Académique Documents

Professionnel Documents

Culture Documents

Week 4 Wida

Transféré par

Eurosol GrupoDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Week 4 Wida

Transféré par

Eurosol GrupoDroits d'auteur :

Formats disponibles

Lecture 4

contract analysis

Recap Lecture 3 - Equty Finance vs Debt Finance - Bretton Woods Institutions (BWI) - What are BWIs? - What is the world bank doing? - What is the difference between the IBRD and the IMF? - What are the typical actors in a hydro-electro dam project? This lecture outline - Sources of law o Investment Law o Contract Law - (Legal Actors) - (Legal Instruments) - Main clauses - Case study: Chad IMF interacts with - National governments - World bank - Private sector o Investors - Civil society o NGOs Contract analysis | sources of law - Public rule setting o International => international investment law [see reader] o Regional => regional investment law o National => national investment law = often regular private law - Private rule setting o [Contract law] o Contract drafting

Contract analysis | ex ante and ex post - Ex ante: when in the process of drafting the contract - Ex post: there already is a contract

Contract analysis | main clauses - Parties o What are the parties to the contract? o Most of the time 2 parties to a contract, find them in the first page of the contract - Considerations o Where is it all about? Is it for example a loan agreement? Look at the whereas this is where the considerations-part starts - Main obligations o In article 1, 2 and 3 - Term & Termination o What are the reasons to terminate the contract? o Accuracy in FD = accounting - Applicable law & Dispute settlement o For eample arbitration (ex post dispute settlement) o Judges of governmental court should declare themselves not competent when we have an arbitration clause o Enforcement is regulated nationally Mechanism of arbitration: - Claim - Refuse (+counterclaim) - Review evidence - Hearing - Arbitrators make an award/judgment

Case study: Chad PARTIES

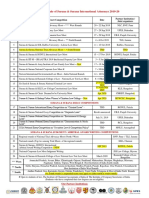

CHAD PROJECT REVENUE PLAN

FINANCES 1

FINANCES 2

General conditions from the IBRD

Case study: India - Parties: Guarantor + Bank=lendor o Borrower? (Powergrid Corporation of India Ltd.) - Considerations - Main obligations o Primary obligor vs. surety o Payment of principal + interest - Time arrangements - Default arrangements - Dispute Settlement Arbitration - Alternative Dispute Settlement (Quarter-5) vs. Governmental Adjudication - Goal: ex post dispute settlement via judgment or award - Basis: party choice + contract clauses + applicable law [Quarter-5] (or ex equo et bono) - Mechanism: procedure like all litigation o Claim o Defense (+Counter claim) o Review evidence o Hearing o Judgment - Enforcement (Treaty New York 1958)

Case Tanzania - Parties - Considerations - Main obligations - Time arrangements - Default arrangements - Dispute settlement Case Egypt - Parties - Considerations - Main obligations - Time arrangements - Default arrangements - Dispute settlement Exam tips - Understand what a loan agreement is - Understand what a guarantee agreement is - Able to identify the story in contract and/or judgments Workshop 4 What is a loan agreement? Loan is money or goods given to someone with the intention/aim of being returned later. What is the purpose of these loans? You borrow money to break the vicious circle and because you have a lack of capital. The interests of the lender are to receive money+interest. What is a sales agreement? The act of exchange of money for goods/services. What are the risks of having a loan agreement and what solution might be used to obtain the money back? The risk is default situation (the money cannot be returned from the recipient to the financer). As a solution might be used expropriation (e.g. mortgage of a real estate). Another option is the establishment of a guarantee, which is a promise of a third party to pay the debt on behalf of the other debtor. If the original debtor does not pay, then the original creditor requests the money from the guarantor (an example of a guarantee is the European Fund, from which money is withdrawn in case of a crisis). How is this risk dealt with? Guarantors - If you dont pay the money back (in time) no loans in the future for you anymore

Guarantees: a promise of a 3rd party on behalf of the other party (guarantor)

If a company from the developed countries (in the role of an investor) is dealing with situations in the developing countries, they are guaranteed by a guarantor (such as the Breton Woods institutions) that the investment will be returned. However, the guarantor might also request the money from the debtor in a period of time. If the original debtor does not pay, the creditor knocks on the door of the guarantors. Then the guarantor will step in the shoes of the creditor. States + BWI = guarantor. What is the time-limit for requesting the guarantee? - If the debtor repays the periodical payment, there is no default and the guarantor has no role. - In case that there is default, the money is requested by the guarantor. Why would you want to be a guarantor? - Development - Just 1 signatore would get them more FDI (more airports, harbors etc.)

Who are the 4 acotrs in a bilateral investment treaty? - 2 states - Operating company (building x, owns the dam) - Foreign direct investors In a bilateral investment treaty the parties are two States. Some clauses that are included in it are setting the conditions between the two countries, facilitating the role of a company that is a corporate citizen in the one State to a company that is a corporate citizen of the other State. The role of a bilateral investment treat is to 1) welcome the investors (giving favorable treatment); 2) lay down the conditions for expropriation (without compensation). Maltreatments and issues against investors o By Legislative branch: making laws against the import of some goods/making laws unfavorable for the investor/discrimination against foreign investors o By Executive branch: bans on the import of some goods/not enforcing laws o Adjudicative branch: unfair judgments The two parties are the people who are going to make the project and the company, operating the building process unless the State is a contract party (then the parties to the project are only two).

Bilateral Investment Treaty - NOT the same as a loan agreement - General rule between 2 states concerning investment - Opens the door: invites investors/investors are welcome - Investors do not like expropriateion, therefore the BIT covers them against this - Access to arbitration - Protection against maltreatment (see page 32)

Vous aimerez peut-être aussi

- 6 Full Law Notes Foundation by JKSCDocument158 pages6 Full Law Notes Foundation by JKSCHimanshu RayPas encore d'évaluation

- Intent Letters & TermsDocument36 pagesIntent Letters & TermsperoorPas encore d'évaluation

- Debt Markets Black Book RevisedDocument63 pagesDebt Markets Black Book RevisedPrasad Naik100% (1)

- Law and Practice of International FinanceDocument9 pagesLaw and Practice of International FinanceCarlos Belando PastorPas encore d'évaluation

- Contract LawDocument44 pagesContract LawAkshay PrakashPas encore d'évaluation

- Loan Agreement Representations and WarrantiesDocument14 pagesLoan Agreement Representations and WarrantiesLinming HoPas encore d'évaluation

- Raising Money – Legally: A Practical Guide to Raising CapitalD'EverandRaising Money – Legally: A Practical Guide to Raising CapitalÉvaluation : 4 sur 5 étoiles4/5 (1)

- Contract RulesDocument7 pagesContract Rulescolin87900% (1)

- Report Promissory NoteDocument4 pagesReport Promissory NoteSaiyidah syafiqahPas encore d'évaluation

- Notes.-Legal Systems. - IIPM. - MBA. & LCP FormDocument17 pagesNotes.-Legal Systems. - IIPM. - MBA. & LCP FormamitkaraliaPas encore d'évaluation

- CD and Promisory NoteDocument18 pagesCD and Promisory NoteChar LenePas encore d'évaluation

- Labor Relations NotesDocument33 pagesLabor Relations NotesGeraldine B. MasiglatPas encore d'évaluation

- Credit Transactions UM TSN 2015Document42 pagesCredit Transactions UM TSN 2015Master GanPas encore d'évaluation

- 186) Estrada V DesiertoDocument3 pages186) Estrada V DesiertoMav EstebanPas encore d'évaluation

- Inveraray Jail - Prisoner RecordsDocument95 pagesInveraray Jail - Prisoner RecordsKintyre On Record71% (7)

- Filipino Grievances Against Governor WoodDocument4 pagesFilipino Grievances Against Governor WoodAlthea Mae Paclibar100% (5)

- Case Digest NIL - Without Rigor YetDocument3 pagesCase Digest NIL - Without Rigor YetKik EtcPas encore d'évaluation

- Legal Aspect of FranchisingDocument6 pagesLegal Aspect of FranchisingIannie May ManlogonPas encore d'évaluation

- Contracts General Provisions: Coverage of DiscussionsDocument19 pagesContracts General Provisions: Coverage of DiscussionsAmie Jane MirandaPas encore d'évaluation

- PCI Leasing Vs GiraffeDocument1 pagePCI Leasing Vs GiraffeAddy Guinal100% (3)

- Chapter One. ROBBERY: Against or Intimidation of Persons, Even If The Robbery Was Committed in A Dwelling HouseDocument30 pagesChapter One. ROBBERY: Against or Intimidation of Persons, Even If The Robbery Was Committed in A Dwelling Housemichelle jane reyesPas encore d'évaluation

- Evangelista Vs Abad Santos 51 Scra 416 Case DigestDocument2 pagesEvangelista Vs Abad Santos 51 Scra 416 Case DigestKate Snchz100% (2)

- The 1987 Philippine Constitution Article VDocument14 pagesThe 1987 Philippine Constitution Article VJosietry Pitogo100% (1)

- 204 ContractsDocument48 pages204 Contractse_rollsPas encore d'évaluation

- 11 Managing Payment Risks On International Construction ProjectsDocument7 pages11 Managing Payment Risks On International Construction ProjectsFadi BoustanyPas encore d'évaluation

- Anatomy of A Bond Issue: The Participants and The StepsDocument6 pagesAnatomy of A Bond Issue: The Participants and The Stepsshobu_iujPas encore d'évaluation

- Business Law (Banking)Document9 pagesBusiness Law (Banking)Rosarinho Arruda MoreiraPas encore d'évaluation

- Law Exam Study LadDocument10 pagesLaw Exam Study LadNayeem AfridiPas encore d'évaluation

- Class 1 Notes 06062022Document4 pagesClass 1 Notes 06062022Munyangoga BonaventurePas encore d'évaluation

- Confer 08 NDocument6 pagesConfer 08 Nniraj kumarPas encore d'évaluation

- Bussiness LawsDocument28 pagesBussiness LawsSAVIPas encore d'évaluation

- Law-of-Contract مترجمDocument15 pagesLaw-of-Contract مترجمiafrican64Pas encore d'évaluation

- Damages in Law of ContractDocument14 pagesDamages in Law of ContractPragalbh BhardwajPas encore d'évaluation

- Pháp luật đại cương - Business Law - noteDocument37 pagesPháp luật đại cương - Business Law - noteK60 Nguyễn Minh NgọcPas encore d'évaluation

- Damodarm Sanjivayya National Law - LOC IIDocument17 pagesDamodarm Sanjivayya National Law - LOC IIMugdha TomarPas encore d'évaluation

- 2122 Con lg01 Ce01 Student GuideDocument12 pages2122 Con lg01 Ce01 Student Guidehbird8963Pas encore d'évaluation

- 11.legal Aspects of AdvancesDocument27 pages11.legal Aspects of AdvancesavjosePas encore d'évaluation

- Business Law ContractsDocument10 pagesBusiness Law ContractsSabi HuddinPas encore d'évaluation

- Lecture On Int. RFBT Oblig. and ContractsDocument6 pagesLecture On Int. RFBT Oblig. and ContractsCereixa ZenePas encore d'évaluation

- Contract Law ApuntesDocument4 pagesContract Law ApuntesVerónica Rueda PuyanaPas encore d'évaluation

- 3 and 4 Matters To Consider Before Commencing Legal ProceedingsDocument23 pages3 and 4 Matters To Consider Before Commencing Legal Proceedingsapi-3803117Pas encore d'évaluation

- Civil Procedure Notes - Cha MendozaDocument20 pagesCivil Procedure Notes - Cha Mendozacmv mendozaPas encore d'évaluation

- Hired and Fired: National Law International Treaties Customary Law Private AutonomyDocument3 pagesHired and Fired: National Law International Treaties Customary Law Private AutonomyHazel Lopez GonzalesPas encore d'évaluation

- POL 319 Exam 1 PackageDocument23 pagesPOL 319 Exam 1 PackageNerdy Notes Inc.Pas encore d'évaluation

- Contract Law Chapter 8 NotesDocument6 pagesContract Law Chapter 8 NotesDavidPas encore d'évaluation

- Module 1Document5 pagesModule 1Justine Kaye PorcadillaPas encore d'évaluation

- Good-Faith SlidesDocument35 pagesGood-Faith SlidesZviagin & CoPas encore d'évaluation

- Cours 1 Business LawDocument10 pagesCours 1 Business Lawfajarrizwan94Pas encore d'évaluation

- Rom The Point of View of Transfer of Title To The Mortgaged PropertyDocument4 pagesRom The Point of View of Transfer of Title To The Mortgaged PropertyMonir HossainPas encore d'évaluation

- Bussiness LawsDocument22 pagesBussiness LawsSAVIPas encore d'évaluation

- Debt Finance: of Gwalia-Member With Civil Damages Claim - Unliquidated Sum. Should That Person Be AllowedDocument8 pagesDebt Finance: of Gwalia-Member With Civil Damages Claim - Unliquidated Sum. Should That Person Be AllowedtimtamPas encore d'évaluation

- Nguyễn Thị Phương - 20070304 - INS3022.04Document5 pagesNguyễn Thị Phương - 20070304 - INS3022.0420070304 Nguyễn Thị PhươngPas encore d'évaluation

- BLS 342 Final Exam Review GuideDocument7 pagesBLS 342 Final Exam Review GuideBill AmbrogioPas encore d'évaluation

- Week Three Student Guide: Contracts OBJECTIVE: Analyze The Elements Necessary To Form Valid ContractsDocument6 pagesWeek Three Student Guide: Contracts OBJECTIVE: Analyze The Elements Necessary To Form Valid ContractsBreanne NardecchiaPas encore d'évaluation

- Vietnam National University Hanoi: International SchoolDocument6 pagesVietnam National University Hanoi: International SchoolHương GiangPas encore d'évaluation

- Unit-1-The Indian Contract Act-1872Document44 pagesUnit-1-The Indian Contract Act-1872yamoka2001Pas encore d'évaluation

- Ins3022-Final Exam 6.2022Document6 pagesIns3022-Final Exam 6.2022Phạm Thúy AnPas encore d'évaluation

- Spring 2021 Final Exam Answers Anna AnchutinaDocument4 pagesSpring 2021 Final Exam Answers Anna AnchutinaAnna AnchutinaPas encore d'évaluation

- Contract Law Principles Slades 2023Document35 pagesContract Law Principles Slades 2023Andziso CairoPas encore d'évaluation

- Litigation and Enforcement in MalaysiaDocument27 pagesLitigation and Enforcement in MalaysiaAzam TrudinPas encore d'évaluation

- Law of Contract 1Document42 pagesLaw of Contract 1K venkataiahPas encore d'évaluation

- Study On Practical Usage of Contracts Ofindemnity in The Business Transactions and Its ImpactsDocument8 pagesStudy On Practical Usage of Contracts Ofindemnity in The Business Transactions and Its ImpactsCaptainLuffyPas encore d'évaluation

- Juridical Analysis of The Car Sale and Purchase AgreementDocument8 pagesJuridical Analysis of The Car Sale and Purchase Agreement191001016Pas encore d'évaluation

- BR QbankDocument50 pagesBR QbankDraxPas encore d'évaluation

- BU231 - Class 7Document2 pagesBU231 - Class 7Raj VohraPas encore d'évaluation

- What Are The Remedies For Breach of ContractDocument5 pagesWhat Are The Remedies For Breach of ContractsalalPas encore d'évaluation

- Law For BusinessDocument17 pagesLaw For BusinessԱվետիք ՀարությունյանPas encore d'évaluation

- Contract Lecture NotesDocument15 pagesContract Lecture NotesIsmail PatelPas encore d'évaluation

- Ans 1:-Brief Facts of The CaseDocument3 pagesAns 1:-Brief Facts of The CaseshubhanshuPas encore d'évaluation

- My Litigation and Enforcement in Malaysia Overview 2020Document26 pagesMy Litigation and Enforcement in Malaysia Overview 2020chuan keat tehPas encore d'évaluation

- MBA BA QuestionDocument4 pagesMBA BA QuestionSant KumarPas encore d'évaluation

- The Government of The Hong Kong Special Administrative RegionDocument8 pagesThe Government of The Hong Kong Special Administrative RegionDerek WongPas encore d'évaluation

- Banasthali VidyapeethDocument7 pagesBanasthali VidyapeethNisha PasariPas encore d'évaluation

- Chapter 2, Dispute Resolution Paradigm, Party Autonomy PDFDocument24 pagesChapter 2, Dispute Resolution Paradigm, Party Autonomy PDFDavison JosephPas encore d'évaluation

- Secret Trust Theories EssayDocument4 pagesSecret Trust Theories Essayshahmiran99Pas encore d'évaluation

- Opposition To The Motion - Prac Court IDocument4 pagesOpposition To The Motion - Prac Court IAngel DeiparinePas encore d'évaluation

- Prof S Gutto - Constitutionalism, Elections and Democracy in Africa Theory and PraxisDocument10 pagesProf S Gutto - Constitutionalism, Elections and Democracy in Africa Theory and Praxiszeropointwith100% (1)

- Formula Procedure of Roman Law - KocourekDocument20 pagesFormula Procedure of Roman Law - KocourekErenPas encore d'évaluation

- MGSD 3-07-18Document11 pagesMGSD 3-07-18Mindanao Gold Star DailyPas encore d'évaluation

- G. Ligtas vs. PeopleDocument40 pagesG. Ligtas vs. PeopleFD BalitaPas encore d'évaluation

- Academic Calender PDFDocument1 pageAcademic Calender PDFSuvedhya ReddyPas encore d'évaluation

- Midterms Notes - IpclDocument9 pagesMidterms Notes - IpclBlaise VEPas encore d'évaluation

- Franklin v. Michigan, State of - Document No. 2Document3 pagesFranklin v. Michigan, State of - Document No. 2Justia.comPas encore d'évaluation

- Bank of Philippine Islands v. CADocument2 pagesBank of Philippine Islands v. CARain HofileñaPas encore d'évaluation

- Complainant Vs Vs Respondent: en BancDocument8 pagesComplainant Vs Vs Respondent: en BancPaul Joshua Torda SubaPas encore d'évaluation

- Ational LAW University Odisha Cuttack: Topic: Law of MaintainanceDocument18 pagesAtional LAW University Odisha Cuttack: Topic: Law of Maintainancearsh singhPas encore d'évaluation

- Memorial For Claimant PDFDocument17 pagesMemorial For Claimant PDFAnamika VatsaPas encore d'évaluation

- Tammy E. Hampton v. William D. White, Individually As A Policeman With The City of Ridgeland Police Department, 46 F.3d 1124, 4th Cir. (1995)Document7 pagesTammy E. Hampton v. William D. White, Individually As A Policeman With The City of Ridgeland Police Department, 46 F.3d 1124, 4th Cir. (1995)Scribd Government DocsPas encore d'évaluation

- Aqa Law3 W MS Jun17Document17 pagesAqa Law3 W MS Jun17evansPas encore d'évaluation

- Case Digest 4 NATIONAL IRRIGATION ADMINISTRATION, Petitioner VS. CA and Dick Manglapus, RespondentDocument3 pagesCase Digest 4 NATIONAL IRRIGATION ADMINISTRATION, Petitioner VS. CA and Dick Manglapus, RespondentRomualdo CabanesasPas encore d'évaluation