Académique Documents

Professionnel Documents

Culture Documents

Product Outline Flatsheet

Transféré par

carubelCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Product Outline Flatsheet

Transféré par

carubelDroits d'auteur :

Formats disponibles

ENCORE ADVANCE PS10

Issued by Forethought Life Insurance Company

COVERAGE AMOUNTS1

$500 $25,000 face amount

The Forethought Encore AdvanceSM product suite is a valuable offering to the

families you serve. The features and benefits of the product, coupled with our

service leadership and financial strength, make Forethought Life Insurance

Company the right choice as your preneed provider.

AGE AVAILABILITY BY

PAYMENT PLAN2

Single premium . . ...........0-99

3-pay. . . . . . . . . . . . . . . . ...........0-90

5,7-pay . . . . . . . . . . . . . . ..........0-85

10-pay . . . . . . . . . . . . . . ...........0-80

Payment plan options

The consumer now has the choice between five different payment plan options. They may

choose between a single premium, 3, 5, 7, or 10-year payment plan.

Automated Payment Authorization APA

A $1.00 discount is given on monthly premiums processed through the automatic

payment process.

PAYMENT OPTIONS

Single premium, 3, 5, 7, or 10-year

payment plans

Death benefit

The death benefit is designed to provide protection for future at-need funeral costs. There

is a two-year delayed growth period for issue ages 9199, after which the death benefit

will grow at the announced rate.

Monthly, quarterly, semi-annually

and annually

No one is turned down

Both underwritten and guaranteed-issue options exist. No one will be turned down

regardless of health. We reserve the right to decline coverage based on issue age and/or

total face amount on one life.

APA or coupon book

30-day free look

The Certificate of Coverage provides for a 30-day from receipt free look period. To ensure that

consumers have adequate time to receive and review their contracts, we allow 90 days from

issue to make any changes to the Certificate.

Early payoff option

Consumers who pay off their certificate during the first 12 months pay only the single

premium amount, less premiums paid. A $150 transaction fee will be charged if this option

is exercised on days 91365. After the 12th month, contact Customer Service for the payoff

savings calculation.

WV $1,000 minimum for graded death benefit

coverage only.

CT Ages 40 and above

WV 3-pay ages 46-90

For more information about the

Forethought Encore AdvanceSM

product suite, contact your

Forethought Representative,

or call Customer Service

at 1-800-331-8853.

Death benefit:

Underwritten multiple-payment plans offer first-day coverage for applicants who qualify. The death benefits payable for guaranteed-issue

plans are shown below.2

2

Guaranteed issue plans not available in Minnesota.

Payment plan

Single premium,

initial payment

3-pay

5-pay

7-pay

10-pay

MPS10-05

Months 16

Months 712

Months 1324

Months 25+

100% of premiums paid

105% of premiums paid

105% of premiums paid

105% of premiums paid

105% of premiums paid

100% of face

50% of original face

105% of premiums paid

105% of premiums paid

105% of premiums paid

100% of face

100% of face

70% of original face

110% of premiums paid

110% of premiums paid

100% of face

100% of face

100% of face

100% of face

100% of face

FOR AGENT USE ONLY NOT FOR USE WITH CONSUMERS

2010 Forethought

0910

ENCORE ADVANCE PS10

FACE FACTORS

Issue age

SINGLE PAY STANDARD

SINGLE PAY PREFERRED

MULTI-PAY STANDARD

MULTI-PAY PREFERRED

0-45

46-50

51-55

56-60

61-65

66-70

71-75

76-80

81-85

86-90

91-99

1.327

1.685

2.000

2.000

1.278

1.545

1.900

1.900

1.205

1.390

1.800

1.800

1.145

1.240

1.700

1.700

1.100

1.135

1.190

1.190

1.068

1.090

1.130

1.130

1.049

1.090

1.040

1.060

1.030

1.040

1.015

1.030

1.005

To qualify for underwritten face factors, all health questions must be answered no and signed by the insured. If health questions are not answered, or any

question is answered yes, guaranteed issue face factors must be used.

STANDARD SINGLE-PAY/DOWNPAY PREMIUM FACTORS

Issue age

Factor

Issue age

Factor

0-45

46-50

51-55

56-60

61-65

66-70

0.753580 0.782473 0.829876 0.873362 0.909091 0.936330

71-75

76-80

81-85

86-90

91-95

96-99

0.953289 0.961538 0.970874 0.985222 0.995025 0.995025

STANDARD 3-PAY PREMIUM FACTORS

Issue age

0-45

46-50

51-55

56-60

61-65

66-70

71-75

76-80

81-85

86-90

Annual

0.26505

0.28088

0.30418

0.32703

0.36462

0.38769

0.41077

0.43385

0.45934

0.49615

Semi-annual

0.13518

0.14325

0.15513

0.16679

0.18596

0.19772

0.20949

0.22126

0.23426

0.25304

Quarterly

0.06891

0.07303

0.07909

0.08503

0.09480

0.10080

0.10680

0.11280

0.11943

0.12900

Monthly

0.02412

0.02556

0.02768

0.02976

0.03318

0.03528

0.03738

0.03948

0.04180

0.04515

STANDARD 5-PAY PREMIUM FACTORS

Issue age

0-45

46-50

51-55

56-60

61-65

66-70

71-75

76-80

81-85

Annual

0.18000

0.19286

0.20791

0.22396

0.24813

0.26308

0.27813

0.29308

0.30000

Semi-annual

0.09180

0.09836

0.10603

0.11422

0.12655

0.13417

0.14185

0.14947

0.15300

Quarterly

0.04680

0.05014

0.05406

0.05823

0.06451

0.06840

0.07231

0.07620

0.07800

Monthly

0.01638

0.01755

0.01892

0.02038

0.02258

0.02394

0.02531

0.02667

0.02730

*PREFERRED SINGLE PAY/DOWNPAY PREMIUM FACTORS

Issue age

Factor

*PREFERRED 3-PAY PREMIUM FACTORS

Issue age

0-45

46-50

51-55

56-60

61-65

66-70

Annual

0.15791

0.16857

0.18022

0.19176

0.21121

0.22275

0.23429

0.24582

0.25385

Semi-annual

0.08053

0.08597

0.09191

0.09780

0.10772

0.11360

0.11949

0.12537

0.12946

Quarterly

0.04106

0.04383

0.04686

0.04986

0.05491

0.05792

0.06092

0.06391

0.06600

MPS10-05

Annual

0.11813

0.12396

0.13549

0.14692

0.16440

0.17593

0.18747

0.19615

Semi-annual

0.06025

0.06322

0.06910

0.07493

0.08384

0.08972

0.09561

0.10004

Quarterly

0.03071

0.03223

0.03523

0.03820

0.04274

0.04574

0.04874

0.05100

Semi-annual

0.10536

0.11573

0.13148

0.14700

0.16712

0.18124

Quarterly

0.05371

0.05900

0.06703

0.07494

0.08520

0.09240

Monthly

0.01880

0.02065

0.02346

0.02623

0.02982

0.03234

Issue age

0-45

46-50

51-55

56-60

61-65

66-70

Annual

0.14132

0.15527

0.17582

0.19516

0.22154

0.24000

Semi-annual

0.07207

0.07919

0.08967

0.09953

0.11299

0.12240

Quarterly

0.03674

0.04037

0.04571

0.05074

0.05760

0.06240

Monthly

0.01286

0.01413

0.01600

0.01776

0.02016

0.02184

*PREFERRED 7-PAY PREMIUM FACTORS

Issue age

0-45

46-50

51-55

56-60

61-65

66-70

Annual

0.11868

0.12945

0.14593

0.16132

0.18407

0.20022

Semi-annual

0.06053

0.06602

0.07442

0.08227

0.09388

0.10211

Quarterly

0.03086

0.03366

0.03794

0.04194

0.04786

0.05206

Monthly

0.01080

0.01178

0.01328

0.01468

0.01675

0.01822

*PREFERRED 10-PAY PREMIUM FACTORS

Monthly

0.01437

0.01534

0.01640

0.01745

0.01922

0.02027

0.02132

0.02237

0.02310

STANDARD 10-PAY PREMIUM FACTORS

Issue age

0-45

46-50

51-55

56-60

61-65

66-70

71-75

76-80

Annual

0.20659

0.22692

0.25780

0.28824

0.32769

0.35538

*PREFERRED 5-PAY PREMIUM FACTORS

STANDARD 7-PAY PREMIUM FACTORS

Issue age

0-45

46-50

51-55

56-60

61-65

66-70

71-75

76-80

81-85

0-45

46-50

51-55

56-60

61-65

66-70

0.593472 0.647249 0.719424 0.806452 0.881057 0.917431

Monthly

0.01075

0.01128

0.01233

0.01337

0.01496

0.01601

0.01706

0.01785

Issue age

0-45

46-50

51-55

56-60

61-65

66-70

Annual

0.09615

0.10352

0.11604

0.12747

0.14659

0.16044

Semi-annual

0.04904

0.05280

0.05918

0.06501

0.07476

0.08182

Quarterly

0.02500

0.02692

0.03017

0.03314

0.03811

0.04171

Monthly

0.00875

0.00942

0.01056

0.01160

0.01334

0.01460

*Preferred rates not available in: Maryland, Minnesota and Oklahoma

Single premium pay plans

Applications for single premium coverage must include both the

initial and 6-month face amounts. The initial face amount is the

funeral price. The 6-month face amount is the funeral amount

multiplied by the appropriate Face Factor. Premium is the face

amount multiplied by the appropriate Premium Factor.

FOR AGENT USE ONLY NOT FOR USE WITH CONSUMERS

2010 Forethought

0910

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Freedom Agent GuideDocument16 pagesFreedom Agent GuidecarubelPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- FTFreedom-AprilSalesIncentive 4.3.12Document1 pageFTFreedom-AprilSalesIncentive 4.3.12carubelPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- M8488-02 Freedom Medication Guide Final 1.10.13Document28 pagesM8488-02 Freedom Medication Guide Final 1.10.13carubelPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- TN MedSup Com v1Document1 pageTN MedSup Com v1carubelPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Site Posters V 42011Document1 pageOn Site Posters V 42011carubelPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Growing Your Business Flatsheet - Lead GenerationDocument1 pageGrowing Your Business Flatsheet - Lead GenerationcarubelPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Sales Incentive Commission StufferDocument1 pageSales Incentive Commission StuffercarubelPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Press Release May 2012Document1 pagePress Release May 2012carubelPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Trust Firm Quarterly Newsletter - July 2011Document2 pagesTrust Firm Quarterly Newsletter - July 2011carubelPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Word: FFSB Easy Trust Planners Made Even Easier!Document2 pagesA Word: FFSB Easy Trust Planners Made Even Easier!carubelPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Trust Postcard - 2011Document2 pagesTrust Postcard - 2011carubelPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- TrustGuard Incentive Contest Flatsheet - 2012Document1 pageTrustGuard Incentive Contest Flatsheet - 2012carubelPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Press Release June 2012Document1 pagePress Release June 2012carubelPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Agent CE PostcardDocument2 pagesAgent CE PostcardcarubelPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Individuals Wellness Plan Packages DeluxeDocument2 pagesIndividuals Wellness Plan Packages DeluxeTony Peterz KurewaPas encore d'évaluation

- Accessibility Improvement Ericsson System Rev1Document12 pagesAccessibility Improvement Ericsson System Rev1Prashant GuptaPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- UK, Eastern Europe, Middle East: Globalwide Telecoms LimitedDocument2 pagesUK, Eastern Europe, Middle East: Globalwide Telecoms LimitedHicham MarhanePas encore d'évaluation

- With The Display Vendor Balances App, You CanDocument22 pagesWith The Display Vendor Balances App, You Cancasimirox6224Pas encore d'évaluation

- MalobaDocument1 pageMalobaenyonyoziPas encore d'évaluation

- Acc Ch-7 Average Due Date SaDocument15 pagesAcc Ch-7 Average Due Date SaShivaSrinivas100% (3)

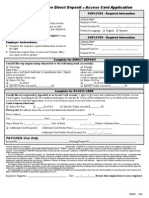

- Dir DepDocument1 pageDir Depfazlah8106Pas encore d'évaluation

- Assessing Cycle Lanes Using The Bicycle CompatibilDocument16 pagesAssessing Cycle Lanes Using The Bicycle CompatibilKashfia Tasnim NishthaPas encore d'évaluation

- Final B-307 SlidesDocument33 pagesFinal B-307 SlidesAftab UddinPas encore d'évaluation

- Cfas ReviewerDocument6 pagesCfas ReviewerJedi Duenas100% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Ssoar 2015 3 Kolekar Ebanking - in - IndiaDocument8 pagesSsoar 2015 3 Kolekar Ebanking - in - IndiaSuny PaswanPas encore d'évaluation

- The Internal Audit FunctionDocument4 pagesThe Internal Audit FunctionRosana PlancoPas encore d'évaluation

- Artificial Intelligence in Retail Whitepaper MovistaDocument14 pagesArtificial Intelligence in Retail Whitepaper MovistaSalvador Ramirez100% (1)

- CP Accounting MIdterm Review 15-16Document11 pagesCP Accounting MIdterm Review 15-16jhouvanPas encore d'évaluation

- Le Minh Hieu BKC12171 Assignment 1 Lan 1 NetworkingDocument25 pagesLe Minh Hieu BKC12171 Assignment 1 Lan 1 NetworkingYoo Hoo BinPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- 4 Cmi Prmdmi160309Document10 pages4 Cmi Prmdmi160309Collblanc Seatours Srl Jose LahozPas encore d'évaluation

- John Doe, RPT: Work ExperienceDocument2 pagesJohn Doe, RPT: Work Experiencejoeyjose18Pas encore d'évaluation

- CAPIFUND MCA Training Material 2022Document11 pagesCAPIFUND MCA Training Material 2022Carmelo PalaciosPas encore d'évaluation

- ExercisesDocument27 pagesExercisesazhar aliPas encore d'évaluation

- Dispensing and Medication CounselingDocument9 pagesDispensing and Medication CounselingMerceditha F. LidasanPas encore d'évaluation

- Neoway N11V2 AT Command Manual V1 6 PDFDocument217 pagesNeoway N11V2 AT Command Manual V1 6 PDFAnilyn AniPas encore d'évaluation

- Current Growth of Internet Subscribers in Bangladesh and Its Benefit Towards Our Economy: A Study On Premium Connectivity Ltd. (PCL)Document50 pagesCurrent Growth of Internet Subscribers in Bangladesh and Its Benefit Towards Our Economy: A Study On Premium Connectivity Ltd. (PCL)Selim KhanPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Bhikaiji Cama PlaceDocument19 pagesBhikaiji Cama PlaceVanya AroraPas encore d'évaluation

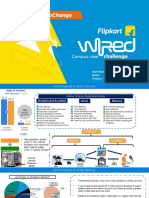

- Flipkart WiRED 4.0 - PPT TemplateDocument15 pagesFlipkart WiRED 4.0 - PPT Templaterohit100% (1)

- Dokumen-WPS OfficeDocument7 pagesDokumen-WPS OfficesigitPas encore d'évaluation

- M-Pesa Public CaseDocument23 pagesM-Pesa Public CaseRinaldo DikaputraPas encore d'évaluation

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancefinancePas encore d'évaluation

- Clinical Practice Guidelines: BY: Ma. Sylvia Emilie B. BeñalesDocument17 pagesClinical Practice Guidelines: BY: Ma. Sylvia Emilie B. Beñalespaulyn ramosPas encore d'évaluation

- I Have Been A Sincere Account Holder at Your Bank Bearing AccountDocument2 pagesI Have Been A Sincere Account Holder at Your Bank Bearing AccountMohammed Nazeer Nizam BashaPas encore d'évaluation

- محتويات أساسيات الحاسوب والأنترنتDocument8 pagesمحتويات أساسيات الحاسوب والأنترنتAdel MahmoudPas encore d'évaluation