Académique Documents

Professionnel Documents

Culture Documents

Outline RA 8762

Transféré par

Tamara Bianca Chingcuangco Ernacio-TabiosDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Outline RA 8762

Transféré par

Tamara Bianca Chingcuangco Ernacio-TabiosDroits d'auteur :

Formats disponibles

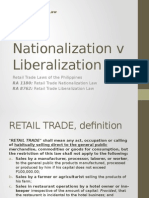

RETAIL TRADE LIBERALIZATION ACT 2000 R. A. No.

8762 (RTLA2000)

Repealed RA 1180 (Retail Trade Nationalization Law) Liberalized the Philippine retail industry to encourage Filipino and foreign investors have an efficient and competitive retail sector; and Empower the Filipino consumers Definition and Coverage of Retail Trade Elements: a. Habitual act or business of selling; b. To the general public; c. Of merchandise, commodities or goods for consumption. Exempted Transactions Sales by a manufacturer, processor, laborer, or worker, to the general public of the products manufactured, processed or produced by him if his capital does not exceed P100, 000.00 Sales by a farmer or agriculturist, of the products of his farm, regardless of the capital Sales in restaurant operations by a hotel owner or inn-keeper irrespective of the amount of capital, provided that the restaurant is incidental to the hotel business Sales to the general public, through a single outlet owned by a manufacturer of products manufactured, processed or assembled in the Philippines, irrespective of capitalization Sales to industrial and commercial users or consumers who use the products bought by them to render service to the general public and/or produce or manufacture of goods which are in turn sold by them. Special Exemption for Former Natural-Born Filipinos Granted the same rights as Filipino citizens for purposes of retail trade under RA 8762

Categories of Retail Trade Enterprises Category A Enterprises with paid-up capital of the equivalent of less than US $ 2, 500, 000 Category B

Enterprises with a minimum paid-up capital of the equivalent in Philippine Pesos US$2,500,000.00 but less US$7,500,000.00 Category C Enterprises with a paid-up capital of the equivalent in Philippine Pesos US$7,500,000.00 or more may be wholly owned by foreigners, provided that in no case shall the investments for establishing a store be less than the peso equivalent of US$830, 000.00 Category D Enterprises specializing in high-end or luxury products with a paid-up capital of the equivalent in Philippine Pesos of US$250,000.00 per store Foreign Retailers Prequalification Requirements a. A minimum of Net Worth of -US$200M of the registrant corporation in Catergories B and C -US$50M of the registrant corporation in Catergory D b. Five retailing branches or franchises, in operation anywhere around the world unless such retailer has at least one store, capitalized at a minimum of US$25M; c. Five- year track record in retailing; d. They must be nationals, or juridical entities formed or incorporated in, countries in which allow the entry of Filipino retailers Application for Prequalification A request duly signed and acknowledges under oath by an authorize officer of the foreign retailer Must be submitted to the Board of Investments before filing a formal application Must be accompanied by a certification from the home-country Prohibited Activities of Qualified Foreign Retailers Not allowed to engage in certain retailing activities outside their accredited stored Penalty Clause a. Imprisonment of not less than 6 years and one day but not more than 8 years; b. Fine not less than P1M, but not more than P2M

Vous aimerez peut-être aussi

- Retail Trade Liberalization Act 2000: R.A. No. 8762 (RTLA2000)Document27 pagesRetail Trade Liberalization Act 2000: R.A. No. 8762 (RTLA2000)Auden Jay Allejos CuramengPas encore d'évaluation

- Retail Trade Liberalization Act 2000Document20 pagesRetail Trade Liberalization Act 2000Joan MacedaPas encore d'évaluation

- Be It Enacted by The Senate and House of Representative of The Philippines in Congress AssembledDocument4 pagesBe It Enacted by The Senate and House of Representative of The Philippines in Congress AssembledHaydee Christine SisonPas encore d'évaluation

- Retail TradeDocument23 pagesRetail TradeErrica Marie De GuzmanPas encore d'évaluation

- Summons - Form 2-SCC (2016)Document2 pagesSummons - Form 2-SCC (2016)Earvin James AtienzaPas encore d'évaluation

- Admin Law - Eligibility of Candidates PaitonDocument46 pagesAdmin Law - Eligibility of Candidates PaitonAejay Villaruz BariasPas encore d'évaluation

- 10 - Leny Villareal - 2 Legal Framework For GI Protection in TheDocument28 pages10 - Leny Villareal - 2 Legal Framework For GI Protection in TheBrunxAlabastroPas encore d'évaluation

- Consolidated Case Digest - Police Power (13-17)Document11 pagesConsolidated Case Digest - Police Power (13-17)AronJamesPas encore d'évaluation

- 12 Ang Tibay Vs CIRDocument2 pages12 Ang Tibay Vs CIRChristiane Marie BajadaPas encore d'évaluation

- Law On Obligations and ContractsDocument29 pagesLaw On Obligations and ContractsErlePas encore d'évaluation

- Research Consultation: Bs Psychology 4ADocument62 pagesResearch Consultation: Bs Psychology 4ARyan Estonio100% (1)

- Chapter 2 - ObliconDocument35 pagesChapter 2 - ObliconHannah BarrantesPas encore d'évaluation

- Case Digest - G.R. No. 15574 - Smith, Bell & Co. (LTD.) v. NatividadDocument3 pagesCase Digest - G.R. No. 15574 - Smith, Bell & Co. (LTD.) v. NatividadJUPITER BARUELO100% (1)

- Divorce and OthersDocument5 pagesDivorce and Othersariel lapiraPas encore d'évaluation

- Kulayan vs. TanDocument18 pagesKulayan vs. TanKarla MTPas encore d'évaluation

- Legal Obligations Arising From LawDocument2 pagesLegal Obligations Arising From LawDanielle BartolomePas encore d'évaluation

- Grace Poe Disqualification Case (Essay)Document2 pagesGrace Poe Disqualification Case (Essay)John Bryan AldovinoPas encore d'évaluation

- Lim Vs PeopleDocument10 pagesLim Vs PeopleDaryl Noel TejanoPas encore d'évaluation

- DC 071 (Guidelines On The Detail And-Or Reassignment of Personnel) October 31, 2013Document5 pagesDC 071 (Guidelines On The Detail And-Or Reassignment of Personnel) October 31, 2013Glenn AquinoPas encore d'évaluation

- PD 851 CommentsDocument3 pagesPD 851 CommentsNoznuagPas encore d'évaluation

- Legal Writing & Research Ex 23 AnswerDocument3 pagesLegal Writing & Research Ex 23 AnswerEdwin Javate100% (1)

- RDO No. 8 Baguio CityDocument257 pagesRDO No. 8 Baguio CityJaylordPataotaoPas encore d'évaluation

- Undertaking of EmployeesDocument3 pagesUndertaking of EmployeesvissamPas encore d'évaluation

- Fully Booked BranchesDocument4 pagesFully Booked BranchesDannah Chryss Sevilla AgudaPas encore d'évaluation

- Samson v. Fiel-Macaraig PDFDocument5 pagesSamson v. Fiel-Macaraig PDFKaye ArendainPas encore d'évaluation

- RA - Republic Act No. 10883Document6 pagesRA - Republic Act No. 10883Kaye ArendainPas encore d'évaluation

- Oblicon - de Leon Chapter 1 General Provisions NotesDocument2 pagesOblicon - de Leon Chapter 1 General Provisions NotesKevin SusonPas encore d'évaluation

- Republic of The Philippines) - , - ) S.SDocument1 pageRepublic of The Philippines) - , - ) S.SjavesPas encore d'évaluation

- Fullido vs. GrilliDocument24 pagesFullido vs. GrilliAngel AmarPas encore d'évaluation

- Labor-Case Digests-Marquez-P4-6Document60 pagesLabor-Case Digests-Marquez-P4-6NiellaPas encore d'évaluation

- Platinum Plans Philippines IncDocument2 pagesPlatinum Plans Philippines Inccamille_faye100% (1)

- GR 238873 CaguioaDocument16 pagesGR 238873 CaguioaArturo AbagnalePas encore d'évaluation

- Commonwealth Act No. 327 As Amended by PD 1445Document1 pageCommonwealth Act No. 327 As Amended by PD 1445Glenda Mae GemalPas encore d'évaluation

- Republic Act 10055: Philippine Technology Transfer Act of 2009Document38 pagesRepublic Act 10055: Philippine Technology Transfer Act of 2009Anonymous wINMQaNPas encore d'évaluation

- Case Digests Freedom of Assembly and ReligionDocument17 pagesCase Digests Freedom of Assembly and ReligionSweet Zel Grace PorrasPas encore d'évaluation

- D.O. 2022-021Document3 pagesD.O. 2022-021NC BergoniaPas encore d'évaluation

- Section 5: Divisible and Indivisible ObligationsDocument13 pagesSection 5: Divisible and Indivisible ObligationsEmjayPas encore d'évaluation

- I. Read Chapter 3: Kinds of Obligations and Complete The Table Below. Other Pertinent FactsDocument5 pagesI. Read Chapter 3: Kinds of Obligations and Complete The Table Below. Other Pertinent FactsGerwin AbejarPas encore d'évaluation

- 2007 Midterm Reviewer: Obligations and Contracts JanuaryDocument18 pages2007 Midterm Reviewer: Obligations and Contracts JanuaryseanPas encore d'évaluation

- The Philippine Legal SystemDocument2 pagesThe Philippine Legal SystemAlyssa Danielle TolentinoPas encore d'évaluation

- G.R. No. 207161 (Y-I Leisure Phils. v. Yu) Full CaseDocument10 pagesG.R. No. 207161 (Y-I Leisure Phils. v. Yu) Full CaseEricha Joy GonadanPas encore d'évaluation

- Promissory Note: 350,000.00) Philippine Currency, Representing Principal and Interest at The Rate of 3% Per MonthDocument1 pagePromissory Note: 350,000.00) Philippine Currency, Representing Principal and Interest at The Rate of 3% Per MonthNicole SantoallaPas encore d'évaluation

- Position Paper of The Book Development Association of The Philippines Re: Tax and Duty Free Importation of Books Into The CountryDocument16 pagesPosition Paper of The Book Development Association of The Philippines Re: Tax and Duty Free Importation of Books Into The CountryManuel L. Quezon III100% (1)

- Doas Mux DavaoDocument2 pagesDoas Mux Davaoanamarie de la cruzPas encore d'évaluation

- YupDocument52 pagesYupBianca EnglatieraPas encore d'évaluation

- Partnership, Case No. 39Document2 pagesPartnership, Case No. 39Rio LorrainePas encore d'évaluation

- Verano & AngelesDocument13 pagesVerano & AngelesYui RecintoPas encore d'évaluation

- Pro-Life Phil vs. Office of The PresidentDocument81 pagesPro-Life Phil vs. Office of The PresidentproliferakoPas encore d'évaluation

- Should We Go BeyondDocument2 pagesShould We Go Beyondpriam gabriel d salidagaPas encore d'évaluation

- Oblicon FInals 2021Document5 pagesOblicon FInals 2021yusepPas encore d'évaluation

- 04 Chrysler Philippines Corp. Vs CADocument6 pages04 Chrysler Philippines Corp. Vs CAIronFaith19Pas encore d'évaluation

- ObliCon SyllabusDocument19 pagesObliCon SyllabusCJ KhaleesiPas encore d'évaluation

- Bible Baptist Church vs. CADocument3 pagesBible Baptist Church vs. CAirene anibongPas encore d'évaluation

- Payment Centers That Authorized To Received University CollectionDocument4 pagesPayment Centers That Authorized To Received University CollectionWilliam Rice100% (2)

- Business Law Notes (Breach of Obli To Transmissibility of Rights)Document8 pagesBusiness Law Notes (Breach of Obli To Transmissibility of Rights)Reina HabijanPas encore d'évaluation

- Articles of General PartnershipDocument4 pagesArticles of General PartnershipHazel Angeline C. BazarPas encore d'évaluation

- Exempted Trade Activities: Retail Trade Liberalization ActDocument2 pagesExempted Trade Activities: Retail Trade Liberalization ActGretchen Alunday SuarezPas encore d'évaluation

- Retail Trade Liberalization Act of 2000 (RA 8762)Document20 pagesRetail Trade Liberalization Act of 2000 (RA 8762)Myron GutierrezPas encore d'évaluation

- RA No. 8762 Retail Trade Liberalization Act of 2000Document5 pagesRA No. 8762 Retail Trade Liberalization Act of 2000SZPas encore d'évaluation

- 63787-2000-Retail Trade Liberalization Act of 200020221030-11-1ja8sv4Document5 pages63787-2000-Retail Trade Liberalization Act of 200020221030-11-1ja8sv4Pena TnPas encore d'évaluation

- Romeo P. Gerochi v. Department of Energy, GR No. 159796, 2007-07-17Document19 pagesRomeo P. Gerochi v. Department of Energy, GR No. 159796, 2007-07-17Tamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Information EstafaDocument2 pagesInformation EstafaTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Republic of The Philippines Vs CAGUIOADocument18 pagesRepublic of The Philippines Vs CAGUIOATamara Bianca Chingcuangco Ernacio-Tabios100% (1)

- Complaint AffidavitDocument3 pagesComplaint AffidavitTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Philippine Health Care Providers, Inc., Petitioner, V.commissioner of Internal RevenueDocument26 pagesPhilippine Health Care Providers, Inc., Petitioner, V.commissioner of Internal RevenueTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Republic of The Philippines Vs CAGUIOADocument14 pagesRepublic of The Philippines Vs CAGUIOAAnonymous NWnRYIWPas encore d'évaluation

- Art 804-806Document23 pagesArt 804-806Tamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Cir Vs Fortune TabaccoDocument27 pagesCir Vs Fortune TabaccoTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Southern Cross Cement Corp. v. Cement Manufacturers Association of The PhilippinesDocument23 pagesSouthern Cross Cement Corp. v. Cement Manufacturers Association of The PhilippinesTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Art 807-808Document4 pagesArt 807-808Tamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Commissioner of Internal Revenue Vs Central Luzon Drug Corporation GR No 159647Document36 pagesCommissioner of Internal Revenue Vs Central Luzon Drug Corporation GR No 159647Tamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Code of Professional ResponsibilityDocument7 pagesCode of Professional ResponsibilityKatherine Aplacador100% (1)

- M. R. Sotelo For Executor and Heir-Appellees. Leopoldo M. Abellera and Jovito Salonga For Oppositor-AppellantDocument15 pagesM. R. Sotelo For Executor and Heir-Appellees. Leopoldo M. Abellera and Jovito Salonga For Oppositor-AppellantTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Art 810-814Document13 pagesArt 810-814Tamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Art 777Document14 pagesArt 777Tamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Manuel A. Zosa, Luis B. Ladonga, Mariano A. Zosa and B. G. Advincula For Appellants. C. de La Victoria For AppelleesDocument5 pagesManuel A. Zosa, Luis B. Ladonga, Mariano A. Zosa and B. G. Advincula For Appellants. C. de La Victoria For AppelleesTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- E. Debuque For Petitioner-Appellant. E. L. Segovia For Oppositors-AppelleesDocument2 pagesE. Debuque For Petitioner-Appellant. E. L. Segovia For Oppositors-AppelleesTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Parish Priest V RigorDocument8 pagesParish Priest V RigorTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Priscilo Evangelista For Appellee. Brigido G. Estrada For AppellantDocument9 pagesPriscilo Evangelista For Appellee. Brigido G. Estrada For AppellantTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Art 777Document14 pagesArt 777Tamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Priscilo Evangelista For Appellee. Brigido G. Estrada For AppellantDocument9 pagesPriscilo Evangelista For Appellee. Brigido G. Estrada For AppellantTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Priscilo Evangelista For Appellee. Brigido G. Estrada For AppellantDocument9 pagesPriscilo Evangelista For Appellee. Brigido G. Estrada For AppellantTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Law On LTDDocument61 pagesLaw On LTDTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Rome Statute of The IccDocument13 pagesRome Statute of The IccTamara Bianca Chingcuangco Ernacio-TabiosPas encore d'évaluation

- Bba - Fa Ii - Notes - Ii Sem PDFDocument40 pagesBba - Fa Ii - Notes - Ii Sem PDFPRABHUDEVAPas encore d'évaluation

- BIOETHICSDocument4 pagesBIOETHICSSherylou Kumo SurioPas encore d'évaluation

- Intra-Class Moot Court 2021 B.A.Ll.B 3 Year: DwelhiDocument17 pagesIntra-Class Moot Court 2021 B.A.Ll.B 3 Year: DwelhiDinesh SharmaPas encore d'évaluation

- Brand Management Assignment 1 FINALDocument4 pagesBrand Management Assignment 1 FINALbalakk06Pas encore d'évaluation

- AcadinfoDocument10 pagesAcadinfoYumi LingPas encore d'évaluation

- Understanding Culture, Society, and Politics Quarter 2 - Module 5 EducationDocument19 pagesUnderstanding Culture, Society, and Politics Quarter 2 - Module 5 EducationMhecy Sagandilan100% (4)

- M.V AFFLATUS & WEN YUE Collision Report by China MSADocument23 pagesM.V AFFLATUS & WEN YUE Collision Report by China MSAJasper AngPas encore d'évaluation

- The Effect of Celebrity Endorsement On Customer Usage Behavior in The Case of Dashen Bank - Copy (Repaired)Document78 pagesThe Effect of Celebrity Endorsement On Customer Usage Behavior in The Case of Dashen Bank - Copy (Repaired)Eyuael SolomonPas encore d'évaluation

- Managing Transaction ExposureDocument34 pagesManaging Transaction Exposureg00028007Pas encore d'évaluation

- Bookkeeping BasicsDocument19 pagesBookkeeping BasicsAbeer ShennawyPas encore d'évaluation

- Intertek India Private LimitedDocument8 pagesIntertek India Private LimitedAjay RottiPas encore d'évaluation

- 08 - Case Law-Unknown Case Law ListDocument28 pages08 - Case Law-Unknown Case Law ListNausheen100% (1)

- Against Open Merit: Punjab Public Service CommissionDocument2 pagesAgainst Open Merit: Punjab Public Service CommissionSohailMaherPas encore d'évaluation

- BARD 2014 Product List S120082 Rev2Document118 pagesBARD 2014 Product List S120082 Rev2kamal AdhikariPas encore d'évaluation

- TWG 2019 Inception Reports forERG 20190717 PDFDocument95 pagesTWG 2019 Inception Reports forERG 20190717 PDFGuillaume GuyPas encore d'évaluation

- Analysis Essay of CPSDocument6 pagesAnalysis Essay of CPSJessica NicholsonPas encore d'évaluation

- 03 - UndercityDocument28 pages03 - UndercityJames Bayhylle100% (1)

- DSSB ClerkDocument4 pagesDSSB Clerkjfeb40563Pas encore d'évaluation

- People or PenguinsDocument6 pagesPeople or Penguinskblitz83Pas encore d'évaluation

- Accounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsDocument9 pagesAccounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsKanika BajajPas encore d'évaluation

- Goldenway Merchandising Corporation vs. Equitable PCI Bank Case DigestDocument1 pageGoldenway Merchandising Corporation vs. Equitable PCI Bank Case DigestTopher Oliva100% (1)

- Customer Perception Towards E-Banking Services Provided by Commercial Banks of Kathmandu Valley QuestionnaireDocument5 pagesCustomer Perception Towards E-Banking Services Provided by Commercial Banks of Kathmandu Valley Questionnaireshreya chapagainPas encore d'évaluation

- Ancient History Dot Point SummaryDocument16 pagesAncient History Dot Point SummaryBert HaplinPas encore d'évaluation

- Market Conduct Guidelines Philippine Life Insurance Association June 2009Document28 pagesMarket Conduct Guidelines Philippine Life Insurance Association June 2009Roselle Perez-BariuanPas encore d'évaluation

- Axess Group - Brazilian ComplianceDocument1 pageAxess Group - Brazilian ComplianceRicardoPas encore d'évaluation

- History One Marks Questions With AnswerDocument49 pagesHistory One Marks Questions With AnsweryasvanthmPas encore d'évaluation

- Poli TipsDocument83 pagesPoli TipsJoyae ChavezPas encore d'évaluation

- Midterm ExamDocument3 pagesMidterm ExamRafael CensonPas encore d'évaluation

- DMDocument12 pagesDMDelfin Mundala JrPas encore d'évaluation

- Artificial Intelligence IBM FinalDocument35 pagesArtificial Intelligence IBM FinalnonieshzPas encore d'évaluation

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyD'EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyÉvaluation : 5 sur 5 étoiles5/5 (22)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeD'EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeÉvaluation : 4.5 sur 5 étoiles4.5/5 (88)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveD'EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurvePas encore d'évaluation

- Summary of Zero to One: Notes on Startups, or How to Build the FutureD'EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (100)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurD'Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurÉvaluation : 4 sur 5 étoiles4/5 (2)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizD'EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizÉvaluation : 4.5 sur 5 étoiles4.5/5 (112)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldD'Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldÉvaluation : 5 sur 5 étoiles5/5 (20)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryD'EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryÉvaluation : 4 sur 5 étoiles4/5 (26)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthD'EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthÉvaluation : 4.5 sur 5 étoiles4.5/5 (1026)

- Anything You Want: 40 lessons for a new kind of entrepreneurD'EverandAnything You Want: 40 lessons for a new kind of entrepreneurÉvaluation : 5 sur 5 étoiles5/5 (46)

- The Master Key System: 28 Parts, Questions and AnswersD'EverandThe Master Key System: 28 Parts, Questions and AnswersÉvaluation : 5 sur 5 étoiles5/5 (62)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeD'EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeÉvaluation : 4.5 sur 5 étoiles4.5/5 (58)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedD'EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedÉvaluation : 4.5 sur 5 étoiles4.5/5 (38)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleD'EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleÉvaluation : 4.5 sur 5 étoiles4.5/5 (48)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessD'EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessÉvaluation : 4.5 sur 5 étoiles4.5/5 (407)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyD'EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyÉvaluation : 4.5 sur 5 étoiles4.5/5 (300)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeD'EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeÉvaluation : 5 sur 5 étoiles5/5 (22)

- Your Next Five Moves: Master the Art of Business StrategyD'EverandYour Next Five Moves: Master the Art of Business StrategyÉvaluation : 5 sur 5 étoiles5/5 (799)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursD'EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursÉvaluation : 5 sur 5 étoiles5/5 (24)

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchD'EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchÉvaluation : 4 sur 5 étoiles4/5 (114)

- 7 Secrets to Investing Like Warren BuffettD'Everand7 Secrets to Investing Like Warren BuffettÉvaluation : 4.5 sur 5 étoiles4.5/5 (121)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsD'EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsÉvaluation : 5 sur 5 étoiles5/5 (48)

- Transformed: Moving to the Product Operating ModelD'EverandTransformed: Moving to the Product Operating ModelÉvaluation : 4 sur 5 étoiles4/5 (1)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsD'EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsÉvaluation : 5 sur 5 étoiles5/5 (2)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelD'EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelÉvaluation : 5 sur 5 étoiles5/5 (51)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyD'EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyPas encore d'évaluation

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessD'EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessÉvaluation : 4.5 sur 5 étoiles4.5/5 (24)

- WEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouD'EverandWEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouÉvaluation : 4.5 sur 5 étoiles4.5/5 (87)