Académique Documents

Professionnel Documents

Culture Documents

Fee Auditor'S Final Report - Page 1: Pac FR Schully 4th Int 12.09-2.10.wpd

Transféré par

Chapter 11 DocketsDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fee Auditor'S Final Report - Page 1: Pac FR Schully 4th Int 12.09-2.10.wpd

Transféré par

Chapter 11 DocketsDroits d'auteur :

Formats disponibles

UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE

In Re: PACIFIC ENERGY RESOURCES, LTD., et al., Debtors.

) ) ) ) ) )

Chapter 11 Case No. 09-10785 (KJC) (Jointly Administered)

FEE AUDITORS FINAL REPORT REGARDING INTERIM FEE APPLICATION OF SCHULLY, ROBERTS, SLATTERY & MARINO PLC FOR THE FOURTH INTERIM PERIOD This is the final report of Warren H. Smith & Associates, P.C., acting in its capacity as fee auditor in the above-captioned bankruptcy proceedings, regarding the Fee Application of Schully, Roberts, Slattery & Marino PLC for the Fourth Interim Period (the Application). BACKGROUND 1. Schully, Roberts, Slattery & Marino PLC (SRSM) was retained as special oil and

gas and transactional counsel to the debtors-in-possession. In the Application, SRSM seeks approval of fees totaling $190,025.251 and costs totaling $3,203.571 for its services from December

In our initial report, we noted that while the Application seeks allowance of $190,025.25 in fees and $3,203.57 in expenses, the monthly invoices for the period reflect $190,325.00 in total fees and $3,381.56 in total expenses, for a discrepancy of $477.74 in the estates favor. We asked Schully about this discrepancy, and Schully confirmed that the Application correctly reflects its fee and expense request:

The invoices contain errors in favor of the Debtor. The Firm submitted the correct amount ($190,025.35 in fees and $3,203.27 in expenses). The confusion occurred because certain expenses were to be charged to the purchasers of the Beta assets and not to the Debtor and were adjusted accordingly. We accept Schullys response and recommend no adjustment in fees or expenses.

FEE AUDITORS FINAL REPORT - Page 1 pac FR Schully 4th int 12.09-2.10.wpd

1, 2009, through February 28, 2010 (the Application Period). 2. In conducting this audit and reaching the conclusions and recommendations

contained herein, we reviewed in detail the Application in its entirety, including each of the time and expense entries included in the exhibits to the Application, for compliance with Local Rule 2016-2 of the Local Rules of the United States Bankruptcy Court for the District of Delaware, Amended Effective February 1, 2010, and the United States Trustee Guidelines for Reviewing Applications for Compensation and Reimbursement of Expenses Filed Under 11 U.S.C. 330, Issued January 30, 1996 (the Guidelines), as well as for consistency with precedent established in the United States Bankruptcy Court for the District of Delaware, the United States District Court for the District of Delaware, and the Third Circuit Court of Appeals. We served on SRSM an initial report based on our review, and received a response from SRSM, portions of which response are quoted herein. DISCUSSION 3. In our initial report for the third interim period, we noted that SRSM had substantially

increased the billing rates of several of its timekeepers during July 2009. These increases included a 22% increase (from $450 to $550) for an attorney (Anthony Marino) who has been a partner at SRSM since 1996 and has been licensed in Louisiana since 1985. The firm also included a 25% increase for an associate (Lynn Wolf) who has been licensed in Louisiana since 1987. Guideline II.A.3 calls for disclosure of the [n]ames and hourly rates of all applicants professionals and paraprofessionals who billed time and for an explanation of any changes in hourly rates from those previously charged. We accordingly asked SRSM to explain these increases. After considering SRSMs response, we concluded that an ad-hoc rate increase cannot be justified by the work entailed

FEE AUDITORS FINAL REPORT - Page 2 pac FR Schully 4th int 12.09-2.10.wpd

by an engagement after the firm is retained with a different fee structure.2 In our initial report for this Application Period, we noted that the increased rates remained in effect for part of the current Application Period. We asked SRSM to explain why SRSM should be compensated at these rates for this portion of the Application Period. SRSM, however, has indicated that a smaller firm-wide rate increase has gone into effect and believes that it may be appropriate to adjust its fees on that basis. Rather than file an amended interim application, SRSM has expressed its desire to reserve the right to seek such an adjustment for this period in the context of its final fee application in this case. Specifically, SRSM has stated the following: The Firm requests that the Fee Auditor permit the Firm to submit proof of its ordinary course yearly fee increases beginning June 2009 and June 2010. This Chapter 11 action has been on-going since March 2009 and continues. Although the Firms request for an increase in fees to accommodate its ordinary course yearly increases and its preclusion of employment by other potential clients during the pendency of these matters due to the magnitude of these matters (one of twelve relevant factors enumerated in Johnson v. Georgia Highway Express, Inc., 488 F.2d 714. 717-719 (5th Cir. 1974)) was rejected, the Firm wishes to reserve the right to submit reasonable partial adjustments to reflect its ordinary course yearly increases in the Final Application to be filed with the Court.

We appreciate this response and will consider SRSMs argument regarding the referenced ordinary course, firm-wide increases if it is raised by SRSM with respect to its future interim applications or its final fee application in the case. For the current Application Period, however, we will recommend reductions based on the reasoning stated in our prior final reports. Using that reasoning, we calculate that for 77.50 hours billed by ACM at $550 per hour (formerly $450), the appropriate reduction is $7,750 (77.50 x $100). For 259.40 hours billed by Lynn Wolf at $375 per hour

The ad-hoc nature of the rate increase is further underscored by the fact that the new rates were not consistently applied during the Application Period. Time entries reflecting the increased rates were sometimes followed by entries reflecting the original lower rates.

FEE AUDITORS FINAL REPORT - Page 3 pac FR Schully 4th int 12.09-2.10.wpd

(formerly $300), the appropriate reduction is $19,455.00 (259.40 x $75). For 38.90 hours billed by paralegal Joan Seelman at $275 per hour (formerly $220), the appropriate reduction is $2,139.50 (38.90 x $55). And for 20.80 hours billed by paralegal Diane Castle at $225 per hour (formerly $200), the appropriate reduction is $520.00 (20.80 x $25). Accordingly, we recommend a total reduction of $29,864.50. 4. In our initial report, we noted the following inadequately detailed expense entry in

the December invoice: Miscellaneous [JGS:Debit-Seal] 153.50

We asked SRSM to provide a further description of this item. SRSM advised us by telephone that this charge was billed in error. We appreciate this response and recommend a reduction $153.50 in expenses. 5. In our initial report, we noted the following inadequately detailed expense entry in

the February invoice: Miscellaneous [Keller & Heckman; 25229] We asked SRSM to provide a further description of this item, and SRSM did so: At the request of the Debtor, the firm was requested to acquire information related to the transfer of certain FCC licenses held by prior lessees and necessary to the successful sale of the Beta assets. Time was of the essence as the transaction had to close by the end of calender year 2009. The Firm sought the services of the firm that had previously handled the transfer of such licenses at the request of the Debtor. The invoice for such services is attached hereto. We appreciate this response and note that SRSM also provided copies of Keller & Heckmans invoice to SRSM and SRSMs check to Keller & Heckman, which are attached collectively hereto as Response Exhibit 1. We have reviewed the fee detail included in the invoice and have no objection to reimbursement of this expense item.

FEE AUDITORS FINAL REPORT - Page 4 pac FR Schully 4th int 12.09-2.10.wpd

2,112.50

CONCLUSION 6. Thus, we recommend approval of fees in the amount of $160,160.75 ($190,025.25

minus $29,864.50) and expenses in the amount of $3,050.07 ($3,203.57 minus $153.50) for SRSMs services for the Application Period. Respectfully submitted, WARREN H. SMITH & ASSOCIATES, P.C.

By: Warren H. Smith Texas State Bar No. 18757050 325 N. St. Paul Street, Suite 1250 Republic Center Dallas, Texas 75201 214-698-3868 214-722-0081 (fax) whsmith@whsmithlaw.com FEE AUDITOR

CERTIFICATE OF SERVICE I hereby certify that a true and correct copy of the foregoing document has been served via First-Class United States mail to the attached service list on this 21st day of September 2010.

Warren H. Smith

FEE AUDITORS FINAL REPORT - Page 5 pac FR Schully 4th int 12.09-2.10.wpd

SERVICE LIST The Applicant Anthony C. Marino, Esq. Lynn G. Wolf, Esq. Schully, Roberts, Slattery & Marino PLC 1100 Poydras Street, Suite 1800 New Orleans, LA 70163-1800 also sent by e-mail: amarino@schullyroberts.com lwolf@schullyroberts.com Notice Parties United States Trustee Office of the United States Trustee 844 N. King Street, Room 2207 Lock Box 35 Wilmington, DE 19801 Counsel to the Debtors Laura Davis Jones, Esq. Ira D. Kharasch, Esq. Scotta E. McFarland, Esq. Robert M. Saunders, Esq. James E. ONeill, Esq. Kathleen P. Makowski, Esq. Pachulski Stang Ziehl & LLP 919 North Market Street, 17th Floor P.O. Box 8705 Wilmington DE 19899-8705 Counsel to the Debtors Ian S. Fredericks, Esq. Skadden Arps, Slate, Meagher & Flom LLP One Rodney Square P.O. Box 636 Wilmington, DE 19899 Special Counsel to the Debtors Penelope Parmes, Esq. Rutan & Tucker, LLP 611 Anton Boulevard 14th Floor Costa Mesa, CA 92626 Canadian Counsel to the Debtors Jensen Lunny MacInnes Law Corp. H.C. Ritchie Clark, Q.C. P.O. Box 12077 Suite 2550 555 West Hastings Street Vancouver, BC V6B 4N5 Engineering Consultant to the Debtors Mark A. Clemans Millstream Energy, LLC 4918 Menlo Park Drive Sugar Land, TX 77479 Special Oil and Gas Transactional Counsel to the Debtors Anthony C. Marino, Esq. Schully, Roberts, Slattery & Marino PLC Energy Centre 1100 Poydras Street, Suite 1800, New Orleans, LA 70163 Financial Advisor to the Debtors Curtis A. McClam Deloitte Financial Advisory Services LLP 350 South Grand Ave, Ste. 200 Los Angeles, CA 90071 Financial Advisor to the Debtors John Rutherford Lazard Freres & Co. LLC 30 Rockefeller Plaza, 61st Floor New York, NY 10020

FEE AUDITORS FINAL REPORT - Page 6 pac FR Schully 4th int 12.09-2.10.wpd

Co-Counsel to the Official Committee of Unsecured Creditors David B. Stratton, Esq. James C. Carignan, Esq. Pepper Hamilton LLP Hercules Plaza, Suite 1500 1313 Market Street Wilmington, DE 19899 Co-Counsel to the Official Committee of Unsecured Creditors Filiberto Agusti, Esq. Steven Reed, Esq. Joshua Taylor, Esq. Steptoe & Johnson LLP 1330 Connecticut Avenue NW Washington, DC 20036

FEE AUDITORS FINAL REPORT - Page 7 pac FR Schully 4th int 12.09-2.10.wpd

Vous aimerez peut-être aussi

- Fee Auditor'S Final Report - Page 1: Pac FR Schully 5th Int 3-5.10 v2.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Schully 5th Int 3-5.10 v2.wpdChapter 11 DocketsPas encore d'évaluation

- In Re:: Fee Auditor'S Final Report - Page 1Document8 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsPas encore d'évaluation

- See Paragraph 5 For Further Discussion.: Fee Auditor'S Final Report - Page 1Document10 pagesSee Paragraph 5 For Further Discussion.: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 4th Int 12.09-2.10 v2.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 4th Int 12.09-2.10 v2.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 4th Int 12.09-2.10 v2.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 4th Int 12.09-2.10 v2.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Schully 2nd Int 6-8.09.wpdDocument22 pagesFee Auditor'S Final Report - Page 1: Pac FR Schully 2nd Int 6-8.09.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Millstream Final 3-12.09.wpdDocument8 pagesFee Auditor'S Final Report - Page 1: Pac FR Millstream Final 3-12.09.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Rutan 7th 8th Final 3.09-12.10.wpdDocument19 pagesFee Auditor'S Final Report - Page 1: Pac FR Rutan 7th 8th Final 3.09-12.10.wpdChapter 11 DocketsPas encore d'évaluation

- In Re:: Fee Auditor'S Final Report - Page 1Document141 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Pepper 7th 8th Final 3.09-12.10.wpdDocument10 pagesFee Auditor'S Final Report - Page 1: Pac FR Pepper 7th 8th Final 3.09-12.10.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 3rd Int 9-11.09.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 3rd Int 9-11.09.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Pachulski 7th 8th Final 3.09-12.10.wpdDocument13 pagesFee Auditor'S Final Report - Page 1: Pac FR Pachulski 7th 8th Final 3.09-12.10.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 7th 8th Final 3.09-12.10.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 7th 8th Final 3.09-12.10.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Loeb Final 6.09-1.10.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Loeb Final 6.09-1.10.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Jensen Final 3.09-6.10.wpdDocument10 pagesFee Auditor'S Final Report - Page 1: Pac FR Jensen Final 3.09-6.10.wpdChapter 11 DocketsPas encore d'évaluation

- In Re:: Fee Auditor'S Final Report - Page 1Document6 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Schully 3rd Int 9-11.09.wpdDocument10 pagesFee Auditor'S Final Report - Page 1: Pac FR Schully 3rd Int 9-11.09.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Jensen 5th Int 10.09-6.10 v2.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Jensen 5th Int 10.09-6.10 v2.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Meyers Final 3.09-12.10.wpdDocument6 pagesFee Auditor'S Final Report - Page 1: Pac FR Meyers Final 3.09-12.10.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Meyers 1st Int 3-5.09 v2.wpdDocument16 pagesFee Auditor'S Final Report - Page 1: Pac FR Meyers 1st Int 3-5.09 v2.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Loeb 4th Int 12.09-2.10.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Loeb 4th Int 12.09-2.10.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Rutan 6th Int 6-8.10.wpdDocument6 pagesFee Auditor'S Final Report - Page 1: Pac FR Rutan 6th Int 6-8.10.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 2nd Int 6-8.09.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 2nd Int 6-8.09.wpdChapter 11 DocketsPas encore d'évaluation

- Et Ai.,: Objection Deadline: 11112/10 at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryDocument41 pagesEt Ai.,: Objection Deadline: 11112/10 at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryChapter 11 DocketsPas encore d'évaluation

- Et Ai.,: Nunc Pro Tunc March 19,2009Document40 pagesEt Ai.,: Nunc Pro Tunc March 19,2009Chapter 11 DocketsPas encore d'évaluation

- 10000016738Document16 pages10000016738Chapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 1st Int 3-5.09.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 1st Int 3-5.09.wpdChapter 11 DocketsPas encore d'évaluation

- Et Ai.,: Objection Deadline: 12/7/09 at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryDocument42 pagesEt Ai.,: Objection Deadline: 12/7/09 at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryChapter 11 DocketsPas encore d'évaluation

- Objection Deadline: at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryDocument43 pagesObjection Deadline: at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryChapter 11 DocketsPas encore d'évaluation

- LTD., Et At.,'Document19 pagesLTD., Et At.,'Chapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Jensen 2nd Int 6-9.09.wpdDocument9 pagesFee Auditor'S Final Report - Page 1: Pac FR Jensen 2nd Int 6-9.09.wpdChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Lazard 3rd Final 3-12.09 v2.wpdDocument12 pagesFee Auditor'S Final Report - Page 1: Pac FR Lazard 3rd Final 3-12.09 v2.wpdChapter 11 DocketsPas encore d'évaluation

- In Re:: Fee Auditor'S Final Report - Page 1Document8 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Pepper 4th Int 12.09-2.10.wpdDocument6 pagesFee Auditor'S Final Report - Page 1: Pac FR Pepper 4th Int 12.09-2.10.wpdChapter 11 DocketsPas encore d'évaluation

- Objection Deadline: Hearing Date: To Be Scheduled Only NecessaryDocument53 pagesObjection Deadline: Hearing Date: To Be Scheduled Only NecessaryChapter 11 DocketsPas encore d'évaluation

- In Re:: Fee Auditor'S Final Report - Page 1Document17 pagesIn Re:: Fee Auditor'S Final Report - Page 1Chapter 11 DocketsPas encore d'évaluation

- Et Ai.,: AndlorDocument42 pagesEt Ai.,: AndlorChapter 11 DocketsPas encore d'évaluation

- Objection Deadline: 71J3/09 at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryDocument57 pagesObjection Deadline: 71J3/09 at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryChapter 11 DocketsPas encore d'évaluation

- Objection Deadline: at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryDocument44 pagesObjection Deadline: at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryChapter 11 DocketsPas encore d'évaluation

- Objection Deadline: at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryDocument36 pagesObjection Deadline: at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Rutan 4th Int 12.09-2.10 v2.wpdDocument7 pagesFee Auditor'S Final Report - Page 1: Pac FR Rutan 4th Int 12.09-2.10 v2.wpdChapter 11 DocketsPas encore d'évaluation

- In Re:) Chapter 11: Debtors.)Document18 pagesIn Re:) Chapter 11: Debtors.)Chapter 11 DocketsPas encore d'évaluation

- Et Ai.Document46 pagesEt Ai.Chapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court District of Delaware: in ReDocument33 pagesUnited States Bankruptcy Court District of Delaware: in ReChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Millstream Termination Fee - WPDDocument5 pagesFee Auditor'S Final Report - Page 1: Pac FR Millstream Termination Fee - WPDChapter 11 DocketsPas encore d'évaluation

- LTD., Etal.,': Objection Deadline: August 23, 2010Document21 pagesLTD., Etal.,': Objection Deadline: August 23, 2010Chapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court District of DelawareDocument76 pagesUnited States Bankruptcy Court District of DelawareChapter 11 DocketsPas encore d'évaluation

- LTD., Et Al., 1: QBJ C41't.oDocument24 pagesLTD., Et Al., 1: QBJ C41't.oChapter 11 DocketsPas encore d'évaluation

- 10000015889Document15 pages10000015889Chapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Pepper 2nd Int 6-8.09.wpdDocument18 pagesFee Auditor'S Final Report - Page 1: Pac FR Pepper 2nd Int 6-8.09.wpdChapter 11 DocketsPas encore d'évaluation

- LTD., Et Al.,: 021.2948a.2795.per1.novDocument20 pagesLTD., Et Al.,: 021.2948a.2795.per1.novChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court District of DelawareDocument27 pagesUnited States Bankruptcy Court District of DelawareChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Rutan 1st Int 3-5.09.wpdDocument10 pagesFee Auditor'S Final Report - Page 1: Pac FR Rutan 1st Int 3-5.09.wpdChapter 11 DocketsPas encore d'évaluation

- Et Al.,: Objection Deadline: at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryDocument47 pagesEt Al.,: Objection Deadline: at 4:00 PM Hearing Date: To Be Scheduled Only NecessaryChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court For The District of DelawareDocument13 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsPas encore d'évaluation

- Fee Auditor'S Final Report - Page 1: Pac FR Steptoe 6th Int 6-8.10.wpdDocument5 pagesFee Auditor'S Final Report - Page 1: Pac FR Steptoe 6th Int 6-8.10.wpdChapter 11 DocketsPas encore d'évaluation

- Nunc Pro TuncDocument43 pagesNunc Pro TuncChapter 11 DocketsPas encore d'évaluation

- Nunc Pro Tunc To March 9, 2009 by Order: 21231023353-0031 II I952 01 A09/1 5/10Document38 pagesNunc Pro Tunc To March 9, 2009 by Order: 21231023353-0031 II I952 01 A09/1 5/10Chapter 11 DocketsPas encore d'évaluation

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsPas encore d'évaluation

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsPas encore d'évaluation

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsPas encore d'évaluation

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsPas encore d'évaluation

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsPas encore d'évaluation

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsPas encore d'évaluation

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsPas encore d'évaluation

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsPas encore d'évaluation

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsPas encore d'évaluation

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsPas encore d'évaluation

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsPas encore d'évaluation

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsPas encore d'évaluation

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsPas encore d'évaluation

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsPas encore d'évaluation

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsPas encore d'évaluation

- APP CredDocument7 pagesAPP CredChapter 11 DocketsPas encore d'évaluation

- APP ResDocument7 pagesAPP ResChapter 11 DocketsPas encore d'évaluation

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsPas encore d'évaluation

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsPas encore d'évaluation

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsPas encore d'évaluation

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsPas encore d'évaluation

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsPas encore d'évaluation

- 18 Raquel-Santos v. CA, 592 SCRA 169 (2009) .Document22 pages18 Raquel-Santos v. CA, 592 SCRA 169 (2009) .Ann MarinPas encore d'évaluation

- Max Weber With QuestionsDocument4 pagesMax Weber With QuestionsDennis MubaiwaPas encore d'évaluation

- Methods of Social Control Through LawDocument3 pagesMethods of Social Control Through LawejovwoulohojenniferPas encore d'évaluation

- Banking OmbudsmanDocument26 pagesBanking OmbudsmanVIVEKPas encore d'évaluation

- EOBI Act 2020Document2 pagesEOBI Act 2020PSHHR ISBPas encore d'évaluation

- Top 35 Legal Maxims For CLAT & Other Law Entrance Exams! - CLAT & LawDocument11 pagesTop 35 Legal Maxims For CLAT & Other Law Entrance Exams! - CLAT & Lawpooja kachhwaniPas encore d'évaluation

- July 7 CasesDocument22 pagesJuly 7 CasesM Azeneth JJPas encore d'évaluation

- Liability LL M IV 22-4Document5 pagesLiability LL M IV 22-4shweta kalyanPas encore d'évaluation

- CFC, FSC and Tax HavensDocument14 pagesCFC, FSC and Tax Havensdigvijay bansalPas encore d'évaluation

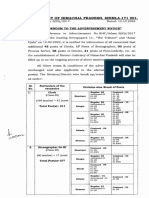

- Addendumto Advertisement 121022Document3 pagesAddendumto Advertisement 121022Robin SinghPas encore d'évaluation

- Arturo Flores v. Spouses LindoG.R. No. 183984, 13 April 2011Document8 pagesArturo Flores v. Spouses LindoG.R. No. 183984, 13 April 2011Johan FranciscoPas encore d'évaluation

- Phil. Phoenix Surety and Ins. Co. vs. Woodworks, Inc., G.R. No. L-22684, August 31, 1967, 92 SCRA 419 (1979)Document2 pagesPhil. Phoenix Surety and Ins. Co. vs. Woodworks, Inc., G.R. No. L-22684, August 31, 1967, 92 SCRA 419 (1979)Rochelle Othin Odsinada MarquesesPas encore d'évaluation

- Law of Guardianship Muslim LawDocument19 pagesLaw of Guardianship Muslim LawMohsinPas encore d'évaluation

- Contracts PDFDocument10 pagesContracts PDFArah OpalecPas encore d'évaluation

- So v. Republic DigestDocument4 pagesSo v. Republic DigestPaoloDimPas encore d'évaluation

- Missouri Last Will and Testament FormDocument7 pagesMissouri Last Will and Testament Formitargeting100% (1)

- App-202-2014-Charles Nyambe and 82 Others and Buks Haulage Ltd-Sep 2017-Kajimanga JSDocument29 pagesApp-202-2014-Charles Nyambe and 82 Others and Buks Haulage Ltd-Sep 2017-Kajimanga JSAngelina mwakamuiPas encore d'évaluation

- Immediate Deferred IndefeasibilityDocument15 pagesImmediate Deferred Indefeasibilityyvonne9lee-3Pas encore d'évaluation

- Columbia County Property Transfers Sept. 5 - 11Document1 pageColumbia County Property Transfers Sept. 5 - 11augustapressPas encore d'évaluation

- Recent Developments in The Alternative Dispute Resolution (ADR)Document5 pagesRecent Developments in The Alternative Dispute Resolution (ADR)aashishgupPas encore d'évaluation

- Lim Tian Teng CaseDocument1 pageLim Tian Teng CasedonsiccuanPas encore d'évaluation

- Strategic Legal WritingDocument242 pagesStrategic Legal WritingTony Leen100% (14)

- Western SaharaDocument6 pagesWestern SaharaemslansanganPas encore d'évaluation

- Donoghue V StevensonDocument32 pagesDonoghue V Stevensonpearlyang_200678590% (1)

- Meralco V QuisumbingDocument35 pagesMeralco V Quisumbingjoan dlcPas encore d'évaluation

- Internship ReportDocument4 pagesInternship ReportSonu SinghPas encore d'évaluation

- Cuizon Vs RamoleteDocument1 pageCuizon Vs RamoleteKim Lorenzo Calatrava100% (1)

- Civics Electoral PoliticsDocument3 pagesCivics Electoral PoliticsMahendrasingh SolankiPas encore d'évaluation

- Odyssey Marine Exploration, Inc. v. The Unidentified Shipwrecked Vessel - Document No. 73Document7 pagesOdyssey Marine Exploration, Inc. v. The Unidentified Shipwrecked Vessel - Document No. 73Justia.comPas encore d'évaluation

- Step by Step DeedsDocument8 pagesStep by Step DeedswuliaPas encore d'évaluation