Académique Documents

Professionnel Documents

Culture Documents

Recommendation: BUY: Dell Deserves A Closer Look

Transféré par

Mayukh MukherjeeDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Recommendation: BUY: Dell Deserves A Closer Look

Transféré par

Mayukh MukherjeeDroits d'auteur :

Formats disponibles

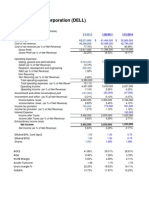

Dell deserves a closer look Recommendation: BUY

Fair Value Estimate: $13.50

Margin of Safety: $10 - $18 Date: November 8, 2012 The key drivers for a long-term stock appreciation are: > A very conservative intrinsic valuation points to a fair value that is at least 30% higher than the current market price. (See valuation grid at the bottom of this note) > Stock price and EPS have diverged as compared to its peers > Even as consumer segment of the business slides, Dell is making strides in enterprise solutions space Risks: > Market continues to punish Dell for poor performance in the consumer segment > Poor stock performance leads to a negative feedback loop > Acquisitions eat up profits, fail to deliver expected growth and/or synergies. Stock Performance: Over the last few years, DELL has been performing poorly relative to its peer group. If theres any solace its that HP has been worse off. Based on just stock performance, signs are not encouraging yet with a long-term view our outlook is that DELL has tremendous upside even if it manages to hold on to its current revenue base.

TOSYY:Toshiba HPQ:Hewlett Packard LNVGY:Lenovo AAPL:Apple

Current Price: $9.50

1-year performance

3-month performance

Business outlook and Management: Dell is an enterprise play, just like Microsoft and more investors need to adjust their expectations that an increasing share of revenues and profitability will be driven by its performance in the enterprise segment.

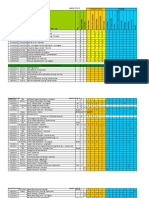

Relative measures DELL 5.53 HP NMF Toshiba 15.34 Lenovo 17.71 Apple 12.33 EMC 20.02

PE

Price/Book ROE ROA EV/EBITDA Total Debt/Equity Cash/share

1.63 33.45% 5.61% 2.56 86.68 6.86

0.85 15.60% 4.72% 3.29 93.04 4.85

1.43 7.62% 2.24% 5.93 129.03 3.07

3.98 23.08% 3.03% 5.96 1.67 7.29

4.43 42.84% 23.61% 8.47 0 30.52

2.38 13.67% 7.15% 9.47 7.48 2.59

These comparisons highlight the fact that Lenovo/Apple/EMC are expected to have higher growth while DELL,HP and Toshiba are cheaper because the market expects them to have low or no growth in the coming years.

Price versus EPS overlay

Dell

HP

EMC

DCF Valuation: Weve taken a rather pessimistic view of revenue growth over the next few years, assuming that DELL continues to lose revenues especially in the consumer segment. Yet the intrinsic value is well over the current

A similar DCF analysis for HP and EMC reveals fair values that are much closer to the current market price. In summary: DELL looks undervalued at it current price levels and looks like a good candidate to initiate a buy.

Additional reading: > New enterprise head Marius Haas talks about plans for the enterprise segment: http://allthingsd.com/20121019/seven-questions-for-dell-enterprise-head-mariushaas-and-software-head-john-swainson/ > Dell investor relations blog: http://en.community.dell.com/dell-blogs/dellshares/default.aspx

Vous aimerez peut-être aussi

- Magnetic Sponsoring by Mike DillardDocument116 pagesMagnetic Sponsoring by Mike DillardChristine Stevie Grey100% (10)

- Llanos de Juna Resort Project Feasibility Study (BSA-5A) 2014-2015Document208 pagesLlanos de Juna Resort Project Feasibility Study (BSA-5A) 2014-2015snsdean100% (1)

- LBO DELL Presentation Case StudyDocument20 pagesLBO DELL Presentation Case StudyJoseph TanPas encore d'évaluation

- The Art of Valuation - PPTX - HFACDocument17 pagesThe Art of Valuation - PPTX - HFACthevariantviewPas encore d'évaluation

- Dell Case - Narmin MammadovaDocument12 pagesDell Case - Narmin MammadovaNarmin J. Mamedova100% (1)

- Financial Management 1Document4 pagesFinancial Management 1Edith MartinPas encore d'évaluation

- DuPont PDFDocument5 pagesDuPont PDFMadhur100% (1)

- Financial Analysis - AppleDocument78 pagesFinancial Analysis - Appleclagurin010% (2)

- National Federation of Labor (NFL) v. EismaDocument2 pagesNational Federation of Labor (NFL) v. Eismaralph_atmosferaPas encore d'évaluation

- Final Micro Finance ReportDocument89 pagesFinal Micro Finance ReportNilabjo Kanti Paul50% (2)

- Relative Valuation: Price To Earnings RatioDocument5 pagesRelative Valuation: Price To Earnings Ratio10manbearpig01Pas encore d'évaluation

- Fa18 Epe 019 (GS 355)Document11 pagesFa18 Epe 019 (GS 355)Usman deoPas encore d'évaluation

- Financial Analysis Report For The DELL Corporation and HP1Document14 pagesFinancial Analysis Report For The DELL Corporation and HP1rizza_jamahari0% (1)

- Financial Analysis of Dell - Inc and HP CompaniesDocument29 pagesFinancial Analysis of Dell - Inc and HP CompaniesObaidullah R Siddiqui0% (2)

- Comparison From An Accounting Point of View Between Two Companies' RatiosDocument14 pagesComparison From An Accounting Point of View Between Two Companies' Ratioszbarcea99Pas encore d'évaluation

- Dell AnalysisDocument5 pagesDell AnalysisshamapantPas encore d'évaluation

- DELL and HPDocument22 pagesDELL and HPKaterina PetrovaPas encore d'évaluation

- Ratio Analysis: (Type The Document Subtitle)Document16 pagesRatio Analysis: (Type The Document Subtitle)Maliha JahanPas encore d'évaluation

- Article 2 Roe Breakd Dec 12 5pDocument5 pagesArticle 2 Roe Breakd Dec 12 5pRicardo Jáquez CortésPas encore d'évaluation

- Research Sample - IREDocument7 pagesResearch Sample - IREIndepResearchPas encore d'évaluation

- Exam 3 ReviewquestionsDocument8 pagesExam 3 ReviewquestionsMuhammad Hassan NaeemPas encore d'évaluation

- Investments: Analysis and Behavior: Chapter 11-Value Stock InvestingDocument26 pagesInvestments: Analysis and Behavior: Chapter 11-Value Stock InvestingShubham DanielPas encore d'évaluation

- Lessons From Apple For African EntrepreneursDocument5 pagesLessons From Apple For African EntrepreneursAdebayo AlongePas encore d'évaluation

- Ratio AnalysisDocument10 pagesRatio AnalysisSandesha Weerasinghe0% (1)

- Dell vs. HP Executive SummaryDocument1 pageDell vs. HP Executive Summaryuaintdown2Pas encore d'évaluation

- Results of OperationsDocument7 pagesResults of OperationsPeter PhanPas encore d'évaluation

- Ratio Analysis of Financial Statements of Hindustan Petroleum and Bharat Petroleum.Document37 pagesRatio Analysis of Financial Statements of Hindustan Petroleum and Bharat Petroleum.Kumar RitambharPas encore d'évaluation

- Chapter 4 - Analysis of Financial StatementsDocument50 pagesChapter 4 - Analysis of Financial Statementsnoor_maalik100% (1)

- BP Strong BuyDocument3 pagesBP Strong BuysinnlosPas encore d'évaluation

- Ratio Analysis ITCDocument15 pagesRatio Analysis ITCVivek MaheshwaryPas encore d'évaluation

- Bogdanka: Investment Story & RecommendationDocument4 pagesBogdanka: Investment Story & Recommendationp_barankiewiczPas encore d'évaluation

- Feedback On Questions For Week 2 of DellDocument8 pagesFeedback On Questions For Week 2 of Dellusernam11100% (1)

- Ratio AnalysisDocument14 pagesRatio AnalysissnsahuPas encore d'évaluation

- WK - 7 - Relative Valuation PDFDocument33 pagesWK - 7 - Relative Valuation PDFreginazhaPas encore d'évaluation

- Western Digital Financial AnalysisDocument9 pagesWestern Digital Financial AnalysisblockeisuPas encore d'évaluation

- GIT - Principles of Managerial Finance (13th Edition) - Cap.3 (Pág.85-90)Document8 pagesGIT - Principles of Managerial Finance (13th Edition) - Cap.3 (Pág.85-90)katebariPas encore d'évaluation

- Saurabh Farma Companies PrasnnaDocument39 pagesSaurabh Farma Companies Prasnnaprasanna deosarkarPas encore d'évaluation

- Reading 22 Market-Based Valuation - Price and Enterprise Value Multiples - AnswersDocument73 pagesReading 22 Market-Based Valuation - Price and Enterprise Value Multiples - Answerstristan.riolsPas encore d'évaluation

- Dell Computer Corporation: James HsuDocument37 pagesDell Computer Corporation: James HsuHoang HaPas encore d'évaluation

- Ratio AnalysisDocument11 pagesRatio Analysisdanita88Pas encore d'évaluation

- Chapter 17 - Fundamental Principles of Relative ValuationDocument3 pagesChapter 17 - Fundamental Principles of Relative ValuationAishwary GuptaPas encore d'évaluation

- An Analysis of The Financial Statement of Godrej India LTDDocument8 pagesAn Analysis of The Financial Statement of Godrej India LTDSachit MalikPas encore d'évaluation

- READING 9 Relative (Market) Based Equity ValuationDocument52 pagesREADING 9 Relative (Market) Based Equity ValuationDandyPas encore d'évaluation

- Allegiant Travel BUY: Market Edge ResearchDocument4 pagesAllegiant Travel BUY: Market Edge Researchchdn20Pas encore d'évaluation

- HBS Toolkit License AgreementDocument6 pagesHBS Toolkit License Agreementcool_gayathiriPas encore d'évaluation

- Integrated Case 4-26Document6 pagesIntegrated Case 4-26Cayden BrookePas encore d'évaluation

- Breaking Down ROE Using The DuPont FormulaDocument1 pageBreaking Down ROE Using The DuPont FormulakotisanampudiPas encore d'évaluation

- Quantitative AnalysisDocument2 pagesQuantitative Analysistom steelePas encore d'évaluation

- Debt Management RatiosDocument5 pagesDebt Management RatiosSudipta Chandra DharPas encore d'évaluation

- Analysis of Financial StatementsDocument46 pagesAnalysis of Financial StatementsAJAJ HALAPas encore d'évaluation

- JJSF Section II Revised Final 2Document4 pagesJJSF Section II Revised Final 2api-252422597Pas encore d'évaluation

- Financial Management Problems SampleDocument67 pagesFinancial Management Problems SamplenyxPas encore d'évaluation

- Price To Earning RatioDocument10 pagesPrice To Earning Ratiopallavi_tikooPas encore d'évaluation

- CH 03Document37 pagesCH 03MrAschedPas encore d'évaluation

- CFA-Chapter 7 Relative ValuationDocument62 pagesCFA-Chapter 7 Relative ValuationNoman MaqsoodPas encore d'évaluation

- Inventory Turn Over Ratio Inventory Turnover Is A Showing How Many Times A Company's Inventory Is Sold andDocument23 pagesInventory Turn Over Ratio Inventory Turnover Is A Showing How Many Times A Company's Inventory Is Sold andrajendranSelviPas encore d'évaluation

- Final Valuation Report GSDocument8 pagesFinal Valuation Report GSGennadiy SverzhinskiyPas encore d'évaluation

- Profitability of The CompanyDocument10 pagesProfitability of The CompanyAscia SummerPas encore d'évaluation

- PNB Ratio AnalysisDocument15 pagesPNB Ratio AnalysisNiraj SharmaPas encore d'évaluation

- Comparative Ratio Analysis of Three Listed Companies of ICT SectorDocument16 pagesComparative Ratio Analysis of Three Listed Companies of ICT Sectorzubair07077371100% (1)

- Valution IndicatorsDocument5 pagesValution Indicatorsramjidixitv987Pas encore d'évaluation

- Breaking Down Roe Using The Dupont Formula PPT K LeyeahDocument5 pagesBreaking Down Roe Using The Dupont Formula PPT K LeyeahUmar NadeemPas encore d'évaluation

- Applied Corporate Finance. What is a Company worth?D'EverandApplied Corporate Finance. What is a Company worth?Évaluation : 3 sur 5 étoiles3/5 (2)

- How To Apply For Pag IBIG Housing Loan in 2019 - 8 StepsDocument48 pagesHow To Apply For Pag IBIG Housing Loan in 2019 - 8 StepsJhanese Bastes SarigumbaPas encore d'évaluation

- Empanel OrgDocument292 pagesEmpanel OrgAnand100% (1)

- Assignment Unit1Document2 pagesAssignment Unit1Akhil DayaluPas encore d'évaluation

- IATA Improved Level of Service ConceptDocument9 pagesIATA Improved Level of Service ConceptYong Shen LimPas encore d'évaluation

- Corporate Identity ManualDocument54 pagesCorporate Identity ManualAleksandra Ruzic67% (3)

- Accounting For Non Specialists Australian 7th Edition Atrill Test BankDocument36 pagesAccounting For Non Specialists Australian 7th Edition Atrill Test Bankfractionswangp5i0ec100% (24)

- Sale Catalog - 2012 Heatwave Featuring The Elite of CrasdaleDocument121 pagesSale Catalog - 2012 Heatwave Featuring The Elite of CrasdaleHolstein PlazaPas encore d'évaluation

- Menu EngineeringDocument9 pagesMenu Engineeringfirstman31Pas encore d'évaluation

- Bus 100 Quiz 6 StrayerDocument4 pagesBus 100 Quiz 6 Strayervfarkus7638Pas encore d'évaluation

- 300 - PEI - Jun 2019 - DigiDocument24 pages300 - PEI - Jun 2019 - Digimick ryanPas encore d'évaluation

- A Question of Ethics - Student Accountant Magazine Archive - Publications - Students - ACCA - ACCA Global f1 PDFDocument5 pagesA Question of Ethics - Student Accountant Magazine Archive - Publications - Students - ACCA - ACCA Global f1 PDFvyoung1988Pas encore d'évaluation

- Internship Ahsan AkhterDocument42 pagesInternship Ahsan Akhterinzamamalam515Pas encore d'évaluation

- 2006 Cpbi PrimerDocument5 pages2006 Cpbi PrimerkatherinePas encore d'évaluation

- A Describe Some of The Stories Rites Rituals and Symbols 2Document1 pageA Describe Some of The Stories Rites Rituals and Symbols 2Amit PandeyPas encore d'évaluation

- Essay GlobalisationDocument2 pagesEssay GlobalisationSabina GrigorePas encore d'évaluation

- Jason Spero: With Johanna WertherDocument41 pagesJason Spero: With Johanna WertherVasco MarquesPas encore d'évaluation

- Solomon Chukwuemeka Ugbaja GUI ProfileDocument6 pagesSolomon Chukwuemeka Ugbaja GUI ProfileGlobal Unification InternationalPas encore d'évaluation

- Chapter 19Document51 pagesChapter 19Yasir MehmoodPas encore d'évaluation

- UBI FullStatement PDFDocument2 pagesUBI FullStatement PDFsamarth agrawal0% (1)

- OR2 Review 2013 PDFDocument17 pagesOR2 Review 2013 PDFhshshdhdPas encore d'évaluation

- What Is A Hot Work Permit PDFDocument3 pagesWhat Is A Hot Work Permit PDFmridul lagachuPas encore d'évaluation

- Project List (Updated 11 30 12) BADocument140 pagesProject List (Updated 11 30 12) BALiey BustamantePas encore d'évaluation

- IOSA Program Manual (IPM) Edition 14Document151 pagesIOSA Program Manual (IPM) Edition 14Eurico RodriguesPas encore d'évaluation

- MSJ FinalizedDocument96 pagesMSJ Finalizedjohnnyg776Pas encore d'évaluation

- Welding Machine Production PlantDocument26 pagesWelding Machine Production PlantJohn100% (1)

- SCC/AQPC Webinar: SCOR Benchmarking & SCC Member Benefits: Webinar Joseph Francis - CTO Supply Chain CouncilDocument23 pagesSCC/AQPC Webinar: SCOR Benchmarking & SCC Member Benefits: Webinar Joseph Francis - CTO Supply Chain CouncilDenny SheatsPas encore d'évaluation