Académique Documents

Professionnel Documents

Culture Documents

IZE V Experian - DOC 35 - Order On MTD

Transféré par

Kenneth G. EadeDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

IZE V Experian - DOC 35 - Order On MTD

Transféré par

Kenneth G. EadeDroits d'auteur :

Formats disponibles

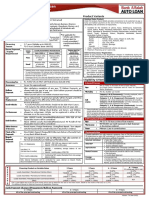

Case 5:12-cv-01547-VAP-OP Document 35

Filed 11/06/12 Page 1 of 8 Page ID #:700

PRIORITY SEND

UNITED STATES DISTRICT COURT CENTRAL DISTRICT OF CALIFORNIA CIVIL MINUTES -- GENERAL Case No. EDCV 12-01547 VAP (OPx) Title: Date: November 6, 2012

IZAK ENGELBRECHT -v- EXPERIAN INFORMATION SERVICES, INC., et al. =============================================================== PRESENT: HONORABLE VIRGINIA A. PHILLIPS, U.S. DISTRICT JUDGE Marva Dillard Courtroom Deputy ATTORNEYS PRESENT FOR PLAINTIFFS: None PROCEEDINGS: None Present Court Reporter ATTORNEYS PRESENT FOR DEFENDANTS: None MINUTE ORDER DENYING DEFENDANTS' MOTION TO DISMISS (DOC. NO. 12) (IN CHAMBERS)

This case arises out of Defendants Experian Information Services, Inc., Trans Union LLC, and Equifax Information Services, LLC's alleged failure to remove erroneous items from Plaintiff Izak Engelbrecht's credit report. Plaintiff seeks monetary, injunctive, and declaratory relief under the Fair Credit Reporting Act. Currently before the Court is Defendants' Motion to Dismiss Plaintiff's claim for injunctive and declaratory relief on the grounds that such relief is unavailable to private plaintiffs (Doc. No. 12). On November 5, 2012, the Court granted the parties' joint stipulation to submit on their Motion papers (Doc. No. 32). The Court, having received and considered all MINUTES FORM 11 CIVIL -- GEN Initials of Deputy Clerk ___md___ Page 1

Case 5:12-cv-01547-VAP-OP Document 35

Filed 11/06/12 Page 2 of 8 Page ID #:701

EDCV 12-01547 VAP (OPx) IZAK ENGELBRECHT v. EXPERIAN INFORMATION SERVICES, INC., et al. MINUTE ORDER of November 6, 2012

papers filed in support of, and in opposition to, Defendants' Motion, finds that the Motion is appropriate for resolution without oral argument. See Fed. R. Civ. P. 78; Local Rule 7-15. For the reasons set forth below, the Court DENIES the Motion. I. BACKGROUND Plaintiff filed a Complaint against Defendants Experian Information Services, Inc., Trans Union LLC, and Equifax Information Services, LLC on September 11, 2012 (Doc. No. 1), alleging that Defendants violated the Fair Credit Reporting Act ("FCRA" or "the Act") by failing and refusing to remove certain "trade lines" from Plaintiff's consumer credit reports, despite direction from Plaintiff and Plaintiff's creditors to do so. The Complaint requests monetary damages as well as declaratory and injunctive relief. On October 5, 2012, Defendants filed a joint Motion to Dismiss Plaintiff's claim for declaratory and injunctive relief, asserting that equitable relief is unavailable to private plaintiffs under the FCRA (Doc. No. 12). Plaintiff filed an Opposition on October 10, 2012 (Doc. No. 15), and Defendants filed a joint Reply on October 22, 2012 (Doc. No. 19). In support of their Reply, Defendants filed the Declaration of Sarah G. Conway (Doc. No. 20), attaching a true and correct copy of a February 23, 2012 Order in Engelbrecht v. JP Morgan Chase Bank, N.A., Case No. CV 11-6809 DSF (DTBx). II. LEGAL STANDARD Federal Rule of Civil Procedure 12(b)(6) allows a party to bring a motion to dismiss for failure to state a claim upon which relief can be granted. Rule 12(b)(6) is read in conjunction with Rule 8(a), which requires only a short and plain statement of the claim showing that the pleader is entitled to relief. Fed. R. Civ. P. 8(a)(2); Conley v. Gibson, 355 U.S. 41, 47 (1957) (holding that the Federal Rules require that a plaintiff provide "'a short and plain statement of the claim' that will give the defendant fair notice of what the plaintiff's claim is and the grounds upon which it rests." (quoting Fed. R. Civ. P. 8(a)(2))); Bell Atl. Corp. v. Twombly, 550 U.S. 544, 555 (2007). When evaluating a Rule 12(b)(6) motion, a court must accept all material allegations in the complaint as well as any reasonable inferences to be drawn from them as true and construe them in the light most favorable to the nonmoving party. See Doe v. United States, 419 F.3d 1058, 1062 (9th Cir. 2005); ARC MINUTES FORM 11 CIVIL -- GEN Initials of Deputy Clerk ___md___ Page 2

Case 5:12-cv-01547-VAP-OP Document 35

Filed 11/06/12 Page 3 of 8 Page ID #:702

EDCV 12-01547 VAP (OPx) IZAK ENGELBRECHT v. EXPERIAN INFORMATION SERVICES, INC., et al. MINUTE ORDER of November 6, 2012

Ecology v. U.S. Dep't of Air Force, 411 F.3d 1092, 1096 (9th Cir. 2005); Moyo v. Gomez, 32 F.3d 1382, 1384 (9th Cir. 1994). "While a complaint attacked by a Rule 12(b)(6) motion to dismiss does not need detailed factual allegations, a plaintiff's obligation to provide the 'grounds' of his 'entitlement to relief' requires more than labels and conclusions, and a formulaic recitation of the elements of a cause of action will not do." Twombly, 550 U.S. at 555 (citations omitted). Rather, the allegations in the complaint "must be enough to raise a right to relief above the speculative level." Id. To survive a motion to dismiss, a plaintiff must allege "enough facts to state a claim to relief that is plausible on its face." Twombly, 550 U.S. at 570; Ashcroft v. Iqbal, 556 U.S. 662, 129 S. Ct. 1937, 1949 (2009). "The plausibility standard is not akin to a 'probability requirement,' but it asks for more than a sheer possibility that a defendant has acted unlawfully. Where a complaint pleads facts that are 'merely consistent with' a defendant's liability, it stops short of the line between possibility and plausibility of 'entitlement to relief.'" Iqbal, 129 S. Ct. at 1949 (quoting Twombly, 550 U.S. at 556). Recently, the Ninth Circuit clarified that (1) a complaint must "contain sufficient allegations of underlying facts to give fair notice and to enable the opposing party to defend itself effectively," and (2) "the factual allegations that are taken as true must plausibly suggest an entitlement to relief, such that it is not unfair to require the opposing the party to be subjected to the expense of discovery and continued litigation." Starr v. Baca, 652 F.3d 1202, 1216 (9th Cir. 2011). Although the scope of review is limited to the contents of the complaint, the Court may also consider exhibits submitted with the complaint, Hal Roach Studios, Inc. v. Richard Feiner & Co., 896 F.2d 1542, 1555 n.19 (9th Cir. 1990), and "take judicial notice of matters of public record outside the pleadings," Mir v. Little Co. of Mary Hosp., 844 F.2d 646, 649 (9th Cir. 1988).

MINUTES FORM 11 CIVIL -- GEN

Initials of Deputy Clerk ___md___ Page 3

Case 5:12-cv-01547-VAP-OP Document 35

Filed 11/06/12 Page 4 of 8 Page ID #:703

EDCV 12-01547 VAP (OPx) IZAK ENGELBRECHT v. EXPERIAN INFORMATION SERVICES, INC., et al. MINUTE ORDER of November 6, 2012

III. DISCUSSION Congress enacted the FCRA, 15 U.S.C. 1681 et seq., to increase the fairness, confidentiality, and accuracy of consumer credit reporting. See 15 U.S.C. 1681(b). Sections 1681n and 1681o of the FCRA create civil liability to consumers for willful and negligent noncompliance, respectively, while Section 1681p grants federal district courts jurisdiction over any "action to enforce any liability created under" the Act. The Act is silent, however, as to the availability of equitable relief to private plaintiffs. Defendants, relying on Washington v. CSC Credit Servs., Inc., 199 F.2d 263 (5th Cir. 2000), argue the FCRA's silence should be interpreted to exclude equitable remedies for private plaintiffs. (Mot. at 4.) Plaintiff, relying on Califano v. Yamasaki, 442 U.S. 682 (1979), asserts the FCRA's silence is insufficient to divest federal courts of their equitable powers. (Opp'n at 3.) The Ninth Circuit has yet to address this issue. "Absent the clearest command to the contrary from Congress, federal courts retain their equitable power to issue injunctions in suits over which they have jurisdiction." Califano, 442 U.S. at 705. While Sections 1681n and 1681o provide for monetary relief under the FCRA, and 1681p vests federal courts with the jurisdiction to "enforce any liability" under the Act, the FCRA does not address the availability of equitable relief to private plaintiffs. To date, the Fifth Circuit is the only court of appeal to have ruled definitively on whether such relief is available. In Washington v. CSC Credit Services Inc., 199 F.3d 263, the court held that injunctive and declaratory relief were unavailable based on three considerations. First, the court stated: the affirmative grant of power to the FTC to pursue injunctive relief, coupled with the absence of a similar grant to private litigants when they are expressly granted the right to obtain damages and other relief, persuasively demonstrates that Congress vested the power to obtain injunctive relief solely with the FTC. Id. at 268. Second, the court compared the FCRA with similar provisions in the Fair MINUTES FORM 11 CIVIL -- GEN Initials of Deputy Clerk ___md___ Page 4

Case 5:12-cv-01547-VAP-OP Document 35

Filed 11/06/12 Page 5 of 8 Page ID #:704

EDCV 12-01547 VAP (OPx) IZAK ENGELBRECHT v. EXPERIAN INFORMATION SERVICES, INC., et al. MINUTE ORDER of November 6, 2012

Debt Collection Practices Act ("FDCPA"), which courts had found did "not allow private actions for injunctive relief." Id. at 268 n.4. Finally, the court pointed to Section 1681u(m), which provides consumers with a damages remedy against the government for improperly obtaining consumer information and explicitly states that injunctive relief is also available for violations of the Section. Id. at 269. Although several courts have followed Washington, others have called its reasoning into doubt. See, e.g., Beaudry v. TeleCheck Servs., Inc., 579 F.3d 702 (6th Cir. 2009); Valentine v. First Advantage Saferent, Inc., No. EDCV 08-142 VAP (OPx), 2009 WL 4349694, at *15 (C.D. Cal. Nov. 23, 2009) (recognizing the split of authority and declining to address the issue); Andrews v. Trans Union Corp. Inc., 7 F. Supp. 2d 1056, 1084 (C.D. Cal. 1998) (finding injunctive relief available), aff'd in part, rev'd in part, 225 F.3d 1063 (9th Cir. 2000), rev'd on other grounds, 534 U.S. 19 (2000). In Beaudry, the Sixth Circuit declined to address the availability of injunctive relief to private plaintiffs, stating: Washington may be right, and the district court thus may have been right to rely on it. But the answer is not free from doubt. Califano v. Yamasaki, 442 U.S. 682, 705 (1979), points out that a district court should start with the assumption that, in actions over which it has jurisdiction, it has authority to issue injunctive relief. In the absence of "the clearest command to the contrary from Congress," the plaintiff may seek injunctive relief. Id. at 709 (citations omitted). The court also pointed out that, although Sections 1681s and 1681u(m) explicitly provide for injunctive relief, creating a negative inference that such relief would not otherwise be available, Section 1681u(l) expressly provides that "the remedies and sanctions set forth in this section shall be the only judicial remedies and sanctions for violation of this section," creating the opposite negative inference that, elsewhere, remedies are not limited to those enumerated. See id. This Court finds Washington unpersuasive. "Unless a statute in so many MINUTES FORM 11 CIVIL -- GEN Initials of Deputy Clerk ___md___ Page 5

Case 5:12-cv-01547-VAP-OP Document 35

Filed 11/06/12 Page 6 of 8 Page ID #:705

EDCV 12-01547 VAP (OPx) IZAK ENGELBRECHT v. EXPERIAN INFORMATION SERVICES, INC., et al. MINUTE ORDER of November 6, 2012

words, or by a necessary and inescapable inference, restricts the court's jurisdiction in equity, the full scope of that jurisdiction is to be recognized and applied." Weinberger v. Romero-Barcelo, 456 U.S. 305, 313 (1982) (quoting Porter v. Warner Holding Co., 328 U.S. 395, 398 (1946)). The FCRA does not restrict a private plaintiff's right to equitable relief "in so many words," and the negative inferences cited by the Washington court are far from "necessary and inescapable," especially in light of the conflicting negative inference that can be drawn from the express limitation of remedies in Section 1681u(l). In Plata v. Schwarzegger, 603 F.3d 1088, 1095 (9th Cir. 2010), the Ninth Circuit rejected the application of the maxim expressio unius est exclusio alterius (the expression of one implies the exclusion of another), holding that Congress, by providing for special masters under the PLRA, did not necessarily mean to negate the appointment of receivers. Id. at 1095. As the court stated: that canon does not work when a single thing provided for is quite different from another thing omitted. The canon 'does not apply to every statutory listing or grouping; it has force only when the items expressed are members of an associated group or series, justifying the inference that items not mentioned were excluded by deliberate choice, not inadvertence. Id. Ultimately the court held that "even if expressio unius did apply, the negative implication arguably drawn from it scarcely could qualify as 'the clearest command' of Congress or a 'necessary and inescapable inference' required to limit the traditional equity powers of the district court." Id. Here, as in Plata, the negative implications to be drawn from the FCRA's silence regarding equitable relief in Sections 1681n and 1681o, express grant of injunctive powers in Sections 1681s and 1681u(m), and express limitation to enumerated remedies in Section 1681u(l) "scarcely could qualify as 'the clearest

MINUTES FORM 11 CIVIL -- GEN

Initials of Deputy Clerk ___md___ Page 6

Case 5:12-cv-01547-VAP-OP Document 35

Filed 11/06/12 Page 7 of 8 Page ID #:706

EDCV 12-01547 VAP (OPx) IZAK ENGELBRECHT v. EXPERIAN INFORMATION SERVICES, INC., et al. MINUTE ORDER of November 6, 2012

command' of Congress or a 'necessary and inescapable inference.'" In the absence of such a clear command, the Court will not restrict its jurisdiction or Plaintiff's remedies. The purpose of the statute further supports the Court's holding. The FCRA "was crafted to protect consumers from the transmission of inaccurate information about them, and to establish credit reporting practices that utilize accurate, relevant, and current information in a confidential and responsible manner." Guimond v. Trans Union Credit Info. Co., 45 F.3d 1329, 1333 (9th Cir. 1995) (citations omitted). The statute's "consumer oriented objectives support a liberal construction," which is well served by the availability of injunctive relief. The harm from which the statute aims to protect consumers is ongoing, and where, as alleged here, credit reporting agencies refuse to correct inaccurate information, monetary damages may not provide an adequate remedy. This fact distinguishes the FCRA from statutes like the FDCPA, under which violators must make additional collection attempts (and, thus, additional actionable violations) to cause further harm. Cf. Andrews, 7 F. Supp. 2d at 1084 n.33 (finding the statutes distinguishable). Likewise, if the FTC lacked the resources to pursue injunctive relief for each consumer whose credit report was inaccurate, a consumer without the right to bring a claim for injunctive relief would be helpless to correct her credit information. These fairness concerns would come to nothing had Congress clearly, unequivocally restricted the availability of injunctive relief. But, as explained above, any intent to restrict equitable relief is murky at best. In their Reply, Defendants raise an additional concern that allowing private plaintiffs to enjoin violations of the FCRA "would essentially create strict liability for credit reporting agencies, regardless of what has been reported to them by furnishers." (Reply Br. at 3.) This contention is not persuasive. A consumer still must prove a violation of the statute in order to obtain injunctive relief, and the Court retains its discretion to grant an injunction only when it is warranted by the balance of equities and in the interests of justice. See Weinberger, 456 U.S. at 312 ("[T]he

MINUTES FORM 11 CIVIL -- GEN

Initials of Deputy Clerk ___md___ Page 7

Case 5:12-cv-01547-VAP-OP Document 35

Filed 11/06/12 Page 8 of 8 Page ID #:707

EDCV 12-01547 VAP (OPx) IZAK ENGELBRECHT v. EXPERIAN INFORMATION SERVICES, INC., et al. MINUTE ORDER of November 6, 2012

basis for injunctive relief in the federal courts has always been irreparable injury and the inadequacy of legal remedies."). In any event, Defendants' fairness concerns are insufficient to overcome Congress's lack of a clear command. Accordingly, the Court finds that equitable relief is available to private plaintiffs under the FCRA. IV. CONCLUSION For the reasons expressed above, Defendant's Motion is DENIED. IT IS SO ORDERED.

MINUTES FORM 11 CIVIL -- GEN

Initials of Deputy Clerk ___md___ Page 8

Vous aimerez peut-être aussi

- Equifax Ethics ReportDocument9 pagesEquifax Ethics ReportAaminah KhanPas encore d'évaluation

- SecuritisationDocument74 pagesSecuritisationrohitpatil699Pas encore d'évaluation

- Complaint Against Kansas Attorney and Debt Collector Jennifer L. Shipman of Blitt and Gaines, P.C. Dated August 25th, 2019Document3 pagesComplaint Against Kansas Attorney and Debt Collector Jennifer L. Shipman of Blitt and Gaines, P.C. Dated August 25th, 2019Conflict GatePas encore d'évaluation

- Blocked Account Contract DetailsDocument13 pagesBlocked Account Contract Detailsshahzeel khanPas encore d'évaluation

- Alfalah Auto Loan: Policy One PagerDocument1 pageAlfalah Auto Loan: Policy One PagerbilalasifPas encore d'évaluation

- Stefanie Goldblatt, CFPB Senior Litigation Counsel Re Case 140304-000750Document102 pagesStefanie Goldblatt, CFPB Senior Litigation Counsel Re Case 140304-000750Neil GillespiePas encore d'évaluation

- Debt Advice - Student - DebtDocument6 pagesDebt Advice - Student - DebtDebt AdvicePas encore d'évaluation

- In The United States District Court For The District of MarylandDocument13 pagesIn The United States District Court For The District of MarylandMikhael Yah-Shah Dean: VeilourPas encore d'évaluation

- 2202-3978375 - 2022 FTL - IRS - and - Form - 990 - Updates - FINALDocument66 pages2202-3978375 - 2022 FTL - IRS - and - Form - 990 - Updates - FINALJamesMinionPas encore d'évaluation

- Money BankingDocument27 pagesMoney BankingParesh ShrivastavaPas encore d'évaluation

- After Judgement Guide To Getting Results ENDocument25 pagesAfter Judgement Guide To Getting Results ENTim GordashPas encore d'évaluation

- Bank Error in Your FavorDocument2 pagesBank Error in Your FavorgargramPas encore d'évaluation

- 22A444Document42 pages22A444Chris GeidnerPas encore d'évaluation

- Universal Premium Acceptance Corporation v. The York Bank & Trust Company, 69 F.3d 695, 3rd Cir. (1995)Document13 pagesUniversal Premium Acceptance Corporation v. The York Bank & Trust Company, 69 F.3d 695, 3rd Cir. (1995)Scribd Government DocsPas encore d'évaluation

- Congress Credit Bills-1174120ihDocument213 pagesCongress Credit Bills-1174120ihBurton HolmesPas encore d'évaluation

- 35 Motion For More Definite StatementDocument18 pages35 Motion For More Definite StatementSamuelPas encore d'évaluation

- Chas Beaman v. Mountain America Federal Credit UnionDocument16 pagesChas Beaman v. Mountain America Federal Credit UnionAnonymous WCaY6r100% (1)

- Project of Merchant BankingDocument18 pagesProject of Merchant BankingKultar Singh100% (2)

- Chery v. Conduent EducationDocument15 pagesChery v. Conduent EducationMooreKuehnPas encore d'évaluation

- BondsDocument10 pagesBondsGeorge William100% (1)

- Credit Card Receipt Privacy Violations - Check Your Receipts!Document13 pagesCredit Card Receipt Privacy Violations - Check Your Receipts!Summer ChildsPas encore d'évaluation

- Protecting Consumers From Deceptive Debt Settlement SchemesDocument33 pagesProtecting Consumers From Deceptive Debt Settlement SchemesScribd Government DocsPas encore d'évaluation

- Kurenitz V Stellar Recovery Inc Debt Collection Minnesota FDCPA Mark L Heaney Heaney Law Firm LLCDocument10 pagesKurenitz V Stellar Recovery Inc Debt Collection Minnesota FDCPA Mark L Heaney Heaney Law Firm LLCghostgripPas encore d'évaluation

- MKDocument4 pagesMKRaju RajuPas encore d'évaluation

- 5 CFPA 7 20 14 ComplaintsconsumerDocument35 pages5 CFPA 7 20 14 ComplaintsconsumerLisbon Reporter100% (1)

- Assignment, StockDocument5 pagesAssignment, StockNawshad HasanPas encore d'évaluation

- Debentures and Loan Capital ExplainedDocument26 pagesDebentures and Loan Capital ExplainedhaninadiaPas encore d'évaluation

- Are Student Loans Considered Revolving DebtsDocument3 pagesAre Student Loans Considered Revolving Debtsfemi adePas encore d'évaluation

- Terms of The ContractDocument27 pagesTerms of The ContractTsholofelo100% (1)

- Bank, Credit or Thrift? Which One Is Right For MeDocument7 pagesBank, Credit or Thrift? Which One Is Right For MeAnna TrimblePas encore d'évaluation

- Eport:: Toxic Document Fallout ImpactsDocument21 pagesEport:: Toxic Document Fallout ImpactsRichard Franklin Kessler100% (1)

- Federal Crop Ins. Corp. v. Merrill, 332 U.S. 380 (1947)Document6 pagesFederal Crop Ins. Corp. v. Merrill, 332 U.S. 380 (1947)Scribd Government DocsPas encore d'évaluation

- Health Care and Education Access of Transnational Children in MexDocument49 pagesHealth Care and Education Access of Transnational Children in MexLatinos Ready To VotePas encore d'évaluation

- Garfield Practice Hints 6-2018Document4 pagesGarfield Practice Hints 6-2018bblythe1Pas encore d'évaluation

- RHemricMeadowbrook Securitization AuditDocument23 pagesRHemricMeadowbrook Securitization AuditrodclassteamPas encore d'évaluation

- JP Duties HandbookDocument162 pagesJP Duties HandbookPranesh Pal0% (1)

- United States Court of Appeals: For The District of Columbia CircuitDocument12 pagesUnited States Court of Appeals: For The District of Columbia CircuitD. BushPas encore d'évaluation

- Banking LawsDocument33 pagesBanking LawsliboaninoPas encore d'évaluation

- Basic Principles of Negotiable InstrumentsDocument13 pagesBasic Principles of Negotiable InstrumentsCherry mae belvizPas encore d'évaluation

- Where Is The LenderDocument2 pagesWhere Is The LenderLoanClosingAuditorsPas encore d'évaluation

- Fdcpa HandoutsDocument7 pagesFdcpa HandoutsStephen MonaghanPas encore d'évaluation

- Common Prospectus EnglishDocument364 pagesCommon Prospectus EnglishRoy KoushaniPas encore d'évaluation

- Policy on Fair Practices CodeDocument5 pagesPolicy on Fair Practices CodeMANOJIT GAINPas encore d'évaluation

- Danielle Joseph LawsuitDocument98 pagesDanielle Joseph LawsuitdenpcarPas encore d'évaluation

- What Do You Know?: ContractsDocument7 pagesWhat Do You Know?: Contractsgastechnician.caPas encore d'évaluation

- Complaint Citigroup in RemDocument7 pagesComplaint Citigroup in RemmschwimmerPas encore d'évaluation

- MAED Reasonable AccomodatiohDocument53 pagesMAED Reasonable AccomodatiohLey CanasaPas encore d'évaluation

- Complaint Michael Nierenberg FHFA 1.11-Cv-06188 Show - TempDocument706 pagesComplaint Michael Nierenberg FHFA 1.11-Cv-06188 Show - TempJaniceWolkGrenadierPas encore d'évaluation

- A Treatise On FranchisesDocument1 243 pagesA Treatise On FranchisesJoseph WertPas encore d'évaluation

- Fidelity Bank 2017 Annual ReportDocument120 pagesFidelity Bank 2017 Annual ReportFuaad Dodoo100% (1)

- TransferDocument2 pagesTransferernestddd737Pas encore d'évaluation

- Νέο έγγραφο κειμένουDocument5 pagesΝέο έγγραφο κειμένουJose ArmandoPas encore d'évaluation

- The Credit Theory of MoneyDocument14 pagesThe Credit Theory of MoneyAlbert GramsciPas encore d'évaluation

- A Tale of Two LedgersDocument3 pagesA Tale of Two LedgersManuel Elijah SarausadPas encore d'évaluation

- The Remedial Powers of The AdmiraltyDocument33 pagesThe Remedial Powers of The AdmiraltyMichael LenzPas encore d'évaluation

- Duke Energy PremierNotes ProspectusDocument37 pagesDuke Energy PremierNotes ProspectusshoppingonlyPas encore d'évaluation

- International Financial MGMT - 2Document49 pagesInternational Financial MGMT - 2Josh ChPas encore d'évaluation

- The Declaration of Independence: A Play for Many ReadersD'EverandThe Declaration of Independence: A Play for Many ReadersPas encore d'évaluation

- Swindled: If Government is ‘for the people’, Why is the King Wearing No Clothes?D'EverandSwindled: If Government is ‘for the people’, Why is the King Wearing No Clothes?Évaluation : 5 sur 5 étoiles5/5 (2)

- Restrictions on Hunting under Wildlife Protection ActDocument14 pagesRestrictions on Hunting under Wildlife Protection ActDashang DoshiPas encore d'évaluation

- English File: Grammar, Vocabulary, and PronunciationDocument4 pagesEnglish File: Grammar, Vocabulary, and PronunciationEvelyn BoccioPas encore d'évaluation

- The Art of Tendering - A Global Due Diligence Guide - 2021 EditionDocument2 597 pagesThe Art of Tendering - A Global Due Diligence Guide - 2021 EditionFrancisco ParedesPas encore d'évaluation

- Role of Education in The Empowerment of Women in IndiaDocument5 pagesRole of Education in The Empowerment of Women in Indiasethulakshmi P RPas encore d'évaluation

- Boardingpass VijaysinghDocument2 pagesBoardingpass VijaysinghAshish ChauhanPas encore d'évaluation

- Syntel Placement Paper 2 - Freshers ChoiceDocument3 pagesSyntel Placement Paper 2 - Freshers ChoicefresherschoicePas encore d'évaluation

- Restoration of All Things - Siegfried J. Widmar 1990Document10 pagesRestoration of All Things - Siegfried J. Widmar 1990zdfhsdfhdsPas encore d'évaluation

- Human Rights Violations in North KoreaDocument340 pagesHuman Rights Violations in North KoreaKorea Pscore100% (3)

- AXIOLOGY PowerpointpresntationDocument16 pagesAXIOLOGY Powerpointpresntationrahmanilham100% (1)

- MNC diversity factors except expatriatesDocument12 pagesMNC diversity factors except expatriatesGanesh Devendranath Panda100% (1)

- Introduction To Asset Pricing ModelDocument8 pagesIntroduction To Asset Pricing ModelHannah NazirPas encore d'évaluation

- Joint Admissions and Matriculation Board: Candidate DetailsDocument1 pageJoint Admissions and Matriculation Board: Candidate DetailsShalom UtuvahwePas encore d'évaluation

- Oath of Protection Paladin OathDocument3 pagesOath of Protection Paladin OathJoseph OsheenPas encore d'évaluation

- Audio Script + Key (Updated)Document6 pagesAudio Script + Key (Updated)khoareviewPas encore d'évaluation

- Illustrative Bank Branch Audit FormatDocument4 pagesIllustrative Bank Branch Audit Formatnil shePas encore d'évaluation

- The Great MughalsDocument14 pagesThe Great MughalsnikitaPas encore d'évaluation

- English JAMB Questions and Answers 2023Document5 pagesEnglish JAMB Questions and Answers 2023Samuel BlessPas encore d'évaluation

- Definition of Internal Order: Business of The Company (Orders With Revenues)Document6 pagesDefinition of Internal Order: Business of The Company (Orders With Revenues)MelaniePas encore d'évaluation

- Immersion-Reviewer - Docx 20240322 162919 0000Document5 pagesImmersion-Reviewer - Docx 20240322 162919 0000mersiarawarawnasahealingstagePas encore d'évaluation

- Regional Diagnostic Assessment Report SY 2022-2023Document3 pagesRegional Diagnostic Assessment Report SY 2022-2023Dina BacaniPas encore d'évaluation

- Ca NR 06 en PDFDocument251 pagesCa NR 06 en PDFZafeer Saqib AzeemiPas encore d'évaluation

- BUSINESS ETHICS - Q4 - Mod1 Responsibilities and Accountabilities of EntrepreneursDocument20 pagesBUSINESS ETHICS - Q4 - Mod1 Responsibilities and Accountabilities of EntrepreneursAvos Nn83% (6)

- Bid for Solar Power Plant under Institute for Plasma ResearchDocument10 pagesBid for Solar Power Plant under Institute for Plasma ResearchDhanraj RaviPas encore d'évaluation

- MSA BeijingSyllabus For Whitman DizDocument6 pagesMSA BeijingSyllabus For Whitman DizcbuhksmkPas encore d'évaluation

- CHAPTER-1 FeasibilityDocument6 pagesCHAPTER-1 FeasibilityGlads De ChavezPas encore d'évaluation

- ICS ModulesDocument67 pagesICS ModulesJuan RiveraPas encore d'évaluation

- 2012 - Chapter 14 - Geberit Appendix Sanitary CatalogueDocument8 pages2012 - Chapter 14 - Geberit Appendix Sanitary CatalogueCatalin FrincuPas encore d'évaluation

- Straight and Crooked ThinkingDocument208 pagesStraight and Crooked Thinkingmekhanic0% (1)

- Hydrography: The Key To Well-Managed Seas and WaterwaysDocument69 pagesHydrography: The Key To Well-Managed Seas and Waterwayscharles IkePas encore d'évaluation

- IMMI Refusal Notification With Decision Record-4Document6 pagesIMMI Refusal Notification With Decision Record-4SHREYAS JOSHIPas encore d'évaluation