Académique Documents

Professionnel Documents

Culture Documents

All India Shri Shivaji Memorial Society's Institute of Management Question Bank 302 Management Control Systems

Transféré par

Aadeel NooraniDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

All India Shri Shivaji Memorial Society's Institute of Management Question Bank 302 Management Control Systems

Transféré par

Aadeel NooraniDroits d'auteur :

Formats disponibles

All India Shri Shivaji Memorial Societys Institute of Management Question Bank 302 Management Control Systems

1. Explain the characteristics of Management Control Systems in detail and discuss how evolution of Control System takes place in an organization? 2. Explain with diagram the Cybernetic paradigm of the control process as proposed by Griessinger. Explain the difference between factual premises and value premises and how the gap between them can be reduced by managers Behavioral Repertoire. 3. Control is the central function in any organization. Do you agree with this statement? Comment in the light of role and utility of control function. 4. Explain the concept strategy. Also explain how BCG Matrix and GE Planning models help in Business Unit level strategy formulation. 5. What do you understand by Goal Congruence? Give examples and explain problem of Goal congruence faced by multidivisional companies at different levels. 6. Describe various types of responsibility centers by giving relevant examples. 7. Explain and compare ROI & EVA as methods of performance measurement in an investment center. Explain with examples how ROI can help in making accept or reject decision regarding investment. 8. What are the features, advantages & disadvantages of a profit center? 9. Distinguish between Engineered Expense Center and Discretionary Expense Center with respect to the following points. Give suitable examples. a) b) c) d) Budget preparation Cost Variability Type of Financial Control Performance Measurement

10. What is budget? Explain the types of budget and the importance of budgetary control system as a tool for Management Control.

11. Explain the traditional and discounting methods of capital budgeting. 12. Describe the concept and different methods of Transfer Pricing. 13. Balance score card started as a performance measurement system but has ended up as a full fledged management control system. Explain with suitable examples. 14. Explain audit function as a control tool covering Financial Audit, Internal Audit, Cost Audit & Management Audit. Give suitable examples. 15. What are the differences in the nature of control in service industry and manufacturing industry? Explain management control system applied in insurance companies. 16. Write short notes on a) b) c) d) Zero Based Budget Strategic Planning & Management Control Value Chain Performance Evaluation

17. Division A of a large divisionalized organization manufactures a single standardized product. Some of the output is sold externally whilst the remainder is transferred to Division B where it is a subassembly in the manufacture of that divisions product. The unit cost of Division As product are as follows: Rs. Direct material Direct labour Direct expenses Variable manufacturing overheads Fixed manufacturing overheads Selling and packing expense variable 4 2 2 2 4 1 15 Annually 10000 units of the product are sold externally at the standard price of Rs.30. In addition to the external sales, 5000 units are transferred annually to Division B at an internal transfer charge of Rs.29 per unit. This transfer price is obtained by deducting variable selling and packing expense from the external price since this expense is not incurred for internal transfers.

Division B incorporates the transferred-in goods into a more advanced product. The unit costs of this product are as follows. Rs. Transferred-in item (from Division A) Direct material and components Direct labour Variable overheads Fixed overheads Selling and packing expense variable 29 23 3 12 12 1 80 Division Bs manager disagrees with the basis used to set the transfer price. He argues that the transfers should be made at variable cost plus an agreed (minimal) mark-up since he claimed that division is taking output that Division A would be unable to sell at the price of Rs. 30. Customer demand at various selling prices: Division A Selling price Demand Division B Selling price Demand Rs.80 7200 Rs.90 5000 Rs.100 2800 Rs.20 15000 Rs. 30 10000 Rs.40 5000

The manager of Division B claims that this study supports his case. He suggests that a transfer price of Rs.12 would give Division A a reasonable contribution to its fixed overheads while allowing Division B to earn a reasonable profit. He also believed that it would lead to an increase of output and an improvement in the overall level of company profits. You are required: a) to calculate the effect hat the transfer pricing system has had on the companys profits, and

b) to establish the likely effect on profit of the suggestion by the manager of Division B of a transfer price of Rs.12. 18. Fastner International Ltd. is having production shops reckoned as profit centers. Each shop is allowed to charge other shops for materials supplied and services rendered. The shops are motivated through goal congruence, autonomy and management efforts. The company is having a welding shop as well as a painting shop. The welding shop welds annually 72,000 purchased items with other 1,56,000 shop made parts in to 12,000 assemblies. Total cost of this assembly for the welding shop works out to Rs. 24,000 p.a. for this level of operations. Out of the total production, 80% is diverted to painting shop at the same price i.e. Rs. 12 per assembly and remaining sold in the market. The printing shops cost of painting including transfer price from welding shop comes to Rs. 20 each. Painting shop sells all the assemblies duly painted at a price of Rs. 25 each. Painting shops fixed costs are Rs. 30,000 p.a. The manager of the welding shop has ascertained from the market that of late demand for the welded (unpainted) assembly has increased substantially and this situation is expected to continue for another 6 to 8 months. This has resulted I an increase in the market price from present Rs. 12 each to Rs. 14 each. He, therefore, proposes to increase the transfer price for supplies to painting shop. Manager of the painting shop refuses to accept the new transfer price of Rs. 14 each on the ground that his profitability will be adversely affected. Welding shop manager, therefore, proposes that, since supplying assemblies to painting shop at existing transfer price he is loosing Rs. 2 per assembly he should at least be allowed to sell in the external market extra quantity of 20% of his total present production in order to partially compensate him for the loss. He is then prepared to continue with the present transfer price for the balance quantity of painted assemblies to the extent of only the quantities received from welding shop.

Will this proposal benefit him? What will be the effect of it on the profitability of the painting shop as well as the total company? Justify your answer with appropriate and detailed calculations.

19. Explain Formal and Informal Management Control Systems with the help of following subsystems. a) Infrastructure. b) Management Style and culture. c) Rewards. d) Coordination and integration; e) Control Process. 20. Zenith Ltd. Uses ROI to measure the performance of its operating divisions. A summary of annual reports from two divisions is shown below; the companys cost is 12 percent. Division A Division B Capital Invested Rs. 2,40,000 Rs.4,00,000 Net Profit Rs. 48,000 Rs. 72,000 ROI 20% 18% 1. 2. 3. 4. What performance measurement procedure involving cost of capital would more clearly show the profitability of the divisions? Show numerically the result Compare merits and demerits of such a performance measurement system with ROI At what cost of capital both divisions be considered equally profitable as per method in Q.1. Suppose the manager of Division A were offered a one year project that would increase the investment base by Rs.1,00,000 and show an additional profit of Rs. 15,000, would the manager accepts this project if he were evaluated . a) On his divisional ROI? b) On the method involving cost of capital as in Q.1? Give reasons for your answer.

Vous aimerez peut-être aussi

- Cost Accounting Question BankDocument6 pagesCost Accounting Question BankAnkit Goswami100% (1)

- Marginal Costing Problems SolvedDocument29 pagesMarginal Costing Problems SolvedUdaya ChoudaryPas encore d'évaluation

- P2 RevisionDocument16 pagesP2 RevisionfirefxyPas encore d'évaluation

- Bba Iii CmaDocument4 pagesBba Iii Cmaarun8134Pas encore d'évaluation

- Revison Class StudentDocument11 pagesRevison Class StudentÁi Mỹ DuyênPas encore d'évaluation

- HW 2.2 Afm SendDocument10 pagesHW 2.2 Afm SendAbiodun OlokodanaPas encore d'évaluation

- FM 02Document3 pagesFM 02Sudhan RPas encore d'évaluation

- Cost Management Problems CA FinalDocument131 pagesCost Management Problems CA Finalmj192100% (1)

- Managerial AccountingDocument1 pageManagerial Accountingacuna.alexPas encore d'évaluation

- Mas AssessmentDocument7 pagesMas AssessmentLuna VPas encore d'évaluation

- Cost AssignmentDocument4 pagesCost AssignmentSYED MUHAMMAD MOOSA RAZAPas encore d'évaluation

- Cost Management PaperDocument8 pagesCost Management PaperHashan DasanayakaPas encore d'évaluation

- MASDocument6 pagesMASIyang LopezPas encore d'évaluation

- PGDM 2012-2014 ONLINE QUIZ Divisions A, B & C Domes 1, 2 & 3 Course Name: Management AccountingDocument5 pagesPGDM 2012-2014 ONLINE QUIZ Divisions A, B & C Domes 1, 2 & 3 Course Name: Management AccountingGouthaman VBPas encore d'évaluation

- Quiz 1 Stratcost F Edited 1Document4 pagesQuiz 1 Stratcost F Edited 1Aeron Arroyo IIPas encore d'évaluation

- Ma 6Document32 pagesMa 6Tausif Narmawala0% (1)

- Cost Accounting Chapter 1 Practice Test and Essay QuestionsDocument5 pagesCost Accounting Chapter 1 Practice Test and Essay QuestionsLorren K GonzalesPas encore d'évaluation

- Intermediate Group II Test Papers (Revised July 2009)Document55 pagesIntermediate Group II Test Papers (Revised July 2009)Sumit AroraPas encore d'évaluation

- CVP EmbaDocument3 pagesCVP EmbaRajibPas encore d'évaluation

- Business Accounting FinalDocument12 pagesBusiness Accounting FinalNikesh Munankarmi100% (1)

- 00 Theories Final Exam To Be PrintedDocument4 pages00 Theories Final Exam To Be PrintedPillos Jr., ElimarPas encore d'évaluation

- Problems On Transfer PricingDocument4 pagesProblems On Transfer Pricingdjgavli11210Pas encore d'évaluation

- COMA Test 1Document3 pagesCOMA Test 1test twotestPas encore d'évaluation

- CUACM 413 Tutorial QuestionsDocument31 pagesCUACM 413 Tutorial Questionstmash3017Pas encore d'évaluation

- Unit Five: Relevant Information and Decision MakingDocument39 pagesUnit Five: Relevant Information and Decision MakingEbsa AbdiPas encore d'évaluation

- MA End TermDocument11 pagesMA End TermShashank AgarwalaPas encore d'évaluation

- Bep ProblemsDocument5 pagesBep ProblemsvamsibuPas encore d'évaluation

- A141 Tutorial 7Document8 pagesA141 Tutorial 7CyrilraincreamPas encore d'évaluation

- Working Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadDocument26 pagesWorking Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadsajedulPas encore d'évaluation

- P2 Nov 2013 Question PaperDocument20 pagesP2 Nov 2013 Question PaperjoelvalentinorPas encore d'évaluation

- Marginal Costing and Break-Even AnalysisDocument6 pagesMarginal Costing and Break-Even AnalysisPrasanna SharmaPas encore d'évaluation

- Cost and Management AccountingDocument5 pagesCost and Management AccountingSolve AssignmentPas encore d'évaluation

- Break-Even Analysis: Calculating Key MetricsDocument6 pagesBreak-Even Analysis: Calculating Key MetricskantarubanPas encore d'évaluation

- MCS Practical For StudentsDocument10 pagesMCS Practical For StudentsrohitkoliPas encore d'évaluation

- How Management Accounting Information Is Useful For Gaya (Manager)Document12 pagesHow Management Accounting Information Is Useful For Gaya (Manager)Kausallyaa JaganathanPas encore d'évaluation

- Rs. Rs. RS.: Indian Metals & Ferro Alloys Limited Indian Metals & Ferro Alloys LimitedDocument8 pagesRs. Rs. RS.: Indian Metals & Ferro Alloys Limited Indian Metals & Ferro Alloys LimitedKUMAR ABHISHEKPas encore d'évaluation

- Assignment 2 Responsibility and Performance EvaluationDocument9 pagesAssignment 2 Responsibility and Performance EvaluationJuhai MacabalangPas encore d'évaluation

- Costing Test Book ProblemsDocument29 pagesCosting Test Book ProblemsSameer Krishna100% (1)

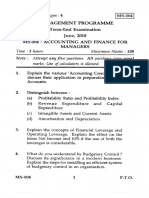

- Management Programme Term-End Examination: December, 2017 Ms-004: Accounting and Finance For ManagersDocument3 pagesManagement Programme Term-End Examination: December, 2017 Ms-004: Accounting and Finance For ManagersreliableplacementPas encore d'évaluation

- ADL 03 Accounting For Managers V3Document20 pagesADL 03 Accounting For Managers V3solvedcarePas encore d'évaluation

- Management Accounting ProblemsDocument14 pagesManagement Accounting ProblemsAnupam DePas encore d'évaluation

- Unit 8 Absorption and Marginal Costing: ObjectivesDocument25 pagesUnit 8 Absorption and Marginal Costing: ObjectivesSanket_Mavlank_1218Pas encore d'évaluation

- Time: 3 Hours Maximum Marks: 100 Note: Attempt Any Five Questions. All Questions Carry Equal Marks. Use of Calculators Is AllowedDocument4 pagesTime: 3 Hours Maximum Marks: 100 Note: Attempt Any Five Questions. All Questions Carry Equal Marks. Use of Calculators Is AllowedashishvasekarPas encore d'évaluation

- 2 ACFN 623 Advanced Cost and Management Accounting Assignment 2Document7 pages2 ACFN 623 Advanced Cost and Management Accounting Assignment 2Ali MohammedPas encore d'évaluation

- Cost Accounting RTP CAP-II June 2016Document31 pagesCost Accounting RTP CAP-II June 2016Artha sarokarPas encore d'évaluation

- 2.problems On Transfer Pricing-From CMA Study NoteDocument4 pages2.problems On Transfer Pricing-From CMA Study Notedjgavli11210100% (1)

- MGT402 Cost and Management Accounting 2010 Final Term Solved With Ref - 1Document10 pagesMGT402 Cost and Management Accounting 2010 Final Term Solved With Ref - 1mc100202172 Ferhan Ahmed SiddiquePas encore d'évaluation

- Cost and Management Accounting QuestionsDocument13 pagesCost and Management Accounting QuestionsSandeepSinghPas encore d'évaluation

- BComDocument3 pagesBComChristy jamesPas encore d'évaluation

- Managerial Accounting Chapter 8 CVP AnalysisDocument4 pagesManagerial Accounting Chapter 8 CVP AnalysisZia Uddin0% (1)

- Cost Accounting MCQ - S For End TermDocument9 pagesCost Accounting MCQ - S For End TermPRASANNA100% (1)

- Elements of Cost Variable Cost Portion Fixed CostDocument65 pagesElements of Cost Variable Cost Portion Fixed CostDipen AdhikariPas encore d'évaluation

- Mg2451 Eeca Questions and AnswersDocument11 pagesMg2451 Eeca Questions and Answerskarthiksubramanian94Pas encore d'évaluation

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChPas encore d'évaluation

- Objectives of Cost-Volume-Profit AnalysisDocument7 pagesObjectives of Cost-Volume-Profit AnalysisAnonPas encore d'évaluation

- Responsibility AccountingDocument3 pagesResponsibility AccountingGemine Ailna Panganiban NuevoPas encore d'évaluation

- Remodelers Cost of Doing Business Study, 2023 EditionD'EverandRemodelers Cost of Doing Business Study, 2023 EditionPas encore d'évaluation

- The Secrets of Successful Strategic Account Management: How Industrial Sales Organizations Can Boost Revenue Growth and Profitability, Prevent Revenue Loss, and Convert Customers to Valued PartnersD'EverandThe Secrets of Successful Strategic Account Management: How Industrial Sales Organizations Can Boost Revenue Growth and Profitability, Prevent Revenue Loss, and Convert Customers to Valued PartnersPas encore d'évaluation

- Recent Employment Trends in India and China: An Unfortunate ConvergenceDocument37 pagesRecent Employment Trends in India and China: An Unfortunate ConvergenceAadeel NooraniPas encore d'évaluation

- Owncloud ManualDocument14 pagesOwncloud ManualAadeel NooraniPas encore d'évaluation

- QBDocument34 pagesQBAadeel NooraniPas encore d'évaluation

- Exploring the Technology Behind Sixth Sense WearablesDocument15 pagesExploring the Technology Behind Sixth Sense WearablesAadeel NooraniPas encore d'évaluation

- Organizational Transformations: Population Ecology TheoryDocument25 pagesOrganizational Transformations: Population Ecology TheoryTurki Jarallah100% (2)

- Choosing the Right Organizational Pattern for Your SpeechDocument19 pagesChoosing the Right Organizational Pattern for Your SpeechKyle RicardoPas encore d'évaluation

- Old Testament Books Bingo CardsDocument9 pagesOld Testament Books Bingo CardsSiagona LeblancPas encore d'évaluation

- Tarea 1Document36 pagesTarea 1LUIS RVPas encore d'évaluation

- History I.M.PeiDocument26 pagesHistory I.M.PeiVedasri RachaPas encore d'évaluation

- CHILD WIFE FinalDocument9 pagesCHILD WIFE FinalProcurement WVMC100% (1)

- List of MeriendasDocument17 pagesList of MeriendasKristoffer OgalinoPas encore d'évaluation

- Joey Cena 2Document1 pageJoey Cena 2api-635313033Pas encore d'évaluation

- Tthe Sacrament of Reconciliation1Document47 pagesTthe Sacrament of Reconciliation1Rev. Fr. Jessie Somosierra, Jr.Pas encore d'évaluation

- HAF F16 ManualDocument513 pagesHAF F16 Manualgreekm4dn3ss86% (7)

- Marketing Case Study - MM1 (EPGPX02, GROUP-06)Document5 pagesMarketing Case Study - MM1 (EPGPX02, GROUP-06)kaushal dhaparePas encore d'évaluation

- Sach Bai Tap Tieng Anh8 - Mai Lan HuongDocument157 pagesSach Bai Tap Tieng Anh8 - Mai Lan Huongvothithao19750% (1)

- AMSY-6 OpManDocument149 pagesAMSY-6 OpManFernando Piñal MoctezumaPas encore d'évaluation

- Guidance for Processing SushiDocument24 pagesGuidance for Processing SushigsyaoPas encore d'évaluation

- BiOWiSH Crop OverviewDocument2 pagesBiOWiSH Crop OverviewBrian MassaPas encore d'évaluation

- Nursing ManagementDocument14 pagesNursing ManagementNolan Ivan EudinPas encore d'évaluation

- Integrating Force - Com With MicrosoftDocument11 pagesIntegrating Force - Com With MicrosoftSurajAluruPas encore d'évaluation

- MHRP Player SheetDocument1 pageMHRP Player SheetFelipe CaldeiraPas encore d'évaluation

- NUC BIOS Update Readme PDFDocument3 pagesNUC BIOS Update Readme PDFSuny Zany Anzha MayaPas encore d'évaluation

- Anti Viral DrugsDocument6 pagesAnti Viral DrugskakuPas encore d'évaluation

- Doctrine of Double EffectDocument69 pagesDoctrine of Double Effectcharu555Pas encore d'évaluation

- PDFDocument72 pagesPDFGCMediaPas encore d'évaluation

- VB6 ControlDocument4 pagesVB6 Controlahouba100% (1)

- Alice Corporation Pty. Ltd. v. CLS Bank International and CLS Services Ltd.Document4 pagesAlice Corporation Pty. Ltd. v. CLS Bank International and CLS Services Ltd.Rachel PaulosePas encore d'évaluation

- F77 - Service ManualDocument120 pagesF77 - Service ManualStas MPas encore d'évaluation

- 1603 Physics Paper With Ans Sol EveningDocument8 pages1603 Physics Paper With Ans Sol EveningRahul RaiPas encore d'évaluation

- Chapter 2 Phil. HistoryDocument4 pagesChapter 2 Phil. HistoryJaylene AlbayPas encore d'évaluation

- User Manual: Imagenet Lite™ SoftwareDocument93 pagesUser Manual: Imagenet Lite™ SoftwareDe Mohamed KaraPas encore d'évaluation

- The Dynamic Law of ProsperityDocument1 pageThe Dynamic Law of Prosperitypapayasmin75% (4)

- JNVD Souvenir FinalDocument67 pagesJNVD Souvenir Finalkundanno1100% (1)