Académique Documents

Professionnel Documents

Culture Documents

10000005133

Transféré par

Chapter 11 DocketsDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

10000005133

Transféré par

Chapter 11 DocketsDroits d'auteur :

Formats disponibles

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK In re: INNKEEPERS USA TRUST, et al.,1 Debtors.

) ) ) ) ) ) ) Chapter 11 Case No. 10-13800 (SCC) Jointly Administered

DECLARATION OF WILLIAM Q. DERROUGH IN SUPPORT OF DEBTORS MEMORANDUM OF LAW (A) IN SUPPORT OF CONFIRMATION OF THE DEBTORS PLANS OF REORGANIZATION PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE AND (B) IN RESPONSE TO OBJECTIONS THERETO

I, William Q. Derrough, declare as follows: 1. I am over the age of 18 and competent to testify. I am a Managing Director of

Moelis & Company LLC (Moelis), resident in Moeliss New York office, located at 399 Park Avenue, 5th Floor, New York, New York 10022. I have over 20 years of investment banking experience, having begun my career in 1988 at Salomon Brothers. During my career, I have worked on a number of transactions in the hotel, leisure, and real estate industries, ranging from debt and equity financings, to mergers, acquisitions, and restructurings. In the past two years, my current employer, Moelis & Company has completed or is engaged in a number of large real estate transactions (financings, restructurings, and mergers and acquisitions) representing approximately $100 billion in value. These include transactions involving Fleet Street (CMBS vehicle restructuring), GGP (chapter 11), Chrysler Corp HQ building (mortgage financing),

1

The list of Debtors in these Chapter 11 Cases along with the last four digits of each Debtors federal tax identification number can be found by visiting the Debtors restructuring website at www.omnimgt.com/innkeepers or by contacting Omni Management Group, LLC at Innkeepers USA Trust c/o Omni Management Group, LLC, 16161 Ventura Boulevard, Suite C, PMB 606, Encino, California 91436. The location of the Debtors corporate headquarters and the service address for their affiliates is: c/o Innkeepers USA, 340 Royal Poinciana Way, Suite 306, Palm Beach, Florida 33480.

1

K&E 19199177

Centro Properties Group (corporate restructuring), Stuyvesant Town / Peter Cooper Village (CMBS restructuring), Xanadu (restructuring, equity financing), Fiddlers Creek (chapter 11 debtor advisory), LNR Partners (corporate restructuring), Dubai World Holdings (advisor to government of Dubai), and Fontainebleau Resorts (restructuring, sale). Moelis was the advisor to Hilton Hotels in its $26.5 billion sale to Blackstone Group in 2007. Our real estate group has completed numerous transactions for REITs, including for Simon Properties, Diamond Rock Hospitality Company, Starwood Financial Group, and iStar Financial. 2. On or around March 24, 2010, the Debtors engaged Moelis to provide general

investment banking and financial advice in connection with the Debtors attempts to complete a strategic restructuring, reorganization, and/or recapitalization of all or a significant portion of the Debtors outstanding indebtedness, as well as to prepare for the potential commencement of chapter 11 cases. 3. I submit this declaration (this Declaration) in support of the Debtors

Memorandum Of Law (A) In Support Of Confirmation Of the Debtors Plans Of Reorganization Pursuant to Chapter 11 Of the Bankruptcy Code and (B) In Response to Objections Thereto (the Confirmation Brief).2 4. The facts set forth in this Declaration are based upon my personal knowledge,

upon information and belief (where indicated), or upon client matter records kept in the ordinary course of business that were reviewed by me or other employees of Moelis under my supervision and direction. The opinions offered herein are based on my professional experience described

Capitalized terms used herein but not otherwise defined shall have the meanings ascribed to such terms in the Debtors Plan of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code [Docket No. 1445] (the Plan).

2

K&E 19199177

above, including more than 20 years of work in finance and investment banking. If called and sworn as a witness, I could and would testify competently to the matters set forth herein. I. THE DEBTORS CONDUCTED A ROBUST MARKETING AND AUCTION PROCESS TO MAXIMIZE VALUE TO THE ESTATES. 5. Since the plan support agreement terminated on September 2, 2010, Moelis, in

conjunction with the Debtors management and other advisors, engaged all key stakeholders to solicit input regarding restructuring alternatives with the goal of promoting the Debtors reorganization process. As part of this process, the Debtors and their advisors actively engaged in discussions with all of the Debtors key stakeholders, including the Debtors secured lenders, the official committee of unsecured creditors (the Creditors Committee), the ad hoc committee of preferred shareholders (Ad Hoc Committee), and Five Mile Capital Partners LLC (Five Mile), to develop a path forward that maximizes the value of the entire enterprise and takes into account the diverse views of their many stakeholders. 6. In consultation with the board of trustees of Innkeepers USA Trust (the Board)

and management, Moelis contacted and scheduled meetings with all of the key parties in interest in the Chapter 11 Cases, inviting them to in-person meetings with the Debtors and their advisors to discuss the process of developing a plan of reorganization and to solicit their input and ideas. At these meetings, Moelis provided an outline of the Debtors enterprise-level, multi-party plan development process to each of these parties and solicited their views. The Debtors and their advisors also participated in additional discussions with these parties to maintain an ongoing dialogue to discuss the status of the Debtors restructuring initiatives. 7. In addition to facilitating and participating in substantive discussions with the (a) develop new plan

Debtors stakeholders, the Debtors and their advisors continued to:

concepts related to the solicitation of interest for a potential plan sponsor; (b) facilitate due 3

K&E 19199177

diligence by interested parties; and (c) advise the Debtors Board, the committee of independent trustees of the Board (the Independent Committee), and management on views of valuation and debt capacity. The Board asked Moelis and the Debtors management to continue

discussions with key stakeholders in an effort to reach a consensual reorganization, if possible, and to evaluate all possible alternatives to maximize the value of the Debtors estates. A. 8. The Stalking Horse Process Beginning in September, the Debtors and their advisors, including Moelis, the

Independent Committee and the full Board conferred numerous times regarding the plan process going forward and the selection of a potential stalking horse bidder. 9. Following a meeting of the Board on October 19, 2010, where a number of

possible restructuring alternatives were discussed, reviewed, and considered, the Board requested that Moelis consider and propose a process to explore an enterprise-level restructuring, based on the belief at that time that such a process would provide the greatest benefits to the Debtors estates. Notwithstanding the Debtors initial preference for an enterprise-based reorganization, they always remained open to considering other structures that would maximize value. 10. On October 22, 2010, the Debtors and their advisors presented the Board with a

detailed timeline with the goal of selecting a stalking horse for plan sponsorship for an enterprise-level restructuring transaction within four weeks and selecting the winning bidder within approximately 14 weeks. After discussion and input, the Board approved the proposed timeline and tasked Moelis and the Debtors management with executing the stalking horse process and meeting the various milestones set forth therein. 11. The Debtors identified Five Mile and four other stalking horse candidates, which

list included large private equity firms and real estate-focused investors, based on, among other

4

K&E 19199177

criteria: (a) availability of funds; (b) breadth and depth of experience within the lodging sector; (c) familiarity with the bankruptcy process; and (d) ability to execute due diligence in a timely manner. On November 10, 2010, the Debtors distributed a process letter to the stalking horse candidates outlining the timeframe and requesting indications of interest on or before November 23, 2010 (the Process Letter). The Debtors management and advisors spent considerable time negotiating with various potential bidders. And, as detailed in my January 14, 2011 declaration in support of the Debtors Stalking Horse Motion3, the Debtors and their advisors worked to facilitate the formulation of offers by the stalking horse candidates in a number of ways, including coordinating over 120 site visits by the stalking horse candidates and over 25 diligence calls with sales, general, and/or regional managers of the Debtors hotels. In addition, Moelis held numerous conference calls with the stalking horse candidates to exchange views, to solicit feedback, and to facilitate the formulation of offers. 12. Following the November 23, 2010 bid deadline provided for in the Process Letter,

four out of the five stalking horse candidates, including Five Mile/Lehman, responded with proposals. The Debtors and their advisors engaged in near around-the-clock negotiations, finally settling, on December 23, 2010, on the bid submitted jointly by Five Mile and Lehman for all of the Debtors assets (the Original Stalking Horse Proposal).4 Proposal encompassed all of the Debtors hotels. The Original Stalking Horse

The Stalking Horse Motion refer to the Debtors Motion for Entry of an Order (I) Authorizing the Debtors to Enter into the Commitment Letter with Five Mile Capital II Pooling REIT LLC, Lehman ALI Inc., and Midland Loan Services, (II) Approving the New Party/Midland Commitment Between the Debtors and Midland Loan Services, (III) Approving Bidding Procedures, (IV) Approving Bid Protections, (V) Authorizing an Expense Reimbursement To Bidder D, and (VI) Modifying Cash Collateral Order to Increase Expense Reserve [Docket No. 820]. In my declaration in Support of the Debtors Stalking Horse Motion, 13-41, [Docket No. 821], incorporated by reference herein, I provide additional factual detail regarding the Debtors Stalking Horse selection process.

5

K&E 19199177

13.

On January 14, 2011, the Debtors filed a motion to, among other things, approve

the Original Stalking Horse Proposal and related bidding procedures. B. 14. The Debtors Continued Marketing Efforts and Final Stalking Horse Proposal. In addition to pursuing the Original Stalking Horse Proposal through the stalking

horse process, the Debtors and their advisors continued to engage in a broad marketing process, which was designed to maximize the value of the estates. 15. In connection with the Debtors selection of the Original Stalking Horse Proposal,

the Debtors and their advisors began transitioning their efforts to the next stage of the Debtors marketing process. As detailed more fully in my February 9, 2011 Supplemental Declaration in Support of the Debtors Stalking Horse Motion [Docket No. 916], consistent with the directions of the Board and the Independent Committee, Moelis and the Debtors management contacted a broad range of prospective buyers, representing a spectrum of potential interest, from established hotel owners and operators, to large private equity investors, sovereign wealth funds, and individual investors. Moelis began contacting additional parties and soliciting indications of interest for competing bids from more than 100 additional potential investors. In preparation for this transition, Moelis prepared teasers, which Moelis sent to those entities that expressed an initial indication of interest. The Debtors and their advisors continued to encourage an open process and always believe that these efforts would lead to the submission of competitive bids through a formal Auction process. 16. Although the Original Stalking Horse Proposal encompassed all of the Debtors

hotels, as a result of certain bids submitted by the Ad Hoc Committee of Preferred Shareholders, it was determined that splitting off the properties that did not collateralize the Seven Sisters

6

K&E 19199177

from the Original Stalking Horse Bid would maximize value, which as discussed below, ultimately resulted in approximately $50 million of extra value for the Debtors estates. 17. On February 15, 2011, the Debtors received an offer from Lehman, with the

support of both Five Mile and Midland, to modify the Original Stalking Horse Proposal with certain proposed amendments that envisioned carving out those Debtors that own and/or lease the Seven SistersAnaheim Hilton Suites, Hilton Ontario, Residence Inn Mission Valley, Residence Inn Anaheim (Garden Grove), Doubletree Washington, DC, Residence Inn Tysons Corner, and Homewood Suites San Antonio. 18. On March 9, 2011, after multiple rounds of negotiations, the parties ultimately

reached an agreement to modify the Original Stalking Horse Proposal. In addition to, among other things, carving out the Seven Sisters, as a prerequisite to moving forward with Five Mile/Lehman, Five Mile/Lehman conceded and eliminated the $7 million break-up fee (creating $7 million of additional value for the Debtors estates). This agreement was memorialized in the final Five Mile/Lehman Commitment Letter with Five Mile, Lehman, and Midland, reflecting revised terms to the Original Stalking Horse Proposal (the Final Stalking Horse Proposal). The Final Stalking Horse Proposal contemplates restructuring the 64 properties that serve as collateral under the Fixed Rate Pool Mortgage Loan Agreement and the Floating Rate Pool Mortgage Loan Agreement (the Fixed/Floating Properties). 19. On March 11, 2011, the Court entered an order approving the Final Stalking

Horse Proposal, granting authority to reimburse Five Mile/Lehman for up to $3 million in expenses under certain circumstances, and approving bidding procedures pursuant to which the Debtors could conduct an auction for the Fixed/Floating Properties [Docket No. 1099] (the Bidding Procedures Order).

7

K&E 19199177

C. 20.

The Debtors Marketing Efforts Resulted In The Receipt of Several Bids. The Debtors encouraged potential bidders to submit formal bids for both the

Fixed/Floating Properties and LNR Properties on or before April 25, 2011 (the bid deadline approved in the Bidding Procedures Order with respect to overbids on the Five Mile/Lehman Bid) (the Bid Deadline), after which they would hold a formal auction for the Fixed/Floating Properties, LNR Properties, or both. 21. On April 25, 2011, the Debtors received the following bids: A bid for the 45 hotels that serve as collateral for the Debtors fixed rate mortgage loan and six of the Seven Sisters (which include the five properties that serve as collateral for the mortgage loans for which LNR is special servicer (the LNR Properties)); Two bids for the LNR Properties; Six bids on multiple assets; Six bids on individual assets; and One bid for the Fixed/Floating Properties.

22.

Included among those offers, Cerberus Capital Management, LP (Cerberus)

and Chatham Lodging Trust (together with Cerberus, Cerberus/Chatham) submitted an overbid that the Debtors deemed a qualified overbid in accordance with the requirements set forth in the Bidding Procedures. Cerberus/Chatham submitted the only qualified overbid on the Fixed/Floating Properties. 23. After the Bid Deadline, the Debtors reviewed all timely submitted bids and

engaged in negotiations with entities that submitted bids satisfying the bid conditions established by the Bidding Procedures Order.

8

K&E 19199177

D. 24.

The Fixed/Floating Rate Auction On April 29, 2011, the Debtors named the bid jointly submitted by Cerberus and

Chatham Trust for the Fixed/Floating Properties as the baseline bid for the auction in accordance with the Bidding Procedures (the Cerberus/Chatham Baseline Bid). 25. Under the Cerberus/Chatham Baseline Bid, holders of Fixed Rate Pool Mortgage

Loan Claims would have received consideration of $622.5 million in the form of a restructured Fixed Rate Note and $3.8 million in cash and holders of Floating Rate Mortgage Loan Claims would receive consideration of $201.5 million in cash. The Cerberus/Chatham Baseline Bid utilized Midlands stapled financing. 26. With the selection of the Cerberus/Chatham Baseline Bid, the Debtors proceeded

with an auction for the Fixed/Floating Properties in accordance with the Bidding Procedures Order on May 2 and 3, 2011. After twelve rounds of competitive bidding between Five

Mile/Lehman and Cerberus/Chatham, the Debtors closed the auction for the Fixed/Floating Properties after an unchallenged bid from Cerberus/Chatham valued at over $1.12 billion (the Cerberus/Chatham Successful Bid). The auction process thus yielded approximately

$154 million in value over and above the Five Mile/Lehman stalking horse bid. Since the closing of the auction no bidder has come forward with a higher or better offer for the Fixed/Floating Properties, and to my knowledge no bidder has questioned the process itself. E. 27. LNR Properties Auction Process In the days immediately following the Courts entry of the Bidding Procedures

Order, the Debtors continued their efforts to market all of their assets, including the LNR Properties, on both an enterprise level and on an individual property basis, to achieve the most value-maximizing outcome for stakeholders. I, along with my colleagues at Moelis, sent to over 125 potential investors a letter summarizing the process by which the Debtors would solicit and 9

K&E 19199177

evaluate restructuring proposals, both with respect to overbids to the Five Mile/Lehman Bid and additional bids.5 28. As a result of the Debtors marketing efforts, the Debtors anticipated they might

receive bids for the LNR Properties in connection with bids for the Fixed/Floating Properties and that the winning bid at the auction for the Fixed/Floating Properties could encapsulate some or all of the LNR Properties. On April 12, 2011, by way of an updated process letter,6 the Debtors informed all potential bidders of the possibility the Debtors could hold a concurrent auction for the LNR Properties on May 2, 2011, to the extent the Debtors determined such an auction would be value-maximizing. The Debtors encouraged potential bidders to submit formal bids on or

before April 25 (the bid deadline approved in the Bidding Procedures Order with respect to overbids on the Five Mile/Lehman Bid). Moeliss marketing effort generated several indications of interest for one or more of the LNR Properties. 29. On May 3, 2011, after concluding the auction for the Fixed/Floating Properties,

the Debtors commenced the auction for the LNR Properties. Of the bids received for the LNR Properties, the highest and best offer came from Chatham Lodging LP (Chatham Bid and its bid, the Chatham Bid). With a purchase price of $195 million, the Chatham Bid provided baseline recoveries for all constituents holding claims against or interests in the Debtors that currently own the LNR Properties. Since the closing of the auction no bidder has come forward with a higher or better offer for the LNR Properties, and to my knowledge no bidder has questioned the process itself.

5 6

See Notice of Process Update Letter [Docket No. 1027]. See Notice of Process Update Letter [Docket No. 1102].

10

K&E 19199177

C. 30.

Financing for the Successful Bids Prior to the commencement of the auctions, the Debtors actively assisted bidders

in their efforts to obtain financing to fund all or a portion of their bids. Moelis contacted 11 potential financing sources to explore their willingness to provide financing to potential purchasers. The prepetition secured creditorsMidland and LNRwere the most willing to provide financing on reasonable terms. 31. Pursuant to the Final Stalking Horse Proposal and the commitment between Five

Mile and Midland in support thereof, Midland agreed to make stapled financing available to competing bidders submitting qualified bids at the auction (the Midland Financing). The amount of Midland Financing available to a competing bidder was to be determined by a sliding scale beginning at $622.5 million plus 70% of any overbid amount above and beyond the initial minimum cash overbid of $8 million, provided that the debt-capitalization ratio of the Fixed/Floating Debtors would not exceed 70%. Midland Financing in its winning bid. 32. Before commencing the auction for the LNR Properties, the Debtors engaged Ultimately, Cerberus/Chatham utilized the

certain of their constituents to (a) establish a framework to allocate value among certain holders of claims and interests related to the LNR Properties and (b) secure financing for bidders to use in a value-maximizing bid for the LNR Properties. 33. On May 3, 2011, after multiple rounds of negotiations, the Debtors entered into a

Stipulation with LNR Partners LLC (LNR) and the Ad Hoc Committee (which the Court approved on May 16, 2011 [Docket. No. 1397]) that memorializes, among other things, (a) a structure to allocate value generated through the sale of the LNR Properties; (b) certain parties agreement to support the bid protections offered to Chatham L.P. (the purchaser of the LNR Properties) and the Disclosure Statement as it relates to the LNR Properties; (c) LNRs 11

K&E 19199177

agreement to provide financing to Chatham L.P. in connection with its bid (the LNR Financing); (d) the release of claims against certain parties; and (e) the Debtors payment of certain fees related to the restructuring. With the LNR Financing in place, Chatham L.P. submitted a $195 million bid for the LNR Properties, which was approximately $8 million over the next highest formal offer received. II. THE AD HOC COMMITTEE OF PREFERRED SHAREHOLDERS MATERIALLY CONTRIBUTED TO THE SUCCESS OF THE DEBTORS REORGANIZATION. 34. Members of the Ad Hoc Committee played an important role by engaging in

vigorous negotiations with the Debtors and other constituents and working to maximize value for stakeholders, and the successful outcome of the Debtors marketing process was materially aided by the participation of members of the Ad Hoc Committee. 35. The Ad Hoc Committee has been an active participant in these Chapter 11 Cases.

The Ad Hoc Committee formed shortly after the Petition Date and retained Dewey & LeBeouf as its legal counsel (Dewey) on July 28, 2010. Shortly thereafter, the Ad Hoc Committee filed a motion requesting appointment of (a) an official committee of preferred shareholders and (b) an examiner to review the 2007 acquisition by Apollo and certain aspects of the Debtors restructuring efforts. 36. On December 20, 2010, while the Debtors were in the final stages of negotiations

with Lehman and Five Mile regarding their stalking horse bid, the Ad Hoc Committee members submitted their own proposal for certain of the Debtors hotel properties. In connection with the proposal, the Ad Hoc Committee members indicated that they were prepared to backstop the $15 million rights offering. 37. Over the course of the next several weeks, the Debtors continued to pursue the The Ad Hoc

Five Mile/Lehman Bid which contemplated an enterprise-level restructuring. 12

K&E 19199177

Committee continued to advocate that the Debtors pursue non-enterprise level restructuring options. On January 12, 2011, the Ad Hoc Committee submitted a second proposal. This second proposal indicated that the LNR Properties had value in excess of the amounts owing on the mortgage loans held by LNR. As a result, Debtors made clear to Five Mile and Lehman that their bid would likely need to be improved with respect to the LNR Properties or face significant objection by the Ad Hoc Committee. 38. In March, the Ad Hoc Committees proposals and continued opposition to the

Five Mile/Lehman Bid ultimately helped the Debtors convince Five Mile and Lehman to modify the Five Mile/Lehman Bid to carve out the Seven Sisters. And, after the Seven Sisters were removed from the Stalking Horse Bid, the Ad Hoc Committee continued to participate in the Debtors efforts to market the Seven Sisters and ensure maximum value for its own members and other Holders of Innkeepers USA Trust Preferred C Interests. 39. In April, the Ad Hoc Committee continued to invest time and other resources into

developing possible restructuring proposals, which I understand included visits to the LNR Properties, the retention of hotel experts to help value the hotels, and discussions with third parties regarding potential proposals for the LNR Properties. On April 25, 2011, while the Debtors were receiving final bids from parties as part of their broad marketing process, the Ad Hoc Committee submitted a third proposal for the LNR Properties that included a new blanket mortgage in the amount of the current principal and accrued interest of the mortgage loans on the LNR Properties and maintained the $15 million rights offering to be backstopped by the Ad Hoc Committee members set forth in the two previous Ad Hoc Committee proposals. 40. In May, Ad Hoc Committee members attended the Debtors auctions for the

Fixed/Floating Debtors and the LNR Properties. The auctions began on the morning of May 2,

13

K&E 19199177

2011 and did not conclude until the afternoon of May 3, 2011. During this time, the Ad Hoc Committee members engaged in multiple rounds of negotiations with the Debtors and LNR that led to a Stipulation resolving a number of issues between the parties and memorializing LNRs agreement to provide Chatham L.P. with financing to utilize in its bid. 41. I believe the Stipulation was critical to achieve global consensus in these Chapter

11 Cases. First, the Stipulation permitted the Debtors to avoid the uncertainty and expense of litigation and preserved the time and resources of the Debtors management. 42. Second, the Stipulation facilitated the financing necessary to fund Chathams

successful, value-maximizing bid for the LNR Properties. I believe LNR became willing to provide financing in light of the Stipulation because it meant that the Ad Hoc Committee would not subject LNR to expensive litigation regarding, among other things, the amount of LNRs claim. The solidification of the financing for the Chatham bid permitted the Debtors to finalize and document the Chatham bid at $195 million. 43. Thus, the Ad Hoc Committees participation during the auction process and its

agreement to the Stipulation was helpful in unlocking more than $7.7 million of incremental value compared to the highest formal offer submitted for the LNR Properties prior to the auctions. 44. Following the auctions, the Debtors negotiated with all of their constituents to

resolve open issues related to these Chapter 11 Cases, including the Ad Hoc Committees concerns regarding the Chatham Hotel Sale Transaction and other terms of the Plan and Disclosure Statement. During this period Ad Hoc Committee members attended meetings at K&Es offices and engaged in meaningful negotiations with the Debtors. These efforts

14

K&E 19199177

ultimately resulted in the Ad Hoc Committee Agreement, in which the Ad Hoc Committee agreed to support the Plan and the Chatham Hotel Sale Transaction. 45. This resolution eliminated substantial execution risk and helped pave the way to

Confirmation as it allowed the Debtors to proceed with the Chatham APA without the worry of the transaction being held up by expensive litigation and other objections brought by the Ad Hoc Committee.

15

K&E 19199177

Pursuant to 28 U.S.C. 1746, I declare under penalty of perjury that the foregoing is true and correct

Dated: June

2011

Wil in~Q. Derrough Managing Director, Moelis & Company LLC

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsPas encore d'évaluation

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsPas encore d'évaluation

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Chapter 8 In-Class Problems SOLUTIONSDocument4 pagesChapter 8 In-Class Problems SOLUTIONSAbdullah alhamaadPas encore d'évaluation

- Cheat Sheet - Bloomberg CommodityDocument1 pageCheat Sheet - Bloomberg CommoditybasitPas encore d'évaluation

- Atrill Capital Structure SlidesDocument8 pagesAtrill Capital Structure SlidesEYmran RExa XaYdiPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Ai Hidayati Amminy BT Ahmad AmminyDocument6 pagesAi Hidayati Amminy BT Ahmad AmminyhidayatiamminyPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Chapter 2Document22 pagesChapter 2Tiến ĐứcPas encore d'évaluation

- Campus 22 - Finance JDDocument2 pagesCampus 22 - Finance JDAryan MaheshwariPas encore d'évaluation

- Tvmreviewlecture 131226185711 Phpapp02Document19 pagesTvmreviewlecture 131226185711 Phpapp02Đào Quốc AnhPas encore d'évaluation

- FABM1-LESSON-2 - Users of Accounting InformationDocument5 pagesFABM1-LESSON-2 - Users of Accounting InformationGheGhe AvilaPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Overview of Financial Modeling: 3 Statement Model Types of Models DCF Model LBO M&ADocument18 pagesOverview of Financial Modeling: 3 Statement Model Types of Models DCF Model LBO M&ALaila Ubando100% (1)

- Warren Buffett 1985Document7 pagesWarren Buffett 1985anil1820Pas encore d'évaluation

- InstaBIZ 1Document14 pagesInstaBIZ 1Sacjin mandalPas encore d'évaluation

- Role of RBI in Indian EconomyDocument17 pagesRole of RBI in Indian Economychaudhary9259% (22)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Strategies Adopted and Swot AnalysisDocument12 pagesStrategies Adopted and Swot AnalysisMehul KhonaPas encore d'évaluation

- CFA Preparation COURSE 2021: Organized by Cfa Society PolandDocument4 pagesCFA Preparation COURSE 2021: Organized by Cfa Society PolandJua perezPas encore d'évaluation

- Stock & Debtor MethodDocument4 pagesStock & Debtor MethodkhanrukshiPas encore d'évaluation

- QutotionDocument1 pageQutotionmanishsngh24Pas encore d'évaluation

- Pfrs For Smes - Acpapp WebsiteDocument56 pagesPfrs For Smes - Acpapp WebsiteThessaloe B. Fernandez100% (2)

- Fundamental AnalysisDocument26 pagesFundamental Analysisaruncbe07Pas encore d'évaluation

- Ind AS 36Document37 pagesInd AS 36rajan tiwariPas encore d'évaluation

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Document8 pagesPakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaPas encore d'évaluation

- CTA Case EB For ReferenceDocument29 pagesCTA Case EB For Referencepatricia_arpilledaPas encore d'évaluation

- Mariel Princess TabilangonDocument2 pagesMariel Princess TabilangonMariel PrincessPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- CMADDocument4 pagesCMADSridhanyas kitchenPas encore d'évaluation

- Wallex HomepageDocument1 pageWallex HomepageRadius KhorPas encore d'évaluation

- Entrepreneurial Financing: Funding Your Startup: EDS 411 Dr. Maxwell OlokundunDocument22 pagesEntrepreneurial Financing: Funding Your Startup: EDS 411 Dr. Maxwell OlokundunAkande AyodejiPas encore d'évaluation

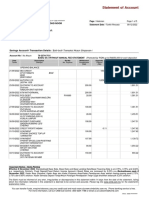

- Statement of Account: No 15 Jalan Awana 12 Taman Cheras Awana 43200 Batu 9 Cheras, SelangorDocument5 pagesStatement of Account: No 15 Jalan Awana 12 Taman Cheras Awana 43200 Batu 9 Cheras, Selangorputri nurishaPas encore d'évaluation

- Greek CrisisDocument3 pagesGreek CrisisΕυα ΕυαPas encore d'évaluation

- BCom TableDocument10 pagesBCom TablesimsonPas encore d'évaluation

- FinalDocument31 pagesFinalAniruddha RantuPas encore d'évaluation

- Jino Jose M CVDocument3 pagesJino Jose M CVJo JiPas encore d'évaluation

- Dopamine Detox: Reduce Instant Gratification, Beat Social Media Addiction, and Stop Wasting Your LifeD'EverandDopamine Detox: Reduce Instant Gratification, Beat Social Media Addiction, and Stop Wasting Your LifePas encore d'évaluation

- To Kill a Mockingbird: A Novel by Harper Lee (Trivia-On-Books)D'EverandTo Kill a Mockingbird: A Novel by Harper Lee (Trivia-On-Books)Évaluation : 3.5 sur 5 étoiles3.5/5 (7)