Académique Documents

Professionnel Documents

Culture Documents

United States Bankruptcy Court District of Delaware Voluntary Petition

Transféré par

Chapter 11 DocketsDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

United States Bankruptcy Court District of Delaware Voluntary Petition

Transféré par

Chapter 11 DocketsDroits d'auteur :

Formats disponibles

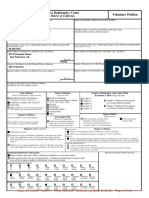

B1 (Official Form 1) (4/10)

United States Bankruptcy Court District of Delaware

Name of Debtor (if individual, enter Last, First, Middle):

Voluntary Petition

Name of Joint Debtor (Spouse) (Last, First, Middle): All Other Names used by the Joint Debtor in the last 8 years (include married, maiden, and trade names): Last four digits of Soc. Sec. or Individual-Taxpayer I.D. (ITIN)/Complete EIN (if more than one, state all): Street Address of Joint Debtor (No. and Street, City, and State):

Perkins & Marie Callenders Holding Inc.

All Other Names used by the Debtor in the last 8 years (include married, maiden, and trade names):

fka The Restaurant Holding Corporation

Last four digits of Soc. Sec. or Individual-Taxpayer I.D. (ITIN)/Complete EIN (if more than one, state all): 62-1803999 Street Address of Debtor (No. and Street, City, and State):

6075 Poplar Avenue Suite 800 Memphis, TN Shelby

ZIP CODE 38119 County of Residence or of the Principal Place of Business: Mailing Address of Debtor (if different from street address):

ZIP CODE County of Residence or of the Principal Place of Business: Mailing Address of Joint Debtor (if different from street address):

ZIP CODE Location of Principal Assets of Business Debtor (if different from street address above):

ZIP CODE ZIP CODE

Type of Debtor (Form of Organization) (Check one box.) Individual (includes Joint Debtors) See Exhibit D on page 2 of this form. Corporation (includes LLC and LLP) Partnership Other (If debtor is not one of the above entities, check this box and state type of entity below.)

Nature of Business (Check one box.) Health Care Business Single Asset Real Estate as defined in 11 U.S.C. 101(51B) Railroad Stockbroker Commodity Broker Clearing Bank Other Tax-Exempt Entity (Check box, if applicable.) Debtor is a tax-exempt organization under Title 26 of the United States Code (the Internal Revenue Code).

Chapter of Bankruptcy Code Under Which the Petition is Filed (Check one box.) Chapter 7 Chapter 15 Petition for Recognition of a Foreign Chapter 9 Main Proceeding Chapter 11 Chapter 15 Petition for Chapter 12 Recognition of a Foreign Chapter 13 Nonmain Proceeding Nature of Debts (Check one box.) Debts are primarily consumer debts, defined in 11 U.S.C. 101(8) as "incurred by an individual primarily for a personal, family, or household purpose." Chapter 11 Debtors Debts are primarily business debts

Filing Fee (Check one box.) Full Filing Fee attached. Filing Fee to be paid in installments (applicable to individuals only). Must attach signed application for the court's consideration certifying that the debtor is unable to pay fee except in installments. Rule 1006(b). See Official Form 3A. Filing Fee waiver requested (applicable to chapter 7 individuals only). Must attach signed application for the court's consideration. See Official Form 3B.

Check one box: Debtor is a small business debtor as defined in 11 U.S.C. 101(51D). Debtor is not a small business debtor as defined in 11 U.S.C. 101(51D). Check if: Debtor's aggregate noncontingent liquidated debts (excluding debts owed to insiders or affiliates) are less than $2,343,300 (amount subject to adjustment on 4/01/13 and every three years thereafter). Check all applicable boxes: A plan is being filed with this petition. Acceptances of the plan were solicited prepetition from one or more classes of creditors, in accordance with 11 U.S.C. 1126(b).

Statistical/Administrative Information Debtor estimates that funds will be available for distribution to unsecured creditors. Debtor estimates that, after any exempt property is excluded and administrative expenses paid, there will be no funds available for distribution to unsecured creditors. Estimated Number of Creditors 1-49 50-99 100-199 200-999 1,0005,000 5,00110,000 10,00125,000 25,00150,000 50,001100,000 Over 100,000

THIS SPACE IS FOR COURT USE ONLY

Estimated Assets $0 to $50,000 $50,001 to $100,000 $100,001 to $500,000 $500,001 to $1 million $1,000,001 to $10 million $10,000,001 to $50 million $50,000,001 to $100 million $100,000,001 to $500 million $500,000,001 to $1 billion More than $1 billion

Estimated Liabilities $0 to $50,000 $50,001 to $100,000 $100,001 to $500,000 $500,001 to $1 million $1,000,001 to $10 million $10,000,001 to $50 million $50,000,001 to $100 million $100,000,001 to $500 million $500,000,001 to $1 billion More than $1 billion

/s/ Robert S. Brady

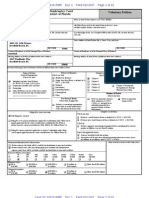

IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE

In re: PERKINS & MARIE CALLENDERS INC.,1 et al., Debtors.

Chapter 11 Case No. 11-______________ (___) Joint Administration Pending

CONSOLIDATED LIST OF CREDITORS HOLDING FORTY (40) LARGEST UNSECURED CLAIMS Perkins & Marie Callenders Inc., a Delaware corporation, and certain of its direct and indirect affiliates and subsidiaries, the debtors and debtors in possession in the above captioned cases (collectively, the Debtors), have filed with the Clerk of this Court voluntary petitions for relief under chapter 11 of the United States Bankruptcy Code, 11 U.S.C. 101, et seq. This list of creditors holding the forty (40) largest unsecured claims (the 40 Largest List) has been prepared on a consolidated basis, from the Debtors books and records as of June 10, 2011. The 40 Largest List was prepared in accordance with Rule 1007(d) of the Federal Rules of Bankruptcy Procedure for filing in the Debtors chapter 11 cases. The 40 Largest List does not include: (1) persons who come within the definition of an insider set forth in 11 U.S.C. 101(31); or (2) secured creditors. The information presented in the 40 Largest List shall not constitute an admission by, nor is it binding on, the Debtors. The information presented herein does not constitute a waiver of the Debtors rights to contest the validity, priority, nature, characterization and/or amount of any claim.

The Debtors, together with the last four digits of each Debtors federal tax identification number, are: Perkins & Marie Callenders Inc. (4388); Perkins & Marie Callenders Holding Inc. (3999); Perkins & Marie Callenders Realty LLC (N/A); Perkins Finance Corp. (0081); Wilshire Restaurant Group LLC (0938); PMCI Promotions LLC (7308); Marie Callender Pie Shops, Inc. (7414); Marie Callender Wholesalers, Inc. (1978); MACAL Investors, Inc. (4225); MCID, Inc. (2015); Wilshire Beverage, Inc. (5887); and FIV Corp. (3448). The mailing address for the Debtors is 6075 Poplar Avenue, Suite 800, Memphis, TN 38119.

Vous aimerez peut-être aussi

- Gregory Owens Chapter 7 Bankruptcy PetitionDocument39 pagesGregory Owens Chapter 7 Bankruptcy Petitiondavid_lat100% (1)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsD'EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsÉvaluation : 5 sur 5 étoiles5/5 (1)

- A Guide to District Court Civil Forms in the State of HawaiiD'EverandA Guide to District Court Civil Forms in the State of HawaiiPas encore d'évaluation

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- Legal Fundamentals For Canadian Business 4th Edition Test BankDocument32 pagesLegal Fundamentals For Canadian Business 4th Edition Test Bankjoess100% (1)

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- Atari Interactive's Bankruptcy FilingDocument12 pagesAtari Interactive's Bankruptcy FilingDealBookPas encore d'évaluation

- Harvard Law Review: Volume 125, Number 1 - November 2011D'EverandHarvard Law Review: Volume 125, Number 1 - November 2011Pas encore d'évaluation

- Lawsuit Against Tornado Masters, Jesse StuttsDocument14 pagesLawsuit Against Tornado Masters, Jesse StuttsThe Huntsville TimesPas encore d'évaluation

- Widow Entitled to Backpay Despite Failure to Exhaust RemediesDocument2 pagesWidow Entitled to Backpay Despite Failure to Exhaust RemediesJohnny English100% (1)

- Mayuga Vs AtienzaDocument2 pagesMayuga Vs AtienzaJoesil Dianne100% (1)

- Solavei Bankruptcy14 14505 TWD 1Document249 pagesSolavei Bankruptcy14 14505 TWD 1John CookPas encore d'évaluation

- MPRE Key Words and PhrasesDocument1 pageMPRE Key Words and PhrasesShaheer AdilPas encore d'évaluation

- World of Discovery Defamation ComplaintDocument20 pagesWorld of Discovery Defamation ComplaintasamahavvPas encore d'évaluation

- Judicial AffidavitDocument5 pagesJudicial AffidavitEarnswell Pacina TanPas encore d'évaluation

- Katarungang Pambarangay Code Sections ExplainedDocument10 pagesKatarungang Pambarangay Code Sections ExplainedMegan MateoPas encore d'évaluation

- Frias V San Diego SisonDocument3 pagesFrias V San Diego SisonArianne CerezoPas encore d'évaluation

- Bombay High Court Commercial Suit JudgmentDocument42 pagesBombay High Court Commercial Suit JudgmentranjanjhallbPas encore d'évaluation

- Philippine Home Assurance Corp v. CADocument2 pagesPhilippine Home Assurance Corp v. CAd2015member100% (2)

- United States Bankruptcy Court District of Delaware Voluntary PetitionDocument19 pagesUnited States Bankruptcy Court District of Delaware Voluntary PetitionChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court District of Delaware Voluntary PetitionDocument19 pagesUnited States Bankruptcy Court District of Delaware Voluntary PetitionChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Central District of California Riverside DivisionDocument2 pagesUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Central District of California Riverside DivisionDocument2 pagesUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsPas encore d'évaluation

- Conway BankruptcyDocument43 pagesConway Bankruptcyhurricanesmith2Pas encore d'évaluation

- Bart Coffee KiosksDocument28 pagesBart Coffee KioskskatherinestechPas encore d'évaluation

- Southern District of New YorkDocument17 pagesSouthern District of New YorkChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Central District of California Riverside DivisionDocument2 pagesUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsPas encore d'évaluation

- Voluntary Petition: United States Bankruptcy Court Central District of CaliforniaDocument47 pagesVoluntary Petition: United States Bankruptcy Court Central District of CaliforniaChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Central District of California Riverside DivisionDocument2 pagesUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Voluntary Petition Western District of Texas San Antonio Division Atled, LTDDocument9 pagesUnited States Bankruptcy Court Voluntary Petition Western District of Texas San Antonio Division Atled, LTDChapter 11 DocketsPas encore d'évaluation

- Voluntary Petition: United States Bankruptcy Court Central District of CaliforniaDocument21 pagesVoluntary Petition: United States Bankruptcy Court Central District of CaliforniaChapter 11 DocketsPas encore d'évaluation

- Palomar Hangar, LLC Chapter 11 Bankruptcy - MacalusoDocument10 pagesPalomar Hangar, LLC Chapter 11 Bankruptcy - MacalusoSpoiledMomPas encore d'évaluation

- Affinity First Day SchedulesDocument101 pagesAffinity First Day SchedulesjaxxstrawPas encore d'évaluation

- United States Bankruptcy Court Voluntary Petition: Western District of WashingtonDocument1 pageUnited States Bankruptcy Court Voluntary Petition: Western District of WashingtonChapter 11 DocketsPas encore d'évaluation

- Joy Taylor BK DocsDocument45 pagesJoy Taylor BK DocsStephen DibertPas encore d'évaluation

- Hargreaves Ch. 11 Bankruptcy FilingDocument24 pagesHargreaves Ch. 11 Bankruptcy FilingNick HalterPas encore d'évaluation

- 001 NYC Opera PetitionDocument10 pages001 NYC Opera Petitionahawkins8223Pas encore d'évaluation

- Senator Sean Nienow Minnesota Bankruptcy FilingsDocument58 pagesSenator Sean Nienow Minnesota Bankruptcy FilingsghostgripPas encore d'évaluation

- U S B C Southern District of New York Voluntary Petition: Nited Tates Ankruptcy OurtDocument19 pagesU S B C Southern District of New York Voluntary Petition: Nited Tates Ankruptcy OurtMelanie CohenPas encore d'évaluation

- Michigan Brewing Company Bankruptcy FilingDocument171 pagesMichigan Brewing Company Bankruptcy FilingLansingStateJournalPas encore d'évaluation

- James R. Rosendall Jr.'s Bankruptcy Filing.Document50 pagesJames R. Rosendall Jr.'s Bankruptcy Filing.rob_snell_1Pas encore d'évaluation

- Sinbad's BankruptcyDocument3 pagesSinbad's BankruptcyGeri KoeppelPas encore d'évaluation

- Circle Family Healthcare Network Voluntary PetitionDocument108 pagesCircle Family Healthcare Network Voluntary PetitionEllyn FortinoPas encore d'évaluation

- 10000005743Document48 pages10000005743Chapter 11 DocketsPas encore d'évaluation

- Dahl's FilingDocument116 pagesDahl's FilingwhohdPas encore d'évaluation

- 05014834923Document41 pages05014834923My-Acts Of-SeditionPas encore d'évaluation

- Dahl's Bankruptcy PetitionDocument116 pagesDahl's Bankruptcy PetitiondmronlinePas encore d'évaluation

- Peticion Quiebra TelexfreeDocument19 pagesPeticion Quiebra TelexfreelordmiguelPas encore d'évaluation

- Allan and Donna Butler Bankruptcy PetitionDocument10 pagesAllan and Donna Butler Bankruptcy PetitionCamdenCanaryPas encore d'évaluation

- Southern Florida: United States Bankruptcy CourtDocument38 pagesSouthern Florida: United States Bankruptcy CourtMy-Acts Of-SeditionPas encore d'évaluation

- United States Bankruptcy Court Voluntary Petition: Central District of California - Santa AnaDocument12 pagesUnited States Bankruptcy Court Voluntary Petition: Central District of California - Santa AnaChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Southern District of New York Voluntary PetitionDocument18 pagesUnited States Bankruptcy Court Southern District of New York Voluntary PetitionChapter 11 DocketsPas encore d'évaluation

- Marlene Davis Bankruptcy FilingDocument51 pagesMarlene Davis Bankruptcy Filingacsamaha100% (1)

- 10000021291Document490 pages10000021291Chapter 11 DocketsPas encore d'évaluation

- Bankruptcy PetitionDocument16 pagesBankruptcy PetitionEmily Amelia HeilPas encore d'évaluation

- Braswell BankruptcyDocument58 pagesBraswell BankruptcyMatt DixonPas encore d'évaluation

- 10000019287Document165 pages10000019287Chapter 11 DocketsPas encore d'évaluation

- FFN PetitionDocument18 pagesFFN PetitionChapter 11 DocketsPas encore d'évaluation

- MMA's Bankruptcy PetitionDocument94 pagesMMA's Bankruptcy PetitionWilliam Wolfe-WyliePas encore d'évaluation

- Far East Energy Corporation - Bankruptcy Petition 15-35970 Doc 1 Filed 10 Nov 15Document15 pagesFar East Energy Corporation - Bankruptcy Petition 15-35970 Doc 1 Filed 10 Nov 15scion.scionPas encore d'évaluation

- Court DocumentsDocument64 pagesCourt DocumentsAnonymous DeZm0ZLptOPas encore d'évaluation

- MOONGABSOOBKFORMDocument3 pagesMOONGABSOOBKFORMJames KimPas encore d'évaluation

- Fisker Automotive Holdings IncDocument4 pagesFisker Automotive Holdings IncChapter 11 DocketsPas encore d'évaluation

- Terri Williams BankruptcyDocument59 pagesTerri Williams BankruptcyThe Greenville Guardian100% (1)

- U S B C: Nited Tates Ankruptcy OurtDocument4 pagesU S B C: Nited Tates Ankruptcy OurtSteve MontrosePas encore d'évaluation

- Transdel First Day PetitionsDocument122 pagesTransdel First Day PetitionsjaxxstrawPas encore d'évaluation

- Full Details SugarmanDocument40 pagesFull Details SugarmanBecket AdamsPas encore d'évaluation

- TVLC Voluntary Petition Chapter 11 2016-11-08Document271 pagesTVLC Voluntary Petition Chapter 11 2016-11-08LivermoreParentsPas encore d'évaluation

- United States Bankruptcy Court Voluntary Petition: Southern District of New York AmendedDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of New York AmendedChapter 11 DocketsPas encore d'évaluation

- Northern District of Georgia - Atlanta Division: Voluntary Petition United States Bankruptcy CourtDocument5 pagesNorthern District of Georgia - Atlanta Division: Voluntary Petition United States Bankruptcy CourtRichard Donald JonesPas encore d'évaluation

- Clark Turner LLCDocument23 pagesClark Turner LLCdaggerpressPas encore d'évaluation

- Aletheia Research and Management's Bankruptcy PetitionDocument35 pagesAletheia Research and Management's Bankruptcy PetitionDealBookPas encore d'évaluation

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsPas encore d'évaluation

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsPas encore d'évaluation

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsPas encore d'évaluation

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsPas encore d'évaluation

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsPas encore d'évaluation

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsPas encore d'évaluation

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsPas encore d'évaluation

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsPas encore d'évaluation

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsPas encore d'évaluation

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsPas encore d'évaluation

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsPas encore d'évaluation

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsPas encore d'évaluation

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsPas encore d'évaluation

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsPas encore d'évaluation

- APP CredDocument7 pagesAPP CredChapter 11 DocketsPas encore d'évaluation

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsPas encore d'évaluation

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsPas encore d'évaluation

- APP ResDocument7 pagesAPP ResChapter 11 DocketsPas encore d'évaluation

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsPas encore d'évaluation

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsPas encore d'évaluation

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsPas encore d'évaluation

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsPas encore d'évaluation

- Rohm Apollo tax refund claim filed out of timeDocument2 pagesRohm Apollo tax refund claim filed out of timeJosef MacanasPas encore d'évaluation

- Robert P. Sheley v. Richard L. Dugger, Robert A. Butterworth, 833 F.2d 1420, 11th Cir. (1987)Document15 pagesRobert P. Sheley v. Richard L. Dugger, Robert A. Butterworth, 833 F.2d 1420, 11th Cir. (1987)Scribd Government DocsPas encore d'évaluation

- Simplehuman v. Itouchless - Motion To DismissDocument31 pagesSimplehuman v. Itouchless - Motion To DismissSarah BursteinPas encore d'évaluation

- Conduct To Be Observed by All Judges and Magistrates in TryingDocument49 pagesConduct To Be Observed by All Judges and Magistrates in TryingBencio AizaPas encore d'évaluation

- 37 144 1 PBDocument21 pages37 144 1 PBUmar RazakPas encore d'évaluation

- Court upholds collation of donated properties in estate settlementDocument10 pagesCourt upholds collation of donated properties in estate settlementCrnc NavidadPas encore d'évaluation

- Arkansas Articles of IncorporationDocument2 pagesArkansas Articles of IncorporationRocketLawyer100% (1)

- Court upholds dismissal of claim to inherited propertiesDocument7 pagesCourt upholds dismissal of claim to inherited propertiesHaniyyah FtmPas encore d'évaluation

- 1+ibasco+vs +ilaoDocument3 pages1+ibasco+vs +ilaoK Dawn Bernal CaballeroPas encore d'évaluation

- IntermediariesDocument21 pagesIntermediariesDean Rodriguez100% (1)

- Consumer Dispute Ruling Dismissed as Barred by LimitationDocument4 pagesConsumer Dispute Ruling Dismissed as Barred by LimitationBhan WatiPas encore d'évaluation

- Petitioner Vs Vs Respondents Rolando P Quimbo The Solicitor GeneralDocument9 pagesPetitioner Vs Vs Respondents Rolando P Quimbo The Solicitor Generalaspiringlawyer1234Pas encore d'évaluation

- Topic: Subsequent Marriage, Upon Reappearance of Absent SpouseDocument43 pagesTopic: Subsequent Marriage, Upon Reappearance of Absent SpouseCars CarandangPas encore d'évaluation

- Baliwag Transit IncsDocument28 pagesBaliwag Transit IncsXavier Hawkins Lopez ZamoraPas encore d'évaluation

- Tamil Nadu Kidneys (Authorities For Use For Therapeutic Purposes) Act, 1987Document6 pagesTamil Nadu Kidneys (Authorities For Use For Therapeutic Purposes) Act, 1987Latest Laws TeamPas encore d'évaluation

- Manila Electric Company vs. Quisumbing, 326 SCRA 172 (2000)Document17 pagesManila Electric Company vs. Quisumbing, 326 SCRA 172 (2000)Kaye Miranda LaurentePas encore d'évaluation

- United States Court of Appeals, Third Circuit. Submitted Under Third Circuit Rule 12Document4 pagesUnited States Court of Appeals, Third Circuit. Submitted Under Third Circuit Rule 12Scribd Government DocsPas encore d'évaluation

- Andersen. Legal OpportunityDocument313 pagesAndersen. Legal OpportunityJuan Camilo Portela GarcíaPas encore d'évaluation

- Assignment No. 2 Drafting of PlaintDocument4 pagesAssignment No. 2 Drafting of PlaintQadir JavedPas encore d'évaluation