktator Trade MaterialrontechtipsPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Murphy PDF OptionsDocument368 pagesMurphy PDF Optionsassas100% (3)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Unit 1Document16 pagesUnit 1Rahul kumar100% (1)

- Three Questions For The Year Ahead: GavekalresearchDocument29 pagesThree Questions For The Year Ahead: GavekalresearchZerohedge100% (1)

- Syllabus OBLICONDocument16 pagesSyllabus OBLICONJonah Rose Guerrero LumanagPas encore d'évaluation

- Project Report On Mutual Fund Schemes of SBIDocument43 pagesProject Report On Mutual Fund Schemes of SBIRonak Jain100% (2)

- Technology and CommunicationDocument23 pagesTechnology and CommunicationSohaib Khan100% (2)

- Next Gen BankingDocument8 pagesNext Gen BankingTarang Shah0% (1)

- Union BankDocument5 pagesUnion BankSohaib KhanPas encore d'évaluation

- Eronomics and Flexible WorkingDocument23 pagesEronomics and Flexible WorkingSohaib KhanPas encore d'évaluation

- Performance of Etf in IndiaDocument22 pagesPerformance of Etf in IndiaSohaib KhanPas encore d'évaluation

- ShairiDocument3 pagesShairiSohaib KhanPas encore d'évaluation

- Ergonomics and Flexible WorkingDocument23 pagesErgonomics and Flexible WorkingSohaib Khan100% (1)

- Exit Interview and Labor TurnoverDocument11 pagesExit Interview and Labor TurnoverSohaib KhanPas encore d'évaluation

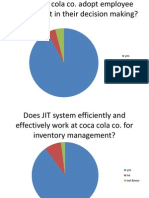

- GraphsDocument3 pagesGraphsSohaib KhanPas encore d'évaluation

- Duc Trinh - ResumeDocument1 pageDuc Trinh - Resumeapi-271904269Pas encore d'évaluation

- iLLUSTRATION OF LUMP SUM LIQUIDATION FOR ENCODINGDocument14 pagesiLLUSTRATION OF LUMP SUM LIQUIDATION FOR ENCODINGMaria Kathreena Andrea AdevaPas encore d'évaluation

- Call OI Strike Put OI Call Value Put Value Total StrikeDocument4 pagesCall OI Strike Put OI Call Value Put Value Total Striked_narnoliaPas encore d'évaluation

- Selecting Asset Class SharesDocument23 pagesSelecting Asset Class SharesdiannebPas encore d'évaluation

- Finantial Management - Ch4Document142 pagesFinantial Management - Ch4댜라댠Pas encore d'évaluation

- Afar ProblemsDocument8 pagesAfar ProblemsSheena BaylosisPas encore d'évaluation

- Listing Exchange BSE FloorDocument41 pagesListing Exchange BSE FloorSAROJPas encore d'évaluation

- KPMG Tax Rate Card 2010-11Document3 pagesKPMG Tax Rate Card 2010-11amit49Pas encore d'évaluation

- Ceka - Icmd 2009 (B01)Document4 pagesCeka - Icmd 2009 (B01)IshidaUryuuPas encore d'évaluation

- BA7062 EXIM Management Unit - I Important Questions: Part-A-MARKS 1. What Is DGFT?Document5 pagesBA7062 EXIM Management Unit - I Important Questions: Part-A-MARKS 1. What Is DGFT?PranavPas encore d'évaluation

- Balance Sheet As at 31st March 2003Document9 pagesBalance Sheet As at 31st March 2003mpdharmadhikariPas encore d'évaluation

- Characteristics of DerivativesDocument17 pagesCharacteristics of DerivativesSwati SinhaPas encore d'évaluation

- Business Combination HO Questions1Document8 pagesBusiness Combination HO Questions1Nicole Gole CruzPas encore d'évaluation

- Working Capital ManagementDocument11 pagesWorking Capital ManagementWonde BiruPas encore d'évaluation

- Sample-Report-DCF As Per RBI Guidelines PDFDocument26 pagesSample-Report-DCF As Per RBI Guidelines PDFRujan BajracharyaPas encore d'évaluation

- Evolution of Short Term LNG MarketDocument7 pagesEvolution of Short Term LNG MarketthawdarPas encore d'évaluation

- Financial Management:: Getting Started - Principles of FinanceDocument41 pagesFinancial Management:: Getting Started - Principles of FinanceiqbalPas encore d'évaluation

- DELL and HPDocument22 pagesDELL and HPKaterina PetrovaPas encore d'évaluation

- $e ., - .22 - May, 2al9: of Af of 42Document12 pages$e ., - .22 - May, 2al9: of Af of 42Ekansh AroraPas encore d'évaluation

- HicDocument7 pagesHicBhavin SagarPas encore d'évaluation

- Debt and Equity MarketDocument2 pagesDebt and Equity MarketprahladtripathiPas encore d'évaluation

- Senior Equity Trader in NYC Resume Victoria DePaoloDocument1 pageSenior Equity Trader in NYC Resume Victoria DePaoloVictoriaDePaoloPas encore d'évaluation

- Resume Swap Markets 15-1 Background: 15-1a Use of Swaps For HedgingDocument9 pagesResume Swap Markets 15-1 Background: 15-1a Use of Swaps For HedgingAbdul Aziz FaqihPas encore d'évaluation