Académique Documents

Professionnel Documents

Culture Documents

In A Fair Value Hedge

Transféré par

Khush PalrechaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

In A Fair Value Hedge

Transféré par

Khush PalrechaDroits d'auteur :

Formats disponibles

In a fair value hedge, a derivative is used to hedge or offset the exposure to changes in the fair value of a recognized asset

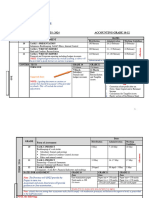

or liability or of an unrecognized firm commitment. In a perfectly hedged position, the gain or loss on the fair value of the derivative and that of the hedged asset or liability should be equal and offsetting. A common type of fair value hedge is the use of interest rate swaps (discussed below) to hedge the risk that fair value hedge is the use of put options to hedge the risk that an equity investment will decline in value. To illustrate the accounting for a fair value hedge, assume that Jones Company issues $1,000,000 of 5-year 8% fixed-rate bonds on January 2, 2001. The entry to record this transaction is as follows:

January 2, 2001

Cash Dr 1,000,000 Bonds Payable Cr 1,000,000 A fixed interest rate was offered to appeal to investors, but Jones is concerned that if market interest rates decline, the fair value of the liability will increase and the company will suffer an economic loss. To protect against the risk of loss, Jones decides to hedge the risk of a decline in interest rates by entering into a 5-year interest rate swap contract. The terms of the swap contract to Jones are: Jones will receive fixed payments at 8% (based on the $1,000,000 amount). Jones will pay variable rates, based on the market rate in effect throughout the life of the swap contract. The variable rate at the inception of the contract is 6.8%. The settlement dates for the swap correspond to the interest payment dates on the debt (December 31). On each interest payment (settlement date), Jones and the counterparty will compute the difference between current market interest rates and the fixed rate of 8% and determine the value of the swap.17 As a result, if interest rates decline, the value of the swap contract to Jones increases (Jones has a gain), while at the same

time Joness fixed-rate debt obligation increases (Jones has an economic loss). The swap is an effective risk management tool in this setting because its value is related to the same underlying (interest rates) that will affect the value of the fixed-rate bond payable. Thus, if the value of the swap goes up, it offsets the loss related to the debt obligation. Assuming that the swap was entered into on January 2, 2001 (the same date as the issuance of the debt), the swap at this time has no value; therefore no entry is necessary:

January 2, 2001

No entry requiredMemorandum to note that the swap contract is signed. At the end of 2001, the interest payment on the bonds is made. The journal entry to record this transaction is as follows:

December 31, 2001

Interest Expense Dr 80,000 Cash (8% 3 $1,000,000) Cr 80,000 At the end of 2001, market interest rates have declined substantially and therefore the value of the swap contract has increased. Recall (see Illustration 26-6) that in the swap, Jones is to receive a fixed rate of 8% or $80,000 ($1,000,000 3 8%) and pay a variable rate (which in this case is 6.8%) or $68,000. Jones therefore receives $12,000 ($80,000 2 $68,000) as a settlement payment on the swap contract on the first interest payment date. The entry to record this transaction is as follows:

December 31, 2001

Cash Dr12,000 Interest Expense Cr 12,000 In addition, a market appraisal indicates that the value of the interest rate swap has increased $40,000. This increase in value is recorded as follows:18

December 31, 2001

Swap Contract Dr 40,000 Unrealized Holding Gain or LossIncome Cr 40,000 This swap contract is reported in the balance sheet, and the gain on the hedging transaction is reported in the income statement. Because interest rates have declined, the company records a loss and a related increase in its liability as follows:

December 31, 2001

Unrealized Holding Gain or LossIncome Dr 40,000 Bonds Payable Cr 40,000.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Treasury BillsDocument35 pagesTreasury BillsChristine HowellPas encore d'évaluation

- Swing Trading CalculatorDocument22 pagesSwing Trading CalculatoriPakistan100% (3)

- Volume and Divergence by Gail MerceDocument7 pagesVolume and Divergence by Gail MerceCryptoFX80% (5)

- Test Bank For Fundamentals of Corporate Finance 9th Edition Richard Brealey Stewart Myers Alan MarcusDocument47 pagesTest Bank For Fundamentals of Corporate Finance 9th Edition Richard Brealey Stewart Myers Alan Marcusdouglaskleinkzfmjoxsqg100% (19)

- Financial Analysis of Apple Inc.Document12 pagesFinancial Analysis of Apple Inc.David RiveraPas encore d'évaluation

- Finance Dossier FinalDocument90 pagesFinance Dossier FinalHarsh GandhiPas encore d'évaluation

- A Comparative Study On FINANCIAL PERFORMANCE OF NEPAL BANGLADESH BANK LIMITED AND HIMALAYAN BANK LIMITEDDocument35 pagesA Comparative Study On FINANCIAL PERFORMANCE OF NEPAL BANGLADESH BANK LIMITED AND HIMALAYAN BANK LIMITEDhimalayaban76% (55)

- Silabus PA 2 2015 2016Document4 pagesSilabus PA 2 2015 2016AngelaMonalisaKurniawanPas encore d'évaluation

- Essay On Market EfficiencyDocument2 pagesEssay On Market EfficiencyKimkhorn LongPas encore d'évaluation

- Accounts InternalDocument6 pagesAccounts Internalaarav balujaPas encore d'évaluation

- R Sundar's Shareholdings and Portfolio As On June 30, 2022Document13 pagesR Sundar's Shareholdings and Portfolio As On June 30, 2022karunamoorthi KarunaPas encore d'évaluation

- 2013 Market in ReviewDocument14 pages2013 Market in Reviewg_nasonPas encore d'évaluation

- Acct 2001 Chapter 1 Student LectureDocument38 pagesAcct 2001 Chapter 1 Student LectureJosephPas encore d'évaluation

- Practice Problems 155Document5 pagesPractice Problems 155leylaPas encore d'évaluation

- Do Read This Note, Prior To Starting The Finance & Banking Fundamentals Masterclass ProgramDocument14 pagesDo Read This Note, Prior To Starting The Finance & Banking Fundamentals Masterclass ProgramShivani NaiduPas encore d'évaluation

- Revised 2024 Accounting Assessment Dates - Grade 10-12Document3 pagesRevised 2024 Accounting Assessment Dates - Grade 10-12maziwisalianPas encore d'évaluation

- What Is PN 17Document2 pagesWhat Is PN 17hazrenhashim89Pas encore d'évaluation

- Measuring and Managing Accounting ExposureDocument10 pagesMeasuring and Managing Accounting ExposureSuryakant KaushikPas encore d'évaluation

- Accounting Basics 3Document1 pageAccounting Basics 3Ludwig DieterPas encore d'évaluation

- Reliance Industries RELI BO Unique Energy Transition Story BuyDocument22 pagesReliance Industries RELI BO Unique Energy Transition Story Buynaman makkarPas encore d'évaluation

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenPas encore d'évaluation

- Corporate Finance - KS KimDocument5 pagesCorporate Finance - KS Kim01202750693Pas encore d'évaluation

- Case Study - Assessing A Firms Future Financial HealthDocument1 pageCase Study - Assessing A Firms Future Financial Healthveda20100% (2)

- Axis Asset Management Company LimitedDocument73 pagesAxis Asset Management Company LimitedMohammad MushtaqPas encore d'évaluation

- Havard Management Company - CASEDocument3 pagesHavard Management Company - CASERandhir KumarPas encore d'évaluation

- FSA - Tutorial 6-Fall 2021Document5 pagesFSA - Tutorial 6-Fall 2021Ging freexPas encore d'évaluation

- Test Bank Ch. 8 Developing New Product-1Document5 pagesTest Bank Ch. 8 Developing New Product-1Hạ XuânPas encore d'évaluation

- The IB Business of EquitiesDocument79 pagesThe IB Business of EquitiesNgọc Phan Thị BíchPas encore d'évaluation

- Chap001 Test Bank For Managerial Accounting, 12th EditionDocument18 pagesChap001 Test Bank For Managerial Accounting, 12th EditionlunaPas encore d'évaluation

- Annual Results 2022 Presentation To Investors and AnalystsDocument67 pagesAnnual Results 2022 Presentation To Investors and AnalystsGaurav KalaPas encore d'évaluation