Académique Documents

Professionnel Documents

Culture Documents

Government Clears 51% FDI in Retail, 49% in Aviation: Email This Article Print This Article Share On Reditt

Transféré par

Prabhat Kumar SinghDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Government Clears 51% FDI in Retail, 49% in Aviation: Email This Article Print This Article Share On Reditt

Transféré par

Prabhat Kumar SinghDroits d'auteur :

Formats disponibles

Government clears 51% FDI in retail, 49% in aviation

Email this article Print this article Share on Reditt

Google Bookmarks Live Bookmarks Yahoo Bookmarks

Newsvine Technorati Blogmarks

Del.icio.us ApnaCircle

Retail

In a much awaited reform measure, commerce minister, Anand Sharma on Friday announced relaxation of Foreign Direct Investment (FDI) norms in the retail sector.The author has posted comments on this articleTNN | Sep 15, 2012, 01.56AM IST NEW DELHI: After months of dilly-dallying, UPA mustered courage on Friday to throw open the gates to foreign investment in a host of sectors considered political no-go zones like multi-brand retail and civil aviation in a bid to dispel the perception of policy paralysis. This will pave the way for the much-awaited entry of foreign retail giants such as Walmart, Tesco and Carrefour into the $450 billion retail market, although their footprint will be limited to million-plus cities in states which have agreed to back the measure.

The decisions on Friday, along with a go-ahead for disinvestment in four PSUs to mop up Rs 14,000 crore, come within a day of the ruling coalition's decision to raise diesel price by a stiff Rs 5 a litre and cap subsidized cooking gas cylinders to six a year for every household. Taken together, they mark the most ambitious reform rush by the beleaguered government which has been roundly attacked for drift and diminished will to take bold measures. Faced with dwindling political fortunes, the UPA appears to have finally resorted to a flurry of actions aimed at salvaging the government's precarious finances and retrieving the sinking reforms legacy of the Manmohan Singh regime. There were loud protests from non-Congress parties which may shortly call for a countrywide shutdown. Govt driven by perform or perish mantra But the government, driven by a "perform or perish" mantra, asserted it will stick to its decisions which have been taken after factoring in the resistance of allies and opponents. There is a recognition that the cost of inaction will be far more severe, given the worsening finances and real threat of a ratings downgrade. With experts and its own top leadership feeling that the window for decision-making is shrinking fast, there was an air of determination in the government taking on allies and outside supporters who have crippled its options for months On the upside, government can expect a roaring reception from the financial markets on Monday as a global rally triggered by monetary easing in the US and Germany's green signal to a Eurozone recovery package ties in with Friday's initiatives. This can prove to be a mood-enhancer for UPA as it heads into state polls in Himachal Pradesh and Gujarat. The decision to leave it to states to allow foreign retailers is meant to blunt the opposition. However, it has been sought to be balanced by improving the terms for the foreign players. Riders such as sourcing norms and rules to open stores in cities with a population of over one million have been tweaked for the benefit of foreign players, who can now pick up 51% stake in Indian joint ventures. So far, these players could only set up single-brand stores or enter the wholesale segment and sell bulk buyers such as canteens, restaurants and kirana shops. Bowing to pressure from foreign players such as IKEA, the government eased sourcing norms for single-brand retail and permitted them to buy at least 30% of the goods from Indian industry, instead of the earlier stipulation that made purchases mandatory from small and medium units. In case of civil aviation, where FDI is already permitted, the government has relaxed rules to allow foreign carriers to buy up to 49% stake in Indian airlines, a decision that throws a lifeline to ailing Kingfisher and other smaller players. PM Manmohan Singh sought support for the decisions, saying they were needed to tide over difficult times and make

India a more attractive destination for foreign investors. Times View Those who are opposing FDI in retail on the grounds that lakhs of small traders will lose out are making big mistake. They are forgetting that the loss for these traders will be more than compensated by the gains to hundreds of millions of consumers and farmers who will benefit from cutting out these middlemen. The big retailers that will result from letting FDI in should hugely improve efficiencies in the retail trade and the economy can only benefit from that. Political parties may have reason to focus on only one half of the picture, but the aam admi should not be misled by this. The gainers should vastly outnumber the losers.

The allowing of FDI in retail is one of the most crtical reforms taking place in India post the great reforms period of 1991. Well the only difference is that this time around there we are not staring at bankrupcty but only at slow down in the economy. There has been huge hue and cry amongst the opposition benches and the some of the allies of the rulling party over the new policy to allow upto 51% FDI in multi brand retail in India. Before understanding the benefits of FDI in retail. Let us understand what the policy states:

The truth is much different from its told , following are TEN direct benefits of entry of multi brand retail in India. 1) Direct benefit to Farmers: The biggest beneficiary of FDI in retail will be directly the farmers in India. Across the world the big retail giants buy the produce directly from the farmers, thereby eliminating the middle men. Thus farmers will get much better price which can be atleast 15-20% higher than the existing price they get.

In present system the farmers get approx only 30-35% of the retail price, rest all is taken over by middle men like traders etc. For eg during the onion shortage in India most of the hoarding was done by onion traders, whereas they got price as high as Rs. 35 Kg, the farmer got only Rs. 4-5 Kg. Thus farmers will directly benefit from direct purchase. 2) Reduction in Food Inflation: The incoming of FDI will bring in strong competition amongst the retailers at the same time the elimination of middle men who are also the hoarders of stocks will help reducing the supply constraint. The direct purchase policy of bigger retailers will help in passing on the benefit of low procurement cost directly to consumers. Thus helping in reducing food based inflation to a great extent. 3) Earning of Forex: India will earn a great amount of foreign exchange reserves from the investments which the mega multi brand retailers will do in India. Each retailer is suppose to do minimum of 100 million dollars, considering that setting up an average one store costs 5-10 million dollars, one can easily expect to get investment upto 1 billion dollar from each retailer in total, which can be approx 15-25 billion dollars spread over 5 years. 4) Huge Employment Benefits: The international model suggests that all those countries which opened up multi brand retail to FDI added huge amount of employment. In India the government expects it to generate atleast 1 million employment over the next few years. It is very critical to note that the government is allowing Foreign retailers to open retail stores in India in joint venture with Indian partners only in top 53 cities with a population of 1 million and above. 5) Drop in Food Wastage: A huge chuck of almost 30-40% of total food is wasted in transportation and poor storage facilities. Not to mention the millions of grains that rot in govermennt godowns every year. The government has made it compulsory for the foreign retailers to invest alteast 50% of the investment in infrastructre. Thus it will become critical for them to reduce food wastage by making better storage and quick transport facilities available. 6) Better Consumer Choice: The other major beneficiar will the consumer. Since most of the retail stores operate over a very large format they generally have a large amount of SKUs (products). Thus they will store as much variety as possible. Which generally kirana stores do not keep since they are not sure of its sale. 7) Benefit to Kirana Stores: Well dont be suprised from this point but its true. As per government approved policy it is compulsory for the mega retailers to have 30% of their sales from small retailers. The Punjab state is a perfect example of this cash and carry model. At the same time one must realise that the kirana store retailers have been paying a high price to middle men to procure good, which they can now procure at much lower price from the bigger multi brand foreign retailers. At the same time the multi brand retailers with FDI will be allowed to sell only in 53 big cities with population of more than one million. Thus the Kirana stores can directly benefit from buying from cities and selling

them in their towns. One must not forget that most of this big brand multi retail shops will be based on out skirts of city whereas the Kirana stores are in heart of city providing home delivery. 8) Creation of backend Infrastructure: The government has made it compulsory for the foreign brand multi retailer to invest alteast 50% if there amount into back end infrastructre. Thus giving a boost to facilites like cold storage, food grain banks etc, .. 9) More Purchase from SMEs: Its been made mandatory by the government for the mega brand multi retailers to procure atleast 30% of its requirement from SMEs. Till today its been very difficult for the SMEs to sell their products via kirana stores since non existence of brand. The kirana stores used to reject the goods produce by SMEs due to lower offload. But the multi brand retailer will have to compulsorily purchase from the SME upto 30%. 10) Overall growth: Indias GDP has been slowing down since last few quarters. The influx of foreign funds will lead to huge incoming of investments in critical sectors like construction, employments etc. Such investment will easily contribute upto 0.5% to the GDP growth backed by other critical reforms. Though the government has to bring down interest rates to boost growth, it also has to bring in more reforms. Biggest Loser will be the middle men, who have been hoarding the goods time and again to make super profits and to work against interest of consumers thereby leading to super inflation. Thus one can safely say that government has done a pretty good home work before coming up with FDI in Indian mulit brand retail. At the same time one must not forget that Kirana stores as in India also exists in US along side Walmart which is mostly in outskirts of city.

Vous aimerez peut-être aussi

- Interoperability Standards For Voip Atm Components: Volume 4: RecordingDocument75 pagesInteroperability Standards For Voip Atm Components: Volume 4: RecordingjuananpspPas encore d'évaluation

- CA Inter Group 1 Book November 2021Document251 pagesCA Inter Group 1 Book November 2021VISHAL100% (2)

- Lea 4Document36 pagesLea 4Divina DugaoPas encore d'évaluation

- FDI in Retail A Necessary Evil October 2012.Document4 pagesFDI in Retail A Necessary Evil October 2012.Praveen Kumar ThotaPas encore d'évaluation

- 1Document3 pages1Hari Shankar LovevanshiPas encore d'évaluation

- FDI IN RETAIL: A PerspectiveDocument5 pagesFDI IN RETAIL: A PerspectiverakeshPas encore d'évaluation

- Raw Data On FDI Retail PolicyDocument16 pagesRaw Data On FDI Retail PolicySuresh ParajuliPas encore d'évaluation

- FDI in IndiaDocument100 pagesFDI in IndiaAlok Prakash0% (1)

- Introduction To FDIDocument22 pagesIntroduction To FDIPRATIKPas encore d'évaluation

- FDI in Retail: Misplaced Expectations and Half-Truths by Sukhpal SinghDocument7 pagesFDI in Retail: Misplaced Expectations and Half-Truths by Sukhpal SinghShihabudeenkunjuPas encore d'évaluation

- Critical Appraisal of FDI On Retail MarketDocument11 pagesCritical Appraisal of FDI On Retail MarketJayesh MahajanPas encore d'évaluation

- FDI in Multi Brand - Gain or Pain For Traditional Retailers?Document2 pagesFDI in Multi Brand - Gain or Pain For Traditional Retailers?royston2304Pas encore d'évaluation

- Trinamool Congress Anmohan Singh Anmohan SinghDocument4 pagesTrinamool Congress Anmohan Singh Anmohan SinghPriyaa DubePas encore d'évaluation

- Foreign Direct InvestmentDocument5 pagesForeign Direct InvestmentBhavya GandhiPas encore d'évaluation

- Advantages of Allowing FDI in RetailDocument6 pagesAdvantages of Allowing FDI in RetailAbaddon Bipul PurkaitPas encore d'évaluation

- Synopsis: FDI in Retail Is A Boon For IndiaDocument6 pagesSynopsis: FDI in Retail Is A Boon For Indiaamit.18.singh2466Pas encore d'évaluation

- FDI in Retail: Cabinet Approves 51% in Multi-Brand & 100% in Single-Brand RetailDocument4 pagesFDI in Retail: Cabinet Approves 51% in Multi-Brand & 100% in Single-Brand RetailloganathprasannaPas encore d'évaluation

- Civil Services Mentor October 2011 WWW - UpscportalDocument100 pagesCivil Services Mentor October 2011 WWW - UpscportalNSRajasekarPas encore d'évaluation

- Union Cabinet Approves 51% FDI in Multi-Brand RetailDocument17 pagesUnion Cabinet Approves 51% FDI in Multi-Brand RetailDeepak NairPas encore d'évaluation

- Fdi in RetailDocument14 pagesFdi in Retailanilpkumar3Pas encore d'évaluation

- FDI in RetailDocument17 pagesFDI in RetailShilpa AroraPas encore d'évaluation

- Impact of Foreign Direct Investment On Retail Shops: Dr. Prasanna KumarDocument7 pagesImpact of Foreign Direct Investment On Retail Shops: Dr. Prasanna KumarShyamSunderPas encore d'évaluation

- FDI in Multi Brand Retail: Will The Cash Infusion Derail The Colossal Retail Structure?Document5 pagesFDI in Multi Brand Retail: Will The Cash Infusion Derail The Colossal Retail Structure?Harsh GagraniPas encore d'évaluation

- FDI in Multi-Brand Retail Will Hurt AllDocument8 pagesFDI in Multi-Brand Retail Will Hurt AllDigvijay RathorePas encore d'évaluation

- Prepared By: Vikram SolankiDocument8 pagesPrepared By: Vikram SolankiHarsh SoniPas encore d'évaluation

- Fdi in Retail IndustryDocument8 pagesFdi in Retail IndustryJacky ShamdasaniPas encore d'évaluation

- C CC YcDocument8 pagesC CC YcAmitabh KumarPas encore d'évaluation

- Fdi in Retail: Naman Jain Sriharsha Jetti Prachi AgarwalDocument19 pagesFdi in Retail: Naman Jain Sriharsha Jetti Prachi AgarwalbhagyashreesathePas encore d'évaluation

- FDI in Multi Brand RetailDocument4 pagesFDI in Multi Brand RetailKaustubh AgrawalPas encore d'évaluation

- FDI in Indian RetailsDocument12 pagesFDI in Indian RetailschoprahridyeshPas encore d'évaluation

- Implications of FDI in Indian RetailDocument8 pagesImplications of FDI in Indian RetailAvishkarzPas encore d'évaluation

- Advantages of FDI in Retail Sector in IndiaDocument16 pagesAdvantages of FDI in Retail Sector in IndiaAmolnanavarePas encore d'évaluation

- Retail Industry in Future: Presented ToDocument17 pagesRetail Industry in Future: Presented ToSavan BhattPas encore d'évaluation

- Retailing in IndiaDocument6 pagesRetailing in IndiaAmmy D ExtrovertPas encore d'évaluation

- What Is Foreign Direct InvestmentDocument2 pagesWhat Is Foreign Direct InvestmentpplahanePas encore d'évaluation

- Fdi in RetailDocument6 pagesFdi in RetailNiranjan KumavatPas encore d'évaluation

- Fdi in Retail: Is It Good or Bad For Indian Economy?Document12 pagesFdi in Retail: Is It Good or Bad For Indian Economy?Manas LahotiPas encore d'évaluation

- FDI On HoldDocument3 pagesFDI On HoldRajat MathurPas encore d'évaluation

- The Retail Industry IndiaDocument2 pagesThe Retail Industry IndiaRajvindRathiPas encore d'évaluation

- Foreign Direct Investment in IndiaDocument5 pagesForeign Direct Investment in IndiaDisha JaniPas encore d'évaluation

- FDI RetailDocument2 pagesFDI Retailparth0388Pas encore d'évaluation

- Note 1305 PDFDocument10 pagesNote 1305 PDFKSRao03Pas encore d'évaluation

- 100% Fdi Allowed in Single-Brand Retail: Hello Walmart, Goodbye InertiaDocument3 pages100% Fdi Allowed in Single-Brand Retail: Hello Walmart, Goodbye InertiaNirav KapadiaPas encore d'évaluation

- Given The Debate ThatDocument3 pagesGiven The Debate ThatKheyali SannigrahiPas encore d'évaluation

- FDI in Retail Sector in India: Challenges and OpportunitiesDocument5 pagesFDI in Retail Sector in India: Challenges and OpportunitiesGlobal Journal of Engineering and Scientific ResearchPas encore d'évaluation

- FDI in Indian Retail Sector-Pros & Cons: Presented By: 1) K.Veena MadhuriDocument10 pagesFDI in Indian Retail Sector-Pros & Cons: Presented By: 1) K.Veena MadhuriebabjiPas encore d'évaluation

- NL NL Indian Retail MarketDocument21 pagesNL NL Indian Retail MarketmmmkiPas encore d'évaluation

- Impact of Fdi On India Retail TradeDocument18 pagesImpact of Fdi On India Retail TradeRaja SekharPas encore d'évaluation

- Fdi 1Document8 pagesFdi 1Rishi Johnny RainaPas encore d'évaluation

- Cabinet Decision On FDI in Retail Facebook PIBDocument4 pagesCabinet Decision On FDI in Retail Facebook PIBPradeep SinghPas encore d'évaluation

- Mock Group Discussion - FDI in Retail Sector Will Boost The Indian EconomyDocument5 pagesMock Group Discussion - FDI in Retail Sector Will Boost The Indian EconomyPiyush ChitlangiaPas encore d'évaluation

- Foreign Direct Investment: The Big Bang in Indian Retail: VSRD-IJBMR, Vol. 2 (7), 2012, 327-337Document11 pagesForeign Direct Investment: The Big Bang in Indian Retail: VSRD-IJBMR, Vol. 2 (7), 2012, 327-337pawan_019Pas encore d'évaluation

- FDI in RetailDocument12 pagesFDI in RetailVignesh Arun S KPas encore d'évaluation

- Fdi in RetailDocument33 pagesFdi in RetailImran KaroliaPas encore d'évaluation

- FDI in Retail Sector in India - A Global PerspectiveDocument19 pagesFDI in Retail Sector in India - A Global PerspectiveHoney VashishthaPas encore d'évaluation

- Iimt PaperDocument9 pagesIimt PaperuttkarshPas encore d'évaluation

- Title Page Foreign Direct Investment in Retail in India: Name of Author: Dr. Gaurav BisariaDocument12 pagesTitle Page Foreign Direct Investment in Retail in India: Name of Author: Dr. Gaurav BisariaharishcoolanandPas encore d'évaluation

- Should FDI Be Allowed in IndiaDocument2 pagesShould FDI Be Allowed in IndiaAmit Kumar SindhupePas encore d'évaluation

- Multi Brand Retailing in IndiaDocument30 pagesMulti Brand Retailing in IndiasupriyaPas encore d'évaluation

- 51% FDI in Retail Exceeded Walmart's Initial ExpectationDocument17 pages51% FDI in Retail Exceeded Walmart's Initial Expectationpathakneha53Pas encore d'évaluation

- Indian Retail Sector: Presented By: Suraj Patil, Shakti Dash, Vidwaita SachanDocument26 pagesIndian Retail Sector: Presented By: Suraj Patil, Shakti Dash, Vidwaita SachanShakti DashPas encore d'évaluation

- PP PP: C PCPPP PPPPPPDocument5 pagesPP PP: C PCPPP PPPPPPAchal ManchandaPas encore d'évaluation

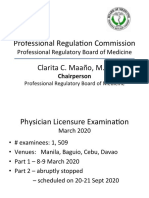

- Professional Regula/on Commission: Clarita C. Maaño, M.DDocument31 pagesProfessional Regula/on Commission: Clarita C. Maaño, M.Dmiguel triggartPas encore d'évaluation

- DC Servo MotorDocument6 pagesDC Servo MotortaindiPas encore d'évaluation

- Fidp ResearchDocument3 pagesFidp ResearchIn SanityPas encore d'évaluation

- Basic Vibration Analysis Training-1Document193 pagesBasic Vibration Analysis Training-1Sanjeevi Kumar SpPas encore d'évaluation

- General Field Definitions PlusDocument9 pagesGeneral Field Definitions PlusOscar Alberto ZambranoPas encore d'évaluation

- Audit On ERP Implementation UN PWCDocument28 pagesAudit On ERP Implementation UN PWCSamina InkandellaPas encore d'évaluation

- XgxyDocument22 pagesXgxyLïkïth RäjPas encore d'évaluation

- PCDocument4 pagesPCHrithik AryaPas encore d'évaluation

- Portrait of An INTJDocument2 pagesPortrait of An INTJDelia VlasceanuPas encore d'évaluation

- KSU OGE 23-24 AffidavitDocument1 pageKSU OGE 23-24 Affidavitsourav rorPas encore d'évaluation

- Hip NormDocument35 pagesHip NormAiman ArifinPas encore d'évaluation

- Cabling and Connection System PDFDocument16 pagesCabling and Connection System PDFLyndryl ProvidoPas encore d'évaluation

- X-17 Manual Jofra PDFDocument124 pagesX-17 Manual Jofra PDFBlanca Y. Ramirez CruzPas encore d'évaluation

- Course Specifications: Fire Investigation and Failure Analysis (E901313)Document2 pagesCourse Specifications: Fire Investigation and Failure Analysis (E901313)danateoPas encore d'évaluation

- ATPDraw 5 User Manual UpdatesDocument51 pagesATPDraw 5 User Manual UpdatesdoniluzPas encore d'évaluation

- BluetoothDocument28 pagesBluetoothMilind GoratelaPas encore d'évaluation

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyDocument2 pagesAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfPas encore d'évaluation

- Seminar On Despute Resolution & IPR Protection in PRCDocument4 pagesSeminar On Despute Resolution & IPR Protection in PRCrishi000071985100% (2)

- Use of EnglishDocument4 pagesUse of EnglishBelén SalituriPas encore d'évaluation

- Cancellation of Deed of Conditional SalDocument5 pagesCancellation of Deed of Conditional SalJohn RositoPas encore d'évaluation

- A Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Document73 pagesA Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Os MPas encore d'évaluation

- Schmidt Family Sales Flyer English HighDocument6 pagesSchmidt Family Sales Flyer English HighmdeenkPas encore d'évaluation

- Basics: Define The Task of Having Braking System in A VehicleDocument27 pagesBasics: Define The Task of Having Braking System in A VehiclearupPas encore d'évaluation

- Sourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocument58 pagesSourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyAlaa Al HarbiPas encore d'évaluation

- Properties of Moist AirDocument11 pagesProperties of Moist AirKarthik HarithPas encore d'évaluation

- Agricultural Economics 1916Document932 pagesAgricultural Economics 1916OceanPas encore d'évaluation

- Online EarningsDocument3 pagesOnline EarningsafzalalibahttiPas encore d'évaluation