Académique Documents

Professionnel Documents

Culture Documents

Special Studies in Finance - Solution 2012-13

Transféré par

QuestTutorials BmsDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Special Studies in Finance - Solution 2012-13

Transféré par

QuestTutorials BmsDroits d'auteur :

Formats disponibles

QUEST TUTORIALS

1

SPECIAL STUDIES IN FINANCE - Solution Section I

Prelims

1. Concepts (5) (a) Segment Reporting The following is the text of Accounting Standard -17, Segment Reporting issued by the Council of the Institute of Chartered Accountants of India. This Standard comes into effect in respect of accounting periods commencing on or after 1.4.2001 and is mandatory in nature, from that date in respect of the following: a. Enterprises whose equity or debt securities are listed on a recognized stock exchange in India, and enterprises that are in the process of issuing equity or debt securities that will be listed on a recognized stock exchange in India as evidenced by the board of directors resolution in this regard. b. All other commercial, industrial and business reporting enterprises, whose turnover for the accounting period exceeds `50 crore. (b) Sweat Equity What are sweat equity shares and under what conditions can companies issue them? Answer: The expression sweat equity shares refers to equity shares issued by the company to employees or directors at a discount or for consideration other than cash for providing know-how or making available rights in the nature of intellectual property rights or similar value additions to the company. 1. All the limitations, restrictions and provisions relating to equity shares are applicable to such sweat equity shares. A company may issue sweat equity shares of a class of shares already issued if the following conditions are fulfilled the issue of sweat equity shares is authorised by special resolution passed by the company in the general meeting. 2. The resolution specifies the number of shares, current market price, consideration, if any, and the class or classes of directors or employees to whom such equity shares are to be issued not less than one year has, at the date of the issue, elapsed since the date on which the company was entitled to commence, business the sweat equity shares of a company whose equity shares are listed on a recognised stock exchange are issued in accordance with the regulations made by the Securities and Exchange Board of India in this behalf. (In case of a company whose equity shares are not listed on any recognised stock exchange, the sweat equity shares can be issued in accordance with such guidelines as may be prescribed.) . 3. All these provisions are laid down in section 79 A of the Companies Act, 1956. This section was inserted by the Companies (Amendment) Act 1999 which provided for issue of sweat equity shares subject to fulfilment of certain conditions. 4. The Companies (Amendment) Act, 2000 laid down that the provisions of this section are to be administered by SEBI in respect of companies already listed or companies, which intend to get listed. In respect of other companies, the administration shall be by the Central Government. (c) Wealth Maximization: Wealth maximization means maximization of the wealth of the shareholders. Wealth maximization objective is superior to profit maximization objective. It overcomes the drawback of profit maximization criteria. Its operational feather satisfies all the three requirements of a suitable operational objective of financial courses of action namely, exactness, quality of benefits and the time value of money. Wealth maximization concept is measured in terms of cash flows rather than accounting profits. Cash flows

QUEST TUTORIALS: B-305, 3 floor, Rajdarshan Society, Behind ICICI ATM, Near Platform No.1, Thane (W). Contact: 67120221 / 25394777 Website: www.questclasses.com

rd

QUEST TUTORIALS

Prelims

are calculated by taking into account the time value of money. Measurement of benefits in terms of cash flows avoids the possibility of ambiguity associated with accounting profits. (d) Non-monitory items as per Accounting standard (AS) 11. Accounting Standard (AS) 11, The Effects of Changes in Foreign Exchange Rates (revised 2003), issued by the Council of the Institute of Chartered Accountants of India, comes into effect in respect of accounting periods commencing on or after 1-4-2004 and is mandatory in nature from that date. The revised Standard supersedes Accounting Standard (AS) 11, Accounting for the Effects of Changes in Foreign Exchange Rates (1994), except that in respect of accounting for transactions in foreign currencies entered into by the reporting enterprise itself or through its branches before the date this Standard comes into effect, AS 11 (1994) will continue to be applicable. Non-monetary items are assets and liabilities other than monetary items. (e) Return on Investment. 2. (A) Case study. Answer the following questions with the help of the following. (15) Greenland Ltd is an extending business set up having sales turnover of Rs. 3 Crores. It wants to double its turnover in the coming years and is very confident of achieving the same. The company produces and sells a basic drug component, being the raw material for OTC (over the counter) medicines. The firm was set up 5 years ago, as partnership firm, but converted itself into a company 2 years ago. The current capital employed of the company is totally debt free at Rs. 2 crores and hopes to raise it to Rs. 4.5 crores, the term loan applied for being Rs. 2 crores. The term lending institution offers the loan for 5 years tenure @ rate of 10% p.a. being advance towards purchase of additional to the primary security. The company has its establishment at Silvasa which enjoys an 8 years tax holiday from the date of inception. Depreciation on new machinery is estimated at Rs. 40 lacs p.a. The average Tax applicable to a company is 30%. Expected ROI @ 18% p.a. for years 1 to 3 years after inception and 22% p.a. thereafter. (a) Prepare a Flash Report of Greenland Ltd. (b) Prepare Statement of Profitability and DSCR for the tenure of the loan. (c) Comment on the viability of the project in brief. Solution: Flash Report: A) Facts: Name of the borrower: Greenland Ltd. Presented & Proposed Set up: Silvasa Proposed Loan: ` 2,00,00,000 I) Market Appraisal: i. Produces and sell a basic drug component. II) Technical Appraisal: i. The product is raw material for medicines. III) Financial Appraisal: i. The companys sales turnover will be double every year. ii. The company enjoys 8 years tax holiday.

QUEST TUTORIALS: B-305, 3 floor, Rajdarshan Society, Behind ICICI ATM, Near Platform No.1, Thane (W). Contact: 67120221 / 25394777 Website: www.questclasses.com

rd

QUEST TUTORIALS

Prelims

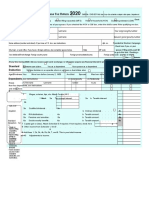

iii. The ROI of the company increases after 3 year. IV) Economic Appraisal: i. The project helps the company to earn more profit. Calculation of EBIT For three years ROI = EBIT / Capital Employed x 100 18% = x / 4,50,00,000 EBIT = 81,00,000 For fourth and fifth year ROI = EBIT / Capital Employed x 100 22% = x / 4,50,00,000 EBIT = 99,00,000 Amortisation schedule for 5 years. Loan at Principal Year beginning installment 1 2,00,00,000 40,00,000 2 1,60,00,000 40,00,000 3 1,20,00,000 40,00,000 4 80,00,000 40,00,000 5 40,00,000 40,00,000

Interest Total @10% Repayment 20,00,000 60,00,000 16,00,000 56,00,000 12,00,000 52,00,000 8,00,000 48,00,000 4,00,000 44,00,000 3 81,00,000 12,00,000 69,00,000 -69,00,000

Loan at end 1,60,00,000 1,20,00,000 80,00,000 40,00,000 ---4 99,00,000 8,00,000 91,00,000 -91,00,000 91,00,000 40,00,000 8,00,000 1,39,00,000 40,00,000 8,00,000 48,00,000 2.90 5 99,00,000 4,00,000 95,00,000 -95,00,000 95,00,000 40,00,000 4,00,000 1,39,00,000 40,00,000 4,00,000 44,00,000 3.16

Calculation of Debt Service Coverage Ratio Particulars 1 2 81,00,000 81,00,000 EBIT Less: Interest 20,00,000 16,00,000 EBT 61,00,000 65,00,000 Less: Tax (30%) --EAT 61,00,000 65,00,000 EAT (+) Depreciation (+) Interest Amount available for repayment(A) Principal Repayment (+)Interest Loan Repayment (B) Debt Service Coverage Ratio (A/B) 61,00,000 40,00,000 20,00,000 1,21,00,000 40,00,000 20,00,000 60,00,000 2.02 65,00,000 40,00,000 16,00,000 1,21,00,000 40,00,000 16,00,000 56,00,000 2.16

69,00,000 40,00,000 12,00,000 1,21,00,000 40,00,000 12,00,000 52,00,000 2.33

(B) Solve any 2 from the following: (10) (i) Explain the term financial assets as per accounting standards 31. Ans) AS 31 will be applicable to all commercial, industrial and business entities other than small and medium sized entities (SMEs). It will be recommendatory for initial period of two years starting on or after 1-4-2009. It will become mandatory for the accounting period commencing on or after 1-4-2011. OBJECTIVE The objective of the Standard is to establish principles for Presenting financial instruments as liabilities or equity

QUEST TUTORIALS: B-305, 3 floor, Rajdarshan Society, Behind ICICI ATM, Near Platform No.1, Thane (W). Contact: 67120221 / 25394777 Website: www.questclasses.com

rd

QUEST TUTORIALS

Prelims

Offsetting financial assets and financial liabilities Compound financial instruments. (1) Financial instrument: A financial instrument is any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity. (2) Financial asset: A financial asset is any asset that is: (a) cash; (b) An equity instrument of another entity; (c) A contractual right: i) To receive cash or another financial asset from another entity; or ii) To exchange financial assets or financial liabilities with another entity under conditions that are potentially favourable to the entity; or (d) A contract that will or may be settled in the entitys own equity instruments and is: i) A non-derivative for which the entity is or may be obliged to receive a variable number of the entitys own equity instruments; or ii) A derivative that will or may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entitys own equity instruments. For this purpose the entitys own equity instruments do not include instruments that are themselves contracts for the future receipt or delivery of the entitys own equity instruments. (ii) From the following information, compute EVA of TCS Ltd. (Assume 35% tax rate) Equity Share Capital ` 1,000 lakhs. 12% Debentures ` 500 lakhs Cost of equity is 20% Financial leverage is 1.5 times. Solution: Interest = 12% of 500lakhs = 60 lakhs Financial Leverage = EBIT / EBT = EBIT / EBIT Interest 1.5 = x / x 60 1.5x 90 = x 1.5x x = 90 0.5 x = 90 X = 90/0.5 EBIT = 180 Calculation of NOPAT: Particulars EBIT (-) Tax @ 35% NOPAT Calculation of WACC: Sources Amount (Lakhs) Equity Share Capital 1,000 12% Debentures 500 1,500 Amount (`) 180 63 117 Cost of Capital (%) 20 7.8 Weighted cost of capital (%) 13.334 2.6 15.93

Proportion (%) 66.67 33.33 100

QUEST TUTORIALS: B-305, 3 floor, Rajdarshan Society, Behind ICICI ATM, Near Platform No.1, Thane (W). Contact: 67120221 / 25394777 Website: www.questclasses.com

rd

QUEST TUTORIALS

Prelims

Kd = I (1-t) = 12 (1 0.35) = 12 (0.65) = 7.8% EVA = NOPAT (WACC x CE) = 117 (15.93% x 1500) = 117 238.95 EVA = (121.95) (iii) Vijay Ltd. Is considering a project with an initial outlay of ` 1,00,000 comprising of machinery worth ` 75,000 and balance towards, working capital exclusively for this project ` 25,000. The entire amount can be borrowed at a rate of 12% p.a. The machinery can be used for 5 yrs at the end of which there is salvage value of ` 10,000. It can be assumed that the machinery is depreciated on SLM basis @20% p.a. for tax purpose. The tax rate assumes to be 35%. Evaluate whether the project is viable under NPV method. Also calculate the pay- back period and briefly recommend for the project given the following annual sales and expenses. Annual Sales - ` 2,00,000. Expenses excluding depreciation ` 20,000. Solution: Depreciation = Original Investment x rate of Depreciation = 75,000 x 20% = 15,000 per year. Calculation of Cash Inflow Particulars Amount Sales 2,00,000 (-) Expenses 20,000 PBDT 1,80,000 (-) Depreciation 15,000 PBT 1,65,000 (-) Tax @ 35% 57,750 PAT 1,07,250 (+) Depreciation 15,000 Cash Inflow 1,22,250 Year 1 2 3 4 5 5 (wc) 5 (sv) Cash Inflow 1,22,250 1,22,250 1,22,250 1,22,250 1,22,250 25,000 10,000 PV Factor@12% 0.893 0.797 0.712 0.636 0.567 0.567 0.567 PV of Cash Inflow (-) PV of Cash Outflow (OI+WC) Net Present Value PVCI 1,09,169 97,433 87,042 77,751 69,316 14,175 5,670 4,60,556 1,00,000 3,60,556

QUEST TUTORIALS: B-305, 3 floor, Rajdarshan Society, Behind ICICI ATM, Near Platform No.1, Thane (W). Contact: 67120221 / 25394777 Website: www.questclasses.com

rd

QUEST TUTORIALS

Prelims

Pay Back Period = Original Investment / Annual Cash Inflow = 75,000 / 1,22,250 = 0.613 years Note: Since the cash inflows were same every year we will use the above formula. Section II 3. What is Lease Financing? Write advantages and limitations of Lease Financing? Conceptually, a lease may be defined as a contractual| arrangement/ transaction in which a party owning an asset/equipment (lessor) provides the asset for use to another, /transfer the right to use the equipment to the user (lessee)' over a certain/ for an agreed period of time, for consideration in form of/in return for periodic payment (rentals), with or without a further payment (premium). At the end of the period of contract (lease period), the asset/equipment reverts back to the lessor unless there is a provision for the renewal of the contract Advantages of Leasing: 1. Conservation of working capital. 2. Income tax considerations. 3. Financial reporting implications i.e., potential to use leasing as off balance sheet financing. 4. Leasing permits 100% financing. 5. Threat of technological obsolescence. E.g. computers. 6. Less restrictive forms of financing when compared with debentures or loans. 7. Ability to maintain flexibility by avoiding ownership commitments. 8. Provides a mechanism for enjoying the benefits of capital allowances in the form of reduced rentals. 9. More easily accessible. 10. Cheaper than other sources of finance. 11. Permits increased capital investment. 12. Leasing is part of planned finance. 13. Makes its possible to design structured leasing arrangement. 14. Assists in prediction of future cash requirements. 15. Leasing is spill over financing i.e. it covers deficiencies or shortfalls in planning. 16. Need for the equipment in temporary 17. Flexibility in repayment. 18. Undisclosed source of financing. 19. Cheaper than purchase. Disadvantages of Leasing: 1. Relatively high cost of lease. 2. More burden when interest rates decline in market. 3. Miscellaneous expenses are owned by lessee. 4. Problem of shifting responsibility, its obsolescence in long term lease. 5. No capital gains when asset prices are poorer. 6. Depreciation cannot be claimed. 4. PQR Ltd. has purchased a machine (cash price ` 1,09,737) on hire purchase system from HP Ltd. on 1-1-2010. The term is that PQR Ltd. would pay ` 40,000 as down payment on signing of the agreement and 4 annual equated instalments of ` 22,000 each including interest @10% commencing from the beginning of the next year. PQR ltd. charged depreciation @20% p.a. on WDV method in their Hire purchase contract.

QUEST TUTORIALS: B-305, 3 floor, Rajdarshan Society, Behind ICICI ATM, Near Platform No.1, Thane (W). Contact: 67120221 / 25394777 Website: www.questclasses.com

rd

QUEST TUTORIALS

Prelims

Prepare Journal Entries, Machinery account and HP Ltd. account for first 2 years in the book of PQR Ltd. Solution: Depreciation @ WDV Particulars Cost of Machine (-) Dep @ 20% year 2010 WDV (-) Dep @ 20% year 2011 WDV (-) Dep @ 20% year 2012 WDV (-) Dep @ 20% year 2013 WDV Cash Price (-) Down payment Year 2011 2012 2013 2014 Opening Balance 69,737 54,711 38,182 20,000 = 1,09,737 = 40,000 69,737 Installment 22,000 22,000 22,000 22,000 Amount (`) 1,09,737 21,947 87,790 17,558 70,232 14,046 56,186 11,237 44,949

Interest @ 10% 6,974 5,471 3,818 2,000

Principal 15,026 16,529 18,182 20,000

Closing Balance 54,711 38,182 20,000 Nil

In the books of PQR Ltd Journal Entries DATE 1/1/2010 PARTICULARS Machine a/c To HP a/c (Being asset purchase) DEBIT (Rs.) 1,09,737 CREDIT (Rs.) 1,09,737

Dr

1/1/2010

HP a/c Dr To Bank a/c (Being down payment made) Depreciation a/c To Machinery a/c (Being depreciation charge) Dr

40,000

40,000

31/3/2010

21,947 21,947

31/3/2010

P&L a/c Dr To Depreciation a/c (Being depreciation transferred to P&L a/c) HP a/c Dr To Bank a/c (Being 1st installment paid)

21,947 21,947

1/1/2011

22,000 22,000

QUEST TUTORIALS: B-305, 3 floor, Rajdarshan Society, Behind ICICI ATM, Near Platform No.1, Thane (W). Contact: 67120221 / 25394777 Website: www.questclasses.com

rd

QUEST TUTORIALS

8

Interest a/c To HP a/c (Being interest paid) Dr 6,974

Prelims

1/1/2011

6,974

31/12/2011 Depreciation a/c To Machinery a/c (Being depreciation charge)

Dr

17,558 17,558

31/12/2011 P&L a/c Dr To Interest a/c To Depreciation a/c (Being interest and depreciation transferred to P&L a/c) Machinery A/c Amt Date 1,09,737 31/12/10 31/12/10 1,09,737 87,790 31/12/11 31/12/11 87,790 70,232 HP A/c Amt Date 40,000 1/1/2010 69,737 1,09,737 22,000 1/1/2011 1/1/2011 54,711 76,711 1/1/2012

24,532 6,974 17,558

Date 1/1/2010

Particulars To HP a/c

Particulars By Depreciation a/c By balance c/d By Depreciation a/c By balance c/d

1/1/2011

To balance b/d

Amt 21,947 87,790 1,09,737 17,558 70,232 87,790

1/1/2012

To balance b/d

Date Particulars 1/1/2010 To Bank a/c 31/12/10 To Balance c/d 1/1/2011 To Bank a/c 31/12/11 To Balance c/d

Particulars By Machine a/c

Amt 1,09,737 1,09,737 69,737 6,974 76, 711 54,711

By Balance b/d By Interest

By Balance b/d

5. Manthan Ltd. Imported goods from Mayur company worth US$ 5 lakhs on 1 - 8 2009 when exchange rate was US$ 1 = ` 42.90. He agreed to pay in 5 instalments as below: Date Instalments (US$) Rate of Exchange (`) 10-10-2009 75,000 42.75 10-12-2009 1,50,000 43.50 10-2-2010 60,000 44.80 10-4-2010 75,000 42.90 10-6-2010 Balance 43.00 The rate of exchange was ` 43.00 as on 31-3-2010. Pass journal entries (including those for cash) in the books of Mayur in accordance with AS-11. Solution:

QUEST TUTORIALS: B-305, 3 floor, Rajdarshan Society, Behind ICICI ATM, Near Platform No.1, Thane (W). Contact: 67120221 / 25394777 Website: www.questclasses.com

rd

QUEST TUTORIALS

9

In the Books of Mayur (Exporter) Amt in $ Amt. Recd `/$ 5,00,000 75,000 1,50,000 60,000 2,15,000 (5,00,000 75,000 -1,50,000 60,000) 75,000 1,40,000 (2,15,000 75,000) 42.90 42.75 43.50 44.80 43.00 Amt to be recd 2,14,50,000 2,14,50,000 32,06,250 32,17,500 65,25,000 26,88,000 92,45,000 64,35,000 25,74,000 92,23,500

Prelims

Date 1/8/09 10/10/09 10/12/09 10/2/2010 31/3/2010

Particulars Sales 1 Installment received nd 2 installment received 3rd installment received Reporting

st

Exchange Diff --11,250 (loss) 90,000 (gain) 1,14,000 (gain) 21,500 (gain)

10/4/2010 10/6/10

4th Installment received th 5 Installment received

42.90 43

32,17,500 60,20,000

32,25,000 60,20,000

7,500 (loss) ----

Journal Entries DATE 1/8/09

10/10/09

PARTICULARS Manthan a/c Dr To Sales a/c (Being goods sold) Bank a/c Dr FEF a/c (loss) Dr To Manthan a/c (Being 1st installment received) Bank a/c Dr To FEF a/c (profit) To Manthan a/c (Being 2nd installment received) Bank a/c Dr To FEF a/c (profit) To Manthan a/c (Being 3rd installment received) Manthan a/c To FEF a/c (Being profit reported) FEF a/c To P& L a/c (Being profit transferred) FEF a/c To P& L a/c (Being net profit transferred) Dr

DEBIT (Rs.) 2,14,50,000

CREDIT (Rs.) 2,14,50,000

32,06,250 11,250 32,17,500

10/12/09

65,25,000 90,000 64,35,000

10/2/2010

26,88,000 1,14,000 25,74,000

31/3/2010

21,500 21,500

31/3/2010

Dr

21,500 21,500

31/3/2010

Dr

2,14,250 2,14,250

QUEST TUTORIALS: B-305, 3 floor, Rajdarshan Society, Behind ICICI ATM, Near Platform No.1, Thane (W). Contact: 67120221 / 25394777 Website: www.questclasses.com

rd

QUEST TUTORIALS

10

Bank a/c Dr FEF a/c (loss) Dr To Manthan a/c (Being 4th installment received) Bank a/c Dr To Manthan a/c (Being 5th installment received) P& L a/c To FEF a/c (Being loss transferred) Dr 32,17,500 7,500

Prelims

10/4/2010

32,25,000

10/6/10

60,20,000 60,20,000

31/3/10

7,500 7,500

6. (a) XYZ Ltd has provided depreciation as per accounting records ` 20 lakhs but as per tax records ` 40 lakhs. The unamortized preliminary expenses, as per tax records are ` 10, 000. There is adequate evidence of future profit sufficiency. Tax rate 30%. How much deferred tax asset /liability should be recognised as transition adjustment as per AS - 22? (5) Solution: Description Calculations Amount Excess Depreciation as per Tax (Tax Depreciation - Accounting Depreciation) Rs. 120 - Rs. 40 80 (-) Unamortized expenses 0.1 Timing Difference 79.9 As tax Expense is more than the current tax due to timing difference of Rs. 79.9 Lakhs, therefore Deferred Tax Liability = 30% x 79.9 Lakhs = Rs. 23.97 Lakhs. P& L a/c Dr 23,97,000 To DTL a/c 23,97,000 (b) ABC Ltd. IPO opened on 6th October & closed on 8th October- Company issued 20 crore shares in the price band 1200-1300. Public applied for 200 crore shares. The BRLM J.P. Morgan in consultation with company announced issue price ` 1250. Average Price of application receive is ` 1270. Pass necessary journal entries in books of coal India Ltd. Refund and Allotment of shares of face value of ` 10 were done on 20th Oct. 2011. (5) Solution: (in cores) No. Date Particulars Debit Credit 6/10/10 Cash/Bank a/c.Dr. 2,54,000 To To share application a/c 2,54,000 8/10/10 (200 x 1270) 20/10/10 Share application a/c.Dr. 2,54,000 To Equity share capital a/c (20x10) 200 To Securities premium a/c (20 x 1240) 24,800 To Cash/Bank a/c (Refund amount) 2,29,000

QUEST TUTORIALS: B-305, 3 floor, Rajdarshan Society, Behind ICICI ATM, Near Platform No.1, Thane (W). Contact: 67120221 / 25394777 Website: www.questclasses.com

rd

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- BMS VI Sem Question Bank of All The Subjects PDFDocument24 pagesBMS VI Sem Question Bank of All The Subjects PDFQuestTutorials Bms50% (4)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- University Questions of Service Sector Management - NewDocument5 pagesUniversity Questions of Service Sector Management - NewQuestTutorials BmsPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Bms - Financial Management Solution - 2012Document12 pagesBms - Financial Management Solution - 2012QuestTutorials BmsPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- SSF 2012-13Document2 pagesSSF 2012-13QuestTutorials BmsPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- University Questions of Financial ManagementDocument3 pagesUniversity Questions of Financial ManagementQuestTutorials BmsPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Logistics and Supply Chain Management NewDocument6 pagesLogistics and Supply Chain Management NewQuestTutorials Bms0% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Special Studies in MarketingDocument5 pagesSpecial Studies in MarketingQuestTutorials BmsPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Human Resource ManagementDocument3 pagesHuman Resource ManagementQuestTutorials BmsPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDDocument35 pagesQuoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDQuestTutorials BmsPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDDocument35 pagesQuoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDQuestTutorials BmsPas encore d'évaluation

- Tybms Sem Vi - International Finance Paper SolutionDocument11 pagesTybms Sem Vi - International Finance Paper SolutionQuestTutorials Bms100% (4)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDDocument32 pagesQuoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDQuestTutorials BmsPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDDocument30 pagesQuoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDQuestTutorials BmsPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Classes Also at Borivali. WebsiteDocument26 pagesClasses Also at Borivali. WebsiteQuestTutorials BmsPas encore d'évaluation

- Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDDocument30 pagesQuoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDQuestTutorials BmsPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Quoin - MBA CET - 2006Document29 pagesQuoin - MBA CET - 2006QuestTutorials BmsPas encore d'évaluation

- Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDDocument33 pagesQuoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDQuestTutorials BmsPas encore d'évaluation

- Quoin CET 2006Document29 pagesQuoin CET 2006QuestTutorials BmsPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDDocument33 pagesQuoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. Ltd. Quoin Education Solutions Pvt. LTDQuestTutorials BmsPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Quoin - Actual MbaCET Paper - 2008Document26 pagesQuoin - Actual MbaCET Paper - 2008QuestTutorials BmsPas encore d'évaluation

- Financial Management - 11 Solution - SsDocument10 pagesFinancial Management - 11 Solution - SsQuestTutorials BmsPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Financial Management - 11 Solution - SsDocument10 pagesFinancial Management - 11 Solution - SsQuestTutorials BmsPas encore d'évaluation

- B326 TMA 23-24 (Fall) V1Document5 pagesB326 TMA 23-24 (Fall) V1adel.dahbour9733% (3)

- Repligen March 2021 Investor PresentationDocument36 pagesRepligen March 2021 Investor PresentationRLPas encore d'évaluation

- CIR Vs HendersonDocument6 pagesCIR Vs Hendersonanon_614984256Pas encore d'évaluation

- SMChap 007Document86 pagesSMChap 007Huishan Zheng100% (5)

- ACC51112 - Responsibility Accounting QuizzerDocument12 pagesACC51112 - Responsibility Accounting QuizzerjasPas encore d'évaluation

- Audit ProbDocument36 pagesAudit ProbSheena BaylosisPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Chapter 11Document23 pagesChapter 11narasimha50% (6)

- Garrison 13th Edition Chapter 9Document18 pagesGarrison 13th Edition Chapter 9Ali HaiderPas encore d'évaluation

- 1-1-2017 Petty Cash FundDocument4 pages1-1-2017 Petty Cash FundMr. CopernicusPas encore d'évaluation

- TDS On Real Estate IndustryDocument5 pagesTDS On Real Estate IndustryKirti SanghaviPas encore d'évaluation

- Frank Wood's Principle of Accounts For HK Book1 Appendix2 Revision PracticeDocument4 pagesFrank Wood's Principle of Accounts For HK Book1 Appendix2 Revision PracticeCHRISTINA LEE100% (1)

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023bluetrans expressPas encore d'évaluation

- Bonifacio Gas v. CIRDocument31 pagesBonifacio Gas v. CIRaudreydql5Pas encore d'évaluation

- Assignment On: Banking Companies Act, 1991Document11 pagesAssignment On: Banking Companies Act, 1991Mehedi Hasan100% (4)

- Valuation of TTK PrestigeDocument20 pagesValuation of TTK PrestigeVivek KumarPas encore d'évaluation

- Business Mathematics (OBE)Document10 pagesBusiness Mathematics (OBE)irene apiladaPas encore d'évaluation

- Management Advisory ServicesDocument4 pagesManagement Advisory ServicesYaj CruzadaPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- FSADocument4 pagesFSAAreeba AslamPas encore d'évaluation

- RvatDocument6 pagesRvatAlyanna Macrine PoncePas encore d'évaluation

- Opportunity ScreeningDocument83 pagesOpportunity ScreeningHannah Patricia PerezPas encore d'évaluation

- FTG Irs Form 990 2005Document17 pagesFTG Irs Form 990 2005L. A. PatersonPas encore d'évaluation

- TRX Case Team 10Document5 pagesTRX Case Team 10Kenji YamamuraPas encore d'évaluation

- The Garden Spot Year OneDocument2 pagesThe Garden Spot Year OneJellyBeanPas encore d'évaluation

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyPas encore d'évaluation

- Consumption Function: "Consumption Is The Sole End and Purpose of All Production." Adam SmithDocument28 pagesConsumption Function: "Consumption Is The Sole End and Purpose of All Production." Adam SmithPooja SheoranPas encore d'évaluation

- Financial Literacy ProjectDocument28 pagesFinancial Literacy Projectapi-293140415Pas encore d'évaluation

- Tax Treaty Required: BDB Law'S "Tax Law For Business" BusinessmirrorDocument2 pagesTax Treaty Required: BDB Law'S "Tax Law For Business" BusinessmirrorMico Maagma CarpioPas encore d'évaluation

- Financial Ratio Analysis Aldar UpdatedDocument36 pagesFinancial Ratio Analysis Aldar UpdatedHasanPas encore d'évaluation

- Annex D CNPF Annual Report 2020 - Consolidated Financial StatementsDocument113 pagesAnnex D CNPF Annual Report 2020 - Consolidated Financial StatementsJC LastimosoPas encore d'évaluation

- SpecialCircumstances AppealForm PDFDocument2 pagesSpecialCircumstances AppealForm PDFEsplanadePas encore d'évaluation