Académique Documents

Professionnel Documents

Culture Documents

Personal Finance Webinar Presentation 11/12/2012 Streettalk Advsiors

Transféré par

streettalk700Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Personal Finance Webinar Presentation 11/12/2012 Streettalk Advsiors

Transféré par

streettalk700Droits d'auteur :

Formats disponibles

The difference a couple of decades can make!

streettalklive.com

With Lance Roberts

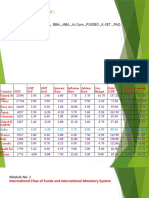

Economic growth and the Grand Illusion. 80s and 90s A distant memory 5 things that will crush your retirement 30 Years to yield 10 Investment Guidelines Q&A

180% GDP & Debt As % Of GDP 160% 140% 120%

72%

70%

Consumption 68% 66%

100%

80%

60% 40% 1959 1965 1972 1979 1986 1993 2000 2006

64% 62% 60% Household Debt To GDP GDP - 10 Yr Rolling % Chg. Consumption As A % Of The Economy

15%

2.5 Debt to Consumption Ratio 2.3

Annual % Change

10%

2.1 1.9

5%

1.7 1.5

0%

1.3 1.1

-5% 1959

0.9 1966 1973 1980 1987 1994 2001 2008

YoY % Change In GDP PCE - YOY % Change

Wages YOY % Change Debt to Consumption Ratio

Government Financial Assistance At Record Levels

2500.0

STREETTALKLIVE.COM

2000.0

1500.0 $ Billions 1000.0 500.0 0.0 1966

1971

1976

1981

1986

1991

1996

2001

2006

2011

Medicare Social Security Other Social Benefits

Unemployment Insurance Medicaid Veterans' Benefits

Food Stamp Usage & Costs

50,000 45,000 40,000 # Of Participants (000's)

STREETTALKLIVE.COM

80 70 60 50 40 30 20 Total Costs (Billions)

35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 1969 1975 1981 1987 1993 1999 2005 2011 10 0

Total Costs ($ Mil)

Avg. Participation (000's) - Left Scale

Deficits Impede Economic Growth

20.0

STREETTALKLIVE.COM

200.0

0.0 15.0 Annual % Change In GDP Growth -200.0 Budget Surplus / Deficit ($ Bil)

10.0

-400.0

-600.0 5.0

-800.0

-1000.0 0.0 -1200.0

-5.0 1947 1952 1957 1962 1967 1972 1977 1982 1987 1992 1997 2002 2007 2012 Surplus/Deficit Gross Domestic Product, 1 Decimal Poly. (Gross Domestic Product, 1 Decimal)

-1400.0

DJIA - 1964-1980 Secular Bear

1100 Int Rate 12% Fed Funds 14% Inflation 12% PE's 9x Div Yield 5% 25

1000

20

900 15 800 Int Rate 4.14% Fed Funds 5.5% Inflation 1.1% PE's 23x Div Yield 3% 10

700

5 600

500 1964 DJIA

0 1967 INT RATE 1970 FED FUNDS 1973 INFLATION 1976 PE's 1979 DIV YIELD

DJIA 1980-2000 Secular Bull

14000 45 40 35 30 25 20 15 4000 10 2000 5 0 1983 DJIA 1986 INT RATE 1989 FED FUNDS 1992 INFLATION 1995 PE's 1998 DIV YIELD

12000 Int Rate 6.46% Fed Funds 6.5% Inflation 2.2% PE's 42x Div Yield 1.14%

10000 Int Rate 12.15% Fed Funds 14.5% Inflation 13.5% PE's 9x Div Yield 5%

8000

6000

0 1980

DJIA 2000-Present Secular Bear

14000 45 40 12000 35 10000 Int Rate 1.8% Fed Funds 0.25% Inflation 2.5% PE's 17x Div Yield 2.56% 30 25 20 15 10 5 2000 0 0 1999 -5 2012

8000 Int Rate 6.46% Fed Funds 6.5% Inflation 2.2% PE's 42x Div Yield 1.14%

6000

4000

2000

2001 DJIA

2002

2003

2004

2005

2006

2007 INFLATION

2008

2009 PE's

2010

2011

INT RATE

FED FUNDS

DIV YIELD

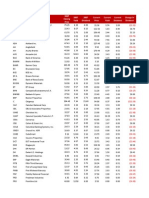

S&P 500 Reported Earnings Per Share

$120

STREETTALKLIVE.COM

4Q 2012 Est.

$100

1Q 2012 Est.

$80

$60

$40

$20

$0 1936

1944

1952

1960

1968

1976

1984

1992

2000

2008

2016

Recessions Growth Trend Line EPS Growth Rate (6% Peak To Peak)

S&P 500 Earnings EPS Growth Rate Lower Bound (5% Trough to Trough) Projected Earnings Reversion Within Norms

Real S&P 500 Index And Earnings

(Robert Shiller Real Price Data)

STREETTALKLIVE.COM

100.00

1,250.00

10.00 250.00

50.00 Jan-1871

1.00 Jan-1886 Jan-1901 Jan-1916 Jan-1931 Jan-1946 Jan-1961 Jan-1976 Jan-1991 Jan-2006

S&P 500 (Real Price)

Real Earnings

You wont live long enough

Allocation & Risk Managment

No professional investor implements buy and hold strategies why should you? Risk is about how much you will lose when you are wrongyou will be wrong.

You cant time the market but you can control investment risk.

The stock market is irrelevant to your retirement.

Market Based Portfolio Returns Vs. Conservative 80/20 Strategy

$180,000.00

5 Mistakes That Will Crush Your Retirement Dreams!

1) 2) Not correctly managing your 401k plan. Investors take on too much risk.

$160,000.00

$140,000.00

$120,000.00

$100,000.00

401k plans are primarily a disaster. Individuals urged to take on excessive risk. Destruction of free money. Compound returns are a myth.

$80,000.00

$60,000.00

Market Based Compounded Value

80/20 Compounded Value

Wall Street Has Wanted Investors To Stay In Stocks

$100k Invested In VFINX (stocks) vs VBTIX (bonds) - Capital Appreciation Only

120000

110000

100000

90000

80000

70000

60000

50000 2000 2001 2002 S&P Index 2003 2004 Bond Market 2005 2006 2007 2008 2009 2010 2011 2012 60/40 Model 50/50 Model 40/60 Model

The Negative Effects Of Risk Taking

130,000.00

STREETTALKLIVE.COM

5 Mistakes That Will Crush Your Retirement Dreams!

4) Not saving enough Wealth is created from SAVINGS. Investing is a tool used to offset the effects of inflation. The stock market is not a wealth creator it is a wealth preserver.

120,000.00

110,000.00

100,000.00

90,000.00

80,000.00

70,000.00

60,000.00

50,000.00 0 1 2 3 4 5 6 7 8 9 10 11 12

Conservative Investor (60/40)

Aggressive Investor (Benchmark)

Be realistic about your situation. If you sacrifice everything for your children, you won't be able to retire. However, it gets worse. You won't live forever, and the average American will spend the bulk of his or her retirement on healthcare in the last few years of their life. Guess who gets to foot the bill when you can't care for yourself?

5 Mistakes That Will Crush Your Retirement Dreams!

5) Time to close the Parents Bank Spending yourself into bankruptcy only insures that you will ultimately become a burden upon your children.

Investing is not a competition. There are no prizes for winning but there are severe penalties for losing. Emotions have no place in investing. You are generally better off doing the opposite of what you "feel" you should be doing. The ONLY investments that you can "buy and hold" are those that provide an income stream with a return of principal function. Market valuations (except at extremes) are very poor market timing devices. Fundamentals and Economics drive long term investment decisions - "Greed and Fear" drive short term trading. Knowing what type of investor you are determines the basis of your strategy.

"Market timing" is impossible - managing exposure to risk is both logical and possible. Investing is about discipline and patience. Lacking either one can be destructive to your investment goals. There is no value in daily media commentary - turn off the television and save yourself the mental capital. Investing is no different than gambling - both are "guesses" about future outcomes based on probabilities. The winner is the one who knows when to "fold" and when to go "all in". No investment strategy works all the time. The trick is to understand the difference between a bad investment strategy and one that is temporarily out of favor.

Vous aimerez peut-être aussi

- Be Your Own BankerDocument51 pagesBe Your Own BankersalemselvaPas encore d'évaluation

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsD'EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsPas encore d'évaluation

- Trend Following Strategies for Equities and ETFsDocument27 pagesTrend Following Strategies for Equities and ETFsDraženS0% (2)

- Digital Wealth: An Automatic Way to Invest SuccessfullyD'EverandDigital Wealth: An Automatic Way to Invest SuccessfullyÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Risk Revisited by Howard MarksDocument17 pagesRisk Revisited by Howard Marksstreettalk700Pas encore d'évaluation

- Investor Intelligence Techical Analysis GuideDocument25 pagesInvestor Intelligence Techical Analysis Guidestreettalk700Pas encore d'évaluation

- Psychology of Risk-Behavioral Finance PerspectiveDocument28 pagesPsychology of Risk-Behavioral Finance Perspectivestreettalk700Pas encore d'évaluation

- Trump Saudi Nuclear Report July 2019Document50 pagesTrump Saudi Nuclear Report July 2019ABC News Politics83% (12)

- Final Project 8460430274 NiraliDocument145 pagesFinal Project 8460430274 NiraliDarshan KasalPas encore d'évaluation

- Valuations Suggest Extremely Overvalued MarketDocument9 pagesValuations Suggest Extremely Overvalued Marketstreettalk700Pas encore d'évaluation

- Clinker DROP TEST 01092021Document36 pagesClinker DROP TEST 01092021Valipireddy NagarjunPas encore d'évaluation

- Direct Selling Presentation English v97 As PDFDocument27 pagesDirect Selling Presentation English v97 As PDFVikas AgrawalPas encore d'évaluation

- 02 Oct 08Document12 pages02 Oct 08Paweł ŁakomyPas encore d'évaluation

- Quickfix Financial AnalysisDocument9 pagesQuickfix Financial AnalysisMuhammad Iqbal Huseini0% (1)

- Managing in Global EnvironmentDocument21 pagesManaging in Global EnvironmentShelvy SilviaPas encore d'évaluation

- RA 7183 FirecrackersDocument2 pagesRA 7183 FirecrackersKathreen Lavapie100% (1)

- Greg Morris - 2017 Economic & Investment Summit Presentation - Questionable PracticesDocument53 pagesGreg Morris - 2017 Economic & Investment Summit Presentation - Questionable Practicesstreettalk700Pas encore d'évaluation

- SIMPLE INTEREST AND DISCOUNT WORD PROBLEMS SOLVEDDocument3 pagesSIMPLE INTEREST AND DISCOUNT WORD PROBLEMS SOLVEDkris salacPas encore d'évaluation

- Dividends Still Don't Lie: The Truth About Investing in Blue Chip Stocks and Winning in the Stock MarketD'EverandDividends Still Don't Lie: The Truth About Investing in Blue Chip Stocks and Winning in the Stock MarketPas encore d'évaluation

- NomuraDocument37 pagesNomuradavidmcookPas encore d'évaluation

- Chapter 11 AnswerDocument16 pagesChapter 11 AnswerKathy WongPas encore d'évaluation

- The MYTHS WE LIVE by - Late Senator Lorenzo TanadaDocument12 pagesThe MYTHS WE LIVE by - Late Senator Lorenzo TanadaBert M DronaPas encore d'évaluation

- Value Investor Forum Presentation 2015 (Print Version)Document29 pagesValue Investor Forum Presentation 2015 (Print Version)streettalk700Pas encore d'évaluation

- Twelve Key Elements of Practical Personal FinanceDocument65 pagesTwelve Key Elements of Practical Personal FinanceudayudPas encore d'évaluation

- Mankiw8e Chap18Document31 pagesMankiw8e Chap18Sardar AftabPas encore d'évaluation

- Lessons From Capital Market History: Return & RiskDocument46 pagesLessons From Capital Market History: Return & RiskBlue DemonPas encore d'évaluation

- Ten Steps To Making A Million in The Market: A Motley Fool Uk Special ReportDocument8 pagesTen Steps To Making A Million in The Market: A Motley Fool Uk Special ReportJoshua AdomPas encore d'évaluation

- Assignment ADocument6 pagesAssignment Acary_puyatPas encore d'évaluation

- Raghuram Rajan - Fin Devt and RiskDocument20 pagesRaghuram Rajan - Fin Devt and Riska65b66incPas encore d'évaluation

- Market Commentary 7-30-12Document3 pagesMarket Commentary 7-30-12CLORIS4Pas encore d'évaluation

- To Become in Your 30s: WealthyDocument12 pagesTo Become in Your 30s: WealthyParag EkbotePas encore d'évaluation

- Tata Retirement Savings Fund - Final RoadshowDocument70 pagesTata Retirement Savings Fund - Final RoadshowViral ShuklaPas encore d'évaluation

- Global Financial Crisis & Recovery Plan For IndiaDocument36 pagesGlobal Financial Crisis & Recovery Plan For Indiaramit86Pas encore d'évaluation

- FenchelDocument20 pagesFenchelgeertrui1234321100% (1)

- Why Is India PoorDocument49 pagesWhy Is India PoorDeepak Ranjan PadhiPas encore d'évaluation

- From Capitalism To Creditism Feb 27 2014Document22 pagesFrom Capitalism To Creditism Feb 27 2014richardck61Pas encore d'évaluation

- Cna Presentation 1Document20 pagesCna Presentation 1api-258221737100% (1)

- Economic Watch - Will China Enter Into Japanization and Balance Sheet Recession - FDocument10 pagesEconomic Watch - Will China Enter Into Japanization and Balance Sheet Recession - FManuel CHPas encore d'évaluation

- Recent Challenges in Monetary Policy Design in India: Mridul SaggarDocument38 pagesRecent Challenges in Monetary Policy Design in India: Mridul SaggarbafnajayeshPas encore d'évaluation

- Newshrink 2Document50 pagesNewshrink 2David TollPas encore d'évaluation

- Advanco 98Document63 pagesAdvanco 98Ricardo SoaresPas encore d'évaluation

- Deflation Prevention and Cure: Willem BuiterDocument33 pagesDeflation Prevention and Cure: Willem BuiterNavneet AmratePas encore d'évaluation

- The Millionaire Blueprint: Portfolio Strategies For Tomorrow's MillionaireDocument46 pagesThe Millionaire Blueprint: Portfolio Strategies For Tomorrow's MillionairemuiesibaPas encore d'évaluation

- Why Is India PoorDocument49 pagesWhy Is India Poorgangad_1Pas encore d'évaluation

- Chapter 1Document15 pagesChapter 1Manjunath BVPas encore d'évaluation

- Module 5 Market Analysis BeginnerDocument23 pagesModule 5 Market Analysis BeginnerBas KelderPas encore d'évaluation

- No Economy Is An Island - Alpert 021515Document26 pagesNo Economy Is An Island - Alpert 021515AdminAliPas encore d'évaluation

- Financial RulesDocument12 pagesFinancial RulesThanseem Abdul HameedPas encore d'évaluation

- Real Estate - U.S. Real Estate and Inflation - ENDocument9 pagesReal Estate - U.S. Real Estate and Inflation - ENTianliang ZhangPas encore d'évaluation

- ChangeWave RiskOfStayingOnSideline PDFDocument2 pagesChangeWave RiskOfStayingOnSideline PDFlingwindPas encore d'évaluation

- Current Issues Papers July 2016Document13 pagesCurrent Issues Papers July 2016api-263983134100% (1)

- Control Your Cash and Retirement With StocksDocument60 pagesControl Your Cash and Retirement With StocksLaurent DPas encore d'évaluation

- Munich Presentation 2013Document48 pagesMunich Presentation 2013weissincPas encore d'évaluation

- WCM777 English Presentation REVISED1Document48 pagesWCM777 English Presentation REVISED1FiraSmartPas encore d'évaluation

- Financial Bubbles: What They Are and What Should Be Done: CEPR Basic Economics Seminar Dean Baker November 10, 2005Document19 pagesFinancial Bubbles: What They Are and What Should Be Done: CEPR Basic Economics Seminar Dean Baker November 10, 2005wzpttsslPas encore d'évaluation

- Price Indices and InflationDocument27 pagesPrice Indices and InflationPriscilla SamaniegoPas encore d'évaluation

- State of Market Feb 2008Document42 pagesState of Market Feb 2008azharaqPas encore d'évaluation

- The Incredible Volcker Disin Ation: Marvin Goodfriend, Robert G. KingDocument35 pagesThe Incredible Volcker Disin Ation: Marvin Goodfriend, Robert G. KingOkechukwu MeniruPas encore d'évaluation

- Corp Fin - Radio One IncDocument39 pagesCorp Fin - Radio One IncMarco Quispe PerezPas encore d'évaluation

- Abercrombie & Fitch Co.: Matt's Fundamental Stock AnalysisDocument11 pagesAbercrombie & Fitch Co.: Matt's Fundamental Stock Analysismclennan68_13Pas encore d'évaluation

- Annual Letter 2018Document28 pagesAnnual Letter 2018Incandescent Capital100% (1)

- 2011-2012 Review and Outlook: Metwest Total Return Bond Fund Is There Life After Debt?Document55 pages2011-2012 Review and Outlook: Metwest Total Return Bond Fund Is There Life After Debt?Brad SamplesPas encore d'évaluation

- Case 5Document4 pagesCase 5abhilashPas encore d'évaluation

- Chap 15Document66 pagesChap 15jamn1979Pas encore d'évaluation

- Week 6 - Tutorial Questions-1Document6 pagesWeek 6 - Tutorial Questions-1Đan Thanh Nguyễn NgọcPas encore d'évaluation

- Interest Rates and Interest Rate DeterminationDocument46 pagesInterest Rates and Interest Rate DeterminationiluvoraclePas encore d'évaluation

- Opportunity MeetingDocument33 pagesOpportunity Meetingapi-258221737100% (1)

- Macroeconomics Chapter 1Document24 pagesMacroeconomics Chapter 1Hashim Zameer SanghiPas encore d'évaluation

- Savings and InvestmentDocument49 pagesSavings and InvestmentAbhinav DubeyPas encore d'évaluation

- Caught Between Armageddon and Irrational Exuberance: Stop Press ....Document4 pagesCaught Between Armageddon and Irrational Exuberance: Stop Press ....FirstEquityLtdPas encore d'évaluation

- Eclectica FundDocument5 pagesEclectica FundZerohedge100% (9)

- ValuEngine Weekly Newsletter August 27 2010Document11 pagesValuEngine Weekly Newsletter August 27 2010ValuEngine.comPas encore d'évaluation

- Ignore the Hype: Financial Strategies Beyond the Media-Driven MayhemD'EverandIgnore the Hype: Financial Strategies Beyond the Media-Driven MayhemPas encore d'évaluation

- AroundTheWorldIn8Pages Q1 2019 LVDocument41 pagesAroundTheWorldIn8Pages Q1 2019 LVstreettalk700Pas encore d'évaluation

- Not All The Pieces Are in Place For A Sustained Rally - World - Snapshot-3!25!20Document10 pagesNot All The Pieces Are in Place For A Sustained Rally - World - Snapshot-3!25!20streettalk700Pas encore d'évaluation

- S&P 500 Monthly Valuation Analysis & ReviewDocument14 pagesS&P 500 Monthly Valuation Analysis & Reviewstreettalk700100% (1)

- Russell 3000 "Death Cross" Signals More Pain - 03/30/20Document11 pagesRussell 3000 "Death Cross" Signals More Pain - 03/30/20streettalk700Pas encore d'évaluation

- The Great ContaigionDocument9 pagesThe Great Contaigionstreettalk700Pas encore d'évaluation

- Unified Framework For Fixing Our Broken Tax CodeDocument9 pagesUnified Framework For Fixing Our Broken Tax Codestreettalk700Pas encore d'évaluation

- SP500 ValuationDocument14 pagesSP500 Valuationstreettalk700Pas encore d'évaluation

- Lance Roberts - Economic & Investment Summit 2017 Opening PresentationDocument30 pagesLance Roberts - Economic & Investment Summit 2017 Opening Presentationstreettalk700100% (5)

- GTA Introduction RIA ProDocument7 pagesGTA Introduction RIA Prostreettalk700100% (2)

- Lebowitz - Valuations Matter & The Virtuous CycleDocument26 pagesLebowitz - Valuations Matter & The Virtuous Cyclestreettalk700100% (2)

- The US Jobs Market - Much Worse Than The Official Data SuggestDocument14 pagesThe US Jobs Market - Much Worse Than The Official Data Suggeststreettalk700100% (1)

- Employment Trends in The U.S.Document16 pagesEmployment Trends in The U.S.streettalk700Pas encore d'évaluation

- Unconventional Policies and Their Effects On Financial Markets PDFDocument36 pagesUnconventional Policies and Their Effects On Financial Markets PDFSoberLookPas encore d'évaluation

- RIA Economic & Investment Summit 2016Document55 pagesRIA Economic & Investment Summit 2016streettalk700Pas encore d'évaluation

- Summer Market Outlook & ForecastDocument51 pagesSummer Market Outlook & Forecaststreettalk700Pas encore d'évaluation

- Companies Paying Dividend SP500 - 2007-2015Document8 pagesCompanies Paying Dividend SP500 - 2007-2015streettalk700Pas encore d'évaluation

- EmpDocument6 pagesEmpdpbasicPas encore d'évaluation

- Cycles and Possible OutcomesDocument6 pagesCycles and Possible Outcomesstreettalk700Pas encore d'évaluation

- Understanding The Bear CaseDocument17 pagesUnderstanding The Bear Casestreettalk700Pas encore d'évaluation

- Companies Paying Dividend SP500 - 2007-2015Document8 pagesCompanies Paying Dividend SP500 - 2007-2015streettalk700Pas encore d'évaluation

- Companies Paying Dividend SP500 - 2007-2015Document8 pagesCompanies Paying Dividend SP500 - 2007-2015streettalk700Pas encore d'évaluation

- Companies That Cut Dividends in 2008Document3 pagesCompanies That Cut Dividends in 2008streettalk700Pas encore d'évaluation

- Modern Portfolio Theory 2Document21 pagesModern Portfolio Theory 2streettalk700Pas encore d'évaluation

- FOMC Overly Optimistic on Wealth Effect and Economic GrowthDocument5 pagesFOMC Overly Optimistic on Wealth Effect and Economic GrowthTREND_7425Pas encore d'évaluation

- IntroductionDocument3 pagesIntroductionHîmäñshû ThãkráñPas encore d'évaluation

- Money and Monetary StandardsDocument40 pagesMoney and Monetary StandardsZenedel De JesusPas encore d'évaluation

- Robot Book of KukaDocument28 pagesRobot Book of KukaSumit MahajanPas encore d'évaluation

- Quan Tri TCQTDocument44 pagesQuan Tri TCQTHồ NgânPas encore d'évaluation

- CCS NewsletterDocument2 pagesCCS NewsletterCindy Mitchell KirbyPas encore d'évaluation

- Liberal: 3.0 ObjectivesDocument11 pagesLiberal: 3.0 ObjectivesShivam SinghPas encore d'évaluation

- LKP Jalan Reko Pedestrian Hand Railing Sight Distance Issue ReportDocument29 pagesLKP Jalan Reko Pedestrian Hand Railing Sight Distance Issue ReportLokman Hakim Abdul AzizPas encore d'évaluation

- AcpcDocument21 pagesAcpcapi-293268314Pas encore d'évaluation

- Analysis of Mutual Fund PerformanceDocument7 pagesAnalysis of Mutual Fund PerformanceMahaveer ChoudharyPas encore d'évaluation

- Account statement for Naresh Seervi from 28 June to 18 July 2019Document3 pagesAccount statement for Naresh Seervi from 28 June to 18 July 2019Naresh SeerviPas encore d'évaluation

- Kunal Uniforms CNB TxnsDocument2 pagesKunal Uniforms CNB TxnsJanu JanuPas encore d'évaluation

- Econ 002 - INTRO MACRO - Prof. Luca Bossi - February 12, 2014 Midterm #1 SolutionsDocument9 pagesEcon 002 - INTRO MACRO - Prof. Luca Bossi - February 12, 2014 Midterm #1 SolutionsinmaaPas encore d'évaluation

- Sentence Completion..fillersDocument5 pagesSentence Completion..fillersShahan DashtiPas encore d'évaluation

- Liquidity Preference TheoryDocument5 pagesLiquidity Preference TheoryAaquib AhmadPas encore d'évaluation

- Civpro Cases FinalsDocument4 pagesCivpro Cases FinalsMc DalayapPas encore d'évaluation

- CH 15 CDocument1 pageCH 15 CstillnotbeaPas encore d'évaluation

- Foregin Policy IndiaDocument21 pagesForegin Policy IndiaJeevandeep Singh DulehPas encore d'évaluation

- Final Presentation On Ambuja Cements LTDDocument25 pagesFinal Presentation On Ambuja Cements LTDRocky SyalPas encore d'évaluation

- Chevron Attestation PDFDocument2 pagesChevron Attestation PDFedgarmerchanPas encore d'évaluation

- PerdiscoDocument10 pagesPerdiscogarytrollingtonPas encore d'évaluation

- Communicating Vessels Communicating Vessels Issue 20 Fallwinter 20082009Document48 pagesCommunicating Vessels Communicating Vessels Issue 20 Fallwinter 20082009captainfreakoutPas encore d'évaluation

- Economics Higher Level Paper 3: Instructions To CandidatesDocument20 pagesEconomics Higher Level Paper 3: Instructions To CandidatesAndres LopezPas encore d'évaluation